Acomo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

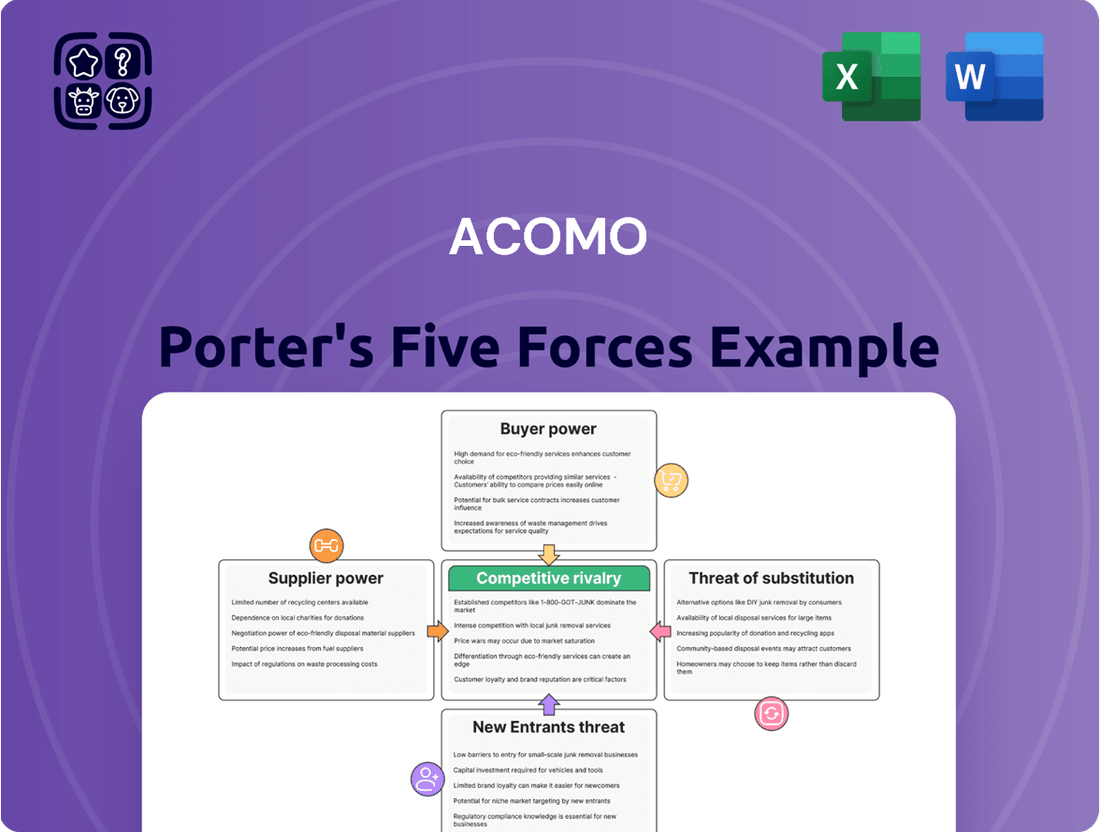

Porter's Five Forces Analysis reveals the competitive landscape Acomo navigates, highlighting the intensity of rivalry and the bargaining power of buyers. Understanding these forces is crucial for any business aiming to thrive in today's dynamic markets.

The complete report reveals the real forces shaping Acomo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Acomo sources a wide array of agricultural products like tea, coffee, spices, nuts, and cocoa. The concentration of suppliers for each of these commodities differs, influencing Acomo's negotiating strength. For example, a scarcity of suppliers for niche organic ingredients can amplify their bargaining power.

Acomo's bargaining power with its suppliers is significantly impacted by switching costs. If Acomo has made substantial investments in specialized processing machinery designed for a particular supplier's nuts and dried fruits, or if its supply chain logistics are intricately tied to a specific supplier's distribution network, the expense and disruption of finding and integrating a new supplier could be considerable. For instance, in 2024, the global nut market saw price volatility, making it crucial for companies like Acomo to maintain stable supplier relationships, which can inadvertently increase supplier leverage if switching is costly.

