Aflac Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aflac Bundle

Aflac operates in a competitive landscape shaped by buyer power, the threat of new entrants, and the bargaining power of suppliers. Understanding these forces is crucial for navigating the insurance market.

The full Porter's Five Forces Analysis dives deep into each of these pressures, revealing the intricate dynamics that influence Aflac's profitability and strategic positioning. Don't miss out on these vital insights.

Ready to move beyond the basics? Get a full strategic breakdown of Aflac’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration for Aflac is generally low because the insurance sector, including Aflac, doesn't depend on a few highly specialized suppliers. Instead, it utilizes a wide array of general service providers, which significantly diminishes the bargaining power any single supplier might hold.

Aflac's key 'suppliers' are primarily the financial markets, where it invests its premiums, and a diverse group of service providers. These markets and providers are typically fragmented, meaning no single entity has substantial leverage over Aflac's operations or costs.

Switching costs for Aflac when dealing with general suppliers like IT services or marketing agencies are typically moderate. While significant IT system overhauls can incur substantial expenses, many other service providers present lower exit barriers, which in turn caps the suppliers' leverage. For instance, Aflac's 2024 IT spending was allocated across various vendors, with no single supplier holding an overwhelmingly dominant position, indicating a degree of flexibility.

However, the landscape shifts for more specialized needs. If Aflac relies on highly specific actuarial or underwriting software, the costs and complexities associated with migrating to an alternative system could be considerably higher. This increased switching cost in niche areas grants those particular suppliers more bargaining power.

The uniqueness of services Aflac procures significantly influences supplier bargaining power. While certain specialized actuarial models or proprietary software developed by suppliers might offer a degree of uniqueness, many of Aflac's operational needs are met by commoditized services. This means that for many standard services, suppliers have less leverage as Aflac can readily switch to alternatives.

Threat of Forward Integration

The threat of suppliers integrating forward into Aflac's core insurance underwriting business is extremely low. Companies that supply Aflac with office equipment or even IT services would face significant hurdles, including extensive regulatory compliance and substantial capital requirements, making such a move impractical.

This minimal threat means Aflac's suppliers have limited ability to leverage their position to demand higher prices or more favorable terms. For instance, while IT vendors are crucial, the complexity of insurance regulations means they are unlikely to transition from providing technology solutions to becoming direct insurance providers.

- Low Likelihood of Supplier Forward Integration: The specialized knowledge and heavy regulation in the insurance sector deter suppliers from entering Aflac's market.

- Capital and Regulatory Barriers: Entering the insurance underwriting space requires immense capital and navigating complex compliance frameworks, which are prohibitive for most suppliers.

- Reduced Supplier Bargaining Power: The absence of a credible forward integration threat significantly weakens the bargaining power of Aflac's suppliers.

Importance of Supplier to Aflac's Business

The bargaining power of suppliers for Aflac is generally low. This is because Aflac operates across diverse markets in the U.S. and Japan and offers a wide array of insurance products, meaning no single supplier holds significant sway over its core operations. For instance, in 2023, Aflac reported total revenue of $22.4 billion, demonstrating the scale and breadth of its business which reduces reliance on any one supplier.

While technology vendors are crucial for Aflac's digital advancements, the company strategically engages with multiple providers. This multi-vendor approach is designed to minimize risks and prevent any single technology supplier from gaining excessive bargaining power. For example, Aflac continues to invest in digital platforms, with IT expenses being a significant operational cost, but these are spread across various service providers.

Key factors contributing to the low supplier bargaining power include:

- Diversified Operations: Aflac's presence in both the U.S. and Japan insulates it from localized supplier disruptions.

- Broad Product Portfolio: The wide range of insurance products means that disruptions from a single component supplier are less impactful.

- Multiple Vendor Relationships: Aflac's strategy of working with numerous suppliers for critical services, especially technology, limits individual supplier leverage.

- Industry Standards: Many of the inputs Aflac requires, such as IT services and actuarial software, are standardized, allowing for easy switching between providers.

