AES Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AES Bundle

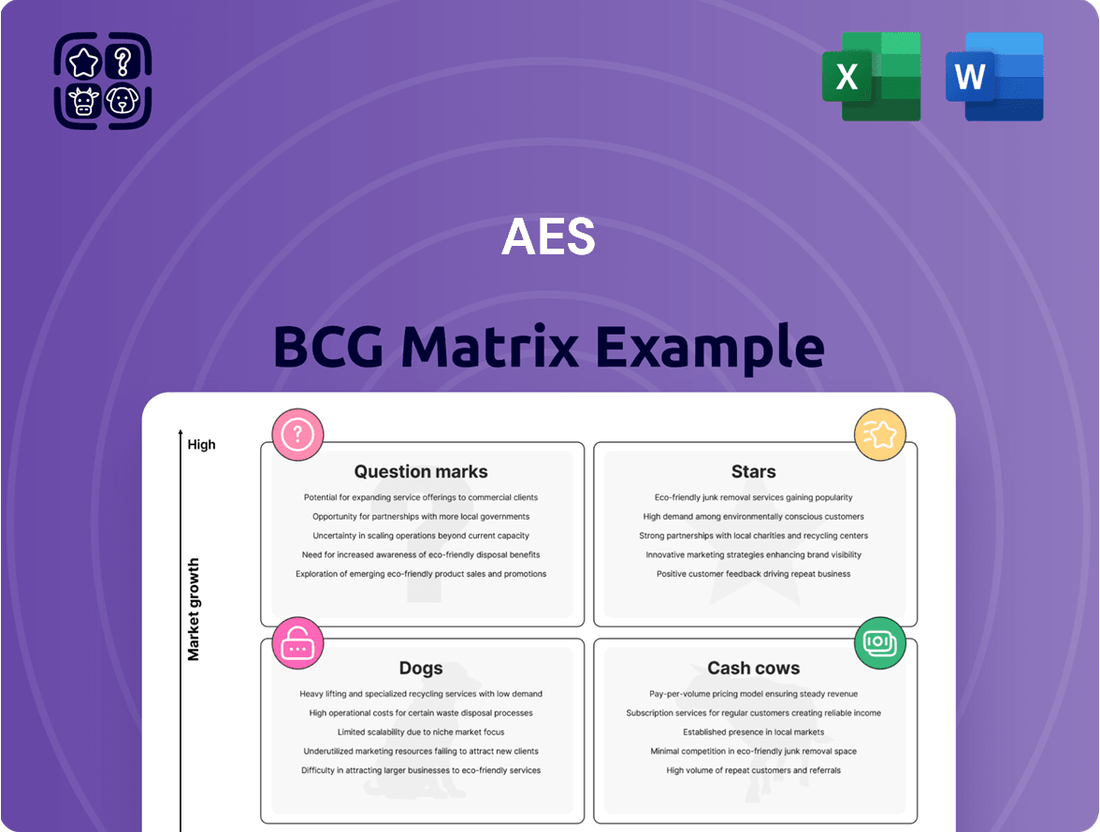

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. This overview provides a glimpse into how these categories can illuminate strategic opportunities and challenges.

Ready to transform this insight into action? Purchase the full BCG Matrix to unlock detailed analysis, actionable recommendations, and a clear roadmap for optimizing your product investments and driving sustainable growth.

Stars

AES is making significant strides in renewable energy development, a crucial area for its future growth. The company boasts an impressive 12 GW of signed Power Purchase Agreements (PPAs) for renewable projects, demonstrating strong market demand and a robust development pipeline.

With 5.2 GW of these projects already under construction, AES is actively translating its backlog into operational assets. This substantial construction phase, with a significant portion slated for completion by 2027, underpins future revenue streams and solidifies AES's position as a key player in the expanding clean energy landscape.

AES is making significant strides in the data center energy sector, a high-growth area with substantial energy needs. In the second quarter of 2025, the company secured 1.6 gigawatts (GW) in new power purchase agreements (PPAs) specifically for data center clients.

This impressive Q2 2025 performance adds to AES's existing portfolio, bringing their total contractual arrangements with major global hyperscalers to an impressive 10.1 GW. This demonstrates a strong market position in a segment characterized by rapid expansion and intense energy demand.

AES's strategic partnerships are a cornerstone of its Star status in the BCG matrix. Their green hydrogen joint venture with Air Products is a prime example, positioning AES at the forefront of a rapidly growing clean energy sector. This collaboration is designed to accelerate the development and deployment of green hydrogen solutions, tapping into a market projected for significant expansion.

