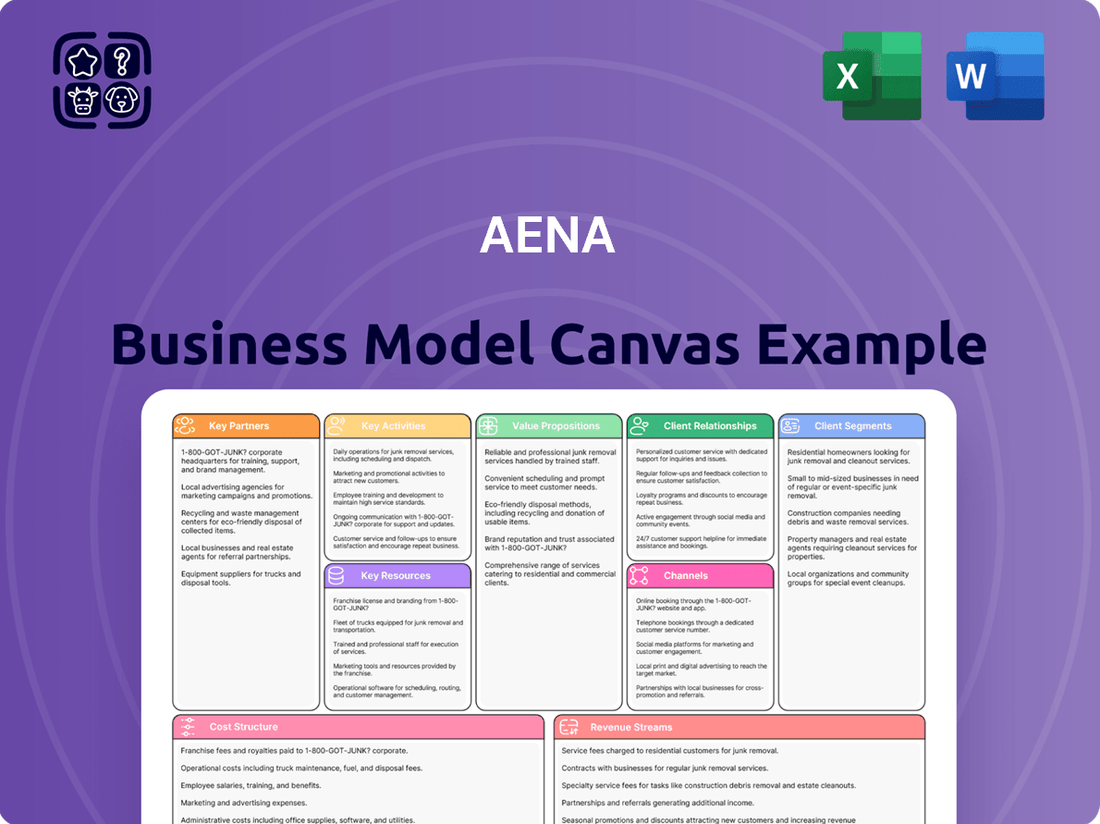

Aena Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Curious about how Aena dominates the aviation infrastructure sector? Our Business Model Canvas breaks down their customer relationships, revenue streams, and cost structure, offering a clear view of their operational genius. Download the full canvas to uncover the strategic framework that fuels their success and gain actionable insights for your own ventures.

Partnerships

Aena's most vital partners are the airlines and air carriers that operate from its airports, as they directly influence passenger volume and the effective use of airport facilities. These collaborations are multifaceted, encompassing the critical aspect of slot allocation, essential ground handling services, and strategic joint marketing efforts aimed at securing new routes and boosting flight frequencies.

The financial framework of these partnerships is significantly influenced by aeronautical charges, which are fees levied for airport services, alongside various incentives designed to encourage the introduction of new routes or the expansion of existing traffic volumes. For instance, in 2024, Aena continued to refine its incentive schemes to attract carriers, a strategy that has historically proven effective in driving passenger growth across its network.

Aena's key partnerships with retail and food & beverage concessionaires are the bedrock of its commercial revenue stream. These businesses, operating everything from duty-free stores to popular cafes within airport terminals, directly contribute to the passenger experience and, crucially, Aena's bottom line. In 2024, Aena continued its strategy of actively tendering these valuable spaces, seeking a diverse mix of operators to enhance passenger choice and, in turn, maximize rental income.

The financial model relies on attracting top-tier operators through competitive bidding processes. Aena secures revenue through a combination of fixed rents and variable rents, typically a percentage of the concessionaire's sales. This dual approach ensures a baseline income while allowing Aena to benefit directly from the success of its partners. For example, in the first nine months of 2024, Aena reported a significant increase in commercial revenue, driven by the strong performance of these retail and food & beverage concessions.

Aena’s ground handling and logistics partners are crucial for day-to-day airport functioning, managing everything from baggage to cargo. In 2024, Aena continued to emphasize sustainability in its partnerships, with new handling licenses often requiring an increased commitment to electric and eco-friendly fleets. This strategic shift aims to enhance both environmental performance and operational efficiency across its network.

Governmental Bodies and Regulatory Authorities

As a public-private entity, Aena’s operations are deeply intertwined with governmental bodies and regulatory authorities. This partnership is crucial for securing licenses, adhering to stringent security protocols, and ensuring environmental compliance across its airport network. For instance, Aena’s 2024 strategic plans for infrastructure development and capacity expansion are subject to approval from Spanish ministries and European Union aviation bodies, ensuring alignment with broader transport policies.