Aflac's supplier bargaining power is generally low due to its diversified operations across the U.S. and Japan and its broad product portfolio. This scale reduces reliance on any single supplier, and the company's strategy of engaging multiple vendors for critical services, especially technology, further limits individual supplier leverage. Many inputs, like IT services, are standardized, facilitating easy switching between providers.

For instance, Aflac's 2023 revenue of $22.4 billion underscores its market presence, which dilutes the power of any individual supplier. While specific actuarial software might present higher switching costs, thereby increasing leverage for those niche providers, the overall impact on Aflac's operations remains limited by the availability of alternative, standardized solutions for the majority of its needs. The threat of suppliers integrating forward into Aflac's core insurance business is also minimal due to high capital and regulatory barriers.

| Factor | Assessment | Impact on Aflac |

|---|---|---|

| Supplier Concentration | Low | Reduces individual supplier leverage. |

| Switching Costs (General) | Moderate | Limits supplier ability to dictate terms. |

| Switching Costs (Specialized) | Higher | Increases leverage for niche providers. |

| Uniqueness of Services | Mixed (many commoditized) | Lowers overall supplier bargaining power. |

| Forward Integration Threat | Very Low | Significantly weakens supplier leverage. |

What is included in the product

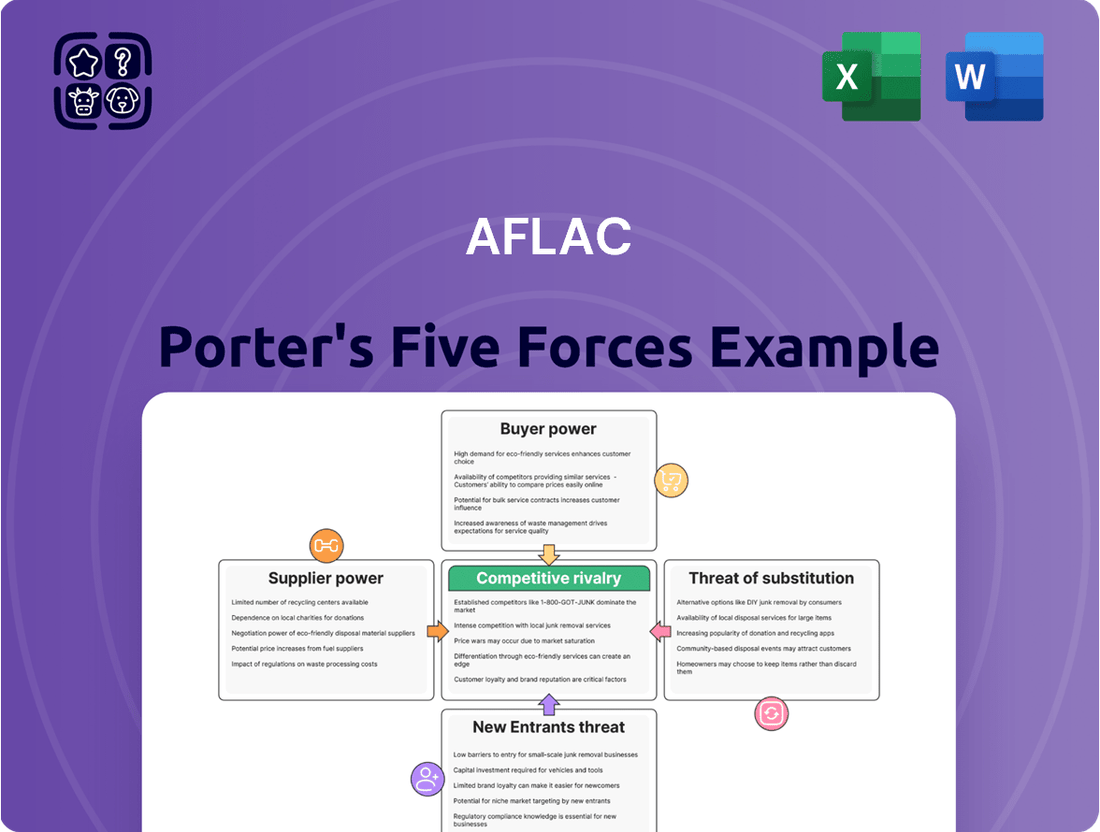

Aflac's Porter's Five Forces Analysis examines the competitive intensity and profitability of the supplemental insurance market, assessing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing firms.