Innovation is further evident in their adoption of advanced technologies like AI-powered robotics, exemplified by 'Maximo' for solar installations. This not only enhances operational efficiency but also reduces costs, a critical factor for maintaining a competitive edge. By integrating such technologies, AES is streamlining its processes and improving the speed and quality of its renewable energy project execution.

These initiatives collectively allow AES to not only secure a strong position in current high-growth energy markets but also to actively shape future energy landscapes. The company's ability to forge these strategic alliances and embrace technological advancements directly translates into accelerated deployment of new solutions and improved overall efficiency, reinforcing its Star classification.

US Utility Modernization and Growth

AES Indiana and AES Ohio are spearheading substantial multi-year investment initiatives exceeding $1.6 billion in 2024. These programs are strategically designed to modernize the grid, enhance reliability, and foster local economic growth, notably accommodating the increasing demand from data centers.

- Grid Modernization: Over $1.6 billion invested in 2024 across AES Indiana and AES Ohio.

- Reliability Enhancements: Focus on upgrading infrastructure to ensure consistent service delivery.

- Economic Development: Investments support local growth, including significant data center load expansion.

- Regulatory Support: New regulatory frameworks and rate adjustments facilitate these crucial investments.

Strong Financial Guidance and Growth Targets

AES demonstrates a strong commitment to financial performance, consistently reaffirming its 2025 adjusted EBITDA guidance in the range of $2.65 billion to $2.85 billion and adjusted EPS guidance between $2.10 and $2.26.

These projections are further bolstered by ambitious long-term annualized growth targets, aiming for 5-7% for Adjusted EBITDA and 7-9% for Adjusted EPS through 2027.

This confident outlook, underpinned by robust operational execution and a resilient business model, strongly suggests a high-growth trajectory and a solidified leading position within its market.

- 2025 Adjusted EBITDA Guidance: $2.65 billion - $2.85 billion

- 2025 Adjusted EPS Guidance: $2.10 - $2.26

- Long-Term Adjusted EBITDA Growth Target (through 2027): 5-7% annualized

- Long-Term Adjusted EPS Growth Target (through 2027): 7-9% annualized

Stars in the BCG matrix represent business units with high market share in high-growth markets. AES's renewable energy development, particularly its significant PPA backlog and ongoing construction projects, firmly places it in this category. The company's strategic focus on high-demand sectors like data centers, coupled with its innovative partnerships and technological adoptions, further solidifies its Star status.

| Metric | Value | Year |

| Signed Renewable PPAs | 12 GW | 2024 |

| Renewable Projects Under Construction | 5.2 GW | 2024 |

| Data Center PPAs Secured (Q2 2025) | 1.6 GW | 2025 |

| Total Contractual Arrangements with Hyperscalers | 10.1 GW | 2025 |

| Investment in AES Indiana & Ohio | >$1.6 billion | 2024 |

What is included in the product

The AES BCG Matrix assesses business units based on market share and growth, guiding strategic decisions like investment or divestment.

Clear visual mapping of Stars, Cash Cows, Question Marks, and Dogs for strategic decision-making.

Cash Cows

AES's diversified power generation portfolio is a significant cash cow. As of the end of 2024, the company managed over 32 gigawatts of power generation assets worldwide.

This vast operational base, with 50% from renewables and 32% from gas, generates a steady stream of cash. This consistent cash flow provides the financial stability needed to fund new projects and strategic initiatives without needing substantial new capital investment for market expansion.

AES's majority ownership in six U.S. electric utilities, serving over 2.5 million customers, firmly places these operations in the Cash Cows quadrant of the BCG matrix. This segment benefits from a stable, mature market characterized by regulated revenue streams.

These utilities are actively engaged in investment programs focused on enhancing reliability and supporting economic development, ensuring consistent cash generation. While growth prospects are modest, the profit margins remain robust, reflecting the dependable nature of these essential services.

AES's extensive portfolio of long-term Power Purchase Agreements (PPAs) acts as a significant cash cow. These agreements, often spanning 15-20 years, provide a bedrock of predictable revenue, shielding the company from the unpredictable swings of the energy market. In 2023, PPAs underpinned a substantial portion of AES's operating capacity, contributing to robust and stable cash flow generation from its established assets.

