Gallagher Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

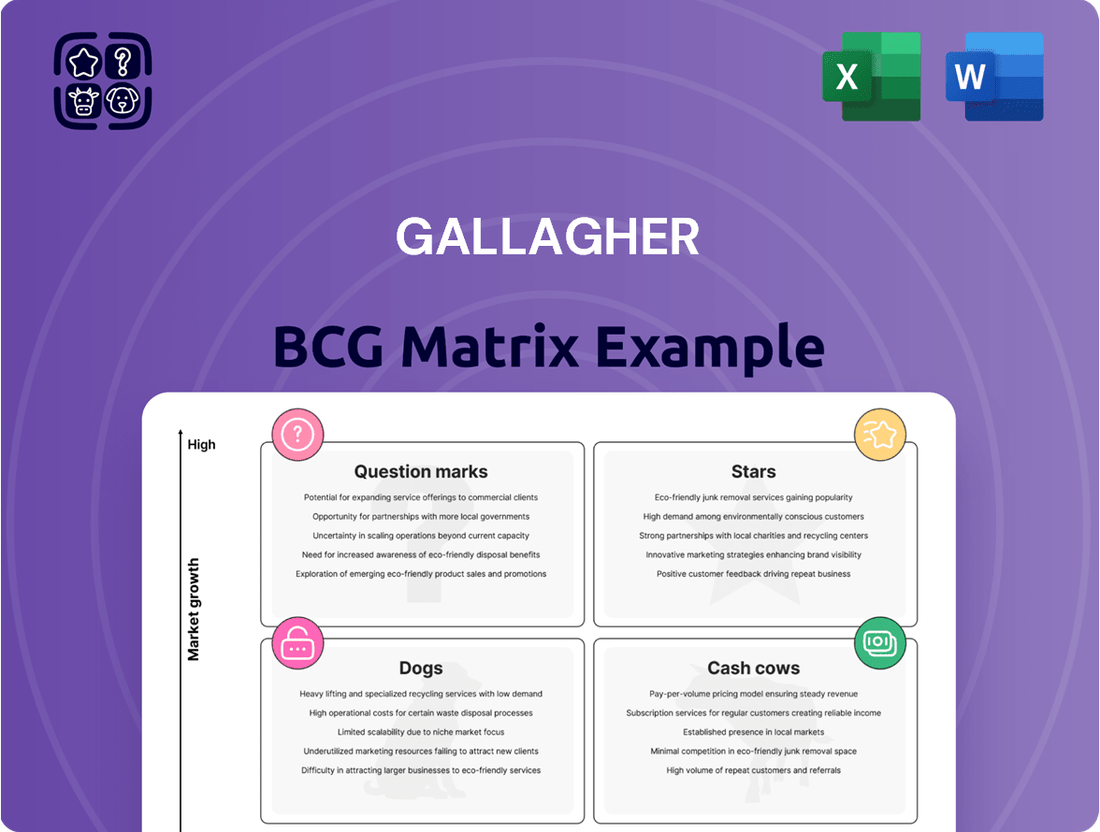

The BCG Matrix is a powerful tool for understanding your product portfolio's health. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth rate, offering a visual roadmap for strategic decisions. This preview highlights key placements, but to truly unlock your company's potential and make informed investment choices, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Gallagher's global insurance brokerage stands as a strong star in its business portfolio. This segment consistently shows high market share and impressive organic revenue growth, with Q1 2025 reporting a 9.5% organic increase and a 16% rise in brokerage revenue compared to Q1 2024.

The company's strategic focus on acquisitions, exemplified by the significant AssuredPartners deal, further cements its status as the third-largest insurance brokerage globally. This segment is the main engine driving Gallagher's overall expansion and market reach.

Gallagher's reinsurance, wholesale, and specialty segments are truly shining stars. In the first quarter of 2025, Gallagher Re saw an impressive 20% organic growth.

