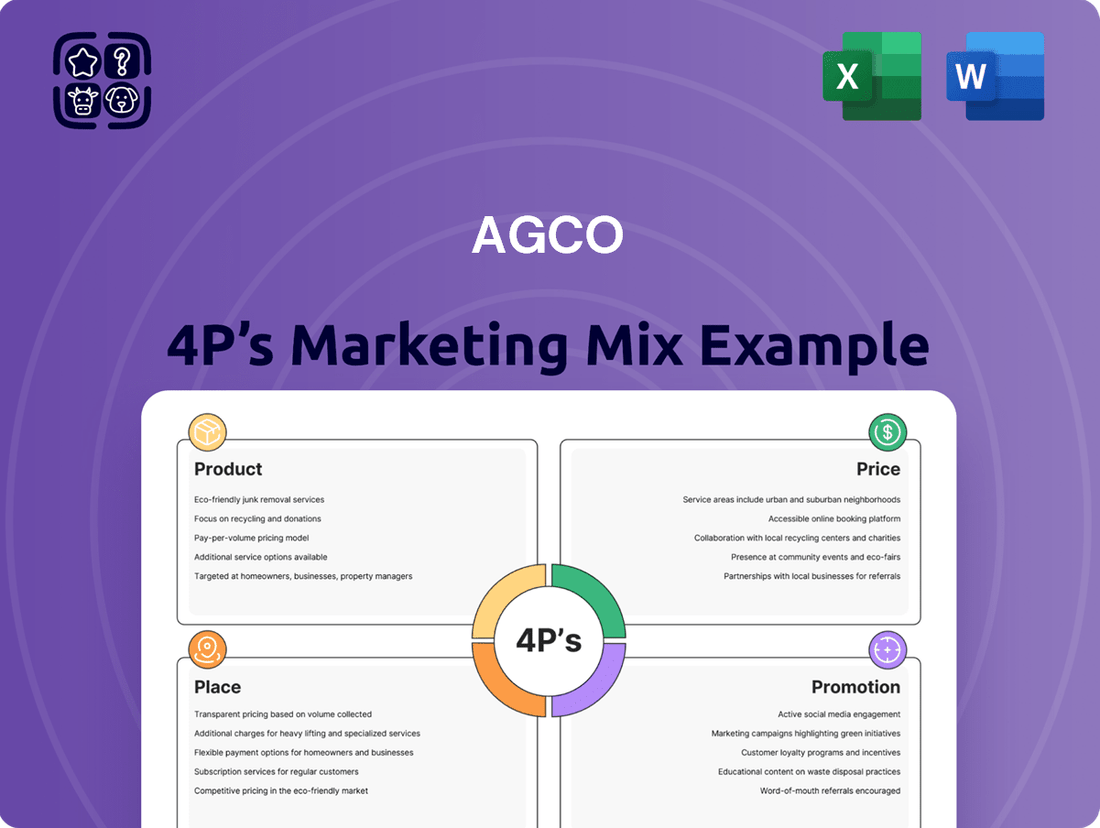

AGCO Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGCO Bundle

AGCO's marketing success hinges on a strategic blend of its Product, Price, Place, and Promotion. From innovative agricultural machinery to competitive pricing and extensive dealer networks, each element plays a crucial role in their market dominance. Discover the intricate details of their approach.

Uncover the full AGCO 4Ps Marketing Mix Analysis to gain a comprehensive understanding of their market positioning, pricing architecture, channel strategy, and communication mix. This in-depth report is your key to unlocking actionable insights and strategic advantage.

Product

AGCO's comprehensive agricultural equipment portfolio is a cornerstone of its marketing strategy, offering a vast array of machinery from tractors and combines to specialized hay tools, sprayers, and grain storage systems. This extensive product line ensures that farmers worldwide have access to the precise solutions needed for every stage of crop production, from planting to harvest and storage. In 2024, AGCO continued to invest in innovation, with product development efforts heavily focused on enhancing farmer productivity and promoting sustainable agricultural practices, a key driver for their global customer base.

