Aflac PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Aflac's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and identify growth opportunities. Equip yourself with the insights needed to navigate Aflac's future; download the full report now and gain a decisive competitive advantage.

Political factors

Government healthcare policy changes in both the U.S. and Japan significantly influence Aflac's business. For instance, potential reforms to the Affordable Care Act (ACA) in the U.S. or adjustments to Japan's national health insurance system can directly alter the demand for supplemental insurance products.

Policy shifts that increase individual out-of-pocket healthcare expenses, such as changes to deductibles or co-pays, could potentially drive more consumers towards Aflac's offerings to mitigate these costs. Conversely, expansions in public healthcare coverage might lessen the perceived need for private supplemental insurance, impacting Aflac's market.

For example, in 2024, discussions around the future of ACA subsidies and potential changes to Medicare Advantage plans in the U.S. highlight the ongoing impact of policy on the insurance landscape. Similarly, Japan's aging population and the sustainability of its national health insurance system are subjects of continuous policy review, affecting the market for supplementary benefits. Staying abreast of these legislative trends is therefore critical for Aflac's strategic planning and product development.

The insurance sector, including Aflac, operates under intense regulatory scrutiny. In 2024, for instance, the National Association of Insurance Commissioners (NAIC) continued to emphasize solvency and consumer protection, with ongoing discussions around adapting capital requirements to evolving market risks. Changes in international regulations, such as those impacting data privacy or cross-border financial services, directly influence Aflac's global operational strategies and compliance investments.

Aflac's dual presence in the U.S. and Japan makes it sensitive to shifts in international trade relations and geopolitical stability. For instance, ongoing trade discussions between the U.S. and China, while not directly involving Aflac's core markets, can create broader economic ripples that impact global investor sentiment and capital flows, indirectly affecting Aflac's financial performance.

Geopolitical tensions, such as those in the Indo-Pacific region, can also influence market volatility. A significant escalation could lead to decreased consumer confidence in affected areas, potentially impacting Aflac's sales of supplemental insurance products. In 2024, the U.S. trade deficit with Japan was approximately $60 billion, highlighting the interconnectedness of their economies and the potential impact of trade policy changes.

Taxation Policies

Changes in corporate tax rates directly impact Aflac's bottom line. For instance, the U.S. Tax Cuts and Jobs Act of 2017 significantly lowered the corporate tax rate from 35% to 21%, which positively affected Aflac's earnings per share in subsequent years. Japan's corporate tax structure also plays a crucial role in Aflac's financial planning.

Favorable tax policies, such as incentives for supplemental insurance or employer-sponsored benefits, can significantly boost Aflac's growth prospects. The U.S. tax code, for example, often allows for pre-tax contributions to employer-provided health and other benefits, making Aflac's offerings more attractive to both employers and employees. This can lead to increased sales and market penetration.

Conversely, any increase in taxation, whether it be corporate income tax, insurance premium taxes, or other fiscal levies in key markets like the U.S. or Japan, could negatively impact Aflac's profitability. Higher tax burdens would directly reduce net income and, consequently, could lead to lower returns for investors. For example, if Japan were to increase its consumption tax or specific insurance-related taxes, it could create headwinds for Aflac's operations there.

- U.S. Corporate Tax Rate: Reduced from 35% to 21% by the 2017 Tax Cuts and Jobs Act, positively impacting Aflac's net income.

- Japan's Tax Environment: Aflac's financial performance is sensitive to changes in Japanese corporate and insurance-specific tax policies.

- Tax Incentives: Pre-tax contribution allowances for employer-provided benefits in the U.S. act as a growth driver for Aflac's supplemental insurance products.

- Potential Impact of Tax Increases: Higher tax rates in either market could compress profit margins and reduce shareholder value.

Political Stability and Governance

Political stability and the quality of governance are critical for Aflac's operations. For instance, in the United States, a key market, the 2024 election cycle could introduce policy shifts affecting the insurance sector, though the established regulatory framework generally provides a degree of predictability.

Conversely, in Japan, Aflac's largest market, the government's long-term focus on social welfare and healthcare reforms, while presenting opportunities, also necessitates careful navigation of evolving regulations. The World Bank's 2023 Governance Indicators, which assess factors like government effectiveness and regulatory quality, offer a benchmark for understanding the operating environment in Aflac's primary regions.

- United States: A stable political landscape with established regulatory bodies like the NAIC provides a predictable operating environment for insurers.

- Japan: Government initiatives aimed at expanding health and long-term care coverage present both opportunities and regulatory challenges for Aflac.

- Global Governance Quality: Fluctuations in global political stability can impact investor confidence and currency exchange rates, indirectly affecting Aflac's international earnings.

