Aflac Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Aflac's marketing prowess is built on a strategic foundation of the 4Ps. Discover how their unique product offerings, competitive pricing, accessible distribution, and impactful promotions create a powerful market presence.

Dive deeper into Aflac's marketing engine by exploring the full 4Ps analysis. This comprehensive report reveals the intricate details of their product development, pricing strategies, channel management, and promotional campaigns, offering invaluable insights for your own business planning.

Product

Aflac's product strategy centers on a robust portfolio of supplemental health and life insurance policies. These products are specifically crafted to bridge the gaps left by traditional major medical coverage, offering direct cash benefits to policyholders. This financial support is crucial for managing out-of-pocket medical costs like deductibles and copays, as well as non-medical expenses incurred during periods of illness or injury.

The company's product line encompasses a broad spectrum of needs, including coverage for accidents, cancer, critical illnesses, hospital stays, and short-term disabilities. This comprehensive approach aims to provide a safety net against a variety of health-related financial burdens. For instance, Aflac reported total revenue of $22.4 billion for the fiscal year 2023, demonstrating the significant market penetration and demand for its specialized insurance solutions.

Aflac's diverse portfolio is a cornerstone of its marketing strategy, ensuring it meets a wide array of customer needs across its key markets. This variety allows Aflac to be more than just a supplemental health insurer, broadening its appeal and revenue streams.

In the U.S., beyond its traditional supplemental health insurance, Aflac has strategically added dental and vision plans. This expansion, which gained traction in 2024, caters to the growing demand for comprehensive, yet affordable, ancillary benefits.

Japan remains a critical market with a similarly diverse product suite. Aflac Japan offers robust cancer and medical insurance, alongside income support products and unique asset-formation tools like 'Tsumitasu.' This approach directly addresses the varied life stages and financial goals of Japanese consumers.

For the fiscal year ending December 31, 2024, Aflac reported total revenues of $22.4 billion, with its diversified product offerings contributing significantly to this performance. This broad product mix is a key driver of customer retention and new business acquisition.

Aflac's core strength lies in its direct cash benefits, a significant advantage that empowers policyholders. Unlike some insurance products that pay providers directly, Aflac typically sends the cash to the insured person, offering unparalleled flexibility. This means the money can be used for anything – from covering deductibles and co-pays to replacing lost income or paying for everyday living expenses during recovery.

This flexibility is crucial because medical events often come with unexpected costs beyond direct medical bills. For instance, in 2024, the average out-of-pocket healthcare spending for individuals in the US was estimated to be around $1,200 annually, a figure that can be significantly higher for those facing serious illness or injury. Aflac's cash benefits help bridge this gap, allowing individuals to manage their finances without added stress.

Furthermore, Aflac emphasizes swift claim processing. Many claims are paid within days, a critical factor when immediate financial relief is needed. This rapid disbursement of funds, often via direct deposit, can be a lifeline, ensuring policyholders can meet their financial obligations while focusing on their health. By the end of 2023, Aflac reported paying out over $2.5 billion in claims across its various products, underscoring its commitment to timely financial support.

Tailored for Unexpected Costs

Aflac's offerings are designed to bridge the financial chasm left by conventional health insurance, specifically targeting the unexpected outlays that accompany sickness or injury. This strategic placement establishes Aflac as an essential financial buffer, enabling individuals and households to navigate unforeseen expenditures without jeopardizing their savings or accumulating debt.

The core of Aflac's product philosophy centers on delivering tranquility, allowing policyholders to prioritize their recuperation over the burden of financial worries. For instance, in 2024, Aflac reported paying out over $1.8 billion in claims, a significant portion of which addressed these very types of unexpected costs, demonstrating the tangible impact of their tailored solutions.

- Financial Gap Coverage: Aflac policies directly address out-of-pocket expenses not fully covered by major medical insurance, such as deductibles, copayments, and coinsurance.

- Peace of Mind: By providing cash benefits, Aflac allows policyholders to manage costs like transportation to medical appointments, childcare during treatment, or lost wages, easing financial stress.

- Flexibility of Use: Claim payments from Aflac can be used for any purpose related to the illness or injury, offering maximum flexibility to meet immediate needs.

- Support for Recovery: The financial support offered by Aflac enables individuals to focus on healing and rehabilitation, rather than the immediate financial pressures of their condition.