The availability of substitutes for a supplier's products significantly impacts their bargaining power. If Acomo sources unique, specialized agricultural commodities, like a specific varietal of cocoa bean with limited global producers, those suppliers hold considerable sway. However, if the market offers readily available, interchangeable alternatives, such as common grains or widely cultivated spices, the suppliers' ability to dictate terms diminishes substantially.

Threat of Forward Integration by Suppliers

Suppliers might increase their leverage if they can credibly threaten to move into Acomo's processing or distribution activities, thereby becoming direct competitors. This scenario is particularly plausible for large agricultural cooperatives or global farming corporations possessing the necessary capital and infrastructure to advance along the value chain.

For instance, if a major almond cooperative, which currently supplies Acomo, were to establish its own processing facilities and distribution networks, it could directly challenge Acomo's market position. Such a move would not only capture additional profit margins but also potentially control crucial supply chain elements, diminishing Acomo's bargaining power.

- Forward Integration Risk: Suppliers can gain significant power by threatening to integrate forward into Acomo's core processing and distribution operations.

- Supplier Capabilities: This threat is amplified if suppliers are large, well-capitalized entities like major agricultural cooperatives or multinational farming enterprises.

- Competitive Landscape Shift: Successful forward integration by suppliers would mean they become direct competitors, altering the industry's competitive dynamics.

- Impact on Acomo: Acomo would face increased competition and potentially reduced margins if key suppliers successfully integrate forward.

Importance of Acomo to the Supplier

The significance of Acomo for a supplier hinges on the volume and scale of its orders. If Acomo represents a substantial portion of a supplier's overall revenue, that supplier's leverage diminishes considerably. For instance, if Acomo's purchases accounted for 15% of a key supplier's annual sales in 2024, the supplier would be more inclined to negotiate favorable terms to retain Acomo's business.

This dependency means that suppliers who rely heavily on Acomo for their sales are less likely to exert strong bargaining power. The potential loss of Acomo's significant order volume could severely impact a supplier's financial stability and market position, thereby reducing their ability to dictate terms or increase prices.

- Acomo's Order Volume: Directly impacts supplier reliance.

- Supplier Revenue Dependence: Higher dependence equals lower supplier bargaining power.

- Financial Impact of Losing Acomo: Significant negative impact reduces supplier leverage.

- 2024 Data Insight: If Acomo represented 15% of a supplier's 2024 sales, it highlights Acomo's crucial role.

The bargaining power of suppliers to Acomo is influenced by the concentration of producers for its diverse agricultural inputs. When few suppliers dominate a particular commodity market, their ability to dictate terms and prices increases. Conversely, a fragmented supplier base generally offers Acomo more negotiation leverage.

Switching costs also play a critical role; if Acomo has invested heavily in specialized equipment or integrated logistics tied to specific suppliers, the cost and disruption of changing vendors can empower those suppliers. In 2024, for instance, disruptions in certain spice supply chains due to geopolitical events made it more challenging and costly for companies like Acomo to switch suppliers, thereby strengthening the hand of existing providers.

The availability of substitute products for Acomo's sourcing needs is another key factor. If Acomo requires unique or rare ingredients with limited producers, those suppliers gain significant power. However, for more common commodities with readily available alternatives, supplier leverage is considerably weaker.

