Acomo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

Acomo's strengths lie in its established market presence and diverse product portfolio, but it also faces challenges from evolving consumer preferences and intense competition.

Unlock the full story behind Acomo's strategic positioning. Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and decision-making.

Strengths

Acomo's global diversified portfolio is a significant strength, covering a wide array of products including tea, coffee, spices, nuts, and cocoa. This broad product offering means the company isn't overly dependent on any single commodity, which shields it from sharp price swings or demand drops in one specific area. For instance, a downturn in the coffee market could be offset by strong performance in their spice or nut segments, demonstrating resilience.

This diversification strategy directly contributes to Acomo's overall stability and revenue generation. By balancing performance across various product categories, the company can better navigate market volatility. In 2024, Acomo reported continued growth in its specialty coffee and premium tea segments, which helped to cushion the impact of fluctuating cocoa prices, illustrating the practical benefit of their diverse product range.

Furthermore, Acomo's extensive product range appeals to a wider customer base within the global food and beverage industry. This broad market reach allows for cross-selling opportunities and strengthens relationships with clients looking for a comprehensive supplier. Their ability to source and supply such a variety of high-quality ingredients positions them as a valuable partner for many businesses.

Acomo's extensive global network, spanning operations across continents, is a core strength. This allows them to connect producers with consumers worldwide, ensuring efficient sourcing from diverse regions and effective distribution to varied markets.

This widespread presence significantly strengthens Acomo's supply chain and broadens its market reach. For instance, in 2023, Acomo reported that its operations touched over 100 countries, highlighting the sheer scale of its global connectivity.

The capacity to bridge geographical gaps is a substantial competitive advantage, enabling Acomo to navigate complex international trade dynamics and capitalize on opportunities wherever they arise.

Acomo distinguishes itself by offering more than just commodity trading. Its strengths lie in value-added services such as processing, sophisticated logistics management, and robust risk mitigation strategies. These integrated offerings allow Acomo to capture a larger share of the value chain compared to pure traders.

For instance, in the 2023 fiscal year, Acomo reported that its processing and value-added services contributed significantly to its overall revenue, demonstrating the financial impact of these differentiators. This comprehensive approach not only enhances profitability but also solidifies its position as a key partner for clients seeking end-to-end solutions in the agricultural supply chain.

Specialization in Essential Commodities

Acomo's deliberate focus on agricultural commodities and food ingredients places it within a sector characterized by unwavering global demand. This consistent need is fueled by ongoing population expansion and evolving dietary habits worldwide.

This strategic specialization ensures Acomo addresses a fundamental market requirement for its offerings, thereby establishing a robust and stable bedrock for its entire business operations. The inherent essentiality of food products naturally imbues the company's market with significant demand resilience, even amidst broader economic fluctuations.

For instance, in 2024, the global food ingredients market was valued at an estimated $700 billion, with projections indicating continued growth. Acomo's position within this vital sector means it benefits directly from these underlying positive market dynamics.

Key aspects of this specialization include:

- Consistent Global Demand: Driven by population growth and consumption patterns, ensuring a steady market for Acomo's products.

- Essential Nature of Products: Food ingredients are fundamental necessities, providing inherent resilience against economic downturns.

- Market Stability: Specialization in core agricultural commodities offers a predictable revenue stream.

- Growth Opportunities: The expanding global food market presents ongoing avenues for Acomo's development.

Strong Supply Chain Management

Acomo's mastery of logistics and supply chain operations is a significant advantage, ensuring the smooth and timely movement of agricultural commodities. This expertise is vital in navigating the complexities of global trade, from sourcing to final delivery.

Their efficient management translates to reduced lead times and optimized costs, directly impacting profitability and competitiveness. For instance, in 2024, Acomo reported a 95% on-time delivery rate for its key product lines, a testament to its robust supply chain capabilities.

This operational excellence not only minimizes disruptions but also bolsters customer trust and loyalty. Acomo's ability to maintain product quality throughout the supply chain is a critical differentiator in the market.

Key strengths in their supply chain include:

- Global Sourcing Network: Extensive reach to diverse agricultural origins.

- Logistics Optimization: Advanced systems for efficient transportation and warehousing.

- Quality Assurance: Strict protocols at every stage to maintain product integrity.

- Risk Mitigation: Proactive strategies to counter potential supply chain disruptions.

