Gallagher PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

Unlock the forces shaping Gallagher's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and market position. Gain a strategic advantage by leveraging these expert insights. Download the full PESTLE analysis now to make informed decisions and drive your own success.

Political factors

Governments globally are actively reshaping insurance regulations. For instance, in 2024, the European Union continued its Solvency II review, aiming to enhance risk management and solvency capital requirements for insurers, impacting Gallagher's European operations.

Gallagher must adapt to these evolving rules, which affect everything from operational costs to the types of insurance products it can offer. Changes in capital requirements, like those seen in the UK's Solvency II reforms which came into effect in 2024, directly influence how Gallagher manages its financial resources.

Political stability is paramount; for example, the ongoing geopolitical tensions in Eastern Europe in 2024 present a clear risk to business continuity and market access for global insurers like Gallagher in affected regions.

Escalating geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, present significant challenges. These events can disrupt global supply chains, as seen with the impact on energy and commodity markets throughout 2024. For Gallagher, this translates to increased demand for specialized insurance, like political risk and trade credit insurance, as clients face heightened uncertainty and potential losses from international trade disruptions.

Trade policies, including the potential for new tariffs or shifts in existing trade agreements, directly influence the economic health of Gallagher's client base. For instance, changes in trade relationships between major economies in 2024 could affect manufacturing, logistics, and export-oriented businesses, altering their insurance requirements. Gallagher needs to stay agile, adapting its offerings to address these evolving client needs and potential revenue stream impacts.

Government healthcare and social policies significantly shape the employee benefits landscape, directly impacting Gallagher's core business. For instance, in the US, the Affordable Care Act (ACA) continues to influence employer-sponsored health insurance mandates and reporting requirements, presenting ongoing opportunities for Gallagher's advisory services. Similarly, shifts in pension regulations, such as changes to contribution limits or defined benefit plan funding rules, necessitate expert guidance for businesses navigating these complex areas.

Political Agendas on Climate and ESG

Governments worldwide are intensifying their focus on climate action and Environmental, Social, and Governance (ESG) principles. This political agenda is directly translating into stricter regulations and heightened public expectations for businesses. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in 2024, mandates extensive ESG disclosures, impacting a significant portion of Gallagher's client base.

These evolving political landscapes create new risk exposures for Gallagher's clients, particularly concerning environmental impact and compliance. Companies face increased scrutiny regarding their carbon emissions, waste management, and supply chain sustainability. This necessitates robust reporting mechanisms and a proactive approach to managing these emerging risks, a core area where Gallagher can provide expertise.

The growing demand for specialized ESG-related risk management and insurance solutions is a direct consequence of these political drivers. Gallagher is well-positioned to capitalize on this trend by developing innovative products and advisory services that help clients navigate complex ESG regulations and mitigate associated risks. The global ESG investing market is projected to reach $33.9 trillion by 2026, underscoring the significant market opportunity.

- Increased Regulatory Burden: New ESG reporting mandates, like those in the EU, require companies to disclose more data on their environmental and social impact.

- Emerging Risk Categories: Climate-related physical risks (e.g., extreme weather) and transition risks (e.g., policy changes) are becoming more prominent for insurers.

- Market Demand for ESG Solutions: A growing number of investors and consumers are demanding that companies demonstrate strong ESG performance, influencing corporate strategy and insurance needs.

- Growth in ESG Insurance Products: Expect to see more specialized insurance offerings covering carbon offsets, green supply chains, and climate-related liabilities.

Data Protection and Cybersecurity Legislation

Governments worldwide are intensifying their focus on data protection and cybersecurity. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar, with ongoing enforcement actions. In 2023 alone, GDPR fines amounted to over €300 million, underscoring the financial implications of non-compliance. New national privacy acts are also emerging, creating a complex web of regulations that companies like Gallagher must navigate.

Gallagher's ability to manage and protect sensitive client data is critical, directly impacting its legal standing and public trust. Failure to adhere to these evolving data protection mandates can result in substantial financial penalties and severe reputational damage. Staying ahead of these legislative changes is not just a matter of compliance but a strategic imperative for business continuity.

Political efforts to bolster national cyber resilience are also influencing the market. These initiatives often translate into increased demand for specialized services such as cyber insurance and risk consulting. As cyber threats become more sophisticated, governmental support for cybersecurity frameworks can create new opportunities for firms offering related solutions.

- GDPR Fines: Over €300 million in GDPR fines were issued in 2023, highlighting the financial risks of data breaches.

- New Privacy Acts: The proliferation of national data protection laws creates a complex compliance landscape.

- Cyber Resilience Initiatives: Government-led efforts to improve cybersecurity are driving demand for related insurance and consulting services.

