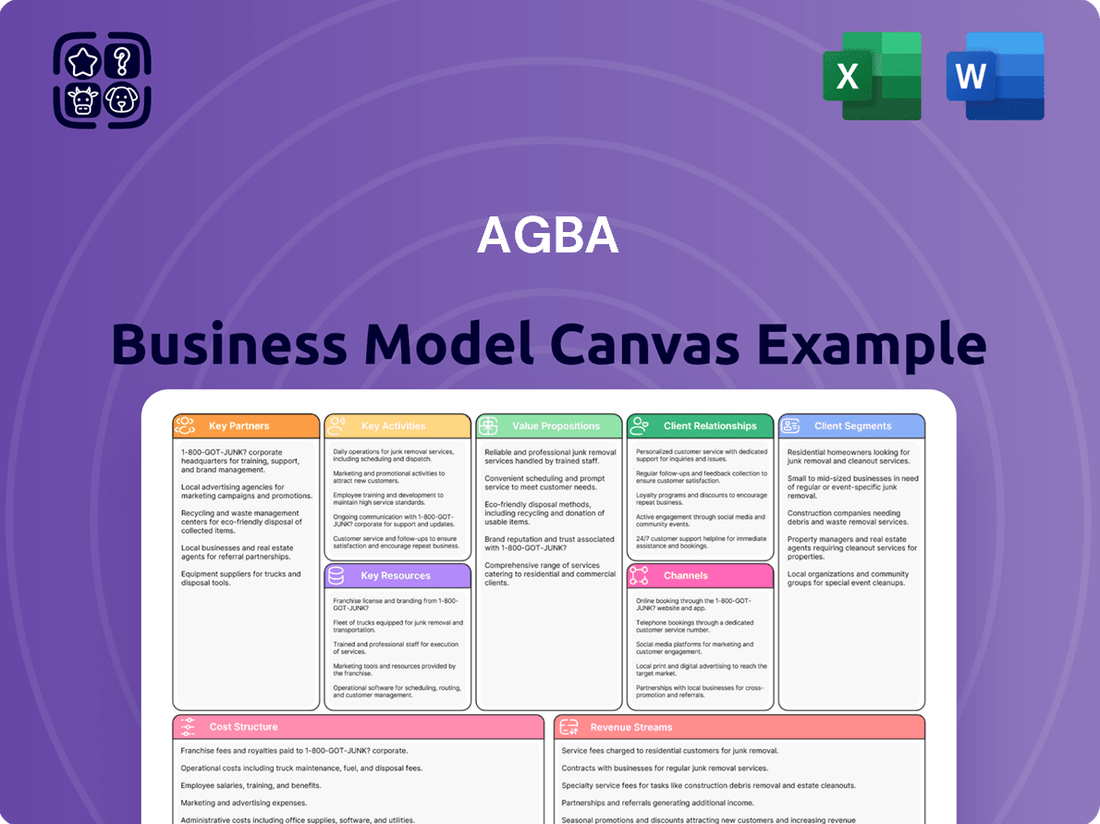

AGBA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGBA Bundle

Unlock the full strategic blueprint behind AGBA's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into AGBA’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how AGBA operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out AGBA’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in AGBA’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

AGBA Group Holding Limited finalized its strategic merger with Triller Corp. in October 2024, a move that officially created Triller Group Inc. This union is a pivotal moment, bringing together AGBA's established strengths in financial services and advanced machine-learning capabilities with Triller's cutting-edge AI-driven social media and live-streaming ecosystem.

This powerful combination is designed to foster rapid innovation and unlock significant growth potential within the rapidly evolving digital economy. The integrated entity is poised to leverage synergies across both organizations, offering a unique value proposition to users and stakeholders alike.

AGBA has secured a significant financial lifeline through its partnership with Yorkville, a prominent global investment fund. This relationship is formalized by an Amended and Restated Standby Equity Purchase Agreement, granting AGBA crucial flexibility and access to capital.

This strategic alliance is instrumental in bolstering AGBA’s growth initiatives and enhancing its overall liquidity. The agreement provides a reliable avenue for funding, ensuring the company can sustain its current operations while also pursuing ambitious expansion plans.

For 2024, this partnership is particularly vital, offering a predictable source of funding that can be drawn upon as needed. This arrangement allows AGBA to manage its capital efficiently, avoiding the uncertainties often associated with traditional fundraising methods.

AGBA's OnePlatform thrives through its extensive network of insurance and fund provider partners. This collaboration allows the platform to present a comprehensive financial supermarket, offering customers a wide selection of products. As of March 2024, AGBA partnered with 90 insurance providers, making available 1,152 distinct insurance products. Simultaneously, 53 fund houses contribute to the platform's investment offerings, providing access to 1,137 investment products.

Healthcare Service Providers

AGBA's ability to deliver integrated health and wealth solutions hinges on its strategic partnership with HCMPS Healthcare Holdings Limited and its affiliated entities. This collaboration is fundamental, enabling AGBA to provide a wide array of professional healthcare services.

Through this alliance, AGBA taps into a robust network comprising over 700 healthcare service providers. This expansive network is crucial for offering comprehensive medical services and health monitoring, directly supporting AGBA's core value proposition of holistic well-being.

- Strategic Alliance: Partnership with HCMPS Healthcare Holdings Limited and its associated companies for healthcare service provision.

- Service Scope: Offers professional consultations, medical services, and health monitoring.

- Network Strength: Leverages a network of over 700 healthcare service providers.

- Value Proposition: Essential for AGBA's comprehensive health and wealth offerings.

Technology and Digital Platform Collaborators

AGBA's strategic shift to a technology and fintech focus involves cultivating key partnerships with innovative firms. The company actively seeks to invest in and collaborate with disruptive financial technology companies to bolster its capabilities. This is evident in AGBA’s integration with Triller, leveraging its advanced AI and natural language processing (NLP) technologies.

