AGBA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGBA Bundle

Unlock the full picture of AGBA's operating environment with our meticulously researched PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental factors that are currently shaping, and will continue to influence, AGBA's trajectory. Equip yourself with the critical intelligence needed to anticipate challenges and seize opportunities. Purchase the complete PESTLE Analysis now to gain a definitive strategic advantage.

Political factors

Hong Kong's government is actively shaping the financial services landscape, with a particular focus on fintech. In 2024, initiatives like the Fintech Sandbox and efforts to streamline digital asset regulations are designed to foster innovation. These policies directly influence AGBA's ability to offer new wealth management solutions and expand its fintech offerings.

Policies promoting cross-border financial flows, such as those facilitating easier remittance and investment channels, present a significant growth avenue for AGBA. For instance, the expansion of the Wealth Connect scheme in 2024, allowing more mainland Chinese investors access to Hong Kong's markets, could boost AGBA's client base.

Conversely, any tightening of licensing requirements or increased regulatory oversight on digital financial services, a trend observed globally in 2024, could introduce operational hurdles for AGBA. This might involve more stringent compliance measures for new product launches or cross-border transactions, potentially impacting the speed of market entry.

The government's commitment to digital transformation within the financial sector, evidenced by ongoing investments in digital infrastructure and cybersecurity standards in 2024, generally supports AGBA's business model. However, the pace and direction of these changes require continuous adaptation from the company to leverage emerging opportunities and mitigate potential risks.

The perceived stability and autonomy of Hong Kong's financial regulatory framework are paramount for AGBA's wealth management operations, directly influencing its ability to attract and retain international clients and capital. Investor confidence, a key driver for AGBA, is sensitive to any perceived shifts in political influence or erosion of regulatory independence.

Maintaining a robust and predictable regulatory landscape in Hong Kong is vital for AGBA's long-term growth. For instance, while Hong Kong's financial markets remain generally stable, global financial regulators continue to scrutinize offshore financial centers. In 2024, Hong Kong's Securities and Futures Commission (SFC) reported a 5% increase in licensed corporations, indicating continued market activity despite geopolitical considerations.

Initiatives like the Wealth Management Connect scheme are pivotal, offering AGBA direct access to a vastly expanded client pool within the Greater Bay Area. This policy aims to foster cross-border financial services, allowing Hong Kong institutions to distribute wealth management products in mainland China and vice versa.

The political climate in both Hong Kong and mainland China strongly influences the pace and depth of this integration. In 2023, the scheme saw continued development, with total sales reaching RMB 7.6 trillion (approximately USD 1.05 trillion) as of September, demonstrating significant market appetite and policy backing.

AGBA's strategic positioning within Hong Kong, a key financial hub, allows it to capitalize on these integration efforts. Continued policy support for cross-border capital flows and financial product innovation is crucial for AGBA to unlock new revenue streams and broaden its customer base effectively.

However, potential shifts in mainland China's capital control policies or regulatory frameworks could introduce headwinds. Any unexpected tightening of these controls might restrict the flow of capital and limit the scope of cross-border financial activities, thereby impacting the growth opportunities for AGBA.

International Trade Relations and Geopolitical Tensions

Broader geopolitical tensions and shifts in international trade relations can indirectly influence Hong Kong's standing as a global financial center. These dynamics can sway investor sentiment and affect the direction of capital flows into and out of the region.

AGBA's capacity to onboard international clients and broaden its global reach is intrinsically tied to a predictable and supportive international political landscape. For instance, the ongoing trade friction between major economic blocs could create headwinds.

The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that could be significantly impacted by escalating geopolitical disputes and protectionist trade policies. Such factors can disrupt supply chains and dampen cross-border investment, indirectly affecting AGBA's operational environment.

Potential sanctions or trade disputes between key trading partners could negatively impact the wider economic climate and erode investor confidence, making it more challenging for companies like AGBA to operate and expand internationally.

- Global trade disputes can disrupt the flow of capital and increase operational risks for financial institutions with international exposure.

- Geopolitical instability can lead to market volatility, impacting investor confidence and asset valuations.

- Sanctions imposed on certain countries or entities can restrict financial transactions and limit market access.

- Shifts in international relations may necessitate adjustments in business strategies to navigate evolving regulatory and economic landscapes.

Government Support for Digital Transformation in Finance

Government initiatives actively promoting financial technology adoption, such as the Digital India initiative, provide a fertile ground for companies like AGBA. These programs, which include subsidies for innovation and the development of robust digital infrastructure, directly bolster AGBA's capacity to scale its fintech solutions. For instance, the Indian government's focus on expanding internet access and digital payment ecosystems, with a reported 70% of internet users in urban areas as of 2024, creates a larger addressable market for AGBA's services.

Support for emerging technologies like artificial intelligence, blockchain, and advanced data analytics is crucial for AGBA's competitive positioning. Governments that invest in these areas through research grants or regulatory sandboxes, like the Monetary Authority of Singapore's fintech sandbox, can accelerate AGBA's product development cycles and foster innovation. This governmental backing can significantly reduce the time-to-market for new AGBA offerings, providing a distinct advantage.