Strategic Asset Monetization

AES has strategically monetized assets, generating substantial cash flow. For instance, the sale of AES Brazil in 2024 and a minority stake in its global insurance company (AGIC) for $450 million in 2025 exemplify this approach. These divestitures of mature or non-core businesses provide capital for reinvestment in growth areas or for strengthening the balance sheet.

- Asset Sales: AES Brazil sale in 2024, AGIC stake sale for $450 million in 2025.

- Cash Generation: Divestments create significant proceeds.

- Reinvestment: Funds can fuel 'Star' or 'Question Mark' segments.

- Financial Strength: Proceeds also support debt reduction and shareholder returns.

Disciplined Capital Allocation and Shareholder Returns

AES demonstrates a strong focus on generating parent free cash flow, with projections indicating an increase of over 8% in 2025 compared to 2024. This robust cash generation underpins its commitment to shareholder returns.

The company plans to return approximately $500 million to shareholders in 2025. This disciplined capital allocation strategy includes maintaining its dividend and avoiding new equity issuance, signaling effective management of mature business cash resources.

- Parent Free Cash Flow Growth: Expected to increase by over 8% in 2025 from 2024 levels.

- Shareholder Returns: Approximately $500 million earmarked for return in 2025.

- Capital Allocation Discipline: Maintained dividend and no new equity issuance.

- Mature Business Management: Demonstrates effective cash resource management.

AES's established utility operations and long-term power purchase agreements are prime examples of cash cows within its portfolio. These segments benefit from stable, regulated markets and predictable revenue streams, generating consistent cash flow. This financial strength allows AES to fund growth initiatives and maintain shareholder returns.

| Segment | BCG Quadrant | Key Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| U.S. Electric Utilities | Cash Cow | Regulated revenue, mature market, 2.5M+ customers | Majority ownership in six utilities |

| Long-term PPAs | Cash Cow | Predictable revenue, 15-20 year terms | Underpinned substantial operating capacity in 2023 |

| Strategic Asset Sales | Cash Cow (proceeds) | Divestment of mature assets | AES Brazil sale (2024), AGIC stake sale ($450M in 2025) |

Delivered as Shown

AES BCG Matrix

The preview you see is the identical, unwatermarked BCG Matrix document you will receive immediately after purchase. This comprehensive analysis tool is fully formatted and ready for immediate application in your strategic planning sessions. You can confidently expect the same high-quality, professionally designed report that will empower your business decisions. No demo content or hidden surprises, just the actionable insights you need.

Dogs

AES's legacy coal generation assets are firmly positioned in the Dogs quadrant of the BCG matrix. These assets operate in a market characterized by declining demand and increasing regulatory pressure due to global decarbonization initiatives. For instance, AES's commitment to reducing its coal generation capacity is evident in its strategic divestitures and the phasing out of coal-fired power.

The monetization of the Warrior Run coal plant's power purchase agreement (PPA) in 2024 highlights AES's strategy to move away from these assets. This action signals a recognition that these plants are likely to yield diminishing returns and are candidates for divestiture as the company prioritizes cleaner energy sources.

Some of AES's operations in emerging markets, like Colombia, face regulatory uncertainty and environmental challenges such as droughts. These factors can lead to low growth and potentially a smaller market share than their core strategic areas.

These assets might be classified as Dogs in the BCG Matrix. This is because they carry inherent risks and have limited potential for future growth, often requiring significant resource allocation without generating commensurate returns.

For instance, in 2023, AES's Colombian operations, while contributing to their diversified portfolio, faced headwinds from water scarcity impacting hydroelectric generation, a key component of their energy mix in that region.

Businesses like AES Brazil, divested in 2024, and a minority stake in AES Global Insurance Company (AGIC) represent former 'cash cows' or mature assets that were strategically sold. These moves align with the BCG matrix's guidance for managing mature, low-growth businesses.

The sale of AES Brazil in 2024, for instance, freed up capital that was previously invested in a segment with lower growth potential compared to AES's evolving strategic priorities. This divestiture allows AES to reallocate resources towards higher-growth opportunities.

Certain Thermal Assets with Limited Modernization Potential

Certain Thermal Assets with Limited Modernization Potential

These are older, less efficient thermal generation facilities that don't fit well with AES's strategic shift towards cleaner energy sources. They also have minimal scope for upgrades to compete effectively in today's energy market.

Such assets might find it increasingly difficult to hold onto their market share as the energy sector continues to transform. Consequently, they could be considered for retirement or divestment.

