Aena Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aena Bundle

Aena's competitive landscape is shaped by powerful forces, from the bargaining power of airlines to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating the aviation industry.

The complete report reveals the real forces shaping Aena’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aena's reliance on a limited number of specialized suppliers, especially for critical air traffic control technology and ground handling equipment, significantly amplifies supplier bargaining power. For instance, if only a handful of firms can provide advanced navigation systems, these suppliers can leverage their position to command higher prices and stricter terms.

Aena faces significant switching costs when dealing with suppliers for critical infrastructure and services. For instance, replacing an existing air traffic control system would involve not only the purchase of new hardware and software but also extensive staff retraining and the potential disruption of operations, making such a switch prohibitively expensive and time-consuming. These high costs effectively lock Aena into existing supplier relationships, granting those suppliers greater bargaining power.

Suppliers offering unique or specialized inputs crucial for Aena's airport operations, like advanced security technology or specialized air traffic control software, hold significant bargaining power. For instance, if a critical piece of navigation equipment is only produced by a single manufacturer, Aena has limited options, making it vulnerable to price hikes or unfavorable contract terms. In 2024, the global market for airport security technology alone was projected to reach over $7 billion, highlighting the substantial value and potential leverage of key suppliers in this sector.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Aena's business, while not a prevalent concern in the airport sector, could theoretically bolster their bargaining power. Imagine a manufacturer of essential ground handling equipment deciding to offer these services directly, bypassing Aena's usual coordination or space leasing. This hypothetical scenario, even if unlikely, could subtly shift Aena's negotiation leverage.

For example, if a major supplier of baggage handling systems were to develop its own airport operations division, it could potentially compete with Aena for contracts or influence pricing. While Aena's diverse supplier base and the capital-intensive nature of airport operations make this a distant prospect, the mere possibility can influence strategic discussions.

- Hypothetical Scenario: A ground handling equipment manufacturer launching its own service operations.

- Impact on Aena: Potential for increased supplier bargaining power and altered negotiation dynamics.

- Industry Context: Forward integration is less common in the airport industry due to high capital requirements and established operational models.

Supplier's Importance to Aena's Quality and Service

Aena's commitment to high-quality service is intrinsically tied to its suppliers. For instance, the punctuality and safety of air traffic control, a core service Aena facilitates, depend heavily on the reliability of its air navigation service providers.

Any lapse in quality from these critical suppliers, such as delays in air traffic management or issues with ground handling equipment, can lead to significant operational disruptions and damage Aena's reputation. This makes Aena highly reliant on suppliers who consistently meet stringent performance standards.

Consequently, suppliers offering superior quality and unwavering reliability in essential areas like airport security, catering, and maintenance possess considerable bargaining power. Aena's inability to easily substitute these providers without impacting its service levels grants these key suppliers leverage in negotiations.

- Supplier Dependency: Aena's operational quality, particularly in air navigation and ground handling, directly reflects supplier performance.

- Risk of Disruption: Supplier failures in critical services pose severe operational and reputational risks to Aena.

- Leverage for Reliable Suppliers: High-quality, dependable suppliers gain significant bargaining power due to Aena's inability to compromise on service standards.

- Strategic Importance: For the fiscal year 2023, Aena reported total operating expenses of €3,647.8 million, highlighting the significant financial impact of its supplier relationships.

Aena's bargaining power with suppliers is influenced by the concentration of suppliers for critical airport components and services. When few suppliers can provide specialized technology, like advanced air traffic control systems, they gain leverage to dictate terms and prices. For example, the global market for airport security technology, valued at over $7 billion in 2024, illustrates the significant power of specialized providers in this sector.

High switching costs further empower suppliers, as Aena faces substantial expenses and operational disruptions when changing providers for essential infrastructure. This lock-in effect strengthens the negotiating position of existing suppliers. Aena's total operating expenses in 2023 were €3,647.8 million, underscoring the financial scale of these supplier relationships.