Quickly assess competitive intensity and identify potential threats with a visual, easy-to-understand breakdown of each force.

Customers Bargaining Power

Customer price sensitivity in the supplemental insurance market is a key factor for Aflac. While rising healthcare costs and awareness of out-of-pocket expenses can make customers more attentive to price, the perceived value of direct cash benefits for unexpected illnesses or injuries can temper this sensitivity. For instance, in 2024, many individuals are still navigating the financial aftermath of health events, making the certainty of cash payouts a significant draw, potentially overriding minor price differences.

The availability of substitutes for Aflac's supplemental insurance products plays a role in customer bargaining power. While direct substitutes for the specific cash benefits offered by Aflac's policies are limited, customers can consider general savings accounts or other financial instruments as indirect alternatives to cover potential out-of-pocket expenses.

Customer information asymmetry can indeed influence bargaining power. The intricate nature of insurance products, like those offered by Aflac, can make it challenging for consumers to thoroughly compare different policies and understand all their nuances. This complexity can initially limit their ability to negotiate effectively or switch providers easily.

However, the landscape is shifting. In 2024, there's a notable trend towards greater transparency in financial services. Numerous online platforms and comparison tools are emerging, simplifying the process for customers to research and evaluate insurance options. This increased access to information is gradually empowering consumers, potentially eroding some of the information advantage insurers once held.

Switching Costs for Customers

Switching costs for Aflac's customers are generally low, particularly for individual policyholders. This makes it easier for customers to move to a competitor without incurring substantial fees or facing complex administrative hurdles. For instance, in 2024, the average customer retention rate in the voluntary benefits market, where Aflac is a major player, remained a key focus, indicating that while loyalty exists, the barriers to switching are not insurmountable.

The low switching costs empower customers, giving them greater leverage in their dealings with Aflac. This necessitates that Aflac consistently offers competitive pricing, robust benefits, and excellent customer service to retain its client base. The ability for customers to easily compare and move to alternative providers means Aflac must remain vigilant in its market positioning.

- Low Switching Costs: Customers can often change providers with minimal financial penalties or administrative complexity.

- Increased Bargaining Power: This ease of switching enhances the customer's ability to negotiate better terms or seek out more attractive offers elsewhere.

- Competitive Pressure: Aflac faces pressure to maintain competitive pricing and service levels to counteract the threat of customer attrition.

- Market Dynamics: In 2024, the voluntary benefits sector saw continued innovation, further reducing barriers and increasing customer options.

Customer Concentration

Customer concentration for Aflac is notably low, as the company serves a broad and diverse customer base across both the United States and Japan. This wide reach means no single customer or even a small group of customers wields significant power to dictate terms or prices.

This low customer concentration directly limits the bargaining leverage customers can exert on Aflac. For instance, in 2024, Aflac's individual policyholder base numbered in the millions, spread across various demographic and economic segments, preventing any single segment from having an outsized impact on the company's revenue streams.

- Low Customer Concentration: Aflac's business model is built on serving a vast number of individuals and businesses, diluting the power of any single customer.

- Limited Bargaining Power: The dispersed nature of its customer base prevents significant customer-driven price pressure or demands for customized services that could impact profitability.

- Diversified Revenue Streams: Serving millions of policyholders in both the US and Japan ensures that Aflac's revenue is not overly reliant on any particular customer segment.

- Market Stability: This broad customer base contributes to Aflac's market stability by reducing vulnerability to shifts in demand from a concentrated group.

The bargaining power of customers for Aflac is generally considered low to moderate. While individual customers have limited power due to the sheer volume of Aflac's policyholders, the collective ability to switch providers or seek alternatives can exert some influence. In 2024, the ease of accessing information through online comparison tools has somewhat leveled the playing field, making customers more informed about pricing and benefits.

