Akzo Nobel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

Akzo Nobel operates in a dynamic industry shaped by intense rivalry, evolving buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating the competitive landscape effectively.

The complete report reveals the real forces shaping Akzo Nobel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The paints and coatings sector, including giants like AkzoNobel, depends on a concentrated supply of critical raw materials such as resins, pigments, and solvents. These essential components are often produced by a small group of large chemical manufacturers, giving them considerable leverage.

This concentration means suppliers can significantly influence pricing and availability. For instance, if a major pigment producer experiences production issues or decides to increase prices, it directly impacts AkzoNobel's cost structure and operational efficiency.

In 2024, the global chemical industry saw continued consolidation, with several key players acquiring smaller competitors. This trend further centralizes supply chains for raw materials, potentially amplifying supplier bargaining power against major consumers like AkzoNobel.

Switching suppliers for AkzoNobel's specialized chemicals and high-performance ingredients can incur significant costs. These include the expense and time needed for reformulating products, conducting rigorous testing, and going through lengthy qualification processes with new suppliers.

These high switching costs effectively increase the bargaining power of AkzoNobel's suppliers. When it's difficult and expensive to change sourcing partners, AkzoNobel becomes more reliant on its existing suppliers, giving them leverage in price negotiations and contract terms.

For example, in the coatings industry, a shift in a key pigment or binder could necessitate extensive re-testing to ensure product performance and regulatory compliance, potentially delaying product launches and impacting sales. This dependency underscores the importance of strong supplier relationships and strategic sourcing for AkzoNobel.

When suppliers offer highly differentiated or proprietary ingredients crucial for AkzoNobel's specialized coatings, particularly in demanding sectors like aerospace or automotive, their products become virtually indispensable. This unique value proposition significantly limits AkzoNobel's capacity to switch suppliers or negotiate pricing effectively.

For instance, a supplier providing a patented, high-performance resin that is key to AkzoNobel's advanced protective coatings for aircraft, which require extreme durability and specific certifications, holds considerable bargaining power. This leverage means AkzoNobel faces higher input costs, directly impacting its profit margins on these specialized product lines.

Threat of Forward Integration by Suppliers

The threat of forward integration by AkzoNobel's key raw material suppliers is a significant factor. If these suppliers, for instance, those providing essential resins or pigments, were to establish their own paint and coatings manufacturing operations, it would directly challenge AkzoNobel's market position. This potential scenario enhances the suppliers bargaining power, as AkzoNobel would be hesitant to engage in direct competition with entities that supply its core inputs.

This strategic risk for AkzoNobel means that suppliers could leverage their capacity for forward integration to secure more favorable terms in their supply agreements. For example, a major pigment supplier might threaten to enter the market with its own branded coatings if AkzoNobel does not agree to higher prices or less favorable payment terms. The global coatings market, valued at approximately $160 billion in 2023, is competitive, making such supplier leverage a serious consideration.

- Supplier Integration Risk: Key raw material providers could move into paint and coatings production, directly competing with AkzoNobel.

- Enhanced Bargaining Power: This threat allows suppliers to negotiate better terms, knowing AkzoNobel wants to avoid supplier-customer competition.

- Market Impact: In a market worth billions, such integration could disrupt supply chains and pricing strategies for AkzoNobel.

Importance of Supplier Volume to AkzoNobel

While AkzoNobel, a global leader in paints and coatings, is a significant purchaser of raw materials, the bargaining power of its suppliers hinges on how crucial AkzoNobel's business is to each individual supplier.

If AkzoNobel constitutes a minor fraction of a key supplier's overall revenue, that supplier would likely possess greater leverage. For instance, in 2024, a specialized chemical producer supplying AkzoNobel might also serve numerous other large industrial clients, diminishing AkzoNobel's individual purchasing impact.

- Supplier Dependence: The degree to which a supplier relies on AkzoNobel's orders directly influences its bargaining power.

