Aena PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

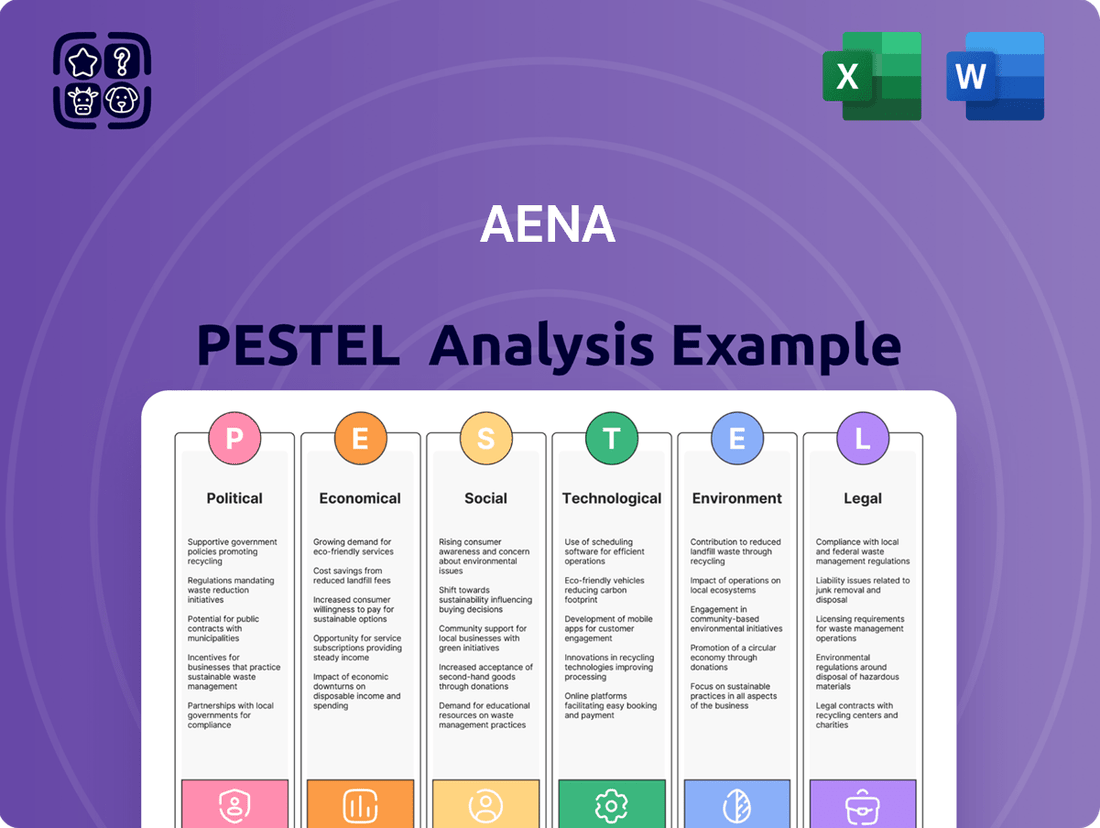

Navigate the complex external forces shaping Aena's future with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that influence its operations and strategic decisions. Equip yourself with the knowledge to anticipate market shifts and identify potential opportunities. Download the full analysis now to gain a decisive advantage.

Political factors

As a state-owned entity, Aena's operations are significantly shaped by the Spanish government, which holds substantial control and influence. This ownership structure can foster stability and long-term strategic alignment, as seen with the government's recent approval of a substantial investment program for Spanish airports, aiming to modernize infrastructure and enhance capacity.

The regulatory framework, especially the Airport Regulation Document (DORA), significantly shapes Aena's revenue per passenger and its investment timelines. This framework is a key determinant of how much Aena can charge airlines and, consequently, its profitability.

