Aena Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

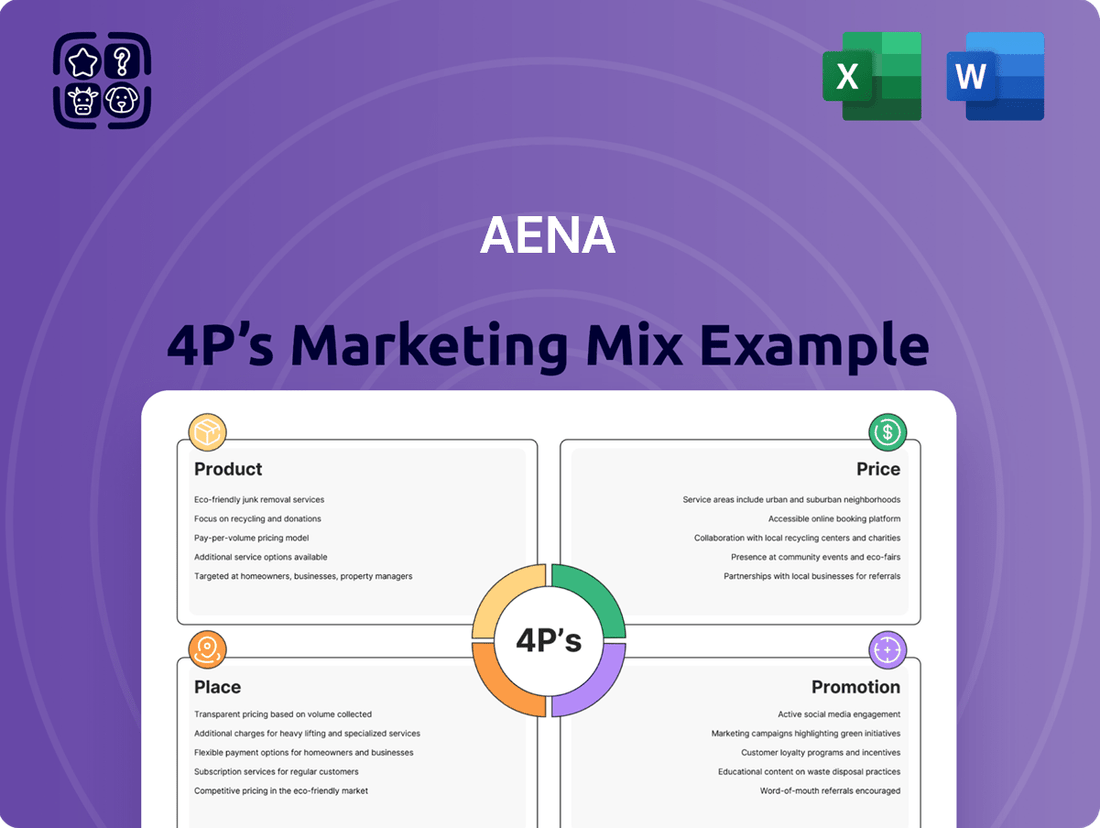

Aena's marketing success is built on a robust 4Ps strategy, from its diverse airport services to its dynamic pricing and extensive global reach. Understand how these elements create a seamless customer journey and drive revenue.

Unlock the full potential of Aena's marketing mix by exploring its product offerings, pricing structures, distribution channels, and promotional activities in detail. This comprehensive analysis provides actionable insights for any business looking to optimize its own strategies.

Go beyond the surface and gain a competitive edge. Our complete 4Ps Marketing Mix Analysis for Aena offers a deep dive into their strategic decisions, providing a ready-to-use framework for your own business planning and research.

Product

Aena's core product is the management and operation of its extensive airport network, which includes 46 airports and two heliports in Spain, London Luton Airport, and 17 airports in Brazil. This vast infrastructure underpins its position as the world's leading airport operator by passenger volume. The efficiency and quality of these operations are paramount to the passenger experience.