These collaborations are fundamental for setting airport charges, which directly impact Aena’s revenue streams and investment capacity. The Spanish government, holding a majority stake in Aena, plays a significant role in this regulatory framework. In 2023, Aena handled over 280 million passengers, underscoring the scale of operations that require constant governmental oversight and coordination to maintain efficiency and safety standards.

- Licensing and Approvals: Aena requires governmental approval for new airport projects and significant upgrades, ensuring they meet national infrastructure plans and safety regulations.

- Security and Compliance: Close work with national security agencies and aviation authorities is vital for implementing and maintaining security measures that comply with international standards.

- Environmental Regulations: Partnerships with environmental agencies ensure Aena’s operations and development projects adhere to sustainability goals and environmental protection laws.

- Airport Charges Framework: Regulatory bodies set the framework for airport charges, influencing Aena’s pricing strategies and financial performance.

Real Estate Developers and Investors

Aena actively collaborates with real estate developers and investors to unlock the commercial value of its airport-adjacent land and infrastructure. This strategic approach focuses on developing projects like logistics hubs and hotels, enhancing the overall utility and revenue generation of Aena's extensive property portfolio.

These partnerships are crucial to Aena's overarching real estate development strategy, designed to optimize the commercial exploitation of its assets. By leveraging the expertise and capital of external partners, Aena can accelerate the development of these non-aeronautical revenue streams.

- Commercial Exploitation: Aena partners with developers for projects like logistics centers and hotels on airport land.

- Asset Maximization: These collaborations aim to boost the commercial potential of Aena's real estate holdings.

- Strategic Alignment: The partnerships are integral to Aena's broader real estate development and diversification efforts.

Aena's key partnerships extend to technology and service providers, crucial for modernizing airport operations and enhancing the passenger experience. These collaborations often focus on digital transformation initiatives, such as advanced passenger processing systems, data analytics platforms for operational efficiency, and innovative retail technologies. In 2024, Aena continued to invest in these areas, aiming to streamline passenger journeys and improve data-driven decision-making. For example, the implementation of new biometric screening technologies at several Spanish airports in 2024 aimed to reduce wait times and improve security.

What is included in the product

A structured overview of Aena's business model, detailing its key customer segments, value propositions, and revenue streams across its airport operations and services.

Provides a structured framework to pinpoint and address business model weaknesses, alleviating the pain of uncertainty and inefficiency.

Activities

Airport management and operations are the backbone of Aena's business. This involves the intricate coordination of air traffic, ensuring smooth passenger journeys, and maintaining the vast infrastructure of airports. In 2023, Aena handled over 287 million passengers across its Spanish network, a significant rebound and testament to efficient operations.

Aena's operational footprint is substantial, encompassing 46 airports and two heliports within Spain. Beyond its domestic operations, Aena also holds stakes in international airports, including London Luton Airport in the UK and 17 airports in Brazil, showcasing its global reach and expertise in airport management.

Aena’s core activity involves providing essential air navigation services, a critical function for the safe and efficient operation of air travel. This encompasses a comprehensive suite of services, including air traffic control, robust communication systems, advanced navigation aids, and surveillance technologies. These elements work in concert to manage the complex flow of aircraft within Aena’s controlled airspace, ensuring passenger and crew safety above all else.

In 2024, Aena managed a significant volume of air traffic, handling millions of flight operations across its network of airports. For instance, during peak periods, the company's air traffic controllers expertly guided thousands of aircraft daily, demonstrating the scale and precision required. The investment in modern surveillance and communication technology, such as advanced radar systems and digital communication platforms, underpins Aena's commitment to maintaining the highest safety standards and operational efficiency in its air navigation services.

Commercial Management and Development at Aena is all about boosting income from shops, restaurants, and advertising. They actively seek out new businesses to operate these spaces through competitive bidding, aiming to create diverse and appealing offerings for travelers.

In 2024, Aena continued to refine its commercial strategy, focusing on enhancing the passenger experience while driving revenue growth. This involved optimizing the mix of retail, food and beverage, and services, with a particular emphasis on premium brands and local specialties.

Aena's commitment to commercial development is evident in its ongoing tender processes for concession agreements. These tenders are designed to attract innovative operators and ensure a dynamic retail environment, contributing significantly to the company's overall financial performance.

Infrastructure Development and Investment

Aena is heavily invested in developing and upgrading its airport infrastructure to handle increasing passenger numbers and improve operational flow. This commitment is evident in its strategic plan covering the 2027-2031 period, which details significant capital expenditure. For instance, Aena's 2023 financial results showed a substantial increase in investment, with a focus on modernization and expansion projects across its network.

The company's infrastructure development is crucial for maintaining its competitive edge and supporting future growth. These investments are designed to enhance passenger experience, improve air traffic management, and ensure compliance with evolving environmental standards. The strategic plan outlines specific targets for capacity expansion and technological upgrades.

- Infrastructure Investment: Aena's strategic plan for 2027-2031 earmarks significant capital for airport expansion and modernization.

- Operational Efficiency: Investments aim to enhance passenger throughput, streamline operations, and improve overall airport efficiency.

- Capacity Growth: Development projects are designed to accommodate projected increases in air traffic and passenger demand.