The broader specialty businesses collectively achieved 13% organic growth during the same period. These sectors are thriving in expanding markets, like the rapidly growing renewable energy insurance space, where Gallagher is making significant strategic investments to solidify its market standing and client relationships.

Gallagher's strategic acquisition approach consistently fuels its growth, with over 150 mergers completed since 2020, including 48 in 2024. These acquisitions are integrated as immediate growth drivers, especially in expanding markets, bringing new capabilities and client bases.

The pending $13.45 billion acquisition of AssuredPartners, slated for completion in the second half of 2025, exemplifies this strategy. This move is poised to significantly accelerate Gallagher's growth trajectory and bolster its market consolidation efforts.

Global Employee Benefits and Consulting

Gallagher's Global Employee Benefits and Consulting segment is a star performer within its business portfolio. In the first quarter of 2025, this division achieved an impressive organic growth rate exceeding 7%. This robust expansion reflects a significant market trend where employers are prioritizing comprehensive employee wellbeing, including enhanced medical and voluntary benefits.

The increasing demand for expert consulting services in designing and managing these holistic wellbeing strategies plays directly into Gallagher's strengths. The company is well-positioned to capitalize on evolving employer needs and the growing emphasis on workforce health and engagement.

- Strong Organic Growth: Exceeded 7% in Q1 2025, demonstrating market demand.

- Holistic Wellbeing Focus: Employers are investing more in medical and voluntary benefits.

- Consulting Demand: Growing need for expert advice on employee benefit strategies.

- Market Positioning: Gallagher is well-equipped to meet these evolving employer needs.

Advanced Risk Management Analytics

Gallagher's commitment to advanced risk management analytics, exemplified by platforms like Luminos RMIS, significantly bolsters its position in a rapidly evolving risk landscape. This focus on sophisticated data analysis and decision support empowers clients to proactively address emerging threats.

The demand for these capabilities is soaring as businesses grapple with multifaceted challenges. For instance, the impact of social inflation on insurance claims, the escalating sophistication of cyber threats, and the persistent volatility in global supply chains necessitate a data-driven approach.

Gallagher's investment in these technological solutions is strategically aligned with market needs, identifying advanced risk management analytics as a key growth driver. This emphasis on leveraging data and technology is paramount for clients seeking to enhance their resilience and achieve better outcomes.

- Data-Driven Insights: Gallagher's analytics tools, such as Luminos RMIS, provide actionable intelligence to understand and mitigate complex risks.

- Addressing Emerging Threats: The focus on social inflation, cyber threats, and supply chain disruptions highlights the practical application of these advanced analytics.

- Technological Leadership: Significant investment in technology underscores Gallagher's commitment to offering cutting-edge risk management solutions.

- High-Growth Potential: The increasing reliance on data and technology for risk navigation positions this area as a critical growth engine for Gallagher.

Gallagher's insurance brokerage, reinsurance, wholesale, specialty, and employee benefits segments are all performing as strong stars. These areas demonstrate high market share and robust organic growth, with Q1 2025 showing significant increases. For instance, brokerage revenue rose 16% year-over-year, while Gallagher Re experienced 20% organic growth.

The company's strategic acquisition of AssuredPartners, valued at $13.45 billion and expected to close in the latter half of 2025, is a prime example of how Gallagher fuels its star performers. This approach, which has seen over 150 mergers completed since 2020, including 48 in 2024, immediately injects growth and expands market reach.

