Gallagher Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

Discover the core components of Gallagher's success with a comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. It's an essential tool for anyone aiming to understand and replicate strategic excellence.

Partnerships

Gallagher’s key partnerships with insurance carriers and underwriters are foundational to its business model, enabling access to a vast array of insurance products. These relationships are vital for securing competitive pricing and ensuring clients receive comprehensive coverage tailored to their specific, often complex, risk profiles across numerous industries.

In 2024, Gallagher continued to leverage its extensive network of over 500 insurance carriers worldwide. This broad access allows the company to effectively place a wide spectrum of risks, from standard property and casualty to highly specialized coverages, thereby providing clients with an unparalleled breadth of options and expert guidance in navigating the insurance marketplace.

Gallagher's strategic alliances with technology providers are crucial for boosting operational efficiency and client service. These collaborations allow for the integration of cutting-edge analytics, digital client access points, and sophisticated risk management solutions. For instance, in 2023, Gallagher continued to invest in digital transformation, aiming to leverage AI and data analytics to personalize client experiences and streamline claims processing, a trend expected to accelerate in 2024.

Gallagher actively engages with key industry associations, such as the Council of Insurance Agents & Brokers (CIAB) and the National Association of Surety Bond Producers (NASBP). This engagement ensures Gallagher remains informed about evolving market dynamics and crucial regulatory shifts impacting the insurance and risk management sectors. For instance, in 2024, these associations were instrumental in advocating for clarity on new data privacy regulations affecting financial services.

These vital partnerships facilitate thought leadership and provide a platform for advocating on behalf of clients' interests. Through active participation in association committees and events, Gallagher contributes to shaping industry best practices and fostering a more favorable operating environment for its clientele. This strategic involvement reinforces Gallagher's reputation as a well-informed and influential player in the market.

Acquired Companies/Brokerages

Gallagher's growth engine heavily relies on acquiring complementary insurance brokerages and consulting firms. This strategic approach allows them to rapidly expand their client base, integrate specialized knowledge, and broaden their operational footprint across new regions. In 2024, Gallagher continued this trend, with numerous acquisitions contributing to their robust financial performance.

These integrations are key to enhancing Gallagher's market position and diversifying its service portfolio. By bringing acquired entities into the fold, Gallagher strengthens its ability to offer a comprehensive suite of insurance and risk management solutions. The company's consistent investment in M&A underscores its commitment to organic and inorganic expansion.

- Acquisition-driven growth: A core element of Gallagher's business model is the strategic acquisition of insurance brokerages and consulting firms.

- Market expansion: These acquisitions are instrumental in gaining access to new client segments and extending geographic reach.

- Expertise integration: Acquired firms bring specialized knowledge and talent, enriching Gallagher's overall service capabilities.

- 2024 activity: Gallagher actively pursued acquisition opportunities throughout 2024, bolstering its market presence and revenue streams.

Legal and Regulatory Advisors

Gallagher’s reliance on legal and regulatory advisors is critical for navigating the intricate compliance demands of the global insurance and risk management sectors. These partnerships are foundational to ensuring Gallagher’s operations align with all applicable legal frameworks and industry best practices.

These advisors are instrumental in maintaining Gallagher’s adherence to evolving regulatory landscapes, which is particularly crucial given the company's extensive international presence. For instance, in 2023, the insurance industry faced increased scrutiny regarding data privacy and consumer protection, necessitating robust legal counsel.

- Navigating Global Compliance: Expert legal guidance ensures adherence to diverse international regulations, preventing costly penalties and operational disruptions.

- Risk Mitigation: Proactive legal counsel helps identify and address potential legal liabilities for both Gallagher and its clientele.

- Client Advisory: Providing clients with accurate and up-to-date information on regulatory changes empowers them to make informed decisions.

- Industry Standards: Collaborations with advisors help uphold the highest industry standards, reinforcing Gallagher’s reputation for integrity and reliability.

Gallagher's key partnerships extend to technology providers, crucial for enhancing operational efficiency and client engagement. These collaborations enable the integration of advanced analytics and digital platforms, streamlining services and improving customer experiences. For example, in 2024, Gallagher continued to invest in digital transformation initiatives, focusing on AI and data analytics to personalize client interactions and optimize claims processing.

| Partnership Type | Description | 2024 Focus/Impact |

| Insurance Carriers & Underwriters | Access to diverse insurance products and competitive pricing. | Leveraged network of over 500 carriers globally for broad risk placement. |

| Technology Providers | Integration of analytics, digital client access, and risk management solutions. | Continued investment in AI and data analytics for personalized client experiences and streamlined operations. |

| Industry Associations | Staying informed on market dynamics, regulatory shifts, and advocating for client interests. | Active participation in groups like CIAB and NASBP to influence industry best practices and navigate regulatory changes. |

| Acquired Firms | Expansion of client base, specialized knowledge, and operational footprint. | Numerous acquisitions in 2024 contributed to revenue growth and broadened service capabilities. |

| Legal & Regulatory Advisors | Ensuring compliance with global regulations and mitigating legal risks. | Crucial for navigating complex international data privacy and consumer protection laws. |

What is included in the product

A structured framework detailing Gallagher's customer segments, value propositions, and revenue streams, offering a clear roadmap for strategic execution.

The Gallagher Business Model Canvas offers a structured approach to pinpoint and address operational inefficiencies, acting as a powerful pain point reliver.

Activities

Gallagher's core activity is assessing client insurance needs and placing policies. This involves negotiating terms with insurance carriers across property & casualty, employee benefits, and specialty lines. In 2024, Gallagher continued to leverage its extensive market access and expertise to secure optimal coverage, ensuring clients were adequately protected against diverse risks.

