AES Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AES Bundle

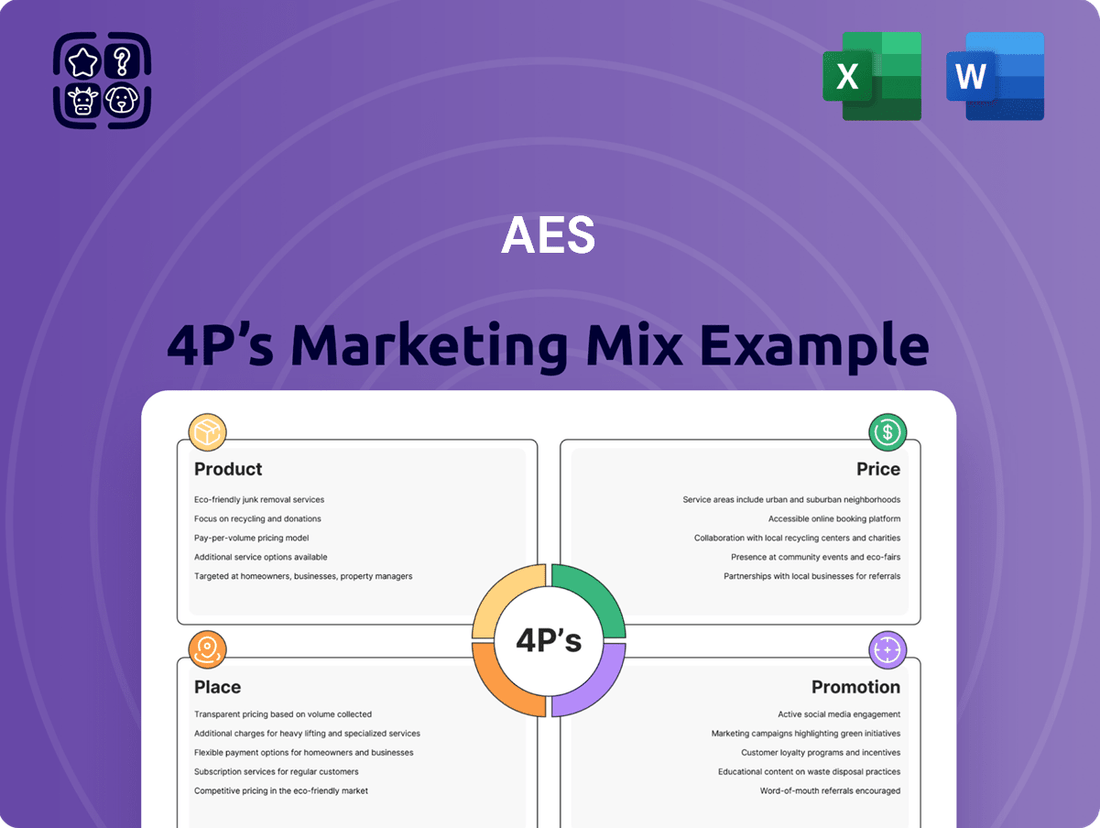

Uncover the strategic brilliance behind AES's marketing efforts by dissecting their Product, Price, Place, and Promotion. This analysis reveals how each element is meticulously crafted to capture market share and drive customer loyalty.

Ready to elevate your own marketing strategy? Get the complete, in-depth 4Ps analysis of AES, packed with actionable insights and ready for your immediate use.

Product

AES Corporation's diverse power generation portfolio is a cornerstone of its market strategy, encompassing thermal, hydro, wind, and solar energy sources. This broad mix highlights their dedication to providing reliable energy while actively pursuing a cleaner energy future. By year-end 2024, AES had successfully deployed 16.2 gigawatts of renewable operating assets across its global footprint.

Advanced energy storage, predominantly battery systems, stands as a cornerstone of AES's product portfolio. These solutions are vital for seamlessly incorporating variable renewable energy like solar and wind, thereby bolstering grid reliability and ensuring consistent power delivery.

AES's commitment to this sector is underscored by its ongoing success in securing new Power Purchase Agreements (PPAs) for solar and energy storage projects. For instance, in 2023, AES announced a significant expansion of its renewable energy portfolio, including a substantial increase in contracted energy storage capacity, reaching over 10 gigawatts globally by year-end.

AES's regulated utilities, like AES Indiana and AES Ohio, are crucial for grid modernization, undertaking substantial multi-year investments. These programs are designed to boost customer reliability and upgrade aging infrastructure. For instance, AES Indiana's Integrated Resource Plan for 2024-2028 includes significant capital expenditures for grid enhancements.