- Reputational Risk: Non-compliance with data protection laws poses a significant threat to corporate reputation and client trust.

Political stability and government policies significantly influence Gallagher's operating environment, dictating regulatory frameworks and market access. For example, ongoing geopolitical tensions in Eastern Europe in 2024 directly impacted global trade and insurance demand, particularly for political risk coverage.

Shifting trade policies and tariffs, such as those discussed between major economies in 2024, can alter the financial health of Gallagher's client base, necessitating adjustments in product offerings. Furthermore, government mandates on ESG reporting, like the EU's CSRD effective in 2024, are driving demand for specialized insurance solutions.

Data protection regulations, exemplified by the over €300 million in GDPR fines issued in 2023, create significant compliance challenges and reputational risks for Gallagher, underscoring the need for robust cybersecurity measures and adherence to evolving privacy laws.

What is included in the product

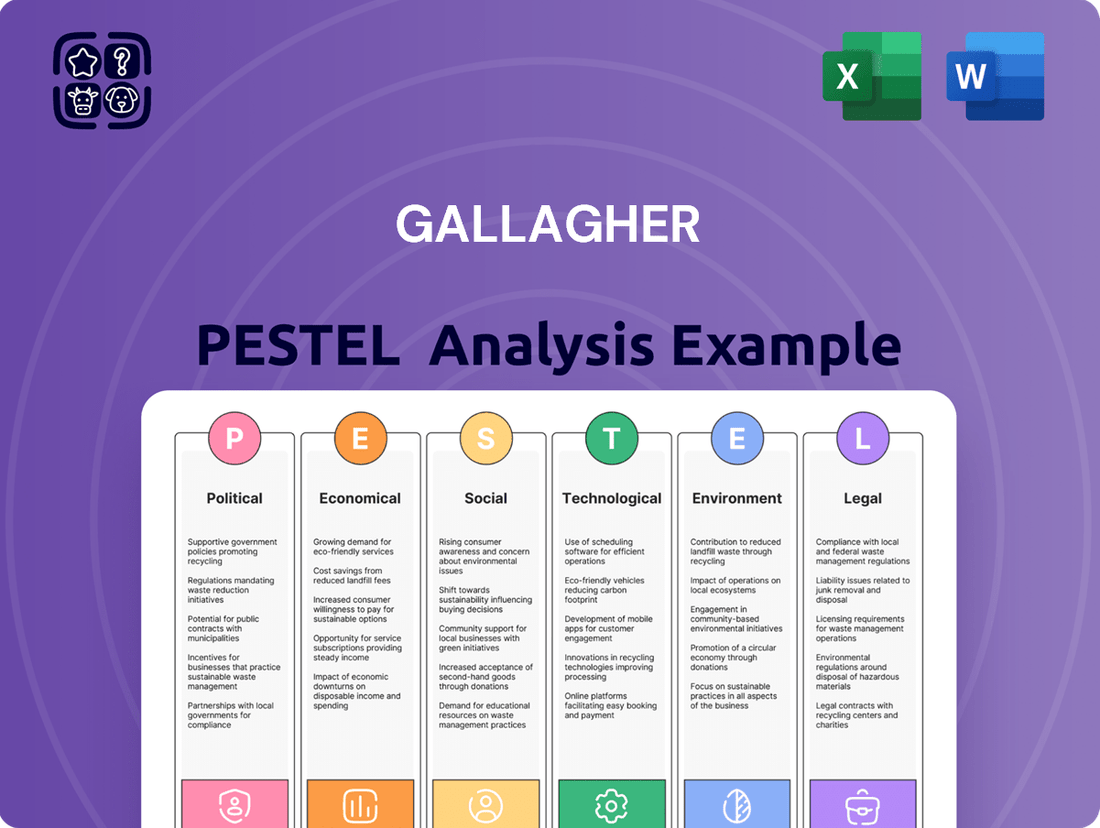

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Gallagher, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Gallagher PESTLE Analysis offers a structured framework to proactively identify and mitigate external threats, thereby reducing uncertainty and potential business disruptions.

Economic factors

Global economic growth projections for 2024 and 2025 indicate a moderate but uneven recovery. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, with a similar outlook for 2025, though regional variations are significant. A slowdown in major economies or persistent inflation could heighten recession risks, directly impacting demand for insurance as businesses scale back operations and consumer spending tightens.

During economic expansions, like the anticipated growth in emerging markets through 2025, Gallagher benefits from increased demand for property, casualty, and specialty insurance as businesses invest and expand. However, a global recession would likely see reduced premium growth and potentially higher claims in lines like credit insurance or business interruption, affecting Gallagher's revenue streams and profitability.

