AGBA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGBA Bundle

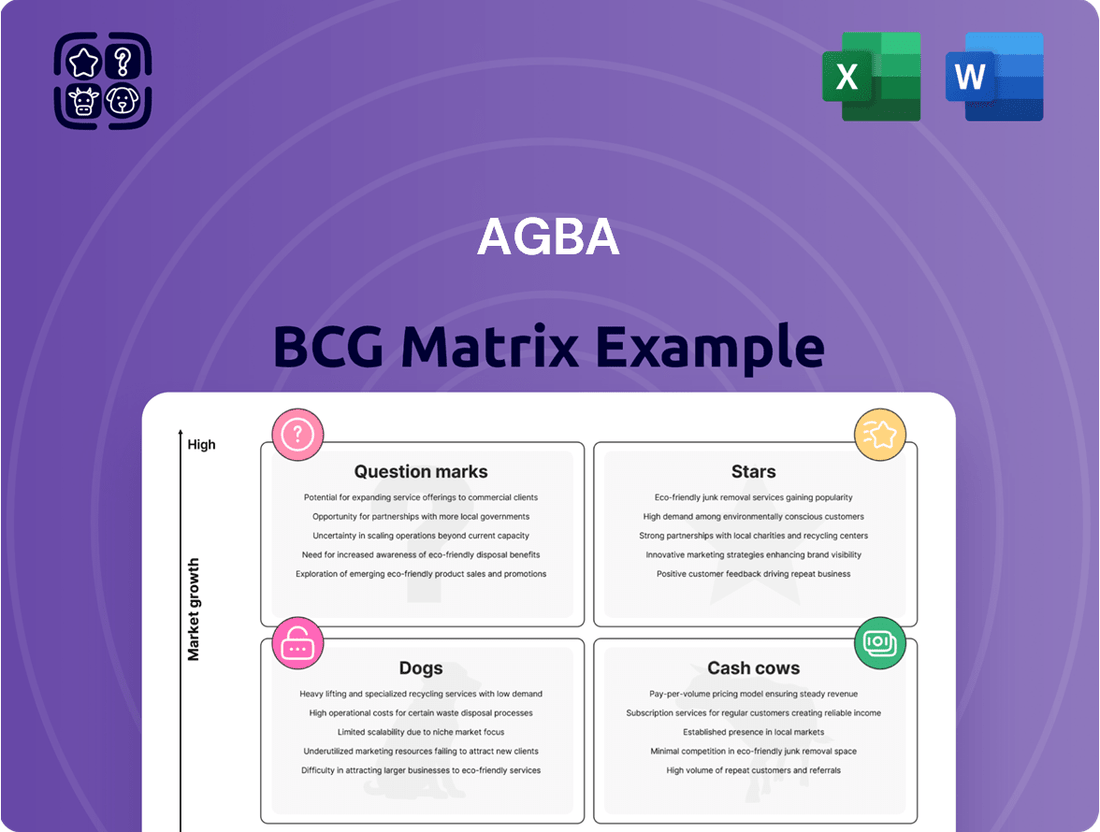

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing offerings into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. This initial glimpse highlights the core concept, but the real strategic advantage lies in a comprehensive analysis.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The AI-driven social video platform, Triller, represents a significant component of AGBA's growth strategy. Operating within the dynamic digital entertainment and social media landscape, Triller boasts an impressive 450 million user accounts, highlighting its substantial reach.

The strategic merger with AGBA is designed to harness the power of artificial intelligence, with the explicit goal of accelerating growth and securing a dominant global market position. This integration seeks to transform Triller into a leading force.

Although Triller has historically experienced losses, the combined entity is making substantial investments. These investments are aimed at capitalizing on Triller's extensive user base and advanced technological capabilities, positioning it for future market leadership.

