AGBA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGBA Bundle

AGBA's market position is shaped by unique strengths, such as its innovative approach, but also faces significant opportunities for expansion. Understanding these dynamics is crucial for any strategic decision-maker.

Are you ready to fully grasp AGBA's competitive landscape, from its internal capabilities to external threats? Our comprehensive SWOT analysis provides the detailed insights you need.

Go beyond the highlights and unlock actionable strategies. The full SWOT analysis offers a deep dive into AGBA's potential, empowering you to plan and invest with confidence.

Don't miss out on the complete picture. Purchase the full AGBA SWOT analysis to gain access to an editable, professionally crafted report designed for strategic advantage.

Equip yourself with the knowledge to navigate AGBA's future. Our complete SWOT analysis is your key to informed planning and impactful decision-making.

Strengths

AGBA Group Holding Limited stands out as a comprehensive financial supermarket in Hong Kong, providing a wide array of services. This one-stop shop approach encompasses wealth management, healthcare, and innovative fintech solutions, effectively serving a diverse clientele.

This broad spectrum of offerings creates significant opportunities for cross-selling financial products and services among its customer base. For instance, a client utilizing AGBA’s wealth management services might also be introduced to its healthcare offerings, thereby deepening client relationships and increasing revenue per customer.

The company's integrated model fosters strong client loyalty and retention, commonly referred to as client stickiness. By offering multiple essential financial and lifestyle services under one umbrella, AGBA reduces the likelihood of clients seeking alternatives from competitors.

AGBA possesses the largest independent financial advisor (IFA) network in Hong Kong, a substantial asset that underpins its market position. This robust network effectively reaches over 400,000 retail and corporate clients, creating a powerful channel for product distribution and client engagement.

This extensive client base and advisor network offer a significant competitive advantage, particularly in penetrating the dynamic Guangdong-Hong Kong-Macao Greater Bay Area (GBA). The company's ability to tap into this large and growing market is a key strength.

AGBA is strengthening its position by embracing a tech-led ecosystem with a strong fintech focus. The company is integrating advanced technologies like machine learning and artificial intelligence to refine its financial services and healthcare solutions. This strategic shift positions AGBA as a technology-centric holding company, evidenced by its targeted investments and development of an AI-driven wealth management platform.

Strategic Acquisitions and Global Expansion

AGBA's strategic acquisitions are a key strength, fueling its global expansion. The recent acquisition of Sony Life in Singapore is a prime example, significantly broadening its operational reach.

Furthermore, the planned merger with Triller Corp. in the U.S. highlights AGBA's forward-thinking approach. This union is designed to merge AGBA's established financial services prowess with Triller's AI-powered social media platform. The aim is to forge a more robust and diversified business, potentially unlocking new revenue streams and market opportunities by leveraging technology in the financial sector.

- Strategic Acquisitions: Completed acquisition of Sony Life in Singapore.

- Global Expansion: Broadening operational reach through key international moves.

- Merger Ambition: Planned integration with Triller Corp. to combine financial services and AI social media.

- Diversification Strategy: Aiming to create a larger, more diversified entity by merging distinct industry players.

Resilience and Cost Management

AGBA's resilience is a key strength, demonstrated by its successful navigation of 2023's challenging macroeconomic landscape. The company actively refined its business model and implemented robust cost-cutting initiatives, setting a clear path toward enhanced profitability. This strategic focus is designed to fuel strong growth throughout 2024 and into subsequent years.

The company has set an ambitious target of achieving break-even by the fourth quarter of 2024. This financial goal is supported by significant capital infusion, with AGBA having secured substantial funds through strategic equity placements. These placements bolster the company's financial stability and provide the necessary resources to execute its growth strategies.

AGBA's cost management prowess is a critical component of its operational strength. By streamlining operations and optimizing expenditures, the company has improved its financial efficiency. This disciplined approach to cost control is fundamental to achieving its profitability targets and strengthening its market position.