Interest rate changes directly affect Gallagher's investment income from its insurance float. For instance, if the Federal Reserve's benchmark interest rate, which influences many other rates, was around 5.25-5.50% in early 2024, this provides a higher base for investment returns compared to periods with near-zero rates.

Higher interest rates generally boost Gallagher's earnings by increasing the yield on its investment portfolio. This means the money collected from premiums but not yet paid out can generate more income.

Conversely, a sustained period of low interest rates, such as those seen in the years leading up to 2022, would compress these investment returns. In such scenarios, Gallagher would need to rely more heavily on its core insurance operations and fee-based businesses to maintain profitability.

Rising inflation significantly impacts property and casualty insurers like Gallagher by increasing the cost of repairing or replacing damaged assets. For instance, the U.S. Producer Price Index (PPI) for goods used in construction saw a notable increase throughout 2023 and into early 2024, directly affecting claims costs for property damage. This necessitates meticulous underwriting and dynamic pricing strategies to ensure profitability.

While higher inflation can lead to increased premium values, the core challenge lies in managing the gap between escalating claims costs and premium adjustments. For Gallagher, this means closely monitoring economic indicators and adapting their pricing models to reflect the real-time impact of inflation on their claims payouts, a critical economic hurdle for the entire insurance sector.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for Gallagher, a global firm operating across diverse markets. Fluctuations in exchange rates directly impact the translation of international earnings into its reporting currency, affecting reported revenues and overall profitability. For instance, a strengthening US dollar against other currencies could reduce the reported value of Gallagher's overseas earnings when converted back to dollars.

Gallagher's exposure to currency risk is substantial given its widespread international operations. Significant swings in currency values can create unpredictable earnings. For example, if Gallagher generates a substantial portion of its revenue in Euros and the Euro weakens considerably against the US dollar, its reported revenue in US dollars will appear lower, even if the underlying business performance remains stable.

Effective currency risk management is therefore crucial for Gallagher. Strategies such as hedging, utilizing forward contracts, or diversifying currency exposures can help mitigate the impact of adverse exchange rate movements. Gallagher's financial reports often detail its hedging activities and the potential impact of currency fluctuations on its financial performance, aiming to provide transparency to investors.

- Global Operations: Gallagher operates in numerous countries, exposing it to a wide array of currency exchange rates.

- Earnings Translation Impact: Significant currency swings can materially affect the reported value of international revenues and profits.

- Risk Mitigation: Implementing robust currency risk management strategies is essential to stabilize financial results.

- 2024/2025 Outlook: Analysts anticipate continued currency volatility in 2024 and 2025 due to global economic uncertainties, potentially impacting multinational corporations like Gallagher.

Client Industry Economic Health

The economic vitality of the various sectors Gallagher operates within is a direct driver of its business volume. For instance, a slowdown in construction could lead to fewer surety bond placements, while a booming tech industry might spur greater demand for specialized cyber insurance. Gallagher's broad client portfolio offers a buffer against dependence on any single industry, but understanding the economic trajectory of each sector remains crucial.

The performance of key industries directly impacts Gallagher's revenue streams. For example, in 2024, the global construction market, a significant area for insurance and risk management, experienced moderate growth, with projections indicating continued expansion driven by infrastructure spending in many developed economies. Conversely, the technology sector, while robust, faces evolving risks, leading to increased demand for sophisticated coverage like cyber insurance, a segment where Gallagher has seen substantial client engagement.

- Construction Sector Impact: A 3.5% projected global growth for the construction industry in 2024, according to industry reports, suggests sustained demand for surety and construction-related insurance products.

- Technology Sector Growth: The global cybersecurity market is expected to reach over $300 billion by 2025, reflecting the increasing need for cyber liability coverage that Gallagher provides.

- Financial Services Trends: Economic health in financial services, a key client base, is linked to market volatility and regulatory changes, impacting demand for financial institutions insurance.

Global economic growth for 2024 and 2025 is projected to be moderate, with the IMF forecasting 3.2% growth for both years, though regional performance will vary. This growth, particularly in emerging markets, fuels demand for Gallagher's services. However, persistent inflation, as seen in rising construction material costs impacting property claims, requires careful underwriting and pricing adjustments to maintain profitability.

Interest rate levels significantly influence Gallagher's investment income. With the U.S. Federal Reserve's rate around 5.25-5.50% in early 2024, investment yields are more favorable than during periods of near-zero rates, boosting earnings from the company's insurance float.

Currency volatility remains a key economic factor for Gallagher's global operations, with fluctuations impacting the translation of overseas earnings. For instance, a stronger U.S. dollar could reduce the reported value of revenue generated in other currencies, highlighting the need for effective currency risk management strategies like hedging.

