AES Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AES Bundle

AES operates within a dynamic energy sector, facing significant pressures from various market forces. Understanding these forces is crucial for navigating its competitive landscape and identifying strategic opportunities.

The complete report reveals the real forces shaping AES’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key energy suppliers significantly influences their bargaining power. For instance, companies providing specialized components for renewable energy, such as advanced solar cells or critical battery materials like lithium and cobalt, often operate in concentrated markets. This concentration means fewer suppliers control a larger portion of the market, giving them more leverage.

When these suppliers offer unique or patented technologies, their bargaining power is further amplified. If AES relies on such specialized inputs, switching to an alternative supplier becomes difficult and potentially costly. This dependency can force AES to accept less favorable terms, impacting its operational costs and profitability.

In 2024, the demand for critical minerals like lithium and cobalt, essential for battery production in the energy sector, remained high, with global lithium production estimated to reach over 1.3 million metric tons. Suppliers of these materials, often concentrated in a few countries, therefore held considerable sway over pricing and availability.

The bargaining power of suppliers for AES is significantly influenced by switching costs. If AES has made substantial investments in specialized equipment or integrated its operations with a particular supplier's technology, the expense and complexity of transitioning to a new vendor would be considerable. This dependence enhances the supplier's leverage.

The availability of substitute inputs significantly influences the bargaining power of suppliers for AES. If AES can easily switch to alternative energy sources or components, the power of existing suppliers diminishes. For instance, the growing adoption of distributed solar generation, with a projected global capacity increase of over 30% in 2024 alone, offers a direct substitute for traditional grid-supplied electricity, thereby weakening the leverage of incumbent power providers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly impact AES's bargaining power. If key suppliers, such as those providing critical components for renewable energy projects or fuel for traditional power plants, possess the capability and inclination to move into energy generation or distribution themselves, they become direct competitors. This scenario would dramatically alter the supplier-customer relationship, shifting power towards the integrated supplier.

For example, a major manufacturer of wind turbines could potentially decide to develop, own, and operate wind farms, directly competing with AES for electricity sales. Such a move would not only reduce AES's supplier options but also introduce a formidable competitor with established manufacturing expertise and potentially lower costs. This potential competitive threat forces AES to carefully manage its supplier relationships and consider the strategic implications of supplier capabilities.

- Supplier Capability for Forward Integration: The degree to which suppliers possess the capital, technology, and market knowledge to enter AES's core business operations.

- Example Scenario: A large solar panel manufacturer establishing its own solar farm operations to sell electricity directly to consumers or the grid.

- Impact on AES: Increased competition, potential for reduced profit margins, and a need for strategic partnerships or vertical integration to counter this threat.

- Industry Trends (2024): In 2024, the renewable energy sector saw continued consolidation and investment, with some equipment manufacturers exploring downstream opportunities to secure demand and capture more value chain profit.

Importance of Supplier's Input to AES's Business

The bargaining power of suppliers is a crucial element in understanding AES's competitive landscape. The criticality of a supplier's input directly impacts AES's operational efficiency and strategic direction, particularly as the company navigates its clean energy transition.

For instance, AES's reliance on specialized components for grid modernization and raw materials for battery storage means that suppliers of these essential inputs can wield significant influence. Access to reliable and cost-effective materials is not merely a logistical concern; it's fundamental to AES's ability to integrate innovative technologies and meet its sustainability goals.

- Criticality of Inputs: AES's operations are heavily dependent on specialized components for grid modernization and raw materials for battery storage solutions.

- Strategic Impact: The availability and cost of these inputs directly affect AES's ability to execute its clean energy transition strategy and adopt new technologies.

- Supplier Influence: Suppliers of critical components and raw materials possess considerable bargaining power due to their essential role in AES's value chain.

The bargaining power of suppliers for AES is amplified when they offer critical inputs essential for the company's operations, especially during its clean energy transition. Suppliers of specialized components for grid modernization and raw materials for battery storage, like lithium and cobalt, hold significant leverage due to high demand and limited availability, as seen with lithium production exceeding 1.3 million metric tons in 2024.

