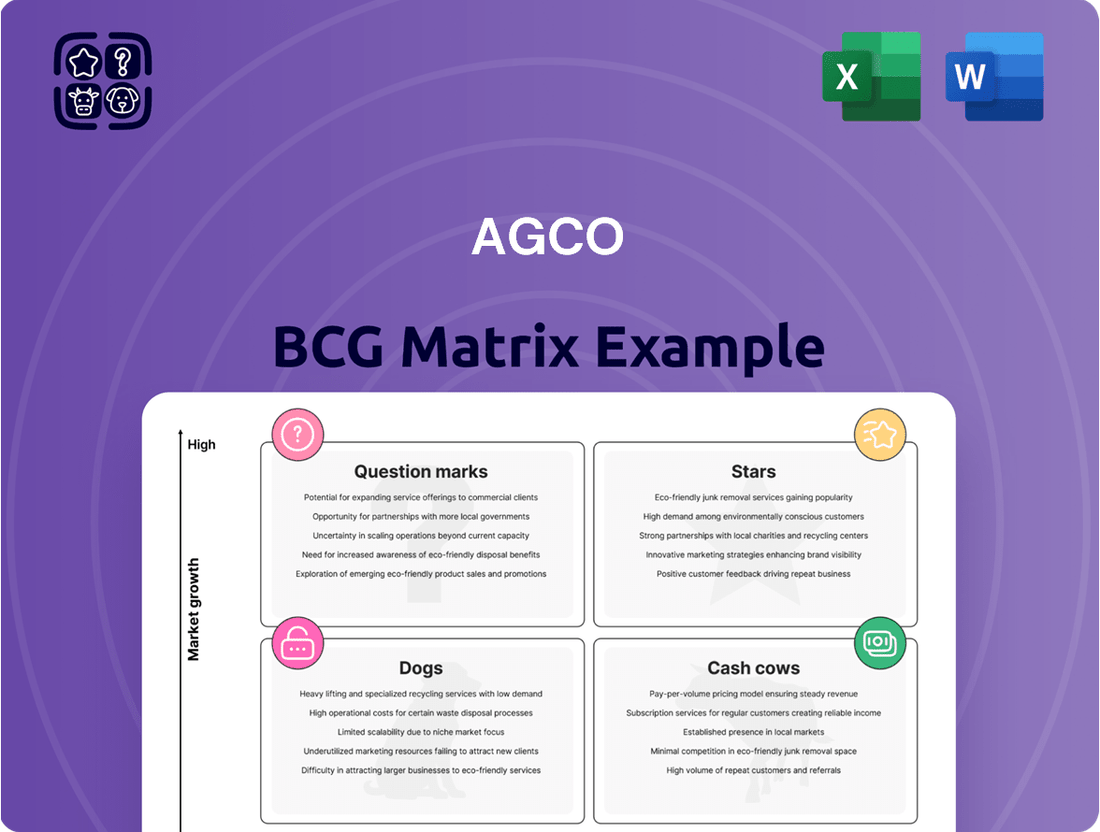

AGCO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGCO Bundle

Understand the strategic positioning of a company's product portfolio with the AGCO BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual representation of their market share and growth potential. Don't miss out on the actionable insights that can drive your business forward.

Ready to transform your product strategy? Purchase the full AGCO BCG Matrix for a comprehensive breakdown of each quadrant, including data-driven recommendations for optimizing your investments. Gain the clarity you need to make informed decisions and secure your competitive edge.

Stars

Fendt, AGCO's premium brand, is a star in the BCG Matrix, driving significant growth. The company aims to boost Fendt's net sales in the Americas to $1.7 billion by 2029, a substantial increase from an estimated $1 billion in 2024. This expansion into new territories with its complete product range, from tractors to sprayers, solidifies Fendt's role as a high-potential income generator.

Fendt's market performance underscores its star status. In 2024, the brand captured 9.5% of the Spanish tractor market and an even more impressive 11.9% in the over 80 horsepower segment. This market share growth, coupled with premium pricing reflecting high demand and limited supply, highlights Fendt's strong brand equity and leadership in a burgeoning market segment.