The economic health of specific industries directly correlates with demand for Gallagher's specialized insurance products. For example, the construction sector's projected 3.5% global growth in 2024 supports demand for surety bonds, while the rapidly expanding cybersecurity market, expected to exceed $300 billion by 2025, drives the need for cyber liability coverage.

Full Version Awaits

Gallagher PESTLE Analysis

The preview shown here is the exact Gallagher PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive look at the external factors affecting Gallagher.

Sociological factors

Workforce demographics are rapidly shifting, with an aging population, the increasing prevalence of gig economy workers, and a multi-generational workforce all influencing benefit needs. Gallagher needs to adapt its services to meet these diverse demands, offering flexible benefits, wellness programs, and tailored retirement solutions. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that nearly 39% of workers are part of a multi-generational workforce, highlighting the need for varied benefit approaches.

Societal awareness of risks, from climate change impacts and pandemics to cybersecurity threats and geopolitical instability, has surged. For instance, the World Economic Forum's 2024 Global Risks Report highlights that extreme weather events and climate action failure are considered the most severe risks in the next decade, impacting supply chains and operational continuity.

This growing perception of uncertainty directly fuels demand for sophisticated risk management services, data analytics, and robust insurance products. Businesses and individuals are actively seeking ways to mitigate potential losses and build resilience against unforeseen events.

Gallagher is well-positioned to capitalize on this trend by offering specialized consulting and customized solutions. By providing expert guidance, Gallagher can help clients effectively navigate the increasingly complex and interconnected risk landscape, thereby enhancing their security and stability.

Societal expectations for businesses to actively engage in Environmental, Social, and Governance (ESG) initiatives are significantly increasing, directly impacting investment choices, consumer loyalty, and talent acquisition. For instance, a 2024 survey indicated that 70% of investors consider ESG factors when making investment decisions.

Gallagher's clientele are increasingly requesting assistance in embedding ESG principles within their existing risk management frameworks and reporting structures. This growing demand highlights a clear opportunity for Gallagher to expand its advisory offerings and showcase its own dedication to ethical and sustainable business operations.

Health and Wellness Trends and Employee Benefits

A growing societal emphasis on health, mental well-being, and proactive care is reshaping employee health benefits. This means employers are increasingly offering robust wellness programs and mental health resources, going beyond standard medical insurance.

For instance, in 2024, a significant portion of employers are expanding their mental health benefits. A recent survey indicated that 70% of companies planned to increase their investment in mental health support for employees in the coming year, reflecting a direct response to societal trends.

Gallagher's role in this evolving landscape is crucial. As companies aim to meet these shifting employee expectations, Gallagher's proficiency in crafting and negotiating these benefit packages becomes even more vital. Their ability to integrate comprehensive wellness and mental health components ensures employers can attract and retain talent by aligning with these key societal priorities.

- Societal Shift: Increased public awareness and demand for mental health support and preventative care.

- Employer Response: Companies are actively investing in wellness programs and mental health benefits, with a projected 15% increase in spending on these areas by the end of 2025.

- Gallagher's Value: Expertise in designing benefit packages that address these evolving employee needs and societal expectations, enhancing employer attractiveness.

Digital Literacy and Customer Experience Expectations

Societal shifts towards higher digital literacy mean customers now demand intuitive, digital-first interactions with insurance providers like Gallagher. This translates to expectations for robust online portals, mobile apps, and streamlined digital communication for everything from claims to policy management.

Gallagher needs to prioritize investment in user-friendly digital platforms to align with these evolving customer expectations and maintain a competitive edge in a rapidly digitizing insurance landscape. For instance, reports from 2024 indicate that over 70% of insurance consumers prefer digital channels for policy inquiries and claims submission, a figure expected to climb.

- Digital Preference: Over 70% of insurance consumers favor digital channels for policy inquiries and claims, a trend projected to increase.

- Platform Investment: Gallagher must invest in user-friendly digital platforms to meet evolving customer expectations.

- Competitive Edge: Enhanced digital experiences are crucial for remaining competitive in the technologically advancing insurance market.

Societal values are increasingly prioritizing work-life balance and employee well-being, influencing how companies structure benefits and workplace policies. Gallagher must adapt by offering solutions that support flexible work arrangements and comprehensive wellness programs, aligning with these evolving societal norms. For example, a 2024 survey revealed that 65% of employees consider flexible work options a key factor when choosing an employer.

Public perception of corporate responsibility, particularly concerning social impact and ethical practices, is a significant driver of consumer and employee loyalty. Gallagher can leverage this by highlighting its commitment to community engagement and ethical operations, reinforcing its brand image. Data from 2024 shows that 75% of consumers are more likely to support businesses with strong social responsibility initiatives.