- Market Concentration: If a supplier has a dominant position in its market for a specific raw material, it can exert more influence.

- AkzoNobel's Share: AkzoNobel's purchase volume as a percentage of a supplier's total sales is a critical factor.

- Alternative Suppliers: The availability and cost of switching to alternative suppliers for AkzoNobel impacts supplier leverage.

The bargaining power of AkzoNobel's suppliers is substantial due to the concentrated nature of raw material production and the high costs associated with switching inputs. Suppliers of specialized resins and pigments, often produced by a few large chemical manufacturers, can dictate terms and prices, impacting AkzoNobel's profitability.

In 2024, ongoing consolidation in the chemical industry further strengthened the position of key suppliers. The proprietary nature of some essential ingredients means AkzoNobel faces significant hurdles, including reformulation and re-testing, if it attempts to change suppliers, reinforcing supplier leverage.

The potential for suppliers to integrate forward into paint and coatings manufacturing represents a significant threat, giving them added power in negotiations. This risk, coupled with AkzoNobel's potentially small share of a supplier's total revenue, amplifies supplier influence in pricing and contract terms.

| Factor | Impact on AkzoNobel | 2024 Context |

|---|---|---|

| Supplier Concentration | High leverage for a few key producers of resins, pigments. | Continued consolidation in chemical sector amplified this. |

| Switching Costs | Significant costs for reformulation, testing, qualification. | Specialized, high-performance ingredients increase these costs. |

| Supplier Differentiation | Proprietary, indispensable ingredients limit negotiation. | Patented resins for aerospace coatings exemplify this. |

| Forward Integration Threat | Suppliers could enter coatings market, creating competition. | This leverage can secure better terms for suppliers. |

| AkzoNobel's Purchase Volume | Low if AkzoNobel is a small part of supplier's revenue. | Suppliers serving multiple large clients reduce AkzoNobel's individual impact. |