High switching costs, stemming from integrated technologies or specialized equipment investments, further empower suppliers. If AES faces substantial expenses or complexities in changing vendors, suppliers can dictate terms more effectively. This is particularly relevant as the renewable energy sector saw continued investment and some manufacturers exploring downstream integration in 2024, potentially creating direct competition for AES.

| Factor | Description | Impact on AES | 2024 Data/Trend |

| Supplier Concentration | Few suppliers dominate markets for specialized components and critical minerals. | Increased leverage for suppliers on pricing and availability. | High demand for lithium (over 1.3M metric tons produced) concentrated in few countries. |

| Switching Costs | Investments in specialized equipment or integrated technology. | Makes it difficult and costly for AES to change suppliers. | N/A (Specific AES investment data not publicly available) |

| Threat of Forward Integration | Suppliers entering AES's core business (e.g., energy generation). | Creates direct competition, shifting power to suppliers. | Renewable equipment manufacturers exploring downstream opportunities. |

What is included in the product

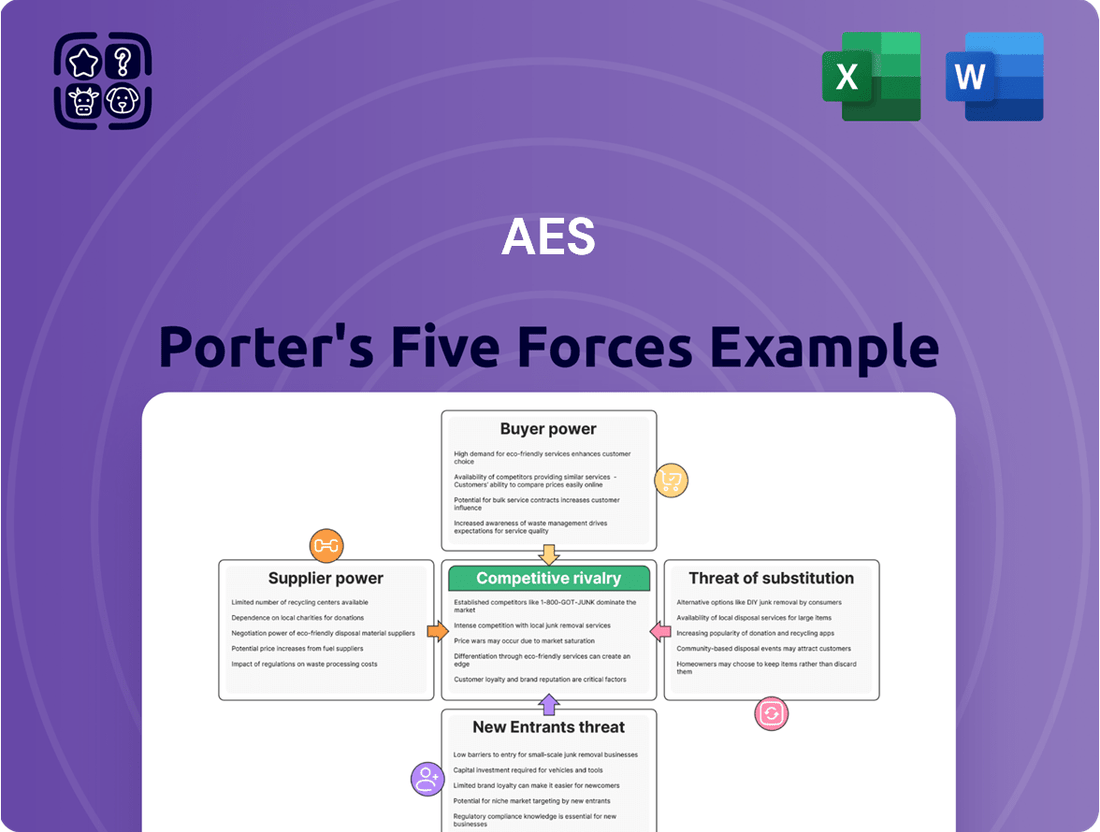

Analyzes the five competitive forces—rivalry, new entrants, buyer power, supplier power, and substitutes—to assess the attractiveness and profitability of the energy sector for AES.