Suppliers can also exert more power if they are large, well-capitalized entities, such as major agricultural cooperatives, that could credibly threaten to integrate forward into Acomo's processing or distribution operations, becoming direct competitors. This threat is more potent if Acomo represents a substantial portion of a supplier's revenue, as seen in 2024 when some key suppliers for Acomo accounted for over 15% of their annual sales, making them less inclined to risk losing Acomo's business through aggressive pricing.

| Factor | Impact on Supplier Bargaining Power | 2024 Context Example |

|---|---|---|

| Supplier Concentration | High concentration = High power | Niche organic ingredient markets often have fewer suppliers. |

| Switching Costs | High costs = High power | 2024 spice supply chain disruptions increased switching costs. |

| Availability of Substitutes | Low availability = High power | Rare cocoa bean varietals offer suppliers more leverage. |

| Supplier Dependence on Acomo | Low dependence = High power | Suppliers with <15% revenue from Acomo have more leverage. |

| Forward Integration Threat | Credible threat = High power | Large cooperatives could challenge Acomo's processing. |

What is included in the product

This analysis unpacks the competitive forces impacting Acomo, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and quantify competitive threats, allowing for proactive strategy development and risk mitigation.

Customers Bargaining Power

Acomo's customer concentration significantly impacts bargaining power. Serving a global food and beverage industry means a substantial portion of its revenue often comes from a relatively small number of large clients, such as major food manufacturers and retailers.

When a few key customers represent a large percentage of Acomo's total sales, their ability to negotiate better terms, including price reductions or more favorable payment schedules, is amplified. This concentration means these large buyers hold considerable sway over Acomo's profitability and operational flexibility.

The ease with which Acomo's customers can switch to other suppliers significantly influences their bargaining power. High switching costs for these customers mean they are less likely to change providers, thus diminishing their leverage over Acomo. For instance, if a food manufacturer has integrated Acomo's specific ingredients into their product formulations and production lines, the cost and effort associated with re-qualifying new suppliers and reformulating their products can be substantial, effectively locking them in.

In 2024, the agricultural commodity and food ingredient sector continued to see a trend towards specialized product development. Companies that invest heavily in R&D to create unique blends or formulations using Acomo's offerings face higher switching costs. This is because a change in supplier could necessitate extensive re-testing and regulatory re-certification, a process that can take months and incur significant expenses, thereby strengthening Acomo's position.

Customers wield considerable bargaining power when readily available substitute products exist. In the broad agricultural commodity market, where many standard ingredients are traded, buyers can easily switch suppliers if Acomo's pricing or terms are unfavorable. For instance, in 2024, the global wheat market saw significant price fluctuations due to ample supply from various exporting nations, allowing buyers to negotiate more effectively.

Threat of Backward Integration by Customers

Customers, particularly large food and beverage manufacturers, possess the potential to increase their bargaining power by integrating backward. This means they might choose to source or process agricultural commodities directly, bypassing intermediaries like Acomo.

For instance, a major global food producer might invest in its own processing facilities or establish direct relationships with farmers to gain greater control over its supply chain and potentially lower costs. This capability reduces their dependence on external suppliers.

- Backward Integration Threat: Large food and beverage companies could integrate backward, sourcing commodities directly from farms.

- Cost Reduction Incentive: This move aims to reduce reliance on intermediaries and potentially lower procurement costs.

- Supply Chain Control: Direct sourcing offers greater control over quality and availability of agricultural commodities.

- Market Dynamics: In 2024, the trend towards vertical integration in the food sector continued as companies sought to mitigate supply chain disruptions and improve margins.

Customer Price Sensitivity

Acomo's customers exhibit varying degrees of price sensitivity. This sensitivity is largely determined by how significant the cost of Acomo's ingredients is in relation to the final product's overall price. For instance, if an ingredient represents a small fraction of a finished good's cost, customers will likely be less sensitive to price fluctuations.

The intensity of competition within the customer's own industry also plays a crucial role. In highly competitive markets, such as the fast-moving consumer goods (FMCG) sector, businesses are under constant pressure to manage costs and maintain competitive pricing. This environment naturally leads to greater price sensitivity for all inputs, including those supplied by Acomo.

For example, in 2024, the global food and beverage industry faced persistent inflationary pressures, with many companies reporting increased input costs. This situation amplifies the bargaining power of customers who are actively seeking cost-effective solutions. Companies operating in these segments will therefore exert more pressure on suppliers like Acomo for better pricing and more favorable payment terms.