The sheer scale of Aena's operations is evident in its passenger traffic figures. In the first half of 2025, the company facilitated the movement of 180.9 million travelers across its global network, a substantial 4.7% increase compared to the same period in 2024. Spanish airports within its network were particularly busy, handling 150.6 million passengers during this timeframe.

Air Navigation Services are Aena's bedrock, ensuring aircraft move safely and efficiently within its managed airspace. This vital function underpins the seamless coordination of flights, directly contributing to aviation safety and smooth operations, especially crucial for the high traffic volumes Aena handles.

In 2023, Aena managed over 1.2 million flights, a significant increase from previous years, highlighting the scale and importance of its navigation services. These operations are critical for maintaining the punctuality and reliability of air travel across its extensive network.

Aena's Ground Handling Coordination is a critical component of its operations, ensuring aircraft turnarounds are seamless and efficient. This involves orchestrating essential services like baggage management, passenger movement, and aircraft servicing. In 2023, Aena handled over 280 million passengers, underscoring the sheer volume and importance of these ground operations.

The effectiveness of ground handling directly impacts airport punctuality and overall operational performance. By optimizing these processes, Aena aims to minimize delays and improve the passenger experience. For instance, efficient baggage handling contributes significantly to achieving on-time departures, a key metric for airport success.

Commercial Activities within Facilities

Aena's commercial activities within its facilities represent a core product, encompassing the strategic management of diverse retail and service offerings. This includes everything from high-end boutiques and essential duty-free shops to a wide array of food and beverage options and premium VIP services, all designed to cater to the passenger journey.

Commercial revenue is a significant and expanding revenue stream for Aena. In 2024, this segment achieved €1.78 billion, marking a robust 14.7% increase compared to the prior year. The momentum continued into the first half of 2025, with commercial revenue reaching €929.1 million, reflecting a healthy 10.4% year-on-year growth.

The primary objective of this product offering is twofold: to elevate the overall passenger experience by providing desirable amenities and services, and to optimize the generation of non-aeronautical revenue, thereby diversifying and strengthening Aena's financial performance.

- Retail Management: Overseeing a wide range of shops, from luxury brands to convenience stores.

- Food & Beverage: Curating diverse dining and drinking options for travelers.

- Duty-Free Operations: Maximizing sales in tax-free retail environments.

- VIP Services: Providing exclusive amenities and personalized experiences for premium passengers.

Real Estate Development

Aena’s Product strategy in real estate development focuses on leveraging its extensive land holdings adjacent to airports. These ventures are designed to maximize the commercial value of its assets, integrating seamlessly with airport operations. For instance, Aena is actively developing logistics hubs, retail centers, hotels, and office buildings at key locations like Madrid-Barajas Airport.

This strategic product development diversifies Aena's revenue streams beyond traditional aeronautical charges. By creating vibrant commercial ecosystems around its airports, Aena aims to enhance its overall asset value and profitability. For example, in 2023, Aena’s commercial revenue grew by 17.8% compared to 2019, partly driven by these non-aeronautical activities.

Key real estate development initiatives include:

- Logistics Centers: Developing modern logistics facilities to capitalize on airport connectivity and e-commerce growth.

- Retail and Leisure: Creating expansive shopping complexes and entertainment zones to attract travelers and local communities.

- Hospitality and Offices: Building hotels and office spaces to cater to business travelers and corporate tenants.

- Mixed-Use Developments: Integrating these components into comprehensive urban districts around major airport hubs.

Aena's product offering is multifaceted, encompassing the core operation of its airport network, air navigation services, and ground handling coordination. This foundational product ensures the safe and efficient movement of millions of passengers and aircraft. The company also strategically develops its commercial and real estate assets, creating diverse revenue streams beyond aeronautical charges.