Gallagher's risk management consulting is a core activity, focusing on helping businesses pinpoint, evaluate, and lessen their potential threats. This involves crafting detailed risk management plans and carrying out thorough assessments. For instance, in 2024, many companies are prioritizing cybersecurity risk assessments due to the increasing frequency of data breaches.

The firm actively develops strategies for mitigation and ongoing monitoring, aiming to build stronger organizational resilience. This often includes implementing robust loss prevention programs tailored to specific industry needs, such as those designed to reduce workplace accidents in manufacturing sectors.

Gallagher's claims administration is a core activity, focusing on managing the entire claims lifecycle for clients. This includes everything from the initial report of a loss to the final settlement, ensuring a smooth and efficient process.

The service actively advocates for clients' interests when dealing with insurers, aiming to streamline claims handling and offer crucial support during difficult periods. In 2024, the insurance industry saw a significant increase in claims complexity, making expert administration vital for policyholders.

Effective claims administration by Gallagher is designed to help clients achieve a quicker and more successful recovery. For instance, robust claims management can reduce the average claims settlement time, a key metric for client satisfaction and operational efficiency.

Client Advisory and Service

Client advisory and service is a core, ongoing activity for Gallagher, focusing on nurturing robust client relationships. This involves consistent communication, thorough policy reviews, and providing timely market insights to address ever-changing client requirements. Exceptional service is the bedrock of client loyalty and overall satisfaction.

This dedication to client needs directly impacts retention. For instance, in 2024, industries with high client engagement, like specialized insurance broking, often see retention rates exceeding 90% when proactive advisory is a consistent offering. Gallagher’s approach ensures clients feel supported and valued, leading to long-term partnerships.

Key aspects of this activity include:

- Proactive Engagement: Regularly reaching out to clients with relevant updates and potential solutions.

- Personalized Advice: Tailoring recommendations based on individual client circumstances and risk profiles.

- Responsive Support: Ensuring prompt and effective resolution of client inquiries and issues.

- Market Expertise: Sharing insights on market trends and regulatory changes that could affect clients.

Mergers and Acquisitions

Gallagher’s growth engine heavily relies on strategic mergers and acquisitions (M&A). In 2023 alone, the company completed 29 acquisitions, a testament to its aggressive expansion strategy. These deals are crucial for broadening its global reach and enhancing its service offerings in brokerage and consulting.

The integration of these acquired businesses is paramount. Gallagher's success hinges on its ability to seamlessly absorb new operations, talent, and client bases to unlock the full potential of each transaction. This focus on integration ensures that the value generated from M&A translates into tangible benefits for the company and its stakeholders.

- Geographic Expansion: Acquiring firms in new territories allows Gallagher to serve a wider international client base.

- Service Enhancement: M&A brings specialized expertise and new service lines, strengthening Gallagher's overall value proposition.

- Client Portfolio Growth: Integrating acquired firms expands Gallagher's customer base and revenue streams.

- Synergy Realization: Effective integration is key to achieving cost savings and operational efficiencies from acquisitions.

Gallagher's key activities revolve around its core brokerage and risk management services. This includes sourcing and placing insurance policies, providing expert advice on risk mitigation, and managing claims efficiently for clients. In 2024, the company continued to focus on expanding its global footprint and enhancing its specialized service offerings through strategic acquisitions.

The company's M&A strategy is a critical activity, aimed at both geographic expansion and service line enhancement. By acquiring complementary businesses, Gallagher broadens its market access and strengthens its expertise in areas like employee benefits and specialty insurance. This approach was evident in 2023, with Gallagher completing 29 acquisitions to fuel its growth.

Client advisory and service form another vital activity, emphasizing strong relationships and tailored solutions. Gallagher's proactive engagement and responsive support are designed to ensure high client retention, a key indicator of its success in the market.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Insurance Brokerage & Placement | Assessing client needs and securing insurance policies from carriers. | Continued focus on market access and negotiation for optimal coverage in 2024. |

| Risk Management Consulting | Identifying, evaluating, and mitigating client risks. | Increased demand for cybersecurity risk assessments in 2024. |

| Claims Administration | Managing the entire claims process from reporting to settlement. | Expert handling crucial due to increased claims complexity in 2024. |

| Client Advisory & Service | Building and maintaining strong client relationships through communication and insights. | High client engagement leads to retention rates exceeding 90% in specialized broking. |

| Mergers & Acquisitions (M&A) | Acquiring businesses to expand geographic reach and service offerings. | 29 acquisitions completed in 2023, highlighting aggressive expansion. |