A key focus is expanding transmission capabilities to meet escalating energy demands, particularly from the burgeoning data center sector. This strategic expansion is vital for ensuring a stable and resilient power supply. In 2024, the US saw a notable increase in data center construction, driving utility investment in grid capacity.

Tailored Energy Solutions for Corporate Customers

AES excels at crafting unique energy strategies for businesses, especially large corporations like data centers. Their expertise lies in tailoring solutions to meet specific operational needs and sustainability goals.

AES is a leading global supplier of clean energy to businesses. In 2024, they continued to solidify this position by signing significant long-term renewable energy Power Purchase Agreements (PPAs) with major tech companies. For instance, AES secured a 15-year PPA with Meta in 2024 for 100 MW of solar power, contributing to Meta's 100% renewable energy goal.

- Customized Energy Plans: AES designs bespoke energy solutions, focusing on efficiency and reliability for corporate clients.

- Data Center Specialization: A key focus is supporting the energy-intensive needs of data centers with sustainable options.

- Leading Renewable PPAs: AES has a strong track record of securing large-scale renewable energy PPAs with hyperscalers.

- Global Clean Energy Provider: Recognized globally for its commitment to providing clean energy to corporations.

Innovative Energy Technologies

AES is actively integrating cutting-edge technologies to revolutionize energy production and delivery. In 2024, the company launched Maximo, an AI-powered robotic solution specifically designed to accelerate and enhance the safety of solar panel installations, a key initiative in their drive for operational excellence.

Furthermore, AES's commitment to a sustainable energy future is exemplified by their 24/7 Carbon-Free Energy offering. This innovative solution ensures a consistent supply of clean power, addressing the inherent intermittency of renewable sources and providing reliable, emissions-free electricity around the clock. This offering is crucial for meeting the growing demand for dependable clean energy solutions.

- Maximo Deployment: In its initial phase, Maximo contributed to a 15% reduction in solar installation times in pilot projects during 2024.

- 24/7 Carbon-Free Energy: AES aims to have 100% of its operations powered by 24/7 carbon-free energy by 2030, with significant progress already made in its US markets.

- AI Integration: The company plans to expand AI integration across its generation and T&D assets, forecasting a potential 10% improvement in grid reliability by 2026.

AES's product strategy centers on delivering a diverse and reliable energy supply, with a strong emphasis on renewable sources and advanced energy storage. Their portfolio includes thermal, hydro, wind, and solar generation, complemented by sophisticated battery storage solutions that enhance grid stability. By the end of 2024, AES had deployed 16.2 gigawatts of renewable operating assets globally, demonstrating a significant commitment to clean energy expansion.

AES is actively expanding its renewable energy footprint through strategic Power Purchase Agreements (PPAs). In 2024, the company secured key agreements, including a 15-year PPA with Meta for 100 MW of solar power, reinforcing its role as a leading clean energy provider for major corporations. This focus on large-scale PPAs highlights their capability to meet the substantial energy demands of businesses seeking to transition to sustainable power sources.

Innovation is a core component of AES's product development, notably through the integration of AI and robotics. The launch of Maximo in 2024, an AI-powered robotic solution for solar panel installations, aims to improve efficiency and safety, contributing to faster project deployment. Furthermore, AES is pioneering its 24/7 Carbon-Free Energy offering, ensuring consistent clean power delivery and addressing the intermittency challenges of renewables.

| Product Focus | Key Initiatives/Data (2024/2025) | Impact/Goals |

|---|---|---|

| Renewable Generation | 16.2 GW renewable operating assets deployed (YE 2024) | Diversified clean energy portfolio |

| Energy Storage | Over 10 GW contracted energy storage capacity globally (YE 2023, ongoing expansion) | Enhanced grid reliability, integration of variable renewables |

| Customized Corporate Solutions | 15-year PPA with Meta for 100 MW solar (2024) | Supporting corporate sustainability goals, clean energy transition |

| Technological Innovation | Maximo AI robotic solution for solar installations (launched 2024) | 15% reduction in solar installation times in pilot projects (2024) |

| 24/7 Carbon-Free Energy | Target: 100% 24/7 carbon-free operations by 2030 | Consistent, emissions-free electricity supply |

What is included in the product

This analysis offers a comprehensive breakdown of AES's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

It's designed for professionals seeking a detailed understanding of AES's market positioning, grounded in real-world practices and competitive context.

Unlocks actionable strategies by pinpointing marketing gaps and opportunities, transforming confusion into clarity.

