AES PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AES Bundle

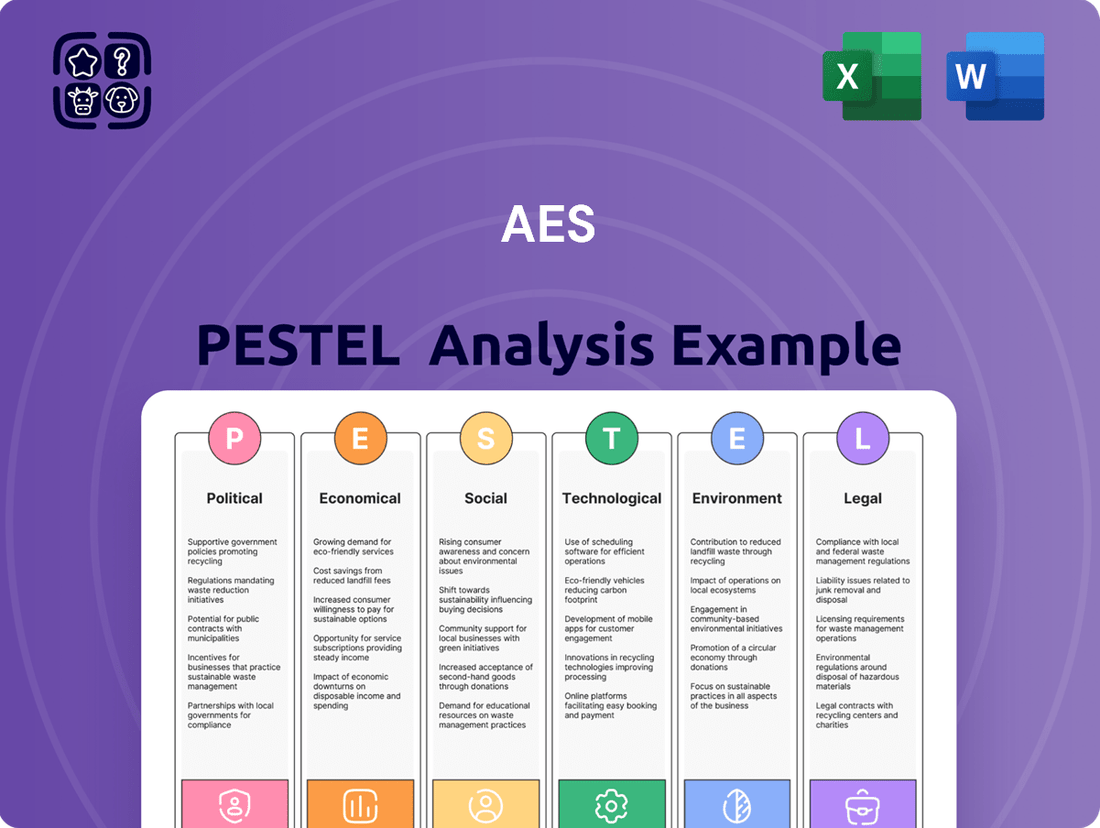

Unlock the critical external factors shaping AES's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the company. Empower your strategic planning and investment decisions by gaining these essential insights. Purchase the full PESTLE analysis now for a deeper understanding and a competitive edge.

Political factors

Governments globally are increasingly prioritizing clean energy, with policies like tax credits for renewables and carbon pricing mechanisms becoming more common. For instance, the Inflation Reduction Act in the United States, enacted in 2022, provides significant incentives for clean energy projects, a move that directly supports AES's strategic focus on renewables and energy storage. These governmental actions are crucial in shaping AES's investment decisions and the viability of its expansion plans in key markets.

Global geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, significantly impact energy markets. These events can disrupt supply chains, leading to price volatility and a heightened focus on energy security. For AES, this translates to a need for robust risk management strategies across its diverse operational footprint, as political instability in any region can affect its project pipelines and revenue streams. For instance, the ongoing conflict in Ukraine has led to a surge in natural gas prices globally, impacting electricity generation costs for AES in Europe.

International climate agreements, such as the Paris Agreement, establish global benchmarks for reducing greenhouse gas emissions. These pacts compel national governments to implement more stringent environmental policies, directly impacting energy companies like AES. For instance, the Paris Agreement aims to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels. This global push necessitates a strategic shift for AES towards cleaner energy sources and sustainable investments.

AES's long-term strategic planning must therefore be meticulously aligned with these international commitments. This alignment influences its investment decisions, guiding the transformation of its energy generation portfolio to prioritize lower-carbon options. By adhering to these evolving global standards, AES can navigate regulatory landscapes more effectively and potentially unlock new market avenues for its clean energy technologies and solutions.

Energy Market Deregulation and Liberalization

The global push towards energy market deregulation and liberalization continues to reshape the operational environment for companies like AES. This trend, particularly evident in regions like Europe and parts of North America, moves away from traditional, state-controlled utility models towards more competitive wholesale and retail energy markets. For AES, this means navigating fluctuating power prices and increased competition for market share.

