AGCO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGCO Bundle

AGCO navigates a complex agricultural machinery landscape, where buyer power and the threat of new entrants significantly shape its competitive environment. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping AGCO’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AGCO's reliance on specialized components like semiconductors and tracks, where optimal inventory management has been a persistent hurdle, highlights a key supplier strength. The concentration of these critical inputs in the hands of a few suppliers gives them significant bargaining power over agricultural equipment makers.

In 2024, the ongoing supply chain fragmentation and bottlenecks, particularly for these specialized parts, continued to create challenges. This directly impacted AGCO's production schedules and the timely availability of essential materials, underscoring the leverage held by these concentrated suppliers.

The prices of key raw materials like steel and plastics have been quite unpredictable, directly affecting AGCO's expenses in making its equipment. This volatility means suppliers can push these rising costs onto AGCO, forcing the company to either accept lower profits or charge more to its customers.

For instance, in early 2024, steel prices saw fluctuations, impacting the cost of manufacturing heavy machinery components. This unpredictability in what AGCO pays for its inputs puts considerable strain on the company's profit margins, making financial planning more challenging.

The agricultural sector's increasing reliance on advanced technologies such as AI, IoT, and GPS for precision farming makes AGCO dependent on specialized technology suppliers. This dependency is a key factor in the bargaining power of these suppliers, as they hold the keys to critical innovations that enhance equipment performance and efficiency.

While AGCO's strategic acquisition of assets like PTx Trimble aims to bolster its in-house precision agriculture capabilities, the company still relies on external sources for cutting-edge technological advancements. This continued reliance allows technology providers to exert influence, particularly in areas where their intellectual property or specialized manufacturing processes are essential for AGCO's competitive differentiation.

High Switching Costs for Specialized Inputs

AGCO faces significant supplier bargaining power when dealing with highly specialized inputs. For instance, switching suppliers for complex integrated technological systems, such as advanced precision farming software or proprietary engine components, can involve substantial costs. These costs stem from necessary investments in research and development to adapt to new systems, the intricate process of integrating new components into existing manufacturing lines, and the rigorous testing required to ensure compatibility and performance. This creates high switching costs, solidifying the leverage of established suppliers who have already made these integration investments with AGCO.

These high switching costs directly empower suppliers. AGCO might find it difficult to negotiate better terms or switch to alternative suppliers without incurring significant financial penalties or operational delays. This situation is common in industries where suppliers offer unique or proprietary technologies that are deeply embedded within the buyer's product. For example, a supplier of a critical, custom-designed hydraulic system might command higher prices because AGCO would face considerable expense and time in re-engineering its machinery to accommodate a different supplier's offering.

- High R&D Investment: Suppliers of specialized agricultural technology often invest heavily in research and development, creating proprietary solutions that are difficult for competitors to replicate.

- Integration Complexity: Integrating new, specialized components into AGCO's existing product lines, like tractors or combines, requires significant engineering effort and testing, leading to high switching costs.

- Supplier Entrenchment: Once a supplier's technology is deeply integrated, they become entrenched, giving them greater leverage in price negotiations and contract renewals.

- Operational Disruption Risk: The risk of disrupting production schedules and product quality during a supplier change further strengthens the bargaining position of incumbent suppliers.

Limited Forward Integration by Suppliers

Limited forward integration by AGCO's suppliers means that the companies providing raw materials or components generally don't move into manufacturing agricultural equipment themselves. This is a significant advantage for AGCO, as it reduces the risk of facing direct competition from its own suppliers in the marketplace.

While some technology providers might offer integrated platforms directly to farmers, this is less common for the core machinery components. For instance, suppliers of steel, engines, or hydraulic systems typically focus on manufacturing and selling those parts, not on producing and marketing tractors or combines. This dynamic allows AGCO to maintain control over its product offerings and market strategy without direct encroachment from its input providers.

In 2023, the global agricultural machinery market was valued at approximately $200 billion, with AGCO holding a notable share. The limited forward integration of its suppliers suggests that AGCO can negotiate favorable terms for its inputs without the added pressure of competing with those same suppliers for end-customer sales.

- Supplier Focus: Suppliers primarily concentrate on component manufacturing, not finished agricultural equipment.

- Reduced Competition: AGCO avoids direct market rivalry from its own input providers.

