Aflac Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Curious about Aflac's strategic product portfolio? This glimpse into their BCG Matrix highlights how their offerings are positioned for growth and profitability. Understand which products are fueling their success and which might need a closer look.

Ready to unlock the full picture? Purchase the complete Aflac BCG Matrix report to gain detailed quadrant placements, identify their Stars, Cash Cows, Dogs, and Question Marks, and receive actionable insights to guide your own strategic decisions.

Stars

Aflac Japan stands as the undisputed leader in cancer and medical insurance within Japan, boasting a commanding market share built on years of experience and strong brand trust. This dominance positions it favorably within the BCG matrix.

The company is set to introduce a new cancer insurance product in the spring of 2025, with early feedback indicating promising results. This strategic move aims to further solidify its market leadership.

The critical illness insurance sector is experiencing robust expansion, with global market size expected to climb from $286.98 billion in 2024 to $330.36 billion in 2025. This substantial growth underscores the high-potential nature of this market segment for Aflac.

Aflac's supplemental health insurance in the U.S. is a clear star in its portfolio. As the leading provider with a substantial 27% market share, Aflac is well-positioned within this expanding sector.

The U.S. supplemental health market is experiencing robust growth, with projections indicating an increase from USD 40.58 billion in 2025 to an estimated USD 66.45 billion by 2034. This impressive compound annual growth rate of 5.60% underscores the market's vitality and Aflac's strong presence within it.

Aflac introduced its new individual Accident Insurance product in February 2025, enhancing coverage with benefits like mental health therapy and expanded preventive care. This launch directly targets a critical financial vulnerability, with a staggering 51% of American employees unable to cover a $1,000 unexpected medical expense out-of-pocket, highlighting a substantial market opportunity.

Group Life and Disability Products (U.S.)

Aflac's Group Life and Disability products in the U.S. are showing strong performance, contributing significantly to the company's overall growth. In the first quarter of 2025, Aflac U.S. reported a 3.5% year-over-year increase in sales, with these group offerings playing a key role in this expansion.

The strategic push through Aflac Group is designed to broaden the company's footprint by empowering brokers to cater to larger employers. This initiative taps into a market segment with considerable growth potential, as more businesses seek comprehensive group benefit solutions.

- Sales Growth: Aflac U.S. experienced a 3.5% year-over-year sales increase in Q1 2025, with group life and disability products being a key driver.

- Market Expansion: Aflac Group's strategy to enable brokers to serve larger employers opens up significant new market opportunities.

- Strategic Focus: The emphasis on growing the group benefits market segment reflects a deliberate effort to capture a larger share in a sector with promising expansion prospects.

Tsumitasu Product (Japan)

Aflac Japan's Tsumitasu product is a key driver of its recent success, contributing to a 12.6% year-over-year sales increase in Q1 2025.

This product is strategically positioned to address both the accumulating wealth for retirement and the ongoing coverage needs after retirement, making it a comprehensive solution.

Its particular success in attracting younger customers is a significant advantage in Japan's aging demographic landscape.

This focus on younger demographics signals a forward-thinking, high-growth strategy aimed at securing future market leadership for Aflac in Japan.

- Product Focus: Tsumitasu addresses both retirement asset formation and post-retirement coverage.

- Sales Growth: Contributed to a 12.6% year-over-year sales increase for Aflac Japan in Q1 2025.

- Demographic Appeal: Highly effective in acquiring younger customers.

- Strategic Importance: Targets younger demographics in an aging market for future growth.