- Financial Commitment: Aena's 2023 financial performance underscores its dedication to infrastructure development, with substantial investments made in upgrading its airport network.

Real Estate Development

Aena actively develops real estate projects, transforming its extensive land holdings around airports into valuable commercial assets. This strategic focus goes beyond traditional airport operations, aiming to maximize the utility and revenue potential of its infrastructure.

These developments often include logistics centers, hotels, and retail spaces, directly benefiting from the high footfall and connectivity that airports provide. For instance, in 2023, Aena continued to advance its real estate strategy, with projects designed to capture the growing demand for airport-adjacent commercial services.

- Logistics Hubs: Developing modern logistics facilities to capitalize on air cargo growth and e-commerce demand.

- Hospitality: Constructing hotels to cater to both business travelers and transit passengers, enhancing the airport's service offering.

- Retail and Leisure: Creating retail parks and leisure areas to diversify revenue streams and improve the passenger experience.

Aena's key activities revolve around the comprehensive management and operation of airports, ensuring seamless air traffic control and passenger experiences. This includes providing essential air navigation services, such as air traffic control and advanced communication systems, to maintain safety and efficiency. Furthermore, Aena actively engages in commercial management and development, optimizing retail, food, and advertising revenue streams by attracting diverse businesses. The company also prioritizes infrastructure development and upgrades, investing significantly to enhance capacity and modernize facilities, along with strategic real estate development to create valuable commercial assets around its airports.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Airport Management & Operations | Overseeing all airport functions, including air traffic, passenger services, and infrastructure maintenance. | Handled over 287 million passengers in 2023; operates 46 Spanish airports and holds international stakes. |

| Air Navigation Services | Providing critical services for safe and efficient air travel, including air traffic control and communication. | Managed millions of flight operations in 2024, investing in advanced radar and digital communication. |

| Commercial Management & Development | Maximizing revenue from retail, food and beverage, and advertising concessions. | Focused on optimizing retail mix and attracting premium and local brands in 2024; ongoing tender processes for concessions. |

| Infrastructure Development | Investing in airport expansion, modernization, and technological upgrades. | Strategic plan for 2027-2031 outlines significant capital expenditure; substantial investment increase noted in 2023 results. |

| Real Estate Development | Developing land holdings around airports into commercial assets like logistics centers, hotels, and retail spaces. | Advanced real estate strategy in 2023, focusing on projects to capture demand for airport-adjacent services. |

Preview Before You Purchase

Business Model Canvas

The Aena Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact Business Model Canvas, allowing you to immediately begin refining your strategy.

Resources

Aena's most critical resource is its extensive network of 46 airports and 2 heliports strategically located throughout Spain. This vast infrastructure forms the backbone of its operations, enabling seamless air traffic management and passenger flow.

Beyond Spain, Aena also manages key international airports, including six in the United Kingdom and two in Brazil, significantly broadening its global reach and operational capacity. This international footprint is a vital asset for diversification and growth.

The value of this network is underscored by its sheer scale, encompassing runways, terminals, control towers, and a multitude of essential operational facilities. For instance, in 2023, Aena's Spanish airports handled over 243 million passengers, a testament to the network's capacity and importance.

Aena leverages a highly skilled workforce and seasoned management teams across critical areas like airport operations, air navigation, and commercial development. This deep expertise is fundamental to maintaining safe, efficient airport functioning and maximizing revenue streams.

In 2024, Aena's commitment to its human capital was evident, with significant investment in training programs aimed at enhancing skills in areas such as sustainability and digital transformation. This focus ensures their teams remain at the forefront of industry best practices.

The company's management expertise is particularly crucial in navigating complex regulatory environments and driving innovation in airport services and real estate ventures, directly contributing to Aena's competitive advantage and operational excellence.

Aena's strategic land holdings are a crucial asset, offering substantial potential for real estate development around its airports. This land bank is earmarked for projects designed to boost commercial revenue and diversify the company's income streams beyond traditional airport operations.

As of the end of 2023, Aena managed approximately 16,000 hectares of land across its network, with a significant portion designated for commercial development. This extensive portfolio provides a solid foundation for future growth, enabling the company to capitalize on the inherent value of its airport locations.

Advanced Technology and Systems

Aena's commitment to advanced technology is a cornerstone of its operations, directly impacting efficiency and passenger experience. In 2023, Aena invested €321 million in technological modernization and infrastructure, a significant portion dedicated to enhancing air traffic control and security systems. This investment fuels the seamless processing of millions of passengers, aiming to reduce wait times and improve overall airport flow.

The company utilizes sophisticated systems for:

- Air Traffic Control: Implementing cutting-edge radar and communication technologies to manage airspace safely and efficiently, handling an average of 4,000 flights daily across its network in 2023.

- Security Systems: Deploying advanced screening equipment and biometric identification technologies to enhance passenger safety and expedite security checks.

- Passenger Processing: Utilizing self-service kiosks, automated boarding gates, and real-time information systems to create a smoother, more intuitive travel journey.

- Operational Management: Employing data analytics and AI-driven platforms to optimize resource allocation, predict demand, and manage airport operations proactively.

Strong Financial Capital and Access to Funding

Aena's strong financial standing, demonstrated by its impressive net profits and EBITDA figures, is a cornerstone of its business model. This robust financial capital directly translates into enhanced access to funding, crucial for both day-to-day operations and ambitious long-term projects. For instance, in 2023, Aena reported a net profit of €1,630 million, a significant increase from previous years, underscoring its financial health.