Aflac's broad customer base, spanning millions across the US and Japan, means no single customer or small group can dictate terms. This low concentration dilutes individual bargaining power. For example, Aflac's extensive reach in the voluntary benefits market in 2024 means that a customer leaving has a negligible impact on overall revenue, thus limiting their leverage.

Switching costs for Aflac's individual policyholders are typically low, allowing for greater flexibility. This encourages Aflac to maintain competitive pricing and service to retain its customer base. The market in 2024 saw continued innovation in voluntary benefits, further reducing barriers and enhancing customer choice.

| Factor | Aflac's Position | Impact on Bargaining Power |

| Customer Price Sensitivity | Moderate; influenced by rising healthcare costs but tempered by perceived value of cash benefits. | Slightly increases bargaining power, especially for price-conscious segments. |

| Availability of Substitutes | Limited direct substitutes, but indirect financial instruments exist. | Lowers bargaining power as direct alternatives are scarce. |

| Customer Information Availability | Increasingly available via online tools, reducing information asymmetry. | Moderately increases bargaining power as customers become more informed. |

| Switching Costs | Generally low for individual policyholders. | Increases bargaining power, allowing customers to switch easily. |

| Customer Concentration | Very low; millions of diverse policyholders. | Significantly limits individual customer bargaining power. |

Same Document Delivered

Aflac Porter's Five Forces Analysis

This preview showcases the comprehensive Aflac Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises or placeholder content. You are looking at the actual, fully formatted analysis, ready for your immediate download and use.

Rivalry Among Competitors

Aflac navigates a competitive insurance market featuring both broad-spectrum insurers and niche supplemental providers. Key rivals such as MetLife, Colonial Life, and Cigna highlight a market characterized by fragmentation and the presence of substantial players.

The U.S. supplemental health market is anticipated to expand at a compound annual growth rate of 5.60% between 2025 and 2034. This robust growth trajectory suggests a dynamic market environment where companies may focus more on market share expansion rather than solely on price-based competition, potentially moderating rivalry.

In Japan, Aflac has demonstrated resilience, with strong sales in its core cancer insurance products. Despite facing headwinds such as currency fluctuations, this sustained performance indicates ongoing demand and growth potential within its established markets, which can influence competitive dynamics.

Aflac stands out by offering specialized supplemental insurance that provides cash benefits directly to policyholders, a key difference from standard medical insurance. This direct cash payment allows individuals to cover a wide range of expenses, including deductibles, co-pays, and even non-medical costs like groceries or rent, offering a unique value proposition.

The company's strong brand identity, famously embodied by the Aflac Duck, plays a significant role in its differentiation. This memorable mascot has helped Aflac build substantial brand recognition and trust among consumers, setting it apart in a competitive market.

In 2023, Aflac's total revenue reached $22.4 billion, with its U.S. segment, a primary focus for its supplemental products, contributing significantly. This financial performance underscores the market's receptiveness to Aflac's differentiated offerings.

Exit Barriers

Exit barriers in the insurance sector, including for companies like Aflac, are notably high. These are driven by stringent regulatory demands, the long-term nature of policyholder commitments, and the considerable capital already invested in operations. For instance, in 2024, insurance companies must maintain specific risk-based capital ratios, which can be challenging to unwind quickly.

These substantial hurdles make it difficult for insurers to exit the market gracefully. Consequently, this often translates into a more persistent and potentially intensified competitive landscape among the remaining players, as they are less likely to be acquired or simply cease operations.

Key factors contributing to these high exit barriers include:

- Regulatory Compliance: Insurers must meet ongoing solvency requirements and adhere to consumer protection laws even when winding down.

- Policyholder Obligations: Fulfilling long-term claims and benefits for existing policyholders necessitates continued financial commitment.

- Capital Investments: Significant investments in technology, distribution networks, and actuarial expertise are not easily recouped.

