AGCO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGCO Bundle

AGCO's strengths lie in its strong brand portfolio and global distribution network, but it faces challenges from intense competition and evolving agricultural technologies. Understanding these dynamics is crucial for navigating the future of farming.

Want the full story behind AGCO's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AGCO Corporation commands a powerful brand lineup, featuring names like Massey Ferguson, Fendt, and Valtra, offering a complete spectrum of agricultural machinery. This extensive product range, from tractors and combines to grain storage solutions, caters to diverse farming requirements globally, solidifying AGCO's market position and fostering strong customer relationships.

AGCO boasts an impressive global distribution network, comprising over 3,000 dealers and service locations that span more than 140 countries. This expansive footprint makes its agricultural machinery and solutions readily available to farmers worldwide, catering to a wide array of farming practices and environments.

This robust network is a significant competitive advantage, ensuring strong market penetration and customer support. For instance, AGCO's commitment to expanding its dealer presence, particularly in key markets like North America, underscores its strategy to deepen customer relationships and enhance service accessibility, reinforcing its market position.

AGCO's strategic investments in precision agriculture, notably consolidating efforts under the PTx brand through acquisitions, represent a significant strength. This focus is backed by a substantial increase in research and development spending, with a considerable portion earmarked for smart machines and clean energy solutions.

The company's ambition to achieve $2.0 billion in precision agriculture net sales by 2029 underscores its commitment to this sector. This forward-looking strategy positions AGCO to effectively leverage the escalating global demand for sophisticated farming technologies.

Demonstrated Financial Resilience and Cost Management

AGCO has demonstrated impressive financial resilience, particularly highlighted by its turnaround from a net loss in 2024 to a profitable position in 2025. This recovery is a direct result of stringent cost management initiatives, which included targeted reductions in engineering, restructuring, and general and administrative expenses.

The company's ability to navigate industry headwinds is further underscored by its adjusted operating margin. For instance, AGCO achieved an adjusted operating margin of 8.9% in 2024, showcasing a strong capacity to maintain profitability even amidst challenging market conditions.

- Turnaround Performance: Transitioned from a net loss in 2024 to profitability in 2025.

- Cost Control Success: Achieved savings through reductions in engineering, restructuring, and G&A expenses.

- Profitability Metric: Maintained an 8.9% adjusted operating margin in 2024 despite industry downturns.

Commitment to Shareholder Value

AGCO's dedication to enhancing shareholder value is evident through proactive financial strategies. In 2024, the company announced a significant $1 billion share repurchase program, underscoring management's confidence in AGCO's intrinsic worth and future prospects. This initiative complements a history of consistent quarterly dividend payments, providing ongoing returns to investors. These actions collectively signal a robust financial position and a commitment to rewarding those who invest in the company's growth.

AGCO's diversified brand portfolio, including Massey Ferguson, Fendt, and Valtra, offers a comprehensive agricultural machinery range, from tractors to combines, catering to global farming needs and fostering strong customer loyalty.