Aflac's U.S. supplemental health insurance and its Group Life and Disability products in the U.S. are strong contenders for Star status. The U.S. supplemental health market is projected to grow from $40.58 billion in 2025 to $66.45 billion by 2034, with Aflac holding a significant 27% market share. Furthermore, Aflac U.S. saw a 3.5% year-over-year sales increase in Q1 2025, partly driven by its group offerings, which are expanding through a strategy to serve larger employers.

| Product Segment | Market Share (U.S. Supplemental Health) | Projected Market Growth (U.S. Supplemental Health) | Q1 2025 Sales Growth (Aflac U.S.) |

| U.S. Supplemental Health | 27% | $40.58B (2025) to $66.45B (2034) | N/A (driven by overall U.S. growth) |

| U.S. Group Life & Disability | N/A | N/A | Key driver of 3.5% YoY growth |

What is included in the product

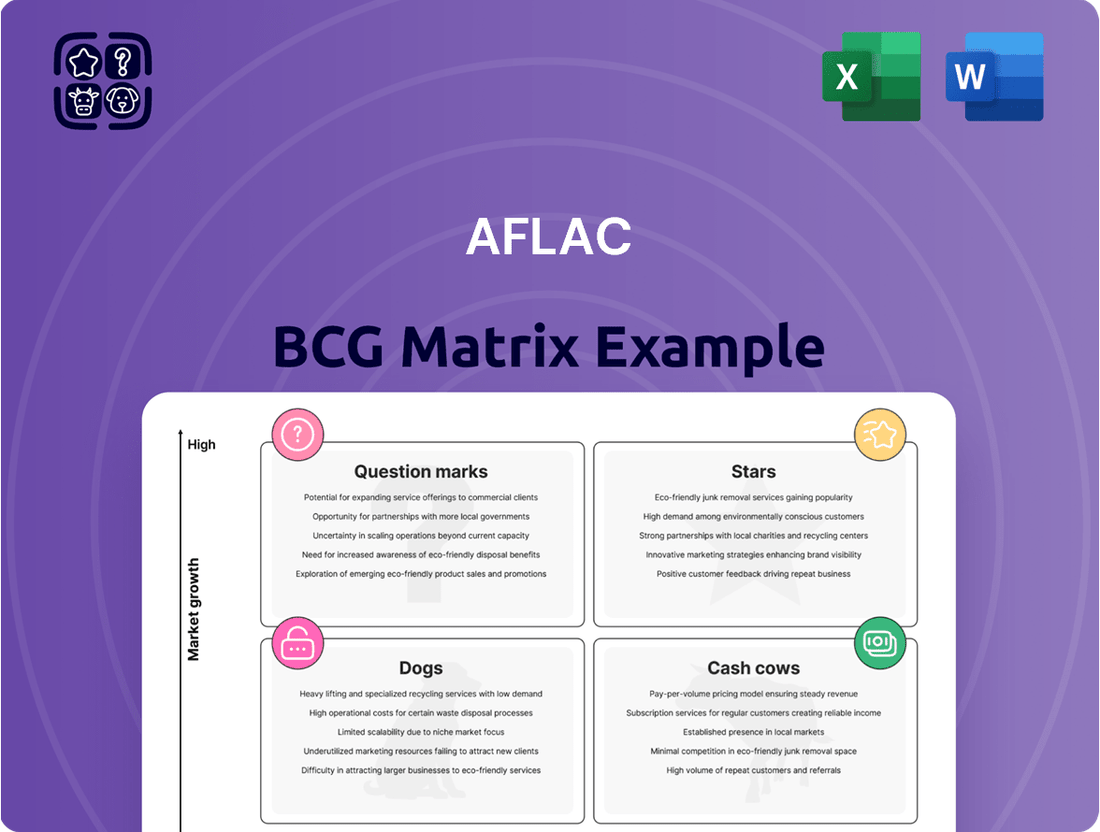

The Aflac BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis helps Aflac allocate resources effectively, identifying which units to invest in, hold, or divest for optimal portfolio performance.

Aflac's BCG Matrix offers a clear, one-page overview of its business units, simplifying complex portfolio analysis for swift decision-making.

Cash Cows

Aflac Japan's established insurance portfolio is a definitive cash cow for the company. This segment is the bedrock of Aflac's financial strength, contributing roughly 70% of its pretax adjusted earnings and holding a substantial 77% of total assets as of recent reporting periods.