- Strategic Advantage: This allows AGCO greater flexibility in product development and market positioning.

- Supply Chain Stability: Limited integration contributes to a more predictable supply chain for AGCO.

AGCO faces considerable bargaining power from suppliers of specialized components, particularly semiconductors and advanced technology systems crucial for precision farming. In 2024, continued supply chain disruptions for these critical inputs, like those affecting semiconductor availability, amplified supplier leverage, impacting AGCO's production schedules and cost structures.

The high cost and complexity of switching suppliers for integrated technology, such as proprietary GPS or AI-driven software, create significant switching costs for AGCO. This entrenchment allows suppliers to command higher prices and favorable contract terms, as evidenced by the ongoing need for AGCO to adapt its machinery to evolving technological standards.

AGCO's suppliers generally do not engage in forward integration by producing finished agricultural equipment, a factor that limits direct competition. This allows AGCO to negotiate for inputs without facing rivalry from its own component providers in the end-customer market, a strategic advantage in the approximately $200 billion global agricultural machinery market of 2023.

| Factor | Impact on AGCO | 2024 Relevance |

| Specialized Component Reliance | Increased supplier power due to unique inputs | Heightened by ongoing supply chain bottlenecks |

| High Switching Costs | Supplier entrenchment and pricing leverage | Significant for integrated tech systems |

| Limited Supplier Forward Integration | Reduced direct competition from suppliers | Maintains AGCO's market positioning |

What is included in the product

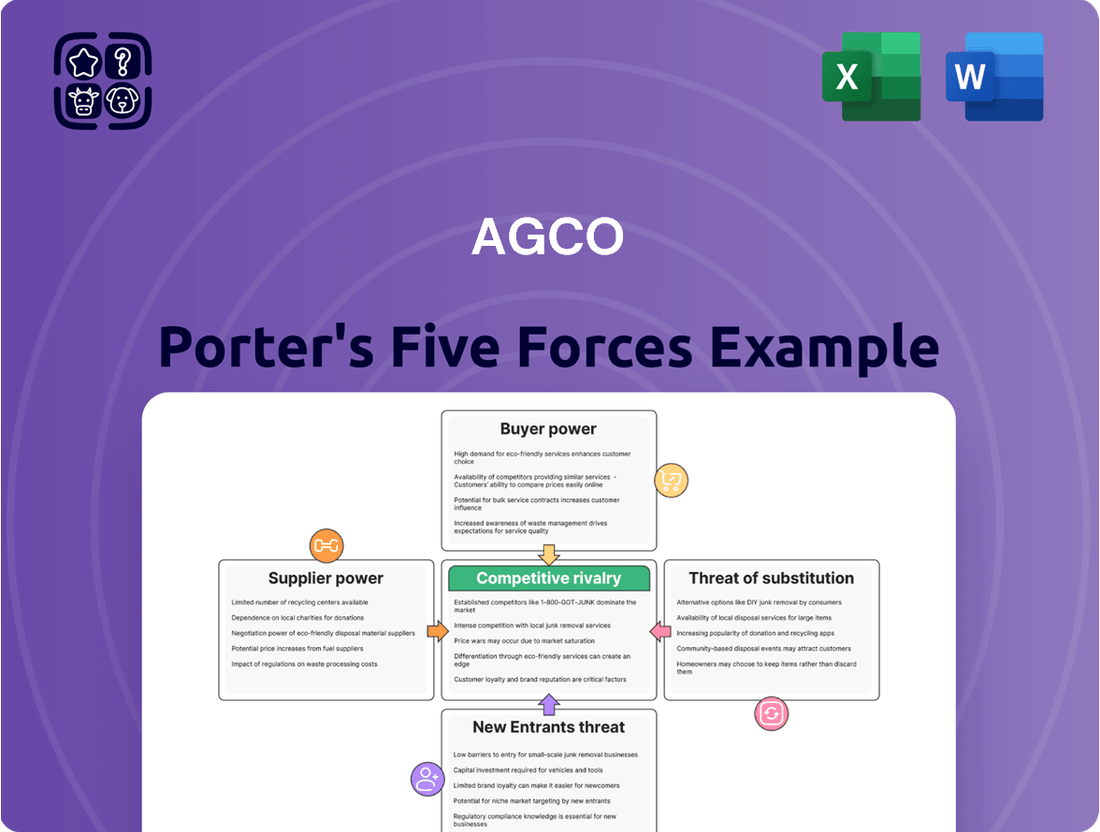

This Porter's Five Forces analysis provides a strategic overview of AGCO's competitive environment, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products.

