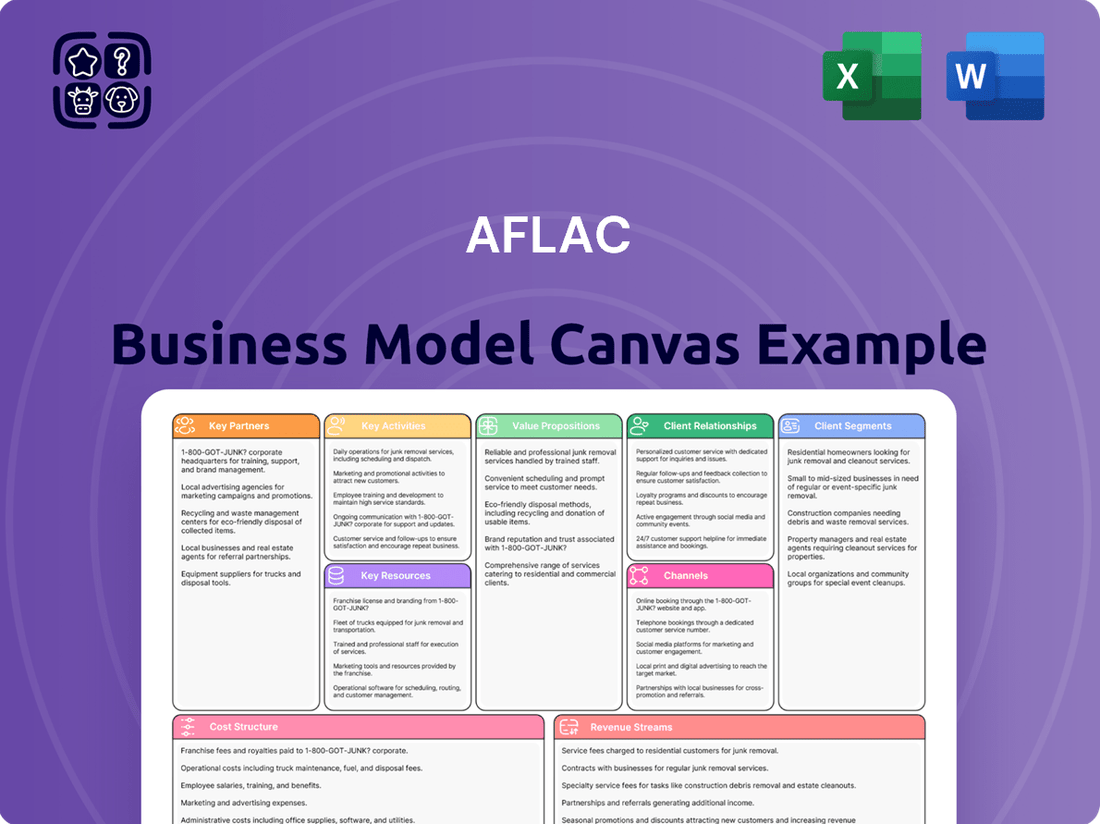

Aflac Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Explore the core of Aflac's success with a focused Business Model Canvas. Understand their unique value propositions and how they connect with key customer segments to deliver specialized insurance products. This snapshot reveals their strategic approach to market penetration and customer loyalty.

Partnerships

Aflac strategically partners with healthcare providers to offer integrated solutions, enhancing policyholder access to a broader service network and simplifying claims. In 2024, Aflac's commitment to these relationships continued to be a cornerstone, aiming to streamline the customer journey during medical events.

These collaborations are designed to leverage existing healthcare infrastructure, improving the overall customer experience. For instance, Aflac's network of providers facilitates easier navigation of benefits for policyholders, especially during critical health moments.

Data exchange with partners is a key element, enabling proactive communication of benefits to policyholders. This proactive approach can significantly reduce out-of-pocket expenses and administrative burdens for individuals facing medical treatments.

Aflac's distribution strategy hinges on its extensive network of independent and captive agents, alongside insurance brokers. In 2024, these partnerships remain vital for Aflac's market penetration, enabling access to a wide array of customer segments, including small businesses and large enterprises.

These intermediaries play a critical role in educating consumers and businesses about the value proposition of supplemental insurance, a key driver for Aflac's continued growth in the competitive landscape.

Aflac strategically partners with technology firms like Nayya to bolster its digital infrastructure. This collaboration directly translates to a smoother claims process and more personalized guidance for policyholders, reflecting a 2024 focus on enhancing customer digital experience.

These technology alliances are crucial for Aflac's ongoing modernization efforts, ensuring the company stays ahead of evolving customer demands for seamless digital interactions within the insurance sector.

Furthermore, Aflac Ventures Lab actively cultivates partnerships with innovative startups. This initiative aims to fast-track the integration of new technologies and ideas across the entire insurance value chain, fostering a culture of continuous improvement and future-proofing its operations.

Financial Institutions in Japan

Aflac's robust network of financial institutions in Japan is a cornerstone of its distribution strategy. In 2024, Aflac Japan continued to deepen its ties with a substantial portion of the nation's banking sector, utilizing these established financial channels to effectively market its insurance products. This extensive reach through banks is critical for Aflac's market penetration, enabling access to a wide and diverse customer base across the country.

These partnerships are not merely transactional; they represent a strategic alliance that allows Aflac to tap into existing customer relationships and trust built by Japanese banks. By leveraging these financial networks, Aflac can offer its specialized insurance solutions directly to bank customers, streamlining the acquisition process and enhancing convenience for policyholders.

Key aspects of these partnerships include:

- Extensive Bank Network: Aflac Japan collaborates with a significant percentage of Japanese banks, providing a vast distribution footprint.

