AGCO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGCO Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal forces shaping AGCO's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full report now to gain a competitive advantage.

Political factors

Government agricultural policies, including subsidies and direct payments, directly shape farmers' ability to invest in new machinery, impacting AGCO's sales. For instance, the U.S. Farm Bill, a significant piece of legislation, provides billions in support annually, influencing planting decisions and equipment upgrades.

Shifts in these policies, such as increased emphasis on conservation programs or incentives for precision agriculture, can steer demand towards AGCO's more technologically advanced and sustainable solutions. In 2024, many governments are reviewing or implementing new climate-smart agriculture initiatives, which could boost demand for efficient, low-emission equipment.

AGCO actively monitors and adapts to these evolving agricultural frameworks across its major markets, including North America, Europe, and South America. Understanding these policy landscapes is crucial for ensuring AGCO's product portfolio remains aligned with farmer needs and regulatory requirements, thereby maintaining its competitive edge.

Global trade policies, including agreements like the USMCA and EU trade deals, significantly impact AGCO's ability to export machinery and source components. Tariffs on agricultural equipment, for instance, can directly increase AGCO's operational costs and affect pricing in key markets. In 2023, global trade in agricultural machinery saw varied performance, with some regions experiencing growth while others faced headwinds due to protectionist tendencies.

Geopolitical stability is a critical factor for AGCO. Political instability and conflicts in key agricultural regions can significantly disrupt supply chains, leading to volatile commodity prices and reduced farmer confidence. This often translates into delayed purchases of agricultural equipment, directly impacting AGCO's sales. For instance, ongoing conflicts in Eastern Europe, a significant agricultural producer, have already demonstrated the potential for supply chain disruptions and price volatility in 2024.

AGCO's extensive global footprint means it's exposed to risks arising from regional unrest that can affect manufacturing, distribution networks, and sales operations. While a diversified geographical presence offers some resilience, a generally stable political climate worldwide is essential for fostering consistent demand for agricultural machinery. The company's 2024 outlook, for example, is closely tied to expectations of improved stability in several key markets.

Food Security Initiatives

Governments worldwide are increasingly focusing on food security, a trend that directly benefits companies like AGCO. For instance, the United States Department of Agriculture's initiatives in 2024 continue to support farmers through various programs aimed at boosting production and resilience. These efforts often translate into increased demand for advanced agricultural machinery and technology, areas where AGCO excels.

Policies designed to enhance domestic food production and agricultural efficiency are a significant driver for AGCO. Many nations are investing in modernizing their farming sectors to reduce reliance on imports. This strategic push creates substantial opportunities for AGCO to supply the sophisticated equipment needed for higher yields and more efficient operations. For example, in 2024, the European Union's Common Agricultural Policy continues to encourage sustainable farming practices, which often require advanced machinery.

AGCO's core business of providing essential agricultural equipment and solutions aligns perfectly with these national food security objectives. The company's product portfolio, ranging from tractors to precision agriculture technology, directly addresses the needs of countries aiming to strengthen their food supply chains. AGCO's commitment to innovation supports these strategic goals by offering tools that improve productivity and sustainability in agriculture.

- Government Investments: Many nations are allocating significant funds to agricultural infrastructure and modernization projects in 2024 to bolster food security.

- Policy Impact: Policies promoting domestic food production and efficiency directly increase the market for AGCO's advanced machinery and solutions.

- Strategic Alignment: AGCO's offerings are crucial for countries aiming to achieve national food security goals, enhancing its market position.

- Market Growth: These initiatives are expected to drive continued growth in the agricultural equipment sector, benefiting AGCO's revenue streams.

Regulatory Changes in Agricultural Practices

Evolving regulations around land use, pesticide application, and farming techniques directly impact the demand for specific agricultural equipment. For instance, stricter rules on water usage or soil health could necessitate machinery with enhanced precision capabilities. AGCO needs to align its product development with these changing environmental and agricultural standards to remain competitive.

Staying ahead of these regulatory shifts offers AGCO a significant advantage. By proactively developing equipment that meets or exceeds new compliance requirements, the company can capture market share from competitors slower to adapt. This proactive approach can also drive innovation, leading to more efficient and sustainable farming solutions.

- Land Use Regulations: Changes in zoning or conservation laws can affect the scale and type of farming, influencing equipment needs.

- Pesticide Application Standards: New regulations on sprayer technology and chemical usage can drive demand for precision application equipment.

- Environmental Compliance: Increasingly stringent rules on emissions and waste management will require manufacturers to innovate in machinery design.

- Subsidies and Incentives: Government programs tied to sustainable practices or specific crop types can create demand for specialized AGCO machinery.

Government agricultural policies are a cornerstone for AGCO's performance, with subsidies and direct payments directly influencing farmers' purchasing power for new machinery. For example, the U.S. Farm Bill's substantial annual allocations shape planting decisions and equipment upgrade cycles. Furthermore, governmental shifts towards climate-smart agriculture initiatives, prevalent in 2024, are expected to boost demand for AGCO's efficient, low-emission equipment.

