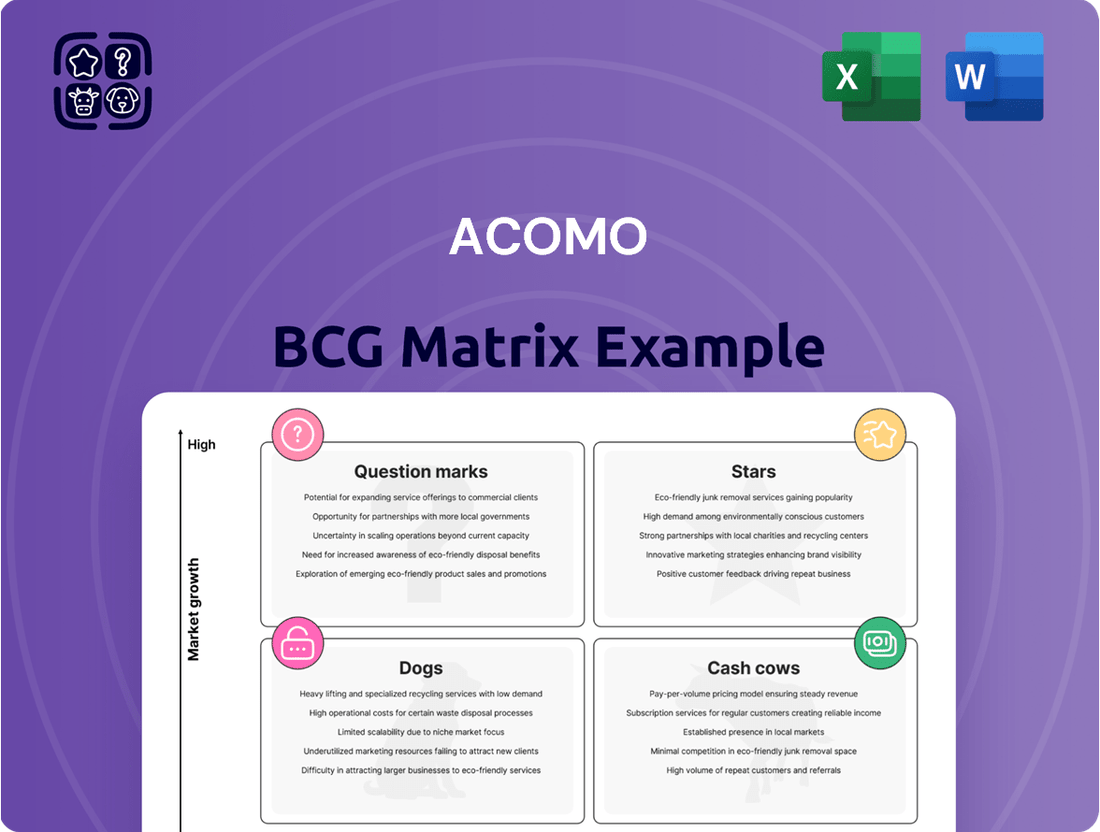

Acomo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

Unlock the strategic potential of this company's product portfolio with a glimpse into its BCG Matrix. See how its offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, and understand the foundational insights for smart resource allocation. Purchase the full BCG Matrix to receive a detailed Word report + a high-level Excel summary, equipping you to evaluate, present, and strategize with absolute confidence.

Stars

The Spices & Nuts segment showed impressive growth in 2024, with sales climbing 13% for the full year. This upward trend accelerated in the fourth quarter, experiencing a 23% sales surge, a testament to Acomo's strong market position and effective pricing strategies.

This positive momentum carried into early 2025, as Q1 2025 sales saw a healthy 12% increase. The global spices market is a significant growth area, with projections indicating a compound annual growth rate of 7.3-7.4% from 2024 to 2029, positioning Acomo favorably within this expanding sector.

