Gallagher SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

Gallagher's robust market presence and diversified service offerings present significant strengths, but understanding their competitive landscape and potential regulatory hurdles is crucial for strategic advantage. What you've seen is just the beginning of a comprehensive deep dive.

Want the full story behind Gallagher's opportunities for expansion and potential weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Gallagher's global presence is a significant strength, with operations spanning roughly 130 countries as of early 2024. This wide reach allows the company to serve a diverse client base and tap into numerous markets, reducing dependence on any single region.

The company's diversified portfolio is another key advantage. Gallagher offers a broad spectrum of services, including property and casualty insurance, employee benefits, specialty coverages, and risk management consulting. This variety caters to a wide range of client needs across different industries, enhancing its resilience.

This diversification helps to smooth out the impact of localized economic downturns and opens up a wider array of growth opportunities. For instance, in 2023, Gallagher reported a 12% increase in revenue, reaching $9.05 billion, showcasing the benefits of its broad operational scope and service offerings.

Gallagher's strength lies in its exceptionally robust acquisition strategy. Since 2002, the company has successfully integrated around 750 acquisitions, a testament to its proven ability to identify and absorb new businesses. This includes significant recent moves like the $13.45 billion acquisition of AssuredPartners and the $1.2 billion purchase of Woodruff Sawyer, highlighting its aggressive yet strategic approach to expansion.

These acquisitions are not just about size; they are a primary engine for Gallagher's growth. By bringing in new companies, Gallagher effectively broadens its geographical footprint, gains access to specialized talent and expertise, and diversifies its client base across various industries. This strategic expansion bolsters its market position and resilience.

Crucially, Gallagher excels at integrating these acquired entities, a capability that directly translates into tangible financial benefits. The company consistently demonstrates effective post-acquisition integration, which fuels strong revenue growth and contributes to impressive margin expansion, showcasing the financial acumen behind its M&A activities.

Gallagher demonstrates remarkable financial resilience, achieving 16 consecutive quarters of double-digit revenue growth up to Q4 2024, a trend that continued into Q1 2025. This consistent financial strength is a key competitive advantage.

The company's core brokerage and risk management segments posted 9% organic revenue growth in Q1 2025, underscoring its ability to expand market share and client base organically. This organic growth fuels sustainable expansion.

Further bolstering its financial performance, Gallagher reported significant increases in both net earnings and adjusted EBITDAC in Q1 2025. These metrics highlight the company's operational effectiveness and its capacity to translate revenue growth into profitability.

Strong Client Relationships and Retention

Gallagher excels in cultivating enduring client connections, a testament to its focus on trust and transparency. This approach is validated by its robust client retention metrics. In 2024, no single client accounted for more than 1% of combined revenues, and the top ten clients represented a mere 3% of total revenue. This significant diversification effectively mitigates revenue concentration risk.

The company’s success in maintaining strong client relationships is further underscored by high satisfaction rates, a critical factor in the insurance and consulting industries. These strong bonds translate directly into impressive client retention, demonstrating Gallagher's ability to consistently meet and exceed client expectations over the long term.

- Minimal Revenue Concentration: In 2024, the top ten clients constituted only 3% of Gallagher's combined revenues, with no single client exceeding 1%.

- High Client Satisfaction: Gallagher consistently achieves high client satisfaction rates, a key driver of its strong retention.

- Industry Trust Factor: The company effectively leverages the industry's emphasis on trust and transparency to foster loyalty.

- Long-Term Relationship Focus: Gallagher's strategy prioritizes building and maintaining deep, long-lasting client partnerships.

Investment in Technology and Data Analytics

Gallagher's commitment to technology and data analytics is a significant strength, evident in its substantial investments. These investments are geared towards building a competitive advantage in the modern insurance market. For instance, the development and rollout of platforms like Gallagher Drive and SmartMarket are central to this strategy.