What is included in the product

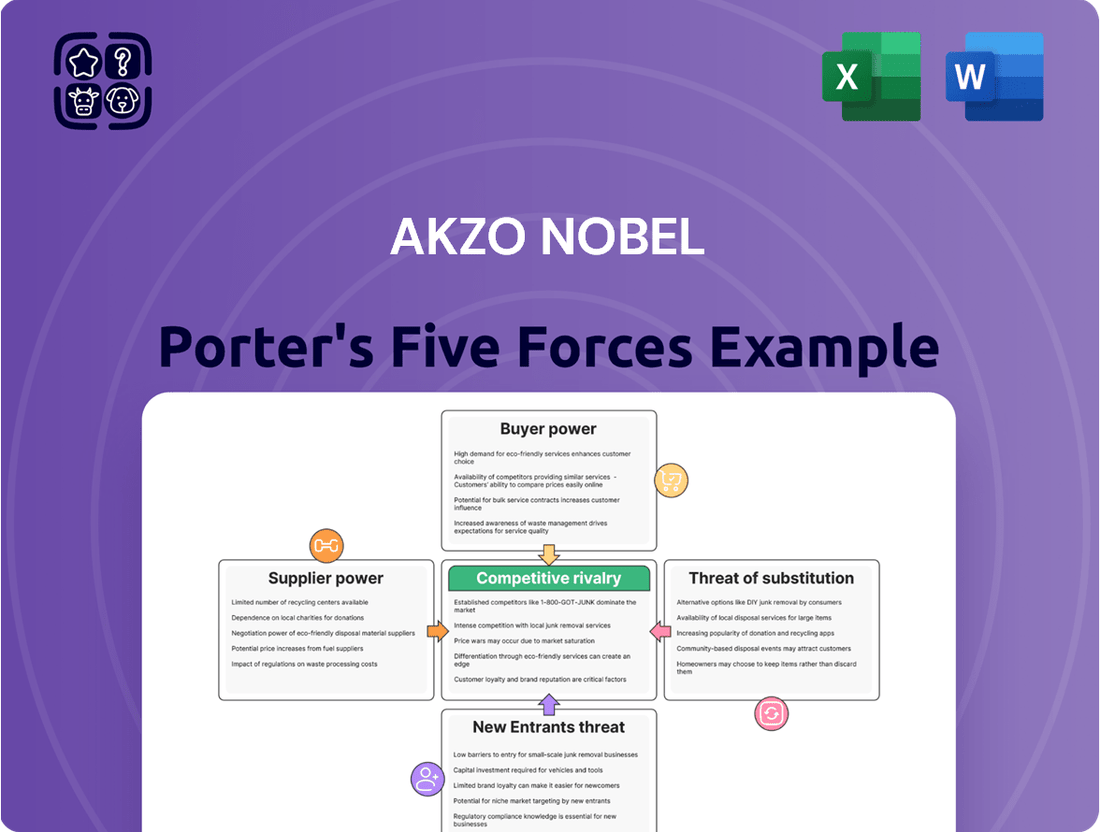

This analysis dissects the competitive landscape for Akzo Nobel, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and their collective impact on profitability.

Instantly identify and address competitive pressures with a visual breakdown of Akzo Nobel's Porter's Five Forces, simplifying strategic planning.

Customers Bargaining Power

Large industrial clients, like major automotive and aerospace manufacturers, are significant buyers of AkzoNobel's performance coatings. These customers’ substantial purchase volumes and consolidated buying power enable them to negotiate for competitive pricing and tailored solutions.

In 2023, AkzoNobel reported that its top ten customers accounted for approximately 15% of its total revenue, highlighting the concentrated nature of its industrial client base. This concentration directly translates into considerable bargaining leverage for these key accounts.

When AkzoNobel's products are highly standardized, particularly in segments like decorative paints, customers often see little difference between AkzoNobel's offerings and those of its rivals. This lack of perceived uniqueness makes it easier for customers to switch suppliers, effectively amplifying their bargaining power.

In the decorative paints segment, customers can often switch between brands with minimal cost or effort. This ease of transition means consumers can readily compare prices and product offerings, applying pressure on AkzoNobel to remain competitive on pricing.

For instance, a homeowner repainting a room can easily choose a different brand for their next project without significant financial or logistical hurdles. This low switching cost directly impacts AkzoNobel's pricing power, as customers are not locked into their products.

Customer Price Sensitivity

Customer price sensitivity significantly impacts AkzoNobel, especially in segments where alternatives are readily available. For instance, in the decorative paints market, consumers often compare prices directly, pushing AkzoNobel to offer competitive pricing to retain market share. In 2023, the global paints and coatings market experienced price fluctuations, with raw material costs impacting finished product pricing, making customer price sensitivity a critical factor in sales volume.

- High Price Sensitivity in Decorative Markets: Consumers in the decorative paint segment are highly attuned to price differences, often opting for lower-cost brands if perceived quality is comparable.

- Impact on AkzoNobel's Pricing Strategy: This sensitivity necessitates that AkzoNobel maintains competitive pricing structures to avoid losing customers to rivals offering cheaper alternatives.

- Competitive Landscape: The presence of numerous smaller, local players in various regions can exacerbate price sensitivity, as they may operate with lower overheads and offer more aggressive pricing.

- Raw Material Cost Influence: Fluctuations in raw material costs, such as titanium dioxide and petrochemicals, directly influence paint prices, further intensifying customer scrutiny on affordability.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant challenge to AkzoNobel. Large industrial clients, particularly those with substantial paint and coatings requirements or unique specifications, may explore the possibility of manufacturing these products internally. This capability directly enhances their bargaining power.

For instance, a major automotive manufacturer or a large appliance producer might evaluate the cost-effectiveness and strategic benefits of establishing their own paint production facilities. Such a move would reduce their reliance on external suppliers like AkzoNobel, thereby increasing their leverage in pricing and supply negotiations.