The passenger experience is central to Aena's product, enhanced by a wide array of commercial activities including retail, food and beverage, and VIP services. Real estate development further diversifies this offering, with logistics centers, retail complexes, and hospitality services being key initiatives. This comprehensive approach aims to maximize asset value and profitability.

| Product Area | Key Offerings | 2024/H1 2025 Data Point | Impact |

|---|---|---|---|

| Airport Operations & Management | Airport network operation, Air Navigation Services, Ground Handling | 180.9 million passengers (H1 2025) | Core service, drives passenger experience and safety |

| Commercial Activities | Retail, Food & Beverage, Duty-Free, VIP Services | €929.1 million commercial revenue (H1 2025) | Significant non-aeronautical revenue stream, enhances passenger journey |

| Real Estate Development | Logistics Centers, Retail Centers, Hotels, Offices | 17.8% commercial revenue growth (2023 vs 2019) | Diversifies revenue, maximizes asset value |

What is included in the product

This analysis provides a comprehensive deep dive into Aena's Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and stakeholders. It grounds Aena's marketing positioning in actual brand practices and competitive context, making it ideal for strategic planning and benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for Aena's teams.

Provides a clear, structured overview of Aena's 4Ps, resolving the challenge of communicating marketing effectiveness across departments.

Place

Aena's extensive Spanish airport network, comprising 46 airports and two heliports, is a cornerstone of its 'Place' strategy. This vast infrastructure ensures comprehensive air connectivity across Spain, reaching major cities and crucial tourist hubs alike.

As the world's largest airport operator by passenger traffic, Aena's strategically located facilities are vital for Spain's robust tourism industry. In 2023, Aena airports handled a record 284.7 million passengers, underscoring the network's immense reach and economic importance.

Aena's international footprint is significantly bolstered by its 51% ownership of London Luton Airport. This key UK asset served 16.7 million passengers in 2024, demonstrating its substantial operational scale and market penetration. The airport acts as a vital entry point into the United Kingdom for Aena, diversifying its revenue and expanding its global reach.

The strategic importance of London Luton is further underscored by approved plans to increase its passenger capacity. This expansion, set to raise capacity from 19 million to 32 million passengers annually, signals considerable future growth prospects for Aena in a major European market.

Aena boasts a significant operational presence in Brazil, where it manages 17 airports. These facilities served a considerable 43.4 million passengers in 2024, highlighting the market's importance.

The company’s strategic expansion in Brazil, notably through the acquisition of 11 additional airports, is a major contributor to its growth trajectory. This international push is crucial for Aena's overall performance.

Looking ahead, Aena anticipates its Brazilian operations to contribute around 15% to its total EBITDA by 2026. This projection underscores the strategic value and future potential of the Brazilian market for the company.

Strategic Hubs (Madrid-Barajas and Barcelona-El Prat)

Adolfo Suárez Madrid-Barajas and Josep Tarradellas Barcelona-El Prat are Aena's crown jewels, acting as vital international gateways and domestic connectors. These airports are central to Aena's strategic vision, with substantial investments planned for infrastructure enhancements and commercial real estate ventures. Their pivotal role guarantees robust passenger traffic and seamless connectivity across global and regional air routes.

These strategic hubs are experiencing significant development. For instance, Madrid-Barajas is undergoing a major modernization project aimed at improving efficiency and passenger experience, with investments expected to reach €2.4 billion by 2030. Barcelona-El Prat is also slated for upgrades, focusing on expanding capacity and sustainability initiatives, although specific investment figures for 2024-2025 are still being finalized within the broader strategic plan.

- Madrid-Barajas: Major modernization project with €2.4 billion investment planned by 2030.

- Barcelona-El Prat: Focus on capacity expansion and sustainability initiatives.

- Strategic importance ensures high passenger volumes, with Madrid handling over 60 million passengers in 2023 and Barcelona over 40 million.

- These airports are key to Aena's commercial strategy, driving retail and service revenue.

Maximizing Customer Convenience and Logistics Efficiency

Aena's 'place' strategy is all about making things easy and accessible for everyone using its airports, from travelers to businesses handling cargo. This means carefully designing airport layouts and managing how people and goods move through them to ensure services are available exactly when and where they're needed. In 2023, Aena handled over 285 million passengers across its Spanish airports, highlighting the critical importance of efficient 'place' management for such high volumes.