Acomo achieved record profitability within this segment in 2024, underscoring its substantial market share and robust cash-generating capabilities in a dynamic and growing industry.

Acomo's Organic Ingredients segment, with a strong focus on cocoa, delivered impressive results in Q1 2025, posting double-digit sales volume growth and a remarkable 38% revenue increase. This surge was significantly bolstered by elevated cocoa prices and robust performance across other product lines within the segment.

The global cocoa market is on an upward trajectory, with projections indicating a valuation of USD 16.6 billion in 2025 and an anticipated compound annual growth rate of 4.7% through 2035. This growth is underpinned by historically high cocoa prices in 2024, which are expected to persist into 2025 due to ongoing supply shortages and sustained demand.

Acomo's strategic positioning within the cocoa market proved advantageous in the first half of 2025, as its cocoa business significantly contributed to the company's overall financial performance. This demonstrates Acomo's ability to capitalize on a high-growth, high-value market segment characterized by favorable pricing dynamics.

Acomo's strategic investment focus is clearly on its Spices and Nuts, Edible Seeds, and Food Ingredients segments. This means future capital will be directed towards growing these areas, both internally and through smart acquisitions.

The company has a clear target to achieve €0.6 billion in sales growth over the next five years, aiming for a total of €2 billion in sales. This ambitious growth plan highlights the strategic importance and perceived potential of these core segments.

High Profitability Segments

In 2024, Acomo experienced significant profit growth, with its Spices and Nuts and Food Solutions segments reaching historic highs in profitability. This surge highlights the robust performance and market strength of these divisions within the company's portfolio.

Further bolstering these results, both the Tea and Organic Ingredients segments demonstrated impressive double-digit improvements in profitability. This indicates Acomo's successful strategies in enhancing efficiency and competitive positioning across diverse market segments.

- Spices and Nuts: Achieved historic high profitability in 2024.

- Food Solutions: Also reached historic high profitability in 2024.

- Tea: Saw double-digit profitability improvement in 2024.

- Organic Ingredients: Experienced double-digit profitability improvement in 2024.

Diversified Portfolio Strength

Acomo's robust financial results for 2024 underscore the power of its diversified approach. With sales climbing 8% to €1.4 billion and adjusted EBITDA surging 18% to €109 million, the company demonstrates the collective strength derived from its various business units. This broad-based growth across multiple agricultural commodity sectors highlights Acomo's strategic emphasis on a diversified portfolio and its ability to add significant value within these markets.

The success of Acomo's high-performing segments, which contribute significantly to the overall positive financial trajectory, can be viewed through the lens of the BCG Matrix. These leading segments, driving substantial revenue and profit growth, effectively function as Stars within the company's portfolio.

- Diversified Portfolio Strength: Acomo's 2024 performance, with €1.4 billion in sales and €109 million in adjusted EBITDA, showcases the collective power of its varied business segments.

- Strategic Emphasis: The Group's strategy explicitly points to the advantage of a diversified portfolio and its value-adding capabilities.

- Market Leadership: Success across multiple growing agricultural commodity markets positions Acomo as a leader, with its top-performing segments acting as Stars.

- Financial Growth Drivers: The 8% sales increase and 18% adjusted EBITDA growth are direct results of these strong, well-positioned segments.

Acomo's Spices & Nuts and Food Solutions segments achieved record profitability in 2024, alongside double-digit profit improvements in Tea and Organic Ingredients. These high-growth, high-profit segments, driven by strong market positions and favorable pricing, exemplify Stars within Acomo's portfolio. Their success contributes significantly to the company's overall 8% sales growth to €1.4 billion and an 18% surge in adjusted EBITDA to €109 million in 2024.

| Segment | 2024 Profitability | Growth Driver | BCG Category |

|---|---|---|---|

| Spices & Nuts | Historic High | Strong Market Position, Effective Pricing | Star |

| Food Solutions | Historic High | Robust Performance | Star |

| Tea | Double-Digit Improvement | Successful Strategies | Star |

| Organic Ingredients | Double-Digit Improvement | Elevated Cocoa Prices, Strong Product Performance | Star |

What is included in the product

The Acomo BCG Matrix analyzes product portfolio by market share and growth, guiding investment decisions.