Furthermore, Aena's reliance on suppliers for consistent quality in crucial areas such as air navigation and ground handling means that dependable providers hold considerable bargaining power. Any compromise on service standards due to supplier issues can significantly impact Aena's operations and reputation.

| Factor | Impact on Aena | Supplier Leverage |

| Supplier Concentration | Limited options for critical tech | High |

| Switching Costs | High expense and disruption | High |

| Quality Dependency | Reliance on consistent performance | High for reliable suppliers |

What is included in the product

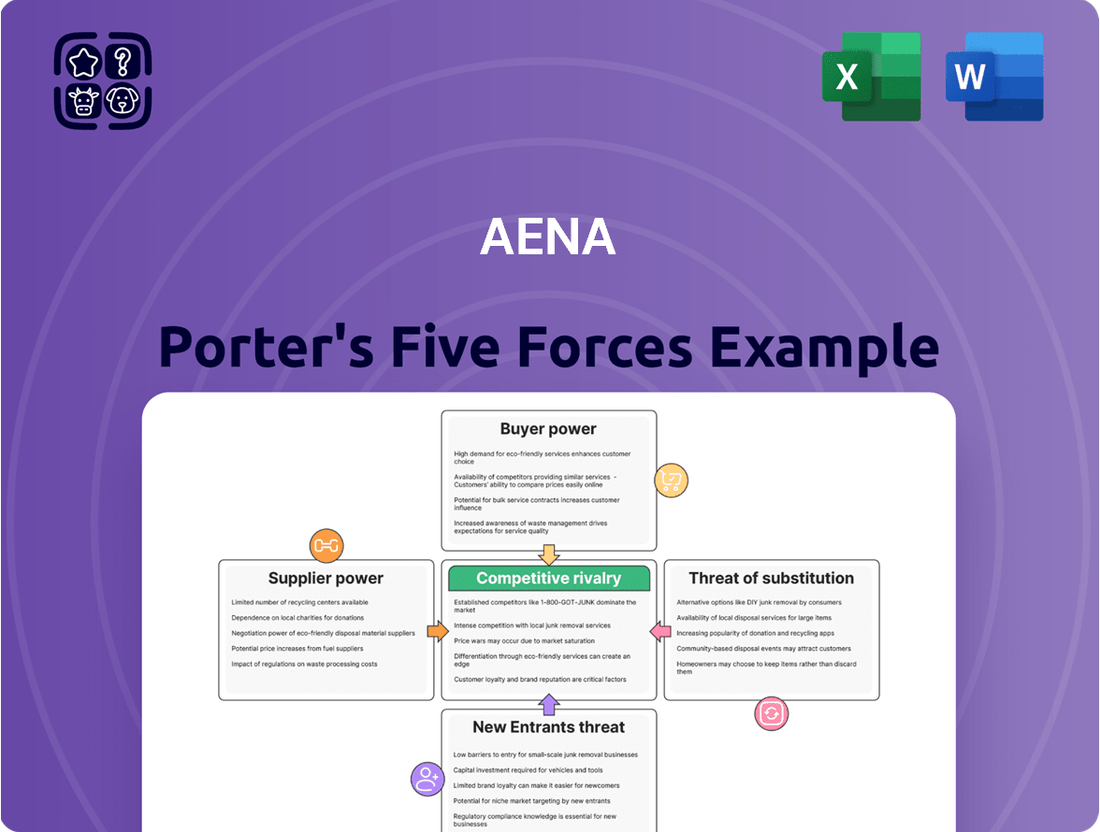

Analyzes the five competitive forces impacting Aena's market position, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly identify and prioritize competitive threats with a visual breakdown of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Aena's customer base is diverse, with passengers and airlines being the most significant. While individual passengers are highly fragmented, airlines, especially major carriers, hold considerable collective bargaining power due to their substantial traffic volumes and contribution to aeronautical revenue.

In 2024, major airlines operating at Aena's key hubs, such as London Heathrow (though not directly managed by Aena, it serves as a benchmark for major European hubs) or Barcelona El Prat, can exert significant pressure on airport charges. These airlines account for a large percentage of passenger throughput, giving them leverage in negotiations over landing fees and other services.