These technological initiatives empower Gallagher to deliver more personalized client solutions and refine its risk assessment capabilities. By streamlining operations through advanced analytics, the company enhances its overall efficiency and client service, which is crucial in today's fast-paced digital environment.

Gallagher's strategic focus on technology is reflected in its financial performance and market positioning. For example, in 2023, the company reported strong revenue growth, partly attributed to its digital transformation efforts. This focus allows them to adapt quickly to market shifts and client demands.

Key aspects of this strength include:

- Investment in proprietary platforms like Gallagher Drive and SmartMarket.

- Enhanced data analytics capabilities for improved risk assessment and client insights.

- Streamlined operational processes leading to greater efficiency.

- Ability to offer more tailored and competitive insurance solutions.

Gallagher's strong financial performance is a significant strength, marked by consistent revenue growth and profitability. The company achieved 16 consecutive quarters of double-digit revenue growth through Q4 2024, continuing this trend into Q1 2025. This financial resilience is further demonstrated by 9% organic revenue growth in its core brokerage and risk management segments in Q1 2025, alongside substantial increases in net earnings and adjusted EBITDAC.

| Metric | 2023 | Q1 2025 |

|---|---|---|

| Total Revenue | $9.05 billion | N/A (Year-to-date trends positive) |

| Organic Revenue Growth (Brokerage/Risk Mgmt) | N/A | 9% |

| Revenue Growth (Overall) | 12% | Double-digit (Consecutive quarters) |

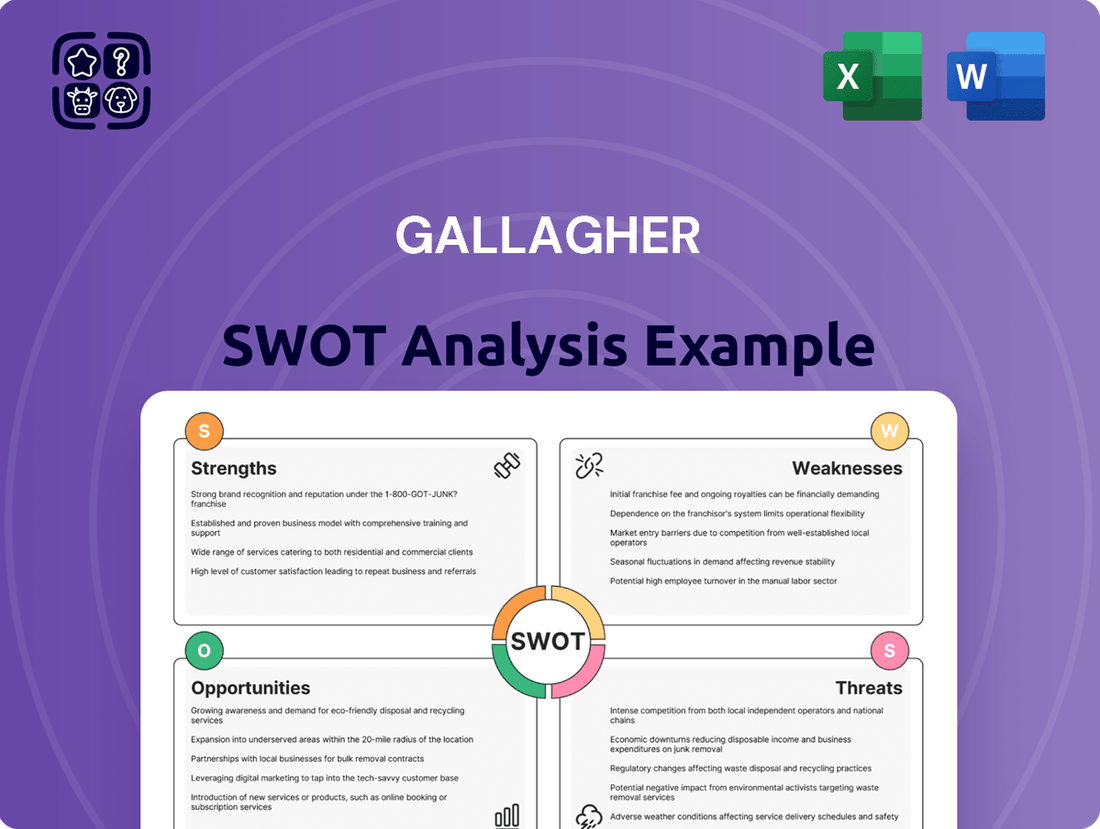

What is included in the product

Analyzes Gallagher’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Streamlines complex SWOT analysis into an easily digestible format, reducing the burden of interpretation and accelerating strategic clarity.

Weaknesses

Gallagher's aggressive acquisition strategy, highlighted by significant deals like the AssuredPartners acquisition, introduces considerable integration risks. Managing the operational complexities of combining numerous distinct entities, each with its own culture, systems, and client relationships, demands immense focus and resources.

The successful assimilation of these diverse businesses is crucial for realizing the projected synergies and preventing potential disruptions to service delivery. Without meticulous planning and execution, the sheer volume of mergers could strain Gallagher's capacity, potentially impacting its operational efficiency and financial performance.

Gallagher's reliance on external insurance markets presents a notable weakness. As a brokerage, its success is directly linked to the health and pricing trends within the insurance industry itself. For instance, while 2024 saw continued strength with renewal premium increases, a future significant downturn or sustained softening in commercial lines pricing could directly dampen Gallagher's organic growth prospects.