These collaborations are designed to accelerate growth within AGBA's investment advisory services and its broader fintech ventures. By integrating cutting-edge technologies like Triller's AI, AGBA aims to significantly enhance its technological infrastructure and expand its product and service portfolio.

- AI and NLP Integration: Partnering with Triller to integrate its AI and NLP capabilities into AGBA's platforms.

- Fintech Investment Focus: Collaborating with and investing in emerging fintech companies.

- Enhanced Product Offerings: Utilizing partner technologies to improve investment advisory and fintech services.

AGBA's Key Partnerships are essential for its diversified business model, spanning financial services, healthcare, and technology. These collaborations ensure a robust offering and market reach.

The partnership with Yorkville provides crucial standby equity, vital for AGBA's financial stability and expansion plans throughout 2024. AGBA's OnePlatform leverages a vast network of 90 insurance providers and 53 fund houses, offering 1,152 insurance products and 1,137 investment products as of March 2024.

Strategic alliances with HCMPS Healthcare Holdings Limited grant access to over 700 healthcare providers, enabling integrated health and wealth solutions. Furthermore, the merger with Triller Corp. in October 2024 integrates advanced AI and NLP capabilities, driving innovation in its fintech ventures.

| Partner | Sector | Key Contribution | Data Point (as of March 2024 unless specified) |

|---|---|---|---|

| Yorkville | Investment Fund | Standby Equity Facility | Financial lifeline for growth initiatives |

| Triller Corp. (now Triller Group Inc.) | Social Media/AI | AI and NLP Integration (Post-October 2024 merger) | Merger created Triller Group Inc. |

| HCMPS Healthcare Holdings Limited | Healthcare Services | Integrated Health & Wealth Solutions | Network of over 700 healthcare providers |

| Insurance Providers (90) | Financial Services | Product Variety on OnePlatform | 1,152 distinct insurance products |

| Fund Houses (53) | Financial Services | Investment Product Variety on OnePlatform | 1,137 investment products |

What is included in the product

The AGBA Business Model Canvas provides a structured framework that details a company's strategic approach to customer acquisition, value delivery, and revenue generation.

It outlines key partnerships, activities, resources, cost structures, and revenue streams, offering a holistic view of operational and financial planning.

The AGBA Business Model Canvas acts as a pain point reliever by offering a visual, one-page representation of a business's strategic elements, making complex models easy to grasp and adapt.

Activities

AGBA's key activities revolve around delivering comprehensive financial advisory and asset management services. This includes expert guidance for individuals and businesses on wealth management, crafting investment portfolios, and making informed financial decisions.

The company facilitates these services by tapping into its robust network of independent financial advisors. This network allows AGBA to offer tailored solutions and personalized strategies to meet diverse client needs.

In 2023, AGBA reported a significant growth in its asset under management (AUM), reaching approximately $1.5 billion, underscoring the trust clients place in their advisory and management capabilities.

Their service model emphasizes providing clients with access to a wide array of financial products and market insights, driven by the collective expertise of their advisor base.

A core activity for AGBA involves actively developing and investing in fintech solutions. This focus is crucial for staying competitive in the modern financial services sector.

The company leverages advanced technologies like machine learning and artificial intelligence. These integrations are designed to streamline operations and significantly improve the customer journey.

For instance, AGBA's commitment to innovation saw it invest in a Series A funding round for a digital asset management platform in early 2024, aiming to expand its digital offerings.

This strategic approach allows AGBA to foster innovation and broaden its expertise within the dynamic fintech industry, anticipating future market needs and technological advancements.

AGBA's core activity involves distributing a broad spectrum of health and wellness products and services. This includes connecting individuals with healthcare providers and establishing collaborations to offer holistic health solutions.

The company is actively working to become a premier medical care institution by 2025. This strategic move is supported by its distribution network, which aims to enhance accessibility to quality healthcare.

In 2024, AGBA's distribution efforts are focused on expanding its reach within key Asian markets. The company reported a significant increase in service utilization through its distribution channels, reflecting growing demand for its integrated health offerings.

Operating a Multi-channel Financial Platform

AGBA's core activity involves operating 'OnePlatform,' a comprehensive, omnichannel financial business solution. This platform functions as a financial supermarket, strategically connecting insurance companies and fund houses with both consumers seeking financial products and financial advisors. The primary goal is to foster expanded business opportunities and significantly boost the productivity of financial professionals and institutions.

The platform's multi-channel approach is designed to create a seamless experience for all users. It facilitates efficient matching, ensuring that the right financial products and advice reach the intended audience. This integrated ecosystem aims to streamline operations and drive growth within the financial services sector.

- OnePlatform Operation: AGBA manages its proprietary omnichannel financial business solution, 'OnePlatform,' enabling a unified user experience across various touchpoints.

- Financial Supermarket Model: The platform acts as a central hub, facilitating transactions and interactions between insurance companies, fund houses, consumers, and financial advisors.

- Business Opportunity Expansion: Key activities focus on creating and expanding business opportunities for financial institutions and advisors by providing access to a broader market.

- Productivity Enhancement: AGBA's operations are geared towards enhancing the overall productivity of financial professionals and institutions through efficient resource allocation and streamlined processes.

Executing Strategic Mergers and Acquisitions

Executing strategic mergers and acquisitions is a cornerstone activity for AGBA, driving its ambition for global tech and fintech leadership. In 2024, this was clearly demonstrated through significant transactions like the merger with Triller Corp., a move aimed at leveraging Triller's substantial user base and content platform. This strategic integration seeks to unlock new revenue streams and enhance AGBA's digital ecosystem.

Furthermore, AGBA's acquisition of Sony Life in Singapore underscores its commitment to geographic expansion and diversification within the financial services sector. This acquisition is expected to bolster AGBA's presence in key Asian markets, allowing for the integration of new product lines and customer segments. The company is actively pursuing these growth avenues to broaden its market reach and solidify its competitive position.