The growing emphasis on diversity, equity, and inclusion (DEI) across society necessitates that businesses foster inclusive environments and equitable opportunities. Gallagher's services can support clients in developing DEI strategies and inclusive benefit plans. In 2025, research indicates that companies with strong DEI practices see a 15% higher employee retention rate.

Technological factors

The rapid evolution of data analytics, machine learning, and artificial intelligence presents substantial opportunities for Gallagher. These advancements can significantly enhance underwriting accuracy, streamline claims processing, and refine risk assessment capabilities. For instance, AI-powered predictive analytics, which saw significant investment and development throughout 2024, can lead to more precise risk pricing and faster claims resolution.

By leveraging these technologies, Gallagher can gain deeper insights into client risk profiles, enabling the development of more tailored and effective insurance solutions. In 2025, the industry is seeing a surge in AI adoption for fraud detection in claims, a sector where efficiency gains are paramount.

Cyberattacks are becoming more sophisticated and frequent, posing a major risk to businesses worldwide. This trend makes cybersecurity a critical issue for Gallagher and its clientele, directly increasing the demand for comprehensive cyber insurance and expert cybersecurity consulting. For instance, in 2024, the average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report.

Gallagher, like many organizations, must safeguard its vast data repositories. Simultaneously, the company is tasked with delivering innovative cybersecurity solutions and guidance to assist clients in navigating their cyber risks. The global cybersecurity market is projected to reach $300 billion by 2025, indicating substantial growth opportunities in this sector.

The rise of InsurTech, fueled by technologies like blockchain and IoT, is fundamentally reshaping the insurance industry. These advancements promise to streamline operations and open up new avenues for product development and distribution. For instance, IoT devices are enabling usage-based insurance models, with telematics data from vehicles in 2024 continuing to inform risk assessment and pricing, potentially leading to more personalized premiums.

Gallagher must actively engage with this technological shift. This could involve integrating cutting-edge InsurTech solutions, forging strategic partnerships with innovative startups, or spearheading its own technological development. Failing to adapt risks leaving Gallagher behind in an increasingly efficient and customer-centric market, where early adopters are gaining significant market share.

Automation and Operational Efficiency

Automation technologies, such as Robotic Process Automation (RPA), are poised to significantly boost operational efficiency across Gallagher's diverse service offerings. This includes streamlining policy administration, claims processing, and customer service interactions. For instance, a 2024 report indicated that companies leveraging RPA saw an average cost reduction of 25% in back-office operations.

By automating routine and time-consuming tasks, Gallagher can achieve substantial cost savings and a marked decrease in errors. This also allows skilled employees to dedicate more time to high-value, client-centric activities, thereby improving the overall client experience and fostering stronger relationships. A study from early 2025 found that businesses implementing automation reported a 15% increase in employee satisfaction due to reduced mundane work.

Gallagher's strategic adoption of automation is critical for maintaining a competitive edge. It directly contributes to enhanced productivity and superior service delivery in a rapidly evolving market. The global RPA market was projected to reach over $13 billion in 2024, highlighting the widespread industry investment in these efficiency-driving technologies.

- Cost Reduction: Automation can lower operational expenses by up to 25% in administrative functions, as seen in industry benchmarks from 2024.

- Error Minimization: Automating repetitive tasks reduces human error rates, leading to more accurate data and processes.

- Resource Optimization: Frees up human capital for strategic and client-facing roles, boosting overall organizational effectiveness.

- Enhanced Productivity: Streamlined workflows result in faster processing times and increased output across departments.

Remote Work Technologies and Infrastructure

The shift towards remote and hybrid work, a trend amplified by global events, fundamentally depends on advanced technological infrastructure. Gallagher, in line with many international businesses, leverages these technologies to ensure seamless connectivity and effective collaboration among its geographically dispersed employees.

This evolving work landscape directly influences the demand for specific employee benefits and risk management solutions. Clients are increasingly seeking coverage for remote work liabilities and enhanced cybersecurity measures to protect against new digital threats. For instance, the adoption of cloud-based collaboration tools surged, with global cloud spending projected to reach $600 billion in 2024, according to Gartner, highlighting the critical role of technology in enabling these new work models.

- Increased reliance on cloud computing and collaboration platforms: Essential for maintaining productivity in distributed teams.

- Growing demand for cybersecurity solutions: Protecting sensitive data accessed remotely is paramount.

- Evolving employee benefits needs: Including support for home office setups and digital wellness programs.

- Impact on insurance product development: Gallagher is adapting offerings to address new risks associated with remote work, such as cyber insurance for small businesses and liability coverage for home-based employees.

Technological advancements, particularly in AI and data analytics, are reshaping Gallagher's operational efficiency and risk assessment capabilities. The increasing sophistication of cyber threats, exemplified by the $4.45 million average cost of a data breach in 2024, directly fuels demand for cyber insurance and consulting services. InsurTech innovations, like IoT-enabled usage-based insurance, are creating new product opportunities and more personalized client offerings.