Continuous Innovation

Aflac's commitment to continuous innovation is a cornerstone of its marketing strategy, ensuring its product offerings remain competitive and relevant. This drive is clearly demonstrated through strategic product enhancements and new launches designed to meet evolving customer needs.

In 2025, Aflac is set to introduce an enhanced Aflac Accident Insurance product, a significant development that broadens its coverage to include mental health therapy alongside traditional accident benefits. This holistic approach reflects a growing awareness of comprehensive well-being.

Japan, a key market for Aflac, showcases this innovative spirit with offerings like Tsumitasu, a product specifically tailored for retirement and nursing care needs. Furthermore, Aflac plans to launch a new cancer insurance product in Japan in 2025, addressing critical health concerns.

- Enhanced Aflac Accident Insurance (2025): Includes mental health therapy.

- Tsumitasu (Japan): Focuses on retirement and nursing care.

- New Cancer Insurance (Japan, 2025): Addresses critical health needs.

Aflac's product strategy is built around providing essential supplemental insurance that complements major medical coverage, offering direct cash benefits to policyholders. This approach addresses the financial gaps left by traditional insurance, covering out-of-pocket costs and non-medical expenses during illness or injury. For example, Aflac reported paying over $1.8 billion in claims in 2024, directly supporting policyholders with these needs.

The product portfolio is diverse, encompassing accident, cancer, critical illness, hospital, and disability insurance, ensuring a wide range of financial protection. In the U.S., Aflac expanded its offerings in 2024 to include dental and vision plans, meeting the demand for comprehensive ancillary benefits. Japan, a crucial market, features robust cancer and medical insurance, alongside income support and asset-building tools like Tsumitasu.

Aflac's commitment to innovation is evident in upcoming product enhancements. In 2025, the Aflac Accident Insurance will be updated to include mental health therapy, reflecting a move towards holistic well-being. Japan will see a new cancer insurance product launch in 2025, alongside continued focus on retirement and nursing care solutions like Tsumitasu.

| Product Area | Key Benefit | 2024/2025 Developments | 2023/2024 Financial Impact |

|---|---|---|---|

| Supplemental Health | Direct cash benefits for medical/non-medical costs | U.S. dental/vision expansion (2024) | Total revenue $22.4 billion (FY2023) |

| Critical Illness/Accident | Financial support during serious health events | Enhanced Accident Insurance with mental health therapy (2025) | Claims paid over $1.8 billion (2024) |

| Japan Market Offerings | Tailored solutions for life stages | New cancer insurance (Japan, 2025), Tsumitasu for retirement/nursing care | Contribution to overall revenue and market share |