Preview Before You Purchase

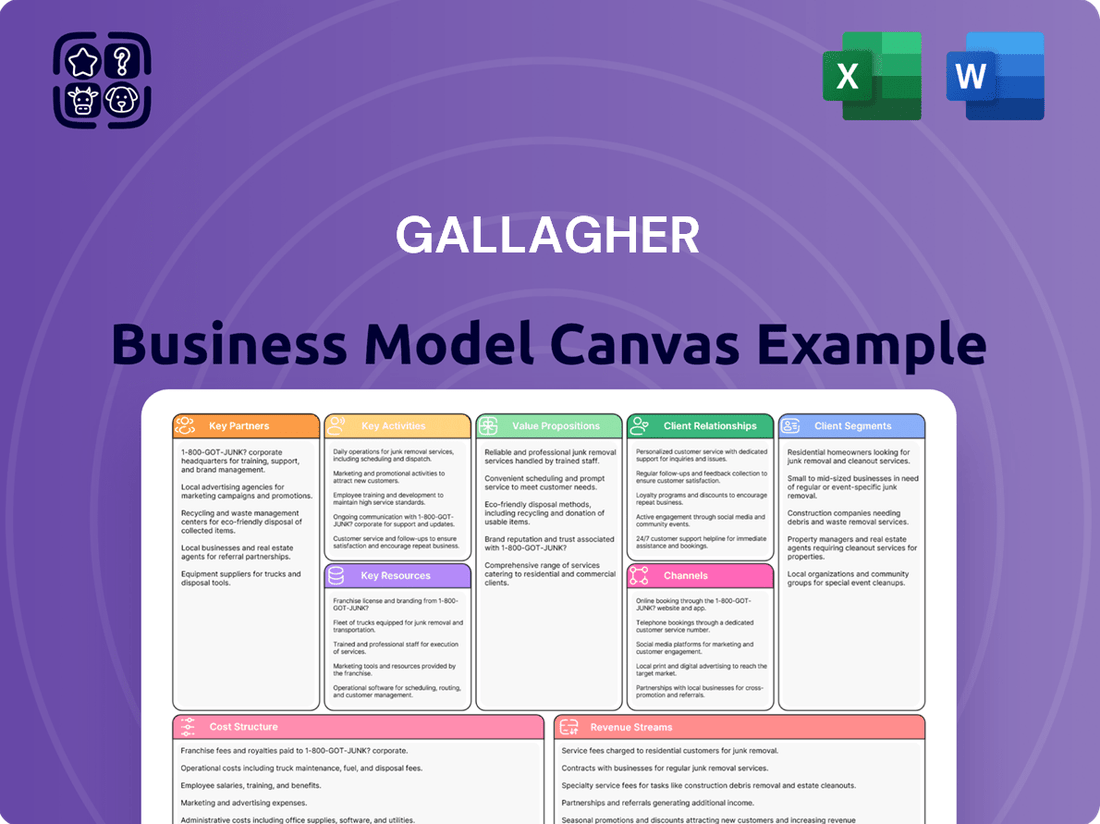

Business Model Canvas

The Gallagher Business Model Canvas preview you're viewing is the exact document you'll receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this ready-to-use, comprehensive Business Model Canvas.

Resources

Gallagher's most crucial asset is its team of experts, encompassing skilled insurance brokers, insightful risk management consultants, precise actuaries, and dedicated claims specialists. This deep well of industry knowledge and technical proficiency is the bedrock of their client service.

The firm's commitment to nurturing this talent through robust acquisition and development programs is paramount to maintaining its competitive edge and delivering exceptional value. For instance, Gallagher consistently invests in continuing education and certifications for its professionals, ensuring they remain at the forefront of industry best practices and regulatory changes.

Gallagher's global network is a cornerstone of its business model, boasting over 130 offices across the United States alone, as of early 2024. This extensive footprint allows them to serve a broad client base, from local businesses to large multinational corporations.

This vast presence, spanning numerous countries, is crucial for delivering localized service while tapping into global expertise. It enables Gallagher to offer seamless cross-border solutions, a significant advantage for clients operating internationally.

By having operations in diverse markets, Gallagher can better understand and cater to the unique needs of each region. This localized approach, combined with their global capabilities, strengthens their ability to provide tailored insurance and risk management services.

Gallagher's proprietary data and analytics platforms are central to its business model, offering clients advanced insights. These platforms utilize sophisticated technology to provide data-driven analysis of risk profiles and insurance programs.

These capabilities facilitate advanced risk modeling, allowing for precise benchmarking and predictive analytics. For instance, Gallagher's investment in these areas aims to enhance the accuracy of risk assessments, a critical factor in optimizing insurance program design.

By leveraging these data resources, clients can make more informed decisions regarding their insurance spend. This data-driven approach helps clients understand their exposures better and identify opportunities for cost savings and improved coverage, a key differentiator in the market.

Brand Reputation and Trust

Gallagher's brand reputation, built on decades of integrity and expertise, is a cornerstone of its business model. This long-standing trust with clients and insurance carriers is a critical intangible asset in the relationship-focused insurance sector. For instance, in 2023, Gallagher's client retention rate remained exceptionally high, a direct testament to this deeply ingrained trust.

This strong brand equity directly fuels business growth by attracting new clients and ensuring the loyalty of existing ones. The company’s consistent focus on client advocacy, a key differentiator, further solidifies its market position. Gallagher's commitment to its values has been a driving force, contributing to its sustained performance and market recognition.

- Reputation for Integrity: Gallagher’s long history fosters a perception of reliability and ethical conduct.

- Client Advocacy: The company actively champions client interests, building strong, trust-based relationships.

- Industry Expertise: Decades of experience translate into deep knowledge, valued by clients and partners.

- Carrier Relationships: Trust with insurance carriers facilitates better terms and access to specialized markets for clients.

Financial Capital

Gallagher's financial capital is the bedrock of its business, enabling it to fund day-to-day operations and invest in future growth. This capital is crucial for staying competitive, particularly in areas like technology upgrades and the pursuit of strategic acquisitions that expand its market reach and service offerings. For instance, Gallagher's robust financial health in 2024 allows it to continue making significant investments in digital transformation initiatives, aiming to enhance client experience and operational efficiency.

A strong financial position provides Gallagher with the stability needed to navigate economic uncertainties and market volatility. This stability is key to maintaining client trust and ensuring consistent service delivery. In 2024, Gallagher demonstrated this resilience, with its diversified revenue streams and prudent financial management contributing to a solid performance despite broader economic headwinds.

Access to capital markets is a vital enabler for Gallagher's expansion strategies. This allows the company to raise funds for significant growth opportunities, including new market entries and the integration of acquired businesses. Gallagher's ability to tap into these markets effectively in 2024 has been instrumental in its ongoing global expansion efforts and its capacity to seize strategic opportunities.

- Operational Funding: Gallagher utilizes its financial capital to cover essential operating expenses, ensuring seamless service delivery to clients.

- Investment in Technology: Significant capital allocation is directed towards technological advancements to enhance efficiency and client engagement.

- Strategic Acquisitions: Financial resources are deployed to acquire complementary businesses, driving market share growth and service diversification.

