AES SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AES Bundle

Unlock the full strategic picture of AES with our comprehensive SWOT analysis. Beyond the highlights, discover the deep-dive insights into their market positioning, operational efficiencies, and competitive landscape. This is your key to understanding their true potential and navigating future growth.

Ready to move beyond the surface? Purchase the complete AES SWOT analysis for an in-depth, professionally written report that includes actionable strategies and financial context. Equip yourself with the knowledge to make informed decisions and gain a competitive edge.

Strengths

AES boasts a diverse and expanding portfolio of energy assets, encompassing thermal, hydro, wind, and solar power generation. This broad mix creates a stable revenue stream and mitigates risks associated with over-reliance on any single energy source.

The company's commitment to renewables is evident in its strong performance, with the renewables segment experiencing a significant 56% EBITDA increase in Q2 2025. AES is well-positioned for continued growth, aiming to bring 3.2 GW of new renewable projects online throughout 2025.

AES is strategically positioning itself for the future by prioritizing cleaner energy and innovation. This involves substantial investments in renewable energy projects, advanced energy storage solutions, and modernizing its energy grids. This focus is a key strength, aligning the company with global sustainability trends and evolving market demands.

The company's commitment to this transition is evident in its impressive backlog of 12 gigawatts (GW) in Power Purchase Agreements (PPAs). Of this, 5.2 GW are already under construction, primarily with strong, investment-grade corporate clients such as data centers. This demonstrates a clear demand for AES's sustainable energy offerings and a robust pipeline for future growth.

Furthermore, AES is embracing innovation by exploring and implementing cutting-edge technologies. An example of this is the use of AI-powered robots for solar panel installation, which enhances efficiency and reduces costs. These forward-thinking approaches underscore AES's dedication to not just cleaner energy, but also to smarter, more effective operational strategies.

AES boasts a robust backlog of 12 gigawatts (GW) secured by long-term Power Purchase Agreements (PPAs). This strong foundation, with 5.2 GW already under construction and an additional 3.2 GW slated for completion in 2025, ensures a predictable revenue stream.

The significant portion of this backlog, particularly from data center clients, offers a degree of insulation from market fluctuations. This secured demand is a key factor supporting AES's reaffirmed 2025 financial guidance and its ambitious long-term growth objectives.

Resilient Business Model and Financial Guidance

AES demonstrates a resilient business model, consistently reaffirming its 2025 adjusted EBITDA and EPS guidance despite some Q1 and Q2 2025 revenue misses and net losses attributed to specific accounting items. This confidence stems from its long-term contracted business, which ensures stable cash flow generation.

The company's strategic asset sales, such as the divestiture of its 50% stake in AES Andes for approximately $300 million in early 2025, bolster its financial flexibility and resilience. Furthermore, a robust supply chain management system underpins its operational stability.

- Resilient Contracted Business: AES's core operations are secured by long-term contracts, providing predictable revenue streams.

- Financial Guidance Reaffirmation: Despite short-term headwinds, the company maintained its 2025 adjusted EBITDA and EPS guidance.

- Strategic Asset Dispositions: Asset sales, like the Andes stake sale, enhance financial health and strategic focus.

- Supply Chain Strength: A well-managed supply chain contributes to operational continuity and cost control.

Investments in Grid Modernization and Utility Growth

AES is strategically investing in modernizing its utility grids, a key strength that underpins its growth. For instance, AES Ohio's Smart Grid Phase 2 Plan is a prime example, designed to boost system stability and reliability while facilitating the integration of distributed energy resources.

These significant capital expenditures in grid modernization translate directly into rate base growth for AES's utility segment. This growth is crucial as it drives consistent revenue expansion and improves the operational efficiency and resilience of the entire grid infrastructure.

- AES Ohio's Smart Grid Phase 2 Plan: Enhancing grid stability and reliability.

- Rate Base Growth: Directly fuels utility segment revenue.

- Distributed Energy Resource Integration: Future-proofing the grid.

- Operational Efficiency: Improving overall grid performance.

AES's diversified energy portfolio, spanning thermal, hydro, wind, and solar, provides revenue stability and risk mitigation. The company's strong commitment to renewables is highlighted by a 56% EBITDA increase in its renewables segment in Q2 2025, with plans to add 3.2 GW of new renewable projects throughout 2025.

AES's robust backlog of 12 GW secured by long-term Power Purchase Agreements (PPAs), with 5.2 GW already under construction, ensures predictable revenue. This secured demand, particularly from data centers, supports AES's reaffirmed 2025 financial guidance and growth objectives.