Gallagher operates within a fiercely competitive insurance brokerage sector, facing formidable global rivals such as Marsh & McLennan Companies, Aon plc, and Willis Towers Watson. This intense rivalry frequently translates into significant pricing pressures, compelling Gallagher to constantly innovate its service offerings to maintain its market position and client retention.

Regulatory and Compliance Burdens

Gallagher, like all players in the insurance sector, faces significant regulatory and compliance burdens. The landscape is constantly shifting, with new rules emerging around data privacy, the ethical use of artificial intelligence, climate-related disclosures, and market conduct. For instance, the General Data Protection Regulation (GDPR) in Europe, and similar initiatives globally, impose strict requirements on how customer data is handled, impacting operational processes and requiring ongoing investment in compliance infrastructure.

These evolving regulations can translate into increased operational costs and administrative overhead for Gallagher. Navigating and adhering to these complex, often country-specific, legal frameworks demands dedicated resources and expertise.

- Increased operational costs: Compliance with new data privacy laws, like GDPR, necessitates investment in secure data management systems and training, potentially adding millions to operational expenses annually.

- Administrative burden: Keeping pace with evolving market conduct regulations and climate risk reporting requirements demands significant administrative effort and specialized personnel.

- Potential for fines: Non-compliance with global regulatory frameworks can result in substantial financial penalties, impacting profitability and brand reputation.

Cybersecurity Risks

Gallagher, like any firm managing sensitive client information, faces significant cybersecurity risks. In today's interconnected environment, a data breach or cyberattack could result in substantial financial losses, severe reputational damage, and costly regulatory penalties. The increasing sophistication of cyber threats means continuous investment in robust security measures is paramount.

The insurance industry, in particular, is a prime target for cybercriminals due to the volume and sensitivity of data handled. For Gallagher, this translates to a constant need to fortify its digital defenses against potential breaches that could compromise client trust and operational continuity. The financial implications of a successful attack can be staggering, impacting not just direct costs but also long-term business viability.

- Data Breach Impact: A significant data breach could lead to millions in recovery costs, regulatory fines (e.g., GDPR, CCPA), and legal liabilities.

- Reputational Damage: Loss of client trust following a cyber incident can be difficult and expensive to repair, impacting future business.

- Operational Disruption: Cyberattacks can halt business operations, leading to lost revenue and productivity.

- Rising Threat Landscape: The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the scale of the risk.