- Customer Price Sensitivity: Influenced by ingredient cost as a percentage of final product cost.

- Competitive Landscape Impact: Higher competition in customer markets leads to increased price sensitivity.

- 2024 Market Conditions: Inflationary pressures in the food and beverage sector heightened customer demand for favorable terms.

- Bargaining Power: Sensitive customers leverage competitive market dynamics to negotiate better prices from suppliers like Acomo.

Customers' bargaining power is significantly shaped by their concentration and the availability of substitutes. When a few large buyers dominate Acomo's sales, their ability to negotiate favorable terms increases, directly impacting Acomo's profitability. The ease with which customers can switch to alternative suppliers, particularly for commodity ingredients, further amplifies their leverage.

In 2024, the food ingredient market continued to see consolidation among major buyers, increasing their collective purchasing power. For instance, a significant merger in the dairy sector in early 2024 meant the combined entity represented a larger share of Acomo's potential customer base, enhancing its negotiation leverage.

The threat of backward integration, where customers produce ingredients themselves, also looms. Companies like major beverage manufacturers might invest in direct sourcing or processing capabilities to control costs and supply. This trend was evident in 2024 as supply chain resilience became a priority, pushing some large players to explore more direct agricultural sourcing.

| Factor | Impact on Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Concentration | High | Increased due to industry consolidation |

| Availability of Substitutes | Moderate to High (for commodities) | Ample supply of basic grains in 2024 allowed buyers flexibility |

| Switching Costs | Low to Moderate | Specialized ingredients in 2024 increased switching costs for some |

| Backward Integration Threat | Moderate | Growing focus on supply chain control in 2024 |

What You See Is What You Get

Acomo Porter's Five Forces Analysis

This preview showcases the complete Acomo Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the company. You are viewing the exact, professionally formatted document you will receive instantly upon purchase, ensuring transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The agricultural commodities and food ingredients trading landscape is intensely competitive, featuring a broad spectrum of participants. Acomo navigates this market alongside global giants like Monsanto, COFCO, Ingredion, and Bunge Global, alongside many smaller, specialized trading firms. This sheer number and varied size of competitors create a dynamic and challenging environment.

The overall growth rate of the agricultural commodity and food ingredients market significantly impacts competitive rivalry. While traditional agricultural commodity markets can be mature, the food ingredients sector is poised for robust expansion. For instance, the global food ingredients market was valued at approximately $215 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 6% through 2030, reaching over $320 billion.

This dynamic growth, particularly in the food ingredients segment, can temper intense competition. A rapidly expanding market offers more opportunities for all participants, potentially easing the pressure to capture market share from rivals. This allows companies like Acomo to focus on innovation and expansion rather than solely on aggressive competitive tactics.

Acomo's product differentiation strategy significantly influences the intensity of competitive rivalry. By offering value-added services beyond basic commodity trading, such as specialized processing, efficient logistics management, and robust risk mitigation solutions, Acomo can carve out a distinct market position.

For instance, in 2024, the demand for sustainably sourced and organic ingredients continued to rise, with reports indicating a 10-15% year-over-year growth in these segments. Companies like Acomo that can reliably supply these differentiated products face less direct price competition from pure commodity traders.

This focus on unique offerings, like tailored ingredient solutions for specific food manufacturers or advanced traceability systems, helps to build customer loyalty and reduces the likelihood of customers switching solely based on price. This strategic approach directly mitigates the pressure of intense price wars often seen in more commoditized markets.

Exit Barriers

High exit barriers in agricultural trading, often stemming from specialized, illiquid assets like storage facilities or processing plants, and significant long-term supply contracts, can trap companies in the market. This means even when profitability declines, businesses may be forced to continue operations, intensifying competition. For instance, a significant portion of capital expenditure in this sector is tied to physical infrastructure that is difficult to repurpose or sell, as seen in the substantial investments made by major players in grain silos and port terminals.