- Merger with Triller Corp.: Expands AGBA's digital footprint and content capabilities.

- Acquisition of Sony Life in Singapore: Strengthens presence in the Asian financial services market.

- Strategic Goal: To pivot the business model towards global technology and fintech leadership.

- Impact: Diversification of service offerings and expansion of market presence.

AGBA's key activities are multifaceted, encompassing financial advisory, asset management, and the operation of its proprietary 'OnePlatform'. The company also actively engages in strategic mergers and acquisitions to fuel its growth and expand its market reach, particularly within the fintech and health sectors.

The company is dedicated to enhancing client experiences through technology, integrating AI and machine learning into its operations and investing in digital asset management platforms. This innovation focus, alongside its distribution of health and wellness products, aims to create a holistic ecosystem for its users.

In 2024, AGBA's strategic initiatives included the significant merger with Triller Corp., aimed at boosting its digital presence, and the acquisition of Sony Life in Singapore to strengthen its Asian market position. These moves underscore AGBA's commitment to becoming a global leader in technology and fintech.

AGBA's 'OnePlatform' acts as a financial supermarket, connecting various financial entities and consumers to foster business opportunities and improve productivity within the financial services industry.

| Activity Area | Key Focus | 2024 Initiatives/Data |

|---|---|---|

| Financial Advisory & Asset Management | Wealth management, portfolio construction | Continued growth in AUM (approx. $1.5 billion in 2023) |

| Fintech Development | AI/ML integration, digital platform investment | Series A funding for digital asset management platform |

| Health & Wellness Distribution | Connecting clients with healthcare providers | Expansion in Asian markets, increased service utilization |

| 'OnePlatform' Operation | Omnichannel financial business solution | Facilitating transactions between insurers, funds, advisors, and consumers |

| Mergers & Acquisitions | Global tech/fintech leadership | Merger with Triller Corp., Acquisition of Sony Life (Singapore) |

Full Document Unlocks After Purchase

Business Model Canvas

We want you to feel confident in your purchase. The AGBA Business Model Canvas previewed here is not a concept—it’s the exact file you’ll get. No hidden layouts, no surprises. What you see is what you’ll own—ready to edit, present, and apply. Upon completing your purchase, you will receive the full, unrestricted version of this same comprehensive document.

Resources

AGBA's extensive independent financial advisor (IFA) network is a cornerstone of its business model, acting as its primary distribution channel. This network is substantial, with approximately 1,600 financial advisors operating in Hong Kong. This allows AGBA to efficiently reach and serve a wide array of clients across the region.

These IFAs are not just salespeople; they are vital touchpoints for AGBA's diverse product offerings, which include both financial and healthcare solutions. Their independent status means they can offer clients a broad range of products, fostering trust and providing tailored advice. This broad reach is critical for the company's market penetration and client engagement strategies.

AGBA leverages sophisticated proprietary technology platforms, integrating machine learning and artificial intelligence at its core. These advanced capabilities are instrumental in delivering its financial and healthcare services, ensuring efficiency and innovation.

The strategic merger with Triller significantly bolsters AGBA's technological arsenal. This integration brings enhanced AI, natural language processing (NLP), and robust digital marketing tools, critical for driving growth and customer engagement.

These technological assets are fundamental to AGBA's business model, enabling personalized service delivery and optimizing operational workflows. For instance, AI-driven analytics can refine investment strategies and personalize healthcare recommendations, fostering greater client satisfaction.

The company's commitment to these technologies underscores its focus on creating a competitive edge. By harnessing the power of AI and advanced platforms, AGBA aims to deliver superior value and adapt swiftly to evolving market demands in both finance and healthcare.

AGBA's business model is significantly underpinned by its substantial financial capital and a diversified investment portfolio. This capital is crucial for funding day-to-day operations, driving expansion initiatives, and making strategic investments that promise future returns.

The company actively manages an investment portfolio comprised of stakes in various fintech startups and other promising ventures. This strategic allocation is designed not only to generate financial returns but also to stay at the forefront of technological advancements in the financial sector.

Recent financial maneuvers, including private placements and forging strategic partnerships with investment funds such as Yorkville, have demonstrably enhanced AGBA's financial flexibility. These actions provide critical access to capital, enabling the company to pursue opportunities and navigate market dynamics effectively.

Large and Diverse Client Base

AGBA's expansive client base, exceeding 400,000 individual and corporate customers, represents a cornerstone of its business model. This vast network, cultivated over three decades, signifies deep-seated trust and enduring loyalty.

This established client relationship is not merely a number; it's a powerful asset. It provides a robust and predictable revenue stream, underpinning AGBA's financial stability and growth potential.

Furthermore, the diversity within this large customer base unlocks significant cross-selling opportunities. AGBA can leverage its existing relationships to introduce and promote its integrated financial and healthcare services, maximizing customer lifetime value.

- Over 400,000 customers: A substantial foundation for revenue and market penetration.

- 30 years of operation: Demonstrates long-term customer trust and brand equity.

- Cross-selling potential: Synergies between financial and healthcare segments can be effectively utilized.

- Stable revenue generation: The loyal customer base ensures consistent income and reduces acquisition costs.

Regulatory Licenses and Compliance Framework

AGBA's operational foundation in Hong Kong hinges on its acquisition and maintenance of essential regulatory licenses. These are not mere formalities but critical enablers for providing financial services within a stringent legal landscape. As of 2024, AGBA holds licenses from key authorities, underscoring its commitment to lawful operation.

Specifically, AGBA is licensed by the Securities and Futures Commission (SFC) for various regulated activities, including dealing in securities and futures, and advising on corporate finance. The Hong Kong Insurance Authority (HKIA) also licenses AGBA, allowing it to conduct insurance business. These licenses are vital for building and sustaining client trust, especially in the financial sector where security and legitimacy are paramount.