Automation, especially RPA, offers significant cost reductions, with some companies seeing up to 25% savings in back-office operations in 2024. The widespread adoption of cloud computing, with global spending projected at $600 billion in 2024, underpins the shift to remote work, necessitating robust cybersecurity and adaptable insurance solutions for new digital risks.

| Technological Trend | Impact on Gallagher | Relevant Data (2024/2025) |

| AI & Machine Learning | Enhanced underwriting, claims processing, risk assessment | AI adoption for fraud detection surging in 2025; AI-powered analytics improve risk pricing. |

| Cybersecurity | Increased demand for cyber insurance and consulting | Average data breach cost: $4.45 million (2024); Global cybersecurity market projected to reach $300 billion by 2025. |

| InsurTech (IoT, Blockchain) | Streamlined operations, new product development (e.g., usage-based insurance) | IoT telematics data informing risk assessment and pricing in 2024. |

| Automation (RPA) | Boosted operational efficiency, cost reduction | RPA can reduce back-office costs by up to 25% (2024); 15% increase in employee satisfaction from reduced mundane work (early 2025). |

| Remote Work Technologies | Enabling distributed workforce, driving demand for related insurance | Global cloud spending: $600 billion (2024); Increased demand for cyber insurance for small businesses. |

Legal factors

Gallagher navigates a complex global insurance regulatory landscape, with rules differing significantly across nations and territories. These regulations cover crucial areas like licensing, capital reserves, market conduct, and safeguarding consumers. For instance, in 2024, the European Union continued to refine Solvency II directives, impacting capital requirements for insurers operating within the bloc, a key consideration for Gallagher's European operations.

Maintaining compliance across these diverse jurisdictions is an ongoing and demanding task, necessitating substantial investment in legal and compliance expertise. Gallagher's commitment to adhering to these varied frameworks, such as the UK's Financial Conduct Authority (FCA) rules and the US's state-specific insurance departments, underscores the operational complexity.

The company's global footprint means it must constantly adapt to evolving legal requirements, including data privacy laws like GDPR and its international equivalents, which significantly influence how customer data is handled. This continuous adaptation is vital to avoid penalties and maintain market trust.

Gallagher must navigate a complex web of data privacy and security laws globally. Regulations like the GDPR, which came into full effect in 2018 and has seen significant enforcement actions, and the CCPA, enacted in 2020, mandate stringent controls over client data. Failure to comply can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is greater. This necessitates ongoing investment in robust data protection measures and continuous adaptation to new legal frameworks, such as the anticipated CPRA amendments in California and potential federal privacy legislation in the US.

Gallagher, as a global insurance brokerage and risk management leader, navigates a complex web of anti-trust and competition laws across numerous countries. These regulations are designed to prevent monopolistic practices and foster a level playing field, impacting everything from market share to pricing strategies.

Significant mergers and acquisitions, a common growth strategy in the financial services sector, face intense scrutiny under these laws. For instance, the European Commission's Directorate-General for Competition actively reviews transactions that could substantially lessen competition. Gallagher's M&A activities must therefore demonstrate a clear lack of anti-competitive effects to gain regulatory approval.

In 2024, regulators globally have shown increased vigilance. The US Federal Trade Commission (FTC) has been particularly active in challenging mergers, with a stated goal of protecting consumers from higher prices and reduced choice. This heightened enforcement environment means Gallagher must meticulously assess the competitive implications of any potential acquisitions to ensure compliance.

Employment and Labor Laws

Gallagher's global operations necessitate adherence to a complex web of employment and labor laws across numerous jurisdictions. These regulations cover critical areas such as recruitment practices, dismissal procedures, minimum wage requirements, workplace safety standards, and anti-discrimination statutes. For instance, in 2024, the International Labour Organization (ILO) reported that over 100 countries have ratified conventions concerning fundamental labor rights, highlighting the pervasive nature of these legal frameworks.

Navigating these varying legal landscapes directly influences Gallagher's human resource strategies, employee engagement initiatives, and overall operational expenditures. Failure to comply can lead to significant penalties, reputational damage, and disruptions to business continuity. For example, in 2023, companies faced an average of $1.5 million in fines for violations of wage and hour laws in the United States alone, according to the Department of Labor.

- Global Compliance Burden: Gallagher must manage compliance with diverse national labor laws affecting hiring, compensation, and working conditions.

- Varying Legal Frameworks: Differences in employment legislation by country impact HR policies, employee relations, and operational costs.

- Talent Management Impact: Staying current with evolving labor laws is essential for effective global talent acquisition and retention.

