Akzo Nobel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akzo Nobel Bundle

Curious about Akzo Nobel's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full strategic potential by purchasing the complete BCG Matrix for a detailed breakdown and actionable insights to guide your investment decisions.

Stars

AkzoNobel's powder coatings segment is a shining star, showing impressive volume growth and beating market performance in 2024, especially in crucial markets like the US and China.

The global powder coatings market is on a significant upward trajectory, with an expected compound annual growth rate of 5.46% between 2024 and 2030, underscoring the strong potential of this business unit.

AkzoNobel's commitment to this segment is evident through its investment of over $30 million to expand manufacturing capacity and integrate cutting-edge technologies at its North American facilities, reinforcing its leading market position in a rapidly expanding sector.

Marine and Protective Coatings represent a star in AkzoNobel's BCG Matrix, demonstrating robust growth and expanding market share. The segment is experiencing strong demand, particularly in new shipbuilding, with significant gains observed in the Chinese market throughout 2024.

The broader marine coatings market is projected to expand at a compound annual growth rate of 3.6% between 2024 and 2031. This growth is fueled by a resurgence in shipbuilding and the increasing influence of environmental regulations shaping industry practices.

AkzoNobel's strategic positioning and a strong product pipeline for 2025 underscore its leadership in this high-potential sector, indicating continued solid performance and market influence.

The market for sustainable and bio-based coatings is booming, fueled by growing environmental consciousness and stricter rules. AkzoNobel is a leader here, creating innovative products like PVC-free and bisphenol-free coatings for packaging, with a focus on high bio-based content. This commitment aligns with their goal to cut carbon emissions by 50% by 2030, positioning them strongly in this expanding sector across many coating uses.

New Generation Automotive Refinish Technologies

AkzoNobel's commitment to its new generation of automotive refinish technologies, exemplified by the 'Productivity Drive 2025' roadshow across EMEA, firmly places these offerings in the Stars category of the BCG Matrix.

This strategic push highlights advanced, productivity-enhancing solutions, catering to a market segment that prioritizes innovation and efficiency. Despite a general market slowdown observed in late 2024 for the broader automotive sector, the demand for cutting-edge and sustainable refinish technologies continues to show resilience, signaling robust future growth potential.

Key aspects driving this classification include:

- Market Leadership in Innovation: AkzoNobel's continuous investment in R&D for next-gen refinish products, focusing on faster application times and reduced waste, appeals to a market seeking operational improvements.

- Growth Potential: The automotive refinish market, particularly for sustainable and efficient solutions, is projected to grow, with industry analysts forecasting a compound annual growth rate (CAGR) of approximately 4-5% through 2027 for advanced coatings.

- Strategic Initiatives: Programs like 'Productivity Drive 2025' actively engage customers, demonstrating the tangible benefits of these new technologies and solidifying their market position.

High-Performance Industrial Coatings (Selected Segments)

High-performance industrial coatings, particularly those designed for demanding applications like automotive alloy wheels and durable kitchen cabinetry, are identified as Stars for AkzoNobel. These segments benefit from strong market growth and AkzoNobel's significant market share, driven by innovation in areas such as advanced powder coatings and UV-cured technologies.

AkzoNobel's strategic investment in these specialized coatings aligns with global trends favoring enhanced product longevity and environmental compliance. For example, their powder coatings for automotive components offer superior durability and a lower environmental footprint compared to traditional liquid coatings, a key advantage in the automotive sector which saw global vehicle production reach approximately 77.7 million units in 2023.

- Automotive Alloy Wheel Coatings: AkzoNobel's advanced powder coatings provide exceptional durability and aesthetic appeal for automotive wheels, a segment experiencing steady demand.

- UV-Cured Coatings for Kitchen Cabinets: In markets like Vietnam, the demand for durable and aesthetically pleasing kitchen cabinetry is rising, with UV-cured coatings offering efficiency and performance.