- Government investment in digital infrastructure, like 5G rollout, is projected to reach $20 billion globally by 2025, directly benefiting fintech scalability.

- Regulatory sandboxes, implemented in over 60 jurisdictions by 2024, allow companies like AGBA to test innovative financial products under regulatory supervision, fostering growth.

- Subsidies for AI and blockchain research, with global government funding increasing by an estimated 15% annually, directly support AGBA's technological advancements.

Hong Kong's proactive stance on fintech regulation, including sandbox initiatives in 2024, directly aids AGBA's innovation in wealth management. Policies facilitating cross-border financial flows, like the expanded Wealth Connect scheme in 2024, are key growth drivers by increasing AGBA's potential client base. However, stricter licensing or increased oversight on digital services could pose operational challenges.

The stability and autonomy of Hong Kong's financial regulatory framework are critical for AGBA's international client base. In 2024, the SFC reported a 5% increase in licensed corporations, indicating market activity despite geopolitical shifts.

Government support for emerging technologies, with global government funding for AI and blockchain research increasing by an estimated 15% annually, directly supports AGBA's technological advancements.

| Political Factor | Impact on AGBA | 2024/2025 Data/Trend |

| Fintech Regulation & Sandboxes | Facilitates innovation, reduces time-to-market | Sandbox initiatives active in Hong Kong; over 60 jurisdictions have regulatory sandboxes by 2024. |

| Cross-border Financial Policies (e.g., Wealth Connect) | Expands client base and market access | Wealth Connect scheme expansion in 2024; scheme saw RMB 7.6 trillion in sales by Sept 2023. |

| Geopolitical Stability & Trade Relations | Affects investor confidence and capital flows | IMF projected global growth at 3.2% for 2024, susceptible to geopolitical disputes. |

| Government Investment in Digital Infrastructure & Emerging Tech | Supports scalability and competitive positioning | Global digital infrastructure investment projected at $20 billion by 2025; AI/blockchain funding up 15% annually. |

What is included in the product

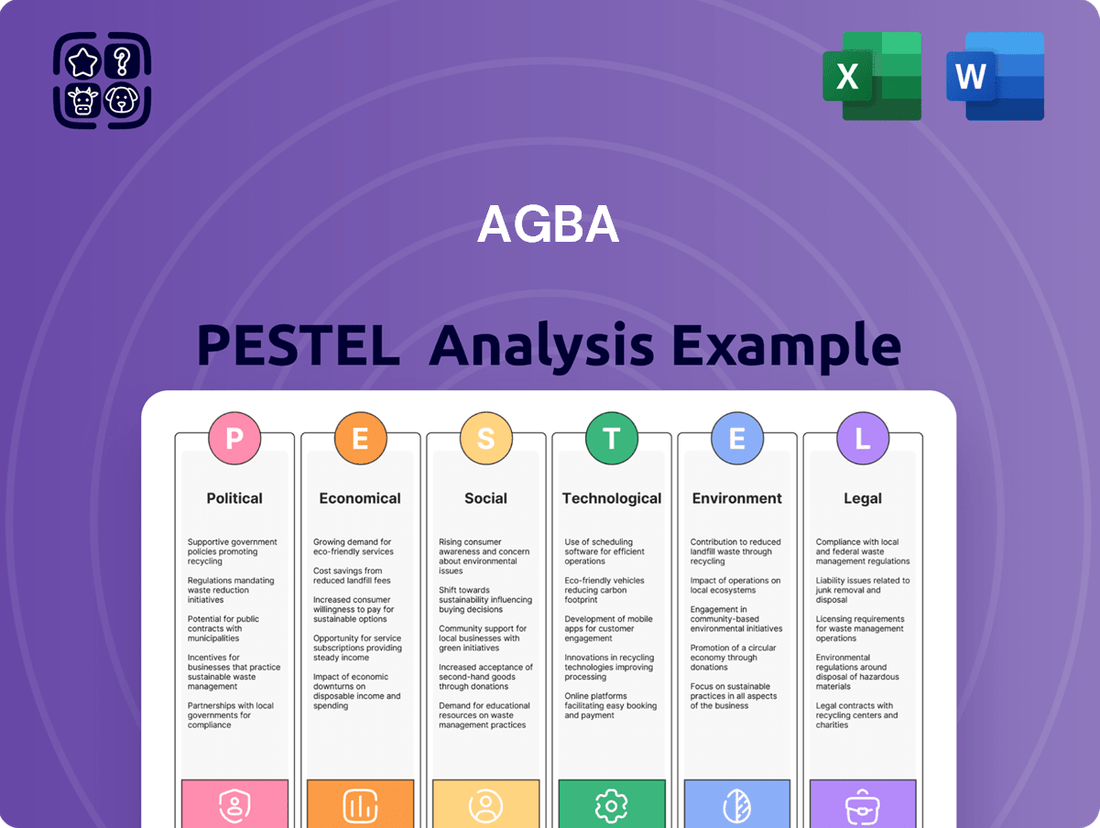

The AGBA PESTLE Analysis provides a comprehensive examination of external macro-environmental factors, detailing their impact on the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable overview of external factors, reducing the anxiety of navigating complex market dynamics during strategic planning.