Gallagher's investment in advanced risk management analytics, such as its Luminos RMIS platform, further solidifies its star status. This focus on data-driven insights is crucial for navigating complex risks like social inflation and cyber threats, positioning Gallagher as a leader in a high-growth area.

| Business Segment | Q1 2025 Organic Growth | Key Drivers | Strategic Importance |

|---|---|---|---|

| Insurance Brokerage | 9.5% | Acquisitions, Market Expansion | Core growth engine, third-largest globally |

| Reinsurance, Wholesale, Specialty | 20% (Re), 13% (Specialty) | Expanding Markets (e.g., Renewables) | High-performing, diversified revenue streams |

| Global Employee Benefits and Consulting | >7% | Demand for Wellbeing, Expert Advice | Capitalizing on evolving employer needs |

| Risk Management Analytics | N/A (Technology Investment) | Data-driven Solutions, Emerging Threats | Critical for client resilience, future growth |

What is included in the product

Provides a framework for analyzing business units based on market share and growth, guiding strategic decisions.

Provides a clear, visual roadmap for resource allocation, alleviating the pain of strategic uncertainty.

Cash Cows

Gallagher's established risk management services represent a solid cash cow within its business portfolio. This segment brought in a substantial $1.45 billion in revenue during 2024, underscoring its significant market share and consistent customer base.

While the organic growth rate for risk management was 4% in the first quarter of 2025, which is lower than the brokerage segment, its stability is undeniable. These services, encompassing vital areas like claims management and risk control consulting, are foundational to Gallagher's operations and provide a reliable stream of cash flow from a wide array of clients.

Mature Property & Casualty (P&C) insurance brokerage lines are Gallagher's Cash Cows. In 2024, these lines saw consistent renewal premium increases averaging above 5%, a trend that continued into early 2025, indicating strong market share and stability.

These established segments demand minimal marketing spend due to their essential nature, generating reliable cash flow for Gallagher. The P&C market's robustness, characterized by rational carrier pricing strategies, underpins the sustained profitability of these operations.

Gallagher Bassett, Gallagher's dedicated Third-Party Claims Administration (TPA) division, stands as a prominent player in the claims and risk management sector. This segment consistently delivers robust revenue streams, underpinned by enduring client partnerships and a reputation for efficient claims resolution.

The TPA business, while not typically characterized by explosive growth, functions as a reliable cash generator. Its fundamental value lies in its ability to effectively manage and settle claims, thereby reducing overall risk costs for its clientele, a critical and established service offering.

Gallagher Bassett's deep-seated expertise in handling complex liabilities across a diverse range of industries further reinforces its capacity to generate stable and predictable cash flow. This specialized knowledge is a key differentiator, ensuring continued demand for its services.

Employee Benefits Consulting (Standard Offerings)

Gallagher's standard employee benefits consulting, focusing on core medical and traditional pharmacy benefits, operates within a large, mature market where the company maintains a substantial market share. This foundational segment provides a consistent and reliable revenue stream, even as newer trends emerge in the benefits landscape.

These essential services for employers are bolstered by deeply entrenched, long-standing client relationships. This stability means less emphasis is needed on aggressive new market development, allowing Gallagher to leverage its existing client base for continued growth.

- Market Maturity: The market for core medical and pharmacy benefits consulting is well-established, indicating a stable demand.

- Significant Market Share: Gallagher's strong position in this segment contributes to its status as a cash cow.

- Stable Revenue: Foundational offerings provide a predictable and consistent income source.

- Client Retention: Long-standing relationships reduce the need for costly new client acquisition efforts.

Renewal Business & Client Retention

Gallagher's robust renewal business and high client retention are foundational cash cows, consistently delivering predictable revenue. In 2023, Gallagher reported a client retention rate of 92%, a testament to the enduring relationships built across its diverse service offerings.

This loyalty, cultivated across numerous industries globally, translates into lower customer acquisition costs, freeing up capital for strategic investments. The stable income generated from renewals allows Gallagher to maintain its market position and fund growth initiatives.

- Consistent Revenue Streams: Gallagher's 2023 financial reports highlighted that a substantial portion of its revenue comes from existing clients renewing their contracts.

- Low Acquisition Costs: Retaining clients is significantly more cost-effective than acquiring new ones, boosting profitability.

- Client Trust and Value: The high retention rate underscores the perceived value and trust clients place in Gallagher's comprehensive suite of services.