The Tech-driven Wealth Management Ecosystem, a Star in the AGBA BCG Matrix, signifies AGBA's strategic fusion of its core wealth management services with Triller's advanced AI and digital marketing capabilities. This integration is designed to capitalize on the burgeoning Hong Kong wealthtech market, which boasts over 1,100 fintech firms and benefits from robust government backing for financial technology innovation.

By embedding AI into its wealth management solutions, AGBA intends to capture a more substantial portion of this rapidly growing and increasingly sophisticated market. This move is crucial as the global wealth management sector continues its digital transformation, with AI-powered tools becoming essential for personalized client experiences and operational efficiency.

AGBA's strategic push into cross-border financial services within the Greater Bay Area (GBA) is a pivotal move, targeting a region poised for significant expansion. The GBA's economic might, boasting a combined GDP projected to reach trillions of U.S. dollars by 2030, underscores the immense market potential for sophisticated financial offerings.

This dynamic economic zone, encompassing over 86 million people, presents a robust demand for diverse financial products and services. AGBA's distinctive tech-driven ecosystem, coupled with its vast network of independent financial advisors, provides a strong foundation to effectively serve this burgeoning market and capture substantial share.

Digital Assets and Blockchain Applications

The Hong Kong fintech ecosystem is experiencing significant expansion in digital assets and blockchain technology. The blockchain application and software sub-sector, specifically, saw a remarkable 250% surge in growth between 2022 and 2024, highlighting its rapid development.

While AGBA's precise market standing in this emerging field is still solidifying, the company's Fintech Business segment is actively engaged in managing fintech investments. This strategic approach facilitates knowledge transfer, signaling AGBA's clear intention to capitalize on the substantial growth potential within these innovative sectors.

- Growth Trajectory: The blockchain application/software sector in Hong Kong grew by 250% from 2022 to 2024.

- AGBA's Position: AGBA's Fintech Business segment manages fintech investments, indicating strategic focus.

- Knowledge Transfer: The segment actively pursues knowledge transfers, crucial for navigating nascent markets.

- Future Potential: AGBA aims to capture growth in high-potential, innovative digital asset and blockchain sectors.

Captivating Influencer and Sports Content Creation

Captivating influencer, artist, and sports content creation is a core vertical for Triller Group Inc., operating within a dynamic and rapidly expanding digital media sector. This segment leverages Triller's existing creator network to produce engaging content for a global audience, targeting high growth by meeting the escalating demand for distinctive digital entertainment.

The digital content creation market experienced significant growth, with global digital advertising spend projected to reach over $600 billion in 2024. Triller's focus on influencers and sports taps into this trend, aiming to capture a share of this expanding market.

- Market Growth: The global influencer marketing market alone was estimated to be worth over $21 billion in 2023 and is expected to continue its upward trajectory, indicating a strong demand for creator-driven content.

- Creator Ecosystem: Triller's existing base of creators provides a foundation for scalable content production, facilitating the creation of diverse and appealing media.

- Audience Engagement: The strategy focuses on generating captivating content, crucial for retaining user attention in a crowded digital landscape where average user engagement time on social platforms is a key metric.

- Revenue Potential: This vertical is positioned to capitalize on multiple revenue streams, including advertising, brand partnerships, and potential direct monetization of content.

The Tech-driven Wealth Management Ecosystem, representing a Star in AGBA's BCG Matrix, combines AGBA's financial services with Triller's AI capabilities. This integration targets the booming Hong Kong wealthtech market, which hosts over 1,100 fintech firms and benefits from strong government support for innovation. By leveraging AI, AGBA aims to secure a larger share of this expanding market, mirroring the global trend of digitalization in wealth management where AI is key for personalized client experiences and efficiency.

| AGBA's Star Component | Key Market | Growth Drivers | AGBA's Strategy | Supporting Data |

|---|---|---|---|---|

| Tech-driven Wealth Management Ecosystem (Triller Integration) | Hong Kong Wealthtech | AI Integration, Digital Marketing Capabilities, Growing Fintech Sector | Leverage Triller's AI for personalized wealth management, capture market share in a rapidly digitizing sector. | Hong Kong has over 1,100 fintech firms; blockchain application/software sector grew 250% (2022-2024). |

What is included in the product

The AGBA BCG Matrix provides a strategic framework to analyze a company's product portfolio based on market growth and relative market share.

