Aena Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

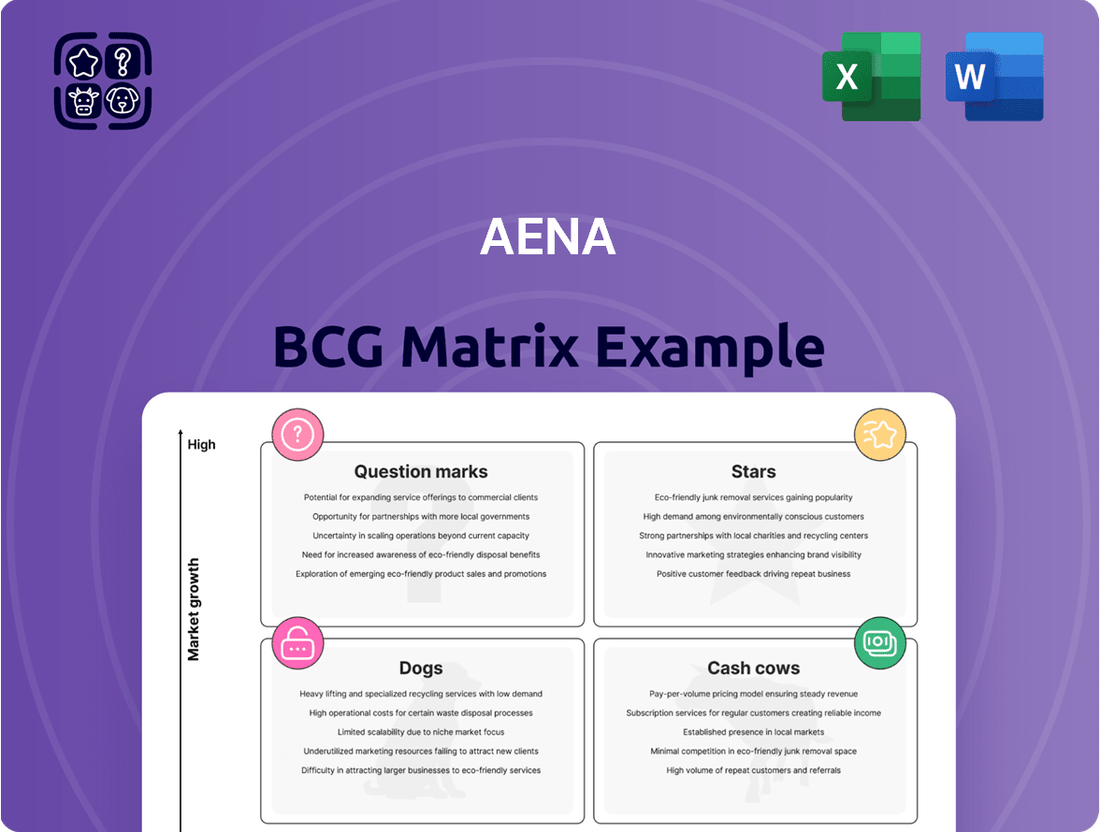

Curious about how Aena's diverse portfolio stacks up in the market? This glimpse into their BCG Matrix reveals the potential of their Stars, the stability of their Cash Cows, and the challenges of their Dogs and Question Marks. Don't miss out on the complete strategic picture; purchase the full BCG Matrix for detailed quadrant analysis and actionable insights to guide your investment decisions.

Stars

Aena's commercial activities are a star performer, demonstrating impressive growth that outpaces passenger traffic. In 2024, commercial revenue surged by 14.7%, and the first half of 2025 saw a solid 10.4% increase.

This robust expansion is driven by high-margin offerings like duty-free shops, premium VIP services, and a diverse food and beverage selection, all of which are undergoing active tendering and expansion.

Looking ahead, Aena projects that its commercial revenues will not only recover but will significantly exceed pre-pandemic levels, reaching an anticipated 48% growth by 2026, underscoring its position as a high-growth segment.

Aena's major airport infrastructure expansions at Madrid-Barajas and Barcelona-El Prat, backed by a €7 billion CAPEX cycle under DORA III (2027-2031), are designed to boost passenger capacity by 28% and 36% respectively.

These significant investments are strategically positioned to capture future passenger and earnings growth in high-demand markets, classifying them as question marks in the BCG matrix.