This financial strength empowers Aena to pursue strategic investments and critical infrastructure development without undue reliance on external debt markets. The company's ability to generate substantial earnings provides a solid foundation for securing favorable financing terms, enabling it to undertake large-scale projects that are vital for maintaining its competitive edge and expanding its global reach.

- Robust Profitability: Aena consistently delivers strong net profits and EBITDA, indicative of efficient operations and healthy revenue streams. For example, its EBITDA reached €4,700 million in 2023.

- Access to Capital Markets: The company's financial stability grants it ready access to both debt and equity markets for raising capital.

- Investment Capacity: Strong financial resources enable Aena to self-fund a significant portion of its capital expenditures for infrastructure upgrades and new developments.

- Creditworthiness: A high level of financial performance enhances Aena's credit rating, leading to lower borrowing costs and improved access to diverse funding sources.

Aena's key resources are its extensive airport network, skilled workforce, strategic land holdings, advanced technology, and strong financial capital. The company's 46 Spanish airports and international holdings, like those in the UK and Brazil, are foundational. In 2023, Aena's Spanish airports alone served over 243 million passengers, showcasing the network's immense capacity. This infrastructure is supported by a dedicated team, with investments in 2024 focusing on digital transformation and sustainability, ensuring operational excellence and innovation.

Value Propositions

Aena ensures highly efficient and safe airport operations, facilitating smooth passenger journeys and reliable air navigation. In 2023, Aena handled 283.7 million passengers across its Spanish airports, a significant increase from previous years, demonstrating its operational capacity and efficiency.

The company's commitment to safety is paramount, with strict adherence to international and national regulations. This focus ensures a secure environment for all travelers and airlines, underpinning the trust placed in Aena's extensive network of airports.

Aena's extensive connectivity is a cornerstone of its value proposition, leveraging its position as the world's leading airport operator by passenger volume. This vast network reach across Spain and growing international presence provides airlines with access to a significant customer base and a wide array of destinations.

In 2023, Aena handled a remarkable 284.7 million passengers, underscoring its unparalleled network reach and appeal to both airlines and travelers. This sheer volume translates directly into commercial opportunities and route development for its airline partners.

The company's strategic investments in infrastructure and route development further enhance this value, ensuring that airlines can efficiently serve a diverse and growing passenger demand, solidifying Aena's role as a critical enabler of global travel and commerce.

Aena is dedicated to crafting a superior passenger journey, evident in its investments in contemporary airport infrastructure and a wide array of retail and dining options. This focus aims to transform travel time into an enjoyable part of the overall experience.

The company further elevates passenger satisfaction through specialized services, including exclusive VIP lounges and essential mobility assistance for those needing extra support. These offerings underscore Aena's commitment to catering to diverse passenger needs.

In 2024, Aena continued to enhance its commercial spaces, with airport retail sales showing a strong recovery, contributing significantly to the company's revenue streams. For instance, passenger traffic across Aena's Spanish airports reached over 275 million in 2023, a figure expected to grow, driving demand for these enhanced passenger services.

Commercial Opportunities for Businesses

Aena provides businesses with prime locations within its airports, offering access to millions of travelers annually. In 2024, Aena airports served over 280 million passengers, presenting an unparalleled opportunity for retailers and service providers to engage with a diverse and captive audience.

These commercial spaces are designed to maximize visibility and customer interaction. For instance, in 2023, Aena's retail revenue per passenger reached €8.80, highlighting the significant spending potential of airport visitors.

- Access to High Footfall: Businesses benefit from direct exposure to a vast number of passengers, increasing potential sales and brand awareness.

- Diverse Customer Base: Airports attract a wide demographic of travelers, allowing businesses to reach various market segments.

- Ancillary Revenue Streams: Beyond retail, opportunities exist for food and beverage, car rental, and other essential services catering to travelers' needs.

- Strategic Partnerships: Aena fosters an environment for businesses to thrive through supportive infrastructure and marketing collaborations.

Sustainable and Environmentally Responsible Operations

Aena champions environmental stewardship, targeting net-zero emissions by 2030. This commitment is backed by concrete actions like reducing noise pollution around its airports and actively promoting the use of sustainable aviation fuels, all contributing to a more eco-friendly aviation industry.

The company's dedication to sustainability is reflected in its operational strategies. For instance, Aena has invested in energy efficiency measures across its infrastructure, with a significant portion of its electricity consumption sourced from renewable energy. This focus on green energy helps reduce its carbon footprint considerably.

- Net-Zero Target: Aena aims to achieve net-zero emissions by 2030, a critical goal for the aviation sector.

- Noise Reduction: Implementing advanced technologies and operational procedures to minimize noise impact on communities surrounding airports.

- Sustainable Aviation Fuels (SAF): Actively supporting and facilitating the uptake of SAF, a key component in decarbonizing air travel.

- Renewable Energy Use: Increasing the proportion of renewable energy powering airport operations, contributing to lower direct emissions.

Aena offers businesses unparalleled access to a massive, diverse customer base, driving significant commercial opportunities. In 2023, Aena's Spanish airports welcomed over 283 million passengers, a figure that continued to grow in early 2024, presenting a consistently high-traffic environment for retailers and service providers.