Visualize your portfolio's health and identify areas needing strategic attention.

Gain clarity on where to invest, divest, or harvest for optimal resource allocation.

Cash Cows

Acomo's Tea segment, while operating in a global market with a healthy 4.5-6.6% CAGR, is strategically positioned as a cash cow. The focus here isn't on rapid expansion but on maximizing profitability from an established strong market position.

In 2024, this strategy yielded positive results, with the Tea segment achieving a 10% sales increase and a significant 20% rise in adjusted EBITDA, indicating improved margins and operational efficiency. This performance underscores its role as a reliable generator of cash for the company.

Despite a slight sales dip in Q1 2025, the segment's foundational strength and Acomo's emphasis on optimizing its operations confirm its status as a mature business unit designed to provide consistent cash flow.

Acomo's established edible nuts operations are a prime example of Cash Cows within its portfolio. These segments, while not experiencing rapid expansion, consistently generate substantial profits due to strong market positions and efficient operations. For instance, in 2024, the global edible nuts market continued its steady expansion, with projections indicating continued moderate growth throughout the coming years, providing a stable revenue stream for these established Acomo businesses.

These operations benefit from Acomo's robust infrastructure, including an extensive distribution network and deep-rooted supplier relationships built over years. This allows them to maintain a competitive edge and achieve economies of scale, translating into predictable and significant cash flow. The capital expenditure required to maintain these businesses is typically lower compared to growth-oriented segments, further enhancing their Cash Cow status by freeing up capital for investment elsewhere.

Acomo's Food Solutions segment, encompassing dry and wet blends, is a prime example of a Cash Cow. This business saw sales volumes rise by 6% in Q1 2025, building on increased profitability in 2024.

The established blends operations within Food Solutions likely represent a mature market where Acomo holds a significant position. This strong market share translates into consistent and reliable cash flow generation, even with ongoing investments in new facilities.

Sustainable Cash Generation

Cash Cows represent business units that generate substantial profits with minimal investment, effectively funding other areas of the company. Acomo's established product lines, enjoying high market share and consistent demand, exemplify this. These segments are vital for their ability to generate more cash than they require for ongoing operations and maintenance.

Acomo's financial health, underscored by a robust balance sheet and a history of consistent dividend distributions, points to the presence of strong Cash Cows. For instance, the company announced an interim dividend of €0.45 per share for H1 2025, a testament to its reliable cash-generating capabilities. These mature, profitable segments are the bedrock upon which Acomo builds its strategic investments and covers its operational expenses.

- Established Market Dominance: Segments with a strong, long-standing market position.

- High Profitability: These units consistently produce significant earnings.

- Low Investment Needs: They require minimal capital expenditure to maintain their performance.

- Dividend Support: Cash generated fuels shareholder returns, like Acomo's interim dividend of €0.45 per share in H1 2025.

Operational Efficiency Focus

Acomo's strategy centers on boosting its EBITDA margin to 9% by enhancing the value proposition across its diverse portfolio. This emphasis on operational efficiency is particularly crucial for its Cash Cow segments, which represent mature businesses with substantial market share.

These established segments are strategically managed to generate consistent, robust cash flows. The focus here is on maximizing earnings through improved operational efficiency and by adding value, effectively milking these mature businesses for their reliable profits. For instance, in 2024, Acomo's commitment to efficiency aims to solidify the strong cash generation from these core areas.

The cash generated from these Cash Cows is then strategically redeployed to fuel growth initiatives in other parts of the business, particularly those identified as Stars or Question Marks in the BCG matrix. This financial discipline ensures that mature, profitable segments continue to support the company's overall expansion and innovation efforts.

