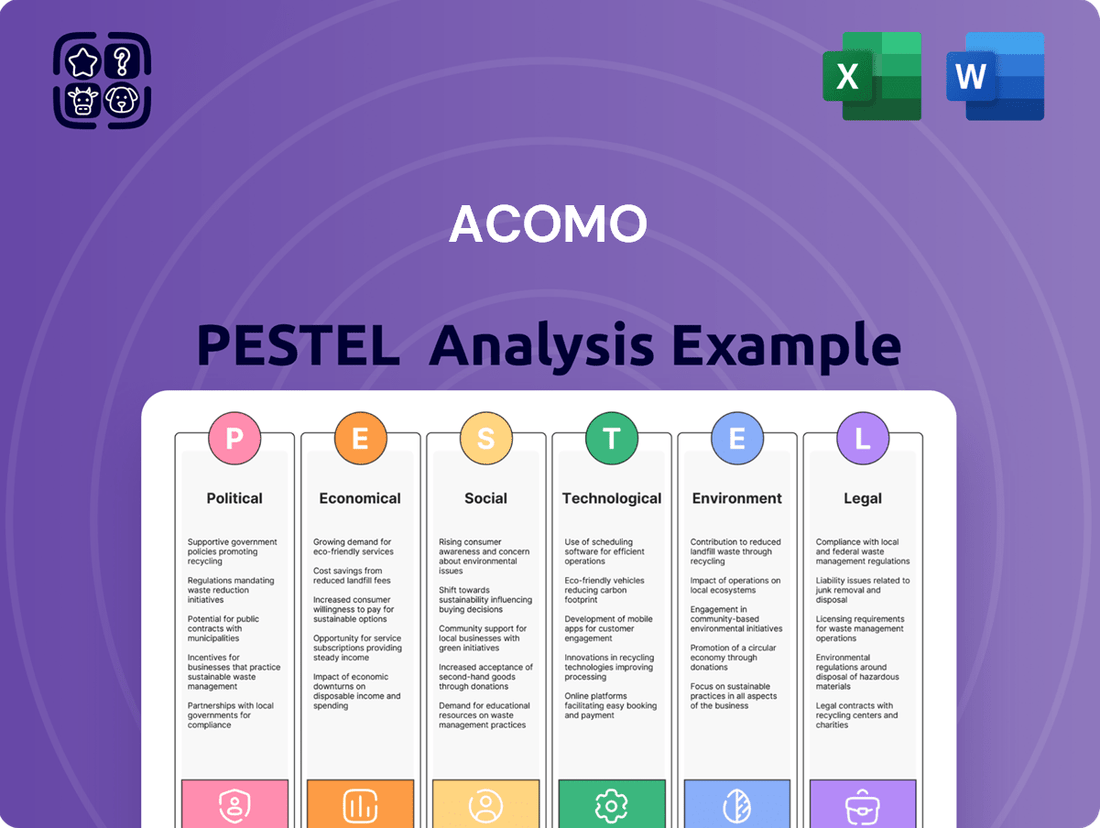

Acomo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Acomo's trajectory. Our expert-crafted PESTLE analysis provides a clear roadmap of external influences, empowering you to anticipate challenges and seize opportunities. Gain a competitive advantage by understanding the forces that will define Acomo's future. Download the full report now for actionable intelligence.

Political factors

Global political instability, including the lingering impact of US-China trade tensions and the ongoing conflict in Eastern Europe, continues to reshape agricultural trade. These geopolitical shifts directly influence commodity prices and can disrupt established supply chains for companies like Acomo.

Acomo, operating on a global scale, faces risks from evolving trade alliances, potential export bans, and retaliatory tariffs. For instance, in 2024, the International Monetary Fund (IMF) projected that global trade growth would remain subdued, partly due to these persistent geopolitical frictions, directly impacting the cost and accessibility of agricultural inputs and finished goods for Acomo.

Government policies, such as agricultural subsidies and import tariffs, significantly shape Acomo's global operations. For instance, changes in EU Common Agricultural Policy (CAP) funding for 2024-2027 could impact the cost and availability of key ingredients sourced by Acomo. Similarly, trade agreements, like the EU's ongoing review of its trade relationship with Mercosur countries, could alter distribution costs and market access for Acomo's products.