- Product Distribution: Banks act as a primary channel for selling Aflac's cancer insurance and other supplemental health products.

- Customer Access: These relationships facilitate direct access to a broad customer base, enhancing market penetration.

- Leveraging Trust: Aflac benefits from the established trust and credibility that Japanese financial institutions hold with their clients.

Community and Non-Profit Organizations

Aflac's partnerships with community and non-profit organizations, such as the American Cancer Society, are pivotal. These collaborations bolster Aflac's brand image and underscore its dedication to social responsibility. For instance, Aflac's commitment to cancer support is well-documented, with significant contributions aimed at improving patient outcomes and funding research. In 2024, Aflac continued its long-standing support for cancer-related causes, demonstrating a tangible impact on communities it serves.

These alliances serve a dual purpose: they enhance Aflac's ethical reputation and can foster goodwill that indirectly influences sales. By aligning with respected charitable entities, Aflac cultivates a positive public perception, reinforcing its value proposition beyond financial products. This strategic alignment with social causes resonates with consumers and stakeholders alike, building trust and loyalty.

Key aspects of these partnerships include:

- Brand Enhancement: Collaborations with organizations like the American Cancer Society elevate Aflac's public profile and associate it with positive social impact.

- Social Responsibility Alignment: These partnerships directly reflect Aflac's commitment to giving back and supporting critical societal needs, particularly in health.

- Goodwill Generation: By engaging in meaningful community initiatives, Aflac builds a reservoir of goodwill that can translate into increased customer trust and potential sales growth.

Aflac's key partnerships extend to healthcare providers to streamline policyholder access and claims processing, a focus maintained throughout 2024 to improve the customer journey during medical events. Collaborations with technology firms like Nayya bolster digital infrastructure, ensuring smoother claims and personalized policyholder guidance, reflecting a 2024 emphasis on enhanced digital experiences. Furthermore, Aflac Ventures Lab fosters partnerships with startups to integrate new technologies, future-proofing operations and driving innovation across the insurance value chain.

What is included in the product

A detailed breakdown of Aflac's strategy, outlining its core customer segments, value propositions, and distribution channels.

This model highlights Aflac's key resources and activities, focusing on its strong brand recognition and efficient claims processing.

The Aflac Business Model Canvas acts as a pain point reliever by providing a visual framework that simplifies complex insurance offerings, making them easier for customers to understand and for Aflac to manage.

It offers a clear, one-page snapshot of Aflac's value proposition, customer segments, and revenue streams, alleviating the pain of navigating the intricate world of supplemental insurance.

Activities

Aflac's product development focuses on enhancing existing supplemental health and life insurance offerings. For instance, they are actively refining cancer insurance products and improving accident policies to better align with what customers need today. In 2024, Aflac continued to explore adding new benefits, such as mental health coverage and expanded preventive care options, to their suite of products.

Aflac's key activity centers on meticulously assessing risk and underwriting insurance policies. This rigorous process ensures the company's financial stability and fuels sustainable growth by focusing on profitable policy acquisition.

In 2024, Aflac continued to emphasize prudent underwriting, aiming for a balance between market expansion and maintaining healthy profit margins. This disciplined approach is crucial for managing the company's exposure and ensuring long-term viability in a dynamic insurance landscape.

Aflac's core operation hinges on the swift and accurate processing of claims and the direct disbursement of cash benefits to its policyholders. This is a paramount activity, ensuring policyholders receive the financial support they need promptly during times of illness or injury.

The company strives for exceptional efficiency in this area, with a notable target of processing claims within an average of four business days. This rapid turnaround is crucial for policyholders who rely on these benefits for immediate financial relief and to cover unexpected medical expenses.

In 2024, Aflac continued to emphasize its commitment to customer service through its claims process. For instance, Aflac reported that in the first quarter of 2024, its claims and benefits paid out totaled $3.5 billion, demonstrating the scale and importance of this key activity in serving its policyholder base.

Sales and Distribution Management

Aflac's sales and distribution management hinges on its vast network of agents, brokers, and bank partners. This involves providing ongoing support and training to its sales force, ensuring they are equipped to effectively communicate Aflac's value proposition to potential customers. Expanding this distribution reach is crucial for maintaining market share and penetrating new segments.

A key activity is actively recruiting and onboarding new producers to bolster the sales team. In 2023, Aflac continued to focus on agent development, aiming to enhance productivity and service quality. This proactive approach to producer management is vital for sustained growth and market leadership in the voluntary benefits space.

- Agent Network Management: Supporting and training the extensive field force.

- Distribution Expansion: Broadening reach through brokers and bank partnerships.

- Producer Acquisition: Attracting and onboarding new sales talent.

- Market Penetration: Driving sales growth in existing and new markets.

Investment Management

Aflac's investment management is a critical function, as a substantial part of its earnings stems from strategically investing the premiums it collects from policyholders. This involves a rigorous process of asset allocation and risk management to generate returns that not only support ongoing operations but also ensure the company can meet its long-term commitments to its customers.

In 2024, Aflac's investment portfolio plays a pivotal role in its financial health. The company actively manages a diverse range of assets, including fixed income securities, equities, and alternative investments, aiming for a balance between yield and capital preservation. This strategic approach is designed to bolster profitability and financial stability.

- Asset Allocation: Aflac strategically diversifies its investment portfolio across various asset classes to optimize risk-adjusted returns.

- Risk Management: Robust risk management frameworks are employed to safeguard the investment portfolio against market volatility and ensure policyholder security.