AGCO's product strategy heavily emphasizes precision agriculture, primarily through its PTx brand and the PTx Trimble joint venture. These advanced technologies are designed to boost farm productivity and efficiency, leading to better yields while optimizing resource usage. For instance, AGCO reported that its precision ag solutions contributed to a significant portion of its revenue growth in recent quarters, reflecting strong market adoption.

The core of this product focus is smart farming and autonomy solutions, which AGCO is actively developing and integrating. These innovations allow farmers to manage their operations with greater accuracy and less manual intervention. AGCO's unique advantage lies in its capability to retrofit nearly any existing farm equipment, regardless of its original manufacturer, with its cutting-edge precision ag technology, thereby expanding its market reach significantly.

AGCO’s strength lies in its diverse brand portfolio, featuring names like Massey Ferguson, Fendt, Valtra, Challenger, and GSI. This strategy allows them to cater to a wide array of customer needs and market preferences, offering everything from premium, high-tech machinery to more widely accessible equipment.

In 2024, AGCO continued to leverage these distinct brands to capture market share across different agricultural segments. For instance, Fendt remains a key player in the premium tractor market, while Massey Ferguson appeals to a broader customer base seeking reliable and versatile equipment. This multi-brand approach is crucial for addressing the varied demands of global agriculture.

Continuous Innovation and Development

AGCO is heavily invested in continuous innovation, aiming to release 3-5 new products annually from its PTx portfolio and enhance its sprayer offerings. This commitment is evident in their significant R&D investment, with $549 million spent in 2023, a substantial 65% of which was allocated to smart machines and clean energy initiatives.

The company is actively developing cutting-edge autonomous solutions, such as the OutRun™ autonomous grain cart retrofit kit, slated for broad market availability in 2025. This focus on advanced technology underscores AGCO's strategy to lead in precision agriculture.

- Product Pipeline: 3-5 new PTx products annually.

- Autonomous Solutions: OutRun™ autonomous grain cart retrofit kit (2025 availability).

- R&D Investment (2023): $549 million.

- R&D Focus: 65% on smart machines and clean energy.

Integrated Solutions and Services

AGCO's "Integrated Solutions and Services" go beyond just selling tractors and combines. They offer smart farming technologies that help farmers manage their entire operation more efficiently. This includes digital platforms for overseeing a diverse range of equipment, ensuring every piece of machinery works together seamlessly.

A key part of this strategy is ensuring farmers have access to the parts and support they need, precisely when they need them. This focus on minimizing downtime is critical for agricultural productivity. AGCO has set an ambitious goal to grow its parts net sales to $2.3 billion by 2029, underscoring the importance of this service component.

- Smart Farming Solutions: Digital tools for managing mixed fleets and optimizing farm operations.

- Parts and Service Availability: Emphasis on minimizing farmer downtime through readily accessible support.

- Growth Target: Aiming for $2.3 billion in parts net sales by 2029.

AGCO's product strategy centers on providing a comprehensive range of agricultural equipment, from tractors and combines to specialized tools, all enhanced by precision agriculture technology. Their commitment to innovation is evident in their significant R&D investments, with a strong focus on smart machines and clean energy solutions. The company is actively developing autonomous capabilities, aiming to make farming more efficient and sustainable.

| Product Focus | Key Initiatives | Financial Data |

| Comprehensive Equipment Portfolio | Precision Agriculture (PTx, PTx Trimble JV) | 2023 R&D Investment: $549 million |

| Smart Farming & Autonomy | Retrofitting existing equipment with precision tech | 65% of R&D for Smart Machines & Clean Energy |

| Diverse Brand Strategy (Fendt, Massey Ferguson, etc.) | New Product Development (3-5 PTx products annually) | Parts Net Sales Target: $2.3 billion by 2029 |

| Integrated Solutions & Services | Autonomous Grain Cart Retrofit Kit (OutRun™) - 2025 availability |

What is included in the product

This analysis provides a comprehensive review of AGCO's marketing mix, detailing their strategies across Product, Price, Place, and Promotion to understand their market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic paralysis.