This aggressive expansion strategy requires substantial cash outlay, reflecting Aena's commitment to securing future leadership and market dominance in its key hubs.

Aena's international airports, like those in Brazil and London Luton, are crucial for its growth. These operations are expected to contribute 15% of Aena's EBITDA by 2026, a notable increase from 11.6% in the first half of 2025, demonstrating their rising importance.

Investments in Brazil, such as the expansion of Congonhas Airport, highlight the strategic value and substantial growth prospects Aena sees in these international markets, directly impacting its overall financial performance.

Air Cargo Services Growth

Air cargo services represent a significant growth area for Aena, as evidenced by a 13.7% revenue increase in 2024. This segment is a key contributor to the company's real estate services revenue, underscoring its importance within the broader portfolio. The robust performance is further highlighted by a substantial 22.7% rise in freight volumes observed in October 2024, pointing to strong market demand and operational efficiency.

The strategic positioning of air cargo within Aena's operations leverages existing airport infrastructure to capitalize on the expanding global freight market. This growth trajectory suggests that air cargo is a strong contender within the BCG matrix, likely categorized as a 'Star' due to its high growth rate and significant market contribution.

- Revenue Growth: Air cargo revenue increased by 13.7% in 2024.

- Market Contribution: A significant contributor to Aena's real estate services revenue.

- Volume Increase: Freight volumes saw a 22.7% rise in October 2024.

- Strategic Importance: Leverages airport infrastructure to capture market growth.

Digital Transformation and Innovation

Aena's digital transformation strategy is geared towards enhancing the passenger journey, streamlining airport operations, and pioneering new ventures in sustainable transport. This focus on technology is a key driver for future growth.

Investments are being channeled into digital solutions such as contactless check-in processes and advanced biometric access points. These initiatives are designed not only to improve customer service but also to contribute to margin growth through operational efficiencies and cost savings.

- Digital Investments: Aena is actively investing in technologies to optimize passenger flow and operational efficiency.

- Service Enhancement: Digital services like remote check-in and biometric gates are being implemented to improve the customer experience.

- Margin Expansion: These technological advancements are expected to drive margin growth via cost reductions and new service offerings.

- Growth Potential: This segment represents a high-growth area for Aena, reflecting the adoption of emerging technologies.

Aena's commercial activities are a star performer, demonstrating impressive growth that outpaces passenger traffic. In 2024, commercial revenue surged by 14.7%, and the first half of 2025 saw a solid 10.4% increase. This robust expansion is driven by high-margin offerings like duty-free shops, premium VIP services, and a diverse food and beverage selection, all of which are undergoing active tendering and expansion. Looking ahead, Aena projects that its commercial revenues will not only recover but will significantly exceed pre-pandemic levels, reaching an anticipated 48% growth by 2026, underscoring its position as a high-growth segment.

Air cargo services represent a significant growth area for Aena, as evidenced by a 13.7% revenue increase in 2024. This segment is a key contributor to the company's real estate services revenue, underscoring its importance within the broader portfolio. The robust performance is further highlighted by a substantial 22.7% rise in freight volumes observed in October 2024, pointing to strong market demand and operational efficiency. The strategic positioning of air cargo within Aena's operations leverages existing airport infrastructure to capitalize on the expanding global freight market. This growth trajectory suggests that air cargo is a strong contender within the BCG matrix, likely categorized as a 'Star' due to its high growth rate and significant market contribution.

Aena's digital transformation strategy is geared towards enhancing the passenger journey, streamlining airport operations, and pioneering new ventures in sustainable transport. Investments are being channeled into digital solutions such as contactless check-in processes and advanced biometric access points. These initiatives are designed not only to improve customer service but also to contribute to margin growth through operational efficiencies and cost savings, marking this as another 'Star' segment.

| Segment | 2024 Revenue Growth | H1 2025 Revenue Growth | Key Drivers | BCG Category |

| Commercial Activities | 14.7% | 10.4% | Duty-free, VIP services, F&B | Star |

| Air Cargo | 13.7% | N/A | Freight volume increase, infrastructure leverage | Star |

| Digital Transformation | N/A | N/A | Contactless services, biometrics | Star |

What is included in the product

The Aena BCG Matrix analyzes its airports based on market share and growth, guiding investment decisions.