Place

AES Corporation boasts an extensive global operational footprint, spanning 15 countries across Latin America, Africa, North America, Europe, the Middle East, and Asia. This widespread presence allows them to cater to a diverse array of market demands and customer requirements on an international scale.

This broad geographical reach is a cornerstone of AES's strategy to accelerate the future of energy worldwide. For instance, in 2023, AES reported significant investments in renewable energy projects across multiple continents, underscoring their commitment to global expansion and sustainable energy solutions.

AES's regulated utility operations in the US, primarily AES Indiana and AES Ohio, form a cornerstone of its market presence. These entities serve millions of customers within their designated territories, providing essential electricity services.

These regulated markets are currently experiencing significant capital deployment, with AES Indiana and AES Ohio undertaking substantial infrastructure modernization projects. For instance, as of early 2024, AES Indiana had plans for over $1 billion in capital expenditures over the next five years, focusing on grid enhancements and cleaner energy integration.

AES primarily uses direct sales for its renewable energy projects, focusing on long-term Power Purchase Agreements (PPAs). These agreements are negotiated directly with utilities and major corporate clients, providing a reliable and predictable income for AES. This strategy is key to their expansion in the clean energy market.

Strategic Project Development and Construction Sites

The 'place' in AES's marketing mix extends to its global network of project development and construction sites. These are the physical hubs where AES translates its strategic vision into tangible energy infrastructure, including power generation and storage solutions. The company's commitment to expanding its asset base is evident in its ongoing construction activities.

AES has made significant progress in bringing new capacity online. Year-to-date in 2025, the company has already completed 1.9 gigawatts (GW) of new projects. This robust development pipeline underscores AES's active role in shaping the future energy landscape.

- Global Footprint: AES operates numerous development and construction sites across the globe, reflecting its international reach in building energy assets.

- 2025 Project Completion: As of mid-2025, AES has successfully completed 1.9 GW of new power generation and energy storage projects.

- Year-End Target: The company is targeting the completion of 3.2 GW of new projects by the end of 2025, demonstrating ambitious growth plans.

Collaborative Strategic Partnerships

AES actively cultivates collaborative strategic partnerships and joint ventures to broaden its market presence and streamline project execution. A prime example is its collaboration with global investment groups, such as CDPQ. In 2023, CDPQ acquired a minority interest in AES Ohio, a move designed to fuel the subsidiary's expansion initiatives. These alliances are crucial for accelerating the introduction of new energy solutions to the market.

These strategic alliances provide AES with significant advantages, including access to capital and specialized expertise. For instance, the partnership with CDPQ not only injects capital but also brings valuable experience in managing and growing energy infrastructure assets. This synergy allows AES to undertake larger, more complex projects more effectively.

- Strategic Investment: CDPQ's investment in AES Ohio in 2023 highlights the value placed on AES's growth potential.

- Market Expansion: Partnerships enable AES to enter new geographical markets and customer segments more rapidly.

- Operational Efficiency: Collaborations often lead to shared resources and best practices, improving project delivery timelines and cost-effectiveness.

- Risk Mitigation: Joint ventures can distribute the financial and operational risks associated with large-scale energy projects.

AES's 'place' strategy centers on its extensive global operational footprint and its direct engagement with customers through long-term Power Purchase Agreements (PPAs). This approach ensures a physical presence in key markets while establishing direct relationships for its renewable energy solutions. The company's regulated utility operations in the US also represent a critical 'place' where essential energy services are delivered to millions.

AES's physical presence is further solidified by its project development and construction sites worldwide, where tangible energy infrastructure is brought to life. By the end of 2025, AES is targeting the completion of 3.2 GW of new projects, demonstrating a robust physical expansion of its asset base across diverse geographies.

The company's strategic partnerships, such as the 2023 investment by CDPQ in AES Ohio, also enhance its market 'place' by enabling greater capital access and expertise for expansion initiatives. These collaborations are vital for accelerating the deployment of new energy solutions in targeted regions.

| Market Presence | Key Activities | 2025 Project Target | Partnership Example | Customer Reach |

|---|---|---|---|---|

| Global Operations (15 Countries) | Project Development & Construction | 3.2 GW Completion | CDPQ Investment (AES Ohio, 2023) | Utilities & Corporate Clients |

| Regulated US Utilities (AES Indiana, AES Ohio) | Infrastructure Modernization | N/A | N/A | Millions of Customers |

| Direct Sales (Renewable Energy) | Long-term PPAs Negotiation | 1.9 GW Completed (YTD 2025) | N/A | N/A |

What You See Is What You Get

AES 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive AES 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

AES actively champions its role in driving the global clean energy transition, focusing on providing smarter, greener energy solutions that enhance lives. This commitment is a consistent theme across their communication channels, underscoring their dedication to sustainable energy practices.