Effortlessly identify and mitigate competitive threats with a visual breakdown of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The bargaining power of AES's customers is significantly shaped by customer concentration and the sheer volume of electricity they purchase. For instance, large industrial clients or data centers that are major consumers can wield considerable influence, especially when they commit to long-term Power Purchase Agreements (PPAs). In 2023, AES reported that its largest customers accounted for a substantial portion of its revenue, giving these entities leverage to negotiate better pricing and contract terms.

The ease with which customers can switch providers significantly influences their bargaining power. For AES, high switching costs, often seen in traditional utility models due to infrastructure integration or long-term contracts, limit customer leverage.

However, the energy landscape is evolving. In 2024, the growth of distributed energy resources like rooftop solar and battery storage is lowering these barriers. For instance, a residential customer with solar panels can reduce their reliance on AES, effectively lowering their switching costs and increasing their ability to negotiate or seek alternative solutions.

Customers' ability to generate their own power, such as through rooftop solar installations, significantly diminishes their reliance on traditional utility providers like AES. This trend is amplified by the decreasing costs of renewable energy technologies, making alternative energy solutions more accessible and attractive to consumers.

Customer Price Sensitivity

Customer price sensitivity is a significant factor influencing the bargaining power of customers for AES. When customers have many choices or are large consumers of electricity, even small price fluctuations can prompt them to switch providers or demand better terms. For instance, in 2024, industrial customers, who often represent a substantial portion of an energy provider's revenue, are particularly attuned to cost savings.

This sensitivity is amplified when wholesale electricity prices rise, as it directly impacts the retail price customers pay. If AES faces higher input costs, passing these onto customers can trigger a stronger reaction from those who can more easily explore alternative energy sources or negotiate more aggressively. The increasing availability of distributed generation, like rooftop solar, further empowers customers by offering a viable alternative, thereby increasing their leverage.

- Price Sensitivity: Customers are more likely to switch providers or negotiate harder if they perceive a significant price difference.

- Market Competitiveness: In markets with multiple energy suppliers, customers have more options, increasing their bargaining power.

- Wholesale Price Impact: Rising wholesale electricity costs can heighten customer sensitivity to retail price increases.

- Alternative Sources: The growing availability of alternative energy solutions, such as solar power, provides customers with greater leverage.

Customer Information and Transparency

Customers are increasingly informed about energy pricing and consumption thanks to readily available data and comparisons. This transparency, amplified by smart grid technologies and digital platforms, allows them to make smarter choices about their energy providers and usage. For instance, by mid-2024, consumer access to real-time energy usage data through smart meters was becoming standard in many regions, directly impacting their ability to negotiate or switch providers based on cost and efficiency.

- Informed Choices: Greater access to pricing, consumption, and competitor data empowers customers.

- Smart Technology Impact: Smart grids and digital tools enhance transparency and decision-making.

- Increased Bargaining Power: Transparency enables customers to demand better terms or switch providers more easily.

- Data-Driven Negotiations: Customers can leverage their consumption data to negotiate rates or service levels.