A clear visualization of your portfolio's strengths and weaknesses, reducing the pain of strategic uncertainty.

Cash Cows

Aena's Spanish airport network, a true cash cow, handled an impressive 309.3 million passengers in 2024, solidifying its position as the world's leading airport operator. This immense passenger volume within a mature tourism market translates into robust and consistent aeronautical revenue streams.

The established dominance of Aena's Spanish airports ensures significant profitability and strong cash flow generation. Despite a projected moderate growth of 3.4% for 2025, the network's mature status means it reliably produces substantial cash, supporting other ventures.

Aena's air navigation services in Spain are a classic cash cow. They hold a dominant market share within a regulated, essential industry, generating consistent and predictable revenue. These services are fundamental to managing air traffic across Spain, ensuring a steady financial contribution without needing significant new investment.

Aena's established commercial rental income, primarily from duty-free, food & beverage, and retail outlets, represents a significant Cash Cow. These operations benefit from long-term contracts with fixed and Minimum Annual Guaranteed (MAG) rents, ensuring a stable and high-margin cash flow. For instance, Aena reported €1.1 billion in commercial revenue in 2023, with MAG rents projected to see substantial growth by 2026, underscoring their reliable income-generating capacity in a mature market.

Existing Real Estate Leases

Aena's existing real estate leases, encompassing office spaces, logistics hubs, and aircraft hangars at its established airports, are a significant contributor to its stable revenue streams. This segment demonstrated robust performance, with an 11% revenue increase observed in 2024, underscoring its consistent generation of cash.

These mature assets, having already undergone development, necessitate minimal further capital expenditure. They consistently deliver predictable, high-margin income, solidifying their position as reliable cash cows within Aena's portfolio.

- Stable Revenue Generation: Aena's airport real estate leases provide a consistent income stream.

- 2024 Performance: The segment experienced an 11% revenue growth in 2024.

- Low Reinvestment Needs: Developed assets require minimal ongoing capital, boosting margins.

- Predictable Income: These leases offer a steady and high-margin cash flow.

Ground Handling Coordination Services

Aena's ground handling coordination services are firmly positioned as a Cash Cow within its portfolio. This is largely due to Aena's dominant market share in Spain, stemming from its comprehensive oversight of airport operations. These services are fundamental, ensuring the smooth flow of aircraft and passengers, and consequently generating consistent, reliable revenue streams.

The mature nature of ground handling means it requires minimal new investment while continuing to yield significant returns. In 2023, Aena reported a substantial contribution from its airport operations, with ground handling being a critical component of this success. For instance, Aena's total revenue in 2023 reached €4,564 million, a significant increase from previous years, underscoring the stability of its core services like ground handling.

- Dominant Market Share: Aena's extensive control over Spanish airports grants it a leading position in ground handling coordination.

- Stable Revenue Generation: As an essential service, ground handling provides a predictable and ongoing income source.

- Operational Efficiency: These services are vital for the smooth functioning of the airport network, contributing to overall profitability.

- Mature Service: The established nature of ground handling allows for consistent performance with limited need for further growth investment.

Aena's Spanish airport network, a true cash cow, handled an impressive 309.3 million passengers in 2024, solidifying its position as the world's leading airport operator. This immense passenger volume within a mature tourism market translates into robust and consistent aeronautical revenue streams.

The established dominance of Aena's Spanish airports ensures significant profitability and strong cash flow generation. Despite a projected moderate growth of 3.4% for 2025, the network's mature status means it reliably produces substantial cash, supporting other ventures.

Aena's air navigation services in Spain are a classic cash cow. They hold a dominant market share within a regulated, essential industry, generating consistent and predictable revenue. These services are fundamental to managing air traffic across Spain, ensuring a steady financial contribution without needing significant new investment.

Aena's established commercial rental income, primarily from duty-free, food & beverage, and retail outlets, represents a significant Cash Cow. These operations benefit from long-term contracts with fixed and Minimum Annual Guaranteed (MAG) rents, ensuring a stable and high-margin cash flow. For instance, Aena reported €1.1 billion in commercial revenue in 2023, with MAG rents projected to see substantial growth by 2026, underscoring their reliable income-generating capacity in a mature market.