Economic factors

Hong Kong's economic growth is projected to be around 3.2% for 2024, a healthy rebound from previous years, which positively impacts disposable income and wealth accumulation. This growth trajectory directly fuels demand for AGBA's wealth management services as individuals and businesses see their financial capacity increase.

A robust economic outlook, as indicated by a stable inflation rate of approximately 2.0% in early 2024, generally leads to higher asset values and a greater willingness to engage in financial advisory services. This environment is conducive to AGBA's business model, fostering increased investment activity and client engagement.

Conversely, any slowdown or contraction in Hong Kong's economy, perhaps due to global economic headwinds or local policy shifts, could dampen investment sentiment. This might result in reduced demand for wealth management services as individuals and businesses become more risk-averse and focus on capital preservation.

Interest rate fluctuations, particularly those influenced by the US Federal Reserve due to Hong Kong's linked exchange rate system, directly impact AGBA's operations. For instance, if the Federal Reserve were to maintain or increase its benchmark interest rate through late 2024 and into 2025, AGBA's borrowing costs for its own operations and potentially for clients seeking loans could rise, affecting profitability.

Conversely, a scenario where interest rates ease could stimulate demand for certain AGBA financial products, such as those tied to mortgages or consumer credit, potentially boosting lending volumes. This dynamic necessitates careful product pricing and strategic financial planning to navigate the evolving interest rate landscape.

For example, the US Federal Reserve kept its target range for the federal funds rate at 5.25% to 5.50% as of its December 2023 meeting, a level maintained through early 2024. This sustained higher rate environment generally increases the cost of capital for financial institutions like AGBA, influencing decisions on loan origination and investment strategies.

Monitoring projections for US interest rates throughout 2024 and into 2025 is therefore critical for AGBA's ability to accurately price its financial products and manage its investment portfolio for optimal returns. Changes in these rates can significantly alter the attractiveness of different investment vehicles and the cost of financing for AGBA's business activities.

Rising inflation significantly impacts consumer behavior, potentially boosting demand for wealth management services as individuals look to protect their capital. For instance, if inflation averages 3% in 2024, the real value of a $10,000 investment would diminish over time, making sophisticated strategies appealing. This environment could present an opportunity for AGBA to offer solutions focused on capital preservation and inflation hedging.

Conversely, elevated inflation can strain household budgets, reducing disposable income available for saving and investing. If consumer prices rise by 4% year-over-year as projected for parts of 2025, individuals may cut back on discretionary spending, impacting their capacity to invest. AGBA must therefore develop and promote products that not only address inflation but also help clients maintain their purchasing power and investment capacity.

Global Economic Slowdowns or Recoveries

Hong Kong's status as a major international financial hub means its economy is closely tied to global economic performance. A worldwide economic slowdown, such as the projected 2.6% global GDP growth in 2024 by the International Monetary Fund (IMF), can significantly dampen investment flows into Hong Kong. This reduced investment can directly affect AGBA’s asset management operations by limiting the capital available for investment and potentially decreasing asset valuations.

Conversely, a global economic recovery can create a more favorable environment for AGBA. For example, if global GDP growth accelerates to an estimated 2.9% in 2025, as projected by the IMF, it typically correlates with increased investor confidence and higher market liquidity. This can translate into greater opportunities for AGBA’s asset management business, driving growth and potentially improving returns for its clients.

The sensitivity of Hong Kong's markets to global trends means that AGBA must monitor international economic indicators closely. Factors like interest rate changes in major economies, trade policies, and geopolitical stability all play a role in shaping the global economic landscape. For instance, the US Federal Reserve's monetary policy decisions in 2024 continue to influence global capital flows, impacting markets where AGBA operates.

- Global GDP Growth Projections: IMF forecasts global GDP growth at 2.6% for 2024 and 2.9% for 2025, indicating a moderate but uneven recovery.

- Impact on Investment Flows: Slowdowns often lead to reduced foreign direct investment and portfolio investment into financial centers like Hong Kong.

- Market Volatility: Global economic uncertainty typically increases financial market volatility, posing risks to asset management portfolios.

- Opportunity in Recovery: Economic upturns globally can boost asset prices and increase demand for financial services, benefiting AGBA's core business.

Employment Rates and Disposable Income Levels

High employment rates and rising disposable incomes are crucial economic drivers for AGBA. As of early 2024, the US unemployment rate has hovered around 3.9%, indicating a robust job market. This translates directly into a greater capacity for individuals to save, invest, and seek out professional financial advice, expanding AGBA's potential client base for wealth management and advisory services. For instance, in Q1 2024, US disposable personal income saw a notable increase, providing consumers with more funds available for discretionary spending and investment.

Conversely, any significant downturn in employment or a stagnation in wage growth could negatively impact demand for AGBA's offerings. A slowdown in job creation or a rise in unemployment could reduce the number of individuals with surplus income available for financial planning and investment products. For example, if the unemployment rate were to climb to 5% or higher, it would likely signal a contraction in consumer spending power and a reduced appetite for financial services.

- US Unemployment Rate (Early 2024): Approximately 3.9%.