Instantly identify and mitigate competitive threats with a comprehensive overview of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

Farmers grappled with considerable financial strain in 2024, with net farm income anticipated to drop significantly. This projected decline represents one of the most challenging periods for the agricultural sector in over a decade, directly impacting farmers' ability to purchase new equipment.

The economic pressures experienced by farmers in 2024 have demonstrably reduced their purchasing power. This financial squeeze makes them more inclined to delay substantial capital investments, such as acquiring new machinery.

Consequently, customers are exhibiting heightened price sensitivity and a greater tendency to postpone major capital expenditures. This shift in farmer sentiment directly amplifies their bargaining power with equipment manufacturers like AGCO.

The agricultural equipment market faced a significant oversupply in 2024, particularly in categories like sprayers, combines, and row crop tractors, a trend expected to continue into 2025. This surplus has shifted the power dynamics, creating a distinct buyer's market where farmers benefit from increased choice and leverage in price negotiations.

Dealers are actively seeking to liquidate older inventory, a situation that further strengthens the bargaining position of customers. For instance, reports from late 2024 indicated that some dealers were offering discounts of up to 15% on specific tractor models to clear out stock, directly reflecting the enhanced purchasing power of farmers.

Farmers are currently facing a double whammy of high input costs, particularly for fertilizers, and elevated interest rates. For example, fertilizer prices saw significant spikes in 2022 and remained elevated through much of 2023, impacting farmers' bottom lines. These combined pressures directly squeeze their profitability and limit the capital they have available for crucial equipment investments.

This financial strain significantly amplifies the bargaining power of farmers. When their margins are thin and borrowing costs are high, they become more aggressive in seeking out cost-effective solutions and negotiating better terms with manufacturers like AGCO. They are actively looking for deals and favorable financing to offset their increased operational expenses.

Availability of Used Equipment as a Viable Alternative

The availability of used equipment significantly bolsters customer bargaining power against AGCO. Many farmers, facing economic headwinds, are opting to keep their current machinery running longer or are purchasing well-maintained, pre-owned equipment. This shift provides a cost-effective alternative to new purchases, directly impacting AGCO's pricing flexibility.

This trend is particularly evident in 2024, where reports indicate a strong market for used agricultural machinery. For instance, auction volumes for tractors and combines have seen a notable uptick, offering farmers more options. This increased supply of alternatives empowers buyers, allowing them to negotiate more aggressively on the price of new equipment from manufacturers like AGCO.

- Increased Used Equipment Availability: Farmers have more choices for pre-owned machinery, reducing reliance on new purchases.

- Cost-Effectiveness: Used equipment offers a substantial cost saving, making it an attractive substitute.

- Farmer Leverage: The availability of alternatives gives farmers greater bargaining power when negotiating with AGCO.

Low Switching Costs for Standard Equipment

While AGCO boasts premium brands like Fendt, many standard agricultural equipment types exhibit minimal functional differentiation among major manufacturers. This makes it easier for customers to switch to competitors. For instance, in 2024, the global agricultural machinery market saw intense competition, with players like John Deere and CNH Industrial offering comparable basic tractor and combine models, contributing to this low switching cost environment.

The competitive agricultural machinery sector, combined with a well-established used equipment market, significantly lowers the financial and operational hurdles for customers looking to change brands. This ease of transition amplifies customer bargaining power, as they face fewer penalties for switching suppliers.

- Low Switching Costs: Customers can readily switch between AGCO and competitors for standard equipment due to minimal functional differences.

- Competitive Landscape: A crowded market with comparable offerings from rivals like John Deere and CNH Industrial enhances customer options.

- Used Equipment Market: The availability of a robust used equipment market further reduces the cost and risk associated with changing brands.

- Increased Bargaining Power: These factors collectively empower customers, allowing them to demand better pricing and terms from AGCO.