The company's proactive financial management and strategic capital raising are crucial strengths that position it favorably for future success.

AGBA's extensive independent financial advisor network in Hong Kong, boasting over 400,000 retail and corporate clients, provides a significant distribution channel and competitive advantage, particularly within the Greater Bay Area.

The company's strategic embrace of a tech-led ecosystem, with a focus on AI and machine learning for its wealth management and healthcare solutions, positions it as a forward-thinking financial services provider.

AGBA's commitment to global expansion is evident through strategic acquisitions, such as Sony Life in Singapore, and the planned merger with Triller Corp., aiming to create a diversified entity leveraging technology.

The company demonstrated resilience in 2023, refining its business model and implementing cost-cutting measures, with a target of achieving break-even by Q4 2024, supported by substantial capital infusions.

| Key Strength | Description | Impact |

|---|---|---|

| Advisor Network | Largest IFA network in Hong Kong with over 400,000 clients | Dominant market reach and distribution capability |

| Tech Ecosystem | AI/ML integration in financial and healthcare services | Enhanced service delivery and competitive edge |

| Global Expansion | Acquisition of Sony Life (SG), planned Triller merger (US) | Diversification and new market opportunities |

| Financial Resilience | Cost optimization and strategic capital raising | Path to profitability and operational stability |

What is included in the product

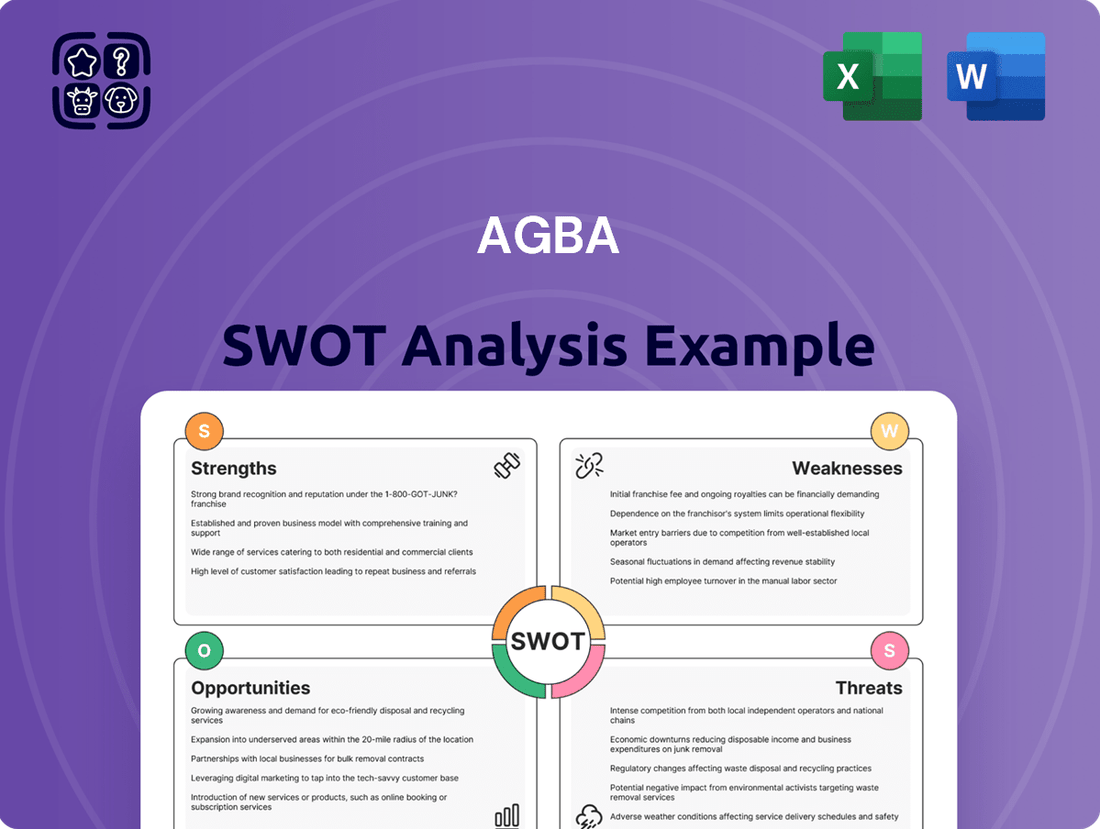

Analyzes AGBA’s competitive position through key internal and external factors.