What is included in the product

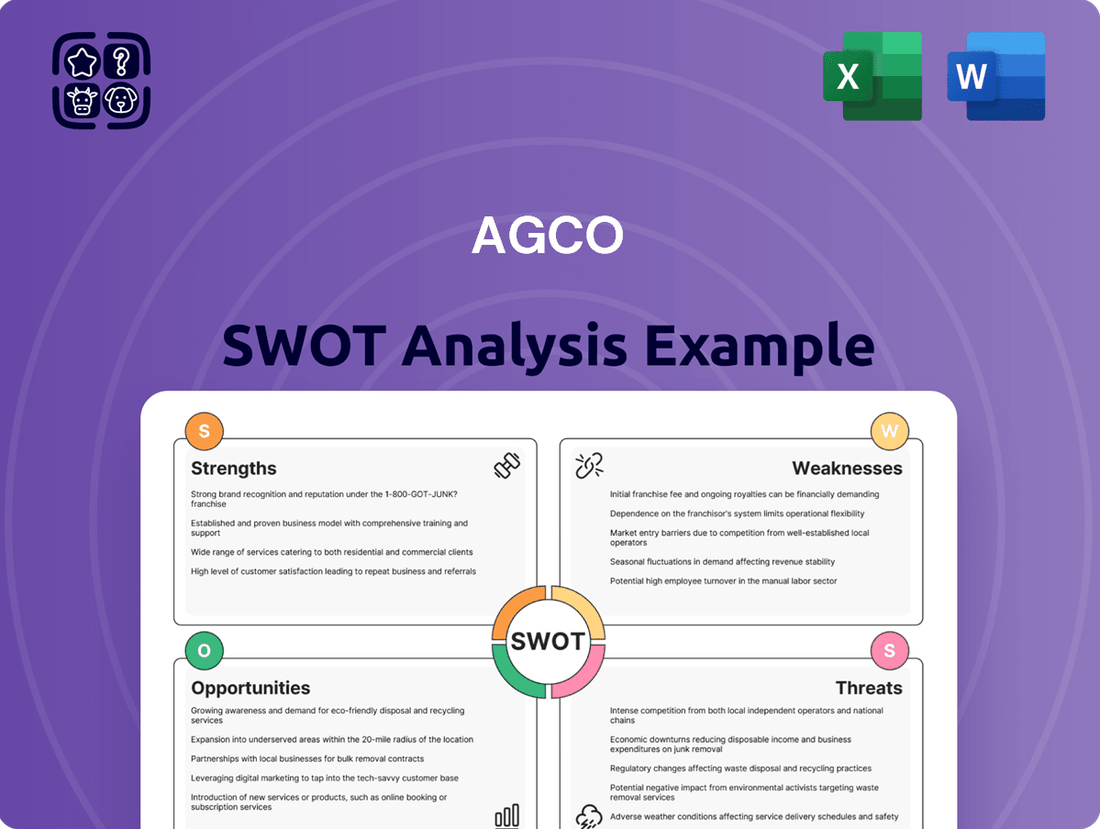

Analyzes AGCO’s competitive position through key internal and external factors, identifying its strengths in product innovation and market presence, alongside weaknesses in brand recognition compared to competitors. It also explores opportunities in emerging markets and technological advancements, while acknowledging threats from economic downturns and supply chain disruptions.

Offers a clear, actionable framework to identify and address AGCO's strategic challenges and opportunities.

Weaknesses

AGCO's financial results are closely tied to the ups and downs of the agricultural sector. This means things like changing crop prices, weather surprises, and the overall economy can really impact how well the company does. For instance, the company saw a notable drop in net sales, and the outlook suggests this softer demand might continue into 2025.

AGCO's significant reliance on Europe and the Middle East for roughly 50%-60% of its sales and operating profits presents a notable weakness. This geographic concentration makes the company particularly vulnerable to economic downturns, shifts in government policies, or unforeseen events within these key regions.

For instance, a slowdown in the European agricultural sector, a major market for AGCO, could disproportionately impact overall company performance. While AGCO is actively working to expand its footprint in North and South America to mitigate this risk, the current sales structure highlights a potential vulnerability.

AGCO is currently grappling with elevated dealer inventory levels, especially in high-horsepower tractors and sprayers. This surplus requires significant production cuts to normalize stock, which in turn affects sales volumes and operational efficiency. For instance, as of the first quarter of 2024, AGCO reported a substantial increase in its days of inventory on hand compared to the previous year, highlighting the scale of this challenge.

Declining Farm Income and Reduced Equipment Demand

Declining net farm income projections for 2024 and 2025 are a significant headwind for AGCO, directly impacting farmers' ability to invest in new machinery. For instance, the USDA's forecast for 2024 indicates a potential 15.5% decrease in net farm income compared to 2023, a trend expected to persist into 2025. This reduced profitability translates into lower purchasing power and a more cautious approach to capital expenditures among the agricultural community.

Consequently, this economic pressure on farmers leads to a direct dampening of demand for agricultural equipment, AGCO's core product. Many farmers are likely to postpone or even cancel planned purchases of tractors, harvesters, and other machinery as they prioritize managing their current financial situations. This slowdown in equipment sales is a critical weakness that AGCO must navigate.

- Projected Decline in Net Farm Income: USDA estimates suggest a significant drop in farm profitability for 2024-2025, impacting farmers' spending capacity.