The bargaining power of customers, particularly farmers, against AGCO remained significant in 2024 due to economic pressures and market dynamics. Farmers faced declining net income, making them more price-sensitive and inclined to delay new equipment purchases. This reduced purchasing power, coupled with a surplus of agricultural machinery and a robust used equipment market, gave them considerable leverage in negotiations.

The availability of comparable standard equipment across major manufacturers also contributed to low switching costs for farmers, further enhancing their ability to demand better terms. For instance, in 2024, dealers were observed offering discounts up to 15% on certain tractor models to clear inventory, a direct reflection of farmers' amplified bargaining strength.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Farmer Financial Health | Increased Price Sensitivity & Delayed Purchases | Projected significant drop in net farm income; elevated input costs (fertilizers) and interest rates |

| Market Supply | Buyer's Market & Increased Choice | Oversupply in key segments (sprayers, combines, tractors) |

| Used Equipment Market | Availability of Substitutes & Cost Savings | Notable uptick in used machinery auction volumes; strong market for pre-owned equipment |

| Product Differentiation | Low Switching Costs | Minimal functional differences in standard equipment across competitors (e.g., John Deere, CNH Industrial) |

Same Document Delivered

AGCO Porter's Five Forces Analysis

This preview displays the complete AGCO Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the agricultural machinery industry. You're viewing the exact, professionally formatted document you'll receive instantly upon purchase, ensuring no surprises or missing sections. This comprehensive analysis is ready for immediate download and use, providing valuable strategic insights into AGCO's market landscape.

Rivalry Among Competitors

The agricultural equipment sector is a battleground dominated by a handful of major global players. Companies like John Deere and CNH Industrial stand as significant rivals to AGCO, each possessing substantial resources and a broad product portfolio. This intense rivalry means AGCO must constantly push for innovation, invest heavily in marketing, and maintain aggressive pricing to stay competitive.

The agricultural equipment sector faced a noticeable downturn in new machinery sales throughout 2024. AGCO, a key player, reported a dip in its sales figures, reflecting this broader market contraction.

This slowdown in demand naturally intensifies the competitive rivalry among manufacturers. With fewer customers actively seeking new equipment, companies are compelled to compete more aggressively for market share.

Projections indicate that new machine sales are likely to remain flat or even slightly decline through 2025, suggesting that the pressure on competitive dynamics will persist, making it harder for companies to grow organically.

The agricultural equipment sector demands massive capital outlays for factories and R&D, resulting in high fixed costs for players like AGCO. This capital intensity creates a barrier to entry and encourages existing firms to operate at high capacity to spread these costs, fueling intense competition.

As 2025 began, dealers found themselves holding significant stocks of new machinery. This inventory overhang forces manufacturers to consider production cuts and offer incentives, like rebates or financing deals, to move unsold units and maintain cash flow.

The need to absorb high fixed costs and clear dealer inventory directly translates into aggressive pricing and promotional activities. Companies are compelled to fight for market share to ensure their operations remain profitable, intensifying the rivalry among established agricultural equipment manufacturers.

Emphasis on Technological Differentiation and Precision Ag

While basic farm equipment can sometimes feel like a commodity, leading companies like AGCO are actively pushing the boundaries with investments in precision agriculture and smart farming. This is a key battleground for differentiation.

AGCO's collaboration with Trimble, forming the PTx Trimble joint venture, exemplifies this. Their goal is to offer sophisticated solutions designed to boost both farmer output and environmental sustainability. This strategic move is reshaping the competitive landscape, moving the focus beyond mere price points to the value derived from advanced technological capabilities.

- Technological Investment: AGCO's significant R&D spending, often exceeding 5% of revenue, is channeled into developing smart farming technologies.

- PTx Trimble JV: This venture, launched in 2023, aims to integrate AGCO's hardware with Trimble's software and data analytics for enhanced farm management.

- Market Shift: Competition is increasingly centered on who can offer the most integrated and data-driven solutions, rather than just the most robust machinery.

High Exit Barriers Due to Specialized Assets and Networks

The agricultural equipment sector faces intense rivalry, partly because exiting the market is incredibly challenging. Companies have poured vast sums into specialized manufacturing facilities and sophisticated machinery, creating significant sunk costs. For instance, a single advanced tractor production line can cost hundreds of millions of dollars, making it impractical to simply shut down.