This focus on convenience translates into optimizing passenger flow, reducing wait times, and ensuring seamless connections. For cargo, it means having efficient logistics and handling facilities readily available. Aena's commitment to this strategy aims to boost customer happiness and make its operations run smoothly across its vast network.

- Airport Layout Optimization: Aena continuously invests in improving terminal designs and gate accessibility to minimize walking distances and enhance passenger experience.

- Efficient Passenger Flow: Implementing advanced technology for security checks and boarding processes helps reduce congestion and improve overall transit times.

- Streamlined Cargo Handling: Investment in modern cargo facilities and efficient logistics partnerships ensures timely and secure movement of goods through Aena's airports.

- Network Accessibility: Strategic location and connectivity of Aena's airports to major urban centers and transport hubs are key to its 'place' strategy.

Aena's 'Place' strategy is fundamentally about leveraging its extensive and strategically located airport network to facilitate seamless travel and commerce. This involves optimizing the physical space and accessibility of its facilities to meet the diverse needs of passengers and businesses. The sheer volume of traffic handled, such as the 284.7 million passengers in 2023, underscores the critical importance of efficient place management.

| Key Aena Locations | Passenger Traffic (2023/2024 Est.) | Strategic Significance | Planned Enhancements |

| Spanish Network (46 airports) | 284.7 million (2023) | Dominant domestic and international connectivity | Ongoing modernization, e.g., Madrid-Barajas (€2.4bn by 2030) |

| London Luton Airport (51% stake) | 16.7 million (2024 est.) | Key UK gateway, revenue diversification | Capacity increase from 19m to 32m passengers |

| Brazilian Airports (17 managed) | 43.4 million (2024 est.) | Significant growth market, projected 15% EBITDA contribution by 2026 | Acquisition of 11 additional airports |

Preview the Actual Deliverable

Aena 4P's Marketing Mix Analysis

The preview you see here is the exact Aena 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This comprehensive analysis covers Product, Price, Place, and Promotion strategies for Aena, providing you with a complete and ready-to-use resource. You can be confident that what you're viewing is the final, high-quality report you'll download immediately.

Promotion

Aena actively cultivates investor confidence by transparently communicating its financial achievements and strategic roadmap. This proactive approach includes the regular dissemination of detailed financial results and investor presentations, such as the anticipated H1 2025 results and comprehensive annual reports. These materials are vital for providing financially-literate decision-makers and investors with the critical insights needed to understand Aena's operational strengths and future trajectory.

Through dedicated investor relations efforts, Aena ensures stakeholders are consistently updated on its robust performance and strategic outlook. For instance, Aena's commitment to clear communication was evident in its 2024 performance, where it reported a significant increase in passenger traffic, underscoring its operational resilience and growth potential.

Aena actively communicates its dedication to environmental stewardship through its annual Sustainability Reports and Climate Action Plan, showcasing a robust commitment to responsible operations. This emphasis on sustainability resonates with an increasing number of investors and partners who prioritize eco-conscious business practices.

The company has accelerated its net-zero emissions goal to 2030, underscoring an aggressive environmental strategy. In 2023, Aena reported a 20.6% reduction in Scope 1 and 2 emissions compared to 2019, a significant step towards its ambitious targets.

Aena actively seeks commercial partners by issuing tenders for diverse airport concessions, covering everything from duty-free and food services to specialized retail. This proactive approach ensures a wide array of businesses compete for space, bringing fresh and engaging options to travelers.

In 2023, Aena's non-aeronautical revenue reached €1.9 billion, a substantial portion of which is driven by these commercial partnerships. The tender process is crucial for securing operators that enhance the passenger experience and boost this vital revenue stream.

Operational Resilience & Service Quality

Aena places a strong emphasis on its operational resilience and the quality of its services, a key component of its marketing mix. This focus aims to assure stakeholders of its dependable operations, even when faced with challenges.

The company actively communicates its capacity to sustain full operational capacity during disruptions, alongside its ongoing initiatives to elevate the passenger journey. For instance, in 2023, Aena airports handled a record 285.9 million passengers, demonstrating their robust operational capabilities.