- Diversified Portfolio Stability: The broad range of services offered ensures that even if one sector experiences a downturn, others contribute to the overall stability of renewal income.

Gallagher's established risk management services and mature Property & Casualty (P&C) insurance brokerage lines are prime examples of its cash cows. These segments, characterized by significant market share and consistent customer bases, generated substantial revenue in 2024, with P&C renewals showing increases above 5%.

The Gallagher Bassett TPA division and core employee benefits consulting also function as reliable cash generators. These areas benefit from deep client relationships and a stable demand, requiring minimal new market development spend and providing predictable income streams.

Overall, Gallagher's strong renewal business and high client retention, evidenced by a 92% rate in 2023, solidify these segments as cash cows. This loyalty translates to lower customer acquisition costs, allowing for reinvestment and sustained profitability.

| Segment | 2024 Revenue (Est.) | Growth (Q1 2025) | Key Characteristics |

|---|---|---|---|

| Risk Management Services | $1.45 Billion | 4% | Stable, foundational, low marketing spend |

| P&C Brokerage | N/A (part of overall brokerage) | Consistent renewal increases >5% | Mature market, rational pricing, strong client base |

| Gallagher Bassett (TPA) | N/A (part of overall brokerage) | Stable | Deep expertise, efficient claims, enduring partnerships |

| Employee Benefits (Core) | N/A (part of overall brokerage) | Stable | Large market share, long-standing relationships |

Delivered as Shown

Gallagher BCG Matrix

The Gallagher BCG Matrix analysis you're previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted by industry experts, provides actionable insights into your business portfolio's strategic positioning. You can confidently expect the exact same high-quality, ready-to-use file for your business planning and decision-making processes.

Dogs

Underperforming niche insurance lines, such as specialized cyber liability for very small businesses or highly localized flood insurance in low-risk areas, often fall into the question mark category of the BCG matrix. These segments might have seen minimal market traction, with a 2024 report indicating that some niche offerings experienced less than a 2% year-over-year growth in premiums. This low growth, coupled with potentially high administrative costs for servicing these specialized products, can lead to a low market share and minimal returns on investment.

Legacy IT systems and older operational processes, often described as Stars or Cash Cows in other frameworks, can be viewed as Dogs within the context of the Gallagher BCG Matrix if they are inefficient and costly. These internal systems, while not directly customer-facing, drain resources and impede a company's ability to adapt quickly. For instance, a 2024 report indicated that companies still relying on mainframe systems for core operations could spend up to 15-20% more on maintenance and upgrades compared to those leveraging cloud-native solutions, directly impacting profitability and hindering investment in growth areas.

Small, unsynergistic acquired entities could become Dogs in Gallagher's BCG Matrix if they fail to integrate effectively and achieve projected synergies. These acquisitions, often smaller in scale, might struggle to contribute to Gallagher's broader platform, consuming valuable resources without aligning with overall strategic objectives.

If these entities maintain low market share post-acquisition and experience stagnant growth, they risk becoming liabilities. Gallagher's robust M&A strategy, which saw them complete 38 acquisitions in 2023 alone, highlights the critical need for meticulous integration processes to prevent such outcomes and ensure each acquisition adds tangible value.

Services with Declining Demand

Services with declining demand, often termed 'Dogs' in the Gallagher BCG Matrix, represent areas where growth prospects are dim and market share is shrinking. These could include consulting services for legacy industries facing disruption or insurance products for risks that are becoming obsolete due to technological advancements. For instance, consulting for traditional print media companies has seen a significant downturn as digital platforms dominate advertising and content distribution. Similarly, insurance policies specifically designed for typewriter manufacturers would fall into this category.