Consider the scale: if a key customer consumes tens of millions of liters of paint annually, the economics of in-house production become more compelling. This potential for customers to become their own suppliers is a constant pressure point for AkzoNobel, influencing contract terms and product development.

- Customer Leverage: The ability of large customers to potentially produce paints and coatings in-house grants them substantial bargaining power.

- Strategic Considerations: For high-volume or specialized needs, customers might deem backward integration a strategic imperative to control costs and quality.

- Negotiation Impact: This threat directly influences AkzoNobel's pricing strategies and contract negotiations, as customers can credibly threaten to switch to internal production.

The bargaining power of AkzoNobel's customers is significant, particularly among large industrial clients who purchase in high volumes. These major buyers, such as automotive and aerospace manufacturers, leverage their substantial spending to negotiate favorable pricing and customized product specifications. The company's 2023 report indicated that its top ten customers represented about 15% of total revenue, underscoring the considerable influence these key accounts wield.

In segments like decorative paints, where AkzoNobel's products are often perceived as similar to competitors', customers face low switching costs. This ease of changing suppliers empowers them to demand competitive pricing, as demonstrated by the general price sensitivity observed in the global paints and coatings market throughout 2023, influenced by raw material cost volatility.

| Customer Segment | Key Factors Influencing Bargaining Power | Impact on AkzoNobel |

|---|---|---|

| Large Industrial Clients (e.g., Automotive, Aerospace) | High purchase volume, consolidated buying power, potential for backward integration | Strong negotiation leverage on pricing and product customization |

| Decorative Paint Consumers | Low switching costs, high price sensitivity, availability of numerous alternatives | Pressure on pricing strategies, need for competitive offerings |

What You See Is What You Get

Akzo Nobel Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Akzo Nobel, offering a thorough examination of industry competition, buyer and supplier power, threat of new entrants, and substitute products. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The global paints and coatings market is a crowded space with significant competition. Major players like Sherwin-Williams, PPG Industries, and Nippon Paint dominate, but a multitude of smaller, regional companies also vie for market share. This creates a dynamic environment where rivalry is consistently high, impacting pricing and innovation strategies for all participants, including Akzo Nobel.

The paints and coatings industry shows mixed growth. While some established markets are mature, others, especially in emerging economies and specialized sectors like automotive or protective coatings, are seeing healthier expansion. For example, the global paints and coatings market was projected to grow at a compound annual growth rate (CAGR) of around 4.5% to 5.5% from 2023 to 2028, indicating a generally positive, albeit varied, outlook.

This uneven growth dynamic directly fuels competitive rivalry. In slower-growing segments, companies must fight harder for every sale, leading to more aggressive pricing strategies and increased marketing efforts. This is particularly true in regions where demand has plateaued, forcing players to battle for market share rather than benefit from broad market expansion.

The paints and coatings industry, including players like Akzo Nobel, is characterized by substantial fixed costs. These investments span manufacturing plants, advanced research and development for new formulations, and extensive distribution channels. For instance, establishing a state-of-the-art coatings facility can run into hundreds of millions of dollars, creating a high barrier to entry and a significant ongoing expense for existing companies.

These high fixed costs often compel companies to operate at high capacity to spread the overheads and achieve economies of scale. This can lead to intense competition, as firms strive to maintain production levels and market share, particularly during economic downturns. Such a scenario frequently results in price wars and aggressive promotional activities, as companies aim to utilize their capacity and prevent competitors from gaining an advantage.

Product Differentiation and Innovation

While some paint and coatings segments operate as commodities, AkzoNobel and its rivals actively pursue differentiation through innovation. This focus on sustainable solutions, enhanced performance characteristics, and application efficiency is a key battleground. For instance, AkzoNobel's commitment to R&D, which saw significant investment in 2023 and is projected to continue in 2024, aims to create distinctive products. However, the industry's structure means that successful innovations are often quickly emulated or improved upon by competitors, fueling intense rivalry.