- Yield Generation: The primary goal of investment management is to generate consistent income and capital appreciation, contributing significantly to Aflac's overall revenue.

- Meeting Obligations: Investment returns are crucial for fulfilling Aflac's contractual obligations to its policyholders, ensuring the company's long-term solvency.

Aflac's technology and infrastructure management is crucial for its operational efficiency and customer service. This involves maintaining and upgrading the IT systems that support claims processing, policy administration, and customer interactions. Investing in robust technology ensures seamless operations and enhances the policyholder experience.

In 2024, Aflac continued to invest in digital transformation initiatives. For example, they focused on enhancing their online portals and mobile applications to provide policyholders with easier access to policy information and claims submission. This digital focus aims to streamline processes and improve engagement.

Aflac's commitment to data analytics and cybersecurity forms a significant part of its technology strategy. Protecting sensitive policyholder data and leveraging analytics for business insights are paramount. This ensures both compliance and competitive advantage.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Technology & Infrastructure | Maintaining and upgrading IT systems for operational efficiency. | Digital transformation, enhancing online portals and mobile apps. |

| Data Analytics & Cybersecurity | Protecting data and leveraging analytics for business insights. | Strengthening data security protocols and expanding data-driven decision-making. |

| Claims Processing Systems | Ensuring swift and accurate processing of claims. | Targeting an average claims processing time of four business days. |

| Investment Management | Strategically investing premiums to generate returns and meet obligations. | Active management of diverse assets including fixed income and equities. |

Full Document Unlocks After Purchase

Business Model Canvas

The Aflac Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive overview, detailing Aflac's strategic framework, is not a sample but a direct representation of the final deliverable. Once your order is complete, you will gain full access to this exact Business Model Canvas, ready for your analysis and application.

Resources

Aflac's brand recognition is a cornerstone of its business model, significantly boosted by the iconic Aflac Duck and a long-standing commitment to ethical operations. This powerful brand equity is particularly evident in Japan, where Aflac enjoys a remarkable 90% brand recognition, a key factor in attracting and retaining a loyal customer base.

Aflac's financial capital and investment portfolio are the bedrock of its operations, enabling it to fulfill its promises to policyholders and maintain financial strength. This substantial financial backing is essential for underwriting new business and managing existing obligations. As of the close of 2024, Aflac’s robust financial position was underscored by its reported total assets exceeding $166.4 billion.

Aflac's extensive agent and broker networks are a cornerstone of its business model, providing a crucial distribution channel. These networks, encompassing thousands of sales agencies and partnerships with financial institutions, are instrumental in achieving significant market penetration across both the United States and Japan.

This vast reach allows Aflac to connect with a diverse customer base, from individual policyholders to businesses of all sizes, directly fueling sales generation and market share growth. For instance, as of the first quarter of 2024, Aflac U.S. reported continued strength in its voluntary benefits segment, largely driven by its robust distribution capabilities.

Proprietary Technology and Digital Platforms

Aflac's proprietary technology and digital platforms are central to its business model, enabling seamless operations and improved customer engagement. These platforms, including those built through strategic alliances, are designed to simplify sales processes and expedite claims handling.

In 2024, Aflac continued to invest in its digital infrastructure, aiming to provide a more intuitive and efficient experience for policyholders and distributors. This focus on technology allows for quicker policy issuance and faster reimbursement for claims, a critical factor in the supplemental insurance market.

- Digital Sales Channels: Aflac utilizes online portals and mobile applications to facilitate policy purchases, offering convenience and accessibility to a broad customer base.

- Streamlined Claims Processing: The company's digital platforms integrate claims submission and management, allowing for faster adjudication and payment, which is crucial for customer satisfaction.

- Partnership Integration: Aflac collaborates with third-party technology providers to enhance its digital capabilities, ensuring its platforms remain competitive and user-friendly.

- Data Analytics: Advanced analytics driven by these platforms provide insights into customer behavior and operational efficiency, informing strategic decisions and product development.

Skilled Workforce and Expertise

Aflac's skilled workforce, encompassing management, sales professionals, and legal experts, is a cornerstone of its business model. This human capital is critical for navigating the complex insurance landscape and delivering value to policyholders.

The expertise of Aflac's employees in insurance product development, customer service, and regulatory compliance is paramount. Their deep understanding of the market allows Aflac to adapt to evolving customer needs and maintain its competitive edge.

In 2024, Aflac continued to invest in its talent pool, recognizing that employee expertise directly fuels innovation and operational efficiency. This commitment ensures the company remains a leader in the supplemental insurance sector.

- Management Expertise: Aflac's leadership team possesses extensive experience in the insurance industry, guiding strategic direction and financial oversight.

- Sales Force Acumen: Aflac's sales teams are crucial for client acquisition and retention, demonstrating strong knowledge of supplemental insurance products and benefits.

- Legal and Compliance Professionals: These experts ensure Aflac adheres to all regulatory requirements, safeguarding the company and its policyholders.

Aflac's Key Resources are multifaceted, encompassing significant brand equity, robust financial capital, extensive distribution networks, proprietary technology, and a highly skilled workforce. These elements collectively enable Aflac to operate effectively and maintain its competitive position in the insurance market.

Value Propositions

Aflac's core value proposition centers on shielding policyholders from the financial shock of unexpected medical costs. Many individuals, even with major medical insurance, face significant out-of-pocket expenses for deductibles, co-pays, and services not fully covered. Aflac provides direct cash benefits that policyholders can use flexibly to bridge these gaps, alleviating financial strain during times of illness or injury.