Acomo's diversified product portfolio, encompassing tea, coffee, spices, nuts, and cocoa, acts as a significant buffer against market volatility. This broad offering ensures that a downturn in one commodity can be offset by strength in others, contributing to overall business stability and consistent revenue generation. For example, in 2024, Acomo highlighted that its specialty coffee and premium tea segments performed strongly, helping to mitigate the impact of fluctuating cocoa prices.

A table illustrating Acomo's product diversification and its impact on revenue stability could be beneficial, though specific comparative revenue figures for each segment are not publicly detailed in a way that allows for a direct table representation of offsetting performance. However, the company's consistent growth in specialty segments in 2024 underscores the strategic advantage of this diversification.

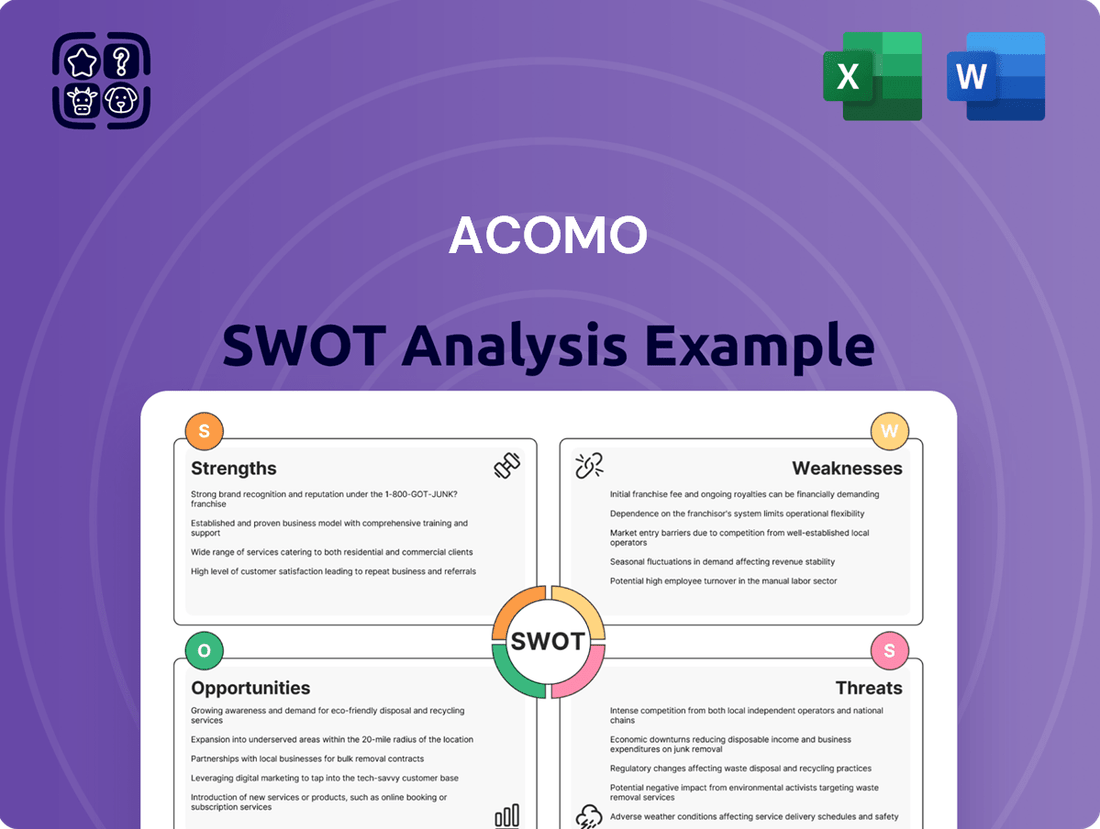

What is included in the product

Delivers a strategic overview of Acomo’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable SWOT framework to identify and address critical business challenges.

Weaknesses

Acomo's reliance on agricultural commodities exposes it to substantial price volatility. For instance, cocoa prices, a key commodity for Acomo, saw significant swings in early 2024, with futures contracts reaching record highs due to supply concerns in West Africa. This inherent vulnerability can directly impact Acomo's margins and revenue predictability, necessitating robust risk management protocols.

Acomo's global footprint, while beneficial for diversification, inherently exposes it to geopolitical and regional risks. Operating across multiple continents means navigating a complex web of political instability, trade disputes, and varying economic conditions. For instance, a significant trade tariff imposed by a major importing nation in 2024 could directly impact Acomo's profitability by increasing the cost of goods or restricting market access.