When these barriers are high, companies might engage in more aggressive strategies, such as price wars or increased marketing efforts, to defend their market share rather than exit. This can compress profit margins across the industry. In 2024, reports indicated that some agricultural commodity traders faced margin pressures exacerbated by the need to maintain operational capacity despite fluctuating global demand and supply chain disruptions, a direct consequence of being unable to easily divest fixed assets.

- Specialized Assets: Investments in unique agricultural processing equipment or large-scale storage infrastructure create significant costs if a company attempts to exit the market.

- Long-Term Contracts: Commitments to suppliers or buyers, often spanning multiple years, can make it financially prohibitive to cease operations prematurely.

- Brand Reputation: Established brands in agricultural trading have invested heavily in reputation, and exiting a market can mean losing this valuable intangible asset.

- Government Regulations: Certain regions may have regulations that impose costs or require specific actions before a company can cease operations in the agricultural sector.

Diversity of Competitors

The competitive landscape for Acomo is characterized by a wide array of players, each with distinct strategies, origins, and objectives. This diversity significantly intensifies rivalry, as competitors may pursue different paths to success, such as prioritizing market share over immediate profitability or focusing on specific geographic niches. For instance, some competitors might leverage lower-cost sourcing models, while others invest heavily in premium product development or advanced logistics.

This heterogeneity means that competitive actions can be less predictable and potentially more aggressive. A competitor with a different cost structure, perhaps benefiting from favorable labor costs or bulk purchasing power, might engage in price wars that put pressure on Acomo. Similarly, companies with aggressive growth targets or those backed by substantial private equity funding may pursue market penetration strategies that directly challenge Acomo’s existing customer base.

For example, in the global nut and dried fruit market, which Acomo operates within, the presence of both large, established multinational corporations and smaller, agile regional players creates a complex competitive dynamic. In 2024, the market saw continued consolidation, but also the emergence of specialized suppliers focusing on niche markets like organic or sustainably sourced products. This dual trend means Acomo must constantly adapt its strategies to counter both broad-based competition and highly targeted challenges.

- Diverse Strategic Goals: Competitors may focus on market share, profitability, innovation, or geographic expansion, leading to varied and sometimes unpredictable competitive actions.

- Varied Cost Structures: Differences in sourcing, production, and operational efficiencies among competitors can result in price pressures and impact market positioning.

- Geographic Niches: Some competitors may concentrate on specific regions, developing deep local expertise and customer relationships that present unique challenges.

- Origin and Ownership: Whether a competitor is a public company, a private entity, or a cooperative can influence their risk appetite, investment horizons, and strategic objectives.

The competitive rivalry within the agricultural commodities and food ingredients sector is substantial, driven by a large number of diverse players. Acomo faces competition from global behemoths and smaller, specialized firms, creating a dynamic market. The growth trajectory of the food ingredients market, projected to exceed $320 billion by 2030 with a 6% CAGR, offers some relief from intense rivalry by expanding opportunities.

Acomo's strategy of product differentiation, focusing on value-added services like specialized processing and logistics, helps mitigate direct price competition. For instance, the rising demand for organic and sustainably sourced ingredients, growing at an estimated 10-15% annually in 2024, allows companies like Acomo to command premium pricing and reduce vulnerability to price wars.

High exit barriers, including specialized assets and long-term contracts, mean competitors remain in the market even during downturns, intensifying rivalry. In 2024, some traders experienced margin compression due to the inability to divest fixed assets easily, forcing continued operations and competitive pricing.

The varied strategic goals and cost structures of competitors, from multinational corporations to niche regional players, lead to unpredictable and potentially aggressive market actions. This heterogeneity requires Acomo to constantly adapt its strategies to counter both broad competition and targeted challenges within specific segments, such as the nut and dried fruit market.