In 2024, many countries are further opening their energy sectors to competition. For instance, the United Kingdom's energy market has seen significant liberalization, leading to a dynamic pricing environment. This shift directly impacts AES's ability to secure long-term contracts and recover investments in new generation capacity, such as renewable energy projects, as wholesale market volatility can affect revenue predictability.

The liberalization process often includes changes to grid access rules and the unbundling of generation, transmission, and distribution services. This restructuring allows new entrants and encourages innovation, but it also necessitates that AES adapt its business strategies. The company must focus on operational efficiency, cost management, and developing flexible assets that can thrive in a more dynamic and competitive landscape. For example, AES's investment in battery storage solutions in 2024 is a direct response to the need for grid flexibility in liberalized markets.

- Market Volatility: Liberalized markets can lead to greater price swings for electricity, impacting AES's revenue predictability.

- Increased Competition: Deregulation opens doors for new players, intensifying competition for customers and market share.

- Investment Recovery: The ability to secure cost recovery for new, often capital-intensive, energy projects becomes more challenging in competitive environments.

- Adaptation of Business Models: AES must evolve its strategies to leverage opportunities and mitigate risks presented by evolving market structures, such as focusing on distributed energy resources or advanced grid services.

Trade Policies and Tariffs

Trade policies, particularly tariffs on renewable energy components like solar panels and wind turbines, directly influence AES's project expenses and supply chain reliability. For instance, in early 2024, the US government continued to review tariffs on solar panels imported from Southeast Asia, creating uncertainty for project developers. These shifts in global trade can escalate capital costs for new clean energy initiatives, potentially hindering their financial feasibility.

AES's ability to navigate these trade dynamics is crucial. The company must proactively adjust its sourcing strategies to buffer against the financial impact of new tariffs or trade disputes. For example, exploring diversified supply chains or investing in domestic manufacturing capabilities could be key mitigation tactics.

- Tariff Impact: Tariffs on imported solar panels and wind turbine components can add significant costs to new renewable energy projects.

- Supply Chain Vulnerability: Fluctuations in international trade relations create risks for AES's global supply chain efficiency.

- Economic Viability: Increased capital expenditure due to tariffs may delay or reduce the attractiveness of certain clean energy investments for AES.

- Mitigation Strategies: AES needs to adapt procurement and sourcing strategies to manage these trade-related risks effectively.

Governmental support for renewables remains a significant driver. For example, the US Inflation Reduction Act is projected to spur over $3 trillion in clean energy investments by 2030, directly benefiting AES's growth strategy. Similarly, in 2024, the European Union continued to implement ambitious renewable energy targets, aiming for 42.5% renewable energy by 2030, which translates to substantial opportunities for AES's European operations.

Geopolitical instability continues to affect energy markets, with ongoing conflicts influencing commodity prices. For instance, the price of natural gas, a key fuel for electricity generation, saw considerable volatility in late 2023 and early 2024 due to supply concerns. This volatility necessitates robust hedging strategies for AES to manage operational costs and revenue predictability across its global portfolio.

International climate agreements and national policies are increasingly aligning to accelerate the energy transition. The Biden-Harris administration's focus on clean energy, including a goal of a carbon-free power sector by 2035, sets a clear regulatory direction. This policy environment supports AES's investments in wind, solar, and energy storage, which are critical for meeting these decarbonization objectives.

Trade policies, particularly those concerning tariffs on renewable energy components, remain a key consideration. For example, ongoing reviews of tariffs on solar cells and modules from Southeast Asia in 2024 introduce uncertainty into project economics. AES must strategically manage its supply chains to mitigate potential cost increases and ensure project timelines are met, impacting the overall capital expenditure for new clean energy developments.

What is included in the product

This AES PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities derived from real-world market and regulatory dynamics.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global economic expansion is a key driver for electricity demand, directly impacting AES's revenue. A strong global GDP growth forecast, such as the International Monetary Fund's projection of 3.2% for both 2024 and 2025, suggests a healthy appetite for energy. This increased demand supports AES's existing asset performance and opens avenues for new infrastructure investments.

Robust economic activity fuels industrial output and commercial operations, leading to higher electricity consumption. For instance, a rebound in manufacturing sectors, often a bellwether for energy use, would directly benefit AES. This correlation means that sustained economic growth translates into greater revenue potential for the company.

Conversely, economic downturns can significantly dampen electricity demand. A projected slowdown in growth, or a recessionary environment, would reduce the utilization of AES's power generation facilities and potentially delay or cancel new project developments. Accurate demand forecasting is therefore crucial for AES to manage its portfolio effectively.

Interest rate fluctuations are a critical factor for AES, impacting the cost of financing its capital-intensive projects. For instance, a rise in the Federal Funds Rate, which influences broader borrowing costs, can directly increase the expense of securing funds for new renewable energy installations or grid modernization efforts. This increased cost of capital can compress project returns, making previously attractive investments less viable.

AES's growth strategy heavily depends on its ability to access affordable capital. In 2024, companies like AES often issue corporate bonds to finance their operations and expansion. If interest rates climb, the yield on these bonds increases, meaning AES would have to offer higher returns to attract investors, thereby raising its overall cost of debt. This makes it harder to fund ambitious plans for renewable energy deployment and essential infrastructure upgrades.