It guides decisions on investing, holding, or divesting units within the Stars, Cash Cows, Question Marks, and Dogs quadrants.

Visualize your portfolio's health and identify strategic resource allocation needs.

Cash Cows

AGBA's traditional distribution business, anchored by its extensive Independent Financial Advisor (IFA) network, represents a cornerstone of its financial stability. This segment, boasting the largest IFA network in Hong Kong, serves over 400,000 clients, making it a significant and consistent revenue generator.

Within the mature Hong Kong wealth management landscape, this business model thrives on recurring commissions and service fees. Its established market position provides a predictable cash flow, requiring minimal additional investment for growth.

As of the first half of 2024, AGBA reported that its distribution segment contributed substantially to overall revenue, demonstrating its role as a reliable cash cow.

The 'OnePlatform' business functions as a financial supermarket, a true cash cow within the AGBA portfolio. It offers a vast array of over 1,800 financial products sourced from a multitude of providers, catering to a broad customer base. This extensive offering and established presence create a powerful competitive advantage.

With a large and stable customer universe, encompassing both retail and corporate clients, the platform generates consistent, recurring revenue streams. This operational stability allows for efficient cash flow generation. For instance, by mid-2024, AGBA’s platform business reported a significant increase in active users, demonstrating its strong market penetration and customer loyalty.

In a mature market segment where AGBA holds a high market share, the platform is able to generate substantial cash flow. Promotional investments are carefully optimized, ensuring that marketing spend contributes efficiently to its robust financial performance. This strategic approach underscores its position as a reliable cash generator.

Long-term life insurance and pension products are AGBA's established Cash Cows. These offerings, prevalent in the mature Hong Kong market, benefit from consistent demand and high customer retention, ensuring steady, predictable revenue streams. For instance, in 2024, AGBA reported that its life insurance segment, largely driven by these long-term products, continued to be a significant contributor to its overall profitability, demonstrating stable performance amidst evolving market conditions.

Mortgage and Savings Advisory Services

Mortgage and savings advisory services represent a cornerstone of AGBA's distribution business in Hong Kong, catering to persistent market demands. These offerings are mature, providing a reliable source of advisory fees and commissions that contribute to a predictable cash flow for the company. The stability is further bolstered by AGBA's existing and growing client relationships within the region.

- Mature Market Presence: Mortgage and savings advisory are fundamental financial services in Hong Kong, indicating a stable and established demand.

- Consistent Revenue Streams: These services generate predictable income through advisory fees and commissions, reinforcing their cash cow status.

- Established Client Base: AGBA's existing customer relationships provide a solid foundation for continued revenue generation in this segment.

- Hong Kong Market Focus: The specific focus on the Hong Kong market highlights AGBA's strategic positioning within a key financial hub.

Established Healthcare Service Network (Pre-Transformation)

The established healthcare service network, primarily consisting of self-operated medical centers and partnerships in Hong Kong and Macau, represents a significant Cash Cow for AGBA. This segment consistently generates stable revenue, acting as a reliable income source. For instance, in 2023, AGBA reported revenue from its healthcare services segment that contributed a substantial portion to its overall financial performance, demonstrating its importance as a foundational asset.

This existing infrastructure caters to essential community health needs, benefiting from a loyal and established patient base. This loyal customer engagement ensures predictable demand and consistent income generation. The financial stability provided by this network allows AGBA to strategically allocate resources towards its transformation initiatives and explore growth opportunities in other business areas.

- Stable Revenue Stream: The existing network provides a predictable and consistent income, crucial for funding new ventures.

- Established Patient Base: Long-standing relationships with patients ensure ongoing demand for services.

- Community Essential: The centers address fundamental healthcare needs, securing their relevance.