The Spanish competition authority, CNMC, holds considerable sway over Aena's pricing strategies. For instance, the CNMC's decision to freeze Aena's airport fees for 2025 directly impacted the company's revenue projections for that year, highlighting the watchdog's influence on financial performance.

Aena navigates a complex web of national and EU aviation policies. These regulations directly influence its operational framework, dictating everything from security procedures to environmental sustainability goals. For instance, potential domestic flight bans on very short routes, as explored in some EU discussions, could reshape Aena's network strategy and revenue streams.

The European Union's evolving stance on airport security, particularly concerning liquid restrictions, also presents a dynamic challenge. As of early 2025, the EU is progressing with the phased implementation of new security scanners that will eventually allow passengers to carry larger quantities of liquids, a change that will require significant investment and operational adjustments at Aena's airports.

International Relations and Tourism Policy

Spain's standing as a premier global tourist destination is a significant boon for Aena, directly influencing passenger traffic and revenue. Government policies aimed at bolstering this sector and enhancing international air connectivity are therefore crucial for Aena's operational success.

Political decisions to support tourism development, such as investing in infrastructure or promoting Spain abroad, directly translate into increased demand for air travel. For instance, the Spanish government's commitment to expanding Madrid-Barajas Airport into a key gateway for Latin America and Asia underscores a strategic political focus on leveraging air transport for economic growth.

- Government support for tourism initiatives directly impacts Aena's passenger volumes.

- Expansion projects, like that at Madrid-Barajas, are politically driven to enhance international connectivity.

- Aena benefits from policies that promote Spain as a desirable travel destination.

Infrastructure Investment and Development Plans

Government-backed investment plans for airport infrastructure are a significant political factor influencing Aena's operations. For instance, Spain's government has committed substantial funds to enhance its aviation network. A prime example is the planned €2.4 billion expansion of Madrid-Barajas Airport, aiming to significantly boost its capacity and modernize facilities.

Beyond major hubs, there's a broader commitment to upgrading regional airports. An additional €351 million has been allocated for various upgrades across Spanish airports, ensuring improved services and efficiency nationwide. These investments are crucial for Aena's long-term capacity and operational capabilities, directly impacting its ability to handle growing passenger numbers and maintain competitive service standards.

- Madrid Airport Expansion: €2.4 billion investment planned.

- Spanish Airport Upgrades: €351 million allocated for general improvements.

- Government Support: Demonstrates political commitment to aviation sector development.

- Impact on Aena: Enhances long-term capacity and operational efficiency.

Political stability and government policies are paramount for Aena, influencing everything from infrastructure investment to pricing. The Spanish government's active role, as a major shareholder, means strategic decisions often align with national economic objectives, such as boosting tourism. For example, the government's approval of significant investment programs, like the €2.4 billion expansion of Madrid-Barajas Airport, directly supports Aena's growth and modernization efforts.

| Political Factor | Description | Impact on Aena | Example/Data (2024/2025 Focus) |

|---|---|---|---|

| Government Ownership & Control | Spanish government holds substantial influence as a majority shareholder. | Ensures strategic alignment with national economic goals, can provide stability for long-term investments. | Government approval of substantial investment programs for airport modernization. |

| Regulatory Framework (DORA) | Airport Regulation Document sets revenue caps and investment parameters. | Directly impacts Aena's revenue per passenger and dictates investment timelines and scope. | CNMC's decision to freeze airport fees for 2025, affecting revenue projections. |

| EU Aviation Policy | Evolving regulations on security, environment, and connectivity. | Requires operational adjustments and investments, potentially reshaping network strategies. | Phased implementation of new security scanners allowing larger liquid quantities (early 2025 progress). |

| Tourism Promotion Policies | Government initiatives to boost Spain as a tourist destination. | Drives passenger traffic growth and enhances air connectivity, directly benefiting Aena's revenue. | Commitment to developing Madrid-Barajas as a key gateway for Latin America and Asia. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Aena's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Aena's PESTLE analysis offers a clear, summarized version of complex external factors, acting as a pain point reliever by simplifying strategic discussions and ensuring all stakeholders grasp key market dynamics.