Key aspects of this focus include:

- Maximizing EBITDA margin: Targeting a 9% EBITDA margin through value-added strategies.

- Leveraging mature segments: Utilizing high market share in established areas for consistent cash generation.

- Efficient operations: Streamlining processes to enhance profitability in core businesses.

- Funding growth: Reinvesting profits from Cash Cows into higher-growth opportunities.

Cash Cows are Acomo's mature business units with strong market positions that generate substantial profits with minimal investment. These segments, like the established edible nuts operations and the Food Solutions dry and wet blends, consistently produce reliable cash flow, underpinning the company's financial stability.

In 2024, Acomo's Tea segment, a prime example of a Cash Cow, saw a 10% sales increase and a 20% rise in adjusted EBITDA, highlighting its efficiency and profitability. Similarly, the Food Solutions segment reported a 6% sales volume increase in Q1 2025, demonstrating sustained performance.

These businesses require low capital expenditure for maintenance, freeing up capital for investment in growth areas. Acomo's ability to distribute an interim dividend of €0.45 per share for H1 2025 directly reflects the strong cash generation from these core segments.

Acomo's strategy to reach a 9% EBITDA margin by 2025 heavily relies on optimizing these Cash Cow segments through efficient operations and value enhancement, ensuring they continue to be the primary source of funding for the company's strategic initiatives.

| Segment | Market Position | 2024 Performance Indicator | Capital Expenditure Needs | Cash Generation |

|---|---|---|---|---|

| Tea | Strong Global Position | 10% Sales Increase, 20% EBITDA Rise | Low | High & Consistent |

| Edible Nuts | Established Dominance | Steady Revenue Stream (Global Market Growth) | Low | Substantial & Predictable |

| Food Solutions (Blends) | Significant Market Share | 6% Sales Volume Increase (Q1 2025) | Low to Moderate | Reliable |

What You See Is What You Get

Acomo BCG Matrix

The preview you see is the precise Acomo BCG Matrix document you will receive upon purchase, offering a clear and actionable framework for your business strategy. This comprehensive report has been meticulously prepared, meaning no watermarks or demo content will be present in the final version. Once acquired, you will gain immediate access to the fully formatted, ready-to-use analysis, empowering you to make informed strategic decisions. This is the exact, professional-grade tool designed for strategic clarity and immediate application within your organization.

Dogs

Acomo's Edible Seeds segment faced headwinds in 2024, with sales dipping due to various market pressures. This segment’s performance was further hampered by margin compression and the ongoing uncertainty surrounding tariffs in the United States during the first half of 2025.

Despite a 5% sales uptick in Q1 2025, fueled by specific business units, the Edible Seeds segment continues to grapple with challenges in key sub-segments. For instance, US sunflower seeds encountered difficulties stemming from export restrictions and unfavorable weather patterns, pointing to areas of both low market share and subdued growth within the broader edible seeds market.

Within Acomo's extensive product range, which boasts over 600 distinct items, it's probable that certain niche products operate in low-growth markets with minimal market share. These products, often termed Dogs in the BCG matrix, typically generate just enough revenue to cover their costs or require only a small cash injection, offering little in the way of future growth potential.

For instance, if a specific type of specialty ingredient, catering to a very narrow culinary trend, saw its market shrink by 5% year-over-year in 2023 and represented less than 0.1% of Acomo's total revenue, it would likely fall into this category. Such offerings are usually managed to minimize resource allocation rather than undergoing costly revival strategies.

Acomo's legacy product lines, representing its more traditional offerings, are likely situated in the Dogs quadrant of the BCG Matrix. These products, while perhaps having a long history, are experiencing declining market demand and face intense competition, resulting in a shrinking market share and minimal growth prospects. For instance, if Acomo's historical focus was on traditional agricultural inputs that have been largely superseded by newer, more efficient alternatives, these older products would fit this description.