The company's strategic investments in grid modernization, such as AES Ohio's Smart Grid Phase 2 Plan, enhance system stability and facilitate the integration of distributed energy resources, directly contributing to rate base growth and operational efficiency.

AES's forward-thinking approach includes embracing innovation, exemplified by AI-powered robots for solar panel installation, which boosts efficiency and lowers costs, underscoring a dedication to smarter operational strategies.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Diversified Asset Portfolio | Broad mix of energy generation sources (thermal, hydro, wind, solar) | Mitigates reliance on single energy sources, ensuring stable revenue. |

| Renewable Energy Growth | Significant expansion and performance in renewables | 56% EBITDA increase in renewables (Q2 2025); 3.2 GW new renewable projects planned for 2025. |

| Strong PPA Backlog | Secured long-term contracts for energy delivery | 12 GW backlog; 5.2 GW under construction, primarily with data centers. |

| Grid Modernization Investment | Upgrading utility infrastructure for efficiency and integration | AES Ohio's Smart Grid Phase 2 Plan; drives rate base growth and operational resilience. |

What is included in the product

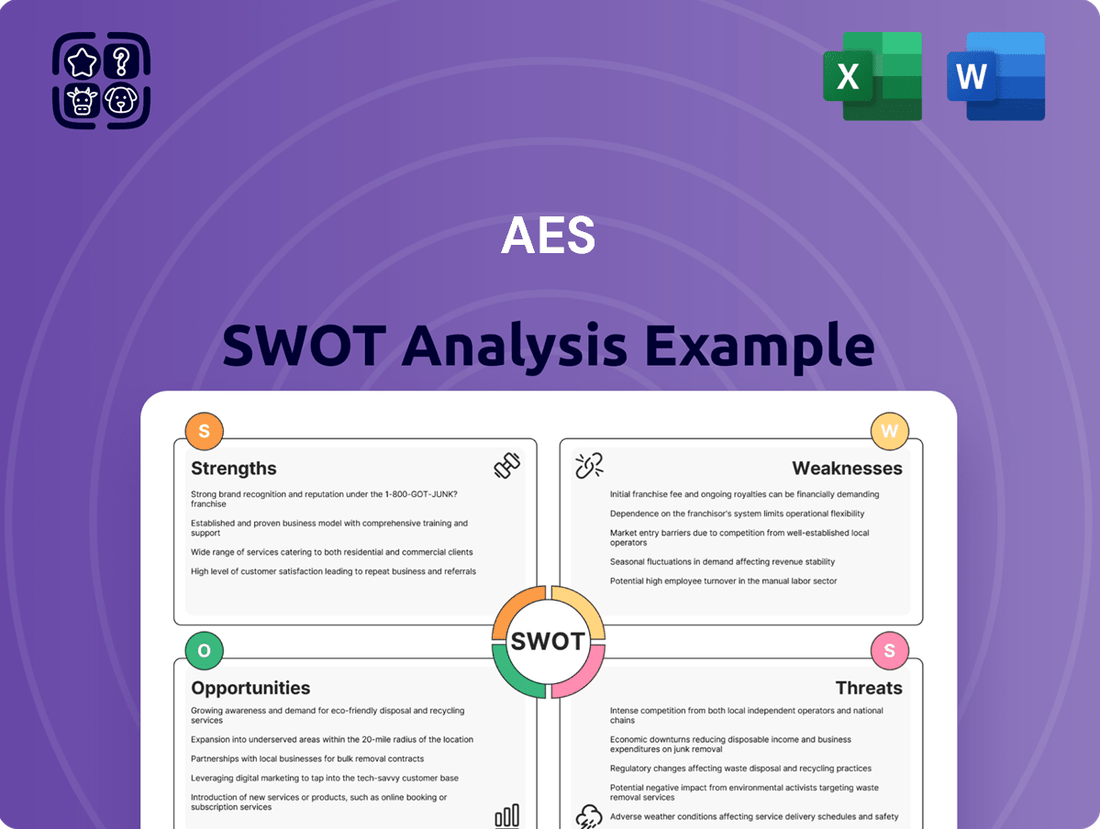

Analyzes AES’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses and threats, thereby alleviating the pain of uncertainty and indecision.

Weaknesses

AES has experienced a mixed financial performance, with net losses reported in the first two quarters of 2025. These losses stemmed from increased income tax expenses, initial losses on sales-type leases, and reduced contributions from its Energy Infrastructure segment. Despite these GAAP-based losses, the company's adjusted earnings have frequently surpassed analyst expectations, highlighting a disconnect between operational strengths and reported net income.