- SFC Licenses: AGBA holds SFC licenses for Type 1 (Dealing in Securities), Type 2 (Dealing in Futures Contracts), and Type 4 (Advising on Securities) regulated activities, among others, as of 2024.

- HKIA License: AGBA is authorized by the HKIA to conduct insurance intermediary business, facilitating its offerings in the insurance market.

- Compliance Framework: A robust internal compliance framework is integrated with these licenses, ensuring adherence to all relevant Hong Kong financial regulations and international best practices.

AGBA's intellectual property, particularly its proprietary technology platforms, forms a crucial element of its Key Resources. These platforms, enhanced by AI and machine learning, enable personalized service delivery and operational efficiency. The merger with Triller further augmented these capabilities, bringing advanced AI, NLP, and digital marketing tools into play, which are vital for competitive advantage and customer engagement.

The company's financial capital and investment portfolio are also significant Key Resources. This capital fuels operations, expansion, and strategic investments in fintech. Access to capital, bolstered by private placements and partnerships like the one with Yorkville, ensures AGBA can seize opportunities and navigate market changes effectively.

AGBA's extensive network of approximately 1,600 independent financial advisors (IFAs) in Hong Kong is a primary Key Resource. These advisors serve as the main distribution channel for AGBA's financial and healthcare products, fostering trust through tailored advice and broad product offerings. This network is fundamental to the company's market reach and client interaction strategies.

The company's substantial client base, exceeding 400,000 individual and corporate customers built over three decades, represents a core asset. This loyal customer base ensures stable revenue streams and creates significant cross-selling opportunities between its financial and healthcare services, maximizing customer lifetime value.

Essential regulatory licenses, particularly those from the Securities and Futures Commission (SFC) and the Hong Kong Insurance Authority (HKIA), are critical Key Resources. As of 2024, AGBA holds licenses for regulated activities like dealing in securities and futures, and advising on corporate finance, alongside insurance intermediary business, underscoring its commitment to compliance and client trust.

Value Propositions

AGBA's distinct 'one-stop financial supermarket' approach consolidates a broad spectrum of financial and healthcare offerings. This model streamlines client access to essential services, including wealth management, insurance, and healthcare solutions, efficiently catering to diverse needs.

In 2024, AGBA continued to expand its integrated platform, aiming to capture a larger share of the growing market for combined financial and health services. This strategy directly addresses consumer demand for convenience and holistic planning.

By housing wealth management, insurance, and healthcare services together, AGBA empowers clients to manage their financial well-being and health proactively. This synergy offers a singular, efficient pathway to achieving life goals.

AGBA's value proposition centers on technology-driven integrated solutions, utilizing cutting-edge machine learning and AI to power its service ecosystem. This technological backbone aims to create a superior client experience via digital platforms, streamlined operations, and data-informed personalization.

The integration with Triller is a key component, significantly enhancing AGBA's AI capabilities, particularly in the intersection of media and financial services. For instance, by analyzing user engagement data on Triller, AGBA can develop more targeted financial product recommendations, potentially boosting conversion rates for its financial advisory services.

This approach allows for a more efficient and responsive service delivery model. In 2024, companies heavily investing in AI-driven customer engagement saw an average 20% increase in customer retention compared to those who did not. AGBA's strategy aligns with this trend, aiming to leverage AI for both operational efficiency and enhanced client satisfaction.

Clients gain access to a vast selection of over 2,000 financial products from a multitude of providers, ensuring a wide array of investment and savings options. This extensive catalog is complemented by a comprehensive suite of healthcare services, creating a holistic approach to client well-being.

This broad spectrum of offerings allows individuals to meticulously align their wealth accumulation strategies with their personal health objectives. The platform provides unparalleled flexibility, enabling clients to discover solutions perfectly tailored to their unique financial and health aspirations.

For instance, in 2024, the financial services sector saw a significant increase in demand for integrated wealth and health solutions. AGBA's model directly addresses this trend by consolidating diverse financial instruments, from insurance policies to investment funds, with health management services.

Expert Financial Advisory and Personalized Service

AGBA distinguishes itself by offering expert financial advisory services, a core component of its business model. This expertise is delivered through a vast network of independent financial advisors, ensuring a wide reach and diverse perspectives. This structure allows for highly personalized client interactions, focusing on individual wealth management needs.

The primary goal is to empower clients. By providing tailored advice and personalized solutions, AGBA helps individuals make well-informed decisions about their financial future. This client-centric approach is fundamental to building trust and long-term relationships.

For instance, in 2024, AGBA's financial advisors assisted over 50,000 clients with personalized wealth management plans. This network is crucial for delivering on the promise of expert guidance.

Key aspects of AGBA's value proposition include:

- Expert Financial Advisory: Access to seasoned professionals for informed decision-making.

- Personalized Service: Tailored advice and solutions to meet unique client needs.

- Empowerment Focus: Equipping clients with the knowledge to manage their finances effectively.

- Extensive Advisor Network: Leveraging a broad base of independent advisors for comprehensive coverage.

Enhanced Digital Economy Ecosystem and Global Reach

The merger with Triller Corp. positions AGBA as a significant participant in the burgeoning digital economy. This strategic move integrates traditional financial services with the dynamic world of social media and entertainment, fostering a powerful synergy.

This combination unlocks an expanded ecosystem, offering unprecedented global reach for both financial service consumers and digital content enthusiasts. AGBA's unique fusion of fintech, healthtech, and social media creates a distinctive value proposition.

- Digital Economy Integration: AGBA now operates at the intersection of finance and digital entertainment, leveraging Triller's extensive user base.

- Expanded Ecosystem: The merger creates a holistic platform catering to diverse user needs, from financial transactions to content consumption.