- Reduced Equipment Investment: Lower farm income directly correlates with farmers delaying or canceling purchases of new agricultural machinery.

- Impact on AGCO's Sales: The slowdown in farmer spending creates a direct pressure on AGCO's sales volumes and revenue streams.

Operational Adjustments Including Production Cuts and Layoffs

AGCO's response to a softening market and elevated inventory has involved significant operational scaling back. This includes a notable reduction in manufacturing hours, with Q1 2025 seeing approximately 33% fewer production hours than the prior year's first quarter.

These adjustments extend to the workforce, with AGCO planning layoffs that could affect up to 6% of its salaried employees. Such measures can negatively impact employee morale and potentially disrupt the smooth continuation of operations.

- Production Cuts: Manufacturing hours reduced by ~33% in Q1 2025 vs. Q1 2024.

- Workforce Reductions: Planned layoffs of up to 6% of salaried staff.

- Impact: Potential negative effects on employee morale and operational continuity.

AGCO's substantial reliance on European and Middle Eastern markets, accounting for approximately 50%-60% of its sales and operating profits, exposes it to regional economic vulnerabilities. This concentration means that downturns or policy shifts in these areas can disproportionately affect the company's overall financial health. While efforts are underway to diversify into North and South America, the current geographic sales structure remains a key weakness.

Elevated dealer inventory levels, particularly for high-horsepower tractors and sprayers, necessitate significant production cuts. This overstocking directly impacts sales volumes and operational efficiency, with Q1 2025 production hours down by approximately 33% compared to the previous year. Furthermore, planned workforce reductions of up to 6% of salaried employees could affect morale and operational continuity.

The projected decline in net farm income for 2024 and 2025, with the USDA forecasting a potential 15.5% drop in 2024, directly hinders farmers' purchasing power for new machinery. This economic pressure on agricultural producers leads to postponed or canceled equipment orders, creating a direct dampening effect on AGCO's core product demand.

| Metric | 2023 (Approx.) | 2024 Projection | 2025 Projection |

|---|---|---|---|

| Net Farm Income (US) | $150 billion | $127 billion (est. -15.5%) | $120 billion (est.) |

| AGCO Production Hours (Q1) | 100% | ~67% (vs. Q1 2024) | |

| AGCO Salaried Workforce | Full | ~94% (post-layoffs) |

Full Version Awaits

AGCO SWOT Analysis

This is the actual AGCO SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full AGCO SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic position.

This is a real excerpt from the complete AGCO SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

Opportunities

The global precision agriculture market is a significant growth area, with forecasts suggesting a compound annual growth rate (CAGR) between 6.8% and 13.3% from 2025 through 2034. This upward trend is fueled by the urgent global demand for increased food production and the widespread integration of cutting-edge technologies such as the Internet of Things (IoT), artificial intelligence (AI), and sophisticated data analytics within farming practices.

AGCO is strategically positioned to capitalize on this burgeoning market. The company's dedicated investments in its PTx precision agriculture initiatives are designed to enhance its market penetration and secure a more substantial share of this rapidly expanding sector.

AGCO has a robust foothold in Europe and the Middle East, but substantial potential exists to grow its market share in North and South America. The company is strategically focused on increasing its presence in these key, larger markets, which could unlock new avenues for sales expansion and geographical diversification.

This strategic push is already showing signs of progress, with AGCO reporting modest growth in Brazil during the second quarter of 2025. This indicates a positive trajectory for its expansion efforts in the Americas, a region offering significant untapped potential for the agricultural equipment manufacturer.

The agricultural sector is rapidly embracing technological advancements like robotics, IoT, and data analytics, creating significant opportunities. AGCO's commitment to R&D, evidenced by its substantial investments, positions it to capitalize on this trend by developing and integrating these smart farming solutions.

By focusing on these innovations, AGCO can enhance its product offerings, driving greater efficiency and productivity for its customers. For instance, the global precision agriculture market was valued at approximately $7.7 billion in 2023 and is projected to reach over $16 billion by 2030, indicating strong growth potential for AGCO's smart farming technologies.