AGCO's precision agriculture business, encompassing PTx, Precision Planting, and PTx Trimble, is a clear star in its portfolio, aiming for $2.0 billion in net sales by 2029. This segment is thriving in a market expected to expand at a robust 10.02% compound annual growth rate from 2025 through 2035.

AGCO is strategically bolstering this star by investing in new product introductions and enhancing its AI and connectivity features, pushing towards fully integrated farm operations. A key differentiator is their capability to equip virtually any existing farm equipment with precision technology, offering farmers a cost-effective path to significant operational upgrades.

Valtra's S and N series tractors are positioned as strong contenders within AGCO's portfolio, evidenced by their recognition as finalists for Tractor of the Year 2025 awards, including the S416 and N175 Direct models. These tractors boast AGCO Power engines and advanced transmissions, underscoring their commitment to high performance and operational efficiency.

The integration of Smart Farming technology across these series reflects Valtra's dedication to innovation, aiming to boost productivity and sustainability for farmers. This technological edge, combined with a focus on customization through Valtra Unlimited, solidifies their market presence and appeal to a wide range of agricultural needs.

High-Capacity Combines and Planters (Specific Models)

AGCO's high-capacity Fendt IDEAL combine and Momentum planter are performing well in their respective markets, which are experiencing growth. These advanced machines cater to the increasing farmer demand for larger, more efficient equipment that boosts productivity. Their technological edge and suitability for large-scale farming operations solidify their strong market standing.

Innovation in this segment remains a priority for AGCO, ensuring these flagship products stay competitive. For instance, the Fendt IDEAL combine line has consistently been recognized for its grain quality and efficiency, with sales figures reflecting a strong uptake among large-acreage growers. Similarly, the AGCO Momentum planter is designed for high-speed, high-precision planting, addressing a critical need for farmers looking to optimize their planting windows and seed placement for better yields.

- Fendt IDEAL Combine: Known for its industry-leading throughput and grain quality, AGCO has seen sustained demand for the IDEAL series, particularly in North America and Europe.

- AGCO Momentum Planter: This planter offers advanced features like individual row shut-offs and variable rate seeding, contributing to its strong adoption by farmers focused on precision agriculture.

- Market Trend: The global agricultural machinery market, while subject to fluctuations, shows a clear trend towards larger, more technologically advanced equipment to enhance operational efficiency.

- AGCO's Strategy: Continued investment in R&D for these high-capacity lines ensures AGCO maintains its leadership in segments demanding peak performance and innovation.

Advanced Sprayers (Fendt Rogator, Massey Ferguson 5S with PTx Trimble)

AGCO's advanced sprayer portfolio, featuring the Fendt Rogator 900 and Massey Ferguson 5S with PTx Trimble guidance, showcases the company's commitment to precision agriculture. These machines are equipped with cutting-edge technology like WeedSeeker 2, which targets specific weeds with remarkable accuracy, reducing herbicide use by up to 90% in trials and significantly cutting costs for farmers.

Despite a general oversupply in the sprayer market during 2024-2025, the demand for sophisticated, high-efficiency application equipment remains robust. Farmers are increasingly investing in these advanced systems to optimize nutrient and pesticide application, a trend driven by the need for greater sustainability and improved operational economics.

Key features and benefits of AGCO's advanced sprayers include:

- Precision Weed Control: Technologies like WeedSeeker 2 enable spot spraying, drastically reducing chemical usage and environmental impact.

- Enhanced Efficiency: Integrated guidance systems from PTx Trimble ensure optimal field coverage and minimize overlaps, saving time and resources.

- Data-Driven Operations: These sprayers facilitate precise data collection, allowing for better farm management decisions and yield optimization.

- Sustainability Focus: By reducing chemical inputs and improving application accuracy, these machines support more environmentally friendly farming practices.