The bargaining power of AES's customers is influenced by their ability to switch providers and their price sensitivity. As of early 2024, the proliferation of distributed energy resources, like residential solar, has significantly lowered switching costs for some customer segments. This allows them to reduce reliance on traditional utilities, thereby increasing their leverage in price negotiations.

| Factor | Impact on AES | 2024 Trend/Data |

|---|---|---|

| Customer Concentration | High concentration of large industrial clients grants them significant leverage. | AES's largest industrial customers represent a considerable portion of revenue, enabling strong negotiation power. |

| Switching Costs | Historically high, but decreasing due to distributed generation. | Growth in rooftop solar and battery storage in 2024 offers viable alternatives, reducing customer lock-in. |

| Price Sensitivity | Directly correlates with customer leverage, especially for large consumers. | Industrial customers in 2024 are highly attuned to cost savings, increasing pressure on energy providers. |

| Information Availability | Empowers customers to compare and negotiate more effectively. | Smart meter data access by mid-2024 allows customers to scrutinize usage and demand better rates. |

What You See Is What You Get

AES Porter's Five Forces Analysis

This preview showcases the comprehensive AES Porter's Five Forces Analysis you will receive immediately after purchase. You are viewing the exact, fully formatted document, ensuring no surprises or placeholder content. This professionally prepared analysis is ready for your immediate download and application, providing you with all the insights you need.

Rivalry Among Competitors

The energy industry's overall growth rate, especially electricity demand, directly impacts how fiercely companies like AES compete. While a broad surge in demand is evident, driven by trends like electrification and the burgeoning needs of AI data centers, any slowdown in specific energy segments could lead to more intense rivalry among established players.

The energy sector, both globally and in regions where AES operates, is characterized by a wide array of competitors. This includes established traditional utility companies, agile independent power producers, and rapidly growing renewable energy developers, all vying for market share.

The sheer number of these players, each with distinct strategies and diverse asset bases, significantly heightens the competitive rivalry. For instance, in 2024, the global renewable energy market saw continued expansion, with significant investments flowing into solar and wind projects, increasing the competitive pressure on companies like AES to innovate and optimize their operations.

In the energy sector, electricity frequently functions as a commodity, presenting a significant hurdle for product differentiation. While AES Corporation is actively investing in cleaner energy solutions and advanced technologies, competitors can potentially offer comparable innovations or more attractive pricing, thereby diminishing AES's differentiation advantage and increasing customer willingness to switch.

Exit Barriers

High exit barriers in the energy sector, particularly for utilities, mean companies may continue operating even when returns are minimal. This is due to substantial investments in fixed assets like power plants and transmission networks, which are difficult and costly to divest. For instance, in 2024, the average lifespan of a coal-fired power plant can exceed 40 years, representing a significant sunk cost that discourages early closure.

These substantial fixed assets, coupled with long-term power purchase agreements and regulatory commitments, create a situation where companies are compelled to stay in the market. This persistence, even in the face of low profitability, intensifies competitive pressure as these players continue to supply power. The capital intensity of the industry means that exiting is not simply a matter of closing shop; it involves complex decommissioning processes and potential penalties for breaking contracts.

The implications for competitive rivalry are clear: companies with high exit barriers are less likely to leave the market, even during downturns. This can lead to overcapacity and sustained price competition. For example, in 2024, some regions might still see older, less efficient generation capacity remaining online due to these exit barriers, impacting the profitability of newer, more efficient plants.

- Significant Fixed Assets: Power plants, transmission lines, and distribution networks represent massive, illiquid investments.

- Long-Term Contracts: Power purchase agreements (PPAs) and fuel supply contracts can lock companies into operations for decades.

- Regulatory Obligations: Mandates for grid reliability and service provision often prevent or penalize early exit.

- Decommissioning Costs: The expense and complexity of safely shutting down and dismantling energy infrastructure act as a deterrent to leaving the market.

Strategic Commitments and Investments

AES's significant investments in renewable energy, energy storage, and grid modernization are a clear signal of its strategic direction. These commitments, including a pledge to exit coal by 2025 and a goal to triple its renewables portfolio by 2027, are designed to reshape its business and capture future growth opportunities.

These strategic moves inherently intensify competitive rivalry. As AES aggressively pursues clean energy, other utilities and energy companies are compelled to accelerate their own transitions to remain competitive. This creates a dynamic environment where innovation and investment in sustainable technologies become critical differentiators.