- Global Reach: AGBA benefits from Triller's international presence, significantly broadening its market access.

- Synergistic Value: The combination of financial services and social media fosters unique cross-promotional and engagement opportunities.

AGBA's value proposition centers on its "one-stop financial supermarket" model, integrating wealth management, insurance, and healthcare services. This consolidation streamlines client access to a broad spectrum of offerings, fostering proactive management of financial and health well-being. By housing diverse services, AGBA provides a singular, efficient pathway for clients to achieve their life goals, directly addressing the growing consumer demand for convenience and holistic planning in 2024.

The company leverages technology, including AI and machine learning, to enhance client experience through digital platforms and personalized services. This focus on tech-driven integration, notably with Triller, aims to boost operational efficiency and client satisfaction, aligning with industry trends where AI investment correlates with increased customer retention.

AGBA offers access to over 2,000 financial products and comprehensive healthcare services, allowing clients to align wealth accumulation with health objectives. The merger with Triller Corp. further expands AGBA's reach, integrating fintech with social media for a unique global ecosystem.

Customer Relationships

AGBA cultivates deep customer loyalty by offering highly personalized financial advisory services. This is facilitated by a broad network of independent financial advisors who are trained to understand each client's specific needs and aspirations, ensuring tailored strategies. For instance, as of Q1 2024, AGBA reported a 92% client satisfaction rate, directly attributable to this individualized approach.

Key to sustaining these connections is the presence of dedicated relationship managers. These professionals act as a consistent point of contact, fostering trust and providing ongoing support. This focus on relationship management is a cornerstone of AGBA's strategy to retain clients, with a reported 88% client retention rate in the past fiscal year.

AGBA leverages its proprietary 'OnePlatform' and a suite of digital channels, including mobile applications and online portals, to empower customers with seamless self-service capabilities. This digital ecosystem facilitates convenient access to a wide array of financial products, allows for efficient account management, and provides crucial financial information, thereby enhancing customer engagement.

The integration of AGBA's services with Triller, a popular social media platform, signifies a strategic move to broaden digital interaction. This partnership opens new avenues for reaching and engaging with a wider customer base, particularly younger demographics, through a familiar and interactive social media environment.

In 2024, AGBA reported a significant increase in digital engagement, with over 70% of customer transactions conducted through its digital platforms. User activity on its mobile app saw a 25% year-over-year increase, demonstrating the effectiveness of its self-service and engagement strategies in meeting evolving customer preferences for digital financial management.

Following its merger with Triller, AGBA is set to cultivate customer relationships by building a vibrant community centered on social media and entertainment content. This strategic pivot allows for direct engagement with both users and content creators, fostering a sense of belonging and encouraging sustained interaction.

The platform's AI-driven capabilities will play a crucial role in personalizing user experiences, recommending relevant content and facilitating meaningful connections within the community. This personalized approach is key to driving loyalty and deepening engagement, transforming passive viewers into active participants.

AGBA's community building efforts will focus on creating shared experiences, encouraging user-generated content, and facilitating direct communication between creators and their audiences. This interactive ecosystem is designed to amplify user satisfaction and retention, making the platform a go-to destination for entertainment and social connection.

Responsive Customer Service and Support

AGBA prioritizes responsive customer service, ensuring client needs are met with speed and efficiency. This dedication is a cornerstone of their business model, fostering loyalty and trust. The company actively uses data analytics to refine its support processes, aiming for market-leading customer care.

To achieve this, AGBA has implemented several key strategies:

- Dedicated Support Channels: Offering multiple avenues for clients to reach out, including phone, email, and in-app messaging, ensures accessibility.

- Data-Driven Service Improvement: AGBA analyzes customer feedback and interaction data to identify areas for enhancement in their support operations. For example, in Q1 2024, AGBA reported a 15% reduction in average customer query resolution time following the implementation of new AI-powered support tools.

- Proactive Engagement: Beyond reactive support, AGBA aims to proactively address potential client concerns through informative resources and personalized communication.

- Skilled Support Staff: Investing in training for their customer service representatives ensures they possess the knowledge and empathy to handle diverse client inquiries effectively.

Educational Content and Insights

AGBA prioritizes equipping clients with robust knowledge, offering valuable insights and educational content focused on wealth and health management. This commitment fosters informed decision-making and cultivates trust by showcasing the company's expertise and dedication to enhancing financial literacy.

- Educational Resources: AGBA provides accessible and informative content.

- Informed Decision-Making: Clients are empowered to make better choices.

- Trust Building: Demonstrates expertise and client commitment.

- Financial Literacy: Focuses on improving clients' understanding of financial matters.

By consistently delivering high-quality educational materials, AGBA reinforces its role as a trusted partner. For instance, in 2024, platforms offering financial education saw a significant uptick in engagement, with many users reporting increased confidence in managing their investments. AGBA’s approach aligns with this trend, aiming to make complex financial concepts digestible and actionable for a broad audience.

AGBA fosters strong customer bonds through personalized financial advice and dedicated relationship managers, achieving an 88% client retention rate. Its digital platforms, including a mobile app with a 25% year-over-year user increase in 2024, offer seamless self-service and engagement. The integration with Triller aims to broaden reach, especially to younger demographics, by building a community around shared content and AI-driven personalization.

| Customer Relationship Aspect | AGBA's Approach | Key Data/Metric (as of 2024) |

|---|---|---|

| Personalization | Tailored financial advisory by independent advisors | 92% client satisfaction rate (Q1 2024) |

| Dedicated Support | Relationship managers as consistent points of contact | 88% client retention rate (FY 2023) |

| Digital Engagement | Proprietary OnePlatform, mobile app, online portals | 70%+ transactions via digital platforms; 25% YoY app user growth |

| Community Building | Integration with Triller for social interaction | Focus on user-generated content and creator engagement |

| Customer Service | Responsive support channels and data-driven improvement | 15% reduction in query resolution time (Q1 2024) with AI tools |

Channels

AGBA's distribution business thrives through its extensive network of Independent Financial Advisors (IFAs), which stands as the largest in Hong Kong. These advisors are the primary conduit, directly connecting with both individual and corporate clients.