Rising inflation presents a significant challenge for AES, directly impacting its operational and maintenance expenses. For instance, the cost of natural gas, a key fuel for many power plants, saw substantial volatility in 2024, with spot prices fluctuating based on global supply and demand dynamics. This escalation in fuel, labor, and equipment costs can squeeze profit margins.

While AES operates in regulated markets where some cost increases can be passed to customers, this mechanism isn't always immediate or complete. Long-term power purchase agreements (PPAs) with fixed pricing become less attractive in an inflationary environment, potentially eroding profitability if AES cannot adjust its costs accordingly. For example, a PPA signed in 2023 with a fixed price for electricity delivery in 2025 might not adequately cover the projected higher operating costs due to inflation.

To counter these pressures, AES must focus on robust cost management. This includes optimizing fuel procurement strategies, investing in energy efficiency technologies to reduce consumption, and leveraging automation to control labor costs. For 2024, companies in the utility sector are exploring innovative supply chain solutions to buffer against rising material costs.

Commodity Prices

Volatility in commodity prices, especially for natural gas and coal, significantly influences AES's thermal power generation profitability. Even as AES shifts towards cleaner energy, a portion of its assets still depend on these fuels. For instance, in 2023, natural gas prices experienced considerable swings, impacting the cost of generation for AES's thermal plants.

Fluctuations in these fuel costs directly affect AES's revenue and operating expenses. Effective hedging strategies are crucial to mitigate these risks. The company's ongoing diversification into non-fuel-dependent renewables, such as solar and wind, is a key strategy to reduce this exposure.

- Natural Gas Price Impact: In early 2024, natural gas prices remained a key variable, with benchmarks like Henry Hub showing significant month-over-month changes, directly impacting AES's operational costs for its gas-fired power plants.

- Coal Price Sensitivity: While declining in importance for AES, coal prices still affect a segment of their portfolio. Global coal benchmarks saw moderate increases throughout 2023, adding to the cost pressures for remaining coal-dependent facilities.

- Renewable Diversification: AES's strategic shift aims to lessen reliance on volatile fossil fuel markets, with substantial investments in solar and wind projects expected to stabilize long-term operational expenses.

Foreign Exchange Rate Fluctuations

Foreign exchange rate fluctuations present a significant challenge for AES, a global operator. When AES converts revenues and expenses from local currencies into US dollars for reporting, currency movements can directly impact its reported earnings. For instance, a stronger US dollar can make foreign earnings less valuable when translated, potentially reducing reported profits.

These shifts can also affect the profitability of AES's international projects and the reported value of its foreign assets. Managing this currency risk is therefore crucial for maintaining financial stability and predictable performance. AES likely employs hedging strategies, such as forward contracts or currency options, to lock in exchange rates for future transactions.

As of early 2024, major currency pairs like EUR/USD and USD/JPY have experienced notable volatility. For example, the Euro saw fluctuations against the dollar throughout 2023 and into 2024, influenced by differing monetary policies and economic outlooks between the US and the Eurozone. Similarly, the Japanese Yen's performance against the dollar has been a key consideration for companies with Japanese operations.

- Impact on Earnings: A 10% depreciation of the Euro against the US dollar could reduce reported earnings from Eurozone operations by a similar percentage, assuming revenues and costs remain constant in local currency.

- Asset Valuation: If AES holds significant assets in a country whose currency depreciates sharply against the dollar, the US dollar-denominated value of those assets will decrease.

- Hedging Costs: Implementing currency hedging strategies incurs costs, which need to be factored into the overall financial planning and can impact profit margins.

- Competitive Landscape: Fluctuations can also alter the competitive positioning of AES relative to local competitors in foreign markets, depending on how their pricing and cost structures are denominated.

Economic growth directly fuels electricity demand, benefiting AES's revenue streams. Projections for global GDP growth around 3.2% for both 2024 and 2025 indicate sustained energy consumption, supporting AES's existing operations and new investments in infrastructure.

Interest rate changes significantly impact AES's financing costs for capital-intensive projects. Higher rates increase borrowing expenses, potentially reducing the profitability of new renewable energy installations and grid upgrades, as seen with the Federal Funds Rate influencing broader borrowing costs in 2024.

Inflation poses a direct threat to AES's operational expenses, increasing costs for fuel, labor, and materials, as observed with natural gas price volatility in 2024. While regulated markets allow some cost pass-through, long-term fixed-price contracts can erode margins if cost increases aren't fully recovered.

Preview the Actual Deliverable

AES PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive AES PESTLE analysis covers all key political, economic, social, technological, legal, and environmental factors impacting the Advanced Encryption Standard.

You'll gain valuable insights into the external forces shaping AES adoption and development, presented in a clear and actionable format.

Sociological factors

Public perception of energy sources is undergoing a significant transformation, with a clear trend favoring renewable options over fossil fuels. This shift directly impacts policy decisions, community buy-in for new energy infrastructure, and the flow of investment capital. For AES, this growing societal preference for clean energy is a tailwind, bolstering its strategic investments in wind, solar, and energy storage technologies.