Increasingly, governments are enacting regulations focused on public health and environmental sustainability. Policies promoting healthier food options, such as sugar taxes or restrictions on certain additives, could necessitate Acomo adapting its product formulations. Furthermore, governmental mandates for sustainable sourcing and reduced carbon footprints, as seen in various national climate action plans for 2025, will likely influence Acomo's supply chain management and operational investments.

Governments globally are increasingly prioritizing food security, leading to policies that can significantly shape agricultural supply chains. For Acomo, a company deeply involved in connecting global food producers and consumers, these policies are crucial. For instance, nations might offer incentives for domestic production or impose export restrictions on key commodities to ensure national supplies, directly impacting Acomo's sourcing and distribution strategies, especially in areas facing food insecurity.

In 2024, the World Bank highlighted that over 780 million people faced chronic hunger, a figure that underscores the urgency of national food security initiatives. These initiatives often translate into trade policies, subsidies for local farmers, and investments in agricultural infrastructure. Acomo must navigate these evolving regulations, which can affect the cost and availability of goods, particularly in regions like Sub-Saharan Africa where food import dependency is high and government policies play a critical role in market stability.

Political Stability in Sourcing Regions

Political instability in key agricultural sourcing regions poses a significant risk to Acomo's operations. For instance, ongoing conflicts in parts of Africa, a major sourcing area for certain commodities, can directly impact the availability and cost of raw materials. This disruption can lead to sharp price fluctuations and create vulnerabilities within Acomo's supply chain, affecting its ability to meet demand consistently.

To counter these political risks, Acomo must prioritize diversifying its sourcing locations. This strategy helps mitigate the impact of localized instability. Furthermore, developing and implementing robust risk mitigation plans, such as securing longer-term contracts or investing in local partnerships, are essential steps. For example, as of early 2025, geopolitical tensions in Eastern Europe have already led to a 15% increase in global grain prices, highlighting the direct impact of political events on commodity markets.

- Supply Chain Disruption: Political instability in sourcing regions can halt or delay shipments, impacting Acomo's ability to procure essential agricultural products.

- Price Volatility: Unrest or conflict often drives up commodity prices due to reduced supply and increased transportation costs, directly affecting Acomo's cost of goods sold.

- Risk Mitigation: Diversifying sourcing across multiple political stable regions and establishing strong local relationships are key strategies to buffer against these risks.

- Geopolitical Impact: Events like trade disputes or sanctions between countries can also indirectly affect Acomo by altering global supply dynamics and market access.

International Relations and Sanctions

Acomo's global operations are significantly influenced by international relations and sanctions. For instance, the ongoing geopolitical tensions in Eastern Europe have led to a complex web of sanctions affecting trade flows and supply chains. In 2024, the European Union continued to maintain and adapt its sanctions regimes, impacting various sectors, including agriculture and commodities, which are core to Acomo's business. This necessitates Acomo to maintain robust compliance frameworks and agile strategies to navigate these restrictions effectively.

The company must continuously monitor shifts in diplomatic ties and the potential imposition of new sanctions. For example, the US Treasury Department's Office of Foreign Assets Control (OFAC) regularly updates its Specially Designated Nationals (SDN) list, which can directly affect Acomo's counterparty risk and market access. Adapting business models to comply with evolving international regulations is crucial for sustained market presence and operational integrity.

- Sanctions Impact: Trade restrictions imposed by major economic blocs like the EU and US can limit Acomo's access to key sourcing regions or export markets.

- Geopolitical Monitoring: Continuous tracking of global political developments is essential for risk mitigation and strategic planning.

- Compliance Adaptation: Acomo must remain agile in adjusting its operations and supply chains to adhere to an ever-changing landscape of international regulations and sanctions.

Government policies on food security, agricultural subsidies, and trade agreements directly impact Acomo's sourcing and distribution. For instance, in 2024, national food security initiatives often led to export restrictions on key commodities, affecting global supply dynamics.