The drive for product differentiation is evident in the increasing emphasis on eco-friendly formulations and advanced functionalities. Competitors are not standing still; they are also channeling resources into developing next-generation coatings. This dynamic means that companies must constantly innovate to maintain a competitive edge, as a technological lead can be fleeting. The rapid pace of innovation in areas like low-VOC (Volatile Organic Compound) paints and coatings with self-healing properties exemplifies this ongoing competitive pressure.

- AkzoNobel's R&D expenditure in 2023 was approximately €300 million, highlighting the industry's investment in innovation.

- The coatings industry is characterized by a continuous cycle of product development and improvement, with competitors actively seeking to match or exceed new offerings.

- Differentiation efforts extend to specialized performance coatings for sectors like automotive and aerospace, where unique properties command premium pricing and drive competition.

Exit Barriers

Akzo Nobel faces significant competitive rivalry, partly due to high exit barriers. These barriers, including specialized manufacturing equipment and long-term supply agreements, make it difficult and costly for companies to leave the paints and coatings market. For instance, the highly specialized nature of producing advanced coatings often requires substantial investments in unique machinery that has limited resale value outside the industry.

These entrenched exit barriers mean that even companies experiencing financial difficulties often remain in the market, contributing to persistent excess capacity. This situation intensifies the pressure on existing players like Akzo Nobel, as they must contend with a larger number of competitors than might otherwise be the case. In 2024, the global paints and coatings market, valued at over $170 billion, continued to see this dynamic play out, with established players needing to innovate and differentiate to maintain market share.

- Specialized Assets: High capital expenditure on unique production lines for specific coating types creates a significant hurdle for exiting firms.

- Long-Term Contracts: Commitments to customers and suppliers can lock companies into operations for extended periods, even if profitability declines.

- Employee Termination Costs: Severance packages and retraining obligations for a specialized workforce add to the expense of market exit.

- Industry Overcapacity: The persistence of less efficient or struggling firms due to these barriers contributes to a more competitive pricing environment.

Akzo Nobel operates in a highly competitive global paints and coatings market, facing intense rivalry from major players like Sherwin-Williams and PPG Industries, as well as numerous regional competitors. This crowded landscape, coupled with mixed market growth dynamics, forces companies to aggressively pursue market share through pricing and innovation. For instance, the global paints and coatings market was valued at over $170 billion in 2024, a significant figure underscoring the scale of competition.

High fixed costs associated with manufacturing and R&D, estimated at hundreds of millions of dollars for a single advanced facility, compel companies to maintain high capacity utilization. This often leads to price wars and promotional battles, especially in mature markets. Akzo Nobel's R&D expenditure of approximately €300 million in 2023 demonstrates the significant investment required to stay competitive through product differentiation.

The continuous cycle of product development, with competitors quickly emulating or improving upon innovations, fuels ongoing rivalry. Differentiation efforts are particularly strong in specialized sectors like automotive and aerospace coatings, where unique properties command premium pricing. High exit barriers, including specialized assets and long-term contracts, also contribute to persistent market competition by keeping even struggling firms active.

| Competitor | Estimated 2023 Revenue (USD Billions) | Key Market Focus |

|---|---|---|

| Sherwin-Williams | ~17.0 | Architectural, Industrial Coatings |

| PPG Industries | ~18.0 | Aerospace, Automotive, Industrial Coatings |

| Nippon Paint | ~10.0 | Architectural, Automotive Coatings (Asia-Pacific focus) |

| Akzo Nobel | ~10.5 | Decorative, Performance Coatings (Global) |

SSubstitutes Threaten

The threat of substitutes for AkzoNobel's liquid paints is significant, stemming from alternative surface treatment methods like films, wraps, anodizing, plating, and powder coatings. These alternatives can offer comparable protection and aesthetic appeal, particularly in demanding sectors such as automotive and industrial manufacturing.