In 2023, global investment in renewable energy reached a record $1.7 trillion, a testament to this evolving public sentiment. This broad acceptance of cleaner alternatives provides a fertile ground for AES to expand its renewable portfolio, as demonstrated by its significant solar and wind project pipeline. However, it's crucial to acknowledge that public concerns regarding land use for solar farms, visual impact of wind turbines, or potential disruptions to grid stability can still present hurdles for project approvals and community engagement, requiring careful management by AES.

Consumer and corporate demand for clean, reliable, and sustainable energy is surging. This trend is a significant driver for the renewable energy and energy storage markets. For instance, by early 2024, global investment in clean energy was projected to reach record highs, demonstrating this powerful shift.

AES's strategic focus on providing customized energy solutions, such as distributed generation and smart grid technologies, directly addresses this growing demand. These offerings are designed to meet the evolving needs of consumers and businesses alike.

By aligning with these preferences, AES can foster stronger customer loyalty and unlock new revenue opportunities. This is particularly true for corporate clients actively pursuing carbon footprint reduction goals, a movement gaining significant momentum throughout 2024 and projected to continue into 2025.

The energy sector, including AES, faces an aging workforce, with a significant portion of experienced professionals nearing retirement. This demographic shift necessitates a proactive approach to knowledge transfer and succession planning. For instance, in 2023, the average age of utility workers in the US was reported to be in the late 40s, highlighting the impending retirement wave.

Concurrently, the rapid expansion of renewable energy and digital technologies creates a substantial demand for specialized skills, leading to a skills gap. AES must prioritize investments in training programs focused on areas like grid modernization, battery storage, and data analytics to equip its workforce for these evolving needs. By 2025, it's projected that the demand for solar photovoltaic installers and wind turbine technicians will grow much faster than the average for all occupations.

Attracting and retaining a diverse talent pool is crucial for AES to foster innovation and meet the complex demands of the modern energy landscape. Initiatives aimed at recruiting from underrepresented groups and promoting inclusive work environments will be key to building a resilient and adaptable workforce capable of navigating the energy transition.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are increasingly shaping business operations. AES, like many energy companies, faces pressure to demonstrate robust environmental, social, and governance (ESG) performance. This translates into a need for transparent reporting on emissions, community engagement, and fair labor practices. For instance, in 2024, investors increasingly scrutinized companies for their Scope 1, 2, and 3 emissions data, with many actively divesting from those lagging in decarbonization efforts.

Strong CSR performance directly impacts brand reputation and investor attraction. Companies with strong ESG credentials often find it easier to secure financing and attract talent. AES's commitment to ethical supply chains and community investment can mitigate risks, such as social opposition to new energy infrastructure projects. By 2025, it's projected that over 70% of institutional investors will integrate ESG factors into their investment decisions, making a proactive approach to CSR critical for capital access.

- Growing Investor Demand: In 2024, assets under management in ESG-focused funds reached over $3.7 trillion globally, highlighting a significant shift in investment priorities.

- Regulatory Scrutiny: Governments worldwide are enhancing regulations around environmental reporting and labor standards, pushing companies like AES to align their practices.

- Brand Loyalty: Consumer surveys in 2024 indicated that over 60% of consumers are more likely to purchase from brands with strong ethical and sustainability commitments.

- Risk Mitigation: Proactive community engagement and transparent operations can prevent costly project delays or cancellations due to social license issues.

Urbanization and Energy Infrastructure Needs

Global urbanization continues to accelerate, placing immense pressure on existing energy infrastructure. By 2050, it's projected that 68% of the world's population will live in urban areas, a significant increase from 56% in 2021, according to the United Nations. This concentration of people in cities directly translates to a surge in energy demand, particularly in developing regions experiencing rapid growth.

AES's capabilities in grid modernization and utility management are well-positioned to meet these escalating urban energy needs. The company's focus on developing smart grids and integrating distributed energy resources, such as solar and battery storage, provides essential solutions for supporting sustainable urban expansion. For instance, AES is actively involved in projects like the development of advanced metering infrastructure in various utility service territories, enhancing grid efficiency and reliability.

This trend creates substantial opportunities for AES to engage in new projects and strategic partnerships within these burgeoning metropolitan centers. The need for resilient and efficient energy systems in rapidly expanding cities offers a fertile ground for investment and innovation. AES's commitment to renewable energy integration and infrastructure upgrades aligns perfectly with the requirements of modernizing urban power networks.

- Urban Population Growth: Global urban population expected to reach 68% by 2050, up from 56% in 2021.

- Increased Energy Demand: Urban concentration drives higher energy consumption, requiring robust infrastructure.

- AES's Role: Expertise in grid modernization and distributed energy resources addresses urban infrastructure needs.

- Project Opportunities: Rapidly expanding cities present significant avenues for new AES projects and partnerships.

Societal expectations for corporate social responsibility are increasingly shaping business operations, with a strong emphasis on ESG performance. In 2024, investors intensified their scrutiny of companies' emissions data, with a notable trend towards divesting from those lagging in decarbonization efforts.