The company's commitment to enhancing the passenger experience translates into increased dwell time and spending potential for businesses. With a focus on modern infrastructure and a wide range of amenities, Aena airports in 2023 saw retail revenue per passenger reach €8.80, demonstrating the lucrative nature of these prime commercial locations.

Aena actively fosters strategic partnerships, providing businesses with not only prime locations but also supportive infrastructure and marketing collaborations. This creates a synergistic environment where businesses can thrive by tapping into the captive audience and leveraging Aena's extensive network and brand recognition.

| Metric | 2023 Data | 2024 Projection/Trend |

|---|---|---|

| Total Passengers (Spanish Airports) | 283.7 million | Continued growth, exceeding 2023 levels |

| Retail Revenue per Passenger | €8.80 | Expected to remain strong or increase with passenger traffic |

| Net-Zero Target Year | 2030 | Ongoing investment in sustainable operations |

Customer Relationships

Aena prioritizes a service-oriented approach for passengers, aiming for a seamless and enjoyable journey. This includes ensuring well-maintained airport facilities and providing clear, accessible information to reduce travel stress.

In 2024, Aena continued to invest in passenger experience, evidenced by ongoing upgrades and a focus on operational efficiency. For instance, efforts to streamline security checks and improve wayfinding are central to maintaining passenger satisfaction and encouraging repeat visits.

Aena's relationships with airlines are deeply strategic, focusing on continuous negotiation of aeronautical charges. These discussions are vital for setting airport fees, directly impacting airline profitability and Aena's revenue streams. For instance, in 2024, Aena continued its policy of offering incentives to airlines that increase traffic, a key driver for airport growth.

These partnerships extend to collaborative efforts aimed at optimizing routes and flight schedules. By working together, Aena and airlines can improve operational efficiency, reduce delays, and enhance the overall passenger experience. This collaboration is crucial for adapting to market demand and ensuring the competitiveness of Aena's airports.

Aena cultivates strong relationships with its diverse commercial tenants, which include a wide array of retailers and food and beverage operators. This is achieved through meticulously structured contractual agreements that clearly define terms and expectations. In 2024, Aena continued to refine these contracts, aiming for mutual benefit and long-term partnerships.

To ensure tenant success and optimize commercial revenue, Aena actively monitors tenant performance. This involves analyzing sales data and operational efficiency, allowing for targeted support and strategic guidance. For instance, Aena's focus on data-driven insights helps identify areas where tenants can improve, ultimately boosting their profitability and contributing to Aena's overall commercial income.

Beyond contractual obligations, Aena provides comprehensive support to its commercial tenants. This can range from operational assistance and marketing initiatives to facilitating access to valuable airport data. By fostering a collaborative environment, Aena empowers tenants to thrive, which is crucial for maximizing the commercial appeal and revenue generation of its airport facilities.

Government and Regulatory Engagement

Aena actively cultivates relationships with government and regulatory bodies through ongoing, structured dialogue. This engagement is crucial for navigating the complex regulatory landscape, ensuring adherence to legal frameworks, and securing necessary approvals for significant projects and tariff changes.

In 2024, Aena's commitment to this dialogue was evident in its proactive discussions with national and European Union authorities regarding aviation policy and infrastructure development. For instance, Aena's proposals for airport development and service charges are subject to rigorous review by regulatory agencies, requiring detailed justification and evidence of economic viability.

- Regulatory Compliance: Ensuring all operations and strategic plans align with current and evolving aviation regulations.

- Policy Influence: Participating in consultations to shape future aviation policies that impact airport operations and investment.

- Strategic Approvals: Obtaining necessary permits and authorizations for major capital expenditures and service level adjustments.

- Tariff Setting: Engaging with regulators to establish fair and sustainable airport charges, balancing commercial needs with public interest.

Community and Stakeholder Engagement

Aena actively cultivates relationships with local communities and various stakeholders, proactively addressing concerns like noise pollution and environmental impact. This engagement is crucial for maintaining their social license to operate.

The company communicates its commitment to sustainability and highlights its positive contributions to the communities it serves. For instance, in 2023, Aena reported investing €163 million in environmental sustainability projects across its airport network.

- Community Dialogue: Aena holds regular meetings with local representatives and residents to discuss airport operations and mitigation measures.

- Environmental Initiatives: The company implements programs aimed at reducing emissions and noise, such as promoting sustainable aviation fuels and optimizing flight paths.

- Social Investment: Aena supports local projects and employment, contributing to the economic and social well-being of the areas surrounding its airports.

- Transparency: Aena publishes sustainability reports detailing its environmental performance and community engagement activities.

Aena fosters passenger loyalty through a consistently high-quality airport experience, focusing on efficient services and clear communication. By investing in facility upgrades and operational improvements, Aena aims to ensure passenger satisfaction and encourage repeat business.

Channels

The physical airport infrastructure, encompassing terminals, gates, runways, and extensive commercial zones, serves as Aena's primary channel. This is where passengers directly experience Aena's offerings, from check-in to boarding and retail. In 2023, Aena handled 284.7 million passengers across its Spanish airports, a significant 16.2% increase from 2022, highlighting the scale and importance of these physical touchpoints.

Aena's primary channel for reaching customers is through airline partnerships. These carriers integrate Aena's airport services into their booking systems and flight networks, effectively acting as the direct interface with passengers. In 2023, Aena handled over 283 million passengers across its network, a testament to the crucial role airlines play in driving this traffic.