What is included in the product

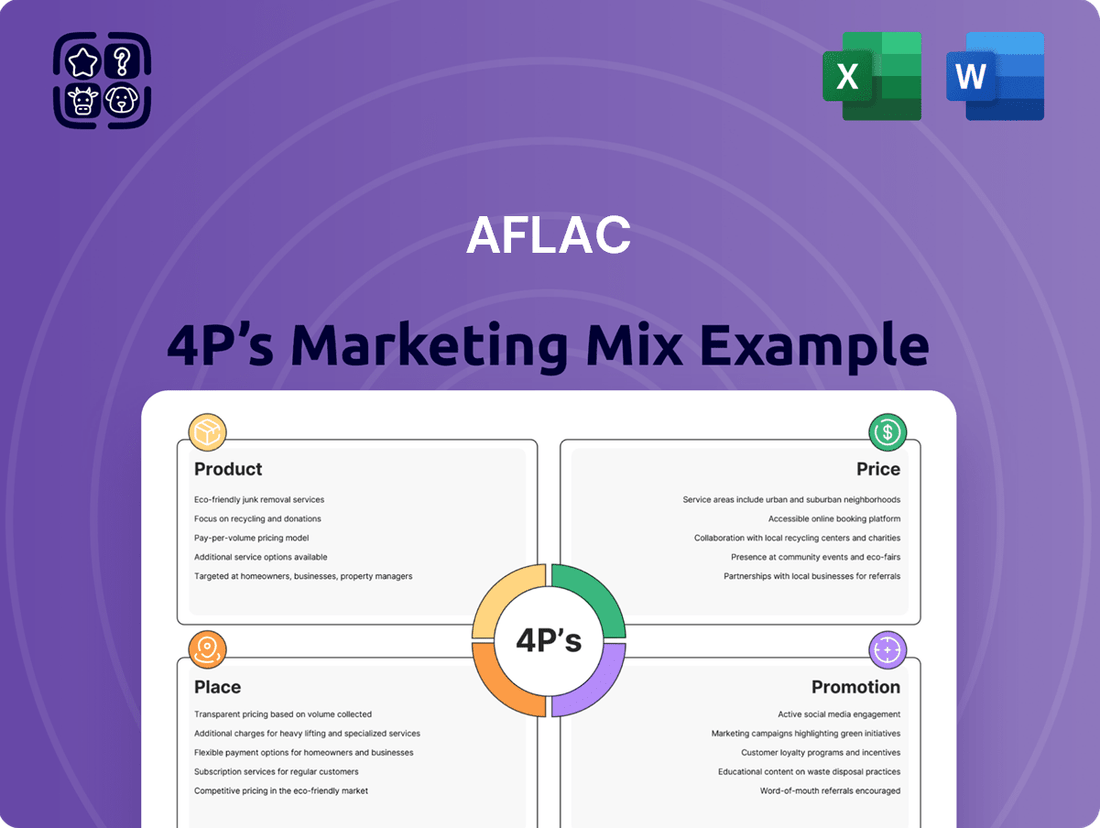

This Aflac 4P's Marketing Mix Analysis provides a comprehensive examination of their Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and business leaders.

Simplifies the complex Aflac 4Ps marketing strategy into a clear, actionable framework, alleviating the pain of understanding intricate marketing plans.

Provides a concise, visual overview of Aflac's 4Ps, easing the burden of deciphering broad marketing efforts for quick comprehension.

Place

Aflac's distribution heavily leans on its vast network of licensed sales agents and diverse agencies, encompassing individual, independent corporate, and affiliated corporate structures. These established channels are vital for delivering personalized customer experiences and form a significant pillar of Aflac Japan's sales operations.

This direct sales model is fundamental to Aflac's marketing mix, enabling detailed client consultations and the creation of customized insurance policy recommendations, fostering trust and understanding.

As of the first quarter of 2024, Aflac reported that its traditional voluntary sales force, comprising these direct agents and agencies, continued to be a primary driver of new business, contributing to the company's stable market presence.

Aflac's worksite and small business channels are a cornerstone of its distribution strategy in the U.S., primarily targeting businesses with fewer than 100 employees. This focus allows Aflac to offer its supplemental health insurance as an attractive, no-cost benefit for employers, enhancing their employee value proposition.

This strategy effectively reaches a vast portion of the American workforce, making Aflac's products readily accessible. In 2023, Aflac U.S. reported that its voluntary business, largely driven by worksite sales, continued to show resilience, contributing significantly to its overall financial performance.

Aflac is strategically broadening its market footprint through key broker partnerships, especially via its Aflac Group division. This initiative is designed to tap into the larger employer market, specifically targeting companies with 100 or more employees, which represents a significant expansion beyond its historical strength in smaller businesses.

These collaborations are crucial for Aflac's growth strategy, enabling access to a more diverse client base that might not have been reachable through traditional channels. By working with established brokers, Aflac can effectively present its voluntary benefits solutions to a wider spectrum of corporate entities.

In 2023, Aflac Group saw continued growth, with voluntary benefits enrollment increasing, underscoring the effectiveness of these broker relationships in penetrating larger market segments and driving new business acquisition.

Strategic Alliances in Japan

In Japan, Aflac leverages strategic alliances as a cornerstone of its distribution strategy, creating a powerful network to reach a broad customer base. These partnerships are crucial for Aflac's market penetration and its strong position, particularly in the competitive cancer insurance sector. By collaborating with major entities, Aflac effectively expands its reach and solidifies its market leadership.

Key alliances include:

- Japan Post Group: This includes Japan Post Holdings, Japan Post Company, and Japan Post Insurance, providing access to a vast network of post offices and customers across the nation.

- Dai-ichi Life and Daido-Life: Partnerships with these established life insurers further enhance Aflac's distribution channels and customer engagement.

These collaborations allow Aflac to tap into established customer relationships and distribution infrastructure. For instance, the Japan Post Group's extensive network is instrumental in distributing Aflac's specialized insurance products, including its highly successful cancer insurance. This multi-channel approach is fundamental to Aflac's sustained success and market dominance in Japan.