For instance, the automotive industry's increasing adoption of paint protection films (PPFs) and vinyl wraps presents a direct substitute for traditional liquid paint in certain cosmetic and protective applications. In 2024, the global automotive coatings market, while substantial, faces pressure from these evolving surface technologies that can offer quicker application or specialized properties.

Advancements in material science pose a significant threat of substitution for AkzoNobel. Emerging innovations could lead to new substrates or inherent material properties that bypass the need for traditional paints and coatings. For example, self-cleaning or inherently corrosion-resistant materials could directly reduce demand for AkzoNobel's protective and decorative coatings, impacting market share in sectors like construction and automotive.

Customers increasingly seek alternatives that deliver the same end result as paint, but through different means. For instance, in the automotive sector, the adoption of pre-finished metal panels or advanced colored plastics can bypass the need for traditional painting processes, directly impacting demand for AkzoNobel's coatings. This trend is particularly visible in consumer electronics and certain construction materials where integrated color and texture are built into the product itself.

Cost-Performance Trade-offs

Customers consistently weigh the cost-performance benefits of various solutions. If a substitute provides a substantially lower price with adequate performance, or better performance at a similar price, it directly challenges AkzoNobel's market standing.

For instance, in the coatings industry, while premium brands like AkzoNobel offer superior durability and finish, lower-cost alternatives, particularly from emerging market manufacturers, are gaining traction. These substitutes often leverage more cost-effective raw materials and streamlined production processes. In 2024, the global paints and coatings market saw a significant influx of value-oriented products, with some reports indicating a 5-7% growth in market share for lower-priced segments due to economic pressures on consumers and businesses.

- Cost Sensitivity: Many end-users, especially in construction and DIY markets, are highly sensitive to price, making them receptive to substitutes that offer acceptable quality at a lower cost.

- Performance Benchmarking: As substitute products improve their performance characteristics, the perceived value proposition of premium brands diminishes, increasing the threat.

- Technological Diffusion: Advancements in coating technology can be more rapidly adopted by smaller, agile competitors, enabling them to offer performance comparable to established players at a reduced cost.

Regulatory and Environmental Shifts

Increasing regulatory pressures, particularly concerning volatile organic compounds (VOCs) and hazardous materials, pose a significant threat. For instance, stricter EU regulations on VOC content in architectural coatings, implemented progressively, could favor alternative surface treatments. In 2024, many regions saw continued focus on sustainability, potentially increasing the cost of compliance for traditional paint manufacturers.

Consumer preferences are also shifting towards more environmentally friendly and healthier living spaces. This could lead to greater demand for natural finishes, bio-based coatings, or even decorative wall coverings that offer a lower environmental impact than conventional paints. Reports from 2024 indicated a growing market share for low-VOC and water-based paints, signaling this trend.

If regulations heavily restrict certain chemicals commonly found in paints, alternative, more sustainable surface treatments might gain traction. For example, a ban on specific biocides or pigments could make traditional paints less viable, pushing consumers and industries towards substitutes like advanced plasters or composite materials for wall finishes.

The threat of substitutes is amplified by innovations in building materials and finishes. Consider the rise of advanced wallpapers, textured wall panels, and even integrated smart surface technologies that offer both aesthetic and functional benefits, potentially reducing reliance on traditional paint applications.

The threat of substitutes for AkzoNobel's liquid paints is substantial, driven by alternatives like powder coatings, films, and advanced material finishes. These substitutes offer comparable aesthetics and protection, particularly in sectors like automotive and industrial manufacturing where performance is key.

For example, the automotive sector's increasing use of paint protection films (PPFs) and vinyl wraps directly competes with traditional liquid paint for cosmetic and protective roles. In 2024, while the automotive coatings market remained robust, these evolving surface technologies presented a notable challenge, offering quicker application and specialized benefits.