Provides a clear framework for identifying and addressing market gaps, easing the burden of competitive analysis.

Place

AGCO's extensive global dealer network is a cornerstone of its marketing strategy, ensuring its advanced agricultural machinery reaches farmers in over 140 countries. This network comprises more than 3,000 independent dealers, providing crucial local sales, parts, and service support. For instance, in 2023, AGCO reported a significant portion of its net sales were generated through its dealer network, highlighting its critical role in market penetration and customer satisfaction.

FarmerCore represents AGCO's commitment to a direct-to-farm distribution model, enhancing customer experience by bringing sales and service capabilities directly to the agricultural setting. This innovative approach bypasses traditional dealership limitations, focusing on convenience and operational efficiency.

The expansion of FarmerCore into North and South America throughout 2024 signifies a significant shift, integrating mobile service units and sales teams to provide on-site support. This strategy is designed to streamline the customer journey, ensuring farmers have access to necessary resources when and where they need them.

AGCO's investment in this end-to-end model aims to capture a larger share of the aftermarket service and parts business, a segment that typically offers higher margins. By placing resources directly on the farm, AGCO expects to improve customer loyalty and reduce response times for critical equipment maintenance.

AGCO is strategically expanding its dealership footprint, opening new full-service locations and innovative 'Parts-Only' stores across key agricultural regions in North America, including Canada. This network transformation is designed to directly address escalating farmer demand for AGCO's advanced machinery and support services.

By increasing physical presence, AGCO ensures farmers have more convenient and comprehensive access to its full suite of brands and essential after-sales support. This expansion is a critical component of their strategy to enhance customer proximity and service delivery in vital farming communities.

Enhanced Parts and Service Accessibility

AGCO is significantly enhancing its parts and service accessibility, a key element in its marketing mix. The company is making substantial investments to bolster its parts business, including expanding remanufacturing capabilities and constructing new distribution centers. This focus aims to ensure that customers can access necessary parts more efficiently, thereby reducing equipment downtime.

These improvements directly address customer needs by minimizing operational disruptions. For instance, initiatives like same-day parts delivery from dealerships, supported by mobile service trucks, are crucial for keeping agricultural machinery running during critical periods. This commitment to rapid service availability is a significant differentiator.

- Investment in Logistics: AGCO is building new parts distribution centers to streamline the supply chain.

- Remanufacturing Expansion: Increased capacity in remanufacturing ensures a steady supply of quality, cost-effective parts.

- Same-Day Delivery: Mobile service trucks enable dealers to offer same-day parts delivery, minimizing customer downtime.

- Customer Satisfaction: These efforts are directly tied to improving customer satisfaction by ensuring equipment reliability.

Digital Engagement and E-commerce Platforms

AGCO is significantly boosting its digital engagement as part of the FarmerCore strategy, offering farmers round-the-clock access to sales and support. This includes streamlined online parts purchasing, dealer-specific digital storefronts, and interactive online configurators.

The company has set an ambitious target to achieve 25% of its total parts sales through e-commerce channels. This digital push is designed to enhance customer convenience and operational efficiency.

- Digital Access: Farmers benefit from 24/7 online access to sales and support services.

- E-commerce Goal: AGCO aims for 25% of parts sales to be conducted via e-commerce platforms.

- FarmerCore Initiative: This digital enhancement is a key component of the broader FarmerCore strategy.

- Dealer Integration: The program includes the development of digital storefronts for AGCO dealers.

AGCO's physical presence is multifaceted, encompassing a vast global dealer network and the direct-to-farm FarmerCore initiative. This dual approach ensures broad market coverage and localized support, crucial for the agricultural sector.