Strong CSR performance directly impacts brand reputation and investor attraction, with over 60% of consumers in 2024 indicating a preference for brands with strong ethical and sustainability commitments. By 2025, it's projected that over 70% of institutional investors will integrate ESG factors into their investment decisions, making proactive CSR critical for capital access.

The energy sector, including AES, faces an aging workforce, with a significant portion of experienced professionals nearing retirement. This demographic shift necessitates proactive knowledge transfer and succession planning, as the average age of utility workers in the US was reported in the late 40s in 2023.

Concurrently, the rapid expansion of renewables and digital technologies creates a substantial skills gap, with demand for solar photovoltaic installers and wind turbine technicians projected to grow much faster than the average for all occupations by 2025.

| Sociological Factor | 2024/2025 Data/Projection | Impact on AES |

|---|---|---|

| Public Preference for Renewables | Global investment in renewables reached $1.7 trillion in 2023; projected record highs for clean energy investment in early 2024. | Supports AES's strategic investments in wind, solar, and storage; potential hurdles from land use/visual impact concerns. |

| Corporate Social Responsibility (CSR) | Over 70% of institutional investors to integrate ESG by 2025; 60%+ consumers prefer ethical brands (2024). | Enhances brand reputation, investor attraction, and risk mitigation; aligns with AES's ethical supply chain and community investment focus. |

| Workforce Demographics & Skills Gap | Average utility worker age late 40s (2023); demand for solar/wind technicians to grow significantly by 2025. | Necessitates succession planning and investment in training for grid modernization, battery storage, and data analytics. |

Technological factors

Continuous innovation in solar photovoltaic, wind turbine, and hydropower technologies is significantly improving efficiency and reducing costs. For instance, solar panel efficiency has seen steady gains, with some commercial panels now exceeding 22% efficiency, a notable leap from earlier generations. This directly enables AES to deploy more cost-effective and higher-performing renewable projects, accelerating its transition away from fossil fuels.

These technological advancements are crucial for enhancing the competitiveness of AES's clean energy portfolio. For example, the levelized cost of electricity (LCOE) for utility-scale solar PV has fallen dramatically, reaching as low as $20-$30 per megawatt-hour in some regions by early 2024, down from over $300 per megawatt-hour in 2010. Similarly, wind turbine technology has advanced, with larger, more efficient turbines capturing more energy, making wind power increasingly competitive with traditional sources.

Staying abreast of these developments is critical for market leadership. AES's strategic investments in emerging technologies, such as advanced battery storage solutions that complement intermittent renewables, are key. The global energy storage market, for example, was projected to reach over $100 billion by 2025, highlighting the significant opportunities and the need for continuous technological adaptation.

AES is heavily influenced by the rapid advancements in energy storage technologies, particularly lithium-ion and emerging long-duration solutions. These innovations are essential for seamlessly integrating variable renewable energy sources like solar and wind into the power grid, ensuring consistent supply. For instance, by the end of 2023, AES had over 4,000 MW of energy storage in operation or advanced development, a significant increase from previous years, demonstrating its commitment to this sector.

The company's strategic investments in energy storage directly translate into its ability to offer flexible capacity, bolster grid stability, and maximize the economic benefits derived from its renewable energy portfolio. As of early 2024, the levelized cost of storage for utility-scale lithium-ion systems has fallen by over 50% in the last five years, making it a more attractive and cost-effective solution for grid modernization.

The ongoing evolution of smart grid technologies, incorporating advanced sensors, digital controls, and artificial intelligence, is significantly boosting grid reliability, efficiency, and resilience. AES is actively pursuing grid modernization by integrating these innovations to better manage distributed energy resources, speed up outage recovery, and enable two-way power flow.

This strategic investment in smart grids is crucial for AES to effectively accommodate the increasing integration of renewable energy sources. For instance, by mid-2024, the U.S. Energy Information Administration reported that renewable energy sources accounted for approximately 22% of total utility-scale net generation, a figure expected to climb.

Digitalization and Data Analytics

The energy sector's embrace of digitalization and big data analytics is significantly reshaping AES's operational landscape. By integrating vast datasets from its power generation facilities, transmission networks, and customer usage, AES can achieve unprecedented levels of asset optimization and predictive maintenance. This data-driven approach translates into tangible improvements in efficiency and cost management across its global operations.

For instance, in 2024, AES has been actively implementing advanced analytics to forecast demand more accurately, which is crucial for grid stability and resource allocation. The company's investment in digital transformation initiatives aims to enhance real-time monitoring and control of its assets, leading to a projected 5-10% improvement in operational efficiency for certain segments by the end of 2025.

- Enhanced Asset Performance: Data analytics enables AES to monitor equipment health in real-time, predicting potential failures before they occur, thus minimizing downtime and associated costs.

- Improved Operational Efficiency: By analyzing consumption patterns and grid performance, AES can optimize energy dispatch and reduce waste, contributing to cost savings and better service delivery.

- Cybersecurity Imperative: The increasing reliance on digital systems necessitates robust cybersecurity measures to protect critical infrastructure and sensitive data from threats.