Furthermore, established players like John Deere and CNH Industrial have built extensive, intricate dealer and service networks spanning the globe. These networks are crucial for sales, support, and parts distribution, representing another substantial investment. Breaking down or divesting these complex infrastructures is not only costly but also risks alienating customers and losing valuable market relationships.

- High Capital Investment: Manufacturing plants for specialized agricultural machinery require billions in initial outlay and ongoing upgrades, making divestment financially prohibitive.

- Specialized Assets: The equipment itself, from combine harvesters to precision planters, is highly specific and lacks broad resale value outside the industry.

- Extensive Dealer Networks: Companies like AGCO have invested heavily in thousands of dealerships worldwide, creating significant barriers to exit due to contractual obligations and brand loyalty.

- Sustained Competition: These high exit barriers mean companies often continue to compete aggressively, even in challenging economic periods, to protect their market share and justify their fixed asset investments.

The agricultural equipment sector is characterized by fierce competition, driven by a few dominant global players like John Deere and CNH Industrial, who directly challenge AGCO's market position. This rivalry is amplified by significant capital investments in manufacturing and R&D, creating high fixed costs that necessitate aggressive pricing and continuous innovation to maintain market share, especially as new machine sales saw a downturn in 2024 and are projected to remain subdued through 2025.

This intense competition is further fueled by the need for companies to move excess dealer inventory, a situation prevalent as 2025 began, leading to incentives and price adjustments. The battleground is also shifting towards technological differentiation, with AGCO's PTx Trimble joint venture highlighting the move from price-based competition to offering integrated, data-driven solutions for precision agriculture.

| Company | 2023 Revenue (USD Billions) | R&D Spending (Approx. % of Revenue) | Key Focus Areas |

|---|---|---|---|

| AGCO | 14.4 | ~5% | Smart farming, precision agriculture, PTx Trimble JV |

| John Deere | 61.3 | ~4% | Autonomous technology, integrated solutions, sustainability |

| CNH Industrial | 21.5 | ~3% | Electrification, precision farming, digital services |

SSubstitutes Threaten

Farmers are increasingly turning to used agricultural equipment due to economic pressures and elevated interest rates, making it a significant threat for companies like AGCO. This trend means that instead of buying new tractors, combines, or planters, many are seeking out pre-owned alternatives.

The market for used agricultural machinery is robust, with a plentiful supply of late-model, low-hour equipment readily available. These machines are often found at auctions or through dealerships, presenting a compellingly priced substitute for AGCO's new offerings. For instance, in 2024, the resale value of tractors, a key AGCO product category, remained strong but also indicated a healthy used market, with many units selling at a significant discount compared to new models.

This heightened adoption of used equipment directly erodes demand for new machinery sales. When farmers can acquire reliable, albeit pre-owned, machinery at a lower upfront cost, the incentive to invest in brand-new, higher-priced units diminishes considerably, impacting AGCO's revenue streams and market share in the new equipment segment.

Farmers are increasingly focused on getting the most out of their existing machinery. This means better maintenance, timely repairs, and targeted upgrades to keep equipment running longer. For instance, in 2024, the average age of agricultural tractors in the US continued to rise, reflecting this trend of extending lifespan.

By optimizing the use and lifespan of current assets, farmers can effectively delay or even forgo the purchase of new equipment. This strategy directly substitutes for new machinery sales, impacting demand for AGCO's latest offerings.

The increasing availability of advanced digital agronomy tools, AI-powered analytics, and IoT-driven farm management systems presents a significant threat of substitutes for traditional agricultural equipment manufacturers like AGCO. These software and service-based solutions allow farmers to boost productivity and efficiency without requiring substantial investments in new machinery.

For instance, precision agriculture software can optimize the use of existing equipment and resources, leading to improved crop yields and reduced input costs. This functional substitution means that farmers might opt for these digital solutions over purchasing new tractors or harvesters, thereby diminishing the demand for AGCO's core product offerings.

Alternative Farming Practices and Technologies

The rise of alternative farming practices poses a significant threat of substitutes for traditional agricultural equipment manufacturers like AGCO. For example, the increasing adoption of regenerative agriculture, which emphasizes soil health and minimal disturbance, could lessen the demand for heavy tillage machinery. This shift means farmers might invest less in plows and cultivators, opting for practices that require different, often less capital-intensive, tools.