Technological advancements in material science also pose a significant substitution threat. Innovations leading to materials with inherent protective qualities, such as self-cleaning or corrosion-resistant surfaces, could diminish the need for conventional paints. This is particularly relevant in construction and automotive industries, impacting AkzoNobel's market share.

Customers are increasingly seeking solutions that achieve the same end result as paint but through different methods. Pre-finished metal panels and advanced colored plastics in consumer electronics and construction bypass traditional painting processes entirely. In 2024, the global paints and coatings market saw a noticeable shift towards value-oriented products, with some segments experiencing 5-7% growth due to economic pressures, highlighting the appeal of cost-effective alternatives.

| Substitute Type | Key Advantage | AkzoNobel Product Impact | 2024 Market Trend |

|---|---|---|---|

| Powder Coatings | Durability, environmental friendliness (low VOCs) | Direct competition in industrial and appliance sectors | Steady growth, especially in applications requiring high durability |

| Paint Protection Films (PPF) & Wraps | Ease of application, customization, paint protection | Threat in automotive cosmetic and protective segments | Increasing adoption in automotive aftermarket and customization |

| Advanced Material Finishes (e.g., colored plastics, pre-finished panels) | Integrated aesthetics, reduced manufacturing steps | Bypasses painting process in electronics, construction, automotive | Growing integration in consumer goods and building materials |

Entrants Threaten

Establishing a new paints and coatings manufacturing facility, complete with R&D labs, production lines, and robust distribution networks, demands a significant capital investment. For instance, the global paints and coatings market was valued at approximately USD 160 billion in 2023, with new entrants needing to invest hundreds of millions to compete effectively.

This substantial financial hurdle acts as a powerful deterrent, effectively keeping many potential new competitors at bay, particularly those aiming for a global or even significant regional presence. The sheer scale of investment required to achieve economies of scale and meet regulatory standards is a major barrier.

Existing players like AkzoNobel leverage substantial economies of scale, particularly in bulk purchasing of raw materials and optimizing production processes. For instance, in 2023, AkzoNobel's revenue was €10.5 billion, indicating a large operational footprint that allows for significant cost advantages.

New entrants face a steep challenge in matching these cost efficiencies, as they would need to invest heavily to achieve comparable production volumes and secure favorable supplier agreements. This disparity in operational scale creates a formidable barrier, making it difficult for newcomers to compete on price against established entities.

AkzoNobel benefits from significant brand loyalty, especially in its decorative paints segment, making it difficult for newcomers to gain traction. In 2023, AkzoNobel reported €10.7 billion in revenue, underscoring its market presence and the challenge new entrants face in matching this scale.

Establishing comparable global distribution networks and securing prime shelf space or industrial contracts requires massive upfront investment and time, acting as a substantial barrier to entry.

Proprietary Technology and R&D

The paints and coatings sector thrives on specialized knowledge and ongoing innovation, making it challenging for newcomers. AkzoNobel's significant investment in research and development, evidenced by its robust patent portfolio, acts as a substantial barrier. For instance, in 2023, AkzoNobel reported €2.5 billion in revenue from its Decorative Paints segment, underscoring the value of its established product lines and technological advancements.

New entrants would need to replicate AkzoNobel's deep technological expertise and invest heavily in R&D to compete effectively. This includes developing unique formulations and application techniques that are difficult to reverse-engineer. The company’s commitment to sustainability, with initiatives like its 'People. Planet. Paint.' approach, also requires significant upfront investment in eco-friendly technologies.

- Proprietary Formulations: AkzoNobel's success is built on unique paint and coating compositions that offer specific performance characteristics, difficult for new firms to replicate without extensive R&D.

- R&D Investment: The company's substantial expenditure on research and development, a key driver of innovation in the sector, creates a high entry cost for potential competitors lacking similar resources.