Stars in AGCO's portfolio represent high-growth, high-market-share businesses. These are typically newer product lines or brands that have gained significant traction and are expected to continue their upward trajectory. AGCO actively invests in these segments to maintain their leadership and capitalize on market opportunities.

Fendt's premium tractors and AGCO's precision agriculture solutions are prime examples of stars. Fendt is projected to reach $1.7 billion in net sales in the Americas by 2029, up from an estimated $1 billion in 2024. The precision agriculture segment, including PTx and Precision Planting, targets $2.0 billion in net sales by 2029, benefiting from a market expected to grow at a 10.02% CAGR.

Valtra's S and N series tractors, recognized as Tractor of the Year 2025 finalists, also demonstrate star potential due to their advanced technology and customization options. Similarly, the Fendt IDEAL combine and Momentum planter are stars, addressing the demand for larger, more efficient equipment and experiencing strong sales, particularly among large-acreage growers.

AGCO's advanced sprayer portfolio, featuring Fendt Rogator 900 and Massey Ferguson 5S with PTx Trimble guidance, is another star segment. These products leverage technologies like WeedSeeker 2, which can reduce herbicide use by up to 90%, appealing to farmers seeking cost savings and sustainability.

| Brand/Product Line | BCG Category | Key Growth Drivers | 2024 Estimate/Status | 2029 Target |

| Fendt Tractors | Star | Premium positioning, expansion in Americas | $1 billion net sales (Americas estimate) | $1.7 billion net sales (Americas) |

| Precision Agriculture (PTx, Precision Planting) | Star | Market growth (10.02% CAGR), AI/connectivity features | N/A | $2.0 billion net sales |

| Valtra S & N Series Tractors | Star | Innovation, Tractor of the Year recognition | Strong market presence | Continued growth |

| Fendt IDEAL Combine & Momentum Planter | Star | High-capacity demand, technological advancement | Strong sales | Continued market leadership |

| Advanced Sprayers (Fendt Rogator, MF 5S) | Star | Precision application, herbicide reduction | Robust demand for advanced systems | Continued innovation |

What is included in the product

The AGCO BCG Matrix analyzes product portfolios by market share and growth, guiding investment decisions.

The AGCO BCG Matrix provides a clear, visual overview of your portfolio, instantly highlighting underperforming units that need attention.

Cash Cows

Massey Ferguson tractors and equipment are AGCO's quintessential cash cows. This globally recognized brand enjoys a significant market share in established agricultural regions, consistently generating substantial revenue for AGCO. Its broad customer acceptance and reputation for reliability ensure a steady cash flow, making it a foundational element of AGCO's financial stability.

AGCO's core tractor lines, representing established models, are firmly positioned as Cash Cows within the BCG matrix. Tractors consistently lead the global agriculture equipment market, holding the largest share, a testament to their mature yet indispensable nature.

Despite potential economic headwinds impacting new equipment sales in 2024 and 2025, the enduring need for dependable tractors guarantees a stable revenue source for AGCO. These foundational tractor segments are significant cash generators, benefiting from extended product lifecycles and reduced marketing expenditures compared to emerging product categories.

AGCO's approach prioritizes maintaining market dominance and maximizing operational efficiency within these vital tractor segments. For instance, in 2023, AGCO reported net sales of $14.4 billion, with their full-line brands, including Fendt, Valtra, and Massey Ferguson tractors, contributing substantially to this figure.

AGCO's global replacement parts business is a quintessential cash cow within its BCG Matrix. This segment is a powerhouse of profitability and stability, with AGCO targeting net sales of $2.3 billion by 2029, up from an estimated $1.8 billion. This impressive growth is fueled by the agricultural sector's increasing emphasis on maintaining and repairing existing machinery, a trend particularly pronounced during economic uncertainties when new equipment purchases are deferred.

The parts business generates substantial and dependable cash flow. It requires minimal investment in marketing and promotion, largely benefiting from AGCO's extensive global installed base of machinery. This consistent revenue stream significantly bolsters the company's overall earnings resilience, proving to be a steady performer regardless of broader market cycles.