Airlines, themselves operating in a highly competitive environment, are acutely sensitive to airport charges. For instance, in 2024, the average operating cost for a transatlantic flight can be significantly impacted by landing fees and passenger charges. Any rise in Aena's aeronautical tariffs directly affects their bottom line, granting airlines leverage to negotiate or seek alternative, more cost-effective airports.

This inherent price sensitivity means Aena must carefully balance its revenue needs with the imperative to keep airlines financially viable and attracted to its network. In 2024, the pressure on airline margins due to fuel costs and economic conditions further amplifies this sensitivity, making competitive pricing a critical factor for Aena in maintaining passenger and cargo volumes.

While individual passengers are a fragmented group, their collective price sensitivity towards the total cost of air travel is substantial. They often choose airlines and routes based on the overall price, indirectly influencing airlines' willingness to accept higher airport charges. This dynamic means Aena's pricing strategies must consider the end-consumer's budget constraints to ensure sustained demand.

The availability of alternative airports significantly impacts airlines' bargaining power with airport operators like Aena. If airlines have viable, cost-effective alternative airports nearby for their routes, they can leverage this to negotiate lower landing fees and service charges. For instance, if a low-cost carrier can easily switch from a major Aena airport to a smaller, less congested regional airport with lower operating costs, it strengthens their position in discussions with Aena.

However, for airlines heavily reliant on major hub airports, the bargaining power shifts. Major hubs like Madrid-Barajas Adolfo Suárez Airport (MAD) and Barcelona-El Prat Airport (BCN) offer extensive connectivity and passenger traffic that smaller airports cannot easily replicate. In 2024, these hubs handled millions of passengers, making it difficult for airlines to simply bypass them without substantial operational and commercial consequences, thus limiting their leverage against Aena.

Switching Costs for Customers

Switching costs for airlines to move operations to a different airport can be substantial. These costs encompass new route planning, securing slot allocations, renegotiating ground handling contracts, and adapting marketing strategies. For instance, in 2024, the average cost for an airline to establish a new hub operation at a secondary airport could range from millions to tens of millions of dollars, depending on the scale and complexity.

These significant switching costs effectively diminish the bargaining power of individual airlines when dealing with airport operators like Aena. This is particularly true for airlines with well-established routes and significant hub operations at a particular airport, as the disruption and expense of relocating are considerable deterrents.

Conversely, for passengers, the switching costs associated with choosing an airport are typically quite low. They can easily opt for alternative airports or different modes of transportation if dissatisfied with the services or prices at a given airport. For example, a passenger might choose to drive an extra hour to a competing airport if it offers significantly cheaper flights or better amenities, demonstrating their low switching costs.

- Airline Switching Costs: Airlines face high costs when changing airports, including route planning, slot acquisition, and ground handling contracts.

- Reduced Airline Bargaining Power: High switching costs limit airlines' ability to negotiate better terms with airport operators.

- Passenger Switching Costs: Passengers generally have low switching costs, allowing them to easily choose different airports or transport options.

Customer Information and Transparency

Airlines, as sophisticated corporate customers, possess extensive information regarding airport charges, service levels, and industry benchmarks. This transparency, coupled with their strong negotiating teams, allows them to effectively challenge Aena's pricing and service offerings. For instance, in 2023, airlines' direct negotiations with airports often focused on ancillary revenue sharing and efficiency gains, impacting airport revenue streams.

Passengers, while less informed individually, benefit from online travel agencies and comparison sites that increase price transparency for air travel. This indirectly pressures airports to maintain competitive service levels and pricing, as passenger satisfaction can influence airline route decisions.

- Airline Bargaining Power: Airlines leverage detailed cost data and industry comparisons to negotiate airport fees.

- Passenger Influence: Increased online transparency for travel services indirectly impacts airport service expectations.

- Information Asymmetry Reduction: Both airlines and passengers have greater access to information, shifting bargaining power.

The bargaining power of customers for Aena is a critical factor, primarily driven by airlines and, to a lesser extent, passengers. Airlines, especially large carriers, hold significant sway due to their substantial traffic volumes and the competitive landscape they operate within. Passengers, while fragmented, exert influence through their collective price sensitivity, which indirectly impacts airline decisions.