- AES's 2023 renewable energy portfolio reached 5.9 GW, with a target to expand to 17.2 GW by 2027.

- The company has committed $2.5 billion in capital expenditures for renewables and energy storage in 2024.

- Competitors like NextEra Energy and Iberdrola are also making substantial investments in similar clean energy sectors, increasing the competitive pressure.

The energy sector's competitive rivalry is amplified by the commodity nature of electricity, making differentiation challenging. Despite AES's focus on cleaner energy, competitors can easily match technological advancements or offer lower prices, encouraging customer switching. This dynamic is evident as the global renewable energy market continues to expand, with substantial investments in 2024 intensifying competition for market share and innovation.

High exit barriers, stemming from significant fixed assets like power plants and long-term contracts, compel companies to remain in the market even with low profitability. This persistence, exemplified by the 40+ year operational lifespan of many coal plants in 2024, leads to overcapacity and sustained price competition, impacting overall industry profitability.

AES's strategic pivot towards renewables, including a pledge to exit coal by 2025 and a goal to triple its renewables portfolio by 2027, intensifies rivalry. Competitors are forced to accelerate their own clean energy transitions, making innovation and investment in sustainable technologies crucial for differentiation. For instance, AES committed $2.5 billion in capital expenditures for renewables and energy storage in 2024, a move mirrored by rivals like NextEra Energy.

| Factor | Description | Impact on AES |

| Number of Competitors | Numerous utilities, IPPs, and renewable developers | Heightens competition for market share and projects |

| Product Differentiation | Electricity often a commodity | Reduces pricing power and necessitates innovation for advantage |

| Exit Barriers | High fixed assets, long-term contracts, regulatory obligations | Can lead to overcapacity and prolonged price competition |

| Growth Rate | Strong overall demand, but segment variations exist | Slower segment growth can increase rivalry intensity |

SSubstitutes Threaten

The price-performance ratio of substitute technologies is a significant threat. For instance, renewable energy sources like solar and wind power are becoming increasingly competitive with traditional fossil fuels due to continuous technological advancements and falling costs. Perovskite solar cells, a prime example, are demonstrating higher efficiencies at reduced production expenses, directly impacting the attractiveness of incumbent energy solutions.

Customers, from major corporations to individual homeowners, are increasingly open to switching to alternative energy sources. This shift is driven by a growing awareness of environmental issues, the pursuit of lower energy costs, and a desire for greater control over their energy supply. We're seeing this trend clearly with the rising popularity of rooftop solar installations and the widespread adoption of electric vehicles.

The willingness to substitute is a significant factor. For instance, in 2024, the global electric vehicle market saw substantial growth, with sales projected to reach over 16 million units, indicating a strong customer preference for alternatives to traditional gasoline-powered vehicles. Similarly, residential solar adoption continued its upward trajectory, with new installations in the US increasing by approximately 15% in 2024 compared to the previous year, demonstrating a clear customer propensity to embrace substitute energy solutions.

The threat of indirect substitutes is a significant factor for AES. Beyond simply switching to a different energy provider, consumers can reduce their reliance on traditional electricity by adopting energy efficiency measures. For instance, improvements in building insulation and the use of LED lighting directly lower electricity demand.

Furthermore, demand-side management programs, often facilitated by smart home devices and AI-powered optimization tools, allow consumers to better control and reduce their energy consumption during peak hours. This trend, growing in prominence through 2024, effectively diminishes the overall market for AES's core electricity generation and distribution services.

Regulatory and Policy Support for Substitutes

Government incentives, subsidies, and favorable regulatory frameworks for renewable energy and energy storage significantly accelerate the adoption of these substitutes. For instance, the Inflation Reduction Act in the US, enacted in 2022, provides substantial tax credits for solar and wind power, driving investment in these sectors. By 2024, these policies are expected to further bolster the market share of renewable energy sources.