Economic factors

Aena's financial performance is intrinsically linked to the number of passengers passing through its airports. The company has experienced a robust rebound in passenger traffic, demonstrating a strong recovery trend.

Significantly, passenger volumes have not only surpassed pre-pandemic 2019 levels but are also projected to exceed 300 million passengers in 2025, an achievement that arrived a year ahead of initial expectations.

Commercial activities at Aena's airports, encompassing retail, dining, and car rentals, are crucial for its financial performance. These non-aeronautical services are increasingly vital, demonstrating robust growth potential.

In the first half of 2025, Aena achieved a notable 10.4% increase in its commercial revenue. This growth outpaced the expansion in passenger traffic, highlighting the effectiveness of Aena's strategy to enhance the passenger experience and diversify its income streams.

Aena is currently in a substantial investment phase, planning to allocate around €7 billion towards capital expenditure (CAPEX) by 2031. This significant outlay is primarily aimed at bolstering airport capacity to accommodate the robust growth in passenger traffic.

Key projects driving this CAPEX cycle include substantial upgrades and expansions at major hubs like Madrid-Barajas and Barcelona-El Prat airports. These initiatives are crucial for Aena to meet projected demand and maintain its competitive edge in the aviation sector.

Operating Costs and Efficiency

Aena's commitment to operational efficiency is evident in its ability to maintain low growth in underlying operating expenses. This focus helps stabilize the company's financial performance even amidst fluctuating economic conditions.

Strategically hedging energy costs is a key component of Aena's expense management. Furthermore, significant investments in renewable energy sources aim to further mitigate the impact of volatile energy prices and contribute to long-term cost stability.

For instance, in 2023, Aena reported a notable improvement in its operating efficiency, with EBITDA margin reaching 44.7%. The company continues to invest in sustainable energy solutions, with solar power projects contributing to its operational cost control.

- Low Operating Expense Growth: Aena has consistently managed to keep the increase in its core operating costs at a manageable level.

- Energy Cost Hedging: The company actively employs hedging strategies to protect against fluctuations in energy prices, ensuring greater predictability in expenses.

- Renewable Energy Investments: Aena is investing in renewable energy sources, such as solar power, to reduce its reliance on fossil fuels and stabilize energy expenditures.

- EBITDA Margin Improvement: In 2023, Aena's EBITDA margin stood at 44.7%, reflecting its operational efficiency and cost management capabilities.

Tariff Adjustments and Financial Performance

Tariff adjustments are a critical factor for Aena's financial performance, as these rates are subject to regulatory oversight. A proposed increase of 6.5% in airport tariffs for 2026 is currently under review, which could significantly impact future revenue streams.

Despite ongoing regulatory considerations, Aena demonstrated strong financial health, reporting a net profit of €893.8 million in the first half of 2025. This figure highlights the company's ability to generate substantial earnings even amidst tariff negotiations.

- Tariff Impact: Proposed 6.5% tariff increase for 2026 pending regulatory approval.

- Financial Strength: Achieved a net profit of €893.8 million in H1 2025.

- Revenue Drivers: Tariffs directly influence Aena's revenue generation capacity.

Economic factors significantly influence Aena's operations, particularly through passenger traffic and commercial revenue. The company is experiencing a strong rebound, with passenger volumes projected to exceed 300 million by 2025, surpassing pre-pandemic levels a year earlier than anticipated. This growth fuels commercial activities, which saw a 10.4% revenue increase in the first half of 2025, outperforming passenger traffic growth.

Aena's strategic financial management includes substantial CAPEX, with €7 billion planned by 2031 for airport expansion, and a focus on controlling operating expenses. The company is also hedging energy costs and investing in renewables to stabilize expenditures, as evidenced by its 44.7% EBITDA margin in 2023.