Global trade policies, including agreements like the USMCA and various EU trade deals, critically affect AGCO's export capabilities and component sourcing. Tariffs on agricultural machinery can directly inflate operational costs and influence pricing strategies in key markets. In 2023, the global trade landscape for agricultural machinery presented a mixed picture, with some regions showing growth while others grappled with protectionist measures.

Geopolitical stability is paramount for AGCO, as conflicts in key agricultural regions can disrupt supply chains and commodity prices, dampening farmer confidence and delaying equipment purchases. The ongoing situation in Eastern Europe, a major agricultural hub, has already highlighted the potential for supply chain volatility in 2024, impacting AGCO's operations.

Governments' increasing focus on food security directly benefits AGCO, with initiatives like those from the U.S. Department of Agriculture in 2024 supporting farmers to boost production. This trend translates into greater demand for advanced agricultural machinery and technology, areas where AGCO holds a strong position. The EU's Common Agricultural Policy, for instance, continues to encourage sustainable practices, driving the need for sophisticated AGCO machinery.

What is included in the product

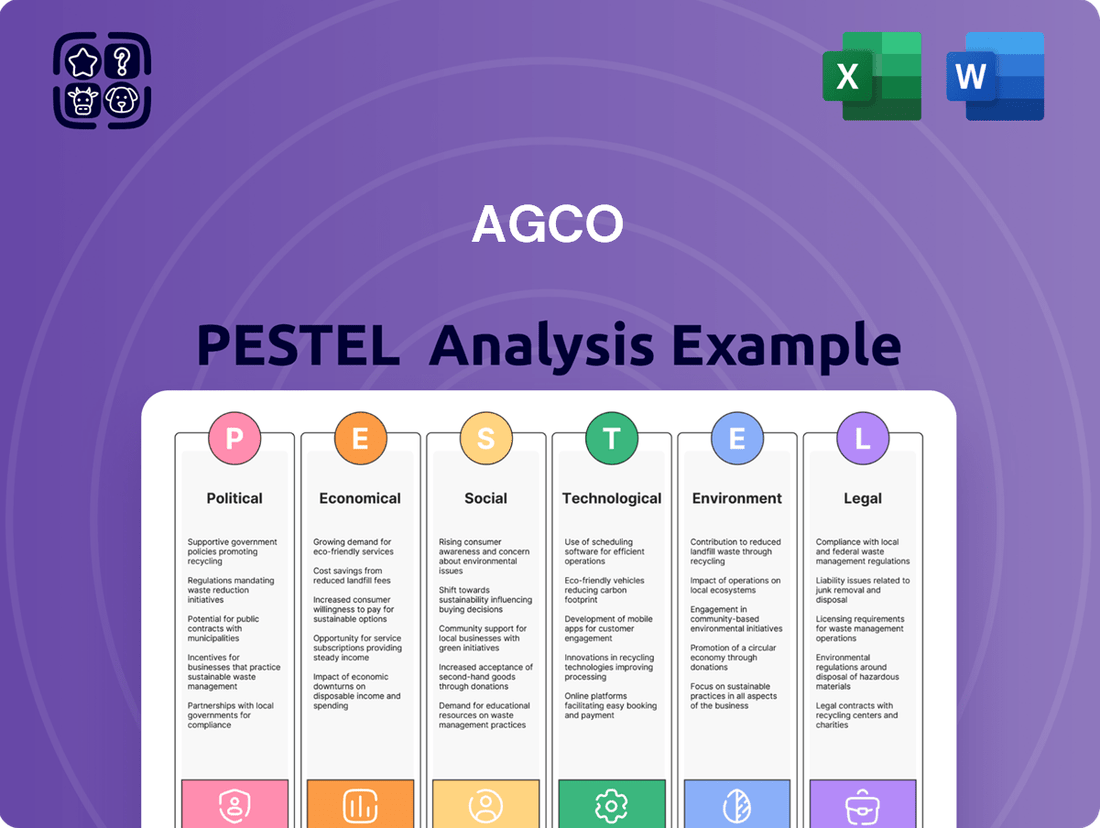

This AGCO PESTLE analysis offers a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategic direction.

The AGCO PESTLE analysis provides a clear, summarized version of external factors, simplifying complex market dynamics for efficient decision-making and reducing the pain of information overload during strategic planning.

Economic factors

Fluctuations in global commodity prices, like corn, wheat, and soybeans, directly affect farmer earnings and their capacity to purchase new machinery. For instance, the USDA projected that U.S. average farm income could see a slight decrease in 2024 compared to 2023, which would influence equipment purchasing decisions.

When commodity prices rise, farmers tend to have more disposable income, boosting demand for AGCO's tractors and other agricultural equipment. Conversely, periods of sustained low prices can dampen sales, potentially prompting AGCO to enhance its financing and leasing programs to support farmer investment.