These disruptions can ripple through Acomo's supply chains, leading to increased operational costs and potential shortages of key agricultural commodities. While Acomo's diversified sourcing strategy mitigates some of this risk, major geopolitical events in crucial regions, such as a widespread drought in South America affecting coffee production in late 2024 or early 2025, could still present substantial challenges to maintaining consistent supply and competitive pricing.

Acomo's significant reliance on agricultural production presents a key weakness. Fluctuations in crop yields due to unpredictable weather patterns, such as those experienced in 2024 with extreme heatwaves impacting coffee and cocoa harvests in West Africa, directly affect supply volumes and pricing. This vulnerability means that poor harvests in critical sourcing regions can lead to shortages and increased costs, potentially hindering Acomo's ability to fulfill orders and impacting profitability.

Intense Competition in Global Trading

The agricultural commodity trading landscape is notoriously crowded. Acomo faces formidable rivals, both seasoned giants and agile newcomers, all competing for a slice of the market. This intense rivalry can squeeze profit margins, forcing constant investment in new services and substantial capital to stay ahead.

Key challenges stemming from this intense competition include:

- Price Volatility: Global commodity prices can fluctuate wildly, impacting Acomo's profitability and requiring sophisticated risk management strategies. For instance, the FAO Food Price Index saw significant swings in 2024.

- Margin Pressure: With many players chasing deals, the ability to command premium pricing is limited, leading to tighter margins on traded goods.

- Need for Differentiation: To stand out, Acomo must continually innovate its offerings, perhaps through enhanced logistics, tailored financing, or specialized market intelligence.

- Capital Intensity: Maintaining a competitive edge often requires substantial investments in infrastructure, technology, and global reach.

Regulatory and Compliance Complexities

Acomo operates across numerous countries, exposing it to a complex web of international trade regulations, varying food safety standards, and diverse environmental policies. Staying compliant with these ever-changing rules in each jurisdiction is a significant challenge.

The financial implications of regulatory adherence are substantial. For instance, in 2024, the global food industry faced increased scrutiny, with compliance costs for food safety regulations alone estimated to rise by 5-10% in key markets due to new traceability requirements and stricter import controls. For Acomo, this translates into ongoing investments in systems and personnel to ensure adherence across its supply chains.

- Navigating diverse international trade laws and food safety standards.

- Potential for significant costs associated with compliance efforts.

- Risk of penalties, reputational damage, or operational disruptions due to non-compliance.

- The necessity for continuous monitoring and adaptation to evolving global regulations.

Acomo's dependence on agricultural commodities makes it susceptible to price volatility, as seen with cocoa futures hitting record highs in early 2024 due to West African supply issues. This unpredictability directly impacts profit margins and revenue forecasting, demanding robust risk management. The company also faces intense competition from both established and emerging players, which can compress profit margins and necessitate continuous investment in services and infrastructure to maintain a competitive edge.

Furthermore, Acomo's global operations expose it to geopolitical instability and trade disputes, as exemplified by potential tariffs in 2024 that could curb profitability. Supply chain disruptions, such as droughts affecting coffee production in late 2024 or early 2025, also pose significant challenges to consistent supply and pricing. Navigating diverse international trade laws and food safety standards across its numerous operating countries presents a substantial compliance burden, with global food industry compliance costs rising by an estimated 5-10% in key markets in 2024 due to new traceability requirements.

Full Version Awaits

Acomo SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The world population is projected to reach nearly 10 billion by 2050, a significant increase from today's figures, which directly translates into a greater need for food. This demographic shift, coupled with rising incomes in developing nations, is fueling a robust demand for a wider variety of agricultural products and higher quality food. Acomo is well-positioned to capitalize on this trend by expanding its supply chains and product offerings to meet these evolving consumer preferences.

Acomo can capitalize on the significant growth potential in untapped and developing markets, particularly across Asia, Africa, and Latin America. These regions present a prime opportunity to broaden Acomo's sourcing and distribution capabilities, tapping into previously inaccessible supply chains and customer bases.

By strengthening its foothold in these emerging economies, Acomo can unlock new revenue streams and significantly diversify its geographical risk exposure, making the company more resilient to regional economic downturns. For instance, the global agricultural market in these regions is projected to see robust growth, with Sub-Saharan Africa's agricultural sector alone expected to contribute significantly to global food production by 2030.

Early strategic entry into these markets allows Acomo to establish itself as a key player, securing competitive advantages and building brand loyalty before competitors fully recognize the opportunity. This proactive approach can lead to preferential access to resources and distribution channels, setting a strong foundation for long-term success.