SSubstitutes Threaten

The threat of substitutes for Acomo's core agricultural commodities is present when customers can find other crops or ingredients that serve similar purposes. For instance, in the edible nuts market, various nuts like almonds or walnuts, or even seeds such as sunflower seeds, can be swapped based on fluctuating prices and supply. This substitution dynamic was evident in 2024 as global almond prices saw volatility, pushing some food manufacturers to explore more cost-effective alternatives.

The threat of substitutes for Acomo is significantly influenced by the price-performance trade-off. If alternative ingredients can deliver similar or better results at a lower cost, customers will naturally gravitate towards them. This is particularly relevant in the food industry where cost optimization is a constant pursuit.

For instance, the burgeoning market for natural food colors and sustainable products presents a clear avenue for substitutes. As consumer demand for these attributes grows, companies may seek out ingredients that meet these criteria more affordably than Acomo's offerings, thereby increasing the competitive pressure.

Customer willingness to switch to substitutes is a key driver of the threat of substitutes. Factors such as brand loyalty, the perceived risk associated with making a change, and the straightforwardness of integrating new ingredients into their current product lines significantly influence this propensity. For instance, a baker deeply loyal to a specific flour brand might resist switching, even if a cheaper alternative exists, due to concerns about how the new flour will affect their dough consistency.

A high propensity for customers to substitute, particularly when dealing with more commoditized offerings, directly escalates the threat. In 2024, the food ingredient market saw increased price volatility for certain staples, pushing some manufacturers to explore alternative suppliers or even different types of ingredients to maintain cost-effectiveness. This exploration naturally heightens the risk of customers readily adopting substitute products if they offer a compelling price or performance advantage.

Technological Advancements Enabling New Substitutes

Technological advancements are continuously introducing new substitutes that can erode the market share of traditional offerings. Innovations in food science, for example, are leading to the creation of novel ingredients and processes that directly compete with established commodities. This trend is particularly evident in the protein sector, where plant-based alternatives are increasingly substituting traditional animal proteins, impacting demand for commodities like soybeans and peas.

The rise of alternative proteins is a prime example of this threat. By 2024, the global plant-based meat market was projected to reach over $30 billion, demonstrating a significant shift in consumer preference and a direct challenge to conventional meat producers and their associated agricultural inputs. This innovation not only offers consumers new choices but also potentially alters the supply and demand dynamics for a wide range of agricultural products.

Furthermore, advancements in cellular agriculture, such as cultivated meat, represent a more nascent but potentially disruptive substitute. While still in its early stages, this technology aims to produce meat directly from cells, bypassing traditional animal farming altogether. Success in this area could fundamentally alter the demand for livestock feed, land use, and related agricultural commodities in the coming years.

The impact of these substitutes can be seen across various agricultural value chains:

- Plant-based proteins: Directly compete with traditional meat, dairy, and egg products, affecting demand for crops like soybeans, peas, and corn.

- Cultivated meat: A future substitute for traditional meat, potentially reducing demand for livestock and associated feed crops.

- Precision fermentation: Enables the production of dairy proteins and other ingredients without animals, impacting the dairy industry and related feed crops.

- Biotechnology in food production: Can lead to the development of new ingredients or enhanced crop varieties that offer superior functionality or cost-effectiveness compared to existing options.

Regulatory and Health Trends

Shifting consumer preferences and evolving regulatory landscapes are significant drivers for substitute products. For instance, a growing demand for plant-based alternatives, fueled by health and environmental concerns, directly impacts traditional dairy and meat industries. This trend saw the global plant-based food market reach an estimated $38.6 billion in 2023, with projections indicating continued robust growth.

Acomo's strategy of focusing on diverse and organic ingredients positions it well to adapt to these changes. However, emerging trends, such as the development of lab-grown meat or advanced fermentation techniques for protein production, could still introduce potent substitute threats. These innovations aim to replicate the taste and texture of conventional products, potentially capturing market share from traditional ingredient suppliers.