Identifying and managing these 'Dogs' is crucial for resource allocation. Companies must continuously monitor market shifts and technological advancements to pinpoint services or products that are losing relevance. A proactive approach involves divesting from or phasing out these offerings to redirect capital and talent towards more promising ventures. For example, in 2024, the demand for IT consulting focused on maintaining on-premise mainframe systems has continued to decline as cloud-based solutions become the industry standard.

- Consulting for legacy IT infrastructure: Services related to maintaining and upgrading outdated on-premise server systems and mainframes are experiencing reduced demand as businesses migrate to cloud computing.

- Insurance for declining industries: Products covering risks specific to industries like physical media manufacturing (e.g., CDs, DVDs) are seeing lower uptake due to market contraction.

- Traditional media advertising services: Consulting or services focused on print or broadcast advertising strategies are facing challenges as digital advertising channels gain prominence.

- Specialized manufacturing support: Services catering to the maintenance or supply chain needs of manufacturing sectors that have significantly shrunk due to automation or global shifts, such as certain types of textile manufacturing, may also be classified as Dogs.

High-Cost, Low-Margin Services

Certain services, characterized by substantial operational expenses and a narrow client reach, can be classified as Dogs within the Gallagher BCG Matrix if their profit margins remain persistently low and growth prospects are negligible. These offerings may just cover their costs, immobilizing capital that could be more effectively deployed in more promising ventures.

For instance, a niche consulting service requiring highly specialized, expensive talent and advanced software, but serving only a handful of clients with limited revenue potential, could exemplify a Dog. In 2024, such a service might have an annual revenue of $500,000 but incur $480,000 in direct costs and overhead, leaving a net profit of only $20,000, a mere 4% margin.

- Low Profitability: Services with consistently low profit margins, such as the 4% example above, indicate an inability to generate significant returns.

- Minimal Growth: A lack of market expansion or increasing client demand further solidifies its Dog status.

- Capital Immobilization: The capital tied up in these services could be reinvested in high-growth potential areas.

- Strategic Re-evaluation: Businesses should consider divesting or restructuring these offerings to optimize resource allocation.

Dogs represent business units or offerings with low market share and low growth potential, often draining resources without significant returns. These segments require careful management, typically involving divestment or a strategic pivot to avoid continued capital immobilization. For example, services catering to declining industries, such as consulting for traditional print media, exemplify this category, as market demand continues to shift towards digital alternatives. In 2024, the demand for such legacy services has continued its downward trend, with some niche areas seeing revenue declines of over 10% year-over-year.

Companies must actively identify and address these Dogs to optimize their portfolio. This might involve phasing out unprofitable product lines or divesting underperforming subsidiaries. Gallagher's own acquisition strategy, which saw them complete 38 acquisitions in 2023, underscores the importance of integrating new entities effectively to prevent them from becoming costly liabilities. A 2024 analysis of industry M&A trends highlighted that post-acquisition integration failures are a primary driver for acquired businesses becoming underperformers.

The key is to reallocate the capital and human resources tied up in Dogs towards more promising Stars or Cash Cows. For instance, a niche insurance product with less than a 2% annual premium growth, as noted in a 2024 industry report, would likely be classified as a Dog. Such segments often have high servicing costs relative to their revenue, further diminishing profitability.

Ultimately, a proactive approach to managing Dogs is essential for long-term strategic health and financial performance. This involves continuous market analysis and a willingness to make tough decisions about shedding non-core or underperforming assets.

Question Marks

The rapid integration of artificial intelligence across industries, including finance and healthcare, is ushering in a new era of complex risks, such as AI liability and algorithmic bias. This burgeoning field presents a significant growth opportunity for specialized insurance and consulting services designed to mitigate these emerging threats. For example, the global AI market was valued at approximately $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, indicating substantial expansion for related risk management solutions.

Gallagher, while a major player in traditional insurance, may find its market share in these highly niche, cutting-edge technology risk solutions still in its nascent stages. This positions AI liability and similar emerging tech risks as ‘Question Marks’ within the BCG Matrix. The high growth potential necessitates substantial investment in expertise, product development, and market penetration to secure a leading position in this evolving landscape.