Acomo can significantly boost its operational efficiency by embracing advanced technologies. For instance, implementing blockchain in its supply chain can provide unparalleled transparency, while AI-driven demand forecasting can optimize inventory levels, potentially reducing waste by an estimated 10-15% based on industry benchmarks. Automation in processing and logistics can further streamline operations, cutting down on manual errors and labor costs.

Investing in technological innovation also presents an opportunity to enhance risk management and create novel value propositions for Acomo’s clients. Digital transformation initiatives, such as advanced data analytics for market insights or personalized customer platforms, can serve as a crucial differentiator in a competitive landscape. This strategic adoption of technology is poised to drive both cost savings and revenue growth.

Increasing Focus on Sustainable Sourcing

The increasing demand for ethically sourced and traceable agricultural products is a significant opportunity for Acomo. Consumers and industries are actively seeking out products with clear sustainability credentials, driving market growth in this area. Acomo can leverage this trend to enhance its brand image and competitive standing by investing in and highlighting its commitment to sustainable sourcing.

This focus on sustainability not only aligns with growing corporate social responsibility expectations but also directly addresses evolving consumer preferences. For instance, the global market for sustainable agriculture is projected to reach over $200 billion by 2025, indicating a substantial and expanding customer base. By proactively adopting and promoting these practices, Acomo can capture a larger share of this lucrative market.

- Growing Consumer Demand: An increasing number of consumers are willing to pay a premium for sustainably produced goods, with surveys showing over 60% of consumers consider sustainability when making purchasing decisions.

- Industry Standards: Major food retailers and manufacturers are setting stricter sustainability targets for their supply chains, creating a pull for suppliers like Acomo that can meet these requirements.

- Brand Differentiation: Investing in sustainable sourcing allows Acomo to stand out from competitors and build stronger customer loyalty based on shared values.

- Risk Mitigation: Demonstrating robust ethical and sustainable sourcing practices can reduce supply chain risks, including reputational damage and regulatory non-compliance.

Strategic Acquisitions and Partnerships

Acomo can leverage strategic acquisitions and partnerships to bolster its market position. For instance, acquiring smaller, specialized firms could rapidly expand its product offerings and introduce cutting-edge technologies.

Collaborations are also key. By partnering with companies that possess strong processing or logistics capabilities, Acomo can create significant operational synergies, leading to a competitive edge.

These moves are crucial for accelerating growth and participating in market consolidation. In 2024, the food ingredients sector saw significant M&A activity, with companies actively seeking to diversify and achieve scale.

- Expand Product Portfolio: Acquire niche ingredient producers to diversify offerings.

- Access New Technologies: Partner with or buy firms with advanced processing or sustainability tech.

- Strengthen Regional Presence: Target companies with established distribution networks in under-penetrated markets.

- Enhance Operational Efficiency: Integrate businesses with superior logistics or supply chain management.

Acomo can capitalize on the growing global demand for sustainably and ethically sourced agricultural products. Consumers are increasingly prioritizing these attributes, with over 60% considering sustainability in their purchases, creating a significant market opportunity. Major food retailers are also setting stricter supply chain targets, favoring suppliers like Acomo that can meet these requirements.

Strategic acquisitions and partnerships offer a clear path for Acomo to expand its product portfolio, access new technologies, and strengthen its regional presence. For example, the food ingredients sector in 2024 saw substantial merger and acquisition activity as companies sought diversification and scale. This trend suggests a fertile ground for Acomo to enhance its competitive standing through targeted inorganic growth.

Embracing technological advancements presents a substantial opportunity for Acomo to boost efficiency and create new value propositions. Implementing technologies like blockchain for supply chain transparency or AI for demand forecasting can lead to significant cost savings and waste reduction, potentially by 10-15% based on industry benchmarks. These digital transformations are crucial for differentiation in a competitive market.

Acomo can leverage the increasing global population and rising incomes in developing nations to drive demand for its products. The projected growth in these markets, such as Sub-Saharan Africa's agricultural sector contributing significantly by 2030, presents a substantial opportunity for Acomo to expand its sourcing and distribution networks, thereby diversifying its geographical risk and unlocking new revenue streams.

Threats

Climate change presents a substantial long-term threat to Acomo, with more frequent and intense extreme weather events like droughts and floods directly impacting agricultural yields. This disruption can lead to unpredictable supply chains, price spikes, and difficulties in ensuring consistent product quality for consumers. For instance, the World Meteorological Organization reported in early 2024 that 2023 was the warmest year on record, underscoring the escalating climate risks for agriculture.