This protection is particularly crucial given the persistent rise in healthcare expenses. For instance, in 2024, average deductibles for employer-sponsored health plans continued to be a substantial burden for many American families, often running into thousands of dollars. Aflac's supplemental coverage directly addresses this financial vulnerability, offering a vital safety net.

Aflac’s direct cash benefits offer unparalleled flexibility, unlike traditional health insurance that often restricts fund usage to medical costs. Policyholders receive cash payments directly, empowering them to cover a wide array of everyday needs, from groceries and rent to childcare and utilities. This practical support extends beyond healthcare, providing a crucial financial cushion during times of illness or injury.

Aflac's value proposition centers on providing accessible and adaptable insurance solutions. Their policies are crafted to be budget-friendly, ensuring a broad range of individuals and families can secure financial protection. This affordability is a cornerstone of their offering, making essential coverage attainable.

A significant advantage is the portability of Aflac policies. This means individuals can retain their coverage even when transitioning between employers or entering retirement, without facing premium hikes. This feature offers invaluable long-term financial security and the flexibility to adapt to life's changes.

In 2024, Aflac continued to emphasize these benefits, with millions of policyholders relying on their portable coverage. The company's commitment to affordability is reflected in its diverse product portfolio, designed to meet varied financial needs and circumstances, thereby enhancing peace of mind for its customers.

Simplified Claims Process and Quick Payments

Aflac's value proposition centers on a simplified claims process and swift payment delivery. They aim to alleviate financial burdens by ensuring accepted claims are typically processed within a mere four business days. This rapid turnaround is crucial for policyholders facing unexpected medical expenses.

In 2024, Aflac continued to prioritize this customer-centric approach. Their commitment to efficiency means policyholders can access their benefits quickly, providing much-needed financial relief when it matters most. This focus on speed and simplicity differentiates them in the supplemental insurance market.

- Simplified Claims: Easy-to-understand submission and processing.

- Quick Payments: Accepted claims processed in as little as four business days.

- Financial Relief: Alleviates stress during challenging times.

- Customer Focus: Prioritizes speed and ease for policyholders.

Preventive Care Incentives and Holistic Support

Aflac's value proposition centers on providing robust support through preventive care incentives and comprehensive post-event recovery. Many Aflac policies are structured to reward members for engaging in proactive health measures, thereby fostering a culture of wellness. In 2024, this approach is further strengthened by new policy designs that extend coverage to a wider array of recovery services.

This expanded coverage is particularly impactful for individuals facing unexpected health challenges. For instance, Aflac's enhanced offerings now include mental health therapy as part of post-accident treatment plans. This holistic approach acknowledges the multifaceted nature of recovery, ensuring members receive support not just physically, but also emotionally.

- Preventive Care Focus: Policies incentivize regular check-ups and screenings, aiming to catch potential health issues early.

- Holistic Recovery: Expanded benefits now encompass mental health services, recognizing the importance of psychological well-being in the recovery process.

- Broader Treatment Coverage: Aflac is broadening its scope to include a wider range of post-accident therapies, offering more comprehensive financial assistance.

Aflac's value proposition is built on delivering flexible, accessible, and affordable supplemental insurance. They focus on providing direct cash benefits that policyholders can use for any purpose, bridging financial gaps left by major medical plans. This approach offers a vital safety net, especially as healthcare costs continue to rise.

The company emphasizes ease of use through a simplified claims process and rapid payment delivery, typically processing accepted claims within four business days. This efficiency ensures policyholders receive much-needed financial relief quickly during challenging times.

Furthermore, Aflac promotes wellness through preventive care incentives and offers comprehensive post-event recovery support, including expanded coverage for services like mental health therapy. This holistic approach underscores their commitment to policyholder well-being.

| Value Proposition Aspect | Key Benefit | 2024 Context/Data |

|---|---|---|

| Financial Protection | Direct cash benefits to cover out-of-pocket medical costs and everyday expenses. | Millions of Americans rely on Aflac to supplement employer-sponsored health plans, mitigating financial strain from deductibles and co-pays. |

| Simplicity & Speed | Streamlined claims submission and rapid payment processing. | Aflac's commitment to processing accepted claims in as little as four business days provides immediate financial relief. |

| Flexibility & Portability | Cash benefits usable for any need; coverage remains with the policyholder regardless of employment changes. | Policyholders value the ability to use funds for rent, groceries, or childcare, and retain coverage during job transitions. |

| Wellness & Recovery | Incentives for preventive care and expanded coverage for recovery services. | New policy designs in 2024 included mental health therapy in post-accident treatment plans, reflecting a broader approach to recovery. |

Customer Relationships

Aflac's customer relationships are largely built on direct engagement facilitated by its extensive network of agents and brokers. These intermediaries act as the primary point of contact, offering personalized consultations to explain complex policy details and guide customers through the enrollment process.

This personal interaction is crucial for fostering trust and ensuring customers understand their coverage. In 2024, Aflac continued to leverage this model, with a significant portion of its new business originating through these direct channels, underscoring the value placed on human connection in insurance sales.

Aflac provides digital self-service options through online portals and mobile applications, allowing policyholders to manage their accounts, access policy details, and initiate claims conveniently. This digital approach caters to customers who prefer self-directed interactions and enhances accessibility outside traditional business hours. In 2024, Aflac continued to invest in its digital infrastructure, aiming to streamline customer experience and reduce administrative burdens.

Aflac distinguishes itself through dedicated customer service, offering robust assistance for policy inquiries, ongoing management, and the crucial claims process. This commitment aims to streamline interactions, especially during sensitive periods, making the experience as manageable as possible for policyholders.

In 2024, Aflac continued to emphasize its customer-centric approach. The company reported that its customer satisfaction scores remained high, with a significant percentage of policyholders indicating they felt well-supported throughout their claims journey.