- Growth in Specialized Industrial Applications: AkzoNobel's focus on high-performance coatings addresses specific needs in sectors like aerospace and electronics, where durability and specialized properties are paramount.

AkzoNobel's Decorative Paints segment, particularly its operations in Europe, is a significant Star. The company has demonstrated strong performance in this region, with notable market share gains in 2024 driven by innovative product launches and effective marketing strategies.

The European decorative paints market is robust, projected to grow at a CAGR of approximately 3.5% from 2024 to 2029, supported by renovation trends and increasing consumer spending on home improvement.

AkzoNobel's strategic focus on sustainability and digital customer engagement further solidifies its leading position in this segment, ensuring continued growth and profitability.

| Segment | BCG Category | Key Drivers | 2024 Performance Highlight |

|---|---|---|---|

| Powder Coatings | Stars | Volume growth, market outperformance, capacity expansion | Strong performance in US and China |

| Marine & Protective Coatings | Stars | New shipbuilding demand, environmental regulations | Market share gains, especially in China |

| Sustainable/Bio-based Coatings | Stars | Environmental consciousness, regulatory push | Leadership in PVC-free and bio-based innovations |

| Automotive Refinish Technologies | Stars | Innovation, productivity enhancement, sustainability | Resilience despite broader automotive market slowdown |

| High-Performance Industrial Coatings | Stars | Durability, environmental compliance, specialization | Growth in automotive alloy wheels and kitchen cabinetry |

| Decorative Paints (Europe) | Stars | Renovation trends, consumer spending, digital engagement | Market share gains through product innovation |