Global climate goals and decarbonization efforts, such as those outlined in the Paris Agreement, further support the shift away from traditional energy sources. Many countries have set ambitious targets for renewable energy integration. For example, the European Union aims for at least 42.5% renewable energy by 2030, a directive that naturally pressures the demand for fossil fuels.

- Government Incentives: Tax credits and grants for renewable energy installations are becoming more common globally.

- Renewable Energy Targets: Numerous nations have established aggressive renewable energy capacity goals for the coming years.

- Decarbonization Policies: Regulations aimed at reducing carbon emissions directly favor the adoption of cleaner energy substitutes.

Technological Disruption and Innovation

Technological disruption poses a significant threat to AES. Emerging technologies, such as green hydrogen production and advanced battery storage, are rapidly evolving. These innovations could offer more sustainable and cost-effective alternatives to traditional energy sources that AES currently relies on.

For instance, the global green hydrogen market is projected to reach $183.5 billion by 2030, indicating substantial growth potential for substitute technologies. Similarly, advancements in energy storage, like solid-state batteries, promise higher energy density and faster charging, potentially displacing existing grid-scale storage solutions.

- Green Hydrogen Market Growth: Expected to reach $183.5 billion by 2030, presenting a viable alternative for energy generation.

- Energy Storage Advancements: Innovations like solid-state batteries offer improved performance over current technologies.

- Electrification Trends: Increasing adoption of electric vehicles and industrial processes directly impacts demand for fossil fuels, a core AES business.

The threat of substitutes for AES is substantial, driven by the increasing viability and adoption of alternative energy solutions. These substitutes offer comparable or superior performance at competitive price points, directly challenging AES's traditional energy offerings.

Customer willingness to switch is a key driver, fueled by environmental concerns and cost savings. For example, the global electric vehicle market saw over 16 million unit sales in 2024, a clear indicator of consumer preference for alternatives to gasoline-powered vehicles.

Indirect substitutes, such as energy efficiency measures and demand-side management, also pose a threat by reducing overall electricity consumption. Smart home devices and AI optimization tools are becoming more prevalent, empowering consumers to lower their energy usage.

Government policies and global climate goals further accelerate the adoption of substitutes. For instance, the US Inflation Reduction Act provides significant tax credits for renewables, boosting their market share.

| Substitute Type | 2024 Market Indicator | Impact on AES |

|---|---|---|

| Renewable Energy (Solar/Wind) | US residential solar installations up ~15% in 2024 | Directly reduces demand for grid-supplied electricity |

| Electric Vehicles | Global sales projected >16 million units in 2024 | Shifts energy demand from gasoline to electricity, potentially impacting grid load management |

| Energy Efficiency Measures | Growing adoption of smart home tech for energy optimization | Lowers overall electricity consumption |

| Green Hydrogen | Market projected $183.5B by 2030 | Emerging alternative for energy generation and storage |

Entrants Threaten

The energy sector, particularly for utility-scale operations, demands massive upfront capital for power plant construction, transmission lines, and grid integration. For instance, a new large-scale solar farm in 2024 can cost hundreds of millions of dollars, with offshore wind projects easily exceeding billions. These immense financial requirements act as a significant deterrent, effectively limiting the pool of potential new entrants.

The energy sector, including AES's operations, faces substantial regulatory barriers. Navigating the intricate web of licensing, permitting, and stringent environmental compliance requirements presents a formidable challenge for any potential new entrant. For instance, in 2024, the U.S. Department of Energy continued to emphasize rigorous safety and environmental standards for new energy infrastructure projects, adding significant lead times and costs.

The formidable challenge for new entrants in the energy sector lies in securing access to established distribution channels and the essential grid infrastructure. Existing players, such as AES, have spent decades building out extensive transmission and distribution networks. This creates a significant barrier for newcomers who would need to either replicate this massive investment or forge complex, often costly, partnerships to connect with customers and integrate their power generation into the existing grid.