Tariff adjustments, such as the proposed 6.5% increase for 2026, are key revenue drivers, though subject to regulatory approval. Despite these negotiations, Aena reported a robust net profit of €893.8 million in the first half of 2025, showcasing its financial resilience.

| Metric | 2023 | H1 2025 (Projected/Actual) | 2025 (Projected) |

|---|---|---|---|

| Passenger Volumes | ~280 million (2023 Actual) | ~150 million+ (H1 2025 Actual) | >300 million |

| Commercial Revenue Growth | N/A | +10.4% | N/A |

| EBITDA Margin | 44.7% | N/A | N/A |

| Net Profit | N/A | €893.8 million | N/A |

| Proposed Tariff Increase | N/A | N/A | 6.5% (for 2026) |

Preview Before You Purchase

Aena PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aena PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain a thorough understanding of Aena's operating environment, enabling informed strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. Our Aena PESTLE Analysis provides actionable insights into the external forces shaping its future success.

Sociological factors

Spain's enduring popularity as a global travel hotspot is a significant driver for Aena, directly bolstering passenger traffic. In 2023, Spain welcomed a record-breaking 85.1 million international tourists, a figure that significantly benefits airport operator Aena by increasing passenger volumes and associated revenues.

Shifting traveler demands are also shaping Aena's operational and commercial approaches. For instance, there's a growing appetite for enhanced travel experiences, including a rise in demand for premium services like airport VIP lounges and convenient car rental options, prompting Aena to adapt its service offerings to capture this market segment.

Global air travel is expected to see continued expansion, with the International Air Transport Association (IATA) forecasting a rise in passenger numbers from 4.7 billion in 2024 to over 5.0 billion by 2025. This growth is largely fueled by a burgeoning global middle class, projected to reach 5.4 billion people by 2030 according to the Brookings Institution, and increasing urbanization rates worldwide.

These demographic trends directly support Aena's long-term passenger volume forecasts and underpin its strategic investments in airport infrastructure and capacity expansion. For instance, Aena's 2024-2028 investment plan includes significant capital expenditures aimed at accommodating this anticipated surge in travelers.

Aena is heavily focused on enhancing the passenger journey, pouring resources into modernizing airport facilities, bolstering security measures, and implementing advanced digital technologies. This commitment to an improved experience is evident in their ongoing investments across their airport network, aiming to streamline processes and increase overall satisfaction.

The caliber of services offered, particularly support for passengers with reduced mobility (PRM), is a cornerstone of Aena's strategy for boosting passenger contentment. In 2023, Aena handled over 280 million passengers, a significant increase from previous years, underscoring the growing importance of service quality in managing such high volumes.

Public Perception and Community Relations

Aena's standing is significantly shaped by how the public views its operations, particularly concerning noise and environmental effects on local populations. For instance, in 2023, Aena reported a 4.1% increase in passenger traffic compared to 2019, highlighting the growing demand and potential for increased community impact.

The company prioritizes mitigating noise disturbances and fostering positive relationships with nearby communities. This commitment is reflected in ongoing investments in noise reduction technologies and community engagement programs. Aena's 2023 sustainability report detailed €120 million invested in environmental initiatives, including noise abatement measures.

- Public Scrutiny: Airport operations, especially noise and environmental impact, are under constant public observation.

- Community Engagement: Aena actively seeks to maintain dialogue and address concerns with communities surrounding its airports.

- Environmental Investment: Significant capital is allocated to reducing the ecological footprint and noise pollution from airport activities.

- Passenger Growth Impact: Increased passenger numbers, such as the 275 million passengers handled by Aena in 2023, necessitate proactive community management.

Employment and Labor Relations

Aena's extensive operations are a significant job creator, directly and indirectly supporting thousands of employment opportunities. For instance, in 2023, Aena managed 46 airports in Spain and two in London, facilitating travel for over 280 million passengers, which underscores the scale of its workforce needs and economic contribution.