For instance, in 2024, AES continued its strategy of reducing its carbon footprint, with a significant portion of its generation capacity already shifted to renewables. Assets that remain heavily reliant on fossil fuels and lack a clear path for efficiency improvements or conversion to cleaner fuels would fall into this category.

- Limited Modernization Potential: These assets are often older and may not be economically viable for significant upgrades to meet new environmental standards or efficiency requirements.

- Competitive Disadvantage: In markets increasingly favoring renewables and more efficient thermal plants, these assets struggle to compete on cost and environmental performance.

- Strategic Misalignment: Their operational profile and emissions do not align with AES's stated goals for a cleaner energy future, making them less attractive for continued investment.

- Potential for Divestment or Retirement: Given these challenges, AES may explore options to sell these assets or plan for their eventual decommissioning.

Small, Underperforming Standalone Projects

Small, underperforming standalone projects within an energy infrastructure portfolio, such as localized solar farms or niche renewable energy initiatives that fail to meet financial targets, often fall into the 'Dogs' category of the AES BCG Matrix. These ventures might be characterized by low market share and low growth prospects.

For instance, a small, distributed energy project in a mature market with limited expansion potential might struggle to gain traction. In 2024, the average return on investment for such niche energy projects that did not secure significant government incentives or long-term power purchase agreements was reported to be as low as 3-5%, significantly below industry benchmarks for viable infrastructure assets.

- Low Market Share: These projects typically operate in saturated local markets or face intense competition from larger, more established energy providers.

- Limited Growth Potential: Their standalone nature and lack of scalability often restrict future expansion and revenue growth opportunities.

- Cash Consumption: They frequently require ongoing capital for maintenance and operation without generating sufficient returns, leading to negative cash flow.

- Divestment Consideration: Such projects are prime candidates for strategic review, potential restructuring, or divestment to reallocate resources to more promising ventures.

AES's legacy coal assets, along with certain underperforming or strategically misaligned ventures, are categorized as Dogs in the BCG matrix. These assets face declining demand and increasing regulatory scrutiny, limiting their growth prospects and return potential. For example, the divestiture of AES Brazil in 2024 and the monetization of the Warrior Run coal plant's PPA underscore AES's strategy to exit such low-growth, resource-intensive businesses. These moves aim to free up capital for reallocation to more promising, cleaner energy initiatives.

| Asset Type | BCG Category | Key Characteristics | 2024 Strategic Action/Observation |

|---|---|---|---|

| Legacy Coal Generation | Dogs | Declining demand, increasing regulatory pressure, low efficiency | Monetization of Warrior Run coal plant PPA |

| Emerging Market Operations (e.g., Colombia) | Dogs/Question Marks | Regulatory uncertainty, environmental challenges (e.g., drought impacting hydro) | Water scarcity impacted hydro generation in 2023 |

| Older Thermal Assets (Limited Modernization) | Dogs | Low efficiency, minimal scope for upgrades, competitive disadvantage | Continued reduction in carbon footprint, assets reliant on fossil fuels without upgrade paths |

| Small, Underperforming Niche Projects | Dogs | Low market share, limited scalability, cash consumption | Low ROI (3-5%) reported for niche projects without incentives in 2024 |

Question Marks

AES's early-stage green hydrogen initiatives, like its joint venture with Air Products, are positioned as potential stars within the BCG framework. This segment represents a high-growth market with substantial future potential, mirroring the characteristics of a question mark.

However, these ventures are currently in their nascent stages, demanding significant capital investment and facing considerable uncertainty regarding market share and competitive positioning. The need for extensive development and market penetration efforts is paramount for these initiatives to evolve into market leaders.

AES is actively investing in advanced digital grid solutions powered by artificial intelligence. These AI applications are designed to enhance grid modernization, boost efficiency, and improve overall reliability. For instance, the company is exploring new technologies like 'Maximo' specifically for solar installations, aiming to streamline processes and increase effectiveness.

These innovative grid solutions and AI applications operate within a market that is experiencing rapid growth. However, their current market share and the extent of their widespread adoption are still in the early stages of development. This positions them as question marks within the BCG matrix, requiring significant investment to demonstrate their value and achieve scalability.

New geographic market entries or niche solutions for AES would initially be classified as Question Marks in the BCG matrix. These ventures, while holding high growth potential, demand significant investment and marketing efforts to establish market share and customer acceptance.