This consistent messaging around reliability and service enhancement is crucial for building trust. It reassures airlines about consistent flight operations, passengers about a smooth travel experience, and investors about the stability of Aena's business model.

- Operational Resilience: Aena's commitment to maintaining airport functionality during unforeseen events.

- Service Quality Enhancement: Continuous efforts to improve the passenger experience across its network.

- Stakeholder Confidence: Building trust with airlines, passengers, and business partners through reliable performance.

- Passenger Growth: Aena's airports saw a 16.4% increase in passenger traffic in 2023 compared to 2022, underscoring operational capacity.

Strategic Plan & Capacity Expansion Communication

Aena actively promotes its strategic vision, highlighting substantial infrastructure investments designed to bolster future growth. A key element is the planned €7 billion capital expenditure (CAPEX) cycle extending until 2031, which aims to increase airport capacity by as much as 18%. This proactive communication strategy informs investors and partners about the company's commitment to meeting escalating travel demand and solidifying its market leadership.

This forward-looking approach to capacity expansion serves to align stakeholder expectations with Aena's long-term development trajectory. By clearly articulating these significant infrastructure plans, Aena demonstrates its dedication to sustained growth and operational excellence.

- Strategic Vision: Communicating long-term plans and infrastructure investment cycles.

- Capacity Expansion: €7 billion CAPEX cycle until 2031, targeting up to 18% capacity increase.

- Stakeholder Alignment: Informing about future growth opportunities and managing expectations.

- Market Leadership: Showcasing commitment to meeting future demand and maintaining a competitive edge.

Aena's promotional efforts focus on showcasing its financial health, strategic investments, and commitment to sustainability to attract and retain stakeholders. This includes clear communication of financial results, such as the anticipated H1 2025 performance, and detailed annual reports to build investor confidence. The company also highlights its progress towards net-zero emissions, with a goal now set for 2030, demonstrating its dedication to responsible operations and appealing to eco-conscious investors.

Furthermore, Aena actively promotes its commercial opportunities through tenders for airport concessions, driving non-aeronautical revenue, which reached €1.9 billion in 2023. This strategy aims to enhance the passenger experience and diversify income streams, attracting businesses that align with Aena's vision for modern airport services.

The company emphasizes its operational resilience and service quality, exemplified by handling a record 285.9 million passengers in 2023, assuring airlines and passengers of its reliability. Aena also communicates its significant infrastructure development plans, including a €7 billion CAPEX cycle until 2031, projected to increase airport capacity by up to 18%, signaling its commitment to future growth and market leadership.

| Key Promotional Focus | Data/Metric | Year | |

|---|---|---|---|

| Financial Communication | Detailed financial results and investor presentations | Ongoing (e.g., H1 2025) | |

| Sustainability Commitment | Net-zero emissions goal | 2030 | |

| Sustainability Performance | Scope 1 & 2 emissions reduction | 20.6% (vs. 2019) | 2023 |

| Commercial Revenue | Non-aeronautical revenue | €1.9 billion | 2023 |

| Operational Capacity | Passengers handled | 285.9 million | 2023 |

| Infrastructure Investment | CAPEX cycle | €7 billion | Until 2031 |

| Capacity Expansion Target | Potential increase | Up to 18% | By 2031 |

Price

Aeronautical charges are a cornerstone of Aena's revenue, representing fees paid by airlines for utilizing airport infrastructure like runways and terminals. These charges are crucial for funding operational expenses and essential infrastructure upgrades.

The Spanish competition authority, CNMC, regulates these aeronautical charges, ensuring fair pricing for airlines. For instance, in 2023, Aena's aeronautical revenue reached €3,698.7 million, a significant portion of its overall income, reflecting the importance of these fees in its business model.

Aena's commercial revenue from rents and concessions forms a significant pillar of its financial performance. This income stream is generated through a variety of airport-based commercial activities, encompassing retail outlets, duty-free shops, diverse food and beverage offerings, and essential services like car parking.

The company has demonstrated robust growth in this area, with commercial revenue per passenger reaching €6.50 in the first half of 2025. This figure highlights the effectiveness of Aena's strategy in maximizing the value derived from its airport commercial spaces and passenger traffic.