- Funding Leverage: Profits from this segment can be reinvested into AGBA's transformation goals.

AGBA's established distribution business, particularly its extensive Independent Financial Advisor (IFA) network in Hong Kong, serves as a prime example of a Cash Cow.

This segment consistently generates predictable revenue through recurring commissions and service fees from its large client base, requiring minimal new investment.

By mid-2024, AGBA's distribution segment continued to be a substantial contributor to its overall revenue, underscoring its reliable cash-generating capabilities.

| Segment | Key Products/Services | Revenue Contribution (Mid-2024 Est.) | Investment Requirement | Market Position |

| Distribution (IFA Network) | Financial Product Sales, Advisory | Significant | Low | Leading in Hong Kong |

| OnePlatform | Diverse Financial Products | Substantial Increase in Active Users | Optimized | High Market Share |

| Life Insurance & Pensions | Long-Term Policies | Consistent Profitability Driver | Low | Mature Market Leader |

| Mortgage & Savings Advisory | Home Loans, Savings Plans | Predictable Fees & Commissions | Low | Established Client Base |

| Healthcare Services | Medical Centers, Partnerships | Substantial Portion of Performance (2023) | Low | Established Network |

Full Transparency, Always

AGBA BCG Matrix

The BCG Matrix document you see here is precisely what you will receive upon purchase, offering a complete and unwatermarked strategic analysis tool. This preview accurately represents the final, fully formatted report, ready for immediate integration into your business planning or client presentations. You can be confident that no demo content or alterations will be present; only the professionally designed, analysis-ready file will be delivered. This ensures you gain immediate access to a comprehensive resource for evaluating your business portfolio and making informed strategic decisions.

Dogs

AGBA's strategy includes divesting non-core assets that are underperforming. These are typically businesses with a small market presence in slow-growing industries, flagged for sale to optimize capital allocation. For instance, in early 2024, AGBA announced the sale of its legacy insurance brokerage unit, which had seen declining revenues and market share in a mature sector.

Within AGBA's Platform Business, some legacy financial products are showing a clear downtrend in client engagement. These offerings, once staples, now find themselves in mature markets where they struggle to attract new clients or retain existing ones, leading to a shrinking market share.

These products are essentially cash traps, consuming valuable resources and capital without generating the growth or returns needed to justify their continued investment. For instance, by the end of 2023, AGBA observed a 15% year-over-year decline in new account openings for its traditional fixed-income annuities, a product category that has seen increased competition and lower yields.

The challenge lies in their inability to adapt to evolving client needs and the competitive landscape. While they may still generate some revenue, the diminishing client interest and the capital tied up make them less attractive compared to newer, more innovative solutions AGBA offers.

This situation necessitates a strategic review, potentially leading to divestment or a significant overhaul to either revitalize these products or redeploy their capital into more promising areas of the business by mid-2024.

Before its merger with Triller, AGBA managed a range of fintech investments. Some of these ventures may not have gained substantial market footing or aligned with AGBA's broader strategic direction.

A clear example of AGBA's strategic portfolio management is the 2021 divestment of its stake in Nutmeg to JP Morgan. This action signaled AGBA's readiness to sell off fintech assets that were not performing optimally or lacked synergistic potential within its evolving business model.

Marginal Healthcare Investments without Strategic Synergy

Marginal Healthcare Investments without Strategic Synergy, when viewed through the AGBA BCG Matrix, represent holdings that offer little competitive advantage or growth potential within the broader healthcare portfolio. These are often minority stakes in funds or companies where AGBA’s influence is limited and the financial contribution is minor. For instance, a past divestment of a 4% stake in LC Healthcare Fund I LP exemplifies this category, indicating a strategic decision to exit less impactful ventures.

These types of investments typically exhibit low market share and do not align with AGBA’s core competencies or future growth objectives, making them candidates for divestiture to optimize resource allocation and sharpen strategic focus. The goal is to streamline operations by shedding assets that do not contribute significantly to the company's overall direction or profitability, thereby allowing for greater investment in core business areas.