Gallagher's aggressive acquisition strategy, while a growth driver, introduces significant integration challenges and demands substantial resources to manage diverse operational complexities. The success of assimilating acquired entities is critical for realizing synergies and avoiding service disruptions, posing a risk if not meticulously executed.

The company's dependence on the external insurance market makes it vulnerable to pricing fluctuations and industry downturns, potentially impacting organic growth. Intense competition from major global players necessitates continuous innovation to maintain market share and client retention.

Gallagher faces considerable regulatory and compliance burdens, with evolving rules on data privacy, AI, and climate disclosures increasing operational costs and administrative overhead. Non-compliance carries the risk of substantial financial penalties and reputational damage.

Cybersecurity risks are a significant weakness, as data breaches can lead to massive financial losses, reputational harm, and operational disruption. The escalating global cost of cybercrime, projected to reach $10.5 trillion annually by 2025, underscores the magnitude of this threat.

Same Document Delivered

Gallagher SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Get a look at the actual SWOT analysis file. The entire document will be available immediately after purchase.

Opportunities

Emerging markets, especially in the Asia-Pacific region, offer substantial growth avenues for insurance brokerage. Projections indicate strong revenue expansion in these areas, driven by increasing economic development and a growing middle class.

Gallagher can capitalize on the rising demand for specialized insurance products. This includes policies addressing climate-related risks and cyber threats, which represent lucrative niche markets where the company can expand its service portfolio and client base.

Gallagher can capitalize on the growing integration of AI and advanced analytics within the insurance sector. This presents a prime opportunity to refine risk assessment, making it more precise and predictive, which in turn can lead to better pricing and underwriting. For instance, by leveraging machine learning for claims processing, Gallagher could significantly reduce processing times and costs, potentially improving customer satisfaction. The global AI in insurance market was valued at approximately $1.5 billion in 2023 and is projected to reach over $10 billion by 2030, highlighting the immense growth potential.

The insurance brokerage sector is poised for continued consolidation, presenting Gallagher with ample avenues for growth through strategic mergers and acquisitions. Gallagher's robust M&A pipeline and financial capacity enable it to pursue deals that expand its global reach, broaden its service offerings, and solidify its market leadership.

In 2023, Gallagher completed 39 acquisitions, adding approximately $500 million in annualized revenue, demonstrating its consistent execution of an acquisitive growth strategy. This ongoing activity allows the company to integrate new capabilities and client bases, reinforcing its competitive standing in a dynamic market.

Increasing Demand for Risk Management Consulting

The escalating complexity of global risks, from geopolitical shifts and climate change impacts to intricate supply chain vulnerabilities, is fueling a significant surge in the need for advanced risk management consulting. Gallagher's established proficiency in this domain positions it to capitalize on this trend by offering businesses the guidance needed to safeguard their operations and assets.

This growing market presents a clear opportunity for Gallagher to expand its service offerings and client base. For instance, the global risk management market was valued at approximately $40 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 8% through 2030, indicating substantial room for expansion.

- Expanding client base: Businesses across all sectors are increasingly seeking expert advice to mitigate emerging threats.

- Enhanced service offerings: Gallagher can develop specialized consulting packages addressing current high-priority risks like cyber threats and climate resilience.

- Strategic partnerships: Collaborations with technology providers or data analytics firms can bolster consulting capabilities and market reach.

- Revenue diversification: A stronger focus on consulting can complement existing brokerage services, creating a more robust revenue stream.

Growth in Employee Benefits and Consulting Services

The increasing emphasis on employee wellbeing and the growing complexity of paid leave policies present a significant opportunity for Gallagher to expand its employee benefits and consulting services. By offering holistic solutions that support employees' physical, emotional, career, and financial health, Gallagher can solidify its position as a valuable partner for businesses navigating these evolving demands.

Gallagher's ability to provide comprehensive and adaptable benefits packages is crucial in today's market. For instance, the demand for mental health support within employee benefits has surged, with many companies actively seeking to integrate these services into their offerings. This trend is underscored by reports indicating that a substantial percentage of employees now expect employers to provide mental health resources as part of their benefits package, a figure that has been steadily climbing in recent years, particularly post-2020.