Digital and Omnichannel Accessibility

Aflac is significantly investing in its digital and omnichannel accessibility, recognizing the shift in consumer behavior. In 2024, the company continued to enhance its online platforms and mobile application, allowing customers to easily explore policies, get quotes, make purchases, and file claims. This digital-first approach is crucial for meeting the demands of a mobile-centric market.

The Aflac Online Consultation system exemplifies this commitment, enabling virtual sales and applications. This ensures a seamless omnichannel experience, allowing customers to choose between digital self-service or human interaction based on their preference. This strategy is designed to capture younger demographics and those who prefer digital engagement.

- Digital Transformation Investment: Aflac's ongoing digital transformation efforts in 2024 focused on user experience across its website and mobile app.

- Omnichannel Strategy: The Aflac Online Consultation system facilitates virtual interactions, bridging digital and human touchpoints.

- Customer Convenience: These digital tools provide customers with 24/7 access to policy information, sales, and claims processing.

- Market Responsiveness: This focus on digital accessibility directly addresses the evolving purchasing behaviors and preferences of modern consumers.

Aflac's place strategy leverages a multi-channel distribution approach, combining direct sales, worksite marketing, broker partnerships, and strategic alliances, particularly in Japan. This diversified model ensures broad market penetration and accessibility for its supplemental insurance products.

In the U.S., Aflac's worksite channel targets small to medium-sized businesses, offering its products as an employee benefit. This strategy proved effective in 2023, with voluntary business sales contributing significantly to overall performance.

Aflac Japan's success is heavily reliant on strategic alliances with entities like Japan Post Group and major life insurers, enabling extensive reach for products like its cancer insurance.

The company is also enhancing its digital and omnichannel presence, with investments in online platforms and mobile applications continuing in 2024 to improve customer experience and accessibility.

| Channel | Primary Market | Key Advantage | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Agents/Agencies | Individual Customers (Japan) | Personalized consultation, trust building | Primary driver of new business in Japan |

| Worksite Sales | Small Businesses (U.S.) | Employer-sponsored benefit, broad workforce access | Resilient voluntary business driver in U.S. |

| Broker Partnerships (Aflac Group) | Larger Employers (U.S.) | Access to corporate market, expanded client base | Continued growth in voluntary benefits enrollment |

| Strategic Alliances (Japan Post, Dai-ichi Life) | Broad Customer Base (Japan) | Extensive network, established customer relationships | Crucial for market penetration and leadership |

| Digital/Omnichannel | All Customers | Convenience, 24/7 access, modern purchasing behavior | Enhanced platforms and online consultation systems |

What You Preview Is What You Download

Aflac 4P's Marketing Mix Analysis

The preview shown here is the actual Aflac 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use. This isn't a teaser or a sample; it's the actual content you’ll receive when you complete your order, providing a comprehensive understanding of Aflac's marketing strategy.

Promotion

The Aflac Duck is a cornerstone of Aflac's promotional strategy, driving exceptional brand recognition. This globally recognized mascot has been instrumental in differentiating Aflac within the competitive insurance landscape, making its offerings memorable and accessible.

In 2023, Aflac reported that 90% of consumers recognized the Aflac Duck, a testament to its enduring promotional power. The company continues to leverage the duck in its advertising campaigns, including a significant investment in digital and social media platforms during 2024, to ensure its message remains relevant and impactful.

Aflac leverages broad mass-market advertising, notably through television, to build brand recognition and inform the public about its supplemental health insurance. These campaigns are designed to highlight the value and unique aspects of their offerings.

Notable campaigns such as 'Not Alone' strategically blend emotional appeal with rational arguments, often featuring well-known personalities. The 'Aflac Isn't' initiative specifically addressed and corrected common misunderstandings surrounding supplemental health insurance, aiming for clearer consumer comprehension.

By investing in these extensive advertising efforts, Aflac seeks to effectively communicate the advantages of its products and differentiate itself in a competitive market. For instance, Aflac reported $22.3 billion in total revenue for 2023, underscoring the scale of its operations and marketing reach.