What is included in the product

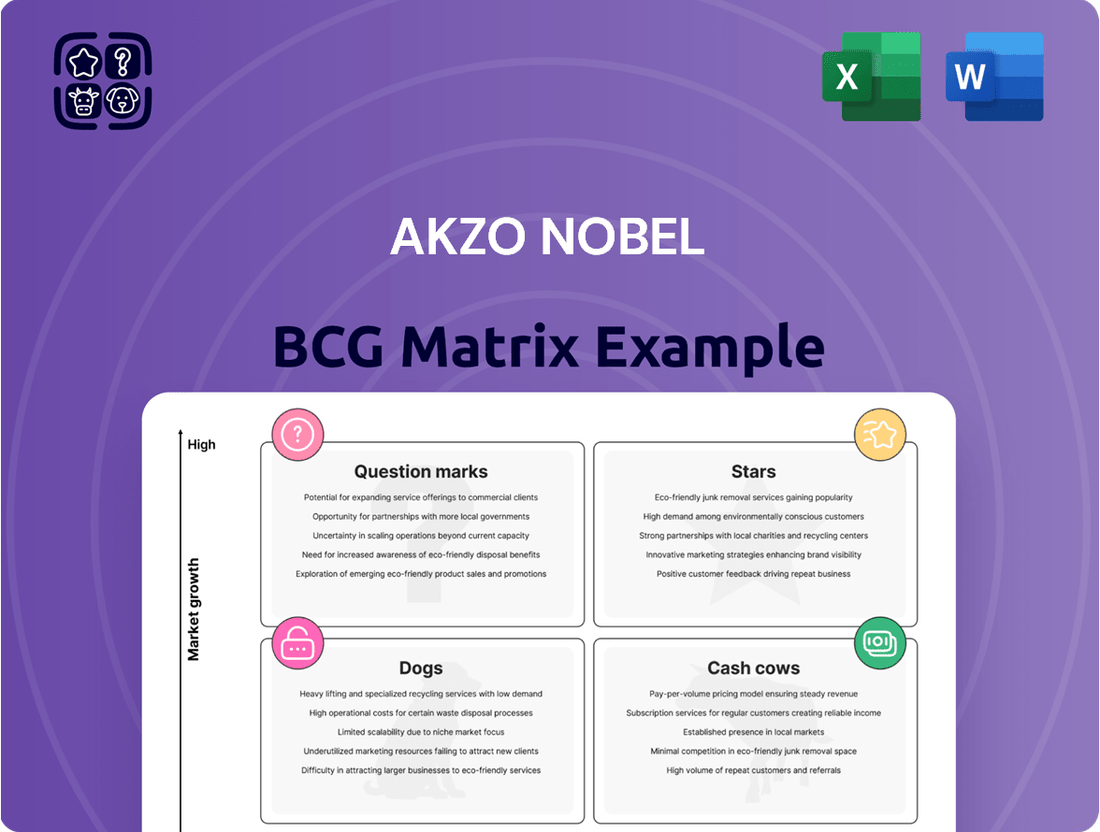

The Akzo Nobel BCG Matrix offers a visual framework to assess its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear Akzo Nobel BCG Matrix visualizes portfolio strengths, relieving the pain of strategic uncertainty.

Cash Cows

AkzoNobel's decorative paints business in mature Western markets, particularly EMEA, represents a classic Cash Cow. The company commands a substantial market share, bolstered by strong brand equity like Dulux. This segment benefits from low market growth, meaning less capital is needed for expansion.

In 2024, the decorative paints segment in EMEA continued to be a significant contributor to AkzoNobel's revenue. Despite the mature nature of these markets, the consistent demand and AkzoNobel's established presence ensure robust and predictable cash flow generation. This allows for efficient operations and steady profitability.

AkzoNobel's traditional automotive OEM coatings are firmly established as cash cows within their portfolio. This segment operates in a mature, substantial global market, benefiting from consistent demand tied to vehicle production volumes. In 2024, the automotive coatings market is projected to reach significant figures, with OEM coatings forming a substantial portion of this.

Established Architectural Coatings represent AkzoNobel's robust presence in the construction and building sector, a mature yet consistently demanding market. These products are a cornerstone of AkzoNobel's operations, generating reliable revenue streams.

The global architectural coatings market, valued at approximately $150 billion in 2023, continues to show steady growth, driven by new construction and renovation projects. AkzoNobel's strong brand recognition and distribution network in this segment ensure sustained sales volumes, making these coatings a significant contributor to the company's cash flow.

Core Marine Maintenance Coatings

AkzoNobel's Core Marine Maintenance Coatings represent a classic Cash Cow within the BCG Matrix. The ongoing need to maintain and repair existing ships, beyond just new construction, creates a consistent and reliable income for the company. This segment benefits from the essential nature of these coatings for vessel longevity and operational safety.

While the marine coatings market might not see explosive growth, AkzoNobel's strong market share in this area ensures these products continue to be significant cash generators. For instance, in 2023, the global marine coatings market was valued at approximately USD 17.3 billion, with maintenance coatings forming a substantial portion. AkzoNobel's established reputation and extensive product portfolio in this segment solidify its Cash Cow status.

- Stable Revenue: Recurring demand for maintenance and repair coatings provides a predictable income.

- Market Dominance: AkzoNobel's strong position in marine coatings ensures consistent sales.

- Essential Products: Coatings are critical for vessel upkeep, guaranteeing continuous demand.

Well-Established Powder Coating Brands and Formulations

Within AkzoNobel's powder coatings division, established brands and formulations are the bedrock cash cows. These mature products, like Interpon, boast strong brand recognition and a loyal customer base, driving consistent revenue streams. Their market leadership in various niches means they require minimal incremental investment to maintain their profitable positions, effectively milking the market for steady cash flow.

These cash cow products have benefited from years of market development and refinement. For instance, AkzoNobel's powder coatings segment, which includes these cash cows, saw a significant contribution to the company's overall performance. In 2024, AkzoNobel reported robust sales in its Decorative Paints and Performance Coatings segments, with powder coatings playing a vital role in the latter's success, demonstrating sustained demand and profitability.

- Proven Market Leadership: Established AkzoNobel powder coating brands hold dominant market share in their respective sub-segments.