Simplifies complex strategic planning by offering a clear, actionable framework for identifying and addressing critical business challenges.

Weaknesses

AGBA's historical reliance on the Hong Kong market presents a notable weakness. This concentration exposes the company to the volatility of Hong Kong's economy and any associated geopolitical shifts. For instance, in the first half of 2024, Hong Kong's GDP growth was projected to be modest, highlighting the potential impact of local economic conditions on AGBA's performance.

While AGBA is pursuing diversification strategies, a substantial portion of its revenue generation remains tied to the Hong Kong and Greater Bay Area markets. This continued dependence means that any adverse developments in these specific regions could disproportionately affect the company's overall financial health. Data from early 2024 indicated that a significant majority of AGBA's assets under management were still located within this geographical focus.

AGBA has faced significant profitability hurdles, with recent quarters showing net losses. This trend continued into the second quarter of 2024, where the company reported a revenue decline.

While management projects a return to profitability by late 2024 or into 2025, the current financial statements highlight the ongoing struggle to generate consistent positive earnings. The company's ability to navigate these profitability challenges remains a key concern for stakeholders.

AGBA's ambitious growth strategy, particularly its planned merger with Triller Corp. and acquisition of Sony Life in Singapore, introduces substantial integration risks. Successfully merging distinct business models, disparate technologies, and varied corporate cultures presents a significant hurdle, especially considering Triller Corp.'s current loss-making status.

The challenge lies in harmonizing operations and achieving synergistic benefits from these diverse entities. For instance, integrating Triller's social media platform with AGBA's financial services requires careful planning to avoid operational disruptions and ensure a smooth transition for both customers and employees.

High Share Price Volatility and Dilution Concerns

AGBA's stock has demonstrated significant price volatility, a characteristic that can deter investors seeking stability. For instance, throughout early 2024, the stock experienced considerable fluctuations, making it a challenging investment for those averse to risk.

The proposed merger with Triller raises concerns about share dilution. Existing AGBA shareholders will see their ownership percentage decrease in the combined company, potentially impacting their control and future returns.

This dilution, coupled with the inherent volatility, could negatively influence investor sentiment. A reduced stake and unpredictable stock performance might lead to a decrease in investor confidence, affecting AGBA's long-term market valuation.

Key concerns for investors include:

- Significant Share Dilution: Existing AGBA shareholders will own a smaller portion of the merged entity.

- High Stock Volatility: The stock price has shown considerable instability, increasing investment risk.

- Impact on Investor Confidence: Volatility and dilution may erode investor trust and affect the stock's stability.

Intense Competition in Financial and Tech Sectors

The financial services and fintech landscapes in Hong Kong and globally are incredibly crowded. AGBA faces a constant challenge from both traditional financial institutions and nimble startups, all vying for customer attention and market share. This intense competition means AGBA must prioritize continuous innovation and unique product development to stand out.

Larger, well-funded competitors often possess greater resources for marketing, research, and development, posing a significant hurdle for AGBA. To maintain its competitive edge, AGBA needs to strategically differentiate its services and adapt quickly to evolving market demands. For instance, the global fintech market was valued at approximately USD 2.4 trillion in 2023 and is projected to grow substantially, underscoring the scale of competition.

- High barriers to entry in established financial services.

- Rapid pace of technological innovation by competitors.

- Price sensitivity of customers in certain market segments.

- Challenge of acquiring and retaining talent against larger firms.