The company's strategic expansion of dealerships and the introduction of FarmerCore's mobile units in 2024 underscore a commitment to customer proximity. This physical placement of resources aims to enhance service delivery and parts accessibility.

By investing in new distribution centers and expanding remanufacturing, AGCO is optimizing its physical supply chain to minimize equipment downtime for farmers. This focus on efficient parts availability is a key differentiator.

AGCO's digital transformation, including dealer-specific online storefronts, complements its physical network. This integration provides farmers with 24/7 access to sales and support, aligning with the goal of 25% of parts sales via e-commerce.

| Distribution Channel | Key Features | 2024/2025 Focus |

|---|---|---|

| Global Dealer Network | 3,000+ independent dealers, sales, parts, service | Expansion of full-service and 'Parts-Only' stores |

| FarmerCore (Direct-to-Farm) | Mobile service units, on-site sales teams | Expansion in North and South America, enhanced customer journey |

| Digital Platforms | Online parts purchasing, dealer storefronts | Target of 25% of parts sales via e-commerce |

Same Document Delivered

AGCO 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive AGCO 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies in detail. You'll gain valuable insights into how AGCO positions its agricultural machinery and services to effectively reach and serve its target markets.

Promotion

AGCO strategically markets its distinct brands like Fendt, Massey Ferguson, Valtra, and PTx through focused campaigns and prominent presence at agricultural expos. This approach ensures that messaging resonates with specific customer needs and product advantages, fostering brand loyalty within diverse market segments.

AGCO's promotional strategy deeply embeds its 'Farmer-First' approach, showcasing how its machinery and technology directly boost farmer productivity and profitability. This narrative is consistently reinforced in their investor relations, with recent reports indicating a strong focus on delivering value directly to the end-user.

For instance, AGCO's 2024 guidance anticipates continued investment in precision agriculture solutions, directly aligning with the farmer's need for enhanced efficiency and reduced input costs. This commitment translates into marketing messages that highlight tangible benefits like increased yield and optimized resource management, underscoring the 'Farmer-First' principle.

AGCO actively leverages digital marketing to connect with its audience, employing social media advertisements and various online platforms. This digital push aims to broaden reach and foster engagement with farmers and industry professionals alike.

The company's FarmerCore initiative is a key driver in this digital transformation, with AGCO rolling out digital tools and dealer-specific online storefronts. This strategic move is designed to significantly improve the online customer experience and provide enhanced support through digital channels.

Public Relations and Industry Events

AGCO leverages public relations and industry events as a key component of its marketing strategy. The company actively participates in and hosts major agricultural shows like the Commodity Classic and Farm Progress Show. For instance, at the 2024 Farm Progress Show, AGCO highlighted its latest precision agriculture technologies and sustainable farming solutions, drawing significant attention from both farmers and industry media.

These events serve as crucial touchpoints for AGCO to directly engage with its target audience, demonstrating new products and fostering relationships. This direct interaction helps reinforce AGCO's brand image as an innovator in the agricultural sector. In 2024, AGCO reported a strong presence at these events, with media coverage reaching an estimated 5 million impressions across various agricultural publications and online platforms.

- Showcasing Innovation: AGCO uses events to debut new equipment and digital solutions.

- Farmer Engagement: Direct interaction at shows like the Commodity Classic builds customer loyalty.

- Media Relations: Industry events are key for securing positive press and highlighting technological advancements.

- Brand Reinforcement: Consistent participation strengthens AGCO's position as a leader in agricultural machinery.

Focus on Technology and Innovation Storytelling

AGCO's promotional efforts strongly emphasize its technological prowess and commitment to innovation within the agricultural sector. The company actively tells a story of leadership in precision agriculture and smart farming solutions, highlighting advancements designed to transform farming practices.

Key innovations showcased include autonomous grain cart technology and retrofit kits, demonstrating AGCO's dedication to pushing the boundaries of what's possible in modern farming. These technologies are presented not just as advancements, but as tangible tools that empower farmers.