Aena leverages its official website and dedicated mobile applications as key direct online platforms. These channels serve as primary touchpoints for customers, offering comprehensive flight status updates, airport information, and a gateway to various services.

Through these digital avenues, Aena facilitates direct customer engagement, enabling bookings for services such as parking reservations and access to VIP lounges. In 2023, Aena's digital channels saw significant traffic, with millions of users accessing information and services, underscoring their importance in the customer journey.

Commercial Concessions and Retail Outlets

Commercial concessions, including duty-free stores, restaurants, and car rental services, are Aena's primary channels for engaging directly with passengers. These outlets offer a wide array of goods and services, enhancing the passenger experience and generating significant revenue. In 2023, Aena's commercial revenue reached €1.76 billion, with concessions contributing a substantial portion of this figure.

These partnerships are crucial for Aena's business model, allowing them to leverage the expertise of specialized operators to provide diverse offerings. The airport environment becomes a vibrant retail and service hub, catering to the varied needs of travelers before, during, and after their flights. This strategy diversifies Aena's income streams beyond aeronautical charges.

- Revenue Generation: Commercial activities are a key driver of Aena's profitability.

- Passenger Experience: Concessions enhance the overall travel journey by providing convenience and choice.

- Partnership Strategy: Collaborations with brands like Dufry and Areas optimize service delivery and product variety.

- Market Presence: The extensive network of outlets across Aena's airports solidifies its market position.

Information and Customer Service Desks

Information and customer service desks are crucial touchpoints within Aena's airport operations, offering passengers direct assistance and support. These desks are staffed to handle a wide range of queries, from flight information and gate changes to lost and found services and general airport navigation. In 2023, Aena airports handled over 280 million passengers, highlighting the significant volume of interactions these desks manage daily.

These service points are designed to enhance the passenger experience by providing timely and accurate information, thereby reducing stress and improving overall satisfaction. For instance, many desks are equipped with multilingual staff to cater to the diverse international passenger base. Aena's commitment to service excellence is reflected in its continuous efforts to optimize the efficiency and accessibility of these desks.

- Passenger Assistance: Providing immediate help with flight details, boarding, and general inquiries.

- Information Dissemination: Offering real-time updates on delays, cancellations, and gate changes.

- Problem Resolution: Assisting with lost property, special needs requests, and complaints.

- Service Enhancement: Contributing to a positive passenger journey and fostering customer loyalty.

Aena's channels extend beyond physical presence to include strategic partnerships and digital engagement. Airlines act as vital conduits, embedding Aena's services within their booking processes, thereby reaching millions of travelers directly. In 2023, Aena's network facilitated the travel of approximately 284.7 million passengers, underscoring the reach of these airline collaborations.

Customer Segments

Commercial passenger airlines and cargo carriers are key customers for Aena, relying on its airports for take-offs, landings, and passenger/cargo handling. In 2024, Aena’s airports served over 280 million passengers, with airlines operating thousands of flights daily across its network.

These airlines pay Aena for landing fees, passenger charges, and aircraft parking, forming a significant revenue stream. The operational efficiency and connectivity offered by Aena’s airports directly impact the airlines' ability to serve their customers and manage costs.

Aena's customer base includes individual passengers, a significant segment encompassing both leisure and business travelers. These passengers rely on Aena's airports as crucial hubs for their journeys, whether for holidays or professional commitments.

The sheer volume of these individual travelers underscores their importance. Aena anticipates handling over 300 million passengers by 2025, a testament to the robust demand from this diverse group.

Commercial tenants and concessionaires are businesses operating retail stores, food and beverage outlets, car rental services, and other commercial activities within Aena's airport facilities. These entities are crucial for generating non-aviation revenue, contributing significantly to Aena's overall financial performance.

In 2024, Aena's commercial activities, including retail and food services, are expected to continue their strong recovery, building on the rebound seen in 2023. For instance, in the first half of 2024, Aena reported a 13.3% increase in commercial revenue compared to the same period in 2023, reaching €770.2 million.

Logistics and Freight Companies

Logistics and freight companies, including major players like DHL, FedEx, and UPS, are crucial customers for Aena. These businesses rely heavily on airport infrastructure for their global air cargo operations. In 2024, air cargo volumes continued to be a significant driver of airport revenue, with Aena airports handling millions of tons of freight annually. For instance, Madrid-Barajas Airport (MAD) is a major European air cargo hub, facilitating the movement of goods for these companies.

These companies utilize Aena's facilities for various services:

- Cargo handling and warehousing: Access to specialized facilities for sorting, storing, and transferring goods.

- Aircraft ground services: Essential services like refueling, baggage handling, and aircraft maintenance support.

- Operational space: Leasing of space for cargo terminals, logistics centers, and administrative offices.

- Connectivity: Leveraging Aena's network for efficient global distribution of shipments.

Airport Service Providers

Airport Service Providers are crucial partners for Aena, offering essential functions that ensure smooth airport operations. These include companies specializing in ground handling, managing aircraft turnarounds, baggage, and cargo. In 2024, the global airport ground handling market was valued at approximately $85 billion, with continued growth projected.

Furthermore, security services are paramount, with specialized firms providing passenger screening, baggage inspection, and perimeter security. The demand for advanced security solutions is increasing, driven by evolving threat landscapes. Cleaning and maintenance services are also vital for maintaining hygiene and operational efficiency, with contracts often awarded based on performance and sustainability metrics.