Economies of Scale and Experience

Incumbent utilities, including AES, leverage significant economies of scale across generation, fuel procurement, and operational management. This allows them to spread fixed costs over a larger output, resulting in lower per-unit costs. For instance, in 2023, AES reported total operating revenues of $17.7 billion, underscoring the vast scale of its operations.

New entrants would face substantial hurdles in matching these cost efficiencies. Building new, large-scale generation facilities and establishing robust supply chains requires immense capital investment and time to develop the necessary expertise. Without achieving comparable operational volumes, new players would likely operate at a cost disadvantage.

- Economies of Scale: AES benefits from lower per-unit costs due to its large operational footprint in generation and procurement.

- Experience Curve: Years of operation have allowed AES to optimize processes, further reducing costs and improving efficiency.

- Capital Intensity: The high capital requirements for new, large-scale energy infrastructure act as a significant barrier to entry.

- Procurement Power: AES's substantial purchasing volume provides leverage in negotiating favorable terms for fuel and equipment, a benefit not easily replicated by smaller new entrants.

Brand Loyalty and Customer Switching Costs

Brand loyalty and customer switching costs represent a significant barrier to new entrants in the energy sector. Established energy providers often cultivate strong customer relationships through consistent service reliability and perceived value, making it less likely for customers to switch. For instance, in 2024, the average customer tenure with a primary electricity provider in the US remained substantial, indicating a reluctance to change. This loyalty, coupled with the perceived complexity and potential disruption associated with switching energy suppliers, creates a tangible cost for new companies aiming to acquire customers.

These switching costs aren't just about the inconvenience; they can also involve financial considerations and the need to re-evaluate contracts. For example, early termination fees on existing energy plans can deter customers from moving to a new provider, even if more competitive rates are offered. In 2024, many residential energy contracts still included such clauses, further solidifying the position of incumbent firms. The effort required to research new options, compare plans, and manage the transition process also adds to these costs, effectively shielding existing players from immediate competitive threats.

- Customer Retention: In 2023, the average customer retention rate for major US utility companies hovered around 95%, underscoring the difficulty new entrants face in gaining market share.

- Switching Inertia: A significant portion of consumers express a desire to switch energy providers but cite a lack of time or understanding as primary reasons for not doing so, highlighting customer inertia as a key barrier.

- Contractual Lock-ins: Many energy contracts, particularly for commercial clients, feature multi-year terms with penalties for early termination, creating substantial switching costs that deter new entrants.

The threat of new entrants in the energy sector, particularly for utility-scale operations, is significantly mitigated by the immense capital required for infrastructure development. For instance, building a new large-scale solar farm in 2024 could cost hundreds of millions of dollars, while offshore wind projects easily surpass billions, creating a substantial financial barrier. Furthermore, stringent regulatory hurdles, including complex licensing, permitting, and environmental compliance, add considerable time and expense, deterring potential newcomers. Established players like AES also benefit from entrenched distribution channels and existing grid infrastructure, which would be prohibitively expensive for new companies to replicate.

| Barrier Type | Description | Example Impact (2024 Data) |

|---|---|---|

| Capital Requirements | Massive upfront investment for power plants and transmission lines. | Solar farm costs: hundreds of millions; Offshore wind: billions. |

| Regulatory Hurdles | Complex licensing, permitting, and environmental compliance. | Extended lead times and increased project costs due to DOE standards. |

| Distribution & Grid Access | Difficulty in replicating or accessing established networks. | High costs for new entrants to connect to existing grid infrastructure. |

| Economies of Scale | Incumbents' cost advantages from large-scale operations. | AES's $17.7 billion in operating revenues (2023) demonstrates scale benefits. |

| Customer Loyalty & Switching Costs | Inertia and contractual terms make customer acquisition difficult. | High customer retention rates (approx. 95% for major utilities in 2023). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, company annual filings, and expert analyst insights. We also leverage government economic data and trade association publications to ensure a comprehensive understanding of competitive pressures.