GSI Grain Storage Systems

GSI, AGCO's brand for grain storage systems, fits the Cash Cow quadrant in the BCG Matrix. This segment benefits from a stable market, fueled by the ongoing agricultural necessity for effective post-harvest management. GSI's consistent demand is largely insulated from the typical ups and downs seen in new equipment sales cycles.

The brand's strong market position and specialized product range translate into a dependable source of cash flow for AGCO. Investments in GSI are strategically directed towards enhancing operational efficiency and making gradual product improvements, rather than pursuing rapid market share growth.

- Market Stability: The grain storage market, where GSI operates, is characterized by consistent demand due to the fundamental need for post-harvest handling and storage.

- Reliable Cash Flow: GSI's established presence and specialized product portfolio ensure a steady and predictable generation of revenue.

- Investment Focus: AGCO's capital allocation for GSI prioritizes operational enhancements and incremental advancements over aggressive expansion initiatives.

- 2024 Data Insight: While specific 2024 revenue figures for GSI as a standalone entity within AGCO's reporting are not publicly itemized in detail, AGCO's overall Grain & Protein segment, which includes GSI, saw significant growth. For instance, AGCO reported a net sales increase of approximately 10% in the first quarter of 2024 compared to the prior year, indicating robust performance in its storage and handling solutions.

Aftermarket Services and Support

Aftermarket services and support represent a strong Cash Cow for AGCO. The agricultural equipment market is seeing a notable increase in demand for maintenance and repair services, as farmers look to extend the operational life of their existing machinery. This trend is particularly beneficial for AGCO, as its extensive service networks and reliable spare parts availability translate into consistent, high-margin cash flow.

With new equipment sales potentially facing challenges, AGCO's focus on its service and support segment becomes even more crucial. This strategy ensures a steady revenue stream from its established customer base, mitigating the impact of slower new unit sales.

AGCO's commitment to providing value-added services is instrumental in supporting farmers, especially during periods of economic uncertainty. This dedication not only helps clients manage their operational costs but also significantly bolsters customer loyalty.

- Growth in Aftermarket Services: Driven by farmers extending machinery lifespan.

- Strong Cash Flow Generation: Supported by AGCO's robust service networks and parts availability.

- Strategic Importance: Critical for revenue continuity as new equipment sales face headwinds.

- Customer Loyalty: Enhanced through value-added services, aiding farmers during economic downturns.

AGCO's established tractor lines, particularly those under brands like Massey Ferguson and Fendt, are prime examples of Cash Cows. These products operate in a mature market with high market share, generating consistent and substantial cash flow with relatively low investment needs. Their longevity and broad customer acceptance ensure their position as reliable revenue drivers for the company.

The global replacement parts business for AGCO is another significant Cash Cow. This segment benefits from the large installed base of AGCO machinery, requiring ongoing maintenance and repairs. The demand for parts is stable, providing a predictable and profitable income stream that requires minimal marketing expenditure.

GSI, AGCO's grain storage and handling solutions brand, also functions as a Cash Cow. The agricultural sector's fundamental need for efficient post-harvest management ensures consistent demand for GSI products. AGCO focuses on optimizing operations and making incremental product improvements within GSI, rather than aggressive growth strategies.

| AGCO Business Segment | BCG Matrix Classification | Key Characteristics | 2023/2024 Data Point |

| Tractors (Massey Ferguson, Fendt) | Cash Cow | High market share, mature market, stable demand, low investment needs | AGCO's full-line brands, including tractors, significantly contributed to $14.4 billion in net sales in 2023. |

| Replacement Parts | Cash Cow | Large installed base, consistent demand, high profitability, low marketing costs | Targeting $2.3 billion in net sales by 2029, up from an estimated $1.8 billion. |

| Grain Storage & Handling (GSI) | Cash Cow | Stable market, essential agricultural need, predictable revenue, operational efficiency focus | AGCO's Grain & Protein segment saw approximately 10% net sales increase in Q1 2024 year-over-year. |

What You’re Viewing Is Included

AGCO BCG Matrix

The AGCO BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered formatting – just the complete, professionally designed analysis ready for your strategic decision-making. You can be confident that the insights and visualizations presented here are exactly what you'll be working with to assess your product portfolio's performance and guide future investments. This is your direct pathway to actionable strategic planning, delivered instantly.