- Market Access: Gallagher leverages its financial strength to access capital markets for funding expansion initiatives and maintaining regulatory compliance.

Gallagher's key resources are its people, global network, proprietary data, strong brand, and financial capital. These elements collectively enable the firm to deliver specialized insurance and risk management solutions to a diverse clientele.

Value Propositions

Gallagher provides a complete suite of risk management services, combining insurance brokerage, expert consulting, and efficient claims handling. This integrated approach ensures clients receive a unified solution for their diverse risk exposures, covering everything from physical assets and liability to employee well-being and niche insurance needs.

This comprehensive strategy simplifies risk management for clients, offering a single, knowledgeable point of contact for all their complex insurance and risk-related requirements. For instance, Gallagher’s 2024 performance, with reported revenue of $9.5 billion, underscores their capacity to manage and deliver these broad-ranging solutions effectively for a vast client base.

Gallagher's customized insurance programs move beyond generic policies, focusing on in-depth analysis of a client's industry, operations, and specific risks. This tailored approach ensures clients receive optimal coverage and cost-effectiveness, a crucial factor for businesses navigating complex exposures.

For instance, in 2024, Gallagher's specialized underwriting for the construction sector, a notoriously high-risk industry, resulted in an average premium reduction of 8% for clients who adopted their bespoke risk management strategies, demonstrating the tangible financial benefits of customization.

Clients tap into Gallagher's profound industry knowledge and specialized consultants for strategic guidance on risk, compliance, and human capital. This advisory service goes beyond just securing insurance, equipping clients with the insights and plans needed to manage risks proactively. The core value is enabling clients to make well-informed decisions.

In 2024, Gallagher's consulting services are particularly crucial as businesses navigate evolving regulatory landscapes. For instance, in the financial services sector, compliance alone presents significant challenges, with estimated global regulatory compliance costs reaching trillions of dollars annually. Gallagher's expert advice helps mitigate these costs and associated penalties.

Global Reach and Local Presence

Gallagher masterfully blends its expansive global network with a deeply ingrained local presence. This dual approach ensures clients benefit from worldwide capabilities while receiving dedicated, personalized support from professionals intimately familiar with their specific regional markets. It’s about accessing international expertise without sacrificing the nuances of local understanding.

This strategy proved particularly effective in 2024, as Gallagher continued to expand its footprint. For instance, their acquisition activity in the UK and Australia during the year bolstered their local service delivery capabilities in key growth regions. This hybrid model allows them to navigate complex international insurance landscapes while remaining agile and responsive to the unique needs of businesses in diverse economic environments.

- Global Network: Access to international markets and risk management expertise.

- Local Presence: Personalized service and understanding of regional business contexts.

- Hybrid Model Benefits: Combines worldwide capabilities with dedicated local support.

- 2024 Expansion: Acquisitions in the UK and Australia enhanced local service delivery.

Cost Efficiency and Optimized Coverage

Gallagher delivers cost efficiencies by leveraging its market influence to negotiate favorable terms with insurance carriers. This strategic approach, combined with expert risk management guidance, helps clients secure optimized coverage, leading to potential premium reductions and a minimized financial impact from claims, thereby maximizing the return on their insurance investment.

In 2024, businesses are increasingly scrutinizing insurance spend. Gallagher's ability to identify savings opportunities, such as through proactive claims management and tailored risk mitigation strategies, directly addresses this need. For instance, a client might see a 5-10% reduction in premiums by implementing Gallagher's recommended safety protocols.

- Negotiated Savings: Gallagher's carrier relationships can unlock premium discounts that individual businesses might not achieve alone.

- Risk Mitigation: Strategic advice reduces claim frequency and severity, lowering overall insurance costs.

- Coverage Optimization: Ensuring clients only pay for necessary coverage prevents overspending and waste.

Gallagher offers clients a holistic risk management solution, integrating insurance brokerage, expert consulting, and efficient claims handling. This unified approach simplifies complex risk exposures, from property and liability to employee benefits and specialized insurance needs.

Their 2024 revenue of $9.5 billion highlights their extensive capacity to manage these comprehensive solutions for a broad clientele.

Gallagher crafts customized insurance programs based on in-depth analysis of a client's industry and specific risks, ensuring optimal coverage and cost-effectiveness. For example, in 2024, specialized underwriting for the construction sector led to an average 8% premium reduction for clients adopting their tailored strategies.

Clients benefit from Gallagher's deep industry knowledge and specialized consultants for strategic risk, compliance, and human capital guidance, enabling proactive risk management and informed decision-making. In 2024, this advisory is vital as businesses navigate evolving regulations, with global compliance costs in financial services alone estimated in the trillions annually.

Gallagher's value proposition is built on delivering integrated, tailored, and expert-driven risk management solutions that simplify complexity, optimize coverage, and provide strategic guidance, ultimately enhancing client financial security and operational resilience.

| Value Proposition Component | Description | 2024 Data/Example |

|---|---|---|

| Integrated Risk Management | Combines insurance brokerage, consulting, and claims handling. | Revenue of $9.5 billion in 2024 demonstrates broad service delivery capacity. |

| Customized Insurance Programs | Tailored policies based on in-depth client risk analysis. | 8% average premium reduction for construction clients in 2024 via bespoke strategies. |

| Strategic Consulting & Guidance | Expert advice on risk, compliance, and human capital. | Crucial for financial services navigating trillions in global compliance costs in 2024. |

| Global Network, Local Presence | Worldwide capabilities with personalized regional support. | 2024 acquisitions in UK and Australia enhanced local service delivery. |

Customer Relationships

Gallagher's customer relationship strategy heavily features dedicated account management, assigning specific individuals or teams to clients. This ensures a consistent and personalized point of contact, fostering deep understanding of each client's unique needs.