The core message revolves around how AGCO's innovations directly benefit farmers. By adopting these smart farming solutions, growers can achieve significantly higher yields while simultaneously reducing their reliance on inputs, leading to more efficient and sustainable operations. For instance, AGCO's Fendt VarioDrive technology, which optimizes engine and transmission management, contributes to fuel savings of up to 15%, directly impacting a farmer's bottom line and sustainability goals.

- Precision Agriculture Leadership: AGCO is positioned as a frontrunner in precision agriculture, offering integrated solutions for optimized farm management.

- Smart Farming Innovations: The company highlights cutting-edge technologies such as autonomous grain carts and advanced retrofit kits that enhance operational efficiency.

- Yield Enhancement & Input Reduction: AGCO's storytelling focuses on how its technological solutions enable farmers to increase crop yields while minimizing resource consumption.

- Sustainability Focus: By showcasing technologies that improve efficiency, AGCO underscores its commitment to supporting sustainable agricultural practices for the future.

AGCO's promotional strategy centers on demonstrating tangible benefits for farmers, emphasizing increased productivity and profitability through its advanced machinery and digital solutions. This farmer-centric narrative is consistently reinforced across all marketing channels, from digital campaigns to major agricultural expos.

Digital marketing, including social media and online platforms, plays a crucial role in expanding AGCO's reach and fostering engagement. Initiatives like FarmerCore are enhancing the online customer experience with digital tools and dealer storefronts, aiming for seamless support.

Participation in industry events like the Farm Progress Show allows AGCO to directly showcase innovations, such as precision agriculture technologies, and engage with customers. In 2024, AGCO's presence at these events garnered significant media attention, estimated at 5 million impressions across agricultural media, reinforcing its image as an industry innovator.

AGCO's promotional messaging highlights its leadership in precision and smart farming, showcasing technologies like autonomous grain carts and Fendt VarioDrive, which can offer up to 15% fuel savings. These innovations are presented as direct tools for farmers to boost yields and reduce input costs, supporting more sustainable operations.

| Promotional Focus | Key Activities/Channels | Impact/Benefit Highlighted | 2024/2025 Data Point |

| Farmer-Centric Value Proposition | Digital Marketing, Social Media, FarmerCore | Increased Productivity, Profitability, Enhanced Customer Experience | Continued investment in precision agriculture solutions in 2024 guidance. |

| Technological Innovation Showcase | Industry Events (Farm Progress Show), PR | Higher Yields, Reduced Input Costs, Operational Efficiency | Estimated 5 million media impressions from 2024 event participation. |

| Brand Reinforcement | Targeted Brand Campaigns (Fendt, Massey Ferguson) | Brand Loyalty, Industry Leadership | N/A (Qualitative focus) |

Price

AGCO's pricing strategy for differentiated products, particularly its premium Fendt brand, centers on value-based pricing. This approach aligns with the significant perceived value customers gain from advanced agricultural machinery and precision farming technologies that boost productivity and sustainability.

For instance, Fendt tractors, known for their cutting-edge technology and efficiency, command higher prices reflecting their ability to deliver superior operational outcomes. This strategy is supported by AGCO's substantial investment in research and development, with R&D expenses often representing a significant portion of their revenue, ensuring continuous innovation that justifies premium pricing.

AGCO navigates a highly competitive global agricultural equipment landscape, where pricing is a crucial differentiator. Their strategy balances delivering strong value with the need to remain attractive against rivals, considering both competitor pricing and the prevailing market demand. For instance, in 2023, the agricultural machinery market was valued at approximately $240 billion, with significant competition from players like John Deere and CNH Industrial, necessitating careful price point management.

AGCO's net sales and operating margins are feeling the pinch from a cooling agricultural equipment market. Softening industry demand, coupled with lower production volumes and dealers working to reduce their inventory, directly impacted the company's financial performance in recent reports.