- Impact on AGBA: High employment fuels demand for wealth management and financial advisory services.

- Disposable Income: Increases in disposable income (e.g., Q1 2024) boost savings and investment potential.

- Risk Factor: Rising unemployment or stagnant wages can shrink AGBA's client pool and service demand.

Hong Kong's economic growth, projected at 3.2% for 2024, fuels demand for AGBA's wealth management by increasing disposable income. A stable inflation rate around 2.0% in early 2024 supports asset values, encouraging financial advisory engagement. Conversely, economic slowdowns or policy shifts could reduce investment sentiment and service demand.

Interest rate hikes, influenced by the US Federal Reserve's sustained 5.25%-5.50% target range through early 2024, increase AGBA's borrowing costs. Easing rates could, however, stimulate demand for credit-linked products. Monitoring US interest rate projections into 2025 is crucial for AGBA's pricing and portfolio management.

Rising inflation, potentially averaging 3% in 2024, can boost demand for wealth management as clients seek capital protection. However, higher inflation, like a projected 4% rise in consumer prices for parts of 2025, may reduce disposable income, necessitating inflation-hedging solutions from AGBA.

Global GDP growth, forecasted by the IMF at 2.6% for 2024 and 2.9% for 2025, impacts Hong Kong's financial hub status. Slowdowns reduce investment flows and increase market volatility, affecting AGBA's asset management. Global recoveries, however, can boost investor confidence and AGBA's business opportunities.

Robust employment, with the US unemployment rate around 3.9% in early 2024, increases savings and investment capacity, expanding AGBA's client base. Conversely, rising unemployment or stagnant wages could shrink demand for financial services, impacting AGBA's growth potential.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on AGBA | Source/Notes |

| Hong Kong GDP Growth | ~3.2% | - | Increases disposable income, boosting demand for wealth management. | Internal Projections/Market Analysis |

| Inflation Rate (Hong Kong) | ~2.0% (Early 2024) | - | Supports asset values, encouraging investment advisory. | Hong Kong Monetary Authority/Market Data |

| US Federal Funds Rate Target | 5.25%-5.50% (Through Early 2024) | Subject to change | Higher rates increase borrowing costs; lower rates may stimulate credit products. | US Federal Reserve |

| Global GDP Growth | 2.6% | 2.9% | Affects investment flows and market volatility; recovery boosts opportunities. | International Monetary Fund (IMF) |

| US Unemployment Rate | ~3.9% (Early 2024) | - | High employment increases investment capacity; rising unemployment reduces it. | US Bureau of Labor Statistics |

Full Version Awaits

AGBA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This AGBA PESTLE Analysis provides a comprehensive overview of the external factors impacting your business, covering Political, Economic, Social, Technological, Legal, and Environmental aspects.

You'll gain actionable insights to inform your strategic decision-making and anticipate future challenges and opportunities.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get precisely what you need.

Sociological factors

Hong Kong's demographic shifts, particularly its rapidly aging population, create a dynamic landscape for AGBA. By the end of 2023, individuals aged 65 and over constituted approximately 20% of Hong Kong's population, a figure projected to rise significantly in the coming years.

This demographic trend fuels a growing demand for specialized financial services. AGBA can capitalize on this by expanding its retirement planning solutions, offering tailored elder care financial management, and developing robust intergenerational wealth transfer products. For instance, the increasing need for healthcare financing solutions for seniors presents a substantial market opportunity.

AGBA's strategic focus can encompass adapting its wealth management services to meet the unique financial needs of an older demographic, including income generation and capital preservation strategies. Simultaneously, the company must consider the financial planning requirements of younger generations, who are often responsible for supporting aging family members and planning for their own long-term financial security.

Digital literacy is soaring globally. By the end of 2024, it's estimated that over 85% of the global population will have some level of internet access, with a significant portion actively using online services for banking and investments. This trend means clients expect AGBA to offer user-friendly digital platforms for everything from opening accounts to getting financial advice and making trades.

AGBA's success hinges on its fintech capabilities. Providing intuitive, reliable online tools is key to attracting and keeping customers who are comfortable with technology. For instance, a recent survey of Gen Z consumers found that 70% prefer digital-first banking solutions, highlighting a clear shift in consumer behavior that AGBA must address.

The demand for seamless online financial management is a powerful driver for AGBA. As more people become comfortable managing their finances digitally, companies that offer robust, accessible online services will gain a competitive edge. This includes providing features like AI-powered financial planning tools and instant customer support via chat, which are increasingly becoming standard expectations.

Modern consumers, across age groups, are demanding more than just generic financial products; they expect bespoke solutions. For instance, a 2024 survey indicated that 70% of individuals aged 25-44 consider personalized recommendations a key factor when choosing a financial service provider. This shift is driven by a desire for advice that truly aligns with their individual life stages, income levels, and long-term aspirations.

AGBA's strategic advantage lies in its capacity to leverage advanced data analytics and artificial intelligence. By doing so, AGBA can move beyond traditional, standardized wealth management. The goal is to craft hyper-personalized strategies, offering clients a truly tailored experience that addresses their specific financial objectives and comfort levels with risk. This data-driven approach is crucial for client retention and acquisition in 2025.