- Ground Handling: Essential for aircraft operations, including baggage, cargo, and passenger services.

- Security Services: Providing passenger and baggage screening, access control, and surveillance.

- Cleaning and Maintenance: Ensuring hygiene, safety, and upkeep of airport facilities.

- PRM Assistance: Offering specialized support for Persons with Reduced Mobility, enhancing accessibility.

Aena's customer segments are diverse, encompassing airlines, individual passengers, commercial tenants, logistics firms, and service providers. Each group relies on Aena's infrastructure and services for their specific operational or travel needs. The company's ability to cater to these varied segments is fundamental to its business model and revenue generation.

Individual passengers represent a massive user base, driving demand for air travel and airport services. Commercial tenants and concessionaires are vital for Aena's non-aviation revenue, with retail and food services showing strong growth. In the first half of 2024, commercial revenue increased by 13.3% year-on-year, reaching €770.2 million.

Airlines are core customers, paying fees for operations and passenger services, with Aena airports serving over 280 million passengers in 2024. Logistics companies utilize airport facilities for cargo handling and distribution, a segment that continues to be a significant revenue driver.

| Customer Segment | Key Needs/Services | 2024/2025 Data Point |

|---|---|---|

| Commercial Airlines | Take-offs, landings, passenger/cargo handling, operational space | Over 280 million passengers served in 2024 |

| Individual Passengers | Travel hubs, retail, food & beverage, car rental | Projected over 300 million passengers by 2025 |

| Commercial Tenants/Concessionaires | Retail space, F&B outlets, services | Commercial revenue up 13.3% H1 2024 vs H1 2023 (€770.2M) |

| Logistics & Freight Companies | Cargo handling, warehousing, operational space | Millions of tons of freight handled annually |

| Airport Service Providers | Ground handling, security, cleaning, PRM assistance | Global ground handling market valued at ~$85 billion in 2024 |

Cost Structure

Aena's operational costs are substantial, encompassing essential utilities like electricity, which are critical for airport functionality. In 2024, Aena continued to focus on optimizing energy consumption across its network, a key driver in managing these expenses.

Infrastructure maintenance represents another significant outlay, ensuring the safety and efficiency of airport operations. This includes everything from runway upkeep to terminal building repairs, all vital for seamless passenger flow and air traffic control.

General administrative overhead, covering staffing, IT systems, and regulatory compliance, forms a core part of the cost structure. For instance, Aena's commitment to digital transformation in 2024 involved investments in advanced systems, contributing to these administrative expenses while aiming for long-term efficiency gains.

Staff costs, encompassing salaries, benefits, and training for a significant workforce, represent a major expense for Aena. This investment is crucial for maintaining efficient airport operations, air navigation services, and commercial management across its extensive network.

In 2023, Aena's personnel expenses amounted to €1,779.6 million, reflecting the substantial human capital required to manage its operations. This figure highlights the importance of skilled personnel in ensuring the smooth functioning and growth of the airport infrastructure.

Aena's commitment to security and safety necessitates significant ongoing expenditure. In 2023, Aena invested €221 million in security and safety measures across its network, a 7% increase from the previous year, reflecting a strategic priority to maintain the highest operational standards.

These investments are crucial for compliance with stringent aviation security regulations set by bodies like EASA and national authorities, ensuring passenger and staff well-being. This includes advanced screening technologies, robust cybersecurity defenses, and continuous training for security personnel, all vital components of Aena's operational cost structure.

Infrastructure Development and Maintenance CAPEX

Aena's significant capital expenditures are driven by the expansion, modernization, and upkeep of its vast airport network. This includes substantial investments in runways, terminals, and critical technological systems to ensure operational efficiency and passenger experience. For instance, in 2023, Aena invested €1.4 billion in its Spanish airports, with a substantial portion allocated to infrastructure development and maintenance.

These ongoing investments are crucial for accommodating growing air traffic and integrating advanced technologies. The company's strategic plan often outlines multi-year CAPEX programs to address these needs. Aena's commitment to infrastructure is evident in its continuous efforts to upgrade facilities, which directly impacts its operational capacity and long-term competitiveness.

- Runway and Airfield Enhancements: Upgrades to runways, taxiways, and aprons to accommodate larger aircraft and improve air traffic flow.

- Terminal Modernization and Expansion: Investments in passenger terminals, including gate expansions, baggage handling systems, and retail spaces.

- Technological Systems: Deployment of advanced air traffic control systems, security screening technology, and digital infrastructure.

- Sustainability Initiatives: Capital outlays for energy efficiency upgrades and environmental protection measures within airport facilities.

Commercial and Real Estate Development Costs

Aena's commercial and real estate development costs are significant, encompassing the investment needed to attract and onboard new commercial operators. This includes expenses related to the design and implementation of innovative retail concepts that enhance the passenger experience and drive revenue. In 2024, Aena continued to invest in modernizing its retail spaces across its airport network, with a focus on creating attractive environments for both passengers and brands.

These costs also cover the substantial outlays for real estate projects, which involve construction, renovation, and infrastructure upgrades. Marketing expenses are crucial for promoting these new commercial offerings and attracting foot traffic. For instance, Aena's ongoing development projects, such as the expansion of Terminal 1 at Madrid-Barajas Airport, involve considerable capital expenditure, including the commercial areas within these new facilities.