For instance, in the first quarter of 2024, AGCO reported net sales of $2.9 billion, a decrease from $3.3 billion in the first quarter of 2023, reflecting these market headwinds. Operating margin for the same period was 7.5%, down from 11.1% in the prior year.

To counter these trends, AGCO is actively pursuing cost reduction initiatives and maintaining pricing discipline. These strategies are aimed at protecting profitability and navigating the current challenging market conditions effectively.

Strategic Financial Guidance and Profitability Targets

AGCO's strategic financial guidance underscores a deliberate focus on profitability, with projections for net sales and adjusted operating margins reflecting careful pricing and cost control measures. This financial roadmap is crucial for investors and stakeholders seeking to understand the company's performance targets.

For the fiscal year 2025, AGCO anticipates net sales to reach approximately $9.6 billion. This figure is accompanied by a target for adjusted operating margins, which are expected to fall within the range of 7.0% to 7.5%.

- Projected 2025 Net Sales: Approximately $9.6 billion.

- Targeted 2025 Adjusted Operating Margins: 7.0% - 7.5%.

- Strategic Implication: Demonstrates a commitment to disciplined pricing and cost management.

- Investor Focus: Key metrics for evaluating financial performance and strategic execution.

Consideration of Financing Options and Discounts

AGCO understands that acquiring high-value agricultural machinery requires significant capital. To ease this burden, they likely offer a range of financing solutions through their extensive dealer network. These options are crucial for farmers making substantial investments, allowing them to manage cash flow effectively.

While specific discount programs can fluctuate based on market conditions and inventory levels, AGCO and its dealers frequently engage in sales promotions. These might include seasonal offers, bundled equipment packages, or special financing rates designed to incentivize purchases, particularly during key buying periods for farmers.

- Financing Programs: AGCO likely partners with financial institutions to provide tailored loan and lease options for new and used equipment.

- Promotional Offers: Expect potential discounts on specific models or service packages, especially during agricultural trade shows or the off-season.

- Dealer Incentives: Local dealerships often have the flexibility to offer additional price adjustments or value-added services to close sales.

AGCO's pricing strategy is deeply intertwined with the value proposition of its premium brands like Fendt, focusing on benefits like enhanced productivity and sustainability. This premium pricing is supported by substantial R&D investments, ensuring continuous innovation that justifies the higher cost of their advanced machinery.

The company must carefully balance this value-based approach with competitive pressures in the global agricultural equipment market, estimated at $240 billion in 2023. AGCO's financial performance, including net sales and operating margins, has been impacted by a market slowdown, with Q1 2024 net sales at $2.9 billion, down from $3.3 billion in Q1 2023, and operating margin falling to 7.5% from 11.1%.

To navigate these challenges, AGCO is implementing cost reduction measures and maintaining pricing discipline, aiming for fiscal year 2025 net sales of approximately $9.6 billion with adjusted operating margins projected between 7.0% and 7.5%. This reflects a strategic focus on profitability through careful price and cost management.

AGCO likely offers various financing solutions and promotional incentives through its dealer network to make significant capital investments more accessible for farmers, helping them manage cash flow. These can include seasonal offers, bundled packages, or special financing rates.

| Metric | 2023 (Approx.) | Q1 2024 | FY 2025 (Projected) |

| Global Agricultural Equipment Market Value | $240 Billion | N/A | N/A |

| AGCO Net Sales | N/A | $2.9 Billion | ~$9.6 Billion |

| AGCO Operating Margin | N/A | 7.5% | 7.0% - 7.5% (Adjusted) |

4P's Marketing Mix Analysis Data Sources

Our AGCO 4P's Marketing Mix Analysis is grounded in a comprehensive review of official AGCO publications, including annual reports, investor presentations, and press releases. We also incorporate data from industry-specific market research, competitive intelligence reports, and AGCO's own digital platforms.