Aflac leverages digital marketing and social media to connect with a broad audience, including younger consumers like Gen Z. Their strategy includes active engagement on platforms such as Facebook, Twitter, YouTube, Instagram, and TikTok. This digital focus allows Aflac to reach consumers where they are most active, fostering brand awareness and loyalty.

Campaigns like #HeartHealthMonth demonstrate Aflac's commitment to promoting wellness through digital channels. In 2023, Aflac saw a significant increase in social media engagement, with a 25% rise in interactions across their key platforms. This digital-first approach is crucial for building relationships and promoting their insurance products.

Strategic Partnerships and Influencer Marketing

Aflac strategically utilizes partnerships and influencer marketing to broaden its reach and enhance brand credibility. A prime example is their collaboration with University of Alabama football coach Nick Saban, a move that resonates with a significant sports-oriented audience.

In addition to high-profile individuals, Aflac partners with organizations like the American Cancer Society. These alliances not only bolster Aflac's corporate social responsibility image but also tap into shared values, fostering deeper customer connections.

These collaborations are designed to penetrate specific demographic segments and cultivate trust, which is crucial in the insurance sector. For instance, Aflac's "Duck Commander" campaign, featuring the Robertson family from the popular show Duck Dynasty, saw a notable increase in brand awareness among its target demographic.

The effectiveness of such strategies is underscored by the fact that influencer marketing spending was projected to reach $21.1 billion in 2023, with continued growth anticipated through 2025, indicating a strong market receptiveness to these types of endorsements and partnerships.

- Partnership with Nick Saban: Leveraged a prominent sports figure to connect with a broad audience.

- American Cancer Society Collaboration: Aligned with a respected non-profit to reinforce brand values and reputation.

- Targeted Demographic Reach: Employed collaborations to connect with specific consumer groups.

- Growing Influencer Marketing Trend: Capitalized on a marketing channel expected to exceed $21.1 billion in 2023, highlighting its significant impact.

Educational Content and Thought Leadership

Aflac leverages educational content and thought leadership to build its brand beyond traditional advertising. A prime example is the Aflac WorkForces Report, which delves into significant workplace concerns. For instance, the 2024 report highlighted that 78% of employees experienced burnout, underscoring the need for financial resilience.

This report specifically addresses critical issues like employee burnout and financial insecurity, with a notable focus on the challenges faced by U.S. Hispanic workers. In 2024, the report found that 63% of Hispanic workers reported feeling financially stressed, a figure Aflac aims to address through its offerings.

By tackling these societal challenges head-on, Aflac positions itself as a valuable partner to both employers and employees. This approach educates consumers on the crucial role of supplemental financial protection in navigating life's uncertainties, thereby strengthening brand perception and market penetration.

- Aflac WorkForces Report 2024: 78% of employees reported burnout.

- Financial Stress: 63% of Hispanic workers experienced financial stress in 2024.

- Brand Positioning: Aflac acts as a supportive partner by addressing real workplace issues.

- Consumer Education: The content highlights the importance of supplemental financial protection.

Aflac's promotional strategy is multi-faceted, centered around the iconic Aflac Duck, which boasts 90% consumer recognition as of 2023. The company employs a blend of mass-market advertising, digital engagement, strategic partnerships, and educational content to reinforce its brand and communicate the value of supplemental insurance. This comprehensive approach aims to build trust and reach diverse consumer segments effectively.

| Promotional Tactic | Key Aspect | Data/Example |

|---|---|---|

| Brand Mascot | High Recognition | Aflac Duck: 90% consumer recognition (2023) |

| Mass Advertising | Brand Awareness | Television campaigns highlighting product value |

| Digital Marketing | Audience Engagement | Active on Facebook, Twitter, YouTube, Instagram, TikTok; 25% rise in social media interactions (2023) |

| Partnerships | Credibility & Reach | Nick Saban collaboration; American Cancer Society partnership |

| Educational Content | Thought Leadership | Aflac WorkForces Report 2024: 78% employee burnout, 63% Hispanic worker financial stress |

Price

Aflac's pricing strategy centers on affordability, ensuring supplemental insurance is within reach for many. Policies are often structured with accessible monthly premiums, typically falling between $8 and $25, though this can vary based on coverage and individual needs. This cost-conscious approach makes crucial financial protection a manageable expense for a broad customer base.