- Data-Driven Decision Making: Insights derived from big data analytics empower AES's management to make more informed strategic and operational decisions, fostering agility in a dynamic market.

Emerging Hydrogen and Carbon Capture Technologies

The advancement of green hydrogen production and carbon capture, utilization, and storage (CCUS) technologies offers significant future avenues for decarbonizing challenging sectors and current thermal power generation assets. AES is actively monitoring and making strategic investments in these developing technologies, viewing them as crucial long-term strategies for achieving net-zero emissions targets, particularly for its thermal fleet and industrial clients pursuing deep decarbonization.

These technologies are critical for sectors like heavy industry and long-haul transport, which are difficult to electrify. For example, the global green hydrogen market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030, driven by government incentives and corporate net-zero commitments.

- Green Hydrogen Potential: The International Energy Agency (IEA) reported that global hydrogen production capacity from renewable sources reached approximately 10 GW by the end of 2023, with significant expansion planned.

- CCUS Investment Growth: Global investment in CCUS projects is accelerating, with over 300 projects announced or in development as of early 2024, representing a substantial increase in the pipeline.

- AES Strategic Focus: AES's commitment to these areas aligns with broader industry trends and regulatory pressures pushing for innovative decarbonization solutions.

Technological factors are fundamentally reshaping the energy landscape, directly impacting AES's operational strategies and market positioning. Advancements in renewable energy generation, such as solar and wind, continue to drive down costs and improve efficiency, making clean energy increasingly competitive. For example, by early 2024, the levelized cost of electricity for utility-scale solar PV had dropped to around $20-$30 per megawatt-hour in certain regions.

Energy storage solutions are also critical, enabling better integration of intermittent renewables and enhancing grid stability. AES had over 4,000 MW of energy storage in operation or advanced development by the end of 2023, reflecting a significant commitment to this area, with storage costs falling by over 50% in the last five years for utility-scale lithium-ion systems as of early 2024.

Furthermore, smart grid technologies, digitalization, and big data analytics are optimizing operations, improving reliability, and enabling more effective management of distributed energy resources. AES's investment in these areas aims for operational efficiency gains, with projections of a 5-10% improvement in certain segments by the end of 2025.

Emerging technologies like green hydrogen and carbon capture, utilization, and storage (CCUS) present long-term decarbonization opportunities. The global green hydrogen market is expected to grow substantially, and CCUS project development is accelerating, with over 300 projects announced or in development as of early 2024.

| Technology Area | Key Advancement/Trend | Impact on AES | Data Point (2023/2024) |

|---|---|---|---|

| Renewable Generation | Improved efficiency, reduced LCOE | Enhanced competitiveness of clean energy portfolio | Solar PV LCOE ~$20-$30/MWh (early 2024) |

| Energy Storage | Cost reduction, increased capacity | Grid stability, renewable integration | AES had >4,000 MW storage in operation/development (end 2023) |

| Smart Grids & Digitalization | AI, big data analytics, IoT | Operational optimization, predictive maintenance | Projected 5-10% operational efficiency gains by end 2025 |

| Green Hydrogen & CCUS | Emerging decarbonization solutions | Long-term emissions reduction strategies | >300 CCUS projects announced/in development (early 2024) |

Legal factors

Stringent environmental regulations, such as the EPA's proposed carbon emission standards for power plants, directly influence AES's operational costs and strategic investments. Compliance with these evolving standards, including air quality and water discharge limits, necessitates significant capital for plant upgrades or can accelerate the retirement of older, less efficient thermal assets, impacting AES's asset portfolio.

These regulatory pressures are a key driver for AES's increasing investment in renewable energy sources and cleaner technologies, aligning with global decarbonization efforts. For instance, AES's continued expansion in solar and wind power generation in 2024 and 2025 reflects this strategic shift, aiming to mitigate risks associated with stricter emissions caps.

Energy sector regulations are a cornerstone of AES's operational landscape. Rules governing electricity generation, transmission, and distribution, including market designs and utility rate structures, directly shape AES's business models and revenue. For instance, the evolving regulatory frameworks around renewable energy procurement, such as Renewable Portfolio Standards (RPS) in various US states, significantly influence investment decisions and project pipelines.

Shifts in these regulations present both avenues for growth and potential headwinds. For example, the introduction or modification of capacity markets, which compensate generators for ensuring power availability, can impact AES's profitability for its thermal generation assets. Similarly, changes in transmission access rules can affect the cost and feasibility of connecting new renewable energy projects to the grid, a critical factor for AES's distributed energy and renewables portfolio.

AES must adeptly manage a multifaceted regulatory environment across its global operations. In 2024, many regions are seeing increased scrutiny on grid reliability and the integration of variable renewable energy sources, leading to updated grid codes and interconnection standards. These evolving requirements necessitate continuous adaptation in AES's operational strategies and technological investments to ensure compliance and maintain competitiveness.

Navigating land use and permitting laws presents significant hurdles for new energy developments, particularly large-scale renewable projects. AES must contend with intricate regulations spanning local, regional, and national jurisdictions. For instance, in 2024, the average permitting timeline for utility-scale solar projects in the United States exceeded 2.5 years, with environmental reviews and community engagement being key drivers of this duration.