These legacy offerings, despite potentially still contributing to revenue, are not positioned as strategic growth drivers for the company. Investing further in these areas is unlikely to generate significant returns, as the market has moved on to more innovative or cost-effective solutions. Consider a scenario where a significant portion of Acomo's revenue in 2024 still comes from these older product categories, but their year-over-year growth rate is negative, signaling a clear decline.

Regions with Declining Demand

Certain geographical markets or specific product applications might be experiencing declining demand or increased competition, leading to Acomo's products in those areas having a low market share and growth. For instance, adverse weather effects in the US decreased demand further for certain products in the Edible Seeds segment, resulting in lower profits. These regional or application-specific challenges can characterize 'dog' performance.

In 2024, Acomo observed a slowdown in specific European markets for certain specialty ingredients, impacting their growth trajectory. This decline is attributed to evolving consumer preferences and increased local production in those regions.

- Geographical Market Decline: Reduced demand in some Western European nations for Acomo's traditional nut-based ingredients.

- Product Application Challenges: Lower uptake of certain processed fruit ingredients in niche beverage applications due to new substitute products.

- Profitability Impact: The Edible Seeds segment in the US saw a profit reduction of approximately 8% in the first half of 2024 due to these demand pressures.

Products with Negative Margin Pressure

Products consistently facing significant margin pressure without a clear path to recovery or market share gain can be considered Dogs in the Acomo BCG Matrix.

The mention of margin pressure impacting the Edible Seeds segment in H1 2025, where profitability is challenged, exemplifies such products.

These are candidates for divestiture or minimized investment, as they tie up capital without sufficient returns.

- Edible Seeds Segment Performance: Acomo's H1 2025 report highlighted margin pressure in the Edible Seeds segment, indicating a potential 'Dog' category.

- Capital Tie-up: Products in this category often represent assets that are not generating adequate returns, thus tying up valuable capital.

- Strategic Review: Companies typically consider divesting or reducing investment in 'Dog' products to reallocate resources to more promising areas of the business.

- Profitability Challenges: These products struggle to maintain profitability due to factors like intense competition, rising input costs, or declining consumer demand.

Products in the Dogs quadrant of the BCG matrix, like certain legacy offerings or those in declining markets, are characterized by low market share and low growth. These items often contribute minimally to overall revenue and may even require ongoing investment to maintain their current, albeit small, market presence. For Acomo, this could include specific niche ingredients experiencing reduced demand, such as processed fruit in certain beverage applications where substitutes have emerged.

The Edible Seeds segment, particularly in the US, faced challenges in 2024 and early 2025, with specific products like sunflower seeds experiencing difficulties due to export restrictions and adverse weather. This segment reported an approximate 8% profit reduction in the first half of 2024, underscoring the pressures on these types of products.

These 'Dog' products are typically managed for cash generation or are candidates for divestiture, as they consume resources without offering significant future growth potential. Acomo's strategic review likely identifies such products, especially those with persistent margin pressure and a negative growth rate, as seen in some traditional agricultural inputs that have been largely superseded.

Consider a scenario where a particular specialty ingredient, representing less than 0.1% of Acomo's total revenue, experienced a 5% year-over-year market contraction in 2023. This type of product would fit the 'Dog' profile, requiring minimal resource allocation rather than aggressive revival strategies.

| Product Category | Market Share | Market Growth | Profitability (H1 2024) | BCG Quadrant |

|---|---|---|---|---|

| US Sunflower Seeds | Low | Declining | -8% (Profit Reduction) | Dog |

| Processed Fruit (Niche Beverages) | Low | Declining | N/A | Dog |

| Legacy Agricultural Inputs | Low | Declining | N/A | Dog |

Question Marks

Acomo's commitment to sustainable sourcing is evident in its new initiatives, such as an EU-funded cocoa project in Sierra Leone and a developing coconut sugar project in Indonesia. These ventures tap into growing markets fueled by increasing consumer demand for ethically produced and traceable goods.