In 2024, major airlines operating at Aena's key hubs, like Madrid-Barajas and Barcelona-El Prat, can exert considerable pressure on airport charges. These airlines, handling millions of passengers annually, have leverage in negotiating fees, as any increase directly impacts their profitability, especially with rising fuel costs and economic pressures. For instance, airlines are highly sensitive to landing fees, which can represent a significant portion of their operating costs for a flight.

The availability of alternative airports and the high switching costs for airlines to relocate operations are key determinants of their bargaining power. While major hubs offer advantages, the expense and complexity of moving operations, potentially costing millions in 2024, deter airlines from easily switching. Conversely, passengers face very low switching costs, easily opting for alternative airports or transport if prices or services are unsatisfactory.

| Customer Segment | Bargaining Power Drivers | Impact on Aena |

|---|---|---|

| Airlines (Major Carriers) | High traffic volume, price sensitivity, competitive pressures, significant switching costs to move operations. | Ability to negotiate lower airport charges and service fees; pressure on ancillary revenue sharing. |

| Airlines (Low-Cost Carriers) | Flexibility to switch to alternative, lower-cost airports, price sensitivity. | Can leverage alternative airport options to negotiate favorable terms, potentially impacting Aena's market share if charges are too high. |

| Passengers (Individual) | Low switching costs, price transparency (online comparison), collective price sensitivity. | Indirect influence on airlines' route decisions; pressure for competitive service levels and pricing at airports. |

Same Document Delivered

Aena Porter's Five Forces Analysis

This preview showcases the complete Aena Porter's Five Forces analysis, offering a thorough examination of competitive forces within the airport sector. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can confidently expect this professionally formatted and ready-to-use analysis to be delivered instantly upon completion of your transaction.

Rivalry Among Competitors

The airport industry is defined by massive fixed costs for building and maintaining runways, terminals, and air traffic control. Aena's significant capital outlays mean they absolutely need to keep planes and facilities busy to turn a profit.

This pressure to fill capacity can lead to fierce competition. Airport operators might be willing to accept lower prices for flights if it means covering at least the variable costs and contributing something towards those huge fixed expenses, driving down overall pricing.

For instance, Aena reported capital expenditures of €1.35 billion in 2023, highlighting the ongoing investment required to maintain and upgrade its facilities, which directly fuels the need for high passenger and cargo volumes.

The Spanish airport market, while possessing established infrastructure, continues to see growth, primarily fueled by robust tourism and overall economic performance. For instance, Aena reported a significant increase in passenger traffic in 2023, with its Spanish airports handling over 285 million passengers, a 12.4% rise compared to 2022. This growth, though moderate, can heighten competitive rivalry as companies strive to capture a greater portion of the expanding passenger base.

When growth rates slow, the competition for existing market share intensifies. This can manifest as more aggressive pricing strategies or enhanced incentives offered to airlines to secure their routes and traffic. Such conditions can put pressure on profitability for all players within the industry.

Aena stands as the primary airport operator in Spain, overseeing a substantial network of airports. While direct competition within Spain's major airport operations is limited, Aena contends with other European hubs for transit passengers and faces competition from alternative transportation methods.

This reduced direct rivalry within Spain, unlike more fragmented markets, offers Aena a degree of insulation. However, the company still experiences competitive pressure from international airport operators vying for global connectivity and passenger traffic.

Exit Barriers for Competitors

Exit barriers for competitors in the airport industry are extremely high. This is largely due to the immense, specialized capital investments required for airport infrastructure, making them difficult to divest or repurpose. For instance, in 2024, major airport development projects often involve billions of dollars in construction and technology upgrades, creating a significant financial lock-in for operators.

These substantial sunk costs, coupled with the strategic national importance of airports, effectively prevent any competitor from easily exiting the market. Even airports struggling with profitability are likely to continue operations rather than abandon such vast investments. This persistence of underperforming entities intensifies competition among the remaining players.

- High Capital Investment: Airports require massive, specialized infrastructure, making exit financially prohibitive.

- Asset Specificity: Airport assets are highly specific and cannot be easily converted to other uses.

- Strategic Importance: Airports are vital national infrastructure, discouraging closure or sale.