Prevailing interest rates directly impact AGCO's sales by influencing farmers' ability to finance expensive equipment. For instance, if the Federal Reserve's benchmark interest rate, which influences many lending rates, remains elevated in 2024-2025, the cost of new machinery for farmers will rise, potentially dampening demand.

AGCO's strategy to partner with financial institutions to offer competitive financing options becomes crucial in such environments. These partnerships can provide farmers with more accessible credit, even when overall credit conditions tighten, helping to stabilize AGCO's sales volumes amidst higher borrowing costs.

Rising inflation in 2024 and into 2025 directly impacts AGCO by increasing expenses for raw materials like steel and aluminum, as well as energy and transportation costs. For instance, the Producer Price Index for industrial commodities saw a notable increase throughout 2024, directly affecting AGCO's manufacturing overhead. This surge in operational costs can squeeze profit margins if not effectively managed.

Furthermore, higher input costs for farmers, such as diesel fuel and fertilizer prices, which remained elevated in early 2025, reduce their available capital for new machinery purchases. This dampens demand for AGCO's products, as farmers prioritize essential operational expenses over capital investments. For example, average diesel prices in key agricultural regions hovered around $4.00-$4.50 per gallon in early 2025, a significant burden for farm operations.

To navigate these economic headwinds, AGCO is focusing on supply chain optimization and strategic pricing adjustments. By securing more favorable terms with suppliers and efficiently managing inventory, the company aims to mitigate the impact of rising input costs. Simultaneously, selective price increases on certain product lines are being implemented to offset inflationary pressures while carefully monitoring market competitiveness and farmer purchasing power.

Currency Exchange Rate Fluctuations

AGCO's global operations mean currency exchange rate fluctuations are a significant economic factor. Changes in rates directly impact the cost of parts AGCO imports and the price competitiveness of its machinery sold in different countries. For instance, a stronger US dollar can make AGCO's exports more expensive for international buyers, potentially reducing sales volume.

Conversely, favorable exchange rates can enhance AGCO's reported earnings when international profits are translated back into its reporting currency. In 2023, AGCO reported that foreign currency movements had a net unfavorable impact on its operating profit, highlighting the real-world effect of these fluctuations.

To manage this exposure, AGCO actively uses financial instruments to hedge against adverse currency movements. These strategies aim to lock in exchange rates for future transactions, providing a degree of certainty amidst market volatility.

- Impact on Costs: A stronger Euro, for example, increases the cost of AGCO's components sourced from outside the Eurozone.

- Competitiveness: A weaker Brazilian Real can make AGCO's tractors less affordable for local farmers, impacting sales.

- Profit Translation: In 2024, AGCO's ability to manage currency translation differences will be crucial for its reported net income.

- Hedging Effectiveness: The success of AGCO's hedging programs directly influences its ability to mitigate the negative effects of currency volatility.

Overall Economic Growth and Farmer Income

The overall health of the global economy is a significant driver for AGCO, directly impacting farmer income and their willingness to invest in new machinery. When economies are robust, demand for food typically rises, leading to better profitability for farmers. This increased income then fuels purchases of advanced agricultural equipment, which AGCO provides.

For instance, in 2024, the International Monetary Fund (IMF) projected global economic growth to be around 3.2%, a slight slowdown from previous years but still indicating a generally expanding global market. This growth, coupled with specific agricultural sector performance, directly influences AGCO's sales. A strong agricultural economy in key markets like North America and Europe, where farmers have higher disposable income, translates into higher equipment sales for AGCO.

- Global Economic Growth: The IMF's 2024 projection of 3.2% global growth suggests a generally supportive environment for AGCO, though regional variations exist.

- Farmer Income Correlation: Higher farmer incomes, often a result of strong commodity prices and economic expansion, directly correlate with increased demand for AGCO's high-tech farming solutions.

- Impact of Downturns: Conversely, economic recessions or significant downturns in the agricultural sector, such as a sharp drop in crop prices, can lead to reduced farmer spending on capital equipment, negatively impacting AGCO's sales performance.

- Investment in Productivity: Farmers facing favorable economic conditions are more likely to invest in productivity-enhancing machinery, a core offering of AGCO, to capitalize on market opportunities.

Fluctuations in commodity prices directly impact farmer profitability and their ability to invest in new machinery. For example, projected U.S. farm income for 2024 indicated a potential dip, influencing equipment purchases.

Interest rates significantly affect the affordability of AGCO's high-cost equipment for farmers. Elevated rates in 2024-2025 would increase financing costs, potentially softening demand, making AGCO's financing partnerships vital.

Inflation increases AGCO's manufacturing costs for materials and energy, impacting profit margins. Simultaneously, higher farmer input costs, like fuel and fertilizer, reduce their capacity for new machinery investment, creating a dual challenge for AGCO's sales volumes.