Aena's existing real estate leases, encompassing office spaces, logistics hubs, and aircraft hangars at its established airports, are a significant contributor to its stable revenue streams. This segment demonstrated robust performance, with an 11% revenue increase observed in 2024, underscoring its consistent generation of cash.

These mature assets, having already undergone development, necessitate minimal further capital expenditure. They consistently deliver predictable, high-margin income, solidifying their position as reliable cash cows within Aena's portfolio.

| Segment | BCG Category | 2024 Performance Highlight | Key Driver | Outlook |

| Spanish Airport Network | Cash Cow | 309.3 million passengers handled | Dominant market share, mature tourism | Stable, robust cash flow |

| Air Navigation Services | Cash Cow | Essential, regulated service | Market dominance, predictable revenue | Consistent financial contribution |

| Commercial Rentals | Cash Cow | €1.1 billion commercial revenue (2023) | Long-term contracts, MAG rents | High-margin, stable cash flow |

| Real Estate Leases | Cash Cow | 11% revenue increase (2024) | Established assets, minimal capex | Predictable, high-margin income |

What You See Is What You Get

Aena BCG Matrix

The Aena BCG Matrix you are currently previewing is the identical, fully completed document you will receive immediately after your purchase. This comprehensive report, meticulously crafted for strategic insight, is ready for your direct use without any alterations or additional steps. You can confidently expect the same high-quality analysis and professional formatting that you see here, enabling immediate application in your business planning and decision-making processes.

Dogs

Within Aena's portfolio, certain smaller regional airports might be classified as Dogs in the BCG Matrix. These facilities often struggle with persistently low passenger numbers and limited potential for significant growth, making them less attractive investments.

These airports can demand substantial operational and maintenance expenses that outweigh the revenue they generate. For instance, in 2023, while Aena's total passenger traffic reached 284 million, a few of its smallest regional airports reported figures in the tens of thousands, highlighting a stark contrast in performance.

If these underperforming airports do not contribute meaningfully to Aena's overall profitability or strategic network goals, they could be viewed as cash traps. They might merely break even or even incur losses, diverting resources that could be better utilized elsewhere in the company's more robust segments.

Ancillary services experiencing a significant drop in passenger interest or becoming irrelevant due to new technologies, such as outdated airport lounge offerings or paper-based baggage tracking systems, would fall into this category. These services often represent a drain on resources, with ongoing costs for maintenance or operation that don't translate into meaningful revenue or strategic advantage. For instance, in 2024, many airports are phasing out traditional check-in kiosks in favor of mobile solutions, making the former an example of an outdated ancillary service.

Non-strategic minority international investments in Aena's portfolio, such as small stakes in airports outside of core markets like Brazil or London Luton, often fall into this category. These are holdings where Aena doesn't have a controlling interest and they aren't central to its expansion plans.

These types of investments can become problematic if they consistently underperform or show very little growth. For instance, if Aena holds a 5% stake in an airport in a less developed region, and that airport’s passenger traffic has been stagnant or declining, it might not be a worthwhile investment. As of early 2024, Aena’s focus remains on its major hubs and strategic international growth, making these smaller, non-controlling stakes less of a priority.

Such holdings can effectively tie up capital that could be better utilized elsewhere, potentially hindering Aena's ability to invest in more promising ventures. If these minority stakes don't contribute to Aena's overall market leadership or strategic objectives, they risk becoming what are sometimes called 'cash traps,' draining resources without providing significant returns or strategic advantage.

Legacy IT Systems or Infrastructure

Legacy IT systems, often characterized by their age and decreasing efficiency, can be viewed as potential Dogs in the Aena BCG Matrix. These systems, while critical for ongoing operations, typically incur substantial maintenance costs. For instance, in 2024, many organizations reported that maintaining outdated IT infrastructure accounted for a significant portion of their IT budgets, sometimes exceeding 70% for legacy systems, diverting funds from innovation and growth initiatives.

These older systems offer minimal functional improvements and fail to provide a competitive edge in today's rapidly evolving market. Their contribution to market share expansion or overall business growth is negligible. The challenge lies in balancing the necessity of these systems for current functions against the potential benefits of replacement or significant upgrades, which would likely be a strategic priority if their inefficiency is demonstrably hindering performance.