The high premium persistency rate observed in Aflac Japan underscores its robust customer loyalty and the enduring value proposition of its offerings. This indicates that policyholders are consistently renewing their coverage, a clear sign of a stable and reliable revenue stream.

Despite market dynamics, Aflac Japan continues to hold its position as the leading provider of cancer and medical insurance policies in force within Japan. This market leadership, coupled with consistent customer retention, ensures this segment remains a significant and dependable generator of substantial cash flow for the entire Aflac organization.

Aflac's U.S. core supplemental offerings, encompassing critical care, cancer, accident, disability, and hospital indemnity insurance, are firmly positioned as cash cows within the company's BCG matrix. These products benefit from stable persistency rates, consistently contributing to Aflac's adjusted earnings. For instance, Aflac reported that its U.S. segment's adjusted earnings per diluted share were $1.45 in the first quarter of 2024, with supplemental insurance playing a significant role in this performance.

Operating in a mature market where Aflac enjoys a leading position, these established offerings generate reliable and predictable cash flow. The mature nature of these markets means lower promotional investments are required to maintain market share and sales volume. This allows Aflac to leverage its strong brand recognition and distribution channels effectively, ensuring sustained profitability from these core products.

Aflac's commitment to shareholder returns is evident in its impressive 42-year streak of consistent dividend growth. This dedication is further underscored by the 16% increase in its first-quarter 2025 dividend to $0.58 per share, signaling strong confidence in future cash flows.

In 2024, Aflac returned a substantial $3.9 billion to its shareholders through a combination of dividends and share repurchases. This significant capital return directly reflects the robust and consistent cash generation capabilities of its established business lines, positioning them as true cash cows.

Established Distribution Channels

Aflac's established distribution channels, particularly its strong presence in the U.S. worksite market and its extensive network in Japan, are key to its Cash Cow status. These mature channels generate consistent premium income with relatively low investment needs, leading to healthy profit margins.

In 2023, Aflac reported U.S. segment total revenues of $12.9 billion, a testament to the enduring strength of its worksite distribution. Similarly, its Japan segment contributed significantly, with total revenues of $15.3 billion for the same period, highlighting the deep penetration and loyalty within its Japanese sales agent and business partner network.

The efficiency of these established channels allows Aflac to capitalize on its market position:

- Worksite Dominance: Aflac's U.S. distribution focuses on offering supplemental insurance at the point of employment, a strategy that has proven highly effective and cost-efficient.

- Japanese Market Depth: In Japan, Aflac leverages a vast network of agents and business partners to reach a broad customer base for its life and cancer insurance products.

- Reduced Investment Needs: Unlike businesses in the question mark or star categories, Cash Cows like Aflac's distribution channels require minimal new investment for growth, freeing up capital.

- High Profitability: The combination of consistent sales volume and lower operational costs translates into substantial and reliable profits for Aflac.

Investment Portfolio Income

Aflac's investment portfolio functions as a robust cash cow, generating consistent income that underpins its financial strength and ability to meet policyholder obligations. This strategic asset allocation is designed for enduring performance, even when short-term market fluctuations, like the net investment losses impacting GAAP earnings in Q1 2025, create temporary headwinds.

The adjusted net investment income in Aflac U.S. demonstrated resilience, remaining stable. This consistent inflow of cash from investments is crucial for Aflac's operational stability and its capacity to pay claims and expenses, acting as a reliable source of funds.

- Stable Adjusted Net Investment Income: Aflac U.S. reported stable adjusted net investment income, a key indicator of its reliable cash flow generation.

- Long-Term Performance Focus: The investment portfolio is actively managed with a view towards long-term capital appreciation and income generation, ensuring sustained cash inflows.

- Financial Stability Pillar: The income generated from these investments provides essential financial backing, supporting policyholder promises and contributing significantly to Aflac's overall financial health.

Aflac's U.S. core supplemental insurance products, including critical care, cancer, accident, disability, and hospital indemnity, are firmly established as cash cows. These offerings benefit from stable persistency rates and consistently contribute to Aflac's adjusted earnings, with the U.S. segment reporting adjusted earnings per diluted share of $1.45 in Q1 2024.