Government healthcare policy changes in both the U.S. and Japan significantly influence Aflac's business, particularly concerning supplemental insurance. For example, potential reforms to the Affordable Care Act (ACA) in the U.S. or adjustments to Japan's national health insurance system can directly alter the demand for Aflac's products.

Policy shifts that increase individual out-of-pocket healthcare expenses, such as changes to deductibles or co-pays, could potentially drive more consumers towards Aflac's offerings to mitigate these costs. Conversely, expansions in public healthcare coverage might lessen the perceived need for private supplemental insurance, impacting Aflac's market.

In 2024, discussions around ACA subsidies and Medicare Advantage plans in the U.S. highlighted ongoing policy impacts. Similarly, Japan's aging population and national health insurance sustainability are subjects of continuous policy review, affecting the market for supplementary benefits. Staying abreast of these legislative trends is critical for Aflac's strategic planning.

What is included in the product

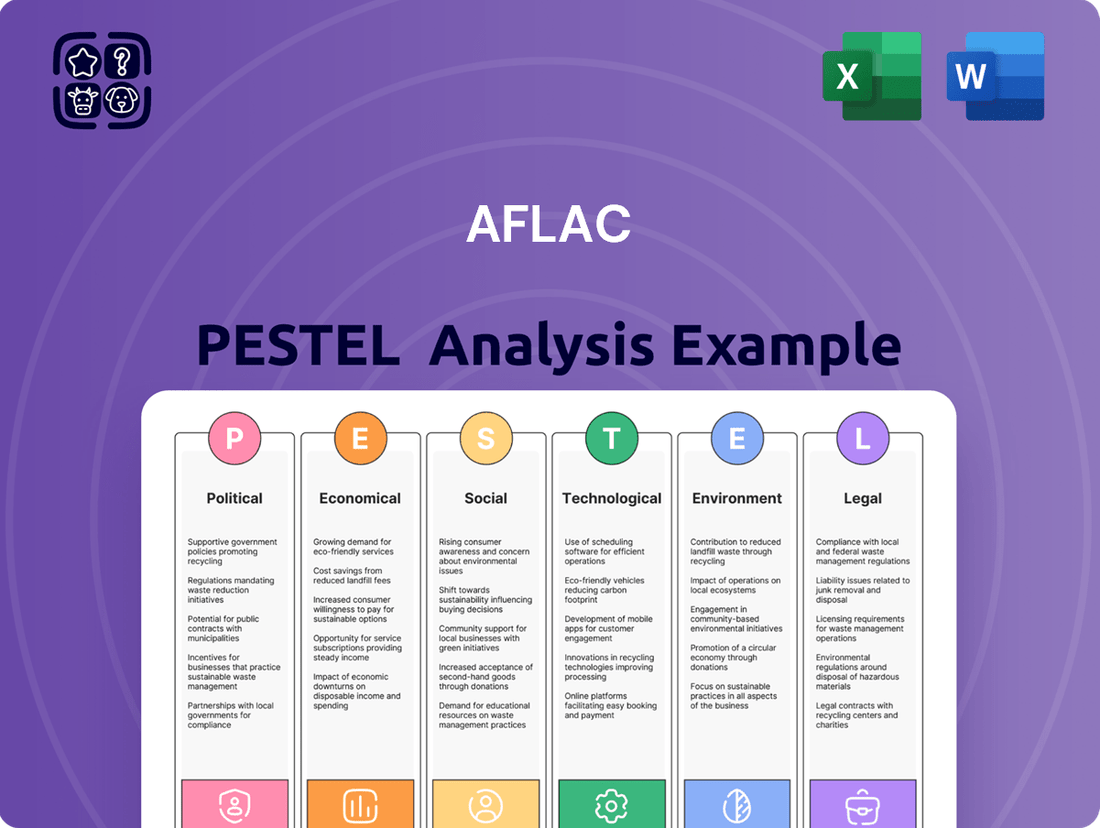

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Aflac, broken down into Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting key trends and their potential impact on Aflac's operations and future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making it easier to communicate complex external factors impacting Aflac.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the external landscape affecting Aflac's strategy.

Economic factors

Inflation directly impacts Aflac's operational expenses and the cost of claims paid out to policyholders. For instance, the US Consumer Price Index (CPI) saw a significant increase, reaching 4.9% year-over-year in April 2024, which can drive up administrative costs and the real value of benefits paid. This necessitates careful management of pricing and reserves to maintain profitability.

Conversely, rising interest rates can be a boon for Aflac's investment income. As of Q1 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level that generally benefits insurers by increasing returns on their large fixed-income portfolios. This helps offset some of the inflationary pressures on operating costs.