- Risk Mitigation: Proactive legal monitoring helps Gallagher avoid costly penalties and maintain a positive employer brand.

Contract Law and Professional Liability

Contract law forms the bedrock of Gallagher's client and insurer relationships, dictating the terms of service and risk transfer. In 2024, the global insurance market, a key sector for Gallagher, saw continued evolution in contractual clauses related to cyber risk and climate change, demanding meticulous legal review of all agreements.

As a professional services firm, Gallagher is inherently exposed to professional liability. This includes risks associated with advice given to clients and the management of insurance policies. The 2024 regulatory landscape, particularly in the UK and US, has seen increased scrutiny on advisory services, emphasizing the need for stringent error and omission (E&O) management and adequate professional indemnity insurance, which Gallagher actively maintains.

- Contractual Foundation: Gallagher's core business relies on legally sound contracts with clients and insurance carriers, governing everything from brokerage agreements to claims handling.

- Professional Negligence: The firm's advisory role exposes it to potential claims of professional negligence, necessitating robust internal controls and compliance.

- E&O Insurance: Adequate Errors and Omissions insurance is critical to mitigate financial losses arising from alleged mistakes or oversights in professional services.

- Regulatory Compliance: Adherence to evolving legal frameworks governing insurance and financial advisory services is paramount to avoid penalties and maintain client trust.

Gallagher operates within a stringent regulatory environment, demanding meticulous adherence to laws governing financial services, data privacy, and competition. The company must navigate varying legal frameworks across its global operations, ensuring compliance with directives like the EU's Solvency II and the US's state-specific insurance regulations.

In 2024, increased regulatory scrutiny on mergers and acquisitions, particularly by bodies like the US Federal Trade Commission, necessitates careful assessment of competitive impacts for Gallagher's growth strategies. Furthermore, evolving data privacy laws, such as GDPR and its global counterparts, require continuous investment in robust data protection measures to avoid substantial penalties.

Employment laws also present a significant legal challenge, with over 100 countries ratifying ILO conventions on labor rights in 2024, impacting Gallagher's HR policies and operational costs. The firm's reliance on contracts and its role as an advisor expose it to professional liability risks, underscoring the importance of Errors and Omissions insurance and strict compliance.

| Legal Area | Key Considerations for Gallagher | 2024/2025 Relevance |

|---|---|---|

| Regulatory Compliance | Adherence to diverse national insurance and financial services laws (e.g., Solvency II, state-specific US regulations). | Ongoing refinement of EU directives and continued state-level regulatory focus in the US. |

| Data Privacy | Compliance with GDPR, CCPA, and other global privacy mandates. | Continued enforcement actions and potential new federal privacy legislation in the US. |

| Antitrust & Competition | Scrutiny of M&A activities to prevent anti-competitive practices. | Increased FTC challenges to mergers in the US; active review by the European Commission. |

| Employment Law | Compliance with diverse labor laws regarding hiring, compensation, and workplace safety. | Global ratification of ILO conventions highlights pervasive legal frameworks impacting HR. |

| Contract & Professional Liability | Ensuring sound contracts and managing risks of professional negligence. | Increased scrutiny on advisory services; critical need for E&O insurance and compliance. |

Environmental factors

The escalating frequency and intensity of climate-related disasters like hurricanes, floods, and wildfires are significantly reshaping the property and casualty insurance landscape. These events are driving up claims expenses for insurers, which in turn can translate to increased premiums for policyholders.

Gallagher's role is crucial in guiding clients through these intensifying environmental risks. This involves not only advising on securing adequate insurance coverage but also developing effective mitigation strategies to lessen potential losses.

For instance, in 2023, insured losses from natural catastrophes globally reached an estimated $110 billion, according to Swiss Re. This figure underscores the growing financial burden and the critical need for expert risk management advice.

The global imperative for companies to disclose their Environmental, Social, and Governance (ESG) performance is intensifying, with a particular focus on environmental factors like carbon footprints and climate-related financial risks. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, widely adopted globally, aim to standardize this reporting. This regulatory evolution directly impacts Gallagher's clientele, who are increasingly seeking expert guidance to navigate these complex disclosure mandates and effectively manage their environmental liabilities.

Resource scarcity, such as dwindling water supplies and the depletion of critical minerals, poses a significant threat to global supply chains. For instance, the World Economic Forum's 2024 Global Risks Report highlighted water crises as a top global risk, impacting industries from agriculture to manufacturing. This scarcity directly increases operational costs and can lead to unforeseen disruptions.

Gallagher's clients, particularly those in sectors reliant on raw materials, are increasingly vulnerable to these environmental shifts. The unpredictability of resource availability creates new avenues for business interruption and contingent business interruption claims, as the failure of a single supplier due to resource constraints can ripple through an entire value chain.