- High Maintenance Costs: In 2024, the average cost to maintain legacy IT systems was estimated to be 3-5 times higher than for modern cloud-based solutions.

- Limited Functional Improvements: These systems often lack the agility and features required for digital transformation and competitive advantage.

- Low Growth Contribution: They do not drive new revenue streams or enhance customer acquisition, thus having a low market share growth potential.

- Strategic Obsolescence: Their inability to adapt to new technologies or business models makes them a liability rather than an asset for future expansion.

Specific Retail Categories with Stagnant Sales

While Aena's commercial revenue generally shows strength, specific retail categories or individual concessionaires within its airports can face stagnant sales. These underperforming segments, contributing minimally to revenue per passenger, might be categorized as 'Dogs' in the BCG matrix context. Aena's ongoing review of commercial tenders aims to enhance profitability, indicating a strategic shift towards more successful areas.

For instance, in 2024, while overall airport retail sales saw positive growth, certain categories like specialized electronics or niche apparel might have lagged. Aena's focus on optimizing its commercial portfolio means these areas are continuously assessed for their contribution to the overall revenue stream. This strategic pruning is essential for maintaining the health of the commercial business.

The company's approach involves:

- Identifying retail categories with sales growth significantly below the airport's average commercial revenue growth.

- Analyzing the contribution of specific concessionaires to revenue per passenger, flagging those with consistently low performance.

- Evaluating the potential for turnaround or the necessity of replacing underperforming concessions during tender processes.

In Aena's portfolio, certain smaller regional airports or specific ancillary services might be classified as Dogs. These segments often exhibit low passenger traffic, minimal growth potential, and high operational costs, leading to poor profitability. For example, in 2023, while Aena's total passenger traffic was 284 million, some smaller airports handled only tens of thousands, highlighting performance disparities. These underperforming assets can act as cash traps, diverting resources from more lucrative areas.

Legacy IT systems and non-strategic minority international investments also fit the Dog profile. Maintaining outdated IT infrastructure, which can cost 3-5 times more than modern solutions in 2024, drains resources without providing a competitive edge. Similarly, small, non-controlling stakes in underperforming foreign airports tie up capital that could be better invested in Aena's core markets or growth initiatives.

Within commercial operations, specific retail categories or concessionaires with stagnant sales can be considered Dogs. These areas contribute minimally to revenue per passenger and are continuously assessed for improvement or replacement. Aena's strategy involves identifying lagging categories and concessionaires to optimize its commercial portfolio and enhance overall profitability.

| Category | Characteristics | Example within Aena (Hypothetical/Illustrative) | Financial Implication |

|---|---|---|---|

| Underperforming Regional Airports | Low passenger numbers, limited growth, high operational costs | A small airport with < 50,000 annual passengers | Negative or minimal contribution to overall profit; potential cash drain |

| Legacy IT Systems | High maintenance costs, low efficiency, lack of competitive advantage | Outdated baggage handling software requiring constant patching | Significant IT budget allocation to maintenance; hinders innovation |

| Stagnant Retail Concessions | Low sales per passenger, declining customer interest | A specific electronics store with consistently below-average sales | Reduced ancillary revenue; opportunity cost for prime retail space |

| Non-Strategic Minority Investments | Low ownership stake, no controlling interest, poor performance | A small stake in a foreign airport with declining traffic | Tied-up capital with low returns; distraction from core strategy |

Question Marks

Aena's airport city developments, like the one at Adolfo Suárez Madrid-Barajas Airport, represent significant long-term investments designed to unlock substantial commercial value. These projects are still in their nascent stages of development, meaning their current impact on Aena's overall revenue is minimal, despite their considerable future promise and potential for market growth.

These initiatives are best categorized as question marks within the BCG matrix. They demand substantial upfront capital to reach their full potential, positioning them as high-growth prospects with inherently uncertain short-term returns. For instance, by the end of 2023, Aena's total investment in property development and related infrastructure projects across its network was substantial, reflecting this commitment to future revenue streams.

Aena is actively investing in early-stage digital passenger services, such as biometric gates and remote check-in systems. These innovations aim to significantly improve passenger journeys and streamline airport operations. The aviation industry sees a high growth potential in these digital solutions, though their current market penetration and immediate revenue generation are still developing.