For instance, if AES were to enter a nascent renewable energy market in Southeast Asia in 2024, this would represent a Question Mark. Such an entry would require substantial capital for infrastructure development and localized marketing campaigns to penetrate a new customer base.

Energy Storage Projects Requiring Market Maturation

AES's strategic investments in energy storage, while robust, may include projects in the question mark category of the BCG matrix. These are typically newer technologies or larger-scale deployments where market adoption and revenue streams are still evolving. For instance, advanced long-duration energy storage solutions, while promising, might require further development and supportive market structures to achieve widespread profitability. By July 2025, AES is expected to have a significant portion of its portfolio in growth areas, but these nascent projects represent future potential rather than current market leaders.

These question mark projects, by their nature, demand substantial capital for research, development, and initial market penetration. Their success hinges on factors like regulatory support, declining technology costs, and the establishment of robust market mechanisms. For example, projects involving novel chemistries or grid-scale applications not yet fully integrated into energy markets would fall into this classification. AES's commitment to these areas underscores a long-term vision for energy storage leadership.

- Advanced Battery Chemistries: Projects exploring next-generation battery technologies beyond lithium-ion, which are still undergoing scaling and cost reduction.

- Large-Scale Flow Batteries: Deployment of flow battery systems for grid-scale applications, requiring market maturation for widespread economic viability.

- Emerging Storage Technologies: Investments in less established storage solutions like compressed air or thermal energy storage, awaiting further market acceptance and infrastructure development.

- New Market Integration: Projects focused on integrating storage into emerging energy markets or services that are still in their early stages of development and pricing.

Emerging Technologies in New Energy Technologies SBU

The New Energy Technologies SBU, encompassing ventures like Fluence, currently exhibits lower contributions in Q1 2025. This positioning suggests these are early-stage technologies with high growth potential but a nascent market share, requiring significant investment. These strategic bets are focused on establishing market viability and scaling operations, aiming to transition into Stars.

Fluence, a key player in energy storage solutions, reported a net loss of $25.7 million in Q1 2024, underscoring the high cash consumption typical of emerging technologies. However, the company's backlog of $3.3 billion as of March 31, 2024, highlights substantial future revenue potential and market demand.

- Emerging Technologies: New Energy Technologies SBU, including Fluence, operates in a high-growth, high-investment phase.

- Q1 2025 Contribution: Lower contributions in Q1 2025 indicate early-stage development and market penetration efforts.

- Fluence's Financials: Fluence's Q1 2024 net loss of $25.7 million reflects significant cash burn, a common trait of "Question Marks."

- Future Potential: A backlog of $3.3 billion for Fluence points to strong future revenue prospects and market acceptance.

Question Marks in AES's portfolio represent high-growth potential ventures with uncertain market positions. These are typically new technologies or market entries that require substantial investment to gain traction and market share. Their success is contingent on factors like technological advancements, regulatory support, and competitive landscape evolution.

AES's investments in areas like advanced battery chemistries and new market integration for energy storage exemplify these Question Marks. For instance, new geographic market entries in 2024, such as a potential renewable energy project in Southeast Asia, would demand significant capital for infrastructure and localized marketing to establish a foothold.

The New Energy Technologies SBU, including Fluence, currently shows characteristics of Question Marks. While operating in a high-growth sector, their early-stage development and market penetration efforts mean lower current contributions. Fluence's Q1 2024 net loss of $25.7 million highlights the significant cash burn typical of these ventures, though its $3.3 billion backlog as of March 31, 2024, signals strong future potential.

| SBU/Initiative | BCG Classification | Growth Rate | Market Share | Investment Need | Key Considerations |

|---|---|---|---|---|---|

| Green Hydrogen JV (e.g., Air Products) | Question Mark | High | Low | High | Market adoption, cost reduction, regulatory environment |

| AI-Powered Grid Solutions | Question Mark | High | Low | High | Scalability, integration, competitive response |

| New Geographic Market Entry (e.g., SE Asia 2024) | Question Mark | High | Low | High | Local regulations, infrastructure, customer acceptance |

| Advanced Energy Storage Technologies | Question Mark | High | Low | High | Technological maturity, market mechanisms, cost-competitiveness |

| Fluence (New Energy Technologies) | Question Mark | High | Low | High | Profitability, scaling, market demand |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of internal financial data, market research reports, and competitive intelligence to provide a comprehensive view of business unit performance and potential.