Innovations in biotechnology also present a substitute threat. Developing climate-resilient crops, for instance, can reduce the need for specialized machinery typically used to manage environmental stressors like drought or pest infestations. This could impact the market for certain spraying or irrigation equipment.

The market for sustainable farming solutions is growing rapidly.

- In 2024, the global regenerative agriculture market was valued at approximately $10.5 billion, with projections indicating continued strong growth.

- Investments in agricultural biotechnology reached over $70 billion globally in 2024, highlighting the pace of innovation in crop resilience.

- This trend suggests a potential decrease in the market share for traditional, input-heavy farming equipment as more farmers adopt these alternative methods.

Emergence of Rental and Sharing Economy Models

The rise of rental and sharing economy models poses a significant threat of substitutes for AGCO in the capital-intensive agricultural equipment sector. Farmers can now access specialized machinery through rental services or peer-to-peer sharing platforms, bypassing the need for outright ownership. This trend allows for temporary access to equipment without the substantial upfront capital investment, directly impacting the sales of less frequently used or highly specialized machinery.

For instance, the global equipment rental market, including agriculture, was valued at approximately $113.5 billion in 2023 and is projected to grow. Platforms facilitating machinery sharing are gaining traction, offering cost-effective alternatives for farmers who might otherwise purchase equipment for seasonal or limited use. This directly competes with AGCO’s traditional sales model, particularly for high-cost items like combine harvesters or advanced tillage equipment.

- Rental Market Growth: The equipment rental market is expanding, providing accessible alternatives to ownership.

- Capital Expenditure Reduction: Sharing platforms enable farmers to avoid large upfront investments in machinery.

- Impact on Specialized Equipment: Sales of specialized or infrequently used machinery are most vulnerable to this substitute threat.

- Competitive Landscape Shift: This trend shifts the competitive focus from product sales to service access.

The threat of substitutes for AGCO is substantial, driven by the growing availability of used equipment, advanced digital farming solutions, and alternative farming practices. Farmers are increasingly opting for pre-owned machinery, rental services, and digital tools that enhance efficiency without requiring new capital investments. This shift directly impacts AGCO's sales of new equipment, particularly specialized or infrequently used machinery.

The market for used agricultural machinery remains robust, with many farmers extending the lifespan of their existing equipment through better maintenance and upgrades. In 2024, the average age of agricultural tractors in the US continued to rise, indicating a preference for optimizing current assets over purchasing new ones. Furthermore, the global regenerative agriculture market, valued at approximately $10.5 billion in 2024, and significant investments in agricultural biotechnology, exceeding $70 billion globally in the same year, highlight a move towards practices that may require less traditional heavy machinery.

| Substitute Category | Description | 2024 Impact/Trend | Example | AGCO Product Vulnerability |

|---|---|---|---|---|

| Used Equipment | Pre-owned machinery offering lower upfront costs. | Strong resale values indicate a healthy used market with significant discounts compared to new. | Late-model tractors and combines available at auctions. | New tractors, combines, planters |

| Digital Agronomy & AI | Software and analytics enhancing existing equipment efficiency. | Precision agriculture tools optimize resource use, reducing the need for new machinery. | Farm management software, IoT sensors | Advanced GPS systems, precision planting technology |

| Alternative Farming Practices | Methods like regenerative agriculture reducing reliance on heavy machinery. | Growing adoption of soil health-focused practices reduces demand for tillage equipment. | No-till farming, cover cropping | Heavy tillage equipment (plows, cultivators) |

| Rental & Sharing Economy | Accessing machinery through rental or peer-to-peer platforms. | Global equipment rental market valued at ~$113.5 billion in 2023, offering cost-effective alternatives to ownership. | Machinery sharing platforms, rental services | Specialized or infrequently used equipment |

Entrants Threaten

Entering the agricultural equipment manufacturing sector, where AGCO operates, requires immense capital. Companies need significant funds to build advanced manufacturing plants, purchase cutting-edge machinery, and invest heavily in research and development to stay competitive. For instance, in 2024, the global agricultural machinery market was valued at approximately $110 billion, with new entrants needing to secure substantial funding to even begin operations.