- Consistent Profitability: These products generate reliable and substantial cash flow with low reinvestment needs.

- Brand Equity: Strong brand recognition and customer loyalty ensure continued demand and pricing power.

- Mature Product Lifecycle: While not high-growth, their stability provides a strong financial foundation for the company.

AkzoNobel's established decorative paints in mature Western markets, particularly EMEA, are prime examples of Cash Cows. These segments benefit from strong brand equity, like Dulux, and low market growth, requiring minimal capital for expansion while generating consistent profits. In 2024, this segment remained a significant revenue driver, underscoring its predictable cash flow generation.

| Segment | BCG Category | Key Characteristics | 2024 Relevance |

| Decorative Paints (EMEA) | Cash Cow | Strong brand equity, mature market, low growth | Continued significant revenue contributor, stable cash flow |

| Automotive OEM Coatings | Cash Cow | Mature global market, consistent demand linked to vehicle production | Substantial portion of automotive coatings market, steady revenue |

| Established Architectural Coatings | Cash Cow | Cornerstone of operations, mature but demanding market | Reliable revenue streams from new construction and renovation |

| Core Marine Maintenance Coatings | Cash Cow | Essential for vessel longevity, consistent income from repairs | Significant cash generators, stable demand in a USD 17.3 billion market (2023) |

| Established Powder Coatings | Cash Cow | Proven market leadership, loyal customer base, minimal reinvestment | Vital role in Performance Coatings segment, demonstrating sustained demand |

What You’re Viewing Is Included

Akzo Nobel BCG Matrix

The Akzo Nobel BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally crafted strategic analysis ready for your immediate use. You can confidently expect the same depth of insight and professional presentation in the final file that you see here.

Dogs

AkzoNobel's decorative paints segment in China is currently positioned as a Dog in the BCG Matrix. The business faced a significant downturn in 2024, largely attributed to the ongoing real estate market crisis and reduced consumer spending within the country.

Despite AkzoNobel's efforts to strengthen its market standing through strategic acquisitions, the decorative paints business in China continues to grapple with substantial challenges. This combination of low market share and limited growth potential in the present economic climate makes it a problematic segment requiring careful consideration and potential strategic adjustments.

Akzo Nobel India's mass and economy decorative paints segment appears to be a 'dog' in the BCG matrix. In the first quarter of 2025, the company experienced a downturn in both net profit and revenue, with these specific categories facing significant pressure from intense competition and subdued consumer purchasing.

This performance indicates a challenging market position for these offerings, characterized by a likely low market share and weak sales volumes. The segment may be struggling to generate substantial profits, potentially acting as a cash trap for the company due to ongoing investment needs without commensurate returns.

Within AkzoNobel's historical portfolio, certain specialty chemical formulations that no longer align with the company's strategic focus on paints and coatings would be classified as Dogs. These legacy products likely operate in mature, low-growth segments and possess negligible market share.

These underperforming specialty chemicals often drain resources, such as research and development or marketing, without generating substantial returns. For instance, if a specific niche chemical formulation, once a market leader, now faces intense competition and declining demand, it would fit this category. AkzoNobel's 2023 annual report highlighted a continued divestment strategy for non-core assets, indicating a proactive approach to shedding such businesses.

Legacy Solvent-Based Coatings

Legacy solvent-based coatings, particularly those with high Volatile Organic Compounds (VOCs), are increasingly being classified as dogs within Akzo Nobel's portfolio. This is driven by a significant industry-wide pivot towards sustainability and eco-friendly alternatives. For instance, in 2024, the global coatings market saw continued pressure on traditional solvent-based formulations due to evolving environmental legislation and a strong consumer demand for low-VOC or water-based options.

These older product lines often exhibit a low market share and face limited growth prospects. The stringent regulatory landscape, with many regions implementing stricter VOC emission limits, directly impacts the viability of these coatings in key applications. Akzo Nobel, like many industry leaders, is actively phasing out or reformulating these legacy products to align with market trends and environmental commitments.