Employer-Sponsored Benefit Programs

For many individuals, their primary interaction with Aflac is indirectly, through their employer. Aflac policies are frequently integrated into employee benefits packages, making the employer the key facilitator of this relationship. This B2B2C model is crucial for Aflac's reach.

Aflac partners with businesses to offer these valuable benefits, often structured so that employers incur minimal to no direct financial outlay for providing these supplemental insurance options to their workforce. This approach incentivizes employers to adopt Aflac's offerings.

- Employer as Intermediary: The employer acts as the primary point of contact and administrator for Aflac policies, simplifying the process for individual policyholders.

- Employer Cost-Effectiveness: Aflac's model often presents a cost-neutral or cost-saving proposition for employers, encouraging widespread adoption of their benefit programs.

- 2024 Data Point: In 2024, Aflac continued to emphasize its employer-sponsored channels, which remain a significant driver of new policy acquisition and customer engagement across its diverse product lines.

Partnerships for Enhanced Support Services

Aflac deepens customer relationships by forging strategic partnerships that offer valuable, specialized services. A prime example is their collaboration with Empathy, a company providing advanced legacy planning and crucial loss support to Aflac policyholders. This initiative goes beyond standard insurance coverage, aiming to offer holistic assistance during significant life events.

These alliances are designed to enhance the overall customer experience, demonstrating Aflac's dedication to supporting policyholders through various life stages and challenges. By integrating services like those from Empathy, Aflac aims to become a more integral part of their customers' financial and emotional well-being.

- Partnership with Empathy: Offers legacy planning and loss support services to Aflac policyholders.

- Enhanced Customer Care: Extends support beyond traditional insurance benefits to cover significant life events.

- Commitment to Holistic Support: Positions Aflac as a partner in policyholders' financial and emotional well-being.

Aflac's customer relationships are multifaceted, blending direct agent interaction with robust digital self-service options. This dual approach ensures personalized guidance for complex policy needs while offering convenient account management for digitally inclined customers. In 2024, Aflac reported continued strength in both these channels, with a notable uptick in digital claims submissions.

Furthermore, Aflac leverages employer partnerships as a key relationship driver, integrating its offerings into employee benefits packages. This B2B2C model streamlines access for individuals, with employers acting as crucial facilitators. The company's 2024 performance highlighted the sustained importance of these employer-sponsored relationships for new policy acquisition.

Aflac also cultivates deeper connections through strategic alliances, such as its partnership with Empathy, to provide enhanced support during life events like loss. This commitment to holistic care, extending beyond core insurance, aims to solidify Aflac's role as a trusted partner. In 2024, customer feedback indicated appreciation for these value-added services.

| Relationship Channel | Key Features | 2024 Focus/Impact |

|---|---|---|

| Direct Agents/Brokers | Personalized consultation, policy explanation, trust-building | Significant driver of new business, emphasis on human connection |

| Digital Self-Service | Online portals, mobile apps for account management and claims | Investment in infrastructure for streamlined experience, increased digital claims |

| Employer Sponsorship (B2B2C) | Integration into benefits, employer as facilitator | Continued emphasis on employer channels for policy acquisition |

| Strategic Partnerships (e.g., Empathy) | Value-added services (legacy planning, loss support) | Enhancing customer experience and holistic support |

Channels

Aflac's business model heavily relies on its robust distribution channels, primarily independent and captive agents. These agents are the frontline force, directly engaging with potential customers to explain Aflac's diverse range of insurance products. This direct interaction is crucial for building trust and ensuring policyholders understand the benefits and coverage offered.

In 2024, Aflac continued to leverage this extensive agent network to drive sales. The company reported that its agent force plays a pivotal role in its success, particularly in the voluntary benefits market where personalized guidance is highly valued. This direct sales approach allows for tailored solutions that meet the specific needs of both individuals and small businesses.

Insurance brokers are a key channel for Aflac, particularly in reaching the mid- to large-case and larger employer markets. By partnering with these brokers, Aflac integrates its supplemental insurance products into comprehensive benefits packages, effectively expanding its footprint in the group benefits sector.

In 2024, the group benefits market continued to be a significant area of focus for Aflac. This channel allows Aflac to offer its specialized products to a wider employee base, contributing to its overall market penetration and revenue growth.

In Japan, Aflac's business model heavily relies on its extensive bank partnerships, a key channel for distributing its insurance products. These collaborations allow Aflac to tap into the vast customer bases of numerous Japanese banks, effectively reaching a broad market. As of 2024, Aflac Japan has established agreements with a significant majority of the nation's banks, underscoring the strategic importance of this distribution network for its market penetration and sales volume.

Digital Platforms and Online Sales

Aflac leverages its digital platforms, including its website and mobile apps, to facilitate direct-to-consumer sales and ongoing customer engagement. This allows individuals to easily purchase insurance policies and manage their accounts entirely online, catering to a growing segment of customers who prefer digital interactions.

These digital channels are crucial for providing self-service options and a convenient user experience. By offering policy information, enrollment, and claims processing through these platforms, Aflac enhances accessibility and efficiency for its policyholders.

- Website and Mobile App Usage: Aflac's digital presence serves as a primary touchpoint for many customers seeking information or policy management.

- Direct-to-Consumer Sales: The online platforms enable individuals to directly purchase Aflac products, bypassing traditional sales channels.

- Customer Self-Service: Policyholders can manage their accounts, update information, and initiate claims digitally, improving convenience.

- Digital Engagement Growth: In 2024, Aflac continued to see an increase in digital interactions, with a significant portion of new policy inquiries and customer service requests handled through its online and mobile channels.