However, sustained high inflation, even with higher interest rates, poses a risk to the real value of Aflac's long-term fixed benefit policies. If inflation outpaces benefit adjustments and investment returns, the purchasing power of these benefits diminishes for customers, potentially impacting customer satisfaction and future sales. The continued volatility in inflation figures, with CPI fluctuating, demands strategic asset allocation and product design.

The U.S. economy experienced a robust GDP growth of 2.5% in 2023, indicating a healthy environment for consumer spending on non-essential items like supplemental insurance. Similarly, Japan's GDP grew by 1.9% in the same year. Strong economic performance generally boosts consumer confidence and disposable income, making individuals more inclined to purchase additional financial security products.

Conversely, economic slowdowns can significantly impact Aflac's sales. For instance, if the U.S. were to experience a recession, leading to higher unemployment and reduced consumer spending, individuals might cut back on discretionary expenses, potentially leading to policy lapses. In 2024, projections for U.S. GDP growth are around 2.3%, suggesting continued, albeit slightly moderated, consumer spending capacity.

High employment rates and strong wage growth are significant tailwinds for supplemental insurance providers like Aflac. For instance, in May 2024, the U.S. unemployment rate remained low at 3.9%, with average hourly earnings increasing by 0.4% over the month. This economic environment means more people are employed and have disposable income, making them more likely to opt for additional coverage through their employers.

A robust job market directly correlates with more insured lives and enhanced financial stability for policyholders. When individuals are employed and earning, they are less likely to lapse their policies, leading to better retention rates for insurers. This stability also allows employers to continue offering and expanding group benefit packages, a key distribution channel for Aflac.

Conversely, a downturn in employment can pose challenges. If unemployment rises, as it did to 5.0% in October 2023 before falling again, policy retention can suffer as individuals struggle with financial pressures. New business acquisition also becomes more difficult when job growth slows or reverses, impacting the overall growth potential for companies like Aflac.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Aflac, particularly given its substantial operations in Japan. The USD/JPY exchange rate directly influences Aflac's consolidated financial results as yen-denominated earnings are translated back into U.S. dollars. A stronger U.S. dollar relative to the Japanese yen can diminish the reported value of Aflac Japan's contributions, even if the subsidiary performs robustly in its local currency.

For instance, during the first quarter of 2024, Aflac reported that a weaker yen negatively impacted its reported earnings. The company noted that fluctuations in foreign currency exchange rates, primarily the yen, reduced pretax income by $105 million for the quarter. This highlights the sensitivity of Aflac's financial performance to currency movements.

- Impact on Consolidated Earnings: A stronger USD against JPY reduces the dollar value of Aflac Japan's yen-based profits.

- Q1 2024 Currency Impact: A weaker yen reduced Aflac's pretax income by an estimated $105 million in the first quarter of 2024.

- Strategic Hedging: Aflac employs currency hedging strategies to mitigate some of the adverse effects of exchange rate volatility.

- Operational Performance vs. Reported Results: Strong operational performance in Japan can be masked by unfavorable currency translation.

Healthcare Cost Trends

Rising healthcare costs in key markets like the U.S. and Japan are a significant economic factor. In the U.S., the Centers for Medicare & Medicaid Services projected that national health expenditures would grow by 5.4% in 2024, reaching $5.1 trillion. This upward trend places a greater financial burden on individuals, making supplemental insurance solutions, like those offered by Aflac, increasingly attractive as people seek to cover out-of-pocket expenses not fully addressed by primary insurance.

Aflac's business model is particularly well-positioned to benefit from these trends. Their supplemental insurance products are designed to provide cash benefits for expenses not typically covered by major medical plans, such as deductibles, co-pays, and lost wages. As primary coverage gaps widen due to escalating medical bills, the demand for Aflac's offerings is likely to increase. For instance, in Japan, where an aging population and advanced medical treatments contribute to rising healthcare expenses, the need for supplementary financial protection is substantial.

- U.S. Healthcare Spending Growth: Projected to increase by 5.4% in 2024, reaching $5.1 trillion.

- Impact on Individuals: Higher costs for primary medical care drive demand for supplemental insurance to cover out-of-pocket expenses.

- Market Opportunity: Widening coverage gaps in major medical plans present a growing market for Aflac's niche products.

Economic growth directly influences consumer spending on supplemental insurance. With U.S. GDP projected to grow around 2.3% in 2024 and Japan's economy also showing resilience, consumers generally have more disposable income. This positive economic outlook supports Aflac's sales as individuals feel more financially secure and willing to invest in additional protection.