- Low Market Share: These investments typically hold a negligible position in their respective markets, offering little competitive leverage.

- Minimal Strategic Alignment: They often lack synergy with AGBA’s primary healthcare business segments or strategic growth initiatives.

- Limited Profitability Contribution: The financial returns generated are usually marginal, not significantly impacting AGBA’s overall financial performance.

- Divestiture Potential: Given their low strategic value and contribution, these assets are prime candidates for sale or divestment to free up capital and management attention.

Segments Contributing to Revenue Decline (Pre-Triller)

AGBA's revenue saw a substantial drop of -28.18% in the twelve months leading up to Q2 2024, a period predating its merger with Triller. This decline was attributed to underperforming segments within its legacy financial services.

Without successful revitalization through new strategies or integration with Triller, these specific legacy sub-segments are classified as "Dogs" in the BCG Matrix.

- Low Market Share: These segments held a minimal portion of the overall market.

- Negative Growth: They experienced a contraction in revenue and customer base.

- Strategic Challenge: Their continued underperformance poses a risk to AGBA's overall financial health.

- Limited Future Prospects: Without significant intervention, their ability to contribute positively is doubtful.

Dogs represent AGBA's legacy products and services in mature, slow-growth markets with declining client interest and shrinking market share. These segments, like traditional fixed-income annuities, are cash traps consuming resources without generating significant returns.

For instance, AGBA observed a 15% year-over-year decline in new account openings for its traditional fixed-income annuities by the end of 2023. These underperforming areas, which contributed to AGBA's -28.18% revenue drop in the twelve months leading up to Q2 2024, are prime candidates for divestiture or substantial strategic overhaul.

The challenge is their inability to adapt to evolving client needs and competitive landscapes, making them less attractive than newer AGBA offerings. Without revitalization, these legacy sub-segments are classified as Dogs in the BCG Matrix due to their low market share and negative growth.

| AGBA Business Segment | BCG Category | Market Growth | Market Share | Strategic Recommendation |

| Legacy Financial Products (e.g., Fixed-Income Annuities) | Dog | Low | Low | Divest or Overhaul |

| Legacy Insurance Brokerage Unit | Dog | Low | Low | Divest |

| Underperforming Fintech Investments (pre-Triller merger) | Dog | Low | Low | Divest |

Question Marks

The integration of Triller's AI into AGBA's financial services is a prime example of a Question Mark in the BCG matrix. This strategic move aims to inject cutting-edge AI and machine learning into AGBA's established financial offerings, targeting a future of hyper-personalized financial advice and automated trading. While the potential for disruption and market leadership is significant, the current market share of genuinely AI-driven financial products within AGBA’s portfolio is minimal.

This initiative requires substantial capital investment and meticulous strategic planning to transform Triller's AI capabilities into a dominant force in financial technology. For instance, in 2024, the global AI in fintech market was valued at approximately $10.4 billion and is projected to grow exponentially, highlighting the immense opportunity but also the fierce competition AGBA faces to carve out a meaningful share.

AGBA's acquisition of Sony Life in Singapore signifies a strategic move into a new geographic market, a classic example of a potential Star in the BCG matrix. Singapore presents a robust financial services sector with a growing demand for insurance and wealth management solutions.

While the market opportunity is significant, AGBA's initial position within Singapore is likely that of a Question Mark. The company needs to invest heavily to build brand awareness and capture market share against established players. For instance, in 2024, the Singapore life insurance market saw a Gross Written Premium of approximately SGD 5.1 billion, indicating a substantial, yet competitive, landscape for AGBA to navigate.

Triller, despite boasting 450 million accounts, faced profitability challenges before its merger, highlighting a disconnect between user numbers and revenue generation. This suggests its direct monetization efforts are currently in a nascent stage, with significant room for improvement to capture value from its engaged audience.