AGBA's concentrated revenue streams in Hong Kong and the Greater Bay Area expose it to significant regional economic and geopolitical risks. This geographic dependence remains a core weakness, as evidenced by early 2024 data showing a majority of its assets under management were still anchored in these locales. Consequently, any downturns in these specific markets could disproportionately impact the company's financial stability and growth prospects.

Full Version Awaits

AGBA SWOT Analysis

The file shown below is not a sample—it’s the real AGBA SWOT analysis you'll download post-purchase, in full detail. This ensures you know exactly what you're getting, with no hidden surprises. You can trust that the comprehensive insights and strategic framework presented here are what you'll receive. Purchase now to unlock the complete, actionable document.

Opportunities

The strategic merger with Triller Corp. and the acquisition of Sony Life in Singapore are pivotal for AGBA's geographical expansion, targeting lucrative U.S. and Southeast Asian markets. This move diversifies revenue streams and reduces reliance on the Hong Kong market, which has shown mixed economic performance in recent years. For instance, Southeast Asia's digital economy is projected to reach $1 trillion by 2030, highlighting the immense growth potential.

Furthermore, these acquisitions allow AGBA to venture into new, high-growth verticals, notably AI-driven social media and entertainment, capitalizing on evolving consumer trends. Triller's established user base and content ecosystem provide a solid foundation for integrating AI technologies to enhance user engagement and personalized content delivery. This diversification strategy aligns with the broader market trend of increasing investment in AI applications across various industries.

AGBA can significantly boost its innovation by channeling more resources into AI, machine learning, and NLP. These technologies are key to developing novel financial products and streamlining operations. For instance, the global AI in fintech market was projected to reach $25.7 billion by 2026, indicating substantial growth potential.

Integrating these advanced tools allows AGBA to create highly personalized customer experiences, a crucial differentiator in today's market. By understanding customer behavior through AI, AGBA can offer tailored advice and products, enhancing engagement and loyalty. This focus on personalization is becoming a standard expectation, with many consumers willing to switch providers for better digital experiences.

Furthermore, AI can automate routine tasks, freeing up human capital for more strategic initiatives. This operational efficiency can lead to cost savings and improved turnaround times for services. The financial services industry is actively adopting AI for fraud detection and risk management, areas where AGBA can also benefit from enhanced accuracy and speed.

The merger with Triller presents a significant opportunity for AGBA by leveraging Triller's extensive user base, which boasted over 100 million registered users as of late 2023, for marketing expansion. This integration aims to utilize Triller's advanced AI and digital marketing prowess to accelerate growth within AGBA's financial advisory and burgeoning fintech sectors. The cross-pollination of user engagement and technological capabilities is projected to unlock novel revenue streams for both entities.

Capitalizing on Greater Bay Area Growth

AGBA is strategically positioned to capitalize on the robust growth anticipated in the Greater Bay Area (GBA). This region presents significant opportunities driven by favorable long-term demographic trends and a burgeoning demand for both financial services and healthcare solutions. The GBA's economic integration, bolstered by government initiatives, creates a dynamic environment for expansion. For instance, the GBA's combined GDP reached approximately US$1.7 trillion in 2023, underscoring its economic powerhouse status and AGBA's potential to tap into this expanding market.

Key opportunities for AGBA within the GBA include:

- Leveraging demographic shifts: The GBA is home to over 86 million people, with a growing middle class and an aging population, both increasing the need for AGBA's core offerings.

- Benefiting from government support: Policies promoting financial innovation and cross-border collaboration within the GBA create a favorable regulatory landscape for AGBA's expansion.

- Expanding financial product offerings: The increasing wealth and investment appetite in the GBA present a strong market for AGBA's diverse financial products and services.

- Meeting healthcare demand: The region's focus on improving healthcare infrastructure and services aligns with AGBA's healthcare segment, offering opportunities for synergy and growth.

Strategic Partnerships and Non-Core Asset Sales

AGBA is actively pursuing new avenues for growth through strategic partnerships. For instance, collaborations with entities like HSBC Life Insurance and Zurich (HK) Life Assurance are designed to broaden AGBA's product portfolio and enhance its market penetration. These alliances are crucial for accessing new customer segments and offering a more comprehensive suite of financial solutions.