Aena's real estate service revenue is a key component of its marketing mix, generating income from diverse assets like office spaces and warehouses situated around its airports. The strategic development of hotel projects in these high-demand locations further bolsters this revenue stream.

In 2024, this segment saw a significant 11% increase in revenue, underscoring its growing importance to Aena's financial health. This growth is directly linked to the strong demand for facilities conveniently located near airport infrastructure.

Regulated Pricing and Tariff Adjustments

Aena's pricing strategy for its aeronautical services is carefully managed through regulatory frameworks, ensuring fairness and stability. These fees are periodically reviewed and can be adjusted to reflect evolving operational needs and economic conditions.

For instance, Aena has put forward a proposal for a 6.5% increase in tariffs, which, if approved, would see the cost per passenger rise to €11.03 starting in 2026. This proposed adjustment is a key element in Aena's plan to maintain its financial health and manage increasing operational expenditures. The final decision on this tariff adjustment rests with the CNMC, the Spanish National Commission on Markets and Competition.

- Regulatory Oversight: Aena's aeronautical fees are not set unilaterally but are subject to approval and regulation by authorities like the CNMC.

- Proposed Tariff Increase: A 6.5% increase in aeronautical tariffs has been proposed for 2026.

- Impact on Passengers: This would result in an estimated cost of €11.03 per passenger.

- Justification for Adjustment: The proposed increase aims to ensure Aena's financial sustainability and cover rising operational costs.

Competitive Pricing Positioning

Aena's pricing strategy, even with anticipated tariff adjustments, is designed to keep its airport charges highly competitive against other major European hubs. For instance, Aena has stated its fees can be as much as 60% lower than those at London Heathrow. This approach is crucial for balancing revenue needs with the imperative to attract and retain airlines, thereby encouraging sustained passenger traffic growth.

This competitive positioning is vital for Aena to maintain its status as a preferred destination for airlines. By offering a more attractive fee structure, Aena aims to secure airline commitment and foster continued expansion of routes and services at its airports.

- Competitive Advantage: Aena's charges are positioned to be significantly lower, potentially up to 60% cheaper than major European competitors like Heathrow.

- Revenue vs. Growth: The strategy balances necessary revenue generation from tariffs with the goal of fostering airline attractiveness and traffic expansion.

- Airline Preference: Aims to be the preferred choice for airlines by offering a cost-effective operational base.

Aena's pricing for aeronautical services is heavily influenced by regulatory bodies, ensuring a balance between operational costs and airline affordability. The company has proposed a 6.5% tariff increase for 2026, which would bring the cost per passenger to €11.03 if approved by the CNMC.

Despite potential adjustments, Aena aims to maintain highly competitive pricing, potentially up to 60% lower than major European airports like London Heathrow. This strategy is key to attracting and retaining airlines, supporting passenger traffic growth.

Commercial revenue per passenger reached €6.50 in H1 2025, demonstrating Aena's success in monetizing its airport spaces. Real estate revenue also saw an 11% increase in 2024, highlighting the growing contribution of non-aeronautical income streams.

| Revenue Stream | 2024/2025 Data Point | Significance |

|---|---|---|

| Aeronautical Revenue | €3,698.7 million (2023) | Core income from airline usage fees |

| Commercial Revenue per Passenger | €6.50 (H1 2025) | Growth in retail and service income |

| Real Estate Service Revenue | 11% increase (2024) | Expanding income from airport-adjacent assets |

| Proposed Aeronautical Tariff | €11.03 per passenger (2026, proposed) | Potential adjustment for operational costs |

| Competitive Pricing | Up to 60% lower than Heathrow | Strategy to attract airlines |

4P's Marketing Mix Analysis Data Sources

Our Aena 4P's Marketing Mix Analysis is grounded in comprehensive data, including Aena's official annual reports, investor relations materials, and public disclosures. We also incorporate insights from industry analysis, market research reports, and competitive benchmarking to ensure a thorough understanding of their strategies.