Diversity of Competitors

The supplemental insurance landscape is populated by a wide array of competitors, from major insurers offering comprehensive coverage to specialized firms targeting specific needs. This broad spectrum of players, each with distinct strategies and market focuses, creates a dynamic and often unpredictable competitive environment. Aflac navigates this complexity across its primary markets in the United States and Japan.

In the U.S., Aflac contends with giants like MetLife, Prudential, and Cigna, which offer a range of voluntary benefits alongside their core insurance products. These large players leverage their scale and existing employer relationships. Niche competitors, such as those focusing solely on accident or critical illness insurance, also present targeted challenges. For instance, in 2023, the U.S. voluntary benefits market saw continued growth, with employers increasingly offering supplemental insurance to attract and retain talent, a trend that intensified in the post-pandemic era.

Japan's market presents its own set of rivals, including established life insurers like Japan Post Insurance and Meiji Yasuda Life Insurance, as well as numerous smaller, specialized companies. The competitive intensity in Japan is driven by a deeply entrenched culture of savings and insurance. Aflac Japan's performance is closely watched, with the company reporting significant premium income in this segment, underscoring the competitive pressures it faces to maintain its market share.

- Diverse Competitor Base: Aflac faces competition from large, diversified insurance providers and specialized niche players in both the U.S. and Japan.

- U.S. Market Dynamics: Major insurers like MetLife and Prudential compete by bundling supplemental offerings with broader benefit packages.

- Japanese Market Landscape: Established Japanese life insurers, such as Japan Post Insurance, are key rivals in Aflac's significant Japan segment.

- Strategic Differentiation: Competitors vary in their strategies, objectives, and geographic reach, leading to multifaceted competitive behaviors impacting Aflac.

Competitive rivalry for Aflac is intense, stemming from a diverse array of players in both the U.S. and Japanese markets. In the U.S., major insurers like MetLife and Cigna compete by integrating supplemental products into broader benefit plans, while niche providers focus on specific needs.

The Japanese market sees competition from established life insurers such as Japan Post Insurance and Meiji Yasuda Life Insurance, alongside smaller, specialized firms. This broad competitive base, coupled with high exit barriers due to regulatory and capital requirements, means rivals are likely to remain persistent, potentially intensifying competition.

| Competitor Type | Key Players (U.S.) | Key Players (Japan) | Competitive Tactics |

| Diversified Insurers | MetLife, Prudential, Cigna | Japan Post Insurance, Meiji Yasuda Life | Bundling, employer relationships, scale |

| Niche/Specialized Providers | (Various, e.g., accident insurance specialists) | (Various smaller firms) | Targeted product offerings, specific benefit focus |

| Market Share Focus | Growth driven by employer demand for voluntary benefits | Leveraging cultural savings/insurance trends | Brand recognition, product differentiation |

SSubstitutes Threaten

Direct substitutes for Aflac's core supplemental insurance products, which provide cash benefits to policyholders for unexpected illnesses or injuries, are relatively scarce. While traditional health insurance covers medical bills, it typically does not compensate for lost wages, travel expenses, or other out-of-pocket costs that Aflac's policies are designed to address.

The limited availability of direct substitutes stems from Aflac's specific value proposition. These policies offer a unique financial safety net for everyday expenses that arise during health events, a niche not fully captured by standard medical coverage. For instance, in 2024, Aflac reported that its U.S. voluntary benefits segment, which includes these supplemental products, continued to be a significant driver of its business, demonstrating sustained demand for its offerings.

The price-performance trade-off of potential substitutes is a critical factor when assessing Aflac's competitive landscape. While personal savings and employer-provided sick leave can offer some financial cushion, they often fall short in providing the specialized, direct cash benefits that Aflac's supplemental insurance policies deliver for a broad spectrum of unexpected events.

For instance, while a personal savings account might cover a minor medical co-pay, it's unlikely to adequately replace lost income due to a serious illness or accident, a core offering of Aflac's products. In 2024, the average out-of-pocket medical expenses for individuals in the US, even with insurance, can still be substantial, making the predictable benefit payouts from Aflac policies a more attractive proposition for many compared to relying solely on accumulated savings.