Concurrently, AGBA is strategically divesting non-core assets to optimize its operational structure and generate capital. This financial discipline allows the company to reallocate resources towards its primary business objectives and invest in high-potential growth areas. The capital raised from these sales is intended to fuel innovation and expand its core service offerings.

- Expanded Product Suite: Partnerships with major insurers like HSBC Life Insurance and Zurich (HK) Life Assurance in 2024 are enabling AGBA to offer a wider array of life and health insurance products, potentially increasing cross-selling opportunities.

- Improved Capital Allocation: The sale of non-core assets, such as certain investment portfolios or subsidiaries, provides AGBA with liquidity to invest in its core financial advisory and wealth management services, a key focus for 2024-2025.

- Streamlined Operations: By shedding non-essential business units, AGBA can concentrate management attention and resources on its core competencies, leading to greater efficiency and a sharper strategic focus.

- Enhanced Market Reach: Strategic alliances can provide AGBA with access to new distribution channels and customer bases, effectively extending its geographical and demographic reach without the need for significant organic investment.

AGBA's strategic acquisitions and mergers, particularly with Triller Corp. and Sony Life in Singapore, open doors to lucrative U.S. and Southeast Asian markets, diversifying revenue and tapping into growth regions like Southeast Asia's digital economy, projected to hit $1 trillion by 2030.

The company can significantly enhance its offerings by integrating AI and machine learning, as seen in Triller's user base of over 100 million, to personalize financial products and streamline operations, mirroring the projected $25.7 billion AI in fintech market by 2026.

Capitalizing on the Greater Bay Area's economic power, estimated at US$1.7 trillion GDP in 2023 and a population exceeding 86 million, presents a prime opportunity for AGBA to expand its financial and healthcare services, supported by favorable government policies for innovation.

Strategic partnerships with firms like HSBC Life Insurance and Zurich (HK) Life Assurance in 2024 are expanding AGBA's product suite, while divesting non-core assets improves capital allocation for core financial advisory services, enhancing market reach and operational efficiency.

Threats

Operating across Hong Kong, Singapore, and the U.S. following the Triller merger means AGBA must navigate a patchwork of financial regulations and data privacy laws, which can be intricate and resource-intensive.

The company faces heightened compliance burdens, particularly concerning financial services regulations and evolving data protection standards across these diverse markets.

Furthermore, AGBA's involvement in combat sports through Triller's ownership of BKFC introduces sector-specific compliance requirements that add another layer of complexity.

Failure to adhere to these varied and changing regulatory landscapes could result in significant fines, operational disruptions, and reputational damage, impacting AGBA's financial performance and market standing.

AGBA faces intense competition in both financial services and technology. Established banks and insurance firms, along with nimble fintech startups, are constantly vying for market share. This requires AGBA to remain agile and innovative to stand out.

The company's expansion into social media and entertainment via Triller introduces an even wider array of competitors, from global social platforms to niche entertainment providers. To avoid market saturation in these new ventures, AGBA must consistently deliver unique value and adapt to rapidly changing consumer preferences.

The financial services sector, in particular, saw significant growth in fintech adoption in 2024, with reports indicating a 15% year-over-year increase in digital payment usage among consumers. This underscores the pressure on traditional players and new entrants like AGBA to offer seamless and competitive digital experiences.

In the social media space, user engagement metrics are key. For instance, average daily active users on leading platforms often exceed hundreds of millions, presenting a substantial hurdle for newer entrants like Triller to capture and retain audience attention amidst a highly fragmented market.

Global and regional economic slowdowns, particularly in key markets like China and Hong Kong, present a significant threat to AGBA. A contraction in economic activity directly translates to reduced demand for financial and wealth management services. For instance, China's GDP growth, while still positive, has shown signs of moderation, impacting consumer spending and investment appetite.