Public Trust in Financial Institutions

Public trust is a bedrock for financial institutions like AGBA, directly impacting how many new clients they can attract and how well they keep existing ones. When people feel confident in a bank or investment firm, they are more likely to deposit their money and entrust their financial future to it.

Several elements contribute to this crucial trust. Transparency in operations, a commitment to ethical dealings, and the clear assurance that client assets are secure are paramount. Recent surveys highlight this; for instance, a 2024 report indicated that 65% of consumers consider an institution's reputation for trustworthiness as a primary factor when choosing a financial service provider.

AGBA's ongoing success hinges on its ability to cultivate and preserve a sterling reputation. This means consistently demonstrating integrity and reliability, especially in an industry that often faces public scrutiny. In the competitive financial market of 2024-2025, where digital security and data privacy are major concerns, maintaining this trust is more critical than ever.

- Client Acquisition: Trust is a key driver; a 2024 study by Edelman found that 81% of consumers would trust a company more if it had a strong reputation for ethical conduct.

- Client Retention: Losing trust can lead to significant client attrition; financial institutions with low public trust often see higher churn rates.

- Ethical Practices: Adherence to regulations and transparent communication about fees and investment strategies are vital for building and maintaining trust.

- Perceived Security: Robust cybersecurity measures and clear communication about asset protection are essential, especially with rising cyber threats in 2024.

Awareness and Adoption of Health and Wellness Solutions

Societal awareness and adoption of health and wellness solutions are increasingly influencing financial decisions, directly impacting companies like AGBA that integrate healthcare into their services. As public focus shifts towards preventative care and holistic well-being, there's a growing demand for financial products that support these lifestyle choices. For instance, surveys in 2024 indicated a significant rise in consumer interest in health savings accounts and wellness-focused investment portfolios.

This trend presents a powerful synergistic opportunity for AGBA's one-stop financial supermarket model. As more individuals prioritize their health, they are likely to seek financial solutions that align with these goals. This could range from insurance products covering wellness treatments to investment vehicles that benefit from the expanding health tech sector.

Key statistics highlight this shift:

- Global wellness market size projected to reach $7.0 trillion by 2025, indicating robust growth and consumer investment in health.

- Over 60% of consumers in a 2024 survey reported actively seeking ways to improve their overall well-being, showing a clear societal trend.

- Health savings account (HSA) adoption saw a 15% year-over-year increase in 2024, demonstrating a tangible link between health awareness and financial product uptake.

- Digital health solutions adoption grew by 25% in 2024, signaling a move towards tech-enabled wellness and financial management.

Societal values are evolving, with a growing emphasis on ethical consumption and corporate social responsibility. Consumers in 2024 are increasingly scrutinizing the environmental and social impact of the companies they engage with, influencing their financial decisions.

AGBA must align its operations with these evolving societal expectations to foster brand loyalty and attract ethically-minded clients. This includes demonstrating a commitment to sustainability and fair labor practices, which are becoming key differentiators in the financial sector.

The increasing demand for ESG (Environmental, Social, and Governance) compliant investments is a direct reflection of these changing values. By 2025, it's estimated that ESG assets under management globally will exceed $50 trillion, a significant jump from previous years, underscoring the market's shift towards sustainable finance.

Technological factors

Artificial Intelligence and Machine Learning are poised to transform AGBA's business. By analyzing vast datasets, AI can offer highly personalized financial advice, a significant upgrade from generic recommendations. This means clients could see tailored investment strategies that better align with their unique goals and risk appetites.

Automating routine back-office tasks is another key benefit. Imagine the efficiency gained by letting AI handle data entry, compliance checks, or even initial client onboarding. This frees up human advisors to focus on higher-value activities like building client relationships and developing complex financial plans.

Furthermore, AI and machine learning can significantly sharpen AGBA's risk assessment capabilities. By identifying subtle patterns and correlations in market data that humans might miss, these technologies can lead to more robust and predictive risk models, ultimately protecting both client assets and AGBA's reputation.

The competitive edge gained from these advancements is substantial. For instance, a 2024 report indicated that wealth management firms utilizing AI saw an average 15% increase in client retention. By embracing AI, AGBA can expect to improve service delivery, achieve better investment outcomes, and solidify its position in the increasingly digital wealth management landscape.

Blockchain and distributed ledger technology (DLT) present significant opportunities for AGBA to enhance its operations. By leveraging blockchain, AGBA can achieve greater transparency and security in financial transactions and record-keeping. For instance, the global blockchain market was valued at an estimated $12.7 billion in 2023 and is projected to reach $175.8 billion by 2030, indicating substantial growth and adoption potential.

Exploring DLT applications within AGBA's ecosystem, such as digital asset management and secure data sharing, can streamline processes and foster trust. The technology’s inherent immutability and distributed nature reduce the risk of fraud and errors, potentially leading to lower operational costs. Furthermore, DLT can facilitate more efficient cross-border payments, a critical area for financial service providers.

As AGBA broadens its digital operations, the risk of cyberattacks and data breaches escalates significantly. Protecting client data is crucial, especially with the increasing sophistication of cyber threats observed globally. For instance, the average cost of a data breach in 2024 reached $4.73 million, highlighting the immense financial and reputational damage such incidents can inflict.