This expansion into broader employee wellbeing consulting allows Gallagher to:

- Develop tailored programs addressing diverse employee needs, from financial wellness to mental health support.

- Assist clients in navigating complex and changing paid leave legislation, ensuring compliance and competitive offerings.

- Enhance client retention and attract new business by demonstrating a deep understanding of current workforce priorities.

- Leverage technology to deliver scalable and personalized benefits administration and consulting.

Gallagher is well-positioned to benefit from the ongoing consolidation within the insurance brokerage industry. The company's consistent execution of its M&A strategy, evidenced by 39 acquisitions in 2023 that added approximately $500 million in annualized revenue, allows it to expand its global footprint and service capabilities.

The increasing demand for specialized insurance, such as coverage for climate-related risks and cyber threats, presents a significant growth opportunity. Gallagher can leverage its expertise to develop and offer tailored solutions in these lucrative niche markets.

The integration of AI and advanced analytics in insurance offers a chance to enhance risk assessment and claims processing. The global AI in insurance market, valued at around $1.5 billion in 2023, is projected to exceed $10 billion by 2030, underscoring the potential for efficiency gains and improved customer service.

The growing need for sophisticated risk management consulting, driven by complex global risks, provides another avenue for expansion. Gallagher's established capabilities in this area allow it to assist businesses in navigating these challenges, tapping into a market valued at approximately $40 billion in 2023.

Threats

Gallagher faces intensifying competition as the insurance brokerage sector undergoes significant consolidation. Major industry players are actively pursuing large-scale acquisitions, a trend that escalated throughout 2024 and is projected to continue into 2025. This consolidation increases the competitive landscape for acquiring talent, securing new clients, and identifying attractive acquisition targets, potentially inflating acquisition costs and challenging Gallagher's ability to maintain its market share.

Global economic uncertainties, particularly persistent inflation and the looming threat of recessionary pressures, pose a significant challenge for Gallagher. These factors can directly curtail client spending on essential insurance and risk management services, impacting revenue streams. For instance, in the first quarter of 2024, while Gallagher reported strong revenue growth, the broader economic climate continues to present headwinds that could temper future demand.

Economic volatility also directly affects Gallagher's investment income, a crucial component of its overall profitability. Fluctuations in market performance and interest rates, common during periods of uncertainty, can create unpredictable swings in earnings. The insurance sector as a whole experienced varied performance in 2023, with some segments showing resilience while others grappled with the impact of rising costs and uncertain investment returns, a trend expected to continue into 2024.

Insurtech startups are rapidly changing the insurance landscape, presenting a significant challenge to established brokerage firms like Gallagher. These agile, digitally-focused companies often leverage advanced technology to offer streamlined customer experiences and innovative products, potentially attracting clients who prioritize convenience and digital interaction. For instance, the global Insurtech market was valued at approximately $11.1 billion in 2023 and is projected to reach $53.2 billion by 2030, indicating a substantial shift towards technology-driven insurance solutions.

This technological disruption threatens to erode market share for traditional players, especially as younger demographics, like millennials and Gen Z, increasingly favor digital-first platforms for their financial needs. These younger consumers, who represent a growing segment of the insurance market, are often drawn to the speed and ease of use offered by Insurtechs, potentially bypassing traditional brokers. Surveys indicate that over 60% of millennials prefer to interact with brands through digital channels, highlighting a clear preference that Insurtechs are well-positioned to meet.

Evolving Regulatory Landscape and Compliance Costs

Gallagher faces significant challenges from an ever-changing regulatory environment. Laws concerning data privacy, the use of artificial intelligence, and market conduct are constantly being updated, requiring continuous adaptation. For instance, the financial services sector, where Gallagher operates, saw increased regulatory scrutiny and compliance burdens throughout 2023 and into 2024, directly impacting operational costs.