These dedicated teams act as the primary liaison, coordinating all of Gallagher's resources to deliver tailored solutions. This proactive approach builds trust and continuity, essential for long-term partnerships in the complex insurance and risk management landscape.

For instance, Gallagher's focus on relationship management contributed to their strong client retention rates, with many clients partnering with them for over a decade. This dedicated model is a cornerstone of their client-centric approach, differentiating them in the market.

Gallagher cultivates long-term advisory partnerships by moving beyond simple transactions to become a trusted, indispensable resource for clients on risk and human capital matters. This proactive approach involves strategic planning and continuous support, aiming to integrate deeply into a client's success trajectory.

Gallagher deeply understands that each client is different, so they focus on providing very personal service. This means talking to clients in a way that fits them best, creating solutions that are just right, and being quick to help with questions or claims. For example, in 2024, Gallagher reported significant growth in client retention, a direct result of this tailored approach.

Technology-Enabled Self-Service Portals

Gallagher leverages technology to enhance customer relationships through self-service portals, offering clients 24/7 access to vital information. These platforms provide a convenient way for clients to manage their policies, track claims, and explore risk management tools, all while complementing Gallagher's commitment to personal interaction. This digital layer empowers clients by giving them direct control over their data and service interactions.

These technology-enabled portals are designed to streamline client experience and provide immediate value. For instance, in 2024, Gallagher reported a significant increase in digital engagement, with a substantial portion of policy inquiries and claims updates being handled through these online channels, demonstrating their growing importance.

- Enhanced Accessibility: Clients can access policy details, renewal information, and risk assessment tools anytime, anywhere.

- Streamlined Claims Management: Real-time updates on claim status are readily available, reducing the need for direct contact for routine checks.

- Empowered Decision-Making: Direct access to data and resources allows clients to make more informed decisions regarding their insurance and risk management needs.

- Complementary to Personal Service: These digital tools work in tandem with Gallagher's dedicated client advisors, offering a hybrid approach that prioritizes both efficiency and personalized support.

Community and Industry Engagement

Gallagher actively cultivates strong customer relationships through deep involvement in industry events and associations. By participating in these forums, Gallagher not only stays abreast of evolving client needs but also positions itself as a knowledgeable partner. For example, their presence at the 2024 Risk & Insurance Management Society (RIMS) Annual Conference allowed for direct interaction with thousands of risk management professionals.

This commitment extends to community initiatives, reinforcing Gallagher's dedication to the sectors it serves and the local areas where its clients operate. Such engagement builds trust and highlights the company's expertise, a critical factor in maintaining long-term customer loyalty. In 2023, Gallagher supported over 100 community programs globally, demonstrating this commitment.

- Industry Event Participation: Gallagher’s presence at key industry conferences like the National Association of Surety Bond Producers (NASBP) Annual Meeting in 2024 provides direct engagement opportunities.

- Association Membership: Active membership in organizations such as the Council of Insurance Agents & Brokers (CIAB) allows Gallagher to contribute to industry standards and best practices.

- Community Support: In 2024, Gallagher continued its focus on local community investment, with employee volunteer hours exceeding 50,000 across its global operations.

- Thought Leadership: Publishing research and insights, such as their 2024 report on emerging cyber risks, showcases Gallagher's expertise and builds credibility with clients.

Gallagher's customer relationships are built on a foundation of dedicated account management, providing clients with a consistent and personalized point of contact. This approach fosters a deep understanding of individual client needs, enabling tailored solutions and strengthening long-term partnerships.

Technology plays a crucial role, with self-service portals offering 24/7 access to policy information and claims management, complementing the personalized service. This hybrid model enhances client experience and empowers informed decision-making.

Active participation in industry events and community initiatives further solidifies Gallagher's role as a trusted advisor, demonstrating expertise and commitment to the sectors and regions it serves.

| Customer Relationship Element | Description | Example/2024 Data Point |

| Dedicated Account Management | Assigning specific individuals or teams to clients for consistent, personalized contact. | Contributed to strong client retention, with many clients partnering for over a decade. |

| Personalized Service | Tailoring communication and solutions to individual client needs. | Significant growth in client retention reported in 2024 due to this approach. |

| Digital Portals | Providing 24/7 access to policy information, claims tracking, and risk management tools. | Substantial increase in digital engagement in 2024, with many inquiries handled online. |

| Industry & Community Engagement | Participating in events and supporting local initiatives to build trust and demonstrate expertise. | Presence at the 2024 RIMS Annual Conference; over 50,000 employee volunteer hours in 2024. |

Channels

Gallagher's direct sales force and brokers are the backbone of its client acquisition and service delivery. In 2024, this channel continued to be a primary driver of revenue, with a significant portion of Gallagher's client base being cultivated and managed through these personal relationships. The emphasis is on providing tailored advice and solutions, fostering trust and long-term partnerships.

These professionals are crucial for understanding the unique risk profiles of businesses and individuals, enabling Gallagher to offer specialized insurance products and risk management strategies. For instance, in 2023, Gallagher reported strong growth in its brokerage segment, underscoring the effectiveness of its direct engagement model in capturing market share and meeting evolving client needs.

Gallagher's extensive global office network is a cornerstone of its business model, acting as the primary channel for client engagement and service delivery. This physical presence, with offices in over 50 countries, ensures clients have readily accessible local support and specialized expertise tailored to their regional needs. For instance, in 2024, Gallagher continued to expand its reach, opening new offices in key growth markets, further solidifying its ability to serve a diverse international clientele.

Gallagher actively utilizes its corporate website and dedicated client portals to deliver essential information and streamline service access. These digital avenues are crucial for disseminating updates and enabling clients to manage their needs efficiently.