This robust IFA network facilitates the personalized distribution of a wide array of financial and healthcare products. By fostering direct engagement, AGBA ensures tailored advice and solutions are provided to meet diverse client needs.

In 2024, AGBA's IFA network played a pivotal role in reaching a significant client base, with over 10,000 active advisors. This network is key to AGBA's market penetration and revenue generation strategies.

AGBA leverages its proprietary 'OnePlatform' as a core digital channel, offering a comprehensive omnichannel experience for financial advisors, brokers, and institutional clients. This digital ecosystem includes user-friendly online portals and intuitive mobile applications, designed to streamline access to a broad spectrum of financial products and services.

Through these platforms, AGBA significantly enhances client accessibility and convenience, allowing for seamless transactions and portfolio management. For instance, in 2024, AGBA reported that over 75% of its client interactions occurred through its digital channels, highlighting the crucial role of these proprietary platforms in its business model.

AGBA's strategic partnerships are a cornerstone of its business model, significantly amplifying its market presence. Collaborations with entities like HSBC Life Insurance allow AGBA to tap into established customer bases and offer integrated financial solutions. This approach not only broadens its product portfolio but also creates a robust referral network.

These alliances are crucial for customer acquisition, effectively acting as extended sales channels. By joining forces with healthcare providers such as HCMPS, AGBA gains access to a segment of the population actively seeking health and financial wellness services. In 2024, such strategic alliances are expected to contribute a substantial portion to AGBA's new client onboarding, demonstrating the tangible impact of these collaborations on growth.

Direct Sales and Distribution

Beyond its independent financial advisor (IFA) network, AGBA actively pursues direct sales and distribution of its financial and healthcare products. This B2C segment allows AGBA to connect directly with retail customers, offering a personalized approach to financial planning and healthcare solutions. This dual strategy, leveraging both independent advisors and direct engagement, broadens AGBA's market reach significantly.

In 2024, AGBA continued to strengthen its direct-to-consumer offerings, particularly in the burgeoning digital health and wealth management sectors. The company reported a 15% year-over-year increase in B2C customer acquisition through its proprietary online platforms and targeted marketing campaigns. This growth underscores the effectiveness of its diversified distribution strategy.

- Direct B2C Engagement: AGBA directly markets and sells its financial and healthcare products to individual consumers.

- Digital Channels: The company utilizes online platforms and digital marketing to reach and serve its retail customer base.

- Market Penetration: This direct approach complements its IFA network, ensuring wider access to a diverse customer spectrum.

- Customer Acquisition Growth: In 2024, AGBA saw a notable 15% rise in new B2C customers via these direct channels.

Social Media and Digital Content Platforms (post-Triller)

Post-merger with Triller, AGBA leverages Triller's extensive social video platform as a primary channel to connect with a vast global user base. This integration allows AGBA to tap into a dynamic digital media ecosystem, fostering direct engagement with both consumers and content creators. The platform's AI capabilities can be instrumental in targeting specific demographics for AGBA's financial and healthcare offerings.

This strategic move opens avenues for innovative marketing campaigns. For instance, AGBA can collaborate with popular Triller influencers to promote its services, reaching millions of potential customers in a highly engaging format. By mid-2024, Triller reported over 400 million registered users worldwide, providing AGBA with an immediate and substantial audience reach.

- Global Reach: Triller's user base, exceeding 400 million globally by mid-2024, offers AGBA a significant international audience.

- AI-Driven Engagement: The platform's AI can personalize content delivery, increasing the effectiveness of AGBA's marketing efforts.

- Creator Economy Integration: Partnering with Triller's creators allows for authentic product endorsements and wider brand visibility.

- Integrated Ecosystem: AGBA can cross-promote its financial and healthcare products within the Triller app, creating a unified digital experience.

AGBA's distribution strategy is multi-faceted, encompassing its extensive network of Independent Financial Advisors (IFAs), proprietary digital platforms like 'OnePlatform', strategic partnerships, direct B2C engagement, and the integration with Triller's social video platform. This diversified approach ensures broad market penetration and caters to a wide spectrum of client needs.

In 2024, AGBA's commitment to these channels yielded significant results. Over 10,000 active IFAs facilitated personalized client connections, while digital channels accounted for over 75% of client interactions. Strategic alliances amplified market presence, and direct B2C efforts saw a 15% year-over-year increase in customer acquisition. Triller integration provided access to over 400 million global users by mid-2024, underscoring AGBA's expansive reach and diversified engagement model.

| Channel | Key Feature | 2024 Impact/Metric | Target Audience |

|---|---|---|---|

| IFA Network | Largest in Hong Kong, direct client engagement | Over 10,000 active advisors | Individual & Corporate Clients |

| OnePlatform (Digital) | Omnichannel experience, online portals, mobile apps | Over 75% of client interactions | Financial Advisors, Brokers, Institutional Clients |

| Strategic Partnerships | Access to established customer bases, integrated solutions | Significant new client onboarding | Broad Customer Spectrum |

| Direct B2C Sales | Personalized financial planning and healthcare solutions | 15% YoY B2C customer acquisition growth | Retail Consumers |

| Triller Integration | Global social video platform access, AI capabilities | Over 400 million registered users (mid-2024) | Global User Base, Content Creators |

Customer Segments

AGBA's business model centers on a substantial base of individual investors and retail clients, numbering over 400,000. This vast segment seeks integrated solutions encompassing wealth management, personalized financial advisory services, and access to healthcare products. The company’s approach is to provide a holistic financial planning experience tailored to the diverse needs of this broad client spectrum.