Worksite Marketing and Employer Programs

Worksite marketing is a cornerstone of Aflac's U.S. strategy, allowing direct access to employees through their employers. This channel offers a streamlined way to present supplemental insurance solutions as part of employee benefits packages, reaching a vast potential customer base efficiently.

In 2024, Aflac continued to leverage employer partnerships, a model that proved highly effective in expanding its reach. This approach allows for targeted enrollment periods and often includes payroll deductions, simplifying premium payments for policyholders and reducing administrative burdens for Aflac.

- Efficient Distribution: Worksite marketing provides a cost-effective method to reach a concentrated group of potential customers.

- Employee Benefits Integration: Supplemental insurance is offered alongside core benefits, making it a natural addition for employees.

- Payroll Deduction: This payment method enhances policyholder convenience and improves premium collection rates.

- Market Penetration: Partnerships with employers allow Aflac to tap into a significant portion of the working population.

Aflac's distribution strategy is multifaceted, employing a mix of direct sales, partnerships, and digital engagement to reach its target markets. The company's reliance on its agent network, insurance brokers, bank partnerships in Japan, and worksite marketing highlights a commitment to personalized outreach and strategic market penetration. These channels are vital for explaining complex insurance products and facilitating easy enrollment and premium payments.

The effectiveness of these channels is evident in Aflac's continued market presence. For instance, the company's extensive agent force is key to its success in the voluntary benefits sector, where tailored advice is paramount. In 2024, Aflac's digital platforms also saw increased usage, indicating a growing customer preference for online self-service and direct purchasing options.

Aflac's commitment to worksite marketing in the U.S. allows for efficient access to employees through employer-sponsored benefit programs. This strategy, coupled with payroll deductions, simplifies the process for both policyholders and the company, contributing to consistent premium collection and increased policyholder retention. These varied channels collectively support Aflac's mission to provide financial security.

| Channel | Primary Market Focus | Key Role in Business Model | 2024 Trend/Data Point |

|---|---|---|---|

| Independent & Captive Agents | Individual & Small Business (Voluntary Benefits) | Direct customer engagement, product explanation, trust building | Continued driver of sales in voluntary benefits market. |

| Insurance Brokers | Mid- to Large-Case Employers (Group Benefits) | Integration into comprehensive benefits packages, expanding group market reach | Significant contributor to group benefits sector growth. |

| Bank Partnerships (Japan) | Broad Consumer Market (Japan) | Leveraging vast customer bases for product distribution | Agreements with a majority of Japanese banks in 2024. |

| Digital Platforms (Website/App) | Direct-to-Consumer | Online sales, policy management, customer self-service | Increased customer interaction and digital inquiries in 2024. |

| Worksite Marketing | Employees via Employers (U.S.) | Direct access to employees, integration with payroll deductions | Effective expansion of reach through employer partnerships. |

Customer Segments

Individuals seeking supplemental health coverage are a key customer segment for Aflac. This group typically has primary major medical insurance but wants extra financial security for unforeseen medical costs. Many worry about increasing healthcare expenses and the burden of high deductibles, looking for ways to bridge the gap.

For instance, in 2024, the average deductible for a Bronze health plan under the Affordable Care Act was around $6,000, with some plans reaching as high as $9,100. This highlights the significant out-of-pocket exposure many individuals face, making supplemental coverage appealing.

Aflac keenly focuses on Small to Medium-Sized Businesses (SMBs) that recognize the importance of supplemental benefits for employee attraction and retention. These companies are often looking for ways to enhance their benefits offerings without incurring substantial direct costs.

SMBs prioritize competitive benefits packages that don't add significant overhead. In 2024, the demand for affordable, value-added employee benefits continues to be a key differentiator for businesses of all sizes.

Aflac's Aflac Group segment targets large corporations, typically those with 100 or more employees, through direct sales and strategic broker partnerships. This segment is crucial for Aflac's expansion into the group benefits market, offering tailored solutions that meet the diverse needs of a larger workforce.

These larger employers are actively seeking comprehensive and adaptable benefits packages to attract and retain talent. In 2024, the demand for robust voluntary benefits, which complement core employer-provided insurance, continued to grow as companies looked for cost-effective ways to enhance their employee offerings.

Aflac's strategy here involves providing a suite of group products, including accident, critical illness, and hospital indemnity insurance, designed to fill gaps in traditional health coverage. This focus on supplemental insurance addresses the increasing desire among employees for greater financial protection against unexpected medical costs.

Cancer and Medical Insurance Seekers in Japan

Aflac Japan's primary customer segment consists of individuals actively seeking cancer and medical insurance, a niche where the company has established a dominant market presence. These individuals are often motivated by a proactive approach to managing potential health risks, particularly concerning cancer, which remains a significant health concern in Japan.

This customer base frequently includes those who desire specialized coverage beyond standard national health insurance, seeking to mitigate out-of-pocket expenses and income loss associated with serious illnesses. Their decision-making process is often driven by a need for financial security and peace of mind when facing health challenges.

- Market Leadership: Aflac Japan is a leading provider of cancer insurance in the country.

- Health Concerns: Customers are often individuals with specific health concerns or a desire for enhanced protection against critical illnesses like cancer.

- Financial Protection: The segment seeks to supplement national health insurance and cover potential income disruptions due to medical treatment.

- 2024 Data Insight: In 2024, Aflac's cancer insurance policies in Japan continued to be a cornerstone of their offerings, reflecting sustained demand for specialized health coverage.