Cyber insurance presents a significant opportunity for small businesses, with only 32% of owners currently holding such coverage. This low adoption rate, despite the prevalence of cyber threats, points to a high-growth market with substantial untapped potential for providers like Gallagher.

To capitalize on this, Gallagher would need to focus on targeted marketing campaigns and streamlined product offerings. Simplifying the complexities often associated with cyber insurance can help overcome adoption barriers for smaller enterprises.

Specialized Global Expansion Initiatives represent Gallagher's 'Question Marks' in the BCG Matrix. These are new ventures into specific, untapped international markets or highly specialized global segments where Gallagher currently has a limited presence.

These markets are characterized by high growth potential but also demand substantial initial investment in infrastructure, talent acquisition, and tailored market penetration strategies. Gallagher's existing global footprint offers a strategic advantage, but these new market entries are inherently high-risk, high-reward endeavors.

For instance, entering a nascent but rapidly growing InsurTech hub in Southeast Asia, like Vietnam, would fit this category. In 2024, Vietnam's digital insurance market was projected to grow by over 15%, presenting a significant opportunity, albeit one requiring considerable upfront capital and localized expertise for Gallagher to establish a strong foothold.

Innovative Digital Client Platforms

Gallagher's innovative digital client platforms are a key component of their ongoing digital transformation. These platforms aim to revolutionize client engagement and service delivery, positioning Gallagher for future growth in an increasingly digital marketplace.

While these digital initiatives are vital for competitive advantage, their current market adoption and impact on market share are still developing. Significant investment in both the development and promotion of these platforms is necessary to drive widespread client uptake and realize their full potential.

- Digital Transformation Investment: Gallagher has committed substantial resources to its digital transformation, with a focus on enhancing client experience through new platforms.

- Evolving Market Impact: The success of these digital platforms in capturing market share is still being measured, reflecting the dynamic nature of digital adoption in the financial services sector.

- Client Adoption Focus: Future growth hinges on effectively encouraging client adoption, requiring continued investment in user-friendly design and robust marketing efforts.

- Competitive Positioning: These platforms are designed to bolster Gallagher's competitive stance by offering advanced digital solutions for client needs.

Niche Consulting for Highly Specialized Industries

Niche consulting for highly specialized industries represents a potential innovation opportunity, akin to a Question Mark in the BCG Matrix. These services target emerging or rapidly evolving sectors with unique challenges, such as advanced biotech or specialized AI applications. For instance, consulting on regulatory compliance for gene-editing therapies, a nascent field, could fall into this category.

Gallagher's strategic approach here would involve significant investment in deep domain expertise and tailored marketing efforts. The current client base might be limited, but the projected growth is substantial as these industries mature and regulatory landscapes solidify. By 2024, the global market for specialized consulting in areas like quantum computing was estimated to be in the billions, indicating strong future potential.

- Targeting nascent industries with unique risk profiles.

- Focusing on sectors like advanced biotechnology or specialized AI.

- Investing in specialized expertise and targeted marketing is crucial.

- Potential for high growth as industries mature and regulations evolve.

Question Marks represent business areas with low market share in high-growth markets. Gallagher's investment in emerging tech risks, like AI liability, fits this profile. The rapid expansion of AI, projected to exceed $1.8 trillion by 2030, presents a significant opportunity, but requires substantial investment to build expertise and market presence.

Similarly, expanding into new, specialized global markets or developing innovative digital client platforms are Question Marks. These ventures offer high growth potential but demand considerable upfront investment and strategic market penetration to overcome initial low market share.

Gallagher's focus on niche consulting for emerging sectors, such as specialized AI applications, also falls into the Question Mark category. The global market for such specialized consulting was in the billions by 2024, indicating substantial future growth, but requires deep domain expertise and targeted marketing to succeed.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to provide a clear strategic overview.