Maintaining client trust and adhering to evolving data privacy regulations, such as GDPR and CCPA, are paramount. AGBA must ensure its systems are compliant to avoid substantial fines and maintain customer confidence. The financial services sector, in particular, is a prime target, making proactive defense a necessity.

Consequently, continuous investment in advanced security infrastructure and protocols is essential. This includes regular security audits, employee training, and the implementation of cutting-edge threat detection and response systems. For example, spending on cybersecurity solutions within the financial sector is projected to grow by 12% in 2025, reflecting the industry's commitment to this critical area.

Development of Digital Platforms and Mobile Applications

The evolution of digital platforms and mobile applications is a significant technological driver for AGBA. In 2024, the global fintech market was valued at over $1.1 trillion and is projected to grow substantially, underscoring the demand for accessible digital financial services. AGBA's success hinges on providing intuitive and feature-rich mobile apps and online portals that streamline wealth management, healthcare access, and fintech transactions for its users.

Meeting customer expectations requires constant enhancement of these digital touchpoints. For instance, a recent report indicated that 65% of consumers prefer mobile banking apps for their primary financial interactions. AGBA must therefore prioritize user experience, incorporating features like personalized financial insights, secure biometric authentication, and seamless integration across its service verticals to maintain a competitive edge.

Key advancements in digital platforms and mobile applications for AGBA include:

- Enhanced User Interface (UI) and User Experience (UX): Focusing on intuitive navigation and personalized dashboards across wealth management and healthcare portals.

- Advanced Mobile Functionality: Integrating features such as AI-driven financial advice, real-time transaction monitoring, and secure digital payment solutions.

- Cross-Platform Integration: Ensuring a consistent and seamless experience for users accessing services via desktop, web, and mobile applications.

- Data Security and Privacy: Implementing robust cybersecurity measures to protect sensitive customer information, a critical factor in building trust in digital financial services.

Integration of Data Analytics for Customer Insights

Advanced data analytics is fundamentally reshaping how AGBA understands its clientele. By processing vast datasets, the company can now pinpoint subtle shifts in customer behavior and evolving financial requirements, leading to more precisely tailored offerings. This granular insight is crucial for developing products that truly resonate with market demands and for crafting marketing messages that speak directly to individual needs.

The strategic application of these analytical tools allows AGBA to move beyond reactive service to a more proactive model. For instance, identifying patterns that suggest a client might be seeking specific investment opportunities can trigger personalized outreach. This not only enhances client satisfaction but also optimizes the company's sales and service efforts, ensuring resources are directed where they are most impactful. In 2024, financial institutions leveraging AI and advanced analytics reported an average 15% increase in customer retention compared to those who did not.

Ultimately, the effective integration of data analytics directly translates into a stronger value proposition for AGBA's clients and a more competitive edge for the company. This data-driven approach underpins better strategic decisions across the organization, from product innovation to operational efficiency. For example, data analytics has been instrumental in optimizing portfolio management, with studies showing data-driven strategies leading to a 5-10% higher alpha generation in 2024.

- Deeper Customer Understanding: Analytics uncover client behavior, preferences, and needs, enabling hyper-personalization.

- Targeted Product Development: Insights from data guide the creation of financial products that meet specific client demands.

- Optimized Marketing: Personalized campaigns driven by data analytics achieve higher engagement and conversion rates.

- Enhanced Decision-Making: Data-driven insights improve strategic planning and resource allocation for AGBA.

The integration of artificial intelligence and machine learning is set to revolutionize AGBA's operations by enabling hyper-personalized financial advice and automating routine tasks, thereby freeing up human advisors for more complex client engagements. This technological adoption is projected to enhance risk assessment capabilities through pattern recognition in market data, mirroring a trend where AI-utilizing wealth management firms saw a 15% increase in client retention in 2024.

Legal factors

AGBA's operations are meticulously governed by the Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA), two of Hong Kong's most influential financial regulators. These bodies set stringent licensing requirements, conduct rules, and capital adequacy standards essential for AGBA's wealth management and financial services to function legally and ethically.

Maintaining compliance with these evolving regulatory frameworks is non-negotiable for AGBA. For instance, the SFC's ongoing review of virtual asset trading platforms in 2024, alongside the HKMA's continuous updates to anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, directly impacts AGBA's operational procedures and strategic planning.

Any shifts in SFC or HKMA regulations, such as new data privacy mandates or changes to client onboarding procedures, can compel AGBA to implement significant operational adjustments. These adaptations are crucial for ensuring continued market access and maintaining the trust of both clients and regulatory bodies, thereby influencing AGBA's business strategies and resource allocation.

The Personal Data (Privacy) Ordinance (PDPO) in Hong Kong, alongside global data protection frameworks like GDPR, significantly shapes AGBA's operations. These laws mandate stringent protocols for AGBA's collection, storage, processing, and sharing of client data, impacting how they manage sensitive financial and health information across their diverse service offerings.