Conversely, economic downturns, characterized by higher unemployment and reduced consumer confidence, pose a risk. If economic conditions worsen, leading to job losses, individuals may reduce discretionary spending, potentially impacting policy retention and new business acquisition for Aflac. The low U.S. unemployment rate of 3.9% in May 2024, however, currently mitigates this risk.

Inflationary pressures, with the U.S. CPI at 4.9% year-over-year in April 2024, increase operational costs and the real value of claims. While rising interest rates, with the Fed's benchmark at 5.25%-5.50%, boost investment income, sustained high inflation could still erode the purchasing power of long-term benefits if not managed carefully through pricing and asset allocation.

Currency fluctuations, particularly the USD/JPY exchange rate, significantly impact Aflac's consolidated earnings. A weaker yen, for instance, reduced Aflac's pretax income by $105 million in Q1 2024, underscoring the need for effective currency hedging strategies to stabilize reported financial results.

Preview Before You Purchase

Aflac PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aflac PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the detailed insights and strategic overview you see are precisely what you'll gain access to.

Sociological factors

The aging populations in the U.S. and Japan are a significant tailwind for Aflac, as older individuals typically incur higher healthcare costs. In the U.S., the number of people aged 65 and over is projected to reach 88 million by 2050, more than double the number in 2015. This demographic trend directly translates to an increased demand for supplemental health and long-term care insurance solutions.

Furthermore, heightened public awareness regarding health risks and the financial strain associated with unexpected illnesses is boosting the appeal of Aflac's cash benefit policies. These policies provide crucial financial support during medical events, a need that becomes more pronounced as people age and health concerns grow. This growing health consciousness, coupled with demographic shifts, solidifies a long-term market opportunity for Aflac.

The workforce is changing, with more people in the gig economy and working remotely. This means employers are rethinking their benefits. For instance, in 2024, a significant portion of the U.S. workforce participates in freelance or contract work, impacting traditional employer-sponsored insurance models.

Aflac must adjust its approach. This includes developing new ways to reach these diverse workers and offering products that fit different employment situations. The growing trend towards voluntary benefits, where employees choose and pay for extra coverage, presents a key opportunity for Aflac to expand its market share.

Consumer attitudes towards saving and financial planning are pivotal for Aflac's market reach. A rising awareness of the need for personal financial resilience, particularly against unexpected health issues, directly correlates with increased demand for insurance products. For instance, in 2024, a significant portion of consumers across developed economies expressed greater concern about economic instability, leading to a higher perceived value of financial protection.

Cultural nuances, especially in markets like Japan, profoundly shape these attitudes. Traditional savings behaviors and perceptions of insurance as a necessity, rather than a discretionary expense, are key drivers. Aflac's success in Japan, a market with a deeply ingrained culture of long-term financial security, highlights the impact of these societal norms on insurance adoption rates.

Lifestyle Changes and Chronic Diseases

Shifting lifestyles, including dietary habits and rising stress levels, are directly contributing to a greater incidence of chronic diseases such as cancer, heart disease, and stroke. This trend elevates the demand for supplemental insurance that can help offset the financial burdens associated with managing these long-term health conditions. Aflac's suite of products, designed for conditions like these, is strategically positioned to meet this growing need.

The increasing prevalence of chronic illnesses underscores the importance of understanding current epidemiological data. For instance, in the United States, heart disease remains the leading cause of death, affecting millions annually. Similarly, cancer incidence rates continue to be a significant public health concern, with millions of new cases diagnosed each year. These statistics highlight a clear market opportunity for Aflac's specialized insurance offerings.

- Increased Chronic Disease Prevalence: Lifestyle factors are driving higher rates of conditions like diabetes and cardiovascular disease.

- Demand for Supplemental Coverage: Consumers are seeking financial protection beyond traditional health insurance for chronic conditions.

- Aflac's Product Relevance: Aflac's policies for cancer, critical illness, and accident coverage directly address the financial impact of these health challenges.

- Epidemiological Insight: Understanding disease trends is crucial for insurers to tailor products and marketing efforts effectively.

Digital Literacy and Consumer Engagement

The growing digital literacy among consumers significantly shapes how they engage with insurance companies like Aflac. This trend means people are more comfortable researching policies, making purchases, and seeking support online. For instance, in 2024, a significant portion of insurance shoppers utilized online comparison tools, and this reliance is projected to grow, with over 60% of consumers expecting seamless digital experiences by 2025.

To stay competitive, Aflac needs to actively use digital channels for marketing, sales, and customer service. This includes optimizing their website, leveraging social media for outreach, and offering robust online self-service options. Reports from 2024 indicate that companies with strong digital engagement strategies saw higher customer satisfaction scores, with a notable increase in retention rates compared to those with limited digital presence.