These advanced digital services require considerable upfront investment to achieve broad adoption and demonstrate their sustained value. Consequently, they are categorized as Question Marks within the Aena BCG Matrix, reflecting the uncertainty surrounding their future market share and profitability. For instance, the global market for airport biometrics was projected to reach $2.5 billion by 2024, indicating substantial future growth but also the early-stage nature of widespread implementation.

New international concessions represent Aena's potential 'Question Marks' in the BCG matrix. While Aena already has a significant international footprint in places like Brazil and London Luton, exploring new markets through concessions signifies high growth prospects but currently minimal market penetration.

These ventures demand substantial initial capital for due diligence and the bidding stages. For instance, in 2023, Aena participated in bidding processes for new concessions, requiring significant resource allocation without guaranteed returns.

The success of these new territories hinges on Aena's ability to win the concessions and effectively implement its proven operational strategies within varied regulatory frameworks and market conditions, mirroring its existing successful international operations.

Investments in Sustainable Aviation Fuels (SAF) Infrastructure

Aena's commitment to sustainability, targeting net-zero emissions by 2030, positions investments in Sustainable Aviation Fuels (SAF) infrastructure as a potential question mark in its BCG Matrix. While the SAF market is poised for significant growth and is crucial for the aviation sector's decarbonization, Aena's current direct involvement in SAF production or infrastructure might be limited, reflecting a low current market share relative to its broader energy investments.

This sector demands substantial capital for development and scaling, making it a strategic area for future expansion and competitive advantage. For instance, the global SAF market was valued at approximately USD 2.8 billion in 2023 and is projected to reach over USD 16 billion by 2030, indicating a high-growth trajectory.

- Strategic Importance: SAF is vital for aviation's decarbonization, aligning with Aena's net-zero goals.

- Market Potential: The SAF market is experiencing rapid growth, offering significant future revenue streams.

- Investment Needs: Developing SAF infrastructure requires substantial upfront capital investment.

- Nascent Stage: Aena's direct participation in SAF infrastructure may currently represent a small portion of its overall operations.

Pilot Programs for Advanced Air Mobility

Aena's potential exploration of pilot programs for advanced air mobility (AAM), including vertiports for eVTOL aircraft, positions it in a nascent, high-growth sector. This market, characterized by very low current market share, represents a significant, albeit speculative, investment opportunity. These early-stage initiatives demand substantial research and development alongside extensive infrastructure build-out to achieve commercial viability, firmly placing them in the 'Question Mark' category of the BCG matrix.

The development of AAM infrastructure is crucial, with projections indicating a substantial need for vertiports. For instance, by 2030, the European AAM market alone could require hundreds of vertiports to support anticipated operations. Companies are actively investing in this space; Joby Aviation, a leading eVTOL developer, secured over $1.5 billion in funding as of early 2024, highlighting investor confidence in the sector's future potential. These pilot programs are essential for testing operational concepts and regulatory frameworks.

- Market Entry: Aena's involvement in AAM pilot programs represents an entry into a market with immense future potential but currently minimal revenue.

- Investment Needs: Significant capital expenditure is required for R&D and the construction of specialized infrastructure like vertiports.

- Technological Uncertainty: The success of AAM hinges on the maturation and widespread adoption of eVTOL technology and supporting systems.

- Regulatory Landscape: Navigating and influencing the evolving regulatory environment is paramount for the long-term viability of AAM operations.

Question Marks in Aena's BCG Matrix represent ventures with high growth potential but low current market share, demanding significant investment. These initiatives, while promising for the future, currently contribute minimally to overall revenue due to their early stages of development. Their success hinges on substantial capital infusion and navigating market uncertainties to capture future growth opportunities.

| Initiative | Growth Potential | Current Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Airport City Developments | High | Low | Substantial | Question Mark |

| Digital Passenger Services | High | Developing | Considerable | Question Mark |

| New International Concessions | High | Minimal | Substantial | Question Mark |

| Sustainable Aviation Fuels (SAF) Infrastructure | High | Limited | Substantial | Question Mark |

| Advanced Air Mobility (AAM) Vertiports | Very High | Very Low | Significant | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Aena's financial data, airport traffic statistics, industry research, and official reports to ensure reliable, high-impact insights.