- Perpetuated Rivalry: High exit barriers keep even underperforming competitors in the market, sustaining rivalry.

Product Differentiation and Service Quality

While the core functions of airports—take-off, landing, and passenger processing—are inherently similar, Aena actively pursues differentiation through strategic investments. This includes upgrading infrastructure, streamlining passenger journeys, and curating diverse retail and dining options. For example, in 2024, Aena continued its significant capital expenditure programs focused on modernization and expansion across its Spanish airport network, aiming to elevate the overall passenger experience.

The effectiveness of Aena's differentiation strategy directly impacts competitive rivalry. By offering superior service quality, enhanced connectivity, and a more convenient passenger experience, Aena can mitigate direct price competition. This focus on non-price factors allows Aena to command loyalty and attract passengers even when alternative airport options might exist.

- Enhanced Connectivity: Aena invests in improving airside and landside infrastructure to facilitate smoother transfers and broader route networks.

- Passenger Experience: Initiatives include digital services, improved waiting areas, and efficient security processes.

- Retail and Commercial Offerings: Developing attractive commercial spaces with a diverse range of shops and restaurants adds significant value and differentiation.

- Operational Efficiency: Streamlining operations leads to reduced waiting times and a more predictable travel experience for passengers.

Competitive rivalry in the airport sector is shaped by high fixed costs and the necessity to maximize capacity utilization. This dynamic encourages price competition, as operators aim to cover operational expenses even with lower yields. Aena's 2023 capital expenditures of €1.35 billion underscore the ongoing investment needed to maintain and upgrade facilities, reinforcing the drive for high passenger volumes to ensure profitability.

SSubstitutes Threaten

High-speed rail is a potent substitute for air travel, especially for journeys within Europe and Spain's domestic routes. Spain's AVE network, for instance, offers city-center convenience and quicker overall travel times when factoring in airport procedures, directly challenging Aena's passenger numbers.

In 2023, Renfe, Spain's national railway company, saw its high-speed rail traffic reach 22.1 million passengers, a substantial increase from previous years and a clear indicator of its growing appeal as an alternative to flying for many routes.

The increasing sophistication and widespread adoption of virtual communication technologies, like Zoom and Microsoft Teams, present a significant threat of substitution for business travel. These platforms allow for seamless remote collaboration and meetings, potentially reducing the need for physical presence.

While leisure travel remains less directly impacted, a sustained trend towards remote work, accelerated by global events, could dampen demand for business flights. This shift directly affects Aena's corporate passenger traffic and revenue streams, as virtual alternatives become more viable and cost-effective for many companies.

The increasing development of road infrastructure and the widespread availability of private vehicles present a significant threat of substitutes for air travel, especially for shorter distances. In 2024, the continued expansion of highway networks and the affordability of car ownership make road travel a compelling alternative. For instance, a journey between two cities that might take an hour by plane, including travel to and from airports, check-in, and security, could be completed in a similar or even shorter timeframe by car, offering greater convenience and flexibility for many travelers.

This substitution is particularly potent for regional airports and routes where driving time is competitive with air travel. The cost-effectiveness and on-demand nature of private vehicles or ride-sharing services can be highly attractive, especially for budget-conscious travelers or those with flexible schedules. In 2024, the average cost per mile for operating a private vehicle, factoring in fuel, maintenance, and depreciation, often remains lower than the equivalent cost of a short-haul flight for a single passenger, further bolstering this substitute threat.

Emergence of Alternative Travel Modes (e.g., Hyperloop)

While still in early development stages, disruptive transportation technologies like Hyperloop pose a potential long-term threat to traditional air travel. These high-speed systems could offer a compelling alternative for inter-city journeys, impacting passenger demand for airlines that utilize Aena's airports. For instance, Virgin Hyperloop One, a prominent player, has been conducting tests and aiming for commercial routes, though widespread adoption remains a future prospect.

The ultimate viability and scale of Hyperloop and similar innovations are still uncertain. However, Aena must monitor these technological advancements closely. The potential for these substitutes to reshape travel preferences means they represent a strategic consideration for the company's future planning and infrastructure investments.