Operating in mature markets where Aflac holds a leading position, these products generate reliable cash flow with minimal need for increased promotional investments, leveraging strong brand recognition and distribution channels for sustained profitability.

The company's impressive 42-year track record of consistent dividend growth, including a 16% increase to $0.58 per share in Q1 2025, directly reflects the robust cash generation from these cash cow segments.

In 2024, Aflac returned $3.9 billion to shareholders via dividends and share repurchases, a clear indicator of the strong and consistent cash-generating power of its established business lines.

Delivered as Shown

Aflac BCG Matrix

The BCG Matrix analysis you are currently previewing is the identical, fully comprehensive document you will receive immediately after completing your purchase. This includes all detailed breakdowns and strategic insights, with no watermarks or demo content, ensuring you get a polished, ready-to-deploy strategic tool.

Dogs

Aflac Japan's net earned premiums saw a 5.0% dip in Q1 2025, largely influenced by internal cancer reinsurance and a growing number of limited-pay policies reaching their paid-up status. These older products, as they mature or are reinsured, naturally contribute less new premium. This trend positions them as potential "dogs" within the portfolio, given their diminishing growth potential and reduced cash flow generation.

Within Aflac's portfolio, certain legacy products in both the U.S. and Japan segments might be classified as Dogs if they exhibit consistently declining premium persistency. This means policyholders are increasingly letting these older policies lapse, indicating a lack of ongoing value or relevance to current customer needs.

For instance, an older supplemental health insurance product in the U.S. that hasn't been updated to reflect current healthcare trends or competitor offerings could see its persistency rate fall. If such a product's persistency drops below a certain threshold, perhaps seeing a year-over-year decline of more than 5% in premium retention, it would signal a move into the Dog quadrant.

Segments with high overhead and stagnant sales, often termed Dogs in the BCG Matrix, represent areas within Aflac that consume significant resources without generating proportional returns. These could be niche insurance products or legacy offerings that require extensive administrative support and sales efforts but exhibit minimal market growth and a declining customer base.

For instance, consider a historical accident insurance product that, while once popular, now faces intense competition and evolving consumer preferences. If this product line requires a dedicated team for claims processing and customer service, and its sales have remained flat or declined over the past few years, it would likely fall into the Dog category.

In 2023, Aflac reported that its U.S. segment, which includes various voluntary insurance products, generated $13.1 billion in total revenue. However, within this broad segment, specific, older product lines might be experiencing the characteristics of a Dog if their overhead costs, such as legacy system maintenance or specialized sales training, outweigh their contribution to overall revenue growth.

Geographical Niche Markets with Minimal Presence

Geographical niche markets where Aflac has a minimal presence, such as parts of Europe, South America, Africa, and the Middle East, could be categorized as Dogs within the BCG Matrix. This classification applies if these regions exhibit low market share and negligible growth prospects, with no concrete strategies for substantial expansion or profitability. Such markets might consume valuable resources without generating significant returns.

For instance, Aflac's international operations, while diverse, might not have achieved the same penetration as its core U.S. and Japan markets. In 2023, Aflac's total revenue was approximately $22.4 billion, with the vast majority stemming from its U.S. and Japan segments. Regions with minimal presence, if they continue to show low revenue contribution and limited growth potential, would fit the Dog profile.

- Low Market Share: Regions where Aflac's brand recognition and customer base are significantly smaller compared to competitors.

- Negligible Growth: Markets demonstrating minimal economic or demographic trends that would drive demand for Aflac's products.

- Resource Drain: Areas that require investment in infrastructure, marketing, and compliance without a clear path to substantial revenue generation.

- Strategic Re-evaluation: These markets might warrant a review to determine if divestment or a significant shift in strategy is more beneficial than continued investment.