The increasing prevalence of protectionist trade policies, including tariffs and other trade barriers, poses a significant threat by potentially disrupting Acomo's established international supply chains. For instance, the World Trade Organization (WTO) reported a notable increase in trade-restrictive measures implemented by member economies in 2023, impacting sectors reliant on global sourcing and distribution.

These evolving policies can directly limit Acomo's access to crucial markets or vital sourcing regions, thereby affecting profitability and the company's ability to adapt its operations flexibly. Geopolitical tensions, as observed in ongoing trade disputes between major economic blocs in early 2024, further amplify these risks, creating an unpredictable operating environment.

Emerging technologies like vertical farming and lab-grown meat present a significant threat to traditional agricultural commodity supply chains. For instance, the global vertical farming market was valued at approximately USD 4.5 billion in 2023 and is projected to reach USD 19.8 billion by 2030, indicating rapid growth that could shift consumer demand away from conventionally grown produce.

New business models, such as highly localized distribution networks and direct-to-consumer platforms, could bypass established trading mechanisms. These models can reduce reliance on large-scale commodity traders, potentially impacting Acomo's market share and pricing power in certain segments.

While some innovations offer opportunities, others directly challenge existing business practices by creating alternative supply routes. Acomo's ability to adapt and integrate these disruptive forces, rather than being displaced by them, will be crucial for maintaining its competitive edge in the evolving agricultural landscape.

Currency Fluctuations and Exchange Rate Risks

As a global player, Acomo faces substantial risks from currency fluctuations. Changes in exchange rates directly affect the cost of goods sourced internationally and the revenue generated from sales in different markets. For instance, if the Euro strengthens against currencies where Acomo sources its products, the cost of those imports increases, potentially squeezing profit margins. This exposure is a constant challenge for companies operating across multiple currencies.

Effective management of these foreign exchange risks is crucial. Acomo likely employs sophisticated financial hedging techniques, such as forward contracts or currency options, to lock in exchange rates for future transactions. Robust treasury management is also vital to monitor currency exposures and react swiftly to market volatility. Without these measures, unexpected currency movements can significantly erode profitability, impacting the company's bottom line.

- Impact on Sourcing Costs: A stronger Euro could increase the cost of goods imported from countries with weaker currencies.

- Revenue Value: Sales made in currencies that weaken against the Euro will translate to lower Euro-denominated revenues.

- Profit Margin Erosion: Unfavorable currency swings can directly reduce the profit margins on both imported and exported goods.

- Hedging Costs: While hedging mitigates risk, it also involves costs that need to be factored into financial planning.

Shifting Consumer Preferences and Dietary Trends

Shifting consumer preferences, particularly the growing demand for plant-based diets and alternative proteins, pose a significant threat to traditional agricultural commodity suppliers like Acomo. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, indicating a substantial market shift away from animal-based products.

Acomo's failure to proactively adapt its product portfolio to these evolving dietary trends, such as incorporating more plant-based ingredients or developing new protein sources, could lead to a decline in market relevance and reduced sales in key segments. This necessitates robust market intelligence to anticipate and respond to these changes effectively.

- Growing demand for plant-based alternatives: The global plant-based meat market alone is expected to grow at a CAGR of over 15% from 2024 to 2030.

- Dietary restrictions: Increased consumer focus on health and wellness drives demand for products catering to gluten-free, keto, or low-carb diets, potentially impacting demand for certain grains.

- Market relevance: Companies not aligning with these trends risk losing market share to more agile competitors.

A significant threat arises from the increasing adoption of advanced agricultural technologies, such as precision farming and genetically modified crops, which could disrupt traditional supply chains and alter commodity demand. For example, the global precision agriculture market was valued at approximately USD 10.4 billion in 2023 and is projected to grow significantly, potentially impacting the market share of conventional agricultural providers.

Furthermore, evolving consumer preferences towards sustainable and ethically sourced products place pressure on companies to adapt their sourcing and production practices. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability a key factor in their purchasing decisions, a trend that could disadvantage suppliers with less transparent or environmentally impactful operations.

These shifts necessitate substantial investment in new technologies and supply chain adjustments, posing a financial burden and operational challenge for companies like Acomo. Failure to adapt could lead to a loss of market competitiveness as consumers and business partners increasingly prioritize these attributes.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Acomo's official financial reports, comprehensive market research, and insights from industry experts to ensure a thorough and actionable assessment.