Maintaining harmonious labor relations is crucial for Aena's operational continuity. This involves managing relationships with its own employees and the workforce of its service contractors, such as those providing security, cleaning, and ground handling.

- Job Creation: Aena's airport network directly and indirectly supports a substantial number of jobs, contributing significantly to local and national economies.

- Labor Relations Management: Effective management of employee and contractor relations is vital for ensuring smooth and uninterrupted airport operations.

- Contracted Services: The company relies on external providers for essential services like security and cleaning, making labor conditions and stability in these sectors a key consideration.

- Employee Well-being: Ensuring fair labor practices and a positive working environment for all staff, both directly employed and contracted, is paramount for operational efficiency and corporate reputation.

Societal attitudes towards travel and aviation safety directly influence passenger volumes and Aena's operational strategies. Public perception of safety, particularly following global events, remains a critical factor for traveler confidence. Aena's commitment to stringent safety protocols, evident in its operational standards, aims to foster this confidence.

Technological factors

Aena is significantly upgrading its passenger screening capabilities. Investments in technologies like Explosive Detection Systems for Cabin Baggage (EDSCB) and Automatic Tray Return Systems (ATRS) are at the forefront of this modernization. These advancements are designed to enhance security efficiency and passenger experience.

A key benefit of these new systems is the ability for passengers to leave liquids and electronics in their hand luggage during the security check. This streamlines the process, reducing wait times and improving overall passenger flow through airports. For instance, the implementation of EDS equipment at major hubs aims to process passengers more rapidly.

By adopting these advanced security screening technologies, Aena is not only bolstering its safety protocols but also aiming to improve operational efficiency. This technological investment is crucial for maintaining competitiveness and meeting the evolving demands of air travel in the 2024-2025 period, ensuring a smoother journey for millions of travelers.

Aena is significantly investing in digitalizing and automating airport operations. For instance, the company is rolling out remote-controlled boarding bridges, a move projected to streamline aircraft turnaround times and improve overall efficiency. This focus on technology is designed to enhance passenger flow and minimize the need for manual tasks.

These advancements are crucial for adapting to the evolving demands of air travel. By reducing manual interventions, Aena aims to create a smoother, faster experience for travelers and optimize resource allocation. This technological push is a key component of their strategy to maintain competitiveness in the global aviation sector.

Aena's operational efficiency is significantly influenced by the modernization of air navigation services, a domain where collaboration with entities like ENAIRE is paramount. ENAIRE, Spain's air navigation service provider, is actively investing in advanced technologies to enhance air traffic management, aiming for greater precision and reduced flight delays. For instance, ENAIRE's 2023 investments included €100 million in modernization projects, focusing on digitalizing air traffic control systems and implementing satellite-based navigation procedures.

These technological advancements directly impact Aena by facilitating smoother air traffic flow into and out of its airports, which can lead to lower fuel consumption for airlines and a better passenger experience. The ongoing integration of systems that allow for more direct routes and optimized descent profiles, supported by ENAIRE's technological upgrades, contributes to Aena's goal of reducing its environmental footprint and improving overall airport capacity. This modernization is key to handling increasing air traffic volumes efficiently.

Sustainable Aviation Fuel (SAF) Development and Integration

Aena is actively driving the adoption of Sustainable Aviation Fuel (SAF) by offering incentives for its integration. This focus on SAF is crucial for reducing the carbon footprint of air travel, a key objective for Aena's sustainability strategy.

The development and scaling of SAF are paramount for the aviation sector's decarbonization efforts. By 2025, the European Union aims for a significant SAF blend, with mandates expected to increase progressively, pushing airlines and airports like Aena to invest in and facilitate SAF supply chains.

- SAF Mandates: The EU's ReFuelEU Aviation initiative targets a minimum SAF blending percentage of 2% in 2025, rising to 6% by 2030, with a sub-target for synthetic fuels.