Currency-Impacted Earnings (Japan)

The weaker yen against the dollar presented a headwind for Aflac Japan's financial performance. Specifically, this currency dynamic negatively affected adjusted earnings per share in both the first quarter of 2025 and the fourth quarter of 2024. This persistent currency impact, while not a product itself, acts as a 'Dog' within the BCG matrix framework, consistently diminishing the value of underlying business strengths due to external market forces beyond direct product management.

The financial implications of this currency trend are significant. For instance, in Q1 2025, the unfavorable currency translation reduced Aflac Japan's reported earnings. Similarly, the fourth quarter of 2024 saw a comparable negative impact on the company's per-share earnings. This situation highlights a challenge where strong operational performance in Japan is partially offset by the strengthening dollar relative to the yen, creating a drag on overall profitability.

- Currency Headwind: The yen's weakness against the dollar negatively impacted Aflac Japan's adjusted earnings per share in Q1 2025 and Q4 2024.

- 'Dog' Factor: The currency impact acts as a 'Dog' by eroding earnings value without direct product-level control.

- Financial Erosion: Persistent currency fluctuations consistently diminish the value of strong performance from the Japan segment.

Products classified as Dogs within Aflac's portfolio are those with low market share and low growth potential, often requiring significant resources without generating substantial returns. These might include older, less competitive insurance lines or products in underperforming geographical markets. For example, legacy accident insurance products facing stiff competition and declining consumer interest, or niche markets with minimal penetration and growth, could fit this description. These segments demand careful strategic review to assess their future viability.

Aflac Japan's net earned premiums declined 5.0% in Q1 2025, partly due to a growing number of limited-pay policies reaching paid-up status, indicating less future premium generation from these older products. Similarly, legacy products in the U.S. with declining policyholder retention, perhaps seeing over a 5% year-over-year drop in premium retention, would also be considered Dogs. These products represent areas consuming resources without proportional growth, such as historical accident insurance lines with stagnant sales and high administrative costs.

Geographical markets where Aflac has a minimal presence and negligible growth prospects, like certain regions in Europe or South America, can be categorized as Dogs. Despite Aflac's total revenue of approximately $22.4 billion in 2023, these underdeveloped regions contribute minimally and lack clear expansion strategies. The persistent weakness of the yen against the dollar also acts as a 'Dog' factor, eroding the value of Aflac Japan's earnings, as seen in the negative impact on adjusted earnings per share in Q1 2025 and Q4 2024.

| Product Category | Market Share | Growth Potential | Resource Allocation | Example |

| Legacy Accident Insurance | Low | Low | High (Admin/Sales) | Historical product facing competition |

| Underpenetrated Markets | Low | Low | Moderate (Infrastructure) | Niche geographical regions |

| Maturing Limited-Pay Policies | N/A (Declining) | Negligible | Low (Maintenance) | Older policies reaching paid-up status |

| Currency Translation Impact | N/A (External) | N/A (External) | N/A (External) | Yen weakness vs. USD |

Question Marks

Aflac is strategically bolstering its footprint in the U.S. dental and vision insurance sectors, a move underscored by the recent appointment of a Senior Vice President to spearhead this burgeoning business. These product lines, while relatively new for Aflac, tap into a segment of the employee benefits market exhibiting robust growth potential.

In 2024, the voluntary benefits market, which includes dental and vision, continued its upward trajectory. While Aflac's overall market share in these specific ancillary benefits is still establishing itself, the company's investment in leadership signals a commitment to capturing a significant portion of this expanding market. Industry analysts project continued strong demand for these supplemental coverages as employers seek comprehensive benefit packages.

Aflac is strategically targeting Japan's younger demographic, recognizing the need to adapt to evolving market demands and challenging demographics. This initiative involves developing and promoting services tailored to this segment, such as the Tsumitasu investment product.

The Tsumitasu product, a key component of Aflac's strategy to attract younger customers in Japan, has demonstrated promising early results. Launched in 2023, it aims to simplify investment for individuals new to the market, aligning with a growing interest in personal finance among millennials and Gen Z.