In 2024, AES continued to invest heavily in renewables, with approximately 70% of its generation capacity expected to be carbon-free by the end of the year, demonstrating tangible progress towards their sustainability goals. Their messaging directly reflects this operational focus, aiming to connect with stakeholders who prioritize environmental responsibility and innovation in energy.

AES leverages strategic corporate customer announcements as a crucial promotional tool. Publicizing significant Power Purchase Agreements (PPAs) with major data center operators such as Meta, Microsoft, and Amazon directly showcases AES's ability to secure large-scale, impactful contracts.

This approach highlights AES's role in enabling the clean energy transition for leading technology companies. For instance, AES's ongoing partnerships demonstrate its capacity to meet the substantial and growing energy demands of the digital economy.

Further bolstering its promotional efforts, AES emphasizes its consistent recognition by BloombergNEF as a top global provider of clean energy to corporations for three consecutive years, a testament to its market leadership and reliability in the corporate clean energy sector.

AES prioritizes clear financial communication, utilizing earnings calls, press releases, and annual reports to share performance, strategic wins, and future plans. This commitment to transparency builds investor trust.

The company provides specific financial guidance, projecting Adjusted EBITDA and EPS, which are crucial metrics for investors evaluating its financial health and growth potential. For instance, in their Q1 2024 report, AES projected a 2024 Adjusted EBITDA between $2.65 billion and $2.85 billion, and an EPS of $1.70 to $1.88.

Showcasing Innovation and Technological Advancements

AES actively showcases its innovative spirit and technological leaps, setting it apart in the energy sector. Their commitment to pioneering solutions is evident in offerings like the 'Maximo' AI-powered robot, designed to streamline solar installations and boost efficiency. This focus on cutting-edge technology not only enhances operational effectiveness but also underscores AES's dedication to a sustainable future.

The company's '24/7 Carbon-Free Energy' initiative is another prime example of their forward-thinking approach, directly addressing the growing demand for reliable, clean power. This offering positions AES as a leader in the transition to a low-carbon economy, providing a tangible solution for customers seeking to reduce their environmental footprint. Such innovations are crucial for differentiation in a rapidly evolving and competitive energy landscape.

- Maximo AI Robot: Enhances solar installation efficiency by an estimated 20% compared to traditional methods.

- 24/7 Carbon-Free Energy: AES aims to provide this service to 100% of its customers by 2030, a significant market differentiator.

- Investment in R&D: AES reported a 15% increase in R&D spending in 2024, focusing on grid modernization and renewable energy integration.

Commitment to Sustainability and ESG Reporting

AES demonstrates a strong commitment to sustainability through its detailed annual sustainability reports and the publication of key ESG indicators. These reports highlight their proactive measures to reduce environmental footprints, enhance social impact, and maintain robust governance practices. This transparency resonates with a growing investor base and the general public who prioritize environmentally and socially responsible corporate behavior.

In 2023, AES reported a 13% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to their 2019 baseline, showcasing tangible progress in their environmental stewardship. Their social initiatives in 2024 focused on community development programs, investing over $5 million in education and workforce training in underserved areas where they operate. Furthermore, their governance framework emphasizes diversity in leadership, with women holding 38% of board seats as of early 2025.

- Environmental Progress: AES achieved a 13% decrease in Scope 1 and 2 GHG emissions intensity by year-end 2023.

- Social Investment: Over $5 million was allocated in 2024 to community education and workforce development programs.

- Governance Diversity: As of early 2025, 38% of AES's board positions are held by women.

- Reporting Standards: AES adheres to GRI and SASB standards for its comprehensive ESG disclosures.

AES's promotional strategy leverages its significant investments in renewable energy and its role in enabling corporate sustainability goals. By highlighting large-scale Power Purchase Agreements with tech giants, AES demonstrates its capacity to drive the clean energy transition for major corporations.

The company's commitment to innovation is showcased through advancements like the Maximo AI robot, designed to improve solar installation efficiency by an estimated 20%. Furthermore, AES's '24/7 Carbon-Free Energy' initiative, aiming for 100% customer coverage by 2030, positions them as a leader in providing reliable, clean power solutions.

AES reinforces its market leadership through consistent recognition, such as being named a top global clean energy provider by BloombergNEF for three consecutive years. This, combined with transparent financial reporting and clear guidance, such as a projected 2024 Adjusted EBITDA between $2.65 billion and $2.85 billion, builds strong investor confidence.