Dogs

AGCO's strategic divestiture of its Grain & Protein business in Q2 2024, with proceeds contributing to other revenue, clearly marks this segment as a 'dog' in the BCG Matrix. This move suggests the business was not meeting performance expectations or strategic alignment, acting as a drain on resources without generating adequate returns.

The decision to sell off the majority of this segment highlights AGCO's commitment to optimizing its portfolio by shedding low-growth, low-market-share operations. This action directly supports the company's strategy to concentrate on its more profitable and growth-oriented agricultural machinery and precision ag technology offerings.

Older or less technologically advanced equipment models are increasingly becoming less desirable due to the rapid pace of innovation in agricultural machinery. These machines often lack crucial features like integrated GPS, auto-steering, and precision application capabilities, which are now standard for efficient farming operations.

The market for these older units is experiencing a significant downturn. A surplus of late-model used equipment has flooded the market, creating a buyer's advantage and driving down prices for less advanced machinery. For instance, in 2024, the average resale value of tractors manufactured before 2015 saw a decline of approximately 15-20% compared to the previous year, according to industry reports.

Furthermore, farmers are prioritizing performance upgrades for their existing equipment over purchasing entirely new, but less advanced, machines. This trend suggests that older models represent a low-growth segment with a shrinking market share, making them prime candidates for reduced investment or eventual discontinuation from product lines.

High-horsepower tractors, typically a strong performer, are currently grappling with an oversupply, especially in North America. This has led to a noticeable dip in sales volumes throughout 2024, with expectations of continued sluggishness into 2025.

The primary drivers behind this downturn include reduced farm income projections, elevated interest rates impacting purchasing power, and a more current equipment base among farmers. These factors collectively contribute to a low-growth environment for this segment.

In response, AGCO has implemented significant production reductions aimed at normalizing dealer inventory levels. This strategic move underscores the challenging market conditions currently faced by these high-horsepower tractor lines.

Self-Propelled Sprayers (Current Oversupply)

The self-propelled sprayer market is currently experiencing a significant oversupply, mirroring trends seen in high-horsepower tractors. This situation, evident throughout 2024, has resulted in downward price pressure, creating a favorable environment for buyers.

Several factors contribute to this market saturation. Increased trade-ins from farmers upgrading their equipment, coupled with the introduction of new models, have swelled inventory levels. This influx, combined with a generally low-growth environment for these specific units, is pushing the segment towards a 'dog' classification within the AGCO BCG Matrix.

Farmers, grappling with tighter profit margins, are also actively seeking more cost-effective solutions. The growing adoption of spray drones, for instance, presents an alternative that is impacting the demand for traditional high-clearance self-propelled sprayers. This shift in farmer preference further exacerbates the oversupply issue.

- Market Oversupply: 2024 has seen a substantial increase in self-propelled sprayer inventory.

- Price Pressure: The oversupply has led to a buyer's market with declining prices.

- Demand Shift: Farmers are exploring alternatives like spray drones due to cost considerations.

- BCG Classification: The segment exhibits characteristics of a 'dog' due to market saturation and reduced demand.

Certain Regional Offerings in Declining Markets

Certain regional product offerings within AGCO could be classified as 'dogs' in the BCG Matrix, particularly those situated in markets experiencing significant and prolonged downturns. For instance, AGCO's net sales in North America saw a substantial constant-currency decline of 32.2% in Q2 2025. This decline, coupled with similar trends in Europe/Middle East and South America, points to challenging market conditions in these regions.

These underperforming segments are often characterized by factors such as low commodity prices, elevated operating costs, and diminished farm income, all of which suppress demand for agricultural equipment. Consequently, regional product lines within these declining markets may exhibit persistently weak demand and a low market share, necessitating careful strategic evaluation.