Currency exchange rates affect AGCO's international sales competitiveness and the cost of imported parts. For instance, a strong U.S. dollar makes exports pricier, while favorable rates can boost reported earnings, as seen with AGCO's 2023 performance.

| Economic Factor | 2024/2025 Impact | AGCO Strategy/Consideration |

|---|---|---|

| Commodity Prices | Potential decrease in farmer income due to lower prices affects purchasing power. | Offer flexible financing and leasing options. |

| Interest Rates | Higher rates increase borrowing costs for farmers, potentially reducing demand for new equipment. | Strengthen partnerships with financial institutions for competitive financing. |

| Inflation | Increased costs for raw materials, energy, and transportation for AGCO; higher input costs for farmers reduce their capital for machinery. | Supply chain optimization, strategic pricing adjustments, and efficient inventory management. |

| Currency Exchange Rates | Fluctuations impact export costs and profit translation; a stronger USD can make AGCO exports more expensive. | Utilize financial instruments for hedging against adverse currency movements. |

| Global Economic Growth | Projected 3.2% global growth in 2024 by IMF suggests a generally supportive market, though regional variations exist. | Focus on markets with strong agricultural economies and higher farmer disposable income. |

Same Document Delivered

AGCO PESTLE Analysis

What you're previewing here is the actual AGCO PESTLE Analysis file. It's fully formatted and professionally structured, providing a comprehensive overview of the factors influencing AGCO's business environment. The content and structure shown in the preview is the same document you’ll download after payment, ready for your immediate use.

Sociological factors

The aging farmer population, with the average age of farmers in the U.S. reaching 57.5 years in 2022 according to the USDA, presents a significant demographic shift. This trend influences equipment demand, as older farmers may prefer familiar, simpler machinery, while the increasing number of younger, tech-savvy farmers entering the sector are actively seeking advanced solutions like precision agriculture and automation technologies. AGCO must adapt its product development and marketing strategies to cater to these diverging preferences.

Consumers are increasingly seeking food that is produced sustainably, organically, or sourced locally. This trend directly impacts how farmers operate, shaping their demand for specific agricultural machinery. For instance, there's a rising interest in equipment that facilitates precision agriculture, organic farming methods, and reduced environmental impact.

This shift means farmers are more likely to invest in tools that support these newer cultivation techniques. AGCO, a major player in farm equipment, can leverage this by providing machinery designed to meet these evolving consumer preferences. For example, in 2024, the global market for organic food was valued at over $200 billion, indicating a significant demand that farmers are trying to meet.

A persistent shortage of agricultural labor in key markets, including North America and Europe, is a significant driver for increased demand for automated and efficient machinery. This trend directly benefits companies like AGCO, as farmers actively seek solutions to mitigate reliance on manual workforces. For instance, in 2024, reports indicated that the agricultural sector in the EU faced a deficit of over 100,000 seasonal workers, underscoring the urgency for technological adoption.

Farmers are increasingly prioritizing investments in technologies that enhance productivity while reducing the need for extensive manual input. This includes a growing interest in autonomous tractors, advanced robotic harvesters, and precision agriculture systems. AGCO's strategic focus on developing and offering these types of solutions positions them to capitalize on this critical labor challenge within the global agriculture industry.

Public Perception and Acceptance of Agricultural Technology

Public sentiment towards agricultural advancements, such as precision farming and automation, significantly shapes regulatory landscapes and consumer choices. For instance, a growing unease regarding pesticide use, as reflected in a 2024 survey by the Pew Research Center indicating that 60% of Americans are concerned about the environmental impact of pesticides, can lead to tighter government controls and a shift in demand away from conventionally grown produce. This, in turn, can impact AGCO's market by influencing the adoption rates of specific equipment designed for certain farming practices.

AGCO must actively engage in transparent communication, highlighting how its technologies contribute to sustainable agriculture and efficient food production to cultivate a more favorable public outlook. Demonstrating a commitment to environmental stewardship and food security is crucial for building trust. For example, AGCO's investments in autonomous farming solutions aim to reduce resource waste and improve crop yields, addressing some of these public concerns. By showcasing these advancements, AGCO can foster greater acceptance and support for modern agricultural practices.

- Public Concern: A 2024 Gallup poll revealed that 55% of consumers are concerned about the health effects of genetically modified organisms (GMOs) in food.

- Policy Impact: Negative public perception can translate into legislative action, such as the proposed 2025 EU regulations aiming to restrict the use of certain crop protection products.

- Market Influence: Consumer demand for 'sustainably farmed' products, influenced by public perception, is projected to grow by 15% annually through 2026, according to Agri-Market Insights.

- AGCO's Role: AGCO's focus on developing technologies that minimize chemical inputs and optimize land use directly addresses these public concerns, aiming to position itself as a solution provider.

Rural Development Trends

Rural development is a key factor influencing the agricultural sector, and trends in this area directly affect companies like AGCO. Investments in infrastructure, such as better roads and transportation networks, are crucial for the efficient movement of farm equipment and produce. For instance, the U.S. Department of Agriculture's ReConnect Program is investing billions to expand broadband internet access in rural areas, aiming to reach over 10 million households and businesses by 2026. This improved connectivity is vital for adopting precision agriculture technologies and digital farming solutions.