AES has experienced revenue misses against forecasts in the first two quarters of 2025. Despite robust expansion in its renewables sector, the company's overall revenue fell short of analyst expectations for both Q1 and Q2 2025. This indicates that while the clean energy push is strong, other business areas or broader market challenges are impacting total revenue generation.

AES's continued operation of thermal and coal plants, despite its renewable transition, presents a significant weakness. These legacy assets are vulnerable to stricter environmental regulations and the volatile nature of commodity prices, which can directly impact the Energy Infrastructure segment's profitability and lead to revenue erosion.

For instance, in 2023, AES reported that its Energy Infrastructure segment's adjusted EBITDA was influenced by factors including the performance of its thermal generation fleet. The ongoing shift in market demand away from fossil fuels further exacerbates this weakness, potentially diminishing the long-term value and operational viability of these older facilities, contributing to overall revenue declines.

High Leverage and Free Cash Flow Concerns

Some financial analyses highlight significant concerns regarding AES's high leverage and negative free cash flow. While the company has pursued strategic asset sales to improve its financial position, these issues could still constrain its ability to finance future growth without taking on more debt.

This elevated debt burden, coupled with potentially insufficient operating cash flow to cover all expenses and investments, presents a notable weakness. For instance, as of the first quarter of 2024, AES reported a negative free cash flow, a trend that warrants close monitoring by investors and analysts.

- High Debt Levels: Continued reliance on debt financing could limit financial flexibility.

- Negative Free Cash Flow: This trend may hinder the company's capacity to fund organic growth or return capital to shareholders.

- Interest Coverage: A high debt load increases exposure to rising interest rates, potentially impacting profitability.

Sensitivity to Policy and Economic Conditions

AES's performance is significantly tied to the evolving regulatory landscape and macroeconomic trends. For instance, shifts in government incentives or tax credits, like those introduced by the Inflation Reduction Act of 2022, can directly impact the financial viability and attractiveness of renewable energy projects, a core area for AES.

Furthermore, broader economic factors such as rising inflation and interest rates, as seen throughout 2023 and projected into 2024, can increase AES's cost of capital and operational expenses. This sensitivity means that changes in monetary policy or unexpected economic downturns pose a notable risk to the company's profitability and its ability to finance new developments.

- Policy Impact: Changes in renewable energy mandates or carbon pricing mechanisms could affect AES's competitive position.

- Interest Rate Sensitivity: As of Q1 2024, interest expenses are a key consideration for capital-intensive projects.

- Inflationary Pressures: Rising costs for materials and labor in 2023 impacted project development timelines and budgets for many energy companies, including AES.

- Economic Downturns: A significant economic slowdown could reduce energy demand, impacting revenue streams for AES.

AES's financial performance has shown inconsistency, with net losses reported in the first half of 2025 due to higher taxes and initial lease losses. Despite these GAAP figures, adjusted earnings have often exceeded expectations, suggesting operational resilience despite reported bottom-line challenges.

Revenue misses in early 2025 indicate that while the company's renewable energy expansion is strong, other segments or market conditions are hindering overall revenue growth. This disconnect between sector-specific strength and aggregate performance is a key weakness.

The continued reliance on legacy thermal and coal assets, despite a strategic shift towards renewables, exposes AES to regulatory risks and commodity price volatility. These older facilities may face diminishing long-term value and operational viability, potentially impacting the Energy Infrastructure segment's profitability.

AES faces significant financial headwinds from high leverage and negative free cash flow, as evidenced by a negative free cash flow reported in Q1 2024. While asset sales are being used to improve its financial standing, these underlying issues could restrict future growth financing and shareholder returns.

| Weakness Category | Specific Issue | Impact on AES | Relevant Data Point (as of latest available, e.g., Q1 2024 or FY 2023) |

| Financial Health | High Debt Levels | Limits financial flexibility and increases interest expense burden. | Debt-to-equity ratio analysis from recent filings. |

| Cash Flow Generation | Negative Free Cash Flow | Hinders ability to fund growth internally or return capital to shareholders. | Reported negative free cash flow in Q1 2024. |

| Operational Mix | Legacy Fossil Fuel Assets | Vulnerability to environmental regulations and commodity price swings. | Contribution of thermal generation to segment EBITDA in FY 2023. |

| Market Sensitivity | Regulatory and Economic Dependence | Impacted by changes in government incentives, interest rates, and inflation. | Sensitivity analysis of project returns to interest rate changes. |

Same Document Delivered

AES SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final AES SWOT analysis.

Unlock the full, detailed report when you purchase.