- North America's Q2 2025 constant-currency net sales decline: 32.2%

- Challenging market conditions include low commodity prices and high operating costs.

- Reduced farm income directly impacts demand for agricultural machinery.

- Segments with weak demand and low market share require strategic review.

AGCO's divestiture of its Grain & Protein business in Q2 2024, coupled with production cuts for high-horsepower tractors and a self-propelled sprayer oversupply in 2024, clearly positions these segments as 'dogs'. These areas face declining demand, market saturation, and price erosion, indicating low market share and low growth potential within AGCO's portfolio.

The North American market, experiencing a 32.2% constant-currency net sales decline in Q2 2025, exemplifies a 'dog' scenario due to depressed farm incomes and high operating costs. These conditions suppress demand, leading to weak market share for certain regional product offerings, necessitating strategic evaluation.

The oversupply of self-propelled sprayers in 2024, driven by increased trade-ins and new model introductions, has created downward price pressure. This, along with farmers seeking cost-effective alternatives like spray drones, signals a low-growth, low-market-share segment for traditional sprayers.

Older agricultural machinery models are increasingly becoming 'dogs' due to rapid technological advancements. In 2024, the resale value of tractors manufactured before 2015 declined by 15-20%, reflecting a shrinking market and reduced demand for less advanced equipment.

| Segment | BCG Classification | Key Indicators (2024-2025) | Strategic Implication |

|---|---|---|---|

| Grain & Protein Business | Dog | Divested in Q2 2024; low performance/strategic alignment | Portfolio optimization; focus on core strengths |

| High-Horsepower Tractors | Dog | Oversupply; reduced sales volumes; sluggish market | Production reduction; inventory normalization |

| Self-Propelled Sprayers | Dog | Market saturation; downward price pressure; demand shift to drones | Addressing oversupply; evaluating product mix |

| Older Equipment Models | Dog | Resale value decline (15-20% for pre-2015 tractors in 2024); shrinking market | Reduced investment; potential discontinuation |

Question Marks

AGCO's OutRun.Ag autonomous grain cart retrofit kit, set for wider availability in 2025 after a year of beta testing in 2024, is a prime example of a Question Mark in the BCG Matrix. This technology targets a high-growth potential market, but currently holds a minimal market share, requiring substantial investment to gain traction.

Farmer interest in autonomous grain cart solutions is on the rise, with many growers seeking ways to enhance their return on investment and overall operational value. The ability of these retrofits to optimize harvest logistics and reduce labor needs is a key driver of this growing demand.

The significant investment needed for market penetration and share expansion underscores the inherent risk and potential reward associated with OutRun.Ag. Its future trajectory hinges on its ability to capture market share and evolve into a Star product within AGCO's portfolio.

AGCO's WeedSeeker 2 and Precision Planting Vision systems represent a significant advancement in smart spraying, offering precise weed detection and targeted application. This technology directly addresses the growing demand for reduced chemical usage and environmental sustainability in agriculture. The market for these solutions is expanding rapidly, driven by both regulatory pressures and farmer interest in efficiency.

Despite their clear benefits, these advanced technologies are still navigating the early stages of widespread adoption and commercialization. Consequently, their current market share within the broader agricultural equipment sector remains relatively modest. This positions them as potential stars within AGCO's portfolio, requiring continued strategic investment to realize their full growth potential.

AGCO's commitment to research, development, and robust marketing efforts for these smart spraying solutions is paramount. By enhancing distribution channels and educating the market on their economic and environmental advantages, AGCO can accelerate adoption. This focus is essential to capture the high-growth opportunities presented by the increasing global adoption of precision agriculture techniques, with the precision agriculture market projected to reach $15.6 billion by 2025.

The PTx data platform is AGCO's strategic move into the high-growth area of integrated farm management for mixed fleets. With a partial launch slated for 2025 and full rollout by 2027, it aims to capture a significant share of this burgeoning market. This platform is crucial for AGCO's ambition to lead in smart farming and autonomy solutions for diverse equipment setups.