AGCO's strength lies in its vast, established distribution network, reaching farmers in 140 countries. This extensive web of independent dealers and service centers is a significant barrier to entry, as replicating it requires immense time, capital, and operational expertise. New competitors would struggle to match AGCO's market penetration and customer support capabilities.

AGCO's robust brand portfolio, featuring names like Massey Ferguson, Fendt, and Valtra, has fostered significant customer loyalty among farmers. This deep-seated trust, built over decades, presents a considerable barrier for any new competitor attempting to enter the agricultural equipment market.

New entrants would need to invest heavily in marketing and product development to even begin to rival AGCO's established brand equity and customer relationships. For instance, AGCO reported net sales of $14.4 billion in 2023, a testament to its market presence and the strength of its brands in attracting and retaining customers.

Technological Complexity and R&D Intensity

The agricultural machinery sector, particularly for companies like AGCO, is characterized by significant technological complexity. Modern equipment incorporates advanced systems such as GPS-guided precision farming, AI-driven analytics for crop management, and sophisticated automation for tasks like planting and harvesting. This intricate integration of technology demands deep engineering expertise and a constant commitment to innovation.

Competing in this space necessitates substantial and ongoing investment in research and development (R&D). For instance, major players are continuously investing billions in developing next-generation autonomous systems and data-driven solutions. AGCO itself reported R&D expenses of approximately $530 million in 2023, highlighting the scale of investment required to stay competitive. This high R&D intensity acts as a formidable barrier to entry, as new companies must possess considerable capital and specialized knowledge to develop comparable, cutting-edge products.

The high technological barrier makes it exceedingly difficult for new entrants to offer competitive products without significant upfront investment in both expertise and capital.

- High R&D Investment: Companies must allocate substantial funds to R&D to develop and maintain technologically advanced agricultural equipment. AGCO's 2023 R&D spending of around $530 million exemplifies this requirement.

- Complex Integration: Modern machinery requires expertise in integrating diverse technologies like AI, automation, and precision agriculture, creating a steep learning curve for new entrants.

- Innovation Pace: The rapid pace of technological advancement demands continuous innovation, making it challenging for new players to catch up and offer comparable solutions without significant resources.

Economies of Scale in Manufacturing and Procurement

Established players like AGCO leverage substantial economies of scale in manufacturing and procurement. Their high production volumes allow for significant cost reductions per unit, a crucial advantage. For instance, in 2023, AGCO's revenue reached $14.4 billion, reflecting their substantial operational scale.

New entrants face a steep challenge in matching these cost efficiencies. They would need to invest heavily to achieve comparable production volumes and negotiate favorable terms with suppliers. This initial cost disadvantage makes it difficult for newcomers to compete on price with established manufacturers.

- Economies of Scale: AGCO's large-scale operations lead to lower per-unit manufacturing costs.

- Procurement Power: Bulk purchasing of raw materials and components provides significant cost savings.

- Competitive Barrier: New entrants struggle to achieve similar cost efficiencies, creating a barrier to entry.

- 2023 Revenue: AGCO's $14.4 billion in revenue underscores their substantial market presence and scale.

The threat of new entrants in the agricultural equipment sector is moderate, primarily due to the substantial capital required to establish operations. AGCO's significant investments in R&D, exemplified by its approximately $530 million spending in 2023, coupled with the need for extensive distribution networks and strong brand loyalty, present formidable barriers.

| Barrier Type | Description | AGCO Example/Data |

|---|---|---|

| Capital Requirements | High initial investment for manufacturing, machinery, and R&D. | Global agricultural machinery market valued at ~$110 billion in 2024. |

| Distribution Network | Building a widespread dealer and service network is time-consuming and costly. | AGCO operates in 140 countries. |

| Brand Loyalty & Equity | Established brands like Massey Ferguson and Fendt foster deep customer trust. | AGCO's 2023 net sales were $14.4 billion. |

| Technological Complexity | Requires expertise in AI, automation, and precision farming. | AGCO's 2023 R&D expenses were ~$530 million. |

| Economies of Scale | New entrants struggle to match cost efficiencies of large-scale producers. | AGCO's 2023 revenue of $14.4 billion indicates significant scale. |

Porter's Five Forces Analysis Data Sources

Our AGCO Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, AGCO's official financial filings and investor relations materials, and reputable agricultural trade publications.