Securing the requisite permits is often a protracted and demanding undertaking. This process typically mandates comprehensive environmental impact assessments, adherence to specific zoning ordinances, and extensive consultations with local communities. In 2025, regulatory bodies are increasingly emphasizing community benefit agreements, adding another layer of complexity to the permitting process.

Any delays or outright denials in obtaining these crucial permits can have a substantial ripple effect on AES's project schedules and overall financial outlays. For example, a single permit denial for a wind farm could push back commercial operation by 18-24 months, leading to millions in lost revenue and increased development costs.

Corporate Governance and Compliance Laws

AES, a global energy company, navigates a complex web of corporate governance and compliance laws. As a publicly traded entity, adherence to regulations like the Sarbanes-Oxley Act (SOX) in the US, which mandates rigorous financial reporting and internal controls, is paramount. Failure to comply can lead to severe consequences, including substantial financial penalties and damage to investor trust. For instance, in 2023, companies faced an average of $4.5 million in fines for SEC reporting violations, underscoring the financial risk of non-compliance.

Key legal considerations for AES include:

- Financial Reporting Accuracy: Ensuring transparency and accuracy in all financial disclosures to meet the requirements of bodies like the Securities and Exchange Commission (SEC).

- Anti-Corruption Measures: Strict adherence to laws such as the Foreign Corrupt Practices Act (FCPA) to prevent bribery and unethical business practices in international operations.

- Data Privacy Compliance: Managing customer and operational data in accordance with regulations like GDPR and CCPA, which govern data protection and privacy rights.

- Environmental Regulations: Complying with a growing body of environmental laws related to emissions, waste management, and renewable energy development, which can impact operational costs and project approvals.

International Trade and Investment Treaties

International trade and investment treaties directly influence AES's global reach, offering a framework for protecting its overseas assets and streamlining the flow of goods and services. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes major economies like Japan and Canada, can provide a stable environment for AES's investments in those regions.

However, the dynamic nature of these agreements means that shifts in treaty terms or any resulting disputes can jeopardize AES's foreign holdings and complicate international business activities. The ongoing renegotiation of certain trade pacts in 2024 highlights the need for AES to remain acutely aware of evolving international legal frameworks to mitigate potential risks.

- Treaty Impact: International agreements can safeguard AES's foreign direct investments, potentially reducing expropriation risk.

- Trade Facilitation: Treaties often reduce tariffs and non-tariff barriers, easing AES's import/export operations.

- Dispute Resolution: Investment treaties typically include mechanisms for resolving disputes between states or between investors and states.

- Regulatory Shifts: Changes in treaty obligations, such as new environmental or labor standards, can necessitate operational adjustments for AES.

Legal factors significantly shape AES's operations and strategic direction, particularly concerning environmental regulations and permitting processes. The increasing stringency of emissions standards, such as those proposed by the EPA, directly impacts operational costs and drives investment towards cleaner energy sources, with AES expanding its solar and wind portfolios in 2024-2025. Navigating complex land use and permitting laws adds considerable time and cost to new energy developments, with utility-scale solar projects in the US averaging over 2.5 years for permitting in 2024, often requiring extensive environmental reviews and community engagement.

Corporate governance and compliance laws, including Sarbanes-Oxley, are critical for AES's financial reporting and internal controls, with SEC reporting violations costing companies an average of $4.5 million in fines in 2023. International trade agreements offer frameworks for global operations but also present risks due to evolving treaty terms. AES must also manage data privacy in line with regulations like GDPR and CCPA.

| Legal Factor | Impact on AES | 2024/2025 Data/Trend |

|---|---|---|

| Environmental Regulations | Increased operational costs, drives investment in renewables | Proposed EPA carbon standards; continued growth in solar/wind capacity |

| Permitting Processes | Extended project timelines, increased development costs | US utility-scale solar permitting averages >2.5 years (2024) |

| Corporate Governance | Mandatory financial reporting accuracy, risk of fines | Average SEC reporting violation fines $4.5M (2023) |

| International Trade | Asset protection vs. risk from treaty shifts | Ongoing renegotiation of trade pacts |

Environmental factors

The growing frequency and intensity of extreme weather events like hurricanes, floods, and wildfires present significant physical risks to AES's power generation and distribution networks. For instance, the U.S. experienced a record 28 separate billion-dollar weather and climate disasters in 2023, impacting infrastructure across the nation.

These events can disrupt operations, damage valuable assets, and require substantial investments in repairs and enhancing resilience. AES's commitment to grid modernization and hardening, as seen in its investments in undergrounding power lines in vulnerable areas, directly addresses these escalating threats.

Adapting infrastructure and operational strategies to mitigate the impacts of a changing climate is crucial for AES's long-term stability and service reliability. The company's focus on renewable energy sources, which are often less susceptible to certain weather disruptions than traditional fossil fuel plants, is a key part of this adaptation strategy.