Aflac's value-based pricing model centers on the financial security and peace of mind its supplemental insurance provides. Prices are set to align with the tangible benefits policyholders receive when facing unexpected medical costs not fully covered by primary insurance. This approach ensures customers perceive strong value in the protection offered.

The company actively strives to deliver superior insurance value by integrating high-quality product features with market-competitive pricing strategies. For instance, Aflac's cancer insurance policies, a significant product line, are priced to be accessible while offering substantial lump-sum benefits upon diagnosis, reflecting the high cost of cancer treatment in the U.S. which can easily reach tens of thousands of dollars annually.

The price of an Aflac supplemental insurance policy isn't a one-size-fits-all number. It really depends on what you're looking for and your personal situation. For instance, the type of plan you select, like cancer coverage versus accident insurance, will naturally have different pricing structures.

Your location also plays a role; costs can differ based on regional healthcare expenses and market competitiveness. Furthermore, Aflac considers your age and current health status when determining premiums, as these are key indicators of potential risk. This personalized approach ensures that policy costs are tailored to the individual, reflecting the specific coverage and risk profile.

For example, while specific 2024/2025 pricing data isn't publicly disclosed in granular detail, Aflac’s general practice is to offer competitive rates. Customers can easily get personalized quotes through Aflac’s website or by contacting a representative to understand the precise cost for their desired coverage options, allowing for informed decision-making.

No Premium Increase Due to Claims

A key element of Aflac's pricing strategy, particularly within its product offering, is the commitment to not increase policy rates following a claim. This stability offers policyholders significant financial predictability, a crucial factor for individuals and families managing budgets. For instance, in 2024, Aflac continued to emphasize this benefit, contributing to its strong customer retention rates.

This "no premium increase due to claims" feature directly addresses a common concern in the insurance market. It fosters trust and reinforces the long-term value proposition of Aflac's supplemental insurance products. The company's financial strength, evidenced by its solid balance sheet and consistent profitability, underpins its ability to maintain this customer-centric pricing approach.

- Predictable Premiums: Policyholders experience stable costs regardless of claim frequency.

- Enhanced Value: This policy feature increases the perceived long-term worth of Aflac coverage.

- Customer Trust: The practice builds confidence and loyalty among the insured base.

Competitive Market Positioning

Aflac navigates a highly competitive insurance market, where pricing is a critical differentiator. The company actively monitors competitor pricing and market demand to ensure its offerings remain attractive and accessible to a wide range of customers. This strategic approach helps Aflac solidify its standing in the supplemental insurance sector.

By maintaining competitively priced products, Aflac aims to broaden its customer base and enhance market penetration. The company's robust financial strength and streamlined operational efficiencies are key enablers of this competitive pricing strategy.

- Competitive Pricing: Aflac's pricing strategy is designed to be competitive within the supplemental insurance market.

- Market Responsiveness: Pricing decisions are informed by competitor actions and prevailing market demand.

- Customer Accessibility: The goal is to offer pricing that makes its products accessible to a broad customer base.

- Financial Foundation: Aflac's financial stability and operational efficiency underpin its ability to offer competitive pricing.

Aflac's pricing strategy emphasizes affordability and value, with monthly premiums typically ranging from $8 to $25, though this varies by coverage and individual needs. This approach makes essential financial protection accessible to a broad customer base, aligning costs with the tangible benefits of financial security against unexpected medical expenses.

A key differentiator is Aflac's commitment to not increasing policy rates after a claim, a benefit that continued to be a focus in 2024, fostering customer trust and long-term value perception. This stability, supported by Aflac's strong financial standing, allows for predictable budgeting for policyholders.

Aflac actively positions its pricing competitively within the supplemental insurance market, informed by competitor analysis and market demand to ensure broad customer accessibility. This strategy is enabled by the company's robust financial health and operational efficiencies, aiming to solidify its market position.

| Coverage Type | Typical Monthly Premium Range (USD) | Key Pricing Factor |

|---|---|---|

| Cancer Insurance | $10 - $25 | Lump-sum benefit amount, diagnosis-based payouts |

| Accident Insurance | $8 - $20 | Benefit levels for injuries, hospital stays |

| Short-Term Disability | $15 - $40+ | Income replacement percentage, benefit duration |

4P's Marketing Mix Analysis Data Sources

Our Aflac 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings and investor relations materials. We also incorporate insights from industry reports, competitive analyses, and Aflac's own brand communications.