While Tsumitasu's initial uptake is encouraging, Aflac's broader objective of significantly expanding its younger customer base in Japan is an ongoing endeavor. This long-term strategy is crucial for sustained growth in a nation facing an aging population and declining birth rates, with the company investing in digital channels and partnerships to reach this audience.

Aflac is increasingly leveraging digital technology in benefits administration, balancing automation with the persistent employee need for human connection. This dual focus aims to streamline processes while ensuring a positive employee experience.

The company is actively exploring Artificial Intelligence (AI) to boost employee job performance, recognizing its potential to enhance productivity and efficiency across various roles. These strategic investments are positioned for future growth and operational improvements.

While Aflac's commitment to digital and AI integration signals a forward-looking strategy, the precise impact on their market share and the full realization of returns from these investments remain subjects of ongoing evaluation and uncertainty.

Strategic Partnerships for Market Expansion

Aflac is actively pursuing strategic partnerships to fuel market expansion, a key consideration within the BCG matrix framework. For instance, its collaboration with the American Cancer Society aims to bolster brand reputation and tap into a new demographic. Similarly, the extended partnership with Empathy for legacy planning services seeks to broaden its customer reach.

These alliances are designed to create synergistic growth opportunities. While the immediate impact on market share is still being assessed, these moves position Aflac to capture new customer segments and enhance its brand value. In 2024, Aflac reported a 7.1% increase in total revenues, reaching $22.2 billion, underscoring the potential of such strategic initiatives.

- American Cancer Society Partnership: Focuses on brand enhancement and reaching new customer segments.

- Empathy Legacy Planning Expansion: Aims to drive sales by offering expanded services to a wider audience.

- Market Share Impact: Contributions to market share are still under evaluation but are a primary objective.

- Financial Context: Aflac's 2024 revenue growth of 7.1% provides a backdrop for the potential success of these partnerships.

New Cancer Insurance Product, Miraito (Japan)

Aflac's new cancer insurance product, Miraito, launched in March 2025 and became fully available across Japan by late April. This product is positioned as a 'Question Mark' within Aflac's BCG Matrix. Its potential to significantly boost Aflac Japan's third-sector sales and maintain sales momentum throughout 2025 is high, but its ability to capture substantial market share is still uncertain.

Aflac is making significant investments to ensure Miraito's success. The company is focusing on aggressive marketing and distribution strategies to establish a strong foothold in the Japanese market. The success of Miraito is crucial for Aflac Japan's growth objectives in the coming year.

- Product Launch: Miraito, cancer insurance, March 2025 (Japan).

- Market Availability: Full sales across Japan by late April 2025.

- BCG Matrix Classification: Question Mark due to uncertain market share potential.

- Strategic Importance: Expected to drive Aflac Japan's third-sector sales and overall momentum in 2025.

Aflac's Miraito cancer insurance product, launched in Japan in March 2025, is classified as a Question Mark in the BCG Matrix. While it holds significant potential to boost third-sector sales for Aflac Japan and maintain sales momentum through 2025, its long-term market share capture remains uncertain. The company is investing heavily in marketing and distribution to support its growth.

The success of Miraito is vital for Aflac Japan's strategic objectives, particularly in a market with evolving healthcare needs. Its positioning as a Question Mark highlights the inherent risk and reward associated with introducing new products in competitive landscapes. Aflac's commitment to aggressive promotion aims to convert this potential into market leadership.

Aflac's overall revenue for 2024 reached $22.2 billion, a 7.1% increase, providing a strong financial foundation for new product initiatives like Miraito. The company's strategic investments in product development and market penetration are key to its continued expansion in diverse insurance sectors.

| Product | Market | Launch Date | BCG Classification | Key Objective |

| Miraito (Cancer Insurance) | Japan | March 2025 | Question Mark | Boost third-sector sales, gain market share |

| Tsumitasu (Investment Product) | Japan | 2023 | Star (Early Stage) | Attract younger demographic |

| U.S. Dental & Vision | United States | Ongoing Expansion | Question Mark | Capture growing voluntary benefits market |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.