- Technological Advancement: Hyperloop aims for speeds exceeding 700 mph, significantly faster than current high-speed rail.

- Investment Landscape: Significant venture capital has been invested in Hyperloop development, indicating industry belief in its potential.

- Market Disruption: Successful implementation could divert a portion of the inter-city travel market currently served by air and rail.

Passenger Preference for Door-to-Door Convenience

Passengers increasingly value the entire door-to-door journey, prioritizing convenience, time savings, and overall cost-effectiveness. If alternative transport methods, such as high-speed rail or private vehicles, can provide a smoother and less fragmented experience, they become compelling substitutes, even if the direct travel time is longer. For instance, in 2024, the average European traveler spent an estimated 45 minutes navigating airport security and boarding processes, a significant portion of the total travel time that could be reduced with more integrated transport solutions.

Aena actively addresses this threat by enhancing its airport infrastructure and improving ground transportation connectivity. Investments in better public transport links and streamlined airport operations aim to minimize the friction points in the passenger journey. However, the inherent complexities of air travel, from check-in to baggage claim, present a persistent challenge compared to simpler, direct modes of transport.

- Door-to-Door Convenience: Passengers weigh the entire travel experience, not just flight time.

- Time Efficiency: Seamless journeys via alternatives can be more appealing than complex air travel.

- Aena's Mitigation: Investments in ground transport and airport process improvements.

- Inherent Complexity: Air travel's multi-stage nature remains a vulnerability.

The threat of substitutes for air travel, particularly impacting Aena, is multifaceted, encompassing high-speed rail, road transport, and emerging technologies. These alternatives often compete by offering greater convenience, competitive pricing, or reduced overall travel time when factoring in airport procedures.

High-speed rail, exemplified by Spain's AVE network, directly challenges Aena. In 2023, Renfe reported 22.1 million high-speed rail passengers, showcasing its growing appeal. Similarly, advancements in road infrastructure and vehicle affordability in 2024 make car travel a viable substitute for shorter routes, with operating costs per mile often undercutting short-haul flights for single travelers.

Virtual communication platforms also substitute for business travel, reducing demand for corporate flights. While nascent, technologies like Hyperloop, which aims for speeds over 700 mph, represent a potential future disruption to inter-city travel markets served by Aena's airports.

| Substitute | Key Advantage | 2023/2024 Data/Trend |

|---|---|---|

| High-Speed Rail | Door-to-door convenience, city-center access | Renfe: 22.1 million passengers (2023) |

| Road Transport | Flexibility, cost-effectiveness for short distances | Continued highway expansion, competitive operating costs |

| Virtual Communication | Cost savings, reduced travel time for business | Increased adoption for remote collaboration |

| Emerging Tech (e.g., Hyperloop) | Potential for ultra-high-speed inter-city travel | Ongoing development and investment |

Entrants Threaten

The airport management sector is characterized by exceptionally high capital requirements, presenting a formidable barrier to new entrants. Building an airport from the ground up, including runways, terminals, and air traffic control systems, can easily cost billions of euros. For instance, the development of new airport infrastructure projects often runs into the tens of billions, making it nearly impossible for smaller or less established companies to compete.

The airport sector is a minefield of extensive regulatory hurdles and licensing requirements. Aspiring new entrants must navigate a complex web of permits, licenses, and rigorous adherence to safety, security, and environmental standards mandated by national and international aviation authorities. For instance, obtaining the necessary certifications can take years and involve substantial upfront investment in compliance, as demonstrated by the lengthy approval processes for new airport infrastructure projects globally.

In Spain, Aena's operations are deeply intertwined with government ownership, as it functions as a state-controlled entity with a substantial public stake. Airports are widely recognized as critical strategic national infrastructure, a status that naturally curtails the threat of new entrants.

This significant government involvement acts as a formidable barrier to entry. It is highly improbable that new private airports would receive approval to directly challenge existing state-owned facilities. Any potential new airport development would necessitate a fundamental shift in government policy and likely involve complex public-private partnerships, further solidifying Aena's protected market position.