Global and national commitments to slash carbon emissions, spurred by escalating climate change concerns, are fundamentally reshaping AES's strategic roadmap toward decarbonization. For instance, the Paris Agreement aims to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels, a benchmark driving significant policy shifts worldwide.

In response, AES is making substantial investments, channeling billions into renewable energy sources like solar and wind, alongside crucial energy storage solutions, to meet these increasingly stringent environmental mandates. The company's 2023 investor day highlighted plans to invest $15 billion in renewables and storage through 2027, underscoring this strategic pivot.

Failure to adapt and align with these evolving carbon reduction targets poses considerable risks for AES, potentially resulting in substantial regulatory fines and significant damage to its corporate reputation among investors and the public alike.

Resource scarcity, especially water, presents a significant environmental challenge for AES. Thermal power plants are heavily reliant on water for cooling, and hydro generation directly depends on water availability. Regions experiencing water stress can increase operational costs and complicate regulatory adherence for AES's current power generation facilities.

For instance, in 2023, several regions where AES operates, particularly in parts of the Americas and Europe, faced heightened water stress according to various environmental indices. This situation necessitates robust water management strategies, including water recycling and efficiency improvements. AES is increasingly prioritizing less water-intensive renewable energy sources, such as solar and wind power, to mitigate these risks in water-scarce areas.

Biodiversity and Land Use Impacts

Developing large renewable energy projects, like wind and solar farms, demands substantial land. This can affect local environments and the variety of life they support. For instance, a 2024 report highlighted that solar farms can lead to habitat fragmentation, impacting ground-nesting birds. AES needs to perform detailed environmental impact studies and put in place strategies to lessen these effects.

AES must prioritize sustainable land management and pick sites very carefully. This approach is key to securing approval from both local communities and regulatory bodies. In 2025, a new wind farm project in Texas faced delays due to concerns over its proximity to sensitive wetland areas, underscoring the importance of thoughtful site selection.

- Land Use Demands: Renewable energy infrastructure requires significant acreage, potentially altering landscapes and natural habitats.

- Ecosystem Impacts: Projects can disrupt local flora and fauna, necessitating careful planning to mitigate biodiversity loss.

- Mitigation Strategies: AES must implement measures like habitat restoration and wildlife corridors to offset environmental damage.

- Regulatory & Community Approval: Sustainable practices and responsible site selection are vital for gaining public and governmental acceptance.

Waste Management and Pollution Control

AES faces continuous environmental duties in managing waste and controlling pollution, especially from its thermal power generation byproducts and the eventual disposal of renewable energy equipment. For instance, in 2023, AES reported a 1.5% decrease in its Scope 1 greenhouse gas emissions intensity compared to 2022, demonstrating efforts to mitigate thermal generation impacts.

Strict adherence to environmental regulations concerning waste disposal, hazardous materials handling, and air and water pollution is critical for AES to prevent significant fines and maintain its operational permits. Failure to comply could lead to substantial penalties, impacting financial performance and public perception.

AES's strategic investment in cleaner technologies is a key factor in reducing its overall waste footprint. This includes exploring advanced recycling methods for solar panels and wind turbine components, aiming to minimize landfill dependency as the renewable energy sector matures.

- Waste Reduction Initiatives: AES is actively pursuing strategies to minimize waste generated from its operations, particularly from its thermal power plants.

- Pollution Control Compliance: The company must maintain rigorous compliance with local and international environmental standards for air, water, and soil pollution.

- Renewable Component Disposal: As renewable energy infrastructure ages, AES needs effective and sustainable plans for managing and recycling retired components.

- Investment in Green Tech: Continued investment in technologies that reduce emissions and waste is vital for AES's long-term environmental stewardship and operational efficiency.

AES's environmental strategy is increasingly shaped by the need to manage land use for renewable projects and mitigate impacts on ecosystems. For example, the company is investing in projects that require significant land, such as large-scale solar and wind farms. These developments necessitate careful environmental impact assessments and sustainable land management practices to gain regulatory and community approval, as highlighted by a 2025 wind farm project delay due to proximity to wetlands.

The company is also focused on waste reduction and pollution control, particularly from its thermal generation operations and the lifecycle management of renewable energy components. AES reported a 1.5% decrease in its Scope 1 greenhouse gas emissions intensity in 2023, showing progress in managing operational impacts. Continued investment in green technologies is key to minimizing waste and ensuring compliance with environmental standards.

| Environmental Factor | AES Actions/Considerations | Data/Example |

|---|---|---|

| Extreme Weather | Grid modernization, hardening, renewable energy focus | 28 billion-dollar weather disasters in the U.S. in 2023 |

| Climate Change & Emissions | Decarbonization, renewable and storage investments | $15 billion planned investment in renewables/storage through 2027 |

| Resource Scarcity (Water) | Water management, less water-intensive renewables | Heightened water stress in regions of operation in 2023 |

| Land Use & Ecosystems | Sustainable land management, careful site selection | 2025 wind farm delay due to wetland concerns |

| Waste & Pollution | Cleaner technologies, recycling, emission reduction | 1.5% decrease in Scope 1 GHG emissions intensity in 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for AES is meticulously crafted using a blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the energy sector.