In 2024, Gallagher reported a significant increase in digital engagement, with client portal usage up by 15% year-over-year, reflecting a growing preference for self-service options. These online tools provide valuable resources and enhance operational efficiency, complementing face-to-face interactions.

Industry Conferences and Events

Gallagher leverages industry conferences and events as crucial channels for engagement and growth. These gatherings are instrumental in generating leads, solidifying brand reputation, and establishing thought leadership within the insurance and risk management sectors. By actively participating in and hosting these events, Gallagher can directly showcase its specialized knowledge and capabilities to a targeted audience.

These events provide a unique platform for Gallagher to network with prospective clients and partners, fostering valuable relationships. Furthermore, attending and organizing such events keeps Gallagher abreast of the latest market dynamics, emerging risks, and technological advancements, ensuring its strategies remain relevant and competitive. For instance, in 2024, Gallagher's presence at events like the Risk & Insurance Management Society (RIMS) annual conference allowed them to connect with thousands of risk professionals.

The strategic importance of these channels is underscored by their direct impact on market visibility and business development. Gallagher’s investment in thought leadership through speaking engagements and sponsored sessions at these events reinforces its position as an industry expert. In 2023, Gallagher reported significant lead generation figures directly attributable to their participation in key industry forums.

- Lead Generation: Conferences are a primary source for identifying and engaging potential clients.

- Brand Building: Association with reputable industry events enhances Gallagher's brand perception.

- Thought Leadership: Presenting expertise positions Gallagher as an authority in risk management.

- Market Intelligence: Events provide insights into competitor activities and client needs.

Referral Networks

Referral networks are a cornerstone of Gallagher's client acquisition strategy, representing a significant driver of growth. This channel leverages the trust and satisfaction of existing clients, alongside the professional endorsements of lawyers, accountants, and other strategic partners. Gallagher's commitment to nurturing these relationships makes it a highly cost-effective method for expanding its reach.

In 2024, Gallagher continued to emphasize the importance of these relationships. For instance, a substantial percentage of new business originates from these trusted sources, underscoring the power of word-of-mouth and professional advocacy in the insurance and risk management sector. This organic growth model allows for efficient client acquisition.

- Client Referrals: Satisfied clients are a primary source of new business, demonstrating the value and trust placed in Gallagher's services.

- Professional Advisor Networks: Partnerships with legal and accounting professionals provide access to a broader client base seeking integrated financial and risk solutions.

- Strategic Partnerships: Collaborations with other businesses and industry associations create mutually beneficial referral opportunities.

- Cost-Effectiveness: Referral-based acquisition is typically more cost-efficient than traditional marketing efforts, yielding higher returns on investment.

Gallagher's channels are multifaceted, blending personal relationships with digital accessibility and strategic partnerships to reach and serve its diverse clientele. The direct sales force and extensive global office network remain critical for personalized service and local expertise, while digital platforms enhance efficiency and self-service options. Industry events and referral networks further amplify reach and build credibility.

In 2024, Gallagher's digital engagement saw a notable 15% year-over-year increase in client portal usage, highlighting the growing importance of online channels. Concurrently, participation in major industry events like RIMS provided significant lead generation opportunities, reinforcing the value of both personal and digital outreach strategies.

| Channel Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Brokers | Personalized client acquisition and service | Primary revenue driver; strong growth in brokerage segment |

| Global Office Network | Local support and specialized expertise | Offices in over 50 countries; continued expansion in growth markets |

| Digital Platforms (Website, Portals) | Information dissemination, service access, self-service | 15% year-over-year increase in client portal usage |

| Industry Conferences & Events | Lead generation, brand building, thought leadership | Significant lead generation; presence at RIMS conference |

| Referral Networks | Client and professional advisor endorsements | Substantial percentage of new business originates from referrals |

Customer Segments

Gallagher excels in providing large corporations and enterprises with intricate, multi-line insurance and advanced risk management services. These clients, often global in scope with diverse risk profiles and substantial workforces, demand highly customized and comprehensive programs to navigate complex challenges.

Gallagher serves a vast array of small and medium-sized businesses (SMBs), recognizing their unique insurance and risk management requirements. These businesses, while perhaps not having the intricate needs of global conglomerates, still depend on expert guidance and cost-effective insurance policies tailored to their specific industries. In 2024, SMBs continue to be a cornerstone of the economy, with data from the U.S. Small Business Administration indicating that they represent 99.9% of all U.S. businesses, underscoring their significance to Gallagher's client base.

Public sector and non-profit organizations, including government agencies, schools, hospitals, and charities, represent a significant customer segment for Gallagher. These entities often grapple with unique risk exposures and stringent regulatory landscapes, necessitating specialized insurance and risk management solutions. For instance, in 2024, the healthcare sector alone faced escalating cyber threats, with the average cost of a data breach reaching $10.10 million, highlighting the critical need for robust protection.

Gallagher's approach involves tailoring coverage to address the distinct operational and liability challenges inherent in these mission-driven organizations. This includes providing expertise on compliance with specific mandates, such as HIPAA for healthcare providers or FERPA for educational institutions. The non-profit sector, which saw significant growth in donations in 2023, also requires specialized coverage for directors and officers liability, volunteer management, and program-specific risks.

Specialty Industries (e.g., Energy, Construction, Healthcare)

Gallagher excels by focusing on specialty industries like energy, construction, and healthcare, where risks are particularly intricate and demand specialized knowledge. This deep sector-specific expertise is a cornerstone of their value proposition, allowing them to craft highly tailored insurance and risk management solutions.

For instance, in the construction sector, Gallagher's understanding of project-specific liabilities, supply chain disruptions, and evolving regulatory landscapes is critical. In 2024, the global construction market was projected to reach over $14.8 trillion, highlighting the significant risk pool Gallagher actively serves within this segment.