- Declining Demand: Stricter environmental regulations in 2024, such as the EU's REACH and VOC directives, have significantly curtailed the use of high-VOC coatings in construction and automotive sectors.

- Low Market Share: In segments where greener alternatives are readily available, legacy solvent-based coatings often hold a minimal market share, sometimes below 5% in specific niche applications.

- Limited Growth Potential: The future growth trajectory for these products is negative, as manufacturers and consumers prioritize sustainable solutions, leading to a shrinking market.

- Strategic Divestment/Reformulation: Companies are strategically divesting from or investing heavily in reformulating these products to meet new environmental standards, signaling a clear move away from their core business.

Underperforming Regional Decorative Paint Segments (e.g., parts of EMEA)

Within AkzoNobel's decorative paints division, certain regional segments in EMEA might be classified as dogs. These are areas where growth has been sluggish, and market share is minimal compared to dominant local players. For instance, while specific 2024 data for every sub-region isn't publicly detailed, broader economic trends in parts of Eastern Europe have indicated slower recovery post-pandemic.

These underperforming areas are characterized by a persistent inability to gain traction, even as other markets rebound. AkzoNobel's financial reports often highlight regional performance variations, and any segment consistently lagging in sales growth and profitability, despite strategic efforts, would fit the dog category. Such segments could be candidates for restructuring or even sale.

- Underperforming EMEA Decorative Paint Segments: Identified by low market share and slow recovery post-COVID.

- Competitive Landscape: Facing strong local competitors in these specific regional markets.

- Potential Actions: Candidates for rationalization or divestment due to persistent underperformance.

- Financial Indicators: Marked by consistently lagging sales growth and profitability compared to other segments.

AkzoNobel's decorative paints segment in China is a dog due to the real estate crisis and reduced consumer spending in 2024. Despite acquisitions, this segment has low market share and limited growth potential.

Akzo Nobel India's mass and economy decorative paints are also dogs, facing intense competition and subdued purchasing in Q1 2025. This segment likely has low market share and weak sales, potentially acting as a cash trap.

Legacy solvent-based coatings, especially those with high VOCs, are dogs due to industry shifts towards sustainability and stricter environmental regulations in 2024. These products have low market share and negative growth prospects.

Certain regional decorative paint segments in EMEA are classified as dogs, exhibiting sluggish growth and minimal market share against local competitors, with some areas showing slower post-pandemic recovery in 2024.

Question Marks

AkzoNobel is actively investing in and developing bio-based and circular economy coatings. A prime example is their focus on wood coatings with increased bio-based content and UV-curable coatings, targeting high renewable content by 2025. This aligns with a rapidly growing market fueled by increasing sustainability demands.

While these innovative coatings operate in a high-growth market, their current market share is likely modest due to their relatively new or niche status. Significant capital expenditure is necessary to scale these advancements and transition them into future high-performing products within AkzoNobel's portfolio.

AkzoNobel is actively investing in AI-powered application solutions like coatingAI, a digital tool designed to enhance coating application efficiency and reduce environmental impact for its clientele. This focus aligns with the growing industrial digitalization trend, positioning these solutions as a potential high-growth segment.

Despite the promise, these advanced digital offerings are currently in their nascent stages of market adoption, reflecting a low market share. Significant investment is still necessary to fully develop and scale these technologies, a characteristic of products in the 'Question Marks' quadrant of the BCG matrix.

AkzoNobel's new 'sunscreen' coating system for urban cooling represents a strategic move into a burgeoning market driven by escalating climate change concerns and the intensifying urban heat island effect. This innovative product targets a new application area, offering a potential solution to rising global temperatures in densely populated cities.