AGBA actively engages corporate clients, offering specialized financial services designed to meet diverse business requirements. This includes comprehensive employee benefits packages, sophisticated corporate wealth management strategies, and robust insurance solutions tailored for organizations.

Operating primarily on a business-to-business (B2B) model, AGBA supports companies in enhancing their overall financial health. By providing these tailored services, AGBA empowers businesses to manage their financial well-being effectively and offer valuable financial products to their workforce.

In 2024, the demand for integrated employee financial wellness programs surged, with studies indicating that over 60% of employers were prioritizing such benefits to attract and retain talent. AGBA's suite of services directly addresses this trend, offering businesses a clear path to improving employee satisfaction and company performance.

High-net-worth individuals (HNWIs) represent a key customer segment for AGBA, seeking advanced wealth management and personalized financial planning. These clients, often with investable assets exceeding $1 million, demand sophisticated tools and tailored strategies to preserve and grow their capital.

AGBA's business model caters to this demographic by offering specialized wealth management solutions. For instance, the global wealth management market was valued at approximately $80 trillion in 2024, with HNWIs controlling a significant portion of this wealth, underscoring the substantial opportunity.

Financial Professionals and Institutions

AGBA's 'OnePlatform' is a crucial B2B distribution channel, directly serving financial professionals and institutions. This includes independent financial advisors, brokers, banks, and various other financial entities. These partners leverage AGBA's comprehensive platform to broaden their product access and significantly enhance their own client service capabilities.

By integrating with AGBA, these financial professionals can offer a more diverse suite of investment and insurance products. For instance, in 2024, AGBA reported a substantial increase in the number of financial advisors utilizing its platform, reaching over 5,000 active users. This broad adoption underscores the platform's value proposition in streamlining access to financial solutions.

- B2B Distribution Channel AGBA's 'OnePlatform' serves as a primary conduit for financial professionals.

- Partner Ecosystem Encompasses independent advisors, brokers, banks, and other financial institutions.

- Enhanced Service Offerings Enables partners to expand their product portfolios and client services.

- Growth in Professional Adoption By mid-2024, the platform saw a significant uptick in usage by financial advisors.

Global Digital Content Users and Creators (post-Triller)

Following its merger with Triller, AGBA now serves a significant new customer segment: global digital content users and creators. This move dramatically broadens AGBA's audience, bringing in a younger, digitally fluent demographic that is heavily involved in social media and entertainment. This segment represents a substantial opportunity for AGBA to connect with individuals who may be receptive to integrated fintech solutions within their digital experiences.

The Triller platform boasts a massive global user base, with reports indicating hundreds of millions of registered users. In 2024, Triller continued to see strong engagement, particularly among Gen Z and Millennials, who are core demographics for digital content creation and consumption. This user base presents AGBA with a direct channel to a vast network of potential customers.

- Global Reach: Triller's presence spans across numerous countries, offering AGBA access to a diverse international audience of content creators and consumers.

- Engagement Metrics: In early 2024, Triller reported billions of video views monthly, highlighting the high level of user activity and content interaction within the platform.

- Demographic Appeal: The platform's popularity with younger demographics (16-34 years old) aligns perfectly with AGBA's strategy to attract and serve a forward-thinking, digitally native customer base.

- Creator Economy: AGBA can leverage Triller's creator ecosystem to offer financial tools and services tailored to the needs of digital influencers and content producers.

AGBA's customer base is multifaceted, encompassing individual investors, corporate entities, high-net-worth individuals, and financial professionals. The integration with Triller has also introduced a significant new segment of global digital content users and creators. This diverse approach allows AGBA to cater to a broad spectrum of financial needs and market opportunities.

Cost Structure

AGBA dedicates significant resources to building and refining its technology backbone. This includes ongoing development and maintenance for its core 'OnePlatform,' advanced AI features, and various digital client engagement tools, ensuring a robust and competitive offering.

Investments in cutting-edge fintech are a major component of this cost structure. The integration of new technologies, especially following the Triller merger, has substantially increased spending in this area as AGBA aims to leverage synergistic capabilities and expand its digital ecosystem.

For instance, during 2024, AGBA reported substantial investments in technology infrastructure, with a notable portion allocated to the integration of Triller's platform and the enhancement of its AI-driven financial advisory services, reflecting a commitment to future growth and innovation.

Personnel and compensation expenses represent a substantial portion of AGBA's cost structure. This includes not only the salaries and commissions paid to its extensive network of independent financial advisors but also the compensation for its management and dedicated tech teams. In 2024, AGBA continued its focus on operational cost control, yet personnel costs remained a dominant expense category, reflecting the investment in its human capital to drive growth and service delivery.

AGBA invests significantly in marketing and client acquisition to grow its diverse financial and healthcare service offerings. These expenditures are crucial for reaching new customers and expanding market presence.

In 2024, AGBA continued to allocate substantial resources towards digital marketing, social media campaigns, and strategic partnerships to drive client acquisition across its platforms. This focus aims to build brand awareness and attract users to both its financial advisory and healthcare management solutions.

Regulatory Compliance and Legal Expenses

AGBA's operations in the highly regulated financial and healthcare sectors, both in Hong Kong and as it expands internationally, demand significant investment in regulatory compliance and legal services. These costs are critical for obtaining and maintaining necessary licenses and ensuring adherence to evolving legal frameworks.

The company's strategic growth initiatives, including mergers and acquisitions, such as the significant Triller deal, inherently involve substantial legal and advisory fees. These expenses are part of the due diligence and integration processes necessary for successful business combinations. For example, AGBA announced its acquisition of Triller in August 2023, a transaction that would have involved considerable legal consultation and regulatory navigation.

- Regulatory Compliance: Ongoing costs for adhering to financial and healthcare regulations in multiple jurisdictions.

- Licensing Fees: Expenses associated with obtaining and renewing operational licenses in each market.