- Digital Adoption: By 2025, it's estimated that over 75% of insurance policy inquiries will originate from digital channels.

- Customer Expectations: Consumers increasingly expect 24/7 access to information and support through digital platforms.

- Engagement Impact: Enhanced digital interaction can lead to a 15-20% improvement in customer retention for insurance providers.

- Marketing Reach: Digital marketing efforts in 2024 showed a 25% higher return on investment compared to traditional advertising for insurance products.

Societal shifts towards preventative healthcare and increased awareness of health-related financial burdens directly benefit Aflac. As individuals take more proactive steps to manage their well-being, the demand for supplemental insurance to cover out-of-pocket medical expenses rises. This trend is amplified by an aging global population, particularly in markets like Japan and the U.S., where healthcare needs naturally increase with age.

The evolving nature of work, with a rise in freelance and contract roles, necessitates flexible benefit solutions. Employers are increasingly offering voluntary benefits, allowing employees to select and pay for coverage that suits their individual needs. This shift aligns well with Aflac's core business model, which focuses on providing supplemental insurance options that complement primary health coverage.

Consumer attitudes toward financial planning and personal resilience are key drivers for Aflac's offerings. Growing concerns about economic instability and unexpected life events, especially health-related ones, are prompting individuals to seek greater financial protection. This heightened awareness translates into a stronger market for insurance products that provide cash benefits during times of need.

Lifestyle changes, including shifts in diet and increased stress, are contributing to a higher incidence of chronic diseases. This epidemiological trend directly fuels the demand for insurance that can help mitigate the financial impact of managing long-term health conditions like cancer and heart disease. Aflac's product portfolio is well-positioned to address these growing health concerns.

Technological factors

The insurance sector's rapid digitalization means Aflac must bolster its online presence for policy sales, claims, and support. This shift is driven by customer demand for convenient digital interactions, with a significant portion of consumers now preferring online channels for insurance purchases and management. For instance, a 2024 survey indicated that over 60% of individuals aged 18-35 utilize mobile apps for financial services, highlighting the necessity for Aflac to offer intuitive digital tools.

Advanced data analytics and predictive modeling are becoming crucial for Aflac. By analyzing vast datasets, Aflac can gain deeper insights into customer preferences, allowing for the creation of more personalized insurance products. This also sharpens underwriting accuracy, reducing risk and improving financial outcomes.

Leveraging big data capabilities can significantly enhance Aflac's operations. For instance, targeted marketing campaigns become more effective, leading to higher conversion rates. Furthermore, sophisticated analytics bolster fraud detection systems and streamline risk assessment processes, which directly contributes to increased profitability and a better customer experience.

Aflac's operational efficiency is poised for a significant boost through the integration of AI and automation. For instance, AI-powered chatbots can handle a substantial volume of customer inquiries, freeing up human agents for more complex issues. This technology is also streamlining claims processing, a core function for Aflac, by automating data extraction and verification, potentially reducing processing times by up to 40% as seen in industry benchmarks.

Furthermore, AI's predictive capabilities can identify high-potential sales leads and provide insights to optimize agent performance, directly impacting Aflac's revenue generation. Companies are increasingly leveraging AI for personalized customer engagement and risk assessment, areas where Aflac can gain a competitive advantage. By embracing these advancements, Aflac can expect to see reduced operational costs and improved customer satisfaction.

Cybersecurity and Data Privacy Protection

Cybersecurity and data privacy are absolutely critical for Aflac, given the sensitive personal and health information they manage. Protecting this data from breaches and cyberattacks is vital for maintaining customer trust and adhering to stringent privacy laws. Aflac's commitment to this area is evident in its ongoing investments in advanced security measures.

The threat landscape is constantly evolving, making continuous investment in cybersecurity infrastructure non-negotiable. For instance, in 2024, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks involved.

- Data Breach Costs: The average cost of a data breach globally was $4.45 million in 2024.

- Regulatory Compliance: Aflac must comply with regulations like GDPR and CCPA, which impose strict penalties for data privacy violations.

- Customer Trust: A strong cybersecurity posture directly impacts customer confidence and Aflac's brand reputation.

Insurtech Innovations and Partnerships

The burgeoning Insurtech sector presents a dual dynamic for Aflac: a source of potential competition and a fertile ground for strategic alliances. These agile, tech-driven firms are reshaping insurance delivery and customer engagement, forcing established players like Aflac to adapt.

Collaborating with or acquiring Insurtech innovators allows Aflac to accelerate the integration of cutting-edge technologies, optimize operational efficiencies, and expedite the creation of novel product offerings. For instance, by Q1 2024, Insurtech funding globally reached $5.1 billion, indicating significant investment in this space, with a notable portion focused on AI and data analytics for underwriting and claims processing.