Opportunities

The relentless growth of data centers, fueled by AI and cloud computing, is creating an unprecedented demand for clean energy. This trend is a prime opportunity for AES to expand its renewable energy footprint.

AES is well-positioned to capitalize on this demand, having already secured significant Power Purchase Agreements (PPAs) with tech giants like Microsoft and Meta. These agreements underscore the market's need for sustainable power solutions and provide AES with a stable revenue stream.

In 2023, AES reported a substantial increase in its renewable energy backlog, partly driven by these large-scale data center projects. The company's strategic focus on renewables aligns perfectly with the energy needs of these rapidly expanding technology sectors.

AES is strategically positioned to benefit from the growing demand for energy storage, a key component for reliably incorporating variable renewable sources like solar and wind into power grids. The company's successful completion of major solar-plus-storage projects, such as the Bellefield 1 facility which boasts 400 MW of solar and 120 MW of energy storage, demonstrates its proven capabilities in this burgeoning sector.

AES can capitalize on the significant ongoing investments in smart grid technologies and the automation of distribution operations. These advancements allow for enhanced grid efficiency and reliability, directly benefiting AES's operational performance and customer service.

The integration of advanced grid intelligence, including AI-driven applications, presents a prime opportunity. This can optimize operations for both grid management and renewable energy deployment, unlocking new avenues for value creation and improved customer experiences.

Strategic Partnerships and International Market Growth

AES is actively pursuing strategic partnerships, such as its collaboration with AI Fund, to develop advanced AI-driven solutions. This focus on innovation is crucial for staying competitive in the evolving energy sector. These collaborations are designed to enhance operational efficiency and create new revenue streams.

The company is strategically structuring projects in international markets, notably avoiding reliance on tax credits to ensure sustainable profitability. This approach demonstrates a commitment to long-term value creation across diverse global energy landscapes. AES's expansive global footprint provides access to a wide array of energy markets and varying demand patterns.

- AI Fund Partnership: Focus on AI-driven solutions for enhanced efficiency and new revenue streams.

- International Market Strategy: Structuring projects to avoid tax credit reliance for sustainable profitability.

- Global Market Access: Leveraging presence in diverse energy markets to tap into varied demand.

Leveraging Tax Attributes and Domestic Supply Chain

AES's strategic focus on building a robust domestic supply chain offers significant advantages. By reducing reliance on international suppliers, the company gains a buffer against potential tariffs and inflationary pressures, particularly relevant in the current global economic climate. This also enhances operational stability and predictability.

Furthermore, AES can leverage its ability to realize higher tax attributes from new projects. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, provides substantial tax credits for renewable energy development. AES can utilize these credits to offset its tax liabilities, thereby improving project economics and overall profitability. This is a key differentiator in the competitive renewable energy landscape.

- Domestic Supply Chain: AES's commitment to local sourcing mitigates risks associated with global trade disruptions and currency fluctuations.

- Tax Attribute Realization: The company is positioned to capitalize on tax incentives, such as those provided by the IRA, enhancing project returns.

- Inflation Hedge: A strong domestic supply chain acts as a natural hedge against rising costs due to inflation.

- Competitive Edge: These combined strategies strengthen AES's financial performance and market position in the rapidly growing renewable energy sector.

The increasing demand for renewable energy, particularly from data centers and AI growth, presents a significant opportunity for AES. The company's strong renewable energy backlog and existing Power Purchase Agreements (PPAs) with major tech firms like Microsoft and Meta, secured through 2023, highlight its ability to meet this demand and ensure stable revenue streams.

AES is also well-positioned to benefit from the expansion of energy storage solutions, crucial for grid stability with renewables. Its proven success in large-scale solar-plus-storage projects, such as Bellefield 1 with its 400 MW solar and 120 MW storage capacity, showcases its capabilities in this vital area.

The company's strategic focus on developing AI-driven solutions through partnerships, like the one with AI Fund, and its international market strategy, which emphasizes projects not reliant on tax credits, further solidify its growth potential. AES's commitment to building a domestic supply chain also serves as a hedge against inflation and trade disruptions, enhancing its competitive edge.

Threats

Changes in energy policies and regulations present a significant threat to AES. For instance, shifts in renewable energy incentives or the imposition of new tariffs, potentially influenced by legislation like the Inflation Reduction Act, could directly affect AES's project economics and future development plans.

The renewable energy landscape is fiercely contested, with a multitude of companies actively pursuing projects and aiming to capture market share. This crowded field can significantly impact pricing for Power Purchase Agreements (PPAs) and compress project profit margins for AES.