- Aena's Role: Aena is collaborating with fuel producers and airlines to establish infrastructure and streamline the supply of SAF at its airports.

- Environmental Impact: SAF can reduce lifecycle carbon emissions by up to 80% compared to conventional jet fuel, directly supporting Aena's commitment to net-zero emissions by 2050.

- Market Growth: The global SAF market is projected to grow substantially, with industry forecasts indicating a demand of over 10 million tonnes by 2030, creating new technological opportunities and challenges for airport operators.

Renewable Energy Technologies and Infrastructure

Aena is strategically prioritizing renewable energy, with significant investments in photovoltaic plants and the procurement of certified renewable electricity. This commitment is designed to achieve a 100% renewable electricity supply by 2027, a crucial step in reducing dependence on fossil fuels and aligning with broader sustainability goals.

The company's proactive approach to decarbonization is evident in its infrastructure development. For instance, Aena inaugurated its largest photovoltaic plant at Madrid-Barajas Airport in late 2023, with a capacity of 1.2 MWp, contributing to the airport's energy self-sufficiency.

- Investment in Photovoltaic Plants: Aena is actively developing solar energy generation capacity across its airports.

- Renewable Electricity Procurement: The company is purchasing certified renewable electricity to meet its operational needs.

- Target for 100% Renewable Electricity: Aena aims to source all its electricity from renewable sources by 2027.

- Fossil Fuel Dependency Reduction: These initiatives are key to decreasing reliance on conventional, non-renewable energy sources.

Aena is enhancing passenger screening with advanced technologies like Explosive Detection Systems for Cabin Baggage (EDSCB) and Automatic Tray Return Systems (ATRS). These upgrades allow passengers to keep liquids and electronics in their hand luggage, speeding up security checks and improving the overall travel experience, a critical factor for airport efficiency in 2024-2025.

Legal factors

The Airport Regulation Document (DORA) is a critical legal factor for Aena, outlining the rules for its investments and charges in Spain. This framework provides Aena with a degree of predictability, essential for long-term planning and capital allocation. The current DORA II period runs until 2026, and the company is actively involved in shaping DORA III, which is slated to cover 2027-2031, ensuring continued regulatory guidance.

Aena operates within a strict framework of EU and national aviation safety regulations, impacting everything from flight procedures to passenger security. These rules are constantly evolving, as seen with recent EU directives on liquid restrictions in hand luggage, which require continuous adaptation by airports.

Compliance with these safety mandates is paramount for Aena's operational integrity and passenger trust. For instance, the European Union Aviation Safety Agency (EASA) sets stringent standards for aircraft maintenance and pilot training, directly influencing airline operations managed at Aena's airports.

Aena must navigate a complex web of environmental regulations, particularly concerning CO2 emissions and noise pollution, which directly impact airport operations and expansion plans. Failure to comply can result in significant fines and operational restrictions.

The company has committed to ambitious sustainability goals, including achieving net-zero emissions by 2030, a target that necessitates substantial investment in cleaner technologies and operational efficiencies. Aena also adheres to specific health and safety legislation, such as Royal Decree 487/2022, which mandates legionella prevention measures across its facilities.

Competition Law and Fee Approvals

The Spanish National Commission on Markets and Competition (CNMC) holds considerable sway over Aena's pricing strategies, particularly concerning airline fees. This regulatory body scrutinizes proposed fee hikes to safeguard fair market practices and prevent Aena from leveraging its dominant position unfairly.

A clear illustration of this oversight is the CNMC's decision to freeze Aena's airport charges for 2025. This move directly impacts Aena's revenue projections and necessitates a strategic review of its operational cost management and service offerings to airlines.

- CNMC Oversight: The CNMC must approve significant changes to Aena's airport charges.

- 2025 Fee Freeze: Aena's proposed fee increases were not approved for 2025, impacting revenue forecasts.