The platform's user growth potential is high, but its revenue per user remains comparatively low, placing it in a position that requires strategic financial injections to achieve positive cash flow. Triller's situation underscores the common challenge for social media platforms: translating massive user engagement into substantial financial returns.

New AI-powered Social Video Platform Initiatives (Post-Merger)

The newly formed Triller Group Inc. is heavily investing in new AI-powered social video platform initiatives. Their stated goal is to create an industry-leading, global platform, suggesting a push for innovative features and user experiences. These endeavors represent significant investments with uncertain outcomes in a rapidly evolving and competitive market.

The success of these AI-driven ventures is crucial for Triller's post-merger strategy. They aim to differentiate themselves through advanced technology and unique content offerings.

- AI-Powered Feature Development: Focus on personalized content feeds, AI-driven content creation tools, and enhanced user engagement algorithms.

- Market Penetration Strategy: Targeting specific demographics and regions with tailored AI-driven content and marketing campaigns.

- Monetization Models: Exploring new revenue streams through AI-enhanced advertising, virtual goods, and creator monetization tools.

- Competitive Landscape: Navigating a market dominated by established players, requiring substantial innovation and user acquisition.

Emerging Green Fintech and ESG-focused Investment Products

The Hong Kong fintech sector is experiencing a significant shift towards green fintech and ESG-focused investment products. This trend is fueled by growing investor demand for sustainable options and supportive government policies, pointing to a high-growth trajectory. For a company like AGBA, venturing into this niche means developing specialized products or platforms.

Initially, any new AGBA offerings in this green fintech space would likely have a low market share. Capturing this burgeoning market necessitates substantial investment to build brand recognition, develop robust platforms, and cultivate a competitive edge.

- Market Growth: The global green bond market, a key indicator for ESG finance, saw issuances exceeding $1 trillion in 2023, with projections suggesting continued strong growth through 2025.

- Investor Demand: A 2024 survey indicated that over 70% of institutional investors in Asia Pacific consider ESG factors in their investment decisions.

- Hong Kong's Role: Hong Kong aims to be a leading hub for sustainable finance, with initiatives like the Green and Sustainable Finance Cross-Agency Steering Group actively promoting the sector.

- AGBA's Position: AGBA's entry into green fintech would place it in a nascent but rapidly expanding segment, requiring strategic investment to overcome early-stage market penetration challenges.

AGBA's ventures into AI-driven financial services and green fintech represent classic Question Mark scenarios within the BCG Matrix. These areas offer substantial growth potential but currently have low market share and require significant investment to establish a strong foothold. The success hinges on strategic execution and the ability to capture market share against established or emerging competitors.

Triller's post-merger focus on AI-powered social video platforms also falls into the Question Mark category. While the platform has a large user base, its monetization strategies are still developing, necessitating investment to convert engagement into revenue. The competitive landscape for social media is intense, demanding innovation to stand out and achieve profitability.

The Hong Kong green fintech sector, while experiencing rapid growth driven by investor demand and policy support, presents AGBA with a Question Mark opportunity. AGBA's entry into this space requires initial heavy investment to build brand awareness and product offerings, aiming to capture a share of this expanding but competitive market.

| Initiative | BCG Category | Market Potential | Current Market Share | Investment Need |

|---|---|---|---|---|

| Triller AI in AGBA Financial Services | Question Mark | High (AI in Fintech Market) | Low | High |

| AGBA Acquisition of Sony Life (Singapore) | Question Mark (Initial Entry) | High (Singapore Financial Services) | Low | High |

| Triller's AI-powered Social Video Platforms | Question Mark | High (Social Media Engagement) | Low (Monetization) | High |

| AGBA's Green Fintech Ventures (Hong Kong) | Question Mark | High (ESG Investing) | Low | High |

BCG Matrix Data Sources

Our AGBA BCG Matrix is built on comprehensive market data, encompassing sales figures, market share reports, industry growth rates, and competitor analysis to provide actionable strategic direction.