Gallagher actively assists these clients by providing expertise in risk assessment and developing tailored insurance solutions. This includes helping businesses understand their exposure to environmental supply chain vulnerabilities and securing coverage that addresses these emerging threats, thereby enhancing their resilience in a changing climate.

Pollution and Environmental Liability

Stricter environmental regulations are increasingly exposing businesses to liabilities related to pollution and ecological damage. For instance, the U.S. Environmental Protection Agency (EPA) continues to enforce the Clean Air Act and Clean Water Act, with significant penalties for non-compliance. In 2023 alone, the EPA reported over $200 million in penalties for environmental violations, highlighting the financial risks companies face.

Gallagher addresses these evolving exposures by offering specialized environmental liability insurance and consulting services. This support helps businesses navigate the complexities of pollution control and remediation costs, which are directly influenced by the dynamic legal and regulatory environment. The demand for such coverages is growing as environmental accountability intensifies globally.

Key aspects of this risk management include:

- Increased Regulatory Scrutiny: Governments worldwide are tightening pollution standards, leading to higher compliance costs and potential fines.

- Growing Remediation Expenses: The cost to clean up contaminated sites can be substantial, with Superfund sites in the US often costing millions for remediation.

- Demand for Specialized Insurance: Environmental liability insurance is becoming crucial for protecting against unforeseen cleanup costs and legal claims.

- Gallagher's Risk Mitigation Role: Providing tailored insurance solutions and expert advice to manage these complex environmental risks.

Sustainable Business Practices and Reputational Risk

Societal and investor expectations for businesses to embrace sustainability are growing. For instance, in 2024, a significant majority of consumers indicated they would switch brands if a competitor offered more sustainable options. This trend directly impacts a company's image and market standing.

Failure to show genuine commitment to environmental responsibility can lead to severe reputational harm. This can manifest as consumer boycotts, negative media attention, and even a loss of investor confidence, as seen in instances where companies faced divestment due to poor environmental, social, and governance (ESG) scores in late 2023 and early 2024.

Gallagher, as a business and a risk advisor, must actively manage these evolving demands. Internally, this means fostering a culture of sustainability. Externally, it involves advising clients on strategies to mitigate environmental reputational risks, ensuring they are prepared for increasing scrutiny.

Key considerations for managing environmental reputational risk include:

- Transparent Reporting: Clearly communicating environmental performance metrics and initiatives.

- Supply Chain Management: Ensuring sustainability throughout the value chain.

- Stakeholder Engagement: Actively listening to and addressing concerns from customers, investors, and communities.

- Proactive Risk Mitigation: Developing strategies to prevent and respond to environmental crises.

The increasing frequency of extreme weather events, such as the record-breaking heatwaves and widespread flooding experienced in various regions during 2024, directly impacts insurance claims and necessitates robust risk management. Global insured losses from natural catastrophes were projected to remain elevated in 2024, following the substantial $110 billion in 2023, as reported by Swiss Re, highlighting the growing financial burden on businesses and individuals.

Gallagher plays a pivotal role in helping clients navigate these environmental shifts, offering guidance on adequate coverage and proactive mitigation strategies to reduce potential losses from climate-related events.

The push for enhanced environmental disclosures, including carbon footprint reporting and climate risk assessments, is intensifying. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024, mandates extensive environmental data for a broad range of companies, increasing the need for expert advice on compliance and liability management.

Gallagher assists clients in meeting these evolving disclosure requirements and managing their environmental liabilities effectively.

| Environmental Factor | Impact on Businesses | Gallagher's Role | Relevant Data/Trend (2023-2024) |

|---|---|---|---|

| Climate Change & Extreme Weather | Increased claims, operational disruptions, supply chain vulnerability | Risk assessment, insurance placement, mitigation advice | Global insured catastrophe losses estimated at $110 billion in 2023; continued elevated risk in 2024. |

| Environmental Regulations & Compliance | Higher compliance costs, potential fines, remediation liabilities | Specialized environmental liability insurance, consulting on pollution control | EPA penalties for environmental violations exceeded $200 million in 2023; CSRD mandates increased disclosure. |

| Resource Scarcity | Increased operational costs, supply chain disruptions | Supply chain risk assessment, contingent business interruption coverage | Water crises identified as a top global risk by the World Economic Forum in 2024. |

| Societal & Investor Expectations (ESG) | Reputational damage, loss of investor confidence | Reputational risk mitigation strategies, stakeholder engagement advice | Majority of consumers in 2024 indicated willingness to switch to sustainable brands. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a comprehensive blend of data, including official government publications, reports from international organizations like the IMF and World Bank, and leading market research firms. This ensures that each aspect of the macro-environment is thoroughly examined with credible, up-to-date information.