Population shifts also play a significant role. While some rural areas experience out-migration, others are seeing renewed interest, particularly from younger generations seeking a different lifestyle or entrepreneurial opportunities. This can lead to a more dynamic and tech-savvy agricultural workforce. The increasing adoption of advanced farm machinery, like autonomous tractors and drone technology, is directly linked to the technological readiness and infrastructure available in these communities. AGCO's strategy must align with these evolving rural landscapes to ensure its products and services meet the needs of modernizing farms.

- Infrastructure Investment: Initiatives like the U.S. ReConnect Program are channeling significant funds into rural broadband, with a target of connecting millions of new users by 2026, enhancing digital farming capabilities.

- Broadband Access: Improved internet speeds and reliability in rural areas are critical enablers for the adoption of data-driven farming practices and advanced machinery.

- Population Dynamics: Shifts in rural demographics, including the return of younger populations and increased entrepreneurial activity, can foster greater demand for innovative agricultural solutions.

- Technological Adoption: The viability of modern farming operations, heavily reliant on advanced machinery and digital tools, is directly correlated with the technological infrastructure and skilled labor available in rural regions.

Sociological factors significantly influence AGCO's market by shaping farmer demographics and consumer food preferences. The aging farmer population, with the average age in the U.S. at 57.5 years in 2022, necessitates catering to both experienced and tech-savvy newcomers. Simultaneously, growing consumer demand for sustainable and organic food, as evidenced by the over $200 billion global organic food market in 2024, drives farmer adoption of precision agriculture and eco-friendly machinery.

Labor shortages in agriculture, with the EU facing over 100,000 seasonal worker deficits in 2024, are a major catalyst for AGCO's automation solutions. Farmers are actively seeking equipment that reduces reliance on manual labor, such as autonomous tractors and robotic harvesters. This trend is further amplified by public sentiment, where concerns about pesticide use, noted by 60% of Americans in a 2024 Pew Research survey, can lead to stricter regulations and a preference for less chemically intensive farming, impacting machinery demand.

Rural development and population shifts also play a crucial role. Investments in rural broadband, like the U.S. ReConnect Program aiming to connect millions by 2026, are vital for the adoption of digital farming. Furthermore, the return of younger, entrepreneurial individuals to rural areas can foster greater demand for advanced agricultural technologies. AGCO's success hinges on aligning its product development and marketing with these evolving sociological trends.

| Sociological Factor | 2024/2025 Data Point | Impact on AGCO |

| Farmer Demographics | Average U.S. farmer age: 57.5 (2022) | Need for diverse product offerings catering to different age groups and tech savviness. |

| Consumer Food Preferences | Global organic food market > $200 billion (2024) | Increased demand for precision agriculture and sustainable farming equipment. |

| Labor Shortages | EU seasonal worker deficit: 100,000+ (2024) | Drives demand for automation and labor-saving machinery. |

| Public Sentiment | 60% of Americans concerned about pesticide impact (2024) | Potential for regulatory changes and demand shift towards eco-friendly solutions. |

| Rural Infrastructure | U.S. ReConnect Program targeting millions by 2026 | Enables adoption of digital farming and advanced machinery in rural areas. |

Technological factors

The rapid evolution of precision agriculture, encompassing GPS-guided steering, variable rate application, and advanced sensor technology, is fundamentally reshaping how farms operate. These innovations allow for highly targeted resource management, leading to increased efficiency and reduced environmental impact.

AGCO is actively integrating these cutting-edge technologies into its machinery, positioning itself as a leader in smart farming solutions. For instance, their Fuse® Technologies platform offers integrated data management and machine control, enabling farmers to make more informed decisions. This focus on optimization directly addresses the growing demand for higher yields and lower input costs.

Continued investment in smart farming is vital for AGCO's sustained competitive advantage. The global precision agriculture market was valued at approximately $7.8 billion in 2023 and is projected to reach over $17.5 billion by 2030, demonstrating a significant growth trajectory. AGCO's commitment to developing and deploying these solutions is therefore critical for maintaining market share and driving future revenue.

The drive towards fully autonomous tractors and robotic farm equipment is a major technological leap, directly tackling agricultural labor shortages and boosting efficiency. AGCO is at the forefront, testing and developing these advanced systems to offer farmers hands-free operation and round-the-clock productivity.

This innovation is poised to fundamentally alter the agricultural machinery market landscape. For instance, by 2024, the global autonomous farming market was projected to reach over $3.5 billion, with significant growth expected as technologies mature and adoption increases.

Artificial intelligence and big data analytics are revolutionizing farm management, offering unprecedented optimization capabilities. These technologies enable predictive maintenance for agricultural machinery, reducing downtime and operational costs. Furthermore, real-time crop health monitoring powered by AI allows for precise interventions, boosting yields and resource efficiency.