Geopolitical instability further exacerbates these economic concerns. Tensions that affect Hong Kong's standing as a premier international financial center can disrupt cross-border capital flows and investor confidence. This instability directly challenges AGBA's core business model, which relies on a stable and open financial ecosystem.

Cybersecurity and Data Privacy Concerns

As a company deeply embedded in financial services and social media, AGBA's reliance on technology makes it a prime target for cybersecurity threats. Protecting the sensitive client data it manages is paramount. A significant data breach or a privacy violation could have devastating consequences for AGBA's reputation and bottom line.

The financial sector, in particular, is experiencing a surge in sophisticated cyberattacks. For instance, in 2023, the global average cost of a data breach reached an all-time high of $4.45 million, according to IBM's Cost of a Data Breach Report 2023. This figure underscores the substantial financial risk AGBA faces.

Beyond direct financial losses from breaches, AGBA could also incur substantial penalties from regulatory bodies. For example, the General Data Protection Regulation (GDPR) in Europe allows for fines up to 4% of global annual turnover or €20 million, whichever is higher. Such regulatory actions, coupled with reputational damage, could severely impact AGBA's market position and investor confidence.

- Reputational Damage: Public trust is a critical asset for financial institutions; a data breach erodes this trust significantly.

- Financial Penalties: Regulatory fines, such as those under GDPR or CCPA, can be substantial and directly impact profitability.

- Operational Disruption: Cyberattacks can halt business operations, leading to lost revenue and increased recovery costs.

- Loss of Competitive Advantage: Competitors may leverage any perceived weakness in AGBA's security to attract customers.

Uncertainty of Triller Merger Success

The success of AGBA's proposed merger with Triller, a social media platform, introduces significant uncertainty. This deal fundamentally reshapes AGBA's business model and its strategic geographic footprint.

Triller's financial performance has been marked by substantial historical losses, raising concerns about the combined entity's profitability. Integrating two distinct businesses presents inherent challenges, including potential operational hurdles and cultural integration issues that could impact overall performance.

Specifically, Triller reported a net loss of $188 million for the fiscal year ending December 31, 2023. The successful integration of Triller's operations, which span content creation, advertising technology, and music licensing, into AGBA's existing financial services framework is a critical factor. Any missteps in this integration could lead to significant integration costs and operational inefficiencies.

Key risks include:

- Integration Challenges: Merging disparate technological infrastructures and corporate cultures can be complex and costly.

- Financial Viability: Triller's history of losses may continue to weigh on the combined company's financial health.

- Market Acceptance: The market's reception to the new, combined business model and its ability to generate sustainable revenue streams is yet to be proven.

AGBA operates in highly regulated environments across multiple jurisdictions, creating significant compliance complexities. Navigating diverse financial regulations and data privacy laws in Hong Kong, Singapore, and the U.S. demands substantial resources and constant adaptation to evolving standards.

The company faces intense competition from both established financial institutions and agile fintech startups, as well as a broad range of social media and entertainment platforms. For instance, the digital payments sector saw a 15% year-over-year increase in consumer adoption in 2024, highlighting the pressure to innovate.

Economic slowdowns and geopolitical instability in key markets like China and Hong Kong pose a threat to AGBA's financial services operations by potentially reducing demand and investor confidence. China's GDP growth moderation impacts consumer spending and investment appetite.

AGBA is vulnerable to cybersecurity threats, with the global average cost of a data breach reaching $4.45 million in 2023. A breach could lead to substantial fines, operational disruptions, and severe reputational damage, impacting investor confidence and market position.

The integration of Triller, which reported a net loss of $188 million in 2023, presents significant financial and operational integration risks for AGBA. The market's reception to the combined entity's business model and its ability to achieve profitability remains a key uncertainty.

SWOT Analysis Data Sources

This AGBA SWOT analysis is built on a robust foundation of data, drawing from official financial filings, comprehensive market research, and validated industry reports. Expert insights and professional forecasts further enrich the analysis, ensuring a well-rounded and accurate strategic assessment.