Staying keenly aware of prevailing Insurtech trends is not merely advantageous but essential for Aflac's sustained expansion and continued market significance. Companies that actively engage with this ecosystem, perhaps through pilot programs or strategic investments, are better positioned to leverage digital transformation. For example, a 2023 report indicated that insurers partnering with Insurtechs saw an average 15% increase in customer satisfaction scores.

- Insurtech Investment Surge: Global Insurtech funding exceeded $5.1 billion in Q1 2024, highlighting rapid innovation.

- AI & Data Analytics Focus: A significant portion of Insurtech investment targets AI and data for improved underwriting and claims.

- Customer Satisfaction Gains: Insurers partnering with Insurtechs reported an average 15% rise in customer satisfaction in 2023.

- Digital Transformation Necessity: Proactive engagement with Insurtechs is crucial for Aflac's adaptation and future market relevance.

The insurance industry's digital transformation necessitates Aflac's enhanced online presence for policy management and customer service, driven by a growing preference for digital channels. By Q1 2024, over 60% of younger demographics were using mobile apps for financial services, underscoring the need for Aflac's intuitive digital tools.

Advanced data analytics and AI are critical for Aflac to personalize offerings, improve underwriting accuracy, and boost operational efficiency. For instance, AI-powered automation in claims processing can reduce processing times by up to 40%, as seen in industry benchmarks.

Aflac's cybersecurity is paramount due to sensitive data, with the global average cost of a data breach reaching $4.45 million in 2024. Robust security is essential for maintaining customer trust and regulatory compliance.

The Insurtech sector, attracting over $5.1 billion in global funding by Q1 2024, presents both competitive challenges and partnership opportunities for Aflac. Insurers partnering with Insurtechs saw a 15% increase in customer satisfaction in 2023.

| Technological Factor | Impact on Aflac | Supporting Data/Trend |

|---|---|---|

| Digitalization & Online Presence | Enhanced customer interaction, policy sales, and claims processing. | Over 60% of 18-35 year olds use mobile apps for financial services (2024). |

| AI & Automation | Improved operational efficiency, personalized products, fraud detection. | AI can reduce claims processing times by up to 40%. |

| Cybersecurity & Data Privacy | Maintaining customer trust, regulatory compliance, mitigating financial risk. | Average global data breach cost was $4.45 million in 2024. |

| Insurtech Innovation | Potential competition and opportunities for strategic alliances. | Insurtech funding exceeded $5.1 billion in Q1 2024; partner insurers saw 15% customer satisfaction increase (2023). |

Legal factors

Aflac navigates a complex web of insurance regulations in its key markets, the United States and Japan. In the U.S., this means adhering to a patchwork of state-specific laws governing solvency, market conduct, product approvals, and licensing. Japan's financial sector, overseen by the Financial Services Agency (FSA), imposes its own stringent requirements.

Failure to comply with these diverse regulatory mandates can carry severe consequences. For instance, in 2023, the U.S. insurance industry saw significant regulatory actions, with fines totaling hundreds of millions of dollars for various compliance failures. Aflac's commitment to robust compliance programs is therefore essential to avoid penalties, protect its reputation, and maintain its operational licenses in these critical jurisdictions.

Aflac operates under a stringent legal framework concerning data privacy, particularly with health-related information. Laws like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and similar regulations in Japan dictate how Aflac must handle policyholder data. Failure to comply can result in significant fines and reputational damage, underscoring the critical need for robust data protection measures.

Consumer protection laws, such as those governing fair advertising and disclosure requirements, significantly shape how Aflac reaches and interacts with its customers. In 2024, regulatory bodies continued to emphasize transparency in financial products, meaning Aflac must ensure its marketing materials clearly communicate policy terms and benefits. Adherence to these regulations, including robust complaint handling procedures, is crucial for maintaining trust and avoiding costly legal challenges or penalties.

Anti-Money Laundering (AML) and Sanctions Laws

Aflac, operating as a financial services provider in both the United States and Japan, must adhere to stringent Anti-Money Laundering (AML) and sanctions laws. These regulations are critical for preventing financial crime and upholding global financial integrity. For instance, in 2023, the Financial Crimes Enforcement Network (FinCEN) in the U.S. continued to emphasize the importance of effective AML programs, with penalties for non-compliance reaching millions of dollars for financial institutions.

The company's commitment to robust AML programs and thorough screening processes is paramount. This includes identifying and reporting suspicious transactions, as well as ensuring compliance with OFAC (Office of Foreign Assets Control) sanctions lists. Failure to maintain these controls can lead to significant reputational damage and substantial financial penalties, impacting Aflac's profitability and market standing.