- Energy Sector Focus: Gallagher provides specialized coverage for oil and gas exploration, renewable energy projects, and utility operations, addressing unique operational and environmental risks.

- Construction Expertise: They offer tailored solutions for general contractors, subcontractors, and developers, covering everything from general liability to complex professional indemnity for design-build projects.

- Healthcare Solutions: Gallagher addresses the critical needs of healthcare providers, including medical malpractice, cyber liability for patient data, and regulatory compliance, a sector that saw significant investment in risk mitigation technologies in 2024.

High-Net-Worth Individuals (via specific offerings)

Gallagher's reach extends to high-net-worth individuals, particularly through specialized offerings and acquired entities. These services are designed for those who need tailored personal insurance, robust wealth protection, and sophisticated lifestyle risk management. This segment often deals with unique assets and intricate personal liability scenarios, demanding bespoke solutions.

For instance, Gallagher's expertise in areas like high-value homes, fine art, classic cars, and complex personal liability insurance directly addresses the needs of this demographic. In 2024, the global wealth management market, which includes services relevant to high-net-worth individuals, was projected to reach trillions, underscoring the demand for specialized financial and risk management services.

- Specialized Personal Insurance: Covering unique assets like luxury properties, yachts, and private aircraft.

- Wealth Protection: Offering strategies for safeguarding assets against unforeseen events and liabilities.

- Lifestyle Risk Management: Addressing complex personal liability concerns and reputational risks.

- Bespoke Solutions: Crafting customized insurance and risk management programs to meet individual needs.

Gallagher serves a broad spectrum of customers, from massive global corporations needing complex, multi-line insurance to small and medium-sized businesses (SMBs) requiring tailored, cost-effective policies. Public sector entities, non-profits, and specialty industries like energy and construction also form key segments, each with unique risk exposures and regulatory demands.

Furthermore, Gallagher caters to high-net-worth individuals, offering specialized personal insurance and wealth protection services. This diverse clientele underscores Gallagher's ability to adapt its offerings to a wide range of risk management needs across various sectors and individual circumstances.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Large Corporations & Enterprises | Intricate, multi-line insurance, advanced risk management, global scope | Global insurance market valued at trillions, with large enterprises driving demand for sophisticated solutions. |

| Small & Medium-Sized Businesses (SMBs) | Cost-effective, tailored policies, expert guidance | Represent 99.9% of U.S. businesses, seeking essential coverage for operations and growth. |

| Public Sector & Non-Profits | Specialized coverage, regulatory compliance, unique liability | Healthcare sector faced average data breach costs of $10.10 million in 2024, highlighting critical risk mitigation needs. |

| Specialty Industries (Energy, Construction, Healthcare) | Deep sector-specific expertise, complex risk management | Global construction market projected over $14.8 trillion in 2024, indicating substantial risk management opportunities. |

| High-Net-Worth Individuals | Personal insurance, wealth protection, lifestyle risk management | Global wealth management market projected to reach trillions, with demand for bespoke financial and risk services. |

Cost Structure

Employee compensation and benefits represent Gallagher's most substantial cost. This includes salaries, commissions, and bonuses for its extensive network of brokers, consultants, and support personnel worldwide. For instance, in 2023, Gallagher reported total employee compensation and benefits expenses of approximately $3.7 billion, highlighting the critical role of human capital in their service-oriented model.

Gallagher's aggressive growth strategy heavily relies on mergers and acquisitions (M&A), leading to significant acquisition costs. These include substantial purchase prices, extensive integration expenses, and considerable professional fees for due diligence and legal services.

In 2023, Gallagher completed 33 acquisitions, adding approximately $500 million in annualized revenue. These deals, while driving growth, represent significant upfront investments in expanding market share and capabilities.

The success of these M&A expenditures hinges on efficient integration, ensuring that the acquired entities are seamlessly incorporated to unlock their full potential and justify the initial outlay.

Gallagher's operating expenses, particularly rent, utilities, and IT, are significant due to its extensive global office network. These costs are essential for maintaining the physical infrastructure and technological backbone that supports its worldwide operations and client services.

In 2024, the ongoing costs of maintaining office spaces, including leases, energy consumption, and supplies, represent a substantial portion of Gallagher's expenditure. This global footprint necessitates considerable investment in real estate and facility management.

Furthermore, the company's reliance on robust information technology infrastructure, including software licenses and cybersecurity measures, adds another layer of significant operational cost. Keeping these systems up-to-date and secure is paramount for business continuity and client trust.

Marketing and Business Development

Gallagher's marketing and business development expenses are crucial for client acquisition and market presence. These costs encompass advertising, public relations, and sales team activities designed to generate leads and foster relationships.

In 2024, the insurance brokerage sector, where Gallagher operates, saw significant investment in digital marketing and data analytics to personalize client outreach. For instance, industry reports indicated that marketing spend in financial services, including client acquisition efforts, often represents a substantial portion of operating costs, sometimes ranging from 5% to 15% of revenue depending on growth stage and competitive landscape.

- Client Acquisition Costs: Funds allocated to attract new clients through various channels.

- Brand Building: Investments in advertising and public relations to enhance market recognition.

- Industry Engagement: Costs associated with participating in conferences and networking events.

- Sales Support: Expenses for client entertainment and travel to nurture business relationships.

Compliance and Regulatory Costs

Gallagher's operational landscape is shaped by substantial compliance and regulatory costs, reflecting its global presence in a heavily regulated insurance sector. These expenditures are critical for maintaining licenses, adhering to diverse legal frameworks across numerous jurisdictions, and securing professional indemnity insurance. For instance, in 2024, insurance companies globally continued to face increasing compliance burdens, with many reporting that regulatory adherence represented a significant portion of their operating expenses. These costs are not merely a financial outlay but a strategic necessity to mitigate substantial legal and reputational risks inherent in the insurance business.