- Intellectual Property: A strong portfolio of patents and trade secrets protects AkzoNobel's technological advantages, serving as a significant deterrent to new entrants.

- Application Expertise: Specialized knowledge in applying coatings for optimal performance and durability, honed over years of experience, presents another hurdle for inexperienced competitors.

Regulatory Hurdles and Environmental Compliance

The paints and coatings industry faces significant regulatory hurdles, particularly concerning environmental, health, and safety standards. New companies entering this market must contend with a complex web of global and local regulations governing chemical content, emissions, and waste disposal. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes substantial data and testing requirements, potentially costing new entrants millions of euros to comply before even launching a product.

Navigating these compliance requirements involves obtaining numerous permits and adhering to strict standards for production, transportation, and product labeling. These processes are time-consuming and resource-intensive, acting as a substantial barrier to entry. In 2024, the increasing focus on sustainable and low-VOC (Volatile Organic Compound) formulations means new entrants must invest heavily in research and development to meet evolving consumer and regulatory demands, adding to the upfront capital expenditure.

These regulatory complexities significantly increase the cost and complexity of market entry, effectively deterring many potential new competitors. Companies must demonstrate robust environmental management systems and product safety protocols, which require substantial investment in specialized expertise and infrastructure. This rigorous compliance landscape favors established players like Akzo Nobel, who have existing systems and expertise to manage these challenges efficiently.

- Regulatory Complexity: Navigating global environmental, health, and safety regulations presents a significant challenge for new entrants in the paints and coatings sector.

- Compliance Costs: Meeting stringent standards, such as those under EU REACH, can involve millions of euros in testing and registration fees for new chemical substances.

- R&D Investment: The push for sustainable and low-VOC products in 2024 necessitates substantial R&D investment, increasing the financial barrier for newcomers.

- Permitting and Standards: Obtaining necessary permits and adhering to production, transport, and labeling standards adds considerable time and expense to market entry.

The threat of new entrants in the paints and coatings industry, including for AkzoNobel, is moderate. Significant capital investment is required, with the global market valued around USD 160 billion in 2023, demanding hundreds of millions for effective competition. Established players benefit from economies of scale, with AkzoNobel's €10.5 billion revenue in 2023 highlighting their cost advantages, making it hard for newcomers to match pricing. Brand loyalty and extensive distribution networks also pose substantial barriers, as do proprietary formulations and intellectual property that require significant R&D investment to overcome.

Regulatory complexities, such as EU REACH compliance, add millions in costs and time delays for new entrants. The 2024 trend towards sustainable, low-VOC products further increases R&D investment needs. These factors collectively elevate the barriers to entry, protecting incumbent firms like AkzoNobel.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

| Capital Requirements | High cost of setting up manufacturing, R&D, and distribution. | Deters smaller players; requires substantial funding. | Global paints & coatings market size: ~USD 160 billion. |

| Economies of Scale | Cost advantages from large-scale production and purchasing. | New entrants struggle to compete on price. | AkzoNobel revenue: €10.5 billion. |

| Brand Loyalty & Distribution | Established customer relationships and wide market reach. | Difficult for newcomers to gain market share and shelf space. | AkzoNobel Decorative Paints revenue: €2.5 billion. |

| Technology & R&D | Proprietary formulations, patents, and application expertise. | Requires significant investment in innovation to match. | AkzoNobel's investment in R&D (implied by patent portfolio). |

| Regulatory Compliance | Meeting environmental, health, and safety standards. | Increases costs and time-to-market; favors established players. | EU REACH compliance costs can reach millions for new substances. |

Porter's Five Forces Analysis Data Sources

Our Akzo Nobel Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Akzo Nobel's annual reports and investor presentations, alongside industry-specific market research from firms like IHS Markit and Bloomberg.

We further enrich this with insights from regulatory filings, financial news outlets, and macroeconomic data to provide a robust understanding of competitive pressures.