AGCO is at the forefront of this technological shift, integrating AI and data analytics into its Fuse Smart Farming platform. This strategic focus empowers farmers with actionable intelligence, derived from vast datasets, to make more informed decisions. The company's commitment to data-driven solutions positions it as a key innovator in the agricultural technology sector, enhancing overall farm performance and profitability for its customers.

Electrification and Alternative Fuel Sources for Equipment

The agricultural sector faces growing pressure to curb carbon emissions, accelerating the push towards electric and alternative-fueled machinery. AGCO is actively investing in research and development for electric tractors and investigating other sustainable power options, responding to both environmental mandates and farmer interest in greener operations. This transition presents a dual challenge and a substantial avenue for innovation.

The market for electric tractors is projected for significant growth. For instance, some analysts predict the global electric tractor market could reach approximately $1.5 billion by 2028, with a compound annual growth rate of around 12% from 2023 to 2028. AGCO’s strategic investments in this area position them to capitalize on this expanding market segment.

- Technological Advancement: AGCO is developing battery-electric and hybrid-electric powertrains for its equipment.

- Market Demand: Farmers are increasingly seeking sustainable solutions to reduce operating costs and meet environmental regulations.

- Investment Focus: AGCO has announced significant R&D investments, with a portion earmarked for electrification initiatives.

- Competitive Landscape: Competitors are also investing heavily in electric and alternative fuel technologies, making innovation crucial for market share.

Biotechnology and Crop Science Innovations

Advances in biotechnology and crop science, like the development of drought-resistant crops and enhanced seed varieties, directly influence the demand for specialized agricultural machinery. AGCO needs to ensure its planting, spraying, and harvesting equipment are compatible with and optimized for these new crop technologies. For instance, precision planting equipment is crucial for maximizing the yield of genetically modified seeds designed for specific soil conditions.

While AGCO is not a direct player in biotechnology research, staying ahead of these innovations is key. The company's machinery must adapt to handle crops with altered growth patterns or specific nutrient requirements. This adaptability ensures AGCO's continued relevance and market share in an evolving agricultural landscape. The global agricultural biotechnology market was valued at approximately USD 100 billion in 2023 and is projected to grow significantly, underscoring the importance of this trend.

- Equipment Compatibility: AGCO's machinery must be designed to work seamlessly with advanced seed varieties and biotech-enhanced crops.

- Market Adaptation: The company needs to monitor and respond to the growing demand for equipment supporting precision agriculture driven by biotech innovations.

- Collaboration Opportunities: Partnering with agri-science companies can lead to the development of integrated solutions that benefit both farmers and AGCO.

- Future Growth Driver: Innovations in crop science are expected to be a significant factor in driving demand for next-generation agricultural equipment.

The integration of AI and big data is revolutionizing farm management, enabling predictive maintenance and real-time crop health monitoring for enhanced yields and efficiency. AGCO's Fuse Smart Farming platform leverages these technologies, providing farmers with actionable intelligence. This data-driven approach is crucial for optimizing farm operations and profitability.

The development of autonomous tractors and robotic farm equipment directly addresses agricultural labor shortages and boosts productivity, with AGCO actively pioneering these advanced systems for hands-free, round-the-clock operation. The global autonomous farming market was projected to exceed $3.5 billion by 2024.

Electrification is a key technological trend, with AGCO investing in battery-electric and hybrid powertrains to meet farmer demand for sustainable, cost-effective solutions. The electric tractor market is anticipated to reach approximately $1.5 billion by 2028, growing at a CAGR of around 12% from 2023.

Precision agriculture, including GPS steering and variable rate application, is transforming farming for greater efficiency and reduced environmental impact. AGCO's Fuse Technologies platform integrates these advancements, supporting farmers in making data-informed decisions. The precision agriculture market was valued at $7.8 billion in 2023 and is expected to reach over $17.5 billion by 2030.

Legal factors

Environmental Protection Laws and Emissions Standards are a major factor for AGCO. Stricter rules, like Tier 4 Final in North America and Stage V in Europe, directly influence how AGCO designs and builds its farm machinery, especially engines. Meeting these standards demands significant investment in research and development, which can also raise manufacturing expenses.

These evolving regulations necessitate continuous innovation from AGCO to ensure its equipment remains compliant and competitive in markets worldwide. For instance, the cost of compliance with emissions standards often translates into higher upfront prices for new agricultural equipment, a trend observed throughout 2024 and projected to continue into 2025.

AGCO navigates a complex web of product safety and machinery certification regulations globally, ensuring its agricultural equipment meets rigorous operational standards. These rules, covering aspects like emission controls and operator safety features, are paramount for market entry and avoiding costly recalls. For instance, in 2024, stricter European Union emissions standards for off-road machinery continued to influence engine development across the industry.

Intellectual property rights are crucial for AGCO, safeguarding its innovations in agricultural machinery, software, and smart farming. Patents on new equipment designs and proprietary algorithms protect AGCO's competitive edge. For instance, the company invests heavily in R&D; in 2023, AGCO's R&D expenses were $349 million, underscoring the importance of IP protection.