Electric Tractors and Sustainable Farming Solutions

The agricultural equipment market is rapidly evolving, with a significant push towards sustainability and advanced technologies like electric tractors. These innovations are poised to invigorate the farm equipment industry by offering cost savings, environmental benefits, and enhanced operational efficiency. For instance, the global electric tractor market was valued at approximately USD 1.5 billion in 2023 and is projected to reach USD 5.2 billion by 2030, demonstrating a compound annual growth rate of over 19%.

While electric tractors currently hold a small fraction of the overall market share, this segment represents a substantial growth opportunity, fueled by increasing environmental awareness and ongoing technological progress. AGCO's strategic investments in developing and promoting these eco-friendly farming solutions position the company to capitalize on this emerging trend and secure future market dominance.

- Market Growth: The electric tractor market is experiencing robust growth, with projections indicating a significant expansion in the coming years.

- Sustainability Driver: Environmental concerns and the pursuit of cost-effective, efficient farming methods are key drivers for electric tractor adoption.

- AGCO's Position: AGCO's commitment to sustainable technology development places it favorably to capture future market share in this high-potential segment.

- Uncertainty: Widespread adoption and market penetration of electric tractors are still developing, making this segment a 'question mark' in the BCG matrix until its long-term success is more established.

New Products from Annual Launch Pipeline

AGCO's PTx portfolio aims for an annual launch of 3 to 5 new products, signaling a robust innovation pipeline focused on high-growth agricultural segments like digitalization and automation.

These new offerings begin as question marks on the BCG matrix, characterized by low market share but positioned within rapidly expanding markets.

Each launch necessitates substantial investment in marketing and sales to build market presence and validate their potential.

For example, in 2024, AGCO continued to invest in its precision agriculture technologies, with new product introductions in areas like autonomous guidance systems and data analytics platforms, reflecting the strategic focus on these emerging segments.

- Innovation Focus: AGCO targets 3-5 new product launches annually from its PTx portfolio, emphasizing growth areas like agricultural digitalization and automation.

- Market Position: These new products are classified as question marks, starting with low market share in high-growth segments.

- Investment Requirement: Significant marketing and sales investment is crucial for these question mark products to gain traction and prove market viability.

- Future Potential: The success of these launches will determine their progression to Stars or potential shift to Dogs within AGCO's portfolio.

Question Marks in AGCO's portfolio represent products or technologies in high-growth markets but with low current market share. These require significant investment to develop and capture market potential.

Examples include the OutRun.Ag autonomous grain cart retrofit and advanced smart spraying systems like WeedSeeker 2, both of which are in nascent stages of adoption but target expanding segments of precision agriculture.

AGCO's PTx data platform and its focus on electric tractors also fall into this category, aiming to establish a strong foothold in emerging, high-potential areas of the agricultural industry.

The success of these Question Marks is critical for AGCO's future growth, as they have the potential to become Stars if they gain significant market traction.

| Product/Technology | Market Growth Potential | Current Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| OutRun.Ag Autonomous Grain Cart | High (Optimized harvest logistics) | Low (Beta testing in 2024, wider 2025) | Substantial (Market penetration, share expansion) | Potential Star if successful |

| WeedSeeker 2 / Precision Planting Vision | High (Reduced chemical usage, sustainability) | Modest (Early adoption stages) | Continued R&D, marketing, education | Potential Star, capitalize on precision ag adoption |

| PTx Data Platform | High (Integrated farm management for mixed fleets) | Low (Partial launch 2025, full 2027) | Significant (Market capture, leadership in smart farming) | Key to smart farming ambitions |

| Electric Tractors | High (Sustainability, cost savings, efficiency) | Low (Small fraction of overall market) | Strategic Investment (Development, promotion) | Capitalize on emerging trend, future dominance |

BCG Matrix Data Sources

Our AGCO BCG Matrix leverages a robust blend of internal financial statements, global market research reports, and agricultural industry trend analyses to provide strategic insights.