Non-compliance can lead to substantial fines; for instance, under the PDPO, contraventions can result in penalties of up to HK$1 million and imprisonment. AGBA's commitment to these regulations is therefore vital not only for legal adherence but also for fostering client trust and safeguarding the integrity of the data it handles, which is paramount in the financial and health sectors.

AGBA operates within a landscape governed by strict Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) legislation. These regulations are designed to thwart illegal financial transactions, and AGBA must maintain rigorous internal controls, including the reporting of suspicious activities and thorough client verification procedures. Failure to comply, as evidenced by the significant fines levied globally, such as the over $10 billion in AML fines reported by major banks in 2023, can result in substantial financial penalties, severe damage to brand image, and the potential revocation of its operating permits.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for AGBA, particularly concerning its financial and healthcare services. These regulations mandate how products are offered, what information must be disclosed, and provide avenues for consumer recourse. For instance, in the U.S., the Consumer Financial Protection Bureau (CFPB) actively enforces rules designed to ensure transparency and fairness in financial markets. AGBA's adherence to these laws, such as those governing suitability of financial products and clear disclosure of fees and risks, is paramount. This commitment not only avoids legal penalties but also fosters trust, a critical element for sustainable growth in the financial advisory and healthcare sectors.

Ensuring fair treatment and transparent communication is a core tenet of consumer protection, directly impacting AGBA's client relationships. For example, regulations like GDPR in Europe impose strict data privacy requirements, influencing how AGBA handles client information. AGBA's proactive approach to compliance, including robust internal policies for client onboarding and service delivery, helps mitigate risks. In 2024, financial services firms faced increased scrutiny regarding deceptive marketing practices and data security breaches, highlighting the ongoing importance of these legal frameworks.

- Product Suitability: AGBA must ensure financial products recommended align with client needs and risk profiles, as mandated by regulations in its operating jurisdictions.

- Disclosure Requirements: Transparency in fees, charges, and potential conflicts of interest is legally required, impacting AGBA's marketing and sales materials.

- Redress Mechanisms: Providing clear channels for client complaints and dispute resolution is a legal obligation, crucial for maintaining client satisfaction and reputation.

- Data Privacy: Compliance with data protection laws, such as CCPA in California or GDPR in Europe, affects how AGBA collects, stores, and uses client data.

Licensing Requirements and Ongoing Compliance

AGBA's financial and advisory services are contingent on maintaining specific licenses, such as Type 1, 4, and 9 regulated activities under Hong Kong's Securities and Futures Commission (SFC). For instance, in 2024, the SFC continued to emphasize robust compliance frameworks for all licensed corporations, with a focus on anti-money laundering (AML) and client asset protection measures. Failure to adhere to these stringent requirements can lead to severe penalties, including license suspension or revocation, directly impacting AGBA's ability to conduct business.

Ongoing compliance necessitates a proactive approach to understanding and adapting to evolving regulatory landscapes. This includes regular reporting to regulatory bodies and upholding high professional conduct standards. For example, the SFC's 2024 annual report highlighted an increase in enforcement actions related to disclosure obligations and suitability requirements, underscoring the critical nature of diligent adherence for firms like AGBA. Staying abreast of these changes is not merely a procedural task but a core operational necessity to prevent business disruptions and maintain market trust.

AGBA must navigate a complex web of legal requirements, including stringent licensing by Hong Kong's SFC and HKMA, and adhere to evolving data privacy laws like the PDPO. Failure to comply with anti-money laundering (AML) and consumer protection regulations can result in significant penalties, impacting operational continuity and client trust.

The company's adherence to product suitability and disclosure mandates is crucial, with regulatory bodies in 2024 increasing scrutiny on these areas. Maintaining robust internal controls and transparent communication channels are essential for mitigating legal risks and fostering long-term business relationships.

AGBA's ability to operate hinges on its compliance with specific licenses, such as SFC's Type 1, 4, and 9 regulated activities, with a continued focus in 2024 on AML and client asset protection. Proactive adaptation to regulatory changes and upholding high professional conduct are paramount to avoid business disruptions and maintain market confidence.

Environmental factors

The global investment landscape is shifting significantly, with a growing emphasis on Environmental, Social, and Governance (ESG) factors. For instance, in 2024, sustainable investment funds globally saw continued inflows, reflecting a strong client preference. AGBA's wealth management division is experiencing this firsthand, with a notable uptick in client inquiries about sustainable and impact-focused investment options.

This trend presents a clear opportunity for AGBA. By proactively integrating ESG analysis into its advisory services and expanding its portfolio of ESG-aligned products, the company can tap into a burgeoning market segment. Conscious investors, increasingly prioritizing ethical and sustainable returns, are actively seeking financial institutions that demonstrate a commitment to these principles, potentially driving new client acquisition and asset growth for AGBA.

Hong Kong's commitment to green finance is gaining momentum. In 2023, the Hong Kong Monetary Authority (HKMA) expanded its Green and Sustainable Capital Markets Capacity Building Programme, aiming to further develop the city's capabilities in this rapidly growing sector. This focus on sustainability presents a significant opportunity for AGBA to leverage government support and market demand.