The pressure from intense competition could also lead to a slowdown in the rate at which AES secures new contracts, potentially affecting future revenue streams and growth projections. For instance, in 2024, renewable energy project development saw increased competition for solar and wind farm sites, leading to more aggressive bidding on PPAs.

AES faces significant operational risks in its large-scale energy projects, with potential for delays and cost overruns impacting financial performance. For instance, in 2023, the company reported that its renewable energy development pipeline, a key growth driver, experienced some schedule adjustments due to permitting and supply chain complexities.

These inherent challenges in the energy sector, particularly in constructing complex infrastructure like solar farms or gas-fired power plants, can lead to unforeseen technical hurdles. While AES's historical project execution is robust, any substantial deviation from planned timelines or budgets, as seen in some industry-wide infrastructure projects in 2024, could affect projected returns on investment.

Fluctuations in Commodity Prices and Interest Rates

Fluctuations in commodity prices, particularly for natural gas and coal, pose a significant threat to AES. For instance, a sharp increase in natural gas prices in late 2023 and early 2024 directly impacted the operational costs for AES's thermal power generation facilities. While AES has a substantial portion of its generation capacity under long-term contracts, which helps to shield it from some of these price swings, there's still residual exposure, especially for uncontracted volumes and during contract renegotiations.

Rising interest rates also present a challenge. Higher borrowing costs can increase AES's financing expenses for new renewable energy projects and infrastructure upgrades. As of the first quarter of 2024, the Federal Reserve's benchmark interest rate remained elevated, making capital more expensive. This can affect the economic viability of new investments and potentially slow down expansion plans.

- Commodity Price Volatility: Natural gas prices saw significant volatility in 2023-2024, impacting fuel procurement costs for AES's thermal plants.

- Interest Rate Sensitivity: Elevated interest rates in 2024 increase the cost of capital for AES's capital-intensive renewable energy projects.

- Contractual Mitigation: While long-term contracts reduce exposure, uncontracted generation capacity remains vulnerable to price shocks.

- Financing Costs: Higher interest rates directly translate to increased debt servicing and financing expenses for AES's ongoing development pipeline.

Environmental and Climate-Related Risks

As a global energy company, AES faces significant environmental and climate-related risks. Extreme weather events, such as hurricanes and floods, can disrupt operations and damage critical infrastructure, leading to increased maintenance costs and potential revenue losses. For instance, in 2023, severe weather events across various regions impacted energy infrastructure, underscoring the vulnerability of the sector.

The company also carries potential liabilities associated with its thermal assets, which are increasingly under scrutiny due to their carbon emissions. As the world transitions to cleaner energy sources, managing the decommissioning of older, less sustainable plants becomes a crucial operational and financial challenge. AES has been actively retiring coal-fired plants, with plans to retire more in the coming years as part of its decarbonization strategy.

- Infrastructure Vulnerability: Extreme weather events pose a direct threat to AES's physical assets, potentially causing significant damage and operational downtime.

- Thermal Asset Liabilities: The company must manage the financial and operational implications of its thermal power generation, including potential regulatory penalties and the cost of eventual decommissioning.

- Decommissioning Costs: The transition to renewables necessitates the careful planning and execution of retiring older, carbon-intensive facilities, which involves substantial costs and environmental considerations.

- Regulatory and Market Shifts: Evolving environmental regulations and market preferences for cleaner energy can impact the long-term viability and profitability of existing assets.

Intensifying competition in the renewable energy sector, particularly for solar and wind projects, can drive down Power Purchase Agreement (PPA) prices and reduce profit margins for AES. This was evident in 2024 with more aggressive bidding for project sites and PPAs, potentially slowing AES's contract acquisition rate.

Operational challenges, including project delays and cost overruns, remain a threat. AES experienced schedule adjustments in its renewable development pipeline in 2023 due to permitting and supply chain issues, highlighting the inherent risks in large-scale energy infrastructure development.

Commodity price volatility, especially for natural gas, directly impacts AES's thermal generation costs, though long-term contracts offer some insulation. Elevated interest rates as of Q1 2024 also increase AES's financing expenses for new projects, potentially slowing expansion.

Environmental risks, such as extreme weather events damaging infrastructure and the liabilities associated with thermal assets, pose ongoing threats. Managing the decommissioning of older, carbon-intensive plants is also a significant financial and operational consideration for AES.

SWOT Analysis Data Sources

The data sources for this AES SWOT analysis are comprehensive and authoritative, drawing from official company financial reports, extensive market research studies, and expert industry analyses to provide a robust and reliable strategic overview.