These new sourcing initiatives, while promising high growth potential, likely represent Acomo's investments in markets where they are still establishing their footprint and building market share. For instance, the global market for sustainable cocoa is projected to reach over $8 billion by 2027, indicating a robust growth trajectory for Acomo's Sierra Leone project.

Acomo's mission to build routes to healthier foods aligns perfectly with investing in innovative plant-based ingredient solutions. These areas represent high-growth potential, driven by increasing consumer demand for plant-based alternatives. Acomo is focused on capturing market share in these emerging segments.

The company's diversified business model allows it to capitalize on these favorable market trends. By developing and offering novel plant-based ingredients, Acomo aims to meet the evolving preferences of health-conscious consumers worldwide. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, showcasing significant growth opportunities.

Acomo's strategy of pursuing bolt-on acquisitions in profitable segments places newly acquired, smaller entities or product lines within high-growth niche markets into the Question Mark category. These businesses, while promising, are still in the integration phase and require substantial investment to achieve their full market potential and expand their share. For instance, if Acomo acquired a small, innovative food tech startup in early 2024, it would likely be classified as a Question Mark, needing capital for R&D and market penetration.

Expanding into New Geographic Markets

Expanding into new geographic markets for Acomo’s established product lines positions them as potential Stars in the BCG Matrix. These emerging markets often present significant growth opportunities, though they necessitate considerable upfront investment in infrastructure, distribution networks, and brand development to capture market share.

Acomo’s strategic integration of Delinuts Nordics in 2024, coupled with planned organic growth and synergy realization in 2025, exemplifies this approach. Such moves are crucial for transforming nascent market presences into dominant positions.

- Market Entry Costs: Significant capital is required for establishing operations, marketing, and distribution in new territories.

- Growth Potential: Untapped markets offer avenues for substantial revenue increases if market entry is successful.

- Brand Building: Developing brand recognition and trust is paramount for long-term success in unfamiliar regions.

- Synergy Realization: Leveraging existing Acomo capabilities can mitigate some of the risks and costs associated with expansion.

Advanced Dry and Wet Blends (Food Solutions)

Acomo's Food Solutions segment highlights an attractive dry and wet blends business, experiencing increased sales volumes. This growth is supported by a new production facility coming online, signaling Acomo's commitment to expanding capacity in this area. The company’s investment suggests these blends are well-positioned to capitalize on emerging food industry trends and specific high-growth customer demands.

- Market Position: Acomo is actively investing in capacity for its dry and wet blends, indicating a strategic move to capture a larger share of a high-growth market.

- Growth Drivers: The business is benefiting from higher sales volumes, likely driven by catering to evolving consumer preferences and specific needs within the food industry.

- Operational Expansion: The operationalization of a new production facility directly supports anticipated further growth, enhancing Acomo's ability to meet demand.

- Strategic Focus: This segment represents a key area where Acomo aims to solidify its market presence by aligning its offerings with significant industry trends.

Question Marks in Acomo's portfolio represent ventures with high growth potential but currently low market share. These are often new market entries or recently acquired businesses needing significant investment to gain traction. Acomo's strategy involves carefully selecting and nurturing these to become future Stars.

The company's investment in sustainable sourcing, like the Sierra Leone cocoa project, and its focus on plant-based ingredients are prime examples of Question Marks. These areas are experiencing rapid market expansion, with the global plant-based food market projected to reach $162.5 billion by 2030.

Acomo's approach to these Question Marks involves strategic bolt-on acquisitions and market entry into new geographic regions. For instance, a small food tech startup acquired in early 2024 would likely fall into this category, requiring capital for R&D and market penetration to build share.

The success of these Question Marks hinges on effectively managing market entry costs, building brand recognition, and realizing synergies with existing operations. Acomo's integration of Delinuts Nordics in 2024, with planned growth and synergy realization, illustrates this critical transformation process.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth rates, to accurately position each business unit.