The company dedicates resources to ensure adherence to evolving national and international laws and standards. This includes ongoing investment in legal counsel, compliance officers, and technology solutions to monitor and manage regulatory requirements. For example, in the United States, the Gramm-Leach-Bliley Act and state-specific insurance regulations necessitate continuous adaptation and spending. Failure to comply can result in severe penalties, operational disruptions, and damage to brand trust, making these costs a foundational element of Gallagher's business model.

Key cost drivers within this category include:

- Licensing Fees: Annual renewal and application fees for operating licenses in various states and countries.

- Legal and Consulting Services: Expenses for external legal expertise and specialized compliance consultants to navigate complex regulations.

- Professional Indemnity Insurance: Premiums paid for insurance that protects against claims of negligence or errors in professional services.

- Compliance Technology: Investment in software and systems for monitoring, reporting, and managing regulatory adherence.

Gallagher's cost structure is dominated by employee compensation and benefits, reflecting its people-centric business model. Significant investments are also channeled into mergers and acquisitions to fuel its growth strategy, alongside substantial operating expenses for its global infrastructure and IT systems. Finally, compliance and regulatory adherence represent a critical, ongoing cost necessary for operating within the insurance sector.

Revenue Streams

Gallagher's core revenue originates from commissions generated by successfully placing insurance policies with diverse insurance carriers for their clientele. These commissions are generally calculated as a percentage of the total insurance premium paid by the client.

This vital revenue stream directly correlates with the sheer volume and overall value of the insurance coverage Gallagher arranges. For instance, in 2023, Gallagher reported total revenue of $8.7 billion, with commissions from insurance brokerage playing a significant role in this figure.

Gallagher earns significant income from fees for its consulting services. These services cover areas like risk management, human capital, and general advisory. For instance, in 2024, Gallagher's Consulting segment, which includes these advisory services, continued to be a strong contributor to its overall financial performance.

The pricing for these consulting engagements is usually determined by the project's complexity, how long it takes, or a set hourly rate for specific expert advice. This revenue stream highlights the value Gallagher provides by offering insights and strategies that go beyond simply arranging insurance policies.

Gallagher generates revenue through fees for its third-party claims administration (TPA) services. This involves managing the entire claims process for clients who are self-insured or acting on behalf of insurance companies.

These TPA fees are structured in various ways, including fixed retainers, per-claim charges, or as a percentage of the total claims value handled. This diversified fee structure allows for flexibility and alignment with client needs.

For instance, in 2024, the demand for specialized claims management services continued to grow, driven by the increasing complexity of claims and the desire for cost efficiency among businesses. Gallagher's expertise in this area positions it well to capture a significant share of this market.

Contingent Commissions

Gallagher's revenue structure includes contingent commissions, which are performance-based incentives earned from insurance carriers. These are paid out when Gallagher achieves certain profitability, volume, or retention targets for the business they place with a carrier. This variable revenue stream directly links Gallagher's compensation to the success and favorable outcomes of the insurance policies they manage.

These contingent commissions serve as a powerful alignment tool, ensuring Gallagher's interests are in lockstep with those of the insurance providers. By rewarding positive loss ratios and growth, these incentives encourage Gallagher to focus on underwriting discipline and client retention. For instance, in 2023, Gallagher's Brokerage segment reported revenue growth, partly driven by such performance-based arrangements, contributing to their overall financial performance.

- Variable Revenue Component: Contingent commissions are not fixed and fluctuate based on the performance of the insurance portfolio.

- Alignment with Carriers: These incentives reward Gallagher for achieving profitability and retention targets set by insurance carriers.

- Performance-Based Incentives: They are earned when Gallagher demonstrates success in managing risk and growing business for their carrier partners.

- Impact on Financials: Contingent commissions can significantly contribute to Gallagher's overall revenue, especially in years with strong underwriting results across their placed business.

Fees for Analytics and Advisory Services

Gallagher generates revenue by offering specialized analytics, benchmarking, and advisory services. These data-driven insights help clients refine their risk management and insurance strategies, often commanding a premium price for the strategic recommendations provided.

This revenue stream capitalizes on Gallagher's extensive data resources and deep industry expertise, delivering tangible value to clients seeking to optimize their operations and mitigate potential losses.

- Specialized Analytics: Gallagher provides in-depth data analysis to identify trends and opportunities for clients.

- Benchmarking Services: Clients gain insights into their performance relative to industry peers.

- Risk Advisory: Strategic guidance is offered to help businesses manage and reduce their risk exposure.

- Data-Driven Insights: Revenue is directly tied to the actionable intelligence derived from Gallagher's proprietary data.

Gallagher's revenue streams are diverse, encompassing commissions from insurance placement, fees for consulting and claims administration, and performance-based contingent commissions. Additionally, they generate income from specialized analytics and advisory services, leveraging their data and expertise.

| Revenue Stream | Description | Example/Data Point (2023/2024) |

|---|---|---|

| Insurance Commissions | Percentage of premiums for placed policies. | A significant portion of Gallagher's $8.7 billion total revenue in 2023. |

| Consulting Fees | Charges for risk management, human capital, and advisory services. | Gallagher's Consulting segment remained a strong contributor in 2024. |

| Third-Party Claims Administration (TPA) Fees | Fees for managing claims for self-insured or insurance companies. | Demand for TPA services grew in 2024 due to claim complexity and cost efficiency needs. |

| Contingent Commissions | Performance-based incentives from carriers for profitability and retention. | Contributed to Brokerage segment revenue growth in 2023. |

| Analytics & Advisory Fees | Fees for data-driven insights, benchmarking, and risk strategy. | Capitalizes on proprietary data to offer premium strategic recommendations. |

Business Model Canvas Data Sources

The Gallagher Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. These sources ensure each component of the canvas is robust and strategically sound.