Customer propensity to substitute for supplemental health insurance is influenced by several factors. High financial literacy and a keen awareness of potential out-of-pocket medical expenses can make consumers more likely to seek alternatives or forgo supplemental coverage if they believe they can self-insure or manage risks. Conversely, as healthcare costs continue their upward trend, the perceived value of supplemental plans often increases, potentially dampening the inclination to substitute.

Ease of Substitution

The threat of substitutes for Aflac's core offerings is relatively low. While general financial planning services and other insurance policies exist, they often don't replicate the specific, direct cash benefit Aflac provides for a broad spectrum of non-medical, illness, or injury-related expenses. This unique value proposition makes direct substitution challenging for consumers seeking that particular type of financial safety net.

Consider the landscape of financial protection:

- Aflac's supplemental insurance directly pays cash benefits to policyholders, usable for a wide range of expenses beyond medical bills, such as rent, utilities, or lost wages.

- General health insurance primarily covers medical treatment costs, not the ancillary living expenses that Aflac policies address.

- Disability insurance can replace lost income but often has waiting periods and may not cover all types of short-term absences or specific incident-related costs as broadly as Aflac's products.

- Savings accounts or investments require significant capital and time to build, and they lack the guaranteed payout structure of insurance for unexpected events.

Regulatory and Legal Barriers to Substitution

The insurance industry's robust regulatory landscape significantly curtails the threat of substitutes for Aflac's products. New entrants offering alternative financial solutions would face substantial compliance hurdles, including licensing, capital requirements, and adherence to consumer protection laws, making it difficult to directly replicate Aflac's established market position.

For instance, in 2024, the U.S. insurance sector is governed by a complex web of state-specific regulations, with varying solvency standards and product approval processes. Any substitute product aiming to provide similar financial security or income replacement would need to navigate these intricate legal frameworks, which are designed to protect policyholders and maintain market stability. This regulatory burden effectively acts as a barrier, limiting the ease with which non-insurance alternatives can emerge and gain traction.

- Insurance industry heavily regulated: Compliance with state and federal laws is mandatory.

- High capital requirements: New entrants need significant financial backing to operate legally.

- Product approval processes: Alternative financial products must undergo rigorous vetting.

- Consumer protection laws: Substitutes must meet stringent standards to safeguard policyholders.

The threat of substitutes for Aflac's core supplemental insurance products remains relatively low due to their unique value proposition. These policies offer direct cash benefits for a wide array of expenses beyond medical bills, a niche not fully addressed by traditional health insurance or even disability insurance, which often have longer waiting periods and may not cover all short-term absences. For example, in 2024, the average out-of-pocket medical expenses in the U.S. can still be substantial, making Aflac's predictable benefit payouts a compelling alternative to relying solely on personal savings, which require significant capital and lack the guaranteed payout structure for unexpected events.

The regulatory environment further insulates Aflac from direct substitution. New entrants offering similar financial protection would face substantial compliance hurdles, including licensing, capital requirements, and adherence to consumer protection laws. For instance, the U.S. insurance sector in 2024 is governed by complex state-specific regulations, making it difficult for non-insurance alternatives to replicate Aflac's established market position and provide equivalent financial security without navigating these intricate legal frameworks.

| Alternative | Coverage Focus | Aflac's Differentiator | 2024 Context |

|---|---|---|---|

| Traditional Health Insurance | Medical treatment costs | Cash benefits for non-medical expenses (rent, utilities, lost wages) | High out-of-pocket medical costs persist despite coverage. |

| Disability Insurance | Replaces lost income due to disability | Broader coverage for various health events, shorter waiting periods for some benefits | Often has waiting periods and may not cover all short-term absences. |

| Personal Savings/Investments | Self-funding for expenses | Guaranteed, predictable cash payouts for specific events | Requires significant capital accumulation; lacks insurance's risk pooling. |

Entrants Threaten

The supplemental insurance market demands substantial capital investment for licensing, product development, and building a robust distribution network, effectively deterring many potential new entrants. Aflac's robust financial health, evidenced by its strong capital reserves and consistent profitability, solidifies its position and makes it challenging for newcomers to compete on a similar scale.