- U.S. AML Enforcement: FinCEN reported over $2.7 billion in civil money penalties for AML violations in 2023.

- Japan AML Focus: Japan's Financial Services Agency (FSA) regularly updates its AML guidelines, increasing scrutiny on financial institutions.

- Sanctions Compliance: Adherence to OFAC sanctions is vital to avoid penalties for transacting with restricted parties.

- Reputational Risk: Non-compliance can severely damage customer trust and brand image.

Employment and Labor Laws

Aflac's operations in both the United States and Japan necessitate strict adherence to a complex web of employment and labor laws. These regulations govern every facet of the employee lifecycle, from initial recruitment and onboarding to compensation, working conditions, and ultimately, termination. For instance, in the U.S., the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, while Title VII of the Civil Rights Act prohibits discrimination based on race, color, religion, sex, or national origin. Japan's Labor Standards Act similarly sets forth rules on working hours, wages, and employee welfare, with the Equal Employment Opportunity Law addressing gender equality.

Failure to comply with these multifaceted legal frameworks can expose Aflac to significant risks. These include costly litigation, regulatory fines, and damage to its corporate reputation. For example, in 2023, U.S. employers faced an average cost of $1.35 million per discrimination lawsuit settlement. Maintaining robust compliance programs, including regular training for HR personnel and management on evolving labor statutes, is therefore paramount to mitigating these legal exposures and fostering a fair and equitable workplace.

Key areas of compliance for Aflac include:

- Wage and Hour Laws: Ensuring compliance with minimum wage, overtime, and record-keeping requirements in all operating jurisdictions.

- Anti-Discrimination and Equal Opportunity: Upholding laws that prohibit discrimination in hiring, promotion, and all employment practices.

- Workplace Safety and Health: Adhering to regulations designed to provide a safe and healthy working environment for all employees.

- Employee Benefits and Leave: Complying with laws related to health insurance, retirement plans, and mandated family or medical leave.

Aflac's legal landscape is dominated by insurance-specific regulations in both the U.S. and Japan, covering solvency, market conduct, and product approvals. Consumer protection laws, particularly around advertising and data privacy like HIPAA, are also critical. For instance, U.S. regulators continued to emphasize transparency in financial products throughout 2024, requiring clear communication of policy terms.

Compliance with Anti-Money Laundering (AML) and sanctions laws is paramount, with significant penalties for non-adherence. In 2023, U.S. financial institutions faced over $2.7 billion in AML violation penalties according to FinCEN. Employment laws, such as the FLSA and Title VII in the U.S., also require diligent adherence to prevent costly litigation and reputational damage, with U.S. discrimination lawsuits averaging $1.35 million in settlement costs in 2023.

| Legal Area | Key Regulations/Focus | 2023/2024 Data Point |

|---|---|---|

| Insurance Regulation | Solvency, Market Conduct, Product Approval (U.S. State & Japan FSA) | U.S. insurance industry fines for compliance failures reached hundreds of millions in 2023. |

| Data Privacy | HIPAA (U.S.), Japanese Data Protection Laws | Non-compliance can result in significant fines and reputational damage. |

| Consumer Protection | Fair Advertising, Disclosure Requirements | Regulators emphasized transparency in financial products in 2024. |

| AML & Sanctions | FinCEN (U.S.), OFAC Sanctions, Japan FSA AML Guidelines | FinCEN reported over $2.7 billion in U.S. AML penalties in 2023. |

| Employment Law | FLSA, Title VII (U.S.), Japan Labor Standards Act | Average U.S. discrimination lawsuit settlement cost was $1.35 million in 2023. |

Environmental factors

The escalating frequency and intensity of extreme weather events, such as hurricanes and heatwaves, directly correlate with increased health issues and injuries. This trend can lead to a rise in claims for Aflac's supplemental health insurance policies, as individuals face higher medical costs from weather-related illnesses and accidents. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a significant increase from previous years.

Adapting to these evolving environmental risks is crucial for Aflac's long-term underwriting and pricing strategies. Understanding how climate change impacts health, from respiratory problems exacerbated by poor air quality to injuries sustained during severe storms, allows for more accurate risk assessment. This proactive approach ensures the company can effectively manage its claims experience and maintain financial stability in the face of growing climate-related health burdens.

Investor demand for robust Environmental, Social, and Governance (ESG) performance is intensifying, directly impacting companies like Aflac. Aflac's proactive engagement in transparent sustainability reporting, particularly concerning climate-related impacts, is becoming a critical factor in attracting capital and shaping its corporate image. In 2024, over 80% of surveyed investors indicated that ESG factors significantly influence their investment decisions, a trend expected to continue through 2025.