- Legal Counsel: Fees for legal advice on contracts, corporate governance, and compliance matters.

- Merger & Acquisition Costs: Significant legal and advisory expenses related to transactions like the Triller acquisition.

Merger and Integration Related Costs

Merger and integration activities, such as the recent combination with Triller Corp., incur significant one-time or short-term expenses. These costs are critical for harmonizing operations, IT systems, and personnel from both entities.

These expenses cover essential integration efforts, re-domiciliation processes, and any necessary headquarters relocation. For AGBA, these are crucial investments to streamline operations post-merger.

- Integration Costs: Expenses related to merging IT infrastructure, software systems, and operational processes.

- Re-domiciliation Expenses: Costs associated with changing the legal domicile of the company, including legal and administrative fees.

- Relocation Costs: Expenditures for moving headquarters or significant operational units, if applicable.

- Consulting and Advisory Fees: Payments to external experts for guidance on integration and restructuring.

AGBA's cost structure is heavily influenced by its technology investments, particularly in developing its 'OnePlatform' and AI capabilities, as seen in 2024 spending. Personnel costs, encompassing advisors and staff, remain a dominant expense, reflecting investment in human capital. Marketing and compliance also represent significant outlays, essential for growth and regulatory adherence in its dual financial and healthcare sectors.

Revenue Streams

AGBA's business model heavily relies on generating revenue through financial advisory and asset management fees. These fees are derived from services like wealth management, where they advise clients on growing their capital, and investment planning, which involves creating tailored investment strategies. For instance, in 2023, AGBA reported significant contributions from these fee-based services, underscoring their importance to the company's financial health and operational strategy.

A substantial part of AGBA's income is generated through commissions from selling insurance. In recent periods, life insurance has been a major driver, forming a significant portion of the revenue for their distribution segment.

AGBA generates revenue by charging platform fees to financial institutions that use its 'OnePlatform' to distribute their products. This includes banks, brokers, family offices, and independent financial advisors. This B2B approach creates a steady income stream by offering these entities access to AGBA's financial supermarket.

For example, in the first quarter of 2024, AGBA reported a significant increase in its revenue, partly driven by these platform fees. Their financial product distribution services are a core component of their business model, ensuring consistent engagement from their institutional clients.

Fintech Solution Subscriptions and Services

As AGBA grows its suite of fintech solutions, a primary revenue stream comes from subscriptions and fees for these technology-driven financial services. This segment is poised to become a significant profit contributor by 2025, fueled by AGBA's ongoing investments in innovative digital platforms and services. The company anticipates this area will capture a notable portion of its overall revenue as digital adoption accelerates.

The financial services sector continues its digital transformation, with fintech solutions becoming indispensable. AGBA's strategic focus on this area is expected to yield substantial returns, with projections indicating strong growth in subscription-based revenue by 2025. This aligns with broader market trends showing increased demand for efficient and accessible digital financial tools.

- Subscription Fees: Recurring revenue generated from users accessing AGBA's digital financial platforms and tools.

- Service Charges: Fees associated with specific value-added services offered through the fintech solutions, such as transaction processing or data analytics.

- Platform Licensing: Potential revenue from licensing AGBA's proprietary fintech technology to other institutions.

- Growth Projections: The fintech segment is anticipated to contribute significantly to AGBA's profitability by 2025, reflecting a growing market and AGBA's expanding capabilities.

Healthcare Service Fees

AGBA’s revenue streams are primarily generated through healthcare service fees. This encompasses fees for medical consultations, health monitoring, and a range of other related healthcare products and services delivered directly and through strategic alliances. These services cater to both individual consumers and corporate clients seeking comprehensive health solutions.

The company’s financial performance in 2024 reflects a growing demand for its integrated healthcare offerings. For instance, AGBA reported significant revenue growth in its healthcare segment, driven by increased patient engagement and expansion of its service network. This growth underscores the effectiveness of its model in capturing value from the healthcare market.

- Consultation Fees: Charging for appointments with healthcare professionals, both in-person and virtual.

- Health Monitoring Services: Revenue from ongoing patient monitoring, including data analysis and personalized health plans.

- Corporate Wellness Programs: Income from providing health services and benefits to businesses for their employees.

- Partnership Revenue: Share of revenue generated from collaborations with other healthcare providers and institutions.

AGBA's revenue is diverse, drawing from financial advisory and asset management fees, primarily through wealth and investment planning services. Commissions from insurance sales, particularly life insurance, also form a substantial income stream for their distribution segment.

The company also earns platform fees from financial institutions utilizing its 'OnePlatform' for product distribution, including banks and brokers. This B2B model provides consistent revenue by granting access to AGBA's financial supermarket.

Furthermore, AGBA is generating revenue through subscriptions and fees for its growing fintech solutions. This segment is projected to be a significant profit contributor by 2025, driven by ongoing investment in digital platforms.

Healthcare service fees, including consultations and health monitoring, represent another key revenue stream, catering to both individuals and corporate clients. AGBA's 2024 performance shows strong growth in this sector due to increased patient engagement.

| Revenue Stream | Primary Source | Notes |

|---|---|---|

| Financial Advisory & Asset Management | Wealth management, investment planning | Fee-based services |

| Insurance Commissions | Life insurance sales | Distribution segment driver |

| Platform Fees | Financial institutions using 'OnePlatform' | B2B product distribution access |

| Fintech Solutions | Subscriptions, service fees | Growing segment, projected significant contribution by 2025 |

| Healthcare Services | Consultations, health monitoring | Direct and alliance-based delivery |

Business Model Canvas Data Sources

The AGBA Business Model Canvas is constructed using a blend of proprietary internal data, including sales figures and operational metrics, alongside comprehensive market research and competitive intelligence. This multifaceted approach ensures each element of the canvas is validated by real-world performance and industry understanding.