New companies looking to enter the insurance market, like Aflac, encounter significant regulatory challenges. These include obtaining licenses, adhering to intricate state and national insurance regulations, and meeting stringent solvency requirements in both the United States and Japan. For instance, in 2023, the National Association of Insurance Commissioners (NAIC) continued to refine its model laws, impacting capital requirements and consumer protection measures across U.S. states.

Aflac benefits from substantial brand loyalty, cultivated through decades of distinctive marketing and specialized product offerings in the supplemental insurance market. This strong brand recognition makes it challenging for new entrants to gain traction without significant upfront investment in marketing and product differentiation.

Distribution Channels Access

New insurance companies face significant hurdles in establishing robust distribution channels, a key barrier to entry. Aflac's established network of agents and brokers provides a substantial advantage, making it difficult and expensive for newcomers to gain comparable market reach. This access is not easily replicated, as building trust and relationships with distribution partners takes considerable time and investment.

Consider the following points regarding distribution channels:

- High Capital Investment: New entrants need substantial capital to build a comparable distribution network, including recruiting, training, and compensating agents and brokers.

- Brand Recognition and Trust: Aflac benefits from decades of brand building, which facilitates easier access to distribution channels compared to an unknown entity.

- Regulatory Complexity: Navigating the diverse regulatory landscapes for insurance distribution across different states and countries adds another layer of complexity and cost for new entrants.

- Existing Partnerships: Aflac's long-standing relationships with a vast array of distribution partners create a formidable barrier, as these partners may be hesitant to switch or allocate resources to a new, unproven insurer.

Economies of Scale

Economies of scale present a significant barrier for new entrants into the insurance market, particularly for companies like Aflac that operate on a large scale. Existing players benefit from lower per-unit costs in critical areas such as underwriting, claims processing, and overall administrative functions. This efficiency allows them to offer more competitive pricing to customers, a crucial factor in attracting and retaining policyholders.

For instance, in 2023, Aflac reported total revenue of $22.4 billion, demonstrating the substantial operational volume that underpins its cost advantages. New companies entering the field would find it exceedingly difficult to match these efficiencies from the outset. They would likely face higher initial operating costs, putting them at a distinct cost disadvantage compared to established giants.

- Economies of Scale in Operations: Aflac leverages its size for cost efficiencies in underwriting and claims processing.

- Cost Disadvantage for New Entrants: Start-ups would struggle to achieve similar per-unit cost savings initially.

- Pricing Competitiveness: Established players can offer more attractive pricing due to their scale.

- 2023 Revenue as Indicator: Aflac's $22.4 billion in revenue highlights the scale of operations that new entrants must overcome.

The threat of new entrants for Aflac remains relatively low due to significant barriers. High capital requirements for licensing and product development, coupled with stringent regulatory compliance in both the U.S. and Japan, deter many potential competitors. Aflac's established brand loyalty and extensive distribution networks, built over decades, also present a formidable challenge for newcomers seeking market access and customer trust.

| Barrier | Impact on New Entrants | Aflac's Advantage |

|---|---|---|

| Capital Requirements | High initial investment needed for licensing, product development, and operations. | Strong financial reserves and consistent profitability reduce capital strain. |

| Regulatory Hurdles | Navigating complex state and national insurance regulations, including solvency requirements. | Established compliance infrastructure and expertise. |

| Brand Loyalty & Trust | Difficulty in building brand recognition and trust against established players. | Decades of marketing and specialized offerings foster strong customer loyalty. |

| Distribution Networks | Costly and time-consuming to build comparable agent and broker networks. | Extensive, long-standing relationships with distribution partners. |

| Economies of Scale | New entrants face higher per-unit costs in underwriting, claims, and administration. | Operational efficiencies from large-scale operations lead to cost advantages. |

Porter's Five Forces Analysis Data Sources

Our Aflac Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Aflac's annual reports, investor presentations, and SEC filings. We also incorporate insights from industry-specific market research reports and reputable financial news outlets.