While the market for urban cooling solutions is anticipated to grow significantly, AkzoNobel's 'sunscreen' coating system, being a recent introduction, likely holds a minimal current market share. This positions it as a question mark in the BCG matrix, requiring substantial investment to gain traction and build market presence in this emerging sector.

Specialty Coatings for Specific High-Growth Niche Industries

AkzoNobel is actively developing specialty coatings for rapidly growing niche sectors. These could include advanced materials for electric vehicles, specialized protective coatings for renewable energy infrastructure, or innovative solutions for the aerospace industry. The company invests heavily in research and development to create these cutting-edge products.

While these niche markets offer significant future potential, AkzoNobel's current market share within them might be relatively low. This is typical for new, specialized product introductions where significant effort is required to establish a strong presence. For instance, in the burgeoning market for advanced battery coatings, AkzoNobel might be a key player, but the overall market is still consolidating.

- High R&D Investment: Specialty coatings often require substantial investment in research and development to meet stringent performance requirements.

- Market Development Focus: AkzoNobel dedicates resources to understanding and penetrating these specialized segments, aiming to build brand recognition and customer loyalty.

- Potential for High Margins: Successful penetration into these high-growth niches can lead to premium pricing and strong profitability as the company establishes its expertise.

- Example: Sustainable Aviation Fuel Coatings: AkzoNobel's efforts in developing coatings for aircraft that can withstand the rigors of sustainable aviation fuels represent a strategic move into a high-potential, specialized area.

Decorative Paints in South Asia Portfolio (under strategic review)

AkzoNobel’s announcement in October 2024 of a strategic review for its South Asia decorative paints portfolio signals a critical juncture, classifying it as a ‘question mark’ within their business portfolio. This review implies the company is assessing whether to commit significant resources to bolster its position or to consider divesting from the segment.

While Asia generally presents a robust growth trajectory for the paints and coatings industry, AkzoNobel's specific South Asian decorative paints business may be experiencing a less dominant or fluctuating market share. For instance, the South Asian paints market, projected to grow at a CAGR of over 8% through 2028, presents opportunities, but AkzoNobel’s specific market penetration needs to be evaluated.

- Strategic Uncertainty: AkzoNobel's October 2024 announcement of a strategic review for its South Asia decorative paints portfolio positions it as a 'question mark' in the BCG matrix, indicating a need for decisive action.

- Market Dynamics: Despite the overall high-growth potential of the broader Asian market, AkzoNobel's specific South Asian decorative paints segment may be facing challenges related to market share or competitive intensity.

- Investment Decision: The review signifies a crucial decision point for AkzoNobel, weighing the potential for significant investment to capture growth against the possibility of exiting the market.

- Regional Performance: In 2023, the Indian decorative paints market, a key component of South Asia, saw significant growth, with major players reporting double-digit revenue increases, highlighting the competitive landscape AkzoNobel operates within.

AkzoNobel's bio-based and circular economy coatings, while targeting a high-growth market driven by sustainability demands, currently represent a modest market share due to their novelty. Significant capital expenditure is required to scale these advancements, characteristic of 'question marks' needing investment to become future stars.

AI-powered application solutions like coatingAI are positioned in a high-growth industrial digitalization trend, but are in nascent stages of market adoption with low market share. This requires substantial investment for full development and scaling, aligning with the 'question mark' quadrant.

The 'sunscreen' coating system for urban cooling addresses a burgeoning market driven by climate change, but as a recent introduction, it likely holds minimal current market share. This necessitates substantial investment to gain traction and establish market presence, classifying it as a question mark.

Specialty coatings for niche sectors like electric vehicles or renewable energy infrastructure offer significant future potential but may have low current market share for AkzoNobel. These require significant effort to establish presence, typical of question marks with high R&D investment and market development focus.

AkzoNobel's strategic review of its South Asia decorative paints portfolio in October 2024 places this segment as a 'question mark'. While the broader Asian market is growing, AkzoNobel's specific penetration needs evaluation, indicating a crucial investment decision point.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.