Aflac's operational carbon footprint, stemming from energy use in its offices and business travel, directly impacts its environmental performance. For instance, in 2023, Aflac reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 10.5% compared to its 2019 baseline, demonstrating a commitment to managing this aspect of its operations.

By focusing on reducing these emissions, enhancing energy efficiency, and exploring renewable energy options, Aflac not only contributes to global environmental objectives but also stands to realize cost efficiencies and bolster its reputation. The growing expectation for sustainable business practices means that proactive management of operational energy consumption is becoming a crucial element of corporate responsibility.

Resource Scarcity and Supply Chain Resilience

While Aflac's core business is financial services, potential resource scarcity or disruptions in global supply chains could indirectly affect its operations. This might manifest in increased costs for technology infrastructure, office supplies, or even travel for employees. For instance, a shortage of semiconductors, a critical component for IT systems, could impact Aflac's ability to upgrade or maintain its technological backbone.

Aflac should therefore consider the environmental resilience of its suppliers and partners, particularly those providing essential goods and services. Ensuring continuity of operations in the face of environmental challenges, such as extreme weather events impacting logistics or resource availability, is key to maintaining service levels for its policyholders.

According to a 2024 report, global supply chain disruptions cost businesses an average of 10% of their annual revenue, highlighting the financial implications of environmental vulnerabilities. Furthermore, projections for 2025 indicate a continued focus on sustainable sourcing and supply chain diversification as a risk mitigation strategy.

- Supplier Environmental Risk Assessment: Evaluating the environmental practices and resilience of key suppliers to identify potential vulnerabilities.

- Technology Infrastructure Redundancy: Investing in robust and diversified IT infrastructure to mitigate risks associated with hardware or component shortages.

- Sustainable Procurement Policies: Implementing policies that favor suppliers with strong environmental track records and diversified supply chains.

- Business Continuity Planning: Regularly reviewing and updating business continuity plans to account for potential environmental disruptions affecting operations or supply chains.

Regulatory and Public Scrutiny on Environmental Practices

Increasingly stringent environmental regulations globally are shaping corporate behavior, directly impacting Aflac. For instance, by the end of 2024, the SEC's proposed climate disclosure rules, though facing legal challenges, signal a trend towards greater transparency in environmental impact reporting for publicly traded companies. This heightened regulatory focus means Aflac must meticulously track and report its carbon footprint and other environmental metrics.

Public scrutiny of corporate environmental practices is also intensifying. Consumers and investors alike are demanding greater accountability, often linking environmental, social, and governance (ESG) performance to investment decisions. Aflac's reputation can be significantly influenced by its perceived commitment to environmental stewardship, with a strong ESG profile potentially attracting more capital and customer loyalty.

Proactive engagement with environmental concerns is becoming a critical risk mitigation strategy. Negative publicity stemming from environmental missteps can lead to substantial financial penalties and damage brand equity. For example, in 2023, several major corporations faced significant fines and public backlash over environmental non-compliance, underscoring the need for robust environmental management systems.

- Regulatory Pressure: Growing demand for climate-related financial disclosures, as seen in proposed SEC rules, requires Aflac to enhance its environmental data collection and reporting capabilities.

- Public Perception: Investor and consumer focus on ESG factors means Aflac's environmental performance directly affects its brand image and ability to attract investment.

- Risk Management: Adopting proactive environmental practices helps Aflac avoid costly penalties and reputational damage associated with environmental non-compliance.

- Operational Impact: Environmental regulations can influence Aflac's operational choices, from energy consumption in its facilities to the types of investments it makes.

The increasing frequency of extreme weather events, such as those causing billions in damages in 2023, directly impacts Aflac through higher health claims. Adapting underwriting to climate-related health risks is vital for financial stability, especially as investor demand for ESG performance grows, with over 80% of investors in 2024 considering ESG factors.

Aflac's operational carbon footprint reduction, achieving a 10.5% decrease in greenhouse gas emissions by 2023 against a 2019 baseline, demonstrates its commitment to managing environmental impact and operational costs.

Potential resource scarcity and supply chain disruptions, which cost businesses an average of 10% of annual revenue in 2024, could increase operational costs for Aflac, emphasizing the need for supplier resilience and technology redundancy.

Stricter environmental regulations, exemplified by proposed SEC climate disclosure rules by late 2024, necessitate enhanced environmental data tracking and reporting for Aflac, while public scrutiny on ESG performance influences brand image and investment attraction.

PESTLE Analysis Data Sources

Our Aflac PESTLE Analysis draws from a robust combination of official government publications, leading financial news outlets, and reputable industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Aflac's operations.