Robust legal frameworks for intellectual property allow AGCO to secure its technological advancements and deter competitors from unauthorized copying. This legal shield is essential for maintaining market differentiation in a rapidly evolving agricultural technology landscape.

Constant vigilance and enforcement of AGCO's intellectual property rights are paramount to recouping its significant research and development investments. Protecting its patents and trade secrets ensures AGCO can sustain its market position and continue to innovate in the agricultural sector.

Labor Laws and Worker Safety Regulations

AGCO, a global agricultural equipment manufacturer, navigates a complex web of labor laws across its operating countries. These regulations, covering everything from minimum wages to workplace safety standards, directly influence manufacturing expenses and HR strategies. For instance, in 2024, many nations continued to strengthen worker safety protocols, potentially increasing compliance costs for companies like AGCO.

Adherence to fair labor practices and maintaining a secure working environment are paramount for AGCO's reputation and its ability to attract and retain talent. In 2025, reports highlighted a growing emphasis on employee well-being and fair compensation as key drivers of productivity and employee loyalty in the manufacturing sector.

- Global Compliance: AGCO must adhere to diverse labor laws in over 150 countries, impacting its operational costs and human capital management.

- Worker Safety Focus: Increasing regulatory scrutiny on workplace safety in 2024 and 2025 necessitates continuous investment in safety training and equipment.

- Reputation and Retention: Strong labor practices are vital for AGCO's brand image and its ability to retain skilled employees in a competitive global market.

Antitrust and Competition Laws

Antitrust and competition laws significantly shape AGCO's strategic maneuvers, particularly concerning its market position and any potential mergers or acquisitions. These regulations are in place to prevent market monopolization and foster a competitive environment, meaning AGCO must carefully consider their implications for growth and consolidation. Failure to comply can result in substantial legal penalties and hinder strategic expansion plans.

Navigating these complex legal frameworks is crucial for AGCO's continued success. For instance, in 2024, regulatory bodies worldwide continue to scrutinize large agricultural equipment manufacturers for potential anti-competitive practices. AGCO's ability to expand its market share through acquisitions is directly tied to its adherence to these evolving competition laws.

- Regulatory Scrutiny: AGCO's market share, particularly in key segments like tractors and harvesting equipment, is under constant review by antitrust authorities globally.

- Merger & Acquisition Compliance: Any proposed mergers or acquisitions by AGCO must undergo rigorous review to ensure they do not unduly restrict competition.

- Global Enforcement Trends: In 2024, there's an increased focus on digital markets and supply chain consolidation, which could impact AGCO's acquisition strategies.

- Legal Ramifications: Non-compliance can lead to significant fines, divestitures, and reputational damage, impacting AGCO's operational freedom and growth trajectory.

AGCO's operations are heavily influenced by international trade agreements and tariffs, impacting the cost of importing and exporting machinery and components. Changes in trade policies, such as those observed throughout 2024, can directly affect AGCO's global supply chain and pricing strategies. For example, new tariffs imposed on steel or essential electronic components in late 2024 could increase production costs.

Navigating diverse customs regulations and product import/export laws is essential for AGCO's global market access. Compliance ensures smooth logistics and avoids costly delays or penalties. The company's ability to effectively manage these legal requirements is a key determinant of its international competitiveness.

Contract law forms the backbone of AGCO's business relationships, governing everything from supplier agreements to customer sales contracts and distribution partnerships. Clear and enforceable contracts are vital for mitigating risks and ensuring operational stability. In 2024, AGCO continued to refine its contractual frameworks to better manage supply chain volatility and protect its intellectual property.

| Legal Factor | Impact on AGCO | 2024/2025 Relevance |

|---|---|---|

| International Trade & Tariffs | Affects import/export costs, supply chain efficiency. | Ongoing scrutiny of global trade policies and potential new tariffs on agricultural inputs and finished goods. |

| Customs Regulations | Ensures market access, avoids delays and penalties. | Adaptation to evolving customs procedures and documentation requirements in key markets. |

| Contract Law | Governs supplier, customer, and distribution agreements. | Emphasis on robust contracts to manage supply chain risks and protect IP in a dynamic market. |

Environmental factors

Climate change is increasingly impacting agriculture, with extreme weather events like droughts and floods becoming more frequent and intense. These shifts directly affect crop yields and highlight the growing need for resilient farming equipment. For instance, the UN projects that by 2050, climate change could reduce global crop yields by up to 30% in some regions.

AGCO can capitalize on this by innovating machinery that aids farmer adaptation. This includes developing advanced precision irrigation systems to combat drought and creating equipment capable of handling diverse and potentially degraded soil conditions resulting from extreme weather. The demand for such robust and adaptable solutions is on the rise as farmers seek to mitigate climate-related risks.