Increasing Demand for Sustainable Farming Practices

The global population is projected to reach 9.7 billion by 2050, creating immense pressure on food systems. This surge, coupled with growing environmental consciousness, fuels a significant demand for agricultural practices that are both productive and sustainable. AGCO is well-positioned to capitalize on this trend by developing and marketing equipment and technologies that support precision agriculture, reduce resource usage, and promote soil health.

This increasing demand translates into substantial market opportunities for AGCO. For instance, the global market for precision agriculture technology was valued at approximately $8.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 13% through 2030. AGCO's investments in smart farming solutions, such as its Fuse® Technologies, directly address this growing market need.

- Growing Market for Sustainable AgTech: The global precision agriculture market is expanding rapidly, offering significant revenue potential for companies like AGCO.

- Enhanced Brand Reputation: By focusing on sustainable solutions, AGCO can strengthen its brand image as a responsible and forward-thinking leader in the agricultural sector.

- New Product Development: The demand for sustainable farming practices creates opportunities for AGCO to innovate and introduce new product lines that cater to eco-conscious farmers.

- Increased Farmer Adoption: As farmers increasingly recognize the long-term economic and environmental benefits of sustainability, AGCO's offerings will see higher adoption rates.

Growth in Aftermarket Parts and Services

The aftermarket for agricultural machinery parts and services offers a resilient and profitable avenue for growth. This segment typically boasts higher margins compared to new equipment sales, providing a stable revenue base even during economic downturns. AGCO is strategically focusing on this area as a significant growth driver.

AGCO has set an ambitious target to increase its parts net sales to $2.3 billion by 2029, underscoring the importance of this segment in its future financial performance. This growth is expected to be fueled by enhanced customer service and a more efficient supply chain.

A concrete example of AGCO's commitment is the investment in a new, state-of-the-art Parts Distribution Centre in France. This facility is designed to bolster AGCO's global parts supply network, ensuring quicker delivery and improved support for its customers worldwide.

Key aspects of this opportunity include:

- High-Margin Revenue: Aftermarket parts and services contribute significantly to profitability due to their typically higher margins.

- Strategic Growth Target: AGCO aims to reach $2.3 billion in parts net sales by 2029, highlighting the segment's importance.

- Supply Chain Enhancement: The new Parts Distribution Centre in France is a strategic investment to improve efficiency and customer satisfaction.

- Customer Loyalty: A robust aftermarket service strengthens customer relationships and encourages repeat business.

The precision agriculture market presents a substantial growth opportunity, with projected CAGRs ranging from 6.8% to 13.3% through 2034, driven by global food demand and technology adoption.

AGCO's strategic investments in PTx precision agriculture are geared towards capturing a larger share of this expanding sector.

The company also sees significant potential to increase market penetration in North and South America, building on its existing European and Middle Eastern presence.

AGCO's focus on the aftermarket for parts and services offers a resilient and profitable growth avenue, with a target of $2.3 billion in parts net sales by 2029.

| Opportunity Area | Market Growth Projection | AGCO's Strategic Focus | Key Initiatives/Targets |

|---|---|---|---|

| Precision Agriculture | CAGR 6.8%-13.3% (2025-2034) | Expand market share via PTx initiatives | Investment in smart farming solutions |

| Geographic Expansion (Americas) | Untapped potential in larger markets | Increase presence in North & South America | Modest growth reported in Brazil (Q2 2025) |

| Aftermarket Parts & Services | Resilient, high-margin revenue | Increase parts net sales | Target: $2.3 billion by 2029; New distribution center in France |

Threats

AGCO’s global operations are inherently exposed to the volatile currents of worldwide economic conditions and geopolitical instability. Trade disputes, such as those impacting agricultural trade flows, and broader geopolitical tensions can directly impede AGCO's ability to source components efficiently and reach its customer base. For instance, in 2023, ongoing supply chain disruptions, partly fueled by geopolitical events, continued to affect manufacturing output across various industries, including agriculture.

These economic and political uncertainties translate into tangible risks for AGCO, including the potential for increased tariffs on imported parts and finished goods, which would raise operational costs. Furthermore, unpredictable shifts in global demand for agricultural machinery, driven by economic downturns or trade policy changes in key markets, can significantly impact sales volumes and revenue streams, as seen in the fluctuating agricultural commodity prices that influence farmer spending.