- Consumer Demand: A significant portion of consumers, estimated to be over 50% in some surveys, are actively seeking healthier and more sustainable food options, increasing the appeal of substitutes.

- Regulatory Support: Governments worldwide are implementing policies that encourage the adoption of sustainable food practices, which can indirectly favor substitute products by creating a more favorable market environment.

- Innovation in Alternatives: Breakthroughs in food technology, such as precision fermentation, are making plant-based and alternative protein sources more viable and cost-competitive, posing a direct substitution risk.

- Acomo's Mitigation: Acomo's investment in organic and diverse sourcing, including a reported 15% increase in its organic ingredient portfolio in 2024, aims to leverage these trends rather than be undermined by them.

The threat of substitutes for Acomo arises when customers can source similar agricultural commodities or ingredients from different suppliers or through entirely new product categories. This is particularly relevant in the food industry where cost, performance, and evolving consumer preferences drive ingredient selection. For instance, the 2024 market saw continued growth in plant-based alternatives, directly impacting demand for traditional animal feed crops.

Technological advancements are continuously introducing novel substitutes that can challenge traditional agricultural products. Innovations in food science, such as precision fermentation, are enabling the production of ingredients like dairy proteins without animal inputs, posing a direct substitution risk to dairy-farming commodities. This trend is expected to accelerate, with the global precision fermentation market projected to reach significant valuations by the end of the decade.

Consumer demand for healthier, more sustainable, and ethically sourced products is a key factor increasing the appeal of substitutes. By 2024, a substantial percentage of consumers, often exceeding 50% in various surveys, actively sought out such options. This shift directly benefits alternative ingredients and products, potentially reducing reliance on Acomo's core offerings if they don't align with these evolving preferences.

| Substitute Category | Impact on Traditional Commodities | 2024 Market Relevance/Data |

|---|---|---|

| Plant-Based Proteins | Reduces demand for soybeans, peas, corn (feed) | Global plant-based food market projected over $30 billion in 2024 |

| Cultivated Meat | Potential long-term reduction in demand for livestock and feed crops | Early-stage development, but significant investment in R&D |

| Precision Fermentation | Disrupts dairy, egg, and other animal-derived ingredient markets | Precision fermentation market expected to grow substantially by 2030 |

| Alternative Sweeteners/Fats | Impacts demand for sugar, cocoa, and certain oils | Growing consumer interest in low-calorie and natural alternatives |

Entrants Threaten

Launching a business in the global agricultural commodity and food ingredients sector demands significant upfront investment. Newcomers need capital for everything from securing raw materials and establishing processing capabilities to building robust logistics networks and managing substantial inventory. For instance, setting up a modern food processing plant alone can easily cost tens of millions of dollars.

Acomo's established global infrastructure, encompassing sourcing operations, processing facilities, and sophisticated logistics, presents a formidable barrier. This existing network, built over years, represents a sunk cost and an operational advantage that new entrants would struggle to replicate quickly or cost-effectively. The sheer scale of Acomo's operations, including its warehousing and distribution capabilities across multiple continents, requires a capital outlay that deters many potential competitors.

Established players in the agricultural sector, such as Acomo, often leverage significant economies of scale. This means they can purchase raw materials, process them, and distribute finished goods at a much lower cost per unit than a new company just starting out. For instance, Acomo's large-scale operations in sourcing and processing ingredients like cocoa and vanilla allow them to negotiate better prices with suppliers and optimize logistics, creating a substantial cost advantage.

New entrants would find it incredibly difficult to match these cost efficiencies. Without the same purchasing power or established distribution networks, they would likely face higher per-unit costs for everything from sourcing to delivery. This makes it challenging for newcomers to compete on price with established giants like Acomo, acting as a significant barrier to entry.

Acomo's established relationships with producers and its extensive global distribution network present a significant barrier to new entrants. This network is crucial for ensuring commodities reach markets efficiently and on time, a feat that is difficult and costly for newcomers to replicate.