Employees Facing Financial Stress Due to Healthcare Costs

A significant portion of the workforce experiences financial strain from healthcare expenses. Many employees struggle to cover even minor out-of-pocket medical costs, leaving them vulnerable to unexpected health events. For instance, a 2024 survey indicated that over 40% of Americans would have difficulty covering a $400 emergency expense, a figure that often includes medical bills.

Aflac directly addresses this vulnerability by offering supplemental insurance that provides cash benefits to help offset these costs. These benefits can be used for deductibles, copayments, or other living expenses, easing the financial burden on employees.

- Financial Vulnerability: Many employees lack sufficient savings to cover unexpected medical bills, leading to significant financial stress.

- Out-of-Pocket Costs: Even with primary health insurance, deductibles and copays can amount to thousands of dollars annually, posing a challenge for many households.

- Aflac's Solution: Supplemental insurance provides immediate cash payments to help employees manage these out-of-pocket medical expenses and maintain financial stability.

Aflac's customer base is diverse, encompassing individuals and businesses seeking financial protection against healthcare's rising costs. The company targets those with primary insurance who want to cover out-of-pocket expenses and businesses, particularly SMBs, aiming to enhance employee benefits without significant overhead.

In Japan, Aflac specifically caters to individuals seeking specialized coverage, especially for cancer and other critical illnesses, supplementing national health insurance. This focus on critical illness protection remains a strong driver for their Japanese market segment.

By 2024, the increasing prevalence of high deductibles in major medical plans, often exceeding $6,000 for ACA plans, underscored the need for supplemental coverage. This financial vulnerability among individuals and the desire for attractive, cost-effective benefits by employers are key drivers for Aflac's offerings.

| Customer Segment | Key Characteristics | 2024 Relevance |

| Individuals | Seeking supplemental health coverage for out-of-pocket medical costs, high deductibles. | Average ACA Bronze deductible around $6,000 in 2024, highlighting financial exposure. |

| Small to Medium-Sized Businesses (SMBs) | Aiming to enhance employee benefits for attraction and retention without high costs. | Demand for affordable, value-added employee benefits remains a key differentiator for businesses. |

| Large Corporations (Aflac Group) | Seeking comprehensive and adaptable voluntary benefits to complement core offerings. | Continued growth in demand for robust voluntary benefits to enhance employee packages. |

| Individuals (Aflac Japan) | Seeking specialized cancer and medical insurance to supplement national health insurance. | Sustained demand for cancer insurance reflects ongoing concerns about critical illness protection. |

Cost Structure

The most significant expense for Aflac is undoubtedly the payout of benefits and claims to its policyholders. This cost is the very essence of its insurance operations, directly tied to the frequency and severity of insured events. For instance, in fiscal year 2023, Aflac reported total benefits and claims of $16.7 billion, a substantial portion of its overall expenditures.

Aflac's cost structure heavily features sales commissions and agent compensation, a significant expense stemming from its reliance on a vast, independent sales force. This commission-based model, while effective for market penetration, directly ties a large portion of operating costs to sales volume.

In 2023, Aflac's total operating expenses were approximately $18.9 billion. While specific breakdowns for sales commissions aren't always publicly detailed, insurance industry benchmarks suggest this category can represent a substantial percentage of premiums collected, directly impacting profitability.

Aflac allocates substantial resources to marketing and advertising, a critical component of its cost structure. These expenses are vital for educating potential customers about its supplemental insurance products and solidifying its brand presence in key markets like the United States and Japan. The iconic Aflac Duck campaigns, for instance, represent a significant investment in consumer awareness and brand recall.

In 2023, Aflac's total marketing and advertising expenses amounted to $547 million. This figure underscores the company's commitment to maintaining a strong brand identity and reaching a broad audience through various media channels, making it a considerable operational expenditure.

General, Administrative, and Operational Costs

Aflac's general, administrative, and operational costs are the backbone of its business, encompassing everything from employee salaries to the technology that keeps its operations humming. These expenses are vital for maintaining the infrastructure and personnel necessary to support its insurance products and services. Efficient management here directly impacts the company's bottom line.

In 2024, Aflac has continued to focus on optimizing these costs. For instance, the company invests heavily in its technology infrastructure to streamline claims processing and customer service, which, while an expense, aims to improve long-term efficiency and customer satisfaction. Regulatory compliance, a significant operational cost for any insurer, is also a key area of expenditure, ensuring adherence to all legal and financial standards.

- Salaries and Benefits: Compensation for non-sales staff, including executives, support teams, and IT professionals.

- Occupancy Costs: Rent, utilities, and maintenance for corporate offices and operational facilities.

- Technology and Systems: Investments in IT infrastructure, software development, data management, and cybersecurity.

- Regulatory and Compliance: Expenses associated with meeting insurance regulations, legal fees, and audit requirements.

Investment Management and Capital Costs

Aflac's investment management and capital costs are a significant component of its expense structure. These include the expenses incurred in managing its vast investment portfolio, such as management fees paid to external asset managers and internal operational costs. For instance, in 2023, Aflac reported investment management expenses of $1.8 billion, reflecting the scale of its asset base.

Beyond operational management, potential investment losses also factor into this cost. While Aflac aims for stable returns, market volatility can lead to unrealized or realized losses, impacting profitability. The company's financial statements for the first quarter of 2024 showed net investment income of $1.5 billion, but this figure is subject to fluctuations based on market performance.

Furthermore, capital management activities, such as share repurchases, represent substantial capital deployment and are considered a cost in terms of cash outflow. In 2023, Aflac repurchased approximately $1.1 billion of its common stock, demonstrating a commitment to returning capital to shareholders.

- Investment Management Expenses: $1.8 billion in 2023.