- Competition Impact: This regulatory action aims to maintain competitive pricing for airlines operating within Aena's airports.

Labor Laws and Employment Regulations

Aena, as a Spanish company, must adhere to stringent labor laws and employment regulations. These laws dictate everything from minimum wage and working hours to employee rights and safety standards across its operations, including crucial services like security and cleaning. For instance, Spain's labor reforms in 2022 aimed to curb precarious employment, impacting how Aena might contract for services.

Compliance with these regulations is paramount for maintaining a stable workforce and avoiding legal repercussions. Aena's adherence ensures fair treatment and promotes a positive employment environment, which is vital for operational efficiency and public image. The company's workforce, which numbered approximately 2,200 direct employees as of the end of 2023, operates under this framework.

Key aspects of Spanish labor law impacting Aena include:

- Contractual Obligations: Regulations govern the types of employment contracts Aena can offer, influencing the stability and terms of employment for its staff and outsourced service providers.

- Worker Rights: Spanish law protects employee rights concerning wages, benefits, working conditions, and the right to collective bargaining, all of which Aena must respect.

- Health and Safety: Strict occupational health and safety standards are enforced to ensure the well-being of Aena's employees and contractors working in often complex airport environments.

Aena's operations are heavily influenced by the Airport Regulation Document (DORA) in Spain, with the current DORA II period extending until 2026. The company is actively involved in shaping DORA III for 2027-2031, ensuring continued regulatory clarity on investments and charges. Furthermore, the Spanish National Commission on Markets and Competition (CNMC) has significant authority, notably freezing Aena's airport charges for 2025, impacting revenue forecasts and necessitating cost management reviews.

Environmental factors

Aena's Climate Action Plan (CAP) is a cornerstone of its environmental strategy, aiming for carbon neutrality by 2026, a target considerably earlier than many industry peers. This aggressive timeline includes a commitment to net-zero emissions by 2030, demonstrating a proactive approach to climate change mitigation.

The plan focuses on tangible reductions in Scope 1 and 2 CO2 emissions, which encompass direct emissions from Aena's operations and indirect emissions from purchased energy. A key component is the promotion of sustainable aviation fuels and operational efficiencies to decarbonize the aviation sector.

In 2023, Aena reported a 16.7% reduction in absolute Scope 1 and 2 emissions compared to its 2019 baseline, showcasing concrete progress towards its ambitious goals. The company is investing in renewable energy sources and electric vehicle fleets to further its decarbonization efforts.

Aena is making significant strides in renewable energy adoption, targeting 100% renewable electricity through guarantees of origin. This commitment is being realized through the development of photovoltaic plants across its airports and the procurement of certified green energy.

By the end of 2023, Aena's airports had already achieved a substantial portion of their electricity needs from renewable sources, with ongoing projects expected to further bolster this figure. For instance, the installation of solar panels at airports like Tenerife South and Josep Tarradellas Barcelona-El Prat is a key part of this strategy, contributing to a more sustainable operational model.

Minimizing noise pollution is a significant environmental challenge for Aena, particularly for communities living near its airports. In 2023, Aena continued its commitment to reducing noise nuisance by implementing various operational strategies and investing in soundproofing programs for affected residences.

Aena actively monitors noise levels through extensive measurement campaigns. For instance, at Madrid-Barajas Airport, a network of noise monitoring stations provides real-time data, allowing for adjustments in flight procedures to mitigate impact. These efforts are crucial as public concern over airport noise remains high.

Waste Management and Resource Use

Aena places a significant emphasis on responsible resource use and waste management across its airport operations. This commitment involves embedding environmental considerations directly into strategic decision-making, aiming to conserve natural resources and foster a more circular economy. For instance, in 2023, Aena reported a reduction in waste sent to landfill by 12% compared to 2019, with 72% of its waste being recycled or recovered.