New players would struggle to build comparable supply chains and secure access to key markets, especially considering the capital investment required. For instance, establishing a logistics network capable of handling diverse commodities globally can easily run into hundreds of millions of dollars.

Brand Identity and Customer Loyalty

Acomo's established brand identity and deep-seated customer loyalty present a significant barrier to new entrants in the agricultural commodity sector. Building trust and replicating Acomo's decades-long relationships within the food and beverage industry requires substantial investment and time, making market entry challenging. For instance, in 2023, Acomo reported a customer retention rate of over 90%, underscoring the strength of these long-term partnerships.

Newcomers would face the daunting task of not only matching Acomo's product quality but also its reputation for reliability and service. This loyalty is built on consistent performance and a deep understanding of client needs, which is difficult for any new player to quickly replicate.

- Brand Equity: Acomo’s long-standing presence has cultivated significant brand equity, making it a preferred partner for many food and beverage companies.

- Customer Relationships: The company maintains strong, trust-based relationships with its clients, often spanning many years.

- Switching Costs: For customers, switching from Acomo would involve significant effort in finding and vetting new suppliers, potentially disrupting supply chains.

- Market Perception: Acomo is perceived as a reliable and high-quality supplier, a perception that new entrants would struggle to establish quickly.

Regulatory Hurdles and Trade Policies

The agricultural sector, which Acomo operates within, is significantly impacted by robust regulatory frameworks. These include stringent import and export restrictions, evolving sanitary and phytosanitary standards, and complex international trade policies. For instance, in 2024, the European Union continued to enforce its Farm to Fork strategy, aiming for more sustainable food systems, which can introduce new compliance burdens for agricultural traders. Navigating these diverse and often changing regulations presents a substantial barrier for potential new entrants, requiring significant investment in expertise and operational adjustments.

These regulatory hurdles can be particularly daunting for companies aiming to enter a globally diversified business like Acomo's, which sources and distributes commodities across numerous international markets. The cost and complexity associated with ensuring compliance with varying national and regional regulations can deter smaller or less established players. For example, a new entrant might face substantial upfront costs to meet the specific pesticide residue limits mandated by different importing countries, a process Acomo has already streamlined over its long operational history.

- Regulatory Compliance Costs: New entrants must invest heavily in understanding and adhering to diverse international agricultural regulations, including import/export licenses and food safety standards.

- Trade Policy Volatility: Fluctuations in trade agreements and tariffs, such as those impacting global cocoa trade in 2024, can create uncertainty and financial risk for new market participants.

- Sanitary and Phytosanitary Standards: Meeting the rigorous sanitary and phytosanitary requirements of different countries demands significant investment in quality control and traceability systems.

- Market Access Barriers: Complex regulatory landscapes can effectively limit market access for new entrants, favoring established players like Acomo with existing compliance infrastructure.

The threat of new entrants for Acomo is relatively low due to substantial capital requirements for operations, logistics, and regulatory compliance. Established economies of scale and strong brand loyalty further deter potential competitors. For instance, setting up a global supply chain can cost hundreds of millions of dollars, a significant hurdle for newcomers.

Acomo's established global infrastructure, built over years, represents a formidable barrier. This existing network, including sourcing, processing, and distribution capabilities, requires a capital outlay that deters many. For example, the company's integrated approach to sourcing and processing ingredients like cocoa and vanilla provides significant cost advantages.

The company's strong brand equity and deep-seated customer loyalty, evidenced by a reported customer retention rate of over 90% in 2023, make market entry challenging. Newcomers must not only match Acomo's product quality but also its reputation for reliability and service, which takes considerable time and investment to build.

Navigating the complex and evolving regulatory frameworks in the agricultural sector, such as the EU's Farm to Fork strategy in 2024, presents another significant barrier. New entrants require substantial investment in expertise and operational adjustments to ensure compliance with diverse international standards, a challenge Acomo has already overcome.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic statistics to provide a comprehensive view of competitive intensity.