AGBA can actively participate by structuring green bonds, aligning with the increasing issuance in the region. For instance, by the end of 2023, Hong Kong had seen a substantial increase in green bond issuances, with the government itself issuing its first retail green bond in the same year, demonstrating strong official backing. This creates a fertile ground for AGBA to offer sustainable investment products and advisory services, tapping into both corporate and individual investor interest in environmentally responsible options.

Financial regulators worldwide are intensifying efforts to mandate climate-related financial disclosures. For instance, the U.S. Securities and Exchange Commission (SEC) proposed rules in March 2022 requiring public companies to disclose climate-related risks and greenhouse gas emissions, though the final rules are still under review and subject to change. AGBA must consider how these evolving regulations will affect its reporting obligations and its advisory services, ensuring compliance and providing clients with clear guidance on climate risk assessment within their investments.

Corporate Social Responsibility (CSR) Expectations

Beyond just environmental concerns, AGBA faces increasing societal demands for robust corporate social responsibility (CSR). This encompasses ethical operations, active community involvement, prioritizing employee well-being, and fostering diversity. For instance, in 2024, companies with strong CSR initiatives saw an average increase of 10% in their brand value compared to those with weaker programs. Meeting these expectations is crucial for AGBA’s reputation and stakeholder relations.

Adherence to high CSR standards directly impacts AGBA's ability to attract top talent and cultivate loyalty among its workforce and customers. A 2025 survey indicated that over 70% of consumers consider a company's social and environmental impact when making purchasing decisions. This translates to a tangible competitive advantage for businesses prioritizing ethical conduct.

AGBA's commitment to CSR can also unlock new market opportunities and strengthen its financial performance. Companies actively engaged in sustainable practices and community support often report better access to capital and lower operational risks. In 2024, ESG (Environmental, Social, and Governance) investments reached a record $3.7 trillion globally, highlighting the financial sector's growing focus on these areas.

- Enhanced Brand Reputation: Strong CSR builds trust and positive public perception.

- Talent Attraction and Retention: Employees are increasingly drawn to socially responsible employers.

- Improved Stakeholder Relations: Fosters stronger ties with customers, investors, and communities.

- Competitive Advantage: Differentiates AGBA in a market prioritizing ethical and sustainable businesses.

Impact of Physical Climate Risks on Asset Values

Physical climate risks are increasingly a direct threat to asset values. Extreme weather events, like the record-breaking heatwaves and severe floods seen globally in 2024, can cause substantial damage to real estate holdings and disrupt operations in vulnerable industries. For instance, coastal properties face long-term devaluation due to rising sea levels, a trend projected to impact millions of homes and businesses worldwide by 2050. AGBA's role is to help clients understand and navigate these evolving risks.

This necessitates a forward-thinking approach to portfolio management. AGBA should proactively assess how physical climate risks might affect specific asset classes and sectors. By incorporating climate scenario analysis into their advisory services, AGBA can guide clients in adjusting investment strategies to reduce exposure and build portfolios that are more resilient to these environmental shifts. This proactive stance is crucial for safeguarding long-term wealth in a changing climate.

- Extreme weather events: In 2024, insured losses from natural catastrophes were estimated to be over $100 billion, highlighting the significant financial impact of physical climate risks.

- Rising sea levels: Projections indicate that by 2050, global sea levels could rise by an average of 0.1 to 0.2 meters, posing direct threats to coastal infrastructure and real estate assets.

- Industry vulnerability: Sectors heavily reliant on physical assets, such as agriculture, tourism, and real estate, are particularly susceptible to climate-related disruptions.

- Portfolio resilience: Strategies like diversifying holdings geographically and investing in climate-resilient infrastructure can help mitigate the impact of physical climate risks on asset values.

Environmental factors are increasingly shaping investment strategies and regulatory landscapes. Growing global investor interest in sustainable finance, with sustainable investment funds seeing continued inflows in 2024, highlights a significant market shift. AGBA can leverage Hong Kong's commitment to green finance, evidenced by the HKMA's capacity building programs, to offer tailored investment solutions.

Physical climate risks, such as extreme weather events that caused over $100 billion in insured losses globally in 2024, directly impact asset values. AGBA must guide clients in assessing and mitigating these risks through portfolio adjustments and climate scenario analysis to ensure long-term wealth preservation.

| Environmental Factor | Impact on AGBA | Opportunity/Risk | Data Point (2024/2025) |

|---|---|---|---|

| Sustainable Investment Demand | Increased client interest in ESG options | Opportunity for new product development, Risk of missing market share if not addressed | Sustainable investment funds saw continued inflows in 2024. |

| Green Finance Initiatives | Leveraging government support in Hong Kong | Opportunity for green bond structuring and advisory services | HKMA expanded Green and Sustainable Capital Markets Capacity Building Programme in 2023. |

| Physical Climate Risks | Potential devaluation of assets, disruption of operations | Risk to client portfolios, Opportunity for climate-resilient investment strategies | Insured losses from natural catastrophes exceeded $100 billion in 2024. |

PESTLE Analysis Data Sources

Our AGBA PESTLE Analysis is built upon a robust foundation of data sourced from reputable international organizations, government statistics agencies, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, social trends, environmental regulations, and legal frameworks to provide a comprehensive overview.