AES's promotional efforts are deeply intertwined with its sustainability narrative. By reporting a 13% reduction in Scope 1 and 2 GHG emissions intensity by year-end 2023 and investing over $5 million in community programs in 2024, AES effectively communicates its commitment to environmental and social responsibility.

Price

Long-term Power Purchase Agreements (PPAs) are a critical element of AES's pricing strategy, particularly for its renewable energy ventures. These agreements lock in electricity prices for many years, offering a predictable revenue stream and reducing the risk associated with new projects. For instance, in 2023, AES announced a 15-year PPA for its 70 MW solar project in Texas with an unnamed investment-grade corporate off-taker.

For its utility operations, such as AES Indiana and AES Ohio, pricing is dictated by regulated rate structures established by state commissions. These approved rates are carefully crafted to cover operational expenses, necessary infrastructure upgrades, and a predetermined return on equity for the company. For instance, in 2024, AES Indiana's electric rate case filing sought to recover significant investments in grid modernization and renewable energy integration, impacting customer bills.

AES actively engages in competitive bidding for new energy projects, a crucial element of its market strategy. In 2024, for instance, the company secured contracts through competitive processes for renewable energy solutions, demonstrating its ability to offer cost-effective proposals. This pricing is directly tied to fluctuating market demand for clean energy and the evolving costs of technologies like solar panels and battery storage.

Strategic Asset Monetization and Sales

AES actively monetizes its asset portfolio to enhance financial flexibility and fund future growth. This strategic approach involves divesting non-core or underperforming assets, thereby optimizing capital allocation.

Notable recent transactions illustrate this strategy. In 2023, AES completed the sale of AES Brasil for $376 million, significantly impacting its liquidity. Additionally, the sale of a minority interest in AES Ohio in early 2024 generated further proceeds, reinforcing its financial position.

These sales are crucial for reinvesting capital into high-growth opportunities, such as renewable energy projects and energy storage solutions. Such strategic asset monetization directly influences AES’s capital structure and overall financial performance, enabling it to adapt to evolving market demands.

- Asset Sales for Capital Reinvestment: AES Brasil sale yielded $376 million in 2023.

- Portfolio Optimization: Divestitures free up capital for strategic investments.

- Financial Flexibility: Monetization enhances the company's ability to pursue new ventures.

- Impact on Performance: Proceeds from sales directly contribute to financial results and growth initiatives.

Capital Expenditure and Financing Management

AES's strategic management of capital expenditures (CapEx) and financing, while not a direct price component, significantly bolsters its pricing competitiveness. By securing CapEx and robust financing, the company effectively shields itself from the volatile impacts of inflation and rising interest rates, which could otherwise inflate project costs and energy prices.

This disciplined approach is crucial for maintaining stable and predictable energy costs for consumers. For example, AES's focus on long-term infrastructure investments, often financed through a mix of debt and equity, allows them to amortize costs over extended periods, smoothing out the per-unit cost of energy. This contrasts sharply with companies heavily reliant on short-term financing, which are more susceptible to immediate market fluctuations.

Consider the implications for 2024 and 2025. With ongoing global economic uncertainty and persistent inflation concerns, AES's proactive financing strategies are likely to provide a significant advantage.

- Reduced Cost Volatility: Secure, long-term financing locks in borrowing costs, mitigating the impact of potential interest rate hikes in 2024-2025.

- Enhanced Project Viability: Disciplined CapEx planning ensures that investments are made efficiently, leading to lower overall project costs and more competitive energy pricing.

- Inflation Hedging: By anticipating and managing CapEx needs well in advance, AES can better absorb inflationary pressures on materials and labor, preventing direct pass-through to customers.

- Investor Confidence: A strong financial footing and prudent CapEx management attract investors, potentially lowering the cost of capital and further supporting competitive pricing.

AES's pricing strategy is multifaceted, encompassing long-term Power Purchase Agreements (PPAs) for renewable projects, regulated rates for utility operations, and competitive bidding for new contracts. These approaches ensure predictable revenue streams and cost-effectiveness. For example, a 15-year PPA was secured in 2023 for a Texas solar project, and in 2024, AES Indiana filed for rate adjustments to cover grid modernization investments.

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis for AES leverages a robust blend of official company disclosures, including annual reports and investor presentations, alongside granular e-commerce data and competitive intelligence reports. This comprehensive approach ensures our insights into Product, Price, Place, and Promotion are grounded in verifiable market realities and strategic actions.