Failure to adhere to these evolving regulations can lead to severe consequences, including substantial financial penalties and significant damage to the company's reputation. The escalating costs associated with maintaining compliance, a trend observed in 2023 with many financial institutions reporting higher spending on compliance functions, can directly affect Gallagher's profitability and resource allocation.

- Increased regulatory scrutiny: Financial services firms are subject to evolving rules on data protection, AI usage, and market conduct.

- Risk of non-compliance: Penalties for non-compliance can be substantial, impacting financial performance and brand image.

- Rising compliance costs: Investments in technology and personnel to meet new regulatory demands are growing, as evidenced by industry-wide trends in 2023.

- Impact on profitability: Higher compliance expenditures can reduce net income and require strategic adjustments to maintain margins.

Talent Shortage and Retention Challenges

The insurance sector, including brokerage firms like Gallagher, is grappling with a significant talent shortage. This scarcity of skilled professionals threatens to impede growth and compromise service delivery. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a slower than average growth for insurance underwriters, highlighting a potential bottleneck in specialized roles.

Attracting and keeping the best people is absolutely vital for Gallagher's continued success. A competitive market makes this even tougher. If Gallagher can't secure and hold onto top talent, its ability to operate efficiently and maintain strong client relationships could be seriously affected. This is a key challenge impacting the entire industry.

The implications of not addressing these talent challenges are substantial:

- Operational Strain: A lack of qualified staff can lead to increased workloads for existing employees, potentially causing burnout and reduced productivity.

- Service Quality Degradation: Insufficient staffing levels or inexperience can result in slower response times and less effective client support, damaging Gallagher's reputation.

- Innovation Stagnation: A shortage of skilled individuals may hinder the adoption of new technologies and innovative strategies needed to stay competitive.

- Increased Recruitment Costs: Competition for talent drives up recruitment expenses, impacting the company's bottom line.

Gallagher faces intense competition from industry consolidation, with major players acquiring rivals, a trend that intensified in 2024 and is expected to continue. This makes acquiring talent, clients, and targets more challenging and costly. Global economic uncertainties, including inflation and recession fears, could reduce client spending on insurance and risk management services, impacting Gallagher's revenue. Economic volatility also affects investment income, a key profit driver, as seen in the varied performance across the insurance sector in 2023.

| Threat Category | Description | Impact on Gallagher | Relevant Data/Trend |

| Intensifying Competition | Industry consolidation through acquisitions. | Increased costs for talent, clients, and acquisitions; potential market share erosion. | 2024 saw significant M&A activity in insurance brokerage, projected to continue into 2025. |

| Economic Uncertainties | Inflation, recessionary pressures, market volatility. | Reduced client spending, unpredictable investment income, tempered revenue growth. | Q1 2024 revenue growth reported, but broader economic climate presents headwinds. Insurance sector performance varied in 2023 due to rising costs. |

| Technological Disruption (Insurtech) | Agile, digitally-focused startups offering innovative products and streamlined experiences. | Potential loss of market share, especially among younger demographics favoring digital platforms. | Global Insurtech market valued at ~$11.1 billion in 2023, projected to reach $53.2 billion by 2030. Over 60% of millennials prefer digital brand interactions. |

| Regulatory Environment | Evolving laws on data privacy, AI, and market conduct. | Increased compliance costs, risk of penalties, and reputational damage. | Financial services sector faced heightened regulatory scrutiny and compliance burdens in 2023-2024. Compliance spending increased for financial institutions in 2023. |

| Talent Shortage | Scarcity of skilled insurance professionals. | Impeded growth, compromised service delivery, higher recruitment costs, potential operational strain and innovation stagnation. | U.S. Bureau of Labor Statistics projected slower-than-average growth for insurance underwriters in 2024. |

SWOT Analysis Data Sources

This Gallagher SWOT analysis is built on a foundation of comprehensive data, drawing from official financial filings, in-depth market research reports, and expert industry commentary to provide a robust and actionable strategic overview.