Increasing water scarcity in key agricultural areas is a significant environmental factor impacting AGCO. This trend is fueling a greater need for technologies that help farmers use water more efficiently. For instance, the UN projects that by 2025, 1.8 billion people will live in countries experiencing absolute water scarcity.

AGCO's product portfolio, especially its precision spraying and irrigation systems, directly addresses this challenge. These solutions enable farmers to apply water precisely where and when it's needed, minimizing waste. In 2023, AGCO reported continued innovation in smart farming technologies aimed at resource optimization, including water management.

The agricultural sector faces growing pressure to adopt sustainable practices that protect soil health and conserve biodiversity. This shift is directly influencing equipment design, pushing for innovations in conservation tillage, cover crop seeding, and technologies that minimize soil compaction. For instance, by 2024, many farmers are seeking equipment that facilitates no-till or minimum-till farming, which can significantly improve soil structure and water retention.

AGCO's strategic focus on developing machinery that supports these environmentally friendly farming methods is a key differentiator. Their investments in precision agriculture technologies, which enable targeted application of fertilizers and pesticides, also contribute to reduced environmental impact and better soil management. This alignment with sustainability trends is crucial as regulatory bodies and consumers increasingly demand more eco-conscious food production.

Demand for Sustainable Farming Practices

Societal pressure for sustainability is driving the agricultural industry towards greener methods, like minimizing chemical inputs and reducing carbon emissions. This trend is a significant environmental factor influencing AGCO's operations and strategy.

AGCO is actively addressing this demand by developing advanced machinery designed for sustainable farming. Examples include their Fendt electric tractors, precision application technology that optimizes fertilizer and pesticide use, and sophisticated data management systems that help farmers use resources more efficiently. These innovations directly respond to the growing need for environmentally conscious agriculture.

The increasing consumer and regulatory focus on sustainability is directly shaping AGCO's product development pipeline and research and development investments. For instance, by 2024, the global precision agriculture market was projected to reach over $10 billion, highlighting the significant financial incentive for companies like AGCO to lead in this area. This demand ensures that AGCO's commitment to sustainable solutions will remain a core part of its business model.

Key aspects of this demand include:

- Reduced reliance on synthetic fertilizers and pesticides.

- Lowering greenhouse gas emissions from farming operations.

- Enhanced soil health and water conservation techniques.

- Increased adoption of precision farming technologies.

Waste Management and Circular Economy Principles

The agricultural sector, including heavy equipment manufacturing like AGCO's, faces growing pressure to implement waste reduction and embrace circular economy concepts. This means minimizing waste generated during production and actively seeking ways to reuse or recycle components. AGCO is actively working on this, aiming to reduce waste in its factories and investigating how to remanufacture parts and recycle machinery at the end of its life. This strategic shift towards designing products for longevity, ease of repair, and eventual recyclability is crucial for building a more sustainable supply chain.

AGCO's commitment to sustainability is evident in its efforts to integrate circular economy principles. For instance, in 2023, the company reported a 5% reduction in manufacturing waste intensity compared to 2022, a tangible step towards its environmental goals. They are actively exploring pilot programs for remanufacturing key engine and transmission components, which could extend the life of parts by up to 50% and significantly reduce the need for new raw materials. Furthermore, AGCO is investing in partnerships to improve the collection and recycling infrastructure for end-of-life agricultural machinery, aiming to recover valuable materials and minimize landfill impact.

- Waste Reduction Targets: AGCO aims to reduce manufacturing waste by 15% by 2027, building on its 2023 achievements.

- Remanufacturing Initiatives: The company is piloting remanufacturing programs for specific tractor components, projecting a potential cost saving of 20-30% for customers compared to new parts.

- Recycling Partnerships: AGCO is collaborating with industry bodies to establish standardized end-of-life vehicle recycling protocols, targeting a 70% material recovery rate for retired equipment by 2026.

- Product Design for Circularity: AGCO's latest generation of harvesters features modular designs that enhance repairability and allow for easier component segregation for recycling.

Climate change is a significant environmental factor, with extreme weather events like droughts and floods increasingly impacting agriculture, necessitating resilient farming equipment. By 2050, climate change could reduce global crop yields by up to 30% in some regions, driving demand for AGCO's adaptable machinery.

Water scarcity is another critical environmental concern, with 1.8 billion people projected to live in water-scarce countries by 2025, increasing the need for AGCO's precision irrigation and water-efficient technologies.

Growing pressure for sustainable practices is pushing the agricultural sector towards reduced chemical inputs and lower emissions, aligning with AGCO's development of electric tractors and precision application systems.

The global precision agriculture market was projected to exceed $10 billion by 2024, underscoring the financial incentive for AGCO to lead in sustainable, resource-optimizing farming solutions.

PESTLE Analysis Data Sources

Our AGCO PESTLE Analysis draws upon a comprehensive blend of data from agricultural industry reports, government agricultural policies, economic forecasts, and technological advancements in farming. We ensure each factor is informed by credible, up-to-date information.