The agricultural equipment sector is a battlefield of giants, with established global manufacturers constantly vying for dominance. This intense rivalry puts pressure on pricing and necessitates relentless innovation, forcing AGCO to consistently offer unique products and services to stay ahead.

For instance, in 2023, the global agricultural machinery market was valued at approximately $210 billion, with major players like John Deere, CNH Industrial, and AGCO itself investing heavily in research and development to capture market share. AGCO's ability to navigate this crowded space hinges on its capacity to deliver superior technology and customer support.

Volatile agricultural commodity prices pose a significant threat to AGCO. Fluctuations in prices directly impact farmers' income, which in turn affects their willingness and ability to invest in new farm equipment. For instance, while some commodity prices experienced upward trends in 2024, projections for 2025 suggest a general decline due to anticipated improvements in supply conditions. This potential downturn in commodity prices could lead to reduced demand for AGCO's products as farmers face tighter budgets.

Rising Input Costs for Farmers

Farmers are grappling with persistently high input costs, impacting their ability to invest in new equipment. Expenses for fuel, fertilizers, and other essential farm supplies have remained elevated, squeezing profit margins and reducing overall farm income. This financial pressure makes farmers more cautious about making significant capital expenditures, directly affecting AGCO's sales pipeline for agricultural machinery.

The ongoing strain on farm profitability is a significant threat to AGCO's revenue streams. For instance, the cost of anhydrous ammonia, a key fertilizer, saw significant price increases in 2023 and early 2024, with some reports indicating year-over-year jumps of over 50% in certain regions, though prices have seen some moderation by mid-2024. This directly impacts a farmer's disposable income for machinery purchases.

- Elevated Fuel Prices: Crude oil prices, a major driver of fuel costs, have remained volatile, impacting diesel prices crucial for farm operations.

- Fertilizer Cost Volatility: Natural gas prices, a key component in nitrogen fertilizer production, continue to influence fertilizer costs, with fluctuations impacting farmer budgets.

- Reduced Capital Expenditure: Lower farm incomes due to input cost pressures lead to delayed or canceled purchases of new, high-value agricultural equipment.

High Interest Rates and Financing Challenges

Elevated interest rates significantly increase the cost of financing for farmers, directly impacting the affordability of new agricultural equipment and potentially deterring crucial investments. For instance, as of early 2024, benchmark interest rates remained substantially higher than in previous years, making loans for large capital expenditures like tractors and combines more expensive.

This challenging financing environment fosters a cautious sentiment among agricultural producers. Many are adopting a 'wait and see' approach, delaying purchases until interest rates become more favorable, which in turn exerts downward pressure on AGCO's equipment sales volumes.

The persistence of high financing costs can lead to:

- Reduced demand for new machinery.

- Increased reliance on used equipment.

- Slower adoption of advanced farming technologies.

- Potential delays in fleet upgrades by agricultural businesses.

Intense competition within the agricultural machinery sector presents a significant threat, as AGCO faces pressure from established global manufacturers. This rivalry necessitates continuous innovation and competitive pricing to maintain market share, with key players heavily investing in research and development. For example, the global agricultural machinery market, valued at approximately $210 billion in 2023, sees substantial R&D spending from competitors like John Deere and CNH Industrial.

Volatile agricultural commodity prices directly impact farmer income, influencing their ability to purchase new equipment. Projections for 2025 suggest a general decline in some commodity prices due to improved supply conditions, potentially reducing farmer spending power and demand for AGCO's products.

Elevated input costs, such as fuel and fertilizers, continue to strain farm profitability. For instance, anhydrous ammonia prices saw significant increases in late 2023 and early 2024, impacting farmers' disposable income for machinery investments. This financial pressure leads to delayed or canceled purchases of new, high-value equipment.

High interest rates increase financing costs for farmers, making new equipment less affordable and potentially deterring investment. As of early 2024, benchmark rates remained elevated, leading to a cautious sentiment and a preference for delaying purchases until financing becomes more favorable, impacting AGCO's sales volumes.

SWOT Analysis Data Sources

This AGCO SWOT analysis is built upon a foundation of robust data, encompassing AGCO's official financial statements, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of the company's internal capabilities and external environment.