- Attracting new commercial operators: Costs associated with tendering processes, contract negotiation, and initial setup support for retailers.

- Developing new retail concepts: Investment in market research, concept design, and pilot programs for innovative retail and dining experiences.

- Real estate projects: Capital expenditure on construction, renovation, and fit-out of commercial spaces, including marketing and launch campaigns.

Aena's cost structure is heavily influenced by operational necessities, including utilities like electricity, and the continuous maintenance of its extensive airport infrastructure. In 2024, Aena's focus on energy efficiency aimed to mitigate rising utility costs across its network.

Staffing costs are a significant component, reflecting the large workforce required for airport operations and air navigation services. In 2023, personnel expenses reached €1,779.6 million, underscoring the substantial investment in human capital.

Security and safety measures represent another critical expenditure, with €221 million invested in 2023, a 7% increase year-on-year, to ensure compliance with stringent aviation regulations and passenger well-being.

Revenue Streams

Aeronautical revenues are primarily derived from fees levied on airlines for utilizing airport facilities. These include charges for aircraft landings, parking, and passenger services.

Aena, a major airport operator, has outlined plans to implement a 6.5% increase in airport fees, scheduled to take effect in March 2026. This adjustment is intended to support ongoing infrastructure development and operational costs.

Commercial revenues are a cornerstone for Aena, generating substantial income from a diverse range of airport services. This includes fixed and variable rents, alongside sales-based commissions, all sourced from retail stores, duty-free operations, food and beverage vendors, advertising spaces, and car rental companies operating within the airports.

In 2024, Aena's commercial revenue demonstrated robust growth, reaching €1,780 million. This figure represents a significant year-on-year increase of 14.7%, highlighting the increasing demand and spending power of passengers utilizing Aena's airport facilities.

Aena generates revenue through the development and commercial exploitation of airport-adjacent land and properties. This includes leasing space for logistics hubs, hotels, and office buildings, capitalizing on the high foot traffic and connectivity airports offer.

In 2024, Aena saw a significant uptick in its real estate services segment, with revenues climbing by 11%. This growth highlights the increasing value and demand for strategically located commercial spaces within the airport ecosystem.

Air Navigation Service Fees

Aena generates significant income from air navigation service fees. These fees are charged to airlines for the use of air traffic control and other navigation services provided to aircraft operating within Aena's controlled airspace. This revenue stream is crucial for covering the operational costs of maintaining sophisticated air traffic management systems and highly trained personnel.

In 2023, Aena's revenue from air navigation services demonstrated a strong recovery, reflecting the rebound in air traffic. For instance, the total revenue from these services saw a substantial increase compared to previous years, driven by higher flight volumes across its network. This income is directly tied to the number of flights handled, making it a key indicator of operational activity.

- Air Navigation Service Fees: Income derived from providing air traffic control and related navigation services to aircraft within Aena's managed airspace.

- 2023 Performance: Revenues from these services showed a robust increase, mirroring the recovery in global air travel.

- Key Driver: The volume of flights handled directly influences the revenue generated from this stream.

International Airport Management Fees and Dividends

Aena generates revenue from managing and investing in airports beyond its Spanish portfolio. This includes income from operations at London Luton Airport and several airports in Brazil.

Furthermore, Aena earns dividends from its minority shareholdings in airports located in Mexico, Jamaica, and Colombia. These international ventures contribute significantly to its overall financial performance.

In the first quarter of 2025, Aena's international revenue reached €168.3 million. This figure highlights the growing importance of its global airport management activities.

- London Luton Airport operations

- Brazilian airport investments

- Dividends from Mexican, Jamaican, and Colombian airport stakes

- Q1 2025 international revenue: €168.3 million

Aena's revenue streams are diversified, encompassing aeronautical charges, commercial activities, real estate development, air navigation services, and international operations.

In 2024, commercial revenues were a significant contributor, reaching €1,780 million, an increase of 14.7% year-on-year, demonstrating strong passenger spending. Real estate services also saw growth, with revenues up 11% in 2024, underscoring the value of airport-adjacent land.

Aena's international segment contributed €168.3 million in the first quarter of 2025, reflecting income from operations like London Luton Airport and dividends from investments in Mexico, Jamaica, and Colombia.

| Revenue Stream | Description | 2024/Q1 2025 Data |

|---|---|---|

| Aeronautical Revenues | Fees from airlines for airport facility usage (landing, parking, passenger services). | Planned 6.5% increase in airport fees from March 2026. |

| Commercial Revenues | Income from retail, duty-free, F&B, advertising, car rentals (rents and commissions). | €1,780 million in 2024 (+14.7% YoY). |

| Real Estate Services | Revenue from development and leasing of airport-adjacent land (logistics, hotels, offices). | 11% revenue growth in 2024. |

| Air Navigation Services | Fees for air traffic control and navigation services. | Strong recovery in 2023 reflecting air traffic rebound. |

| International Operations | Income from managing airports abroad and dividends from foreign stakes. | €168.3 million in Q1 2025 (includes London Luton, Brazil, Mexico, Jamaica, Colombia). |

Business Model Canvas Data Sources

The Aena Business Model Canvas is informed by extensive operational data, including airport traffic statistics and concession revenues. This is supplemented by market research on passenger behavior and competitive analysis of other airport operators.