Economies of Scale and Network Effects

Newcomers face a steep climb due to significant economies of scale enjoyed by established airport operators like Aena. These scale advantages translate into lower per-unit costs for everything from security to baggage handling, a level difficult for new entrants to match from the outset.

Network effects further solidify the position of existing players. Aena's extensive network of airports, for instance, attracts more airlines and routes, which in turn draws more passengers. This creates a self-reinforcing cycle that new entrants would find challenging to break into.

- Economies of Scale: Aena's large operational footprint allows for cost efficiencies in procurement and management, making it harder for new, smaller airports to compete on price.

- Network Effects: The more routes and airlines an airport serves, the more attractive it becomes to passengers, creating a barrier for new airports needing to build passenger volume from scratch.

- Capital Intensity: Building new airport infrastructure requires massive upfront investment, a significant hurdle for potential new entrants compared to leveraging existing, scaled operations.

Limited Availability of Suitable Land and Environmental Concerns

The threat of new entrants for airport operators like Aena is significantly mitigated by the extreme difficulty in securing suitable land. Finding a location near major population centers, clear of existing air traffic, and with minimal environmental impact is a formidable hurdle. For instance, in 2024, the planning and approval process for new airport infrastructure in developed nations often spans a decade or more due to these complexities.

Public opposition, particularly concerning noise pollution and broader environmental impacts, frequently results in lengthy and costly planning disputes. This public sentiment can delay or even halt development, adding substantial risk for any aspiring new airport operator. In Europe, for example, environmental impact assessments are rigorous, with projects facing scrutiny over carbon emissions and biodiversity loss.

The scarcity of appropriate sites, coupled with stringent environmental approval processes, acts as a powerful deterrent. This high barrier to entry means that the potential for new competitors to emerge and challenge established players like Aena is relatively low. The capital investment required and the protracted timelines involved further solidify the position of existing operators.

- Land Scarcity: Difficulty in finding large, strategically located plots near urban areas.

- Environmental Hurdles: Stringent regulations and public opposition to noise and pollution.

- Planning Delays: Protracted approval processes can take over a decade.

- High Capital Costs: Significant financial investment needed for land acquisition and development.

The threat of new entrants in the airport sector is exceptionally low, primarily due to the immense capital required for infrastructure development, often running into billions of euros. For example, new airport projects globally frequently exceed tens of billions in investment, making it nearly impossible for smaller entities to enter. This high capital intensity, coupled with extensive regulatory and licensing hurdles that can take years to navigate, creates a formidable barrier. In 2024, the lengthy approval processes for new airport infrastructure globally underscore these challenges.

Government ownership and the designation of airports as critical national infrastructure further deter new competition. In Spain, Aena's state-controlled status significantly limits the feasibility of new private airports challenging existing state-owned facilities. Economies of scale and network effects enjoyed by established operators like Aena also present significant challenges for newcomers aiming to match cost efficiencies and passenger volume.

The scarcity of suitable land, often requiring a decade or more for planning and approval in developed nations as of 2024, combined with public opposition to environmental impacts like noise pollution, adds further layers of difficulty. These combined factors—high capital costs, regulatory complexity, government control, economies of scale, network effects, land scarcity, and environmental concerns—collectively make the threat of new entrants minimal for established airport operators.

| Barrier Type | Description | Impact on New Entrants | Example Data (Illustrative) |

| Capital Intensity | Massive upfront investment for infrastructure. | Extremely High | New airport development costs often in the tens of billions of euros. |

| Regulatory Hurdles | Complex permits, licenses, and safety standards. | Extremely High | Approval processes can take many years. |

| Government Ownership/Control | Airports as strategic national assets. | Extremely High | Aena's state-controlled status in Spain. |

| Economies of Scale | Cost advantages for large operators. | Very High | Lower per-unit costs in security, baggage handling. |

| Land Scarcity & Planning | Difficulty finding suitable locations and lengthy approvals. | Very High | Planning for new airports can exceed a decade in developed nations (2024 data). |

| Environmental Concerns | Public opposition to noise and pollution. | High | Rigorous environmental impact assessments in Europe. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic indicators to ensure a comprehensive understanding of the competitive landscape.