The company actively pursues initiatives to optimize water and energy consumption. This includes implementing water-saving technologies and investing in renewable energy sources to power its facilities. Aena’s 2023 sustainability report highlighted a 6% decrease in water intensity per passenger and a 25% increase in renewable energy usage for its electricity needs compared to 2019.

- Waste Reduction: Aena aims to further decrease the amount of waste sent to landfills, targeting a 20% reduction by 2025 compared to 2019 levels.

- Circular Economy Initiatives: The company is expanding its programs for material reuse and recycling, including partnerships for upcycling old airport materials.

- Water Efficiency: Efforts continue to reduce water consumption, with a goal of achieving a 15% improvement in water efficiency per passenger by 2025.

- Energy Transition: Aena is increasing its reliance on renewable energy sources, with a target of sourcing 40% of its electricity from renewables by 2025.

Sustainable Mobility and Supply Chain Collaboration

Aena is actively championing sustainable mobility, both for passengers traveling to and from its airports and within its operational ecosystem. This commitment involves fostering collaboration with its extensive supply chain and local communities to amplify sustainability efforts across the board.

A key facet of this strategy is incentivizing airlines to adopt sustainable aviation fuels (SAFs). For instance, in 2023, Aena continued its efforts to promote SAF usage, aiming to reduce the carbon footprint of air travel. Furthermore, the electrification of ground handling fleets is a priority, with ongoing investments in electric vehicles and charging infrastructure to minimize emissions from airport operations.

- Sustainable Fuel Incentives: Aena actively encourages airlines to increase their use of SAF, aligning with broader industry goals for decarbonization.

- Electrification of Ground Operations: Investments are being made to transition ground handling vehicles to electric power, reducing direct emissions at airports.

- Stakeholder Collaboration: Partnerships with supply chain partners and local communities are crucial for driving comprehensive sustainability initiatives beyond Aena's direct control.

- 2024/2025 Focus: Continued expansion of electric vehicle charging infrastructure and increased SAF uptake targets are expected to be central to Aena's environmental strategy in the coming years.

Aena's environmental strategy is deeply intertwined with its climate action plan, aiming for carbon neutrality by 2026 and net-zero emissions by 2030. The company reported a 16.7% reduction in absolute Scope 1 and 2 emissions in 2023 compared to 2019, showcasing tangible progress. Aena is significantly increasing its use of renewable electricity, targeting 40% by 2025, and has already seen substantial contributions from solar installations at its airports.

Noise pollution remains a key focus, with ongoing efforts in 2023 to mitigate nuisance through operational adjustments and soundproofing programs for affected communities. Resource management is also critical, with a 12% reduction in waste sent to landfill by 2023 and a 72% recycling rate. Water efficiency has improved, with a 6% decrease in water intensity per passenger in 2023 versus 2019.

The company is actively promoting sustainable mobility and the use of sustainable aviation fuels (SAFs) among airlines. Aena is also investing in the electrification of its ground handling fleets, expanding electric vehicle charging infrastructure to reduce operational emissions.

| Environmental Target | 2023 Status/Progress | 2025 Target |

|---|---|---|

| Carbon Neutrality | Aiming for 2026 | N/A |

| Net-Zero Emissions | Aiming for 2030 | N/A |

| Scope 1 & 2 Emissions Reduction (vs 2019) | 16.7% reduction (2023) | N/A |

| Renewable Electricity Sourcing | Ongoing increase, significant contribution from solar | 40% |

| Waste to Landfill Reduction (vs 2019) | 12% reduction (2023) | 20% reduction |

| Water Intensity Reduction (per passenger vs 2019) | 6% decrease (2023) | 15% improvement |

PESTLE Analysis Data Sources

Our Aena PESTLE Analysis draws on a comprehensive blend of official government publications, international financial institution reports, and leading aviation industry analyses. This ensures that insights into political, economic, social, technological, legal, and environmental factors are robust and current.