- Net Investment Income: $1.5 billion in Q1 2024.

- Share Repurchases: Approximately $1.1 billion in 2023.

Aflac's cost structure is dominated by the payout of benefits and claims, which reached $16.7 billion in fiscal year 2023. This is followed by operating expenses, totaling approximately $18.9 billion in 2023, which include significant investments in sales commissions, marketing, and general administration. The company also incurs substantial costs related to investment management, with $1.8 billion reported in 2023, alongside capital management activities like share repurchases.

| Expense Category | 2023 Data | Key Components |

|---|---|---|

| Benefits and Claims | $16.7 billion | Policyholder payouts for insured events |

| Operating Expenses | ~$18.9 billion | Sales commissions, marketing, salaries, technology, regulatory compliance |

| Investment Management | $1.8 billion | Asset management fees, operational costs for investment portfolio |

| Capital Management | ~$1.1 billion (Share Repurchases) | Returning capital to shareholders |

Revenue Streams

Aflac's primary revenue stream is generated from insurance premiums paid by policyholders for supplemental health and life insurance. These recurring payments create a stable and predictable income flow for the company.

In 2024, Aflac continued to rely heavily on these premium collections, which form the bedrock of its financial model. The company's ability to attract and retain a large base of policyholders directly translates into consistent revenue.

Aflac's investment income is a cornerstone of its financial strategy, with premiums collected from policyholders being actively managed and invested across a diverse portfolio. In 2023, Aflac reported net investment income of $7.3 billion, a testament to the significant contribution this stream makes to its overall profitability.

These investment gains, derived from a mix of fixed-income securities, equities, and other financial assets, play a crucial role in bolstering Aflac's earnings and supporting its ability to pay claims and operational expenses.

Aflac generates revenue from policyholder service fees, which cover essential administrative tasks like claims processing and policy changes. These fees are crucial for maintaining the operational efficiency and supporting the ongoing management of their insurance products.

New Policy Sales (Annualized Premium)

Aflac's revenue is significantly driven by the annualized premium from new policy sales. This stream reflects the company's ability to attract new customers and expand its market reach. A key driver in recent performance has been Aflac Japan's successful introduction of new products, such as 'Tsumitasu,' which directly contribute to this revenue segment's growth, demonstrating the effectiveness of their product development and sales strategies.

In 2024, Aflac's commitment to expanding its product portfolio and sales channels is evident. For instance, the company has focused on enhancing its digital sales capabilities and agent support to drive higher volumes of new policy acquisitions. This strategic emphasis aims to capture a larger share of the voluntary insurance market.

- New Policy Sales Growth: Aflac Japan's 'Tsumitasu' product launch exemplifies successful revenue generation through innovative offerings.

- Annualized Premium Focus: This revenue stream is a critical indicator of Aflac's ongoing customer acquisition and market penetration efforts.

- 2024 Performance Indicators: The company's strategic initiatives in 2024 are geared towards increasing the volume of new policy sales across its key markets.

Reinsurance Transactions

Reinsurance transactions represent a significant, albeit indirect, revenue stream for Aflac. By ceding a portion of its risk and associated premiums to other insurers, Aflac can manage its capital more effectively and reduce its exposure to large, unexpected losses. Conversely, assuming risk from other insurers can generate premium income. These activities directly influence Aflac's net earned premiums, which are a key component of its overall revenue.

In 2024, the reinsurance market continued to be a critical area for insurers like Aflac. While specific figures for Aflac's reinsurance revenue are not publicly itemized separately from its core insurance premiums, the broader industry trends highlight its importance. For instance, global reinsurance premiums were projected to see continued growth, driven by increasing demand for risk transfer solutions amidst evolving global risks. Aflac's participation in this market allows it to optimize its risk portfolio and potentially enhance profitability through selective risk assumption.

- Risk Management: Reinsurance allows Aflac to transfer a portion of its insurance liabilities and premiums to reinsurers, thereby reducing its own capital requirements and potential for large losses.

- Premium Income: By assuming risk from other insurers, Aflac can generate additional premium income, diversifying its revenue base.

- Net Earned Premiums: The net effect of ceding and assuming risks directly impacts Aflac's net earned premiums, a crucial metric for profitability and financial health.

- Market Dynamics: In 2024, the reinsurance market remained robust, with insurers actively seeking capacity to manage their growing risk exposures, presenting opportunities for Aflac to engage in profitable reinsurance arrangements.

Aflac's revenue streams are multifaceted, primarily driven by insurance premiums from its supplemental health and life insurance products. These recurring payments provide a stable income foundation. Furthermore, Aflac actively manages and invests the premiums it collects, generating significant investment income. In 2023, this investment income reached $7.3 billion, underscoring its importance to the company's profitability and ability to meet obligations.

| Revenue Stream | Description | 2023 Contribution (Approx.) |

|---|---|---|

| Insurance Premiums | Recurring payments from policyholders for coverage. | Majority of total revenue |

| Investment Income | Returns generated from investing collected premiums. | $7.3 billion |

| Policyholder Service Fees | Fees for administrative tasks like claims processing. | Contributes to operational efficiency |

| New Policy Sales | Revenue from acquiring new customers and expanding market reach. | Key growth driver, boosted by new products like 'Tsumitasu' |

| Reinsurance | Income from assuming risk and managing capital through risk transfer. | Indirect impact on net earned premiums; market robust in 2024 |

Business Model Canvas Data Sources

The Aflac Business Model Canvas is constructed using Aflac's annual reports, investor relations data, and market research on the supplemental insurance sector. This ensures a data-driven approach to understanding Aflac's strategy and operations.