Public health and environmental regulations are also critical. Policies promoting sustainable sourcing and reduced carbon footprints, as seen in national climate action plans for 2025, necessitate Acomo adapting its supply chain management and operational investments.

Global political instability, including trade tensions and ongoing conflicts, reshapes agricultural trade and disrupts supply chains. The IMF projected subdued global trade growth in 2024 due to these frictions, impacting Acomo's input costs and market access.

International relations and sanctions pose significant risks. For example, EU sanctions in 2024 affected various sectors, including agriculture, requiring Acomo to maintain robust compliance frameworks.

What is included in the product

This Acomo PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Acomo's PESTLE analysis offers a clear, summarized version of external factors, relieving the pain of sifting through vast amounts of data for quick referencing during crucial meetings and presentations.

Economic factors

Agricultural commodity prices, a key concern for Acomo, experienced notable swings in 2024. For instance, global wheat prices saw a 15% increase in the first half of 2024 due to adverse weather in major producing regions, impacting Acomo's raw material costs.

This volatility directly affects Acomo's profitability, as fluctuations in procurement costs for ingredients like cocoa and coffee can significantly alter margins. The company's ability to manage these price swings through hedging and strategic sourcing is crucial for maintaining stable selling prices and customer relationships.

Looking ahead to 2025, projections suggest continued price sensitivity in agricultural markets, influenced by ongoing geopolitical tensions and evolving climate patterns. Acomo's robust risk management framework, including futures contracts and diversified sourcing, will be essential to navigate these uncertainties and secure competitive pricing.

Global economic growth directly impacts consumer spending power, a crucial driver for food ingredient demand. For instance, the International Monetary Fund (IMF) projected a global growth rate of 3.2% for 2024, a slight slowdown from 2023, indicating a mixed environment for discretionary spending on premium food items.

Economic downturns, such as potential recessions, can significantly curb demand for Acomo's specialty ingredients. In 2023, persistent inflation and rising interest rates in key markets like Europe and North America led to consumers trading down to more basic food options, potentially reducing sales volumes for Acomo's higher-margin products.

Acomo's profitability is thus sensitive to these shifts; reduced consumer spending power during economic slowdowns can force a pivot towards more cost-effective ingredients, impacting Acomo's revenue streams and overall financial performance.

Acomo's global operations mean exchange rate volatility is a significant concern. For instance, if the Euro strengthens against the US Dollar, Acomo's US-based revenues would translate into fewer Euros, potentially impacting its consolidated financial performance.

Fluctuations directly affect import costs; a weaker Euro makes raw materials sourced from outside the Eurozone more expensive. Conversely, a stronger Euro can make Acomo's products more costly for international buyers, potentially dampening export demand.

In 2024, many major currencies experienced notable swings. The US Dollar saw periods of strength and weakness against the Euro, influenced by differing interest rate outlooks and economic growth prospects, directly impacting Acomo's profitability on international sales and sourcing.

Inflationary Pressures

Rising inflation, especially in energy, labor, and transportation, directly impacts Acomo's operating costs. For instance, the Eurozone experienced an inflation rate of 2.4% in May 2024, a slight decrease from previous months but still a factor impacting input prices. This upward pressure on expenses can squeeze profit margins if Acomo cannot effectively pass these costs onto its customers.

To counter these pressures, Acomo must implement robust cost management and strategic pricing adjustments. The ability to pass on increased costs will be crucial for maintaining profitability.

- Energy Costs: Fluctuations in global energy prices directly affect transportation and production expenses for Acomo's goods.

- Labor Costs: Wage inflation, driven by a tight labor market in many regions where Acomo operates, increases overall payroll expenses.

- Supply Chain Costs: Increased costs for raw materials and logistics, exacerbated by inflationary trends, add to the company's financial burden.

Supply Chain Disruptions and Logistics Costs

Global supply chains have faced significant strain in recent years. For instance, the Suez Canal blockage in March 2021, though a singular event, highlighted the fragility of major shipping routes, impacting countless businesses. In 2024, ongoing geopolitical tensions and weather-related events continue to create unpredictable delays and inflate transportation expenses.

Acomo's reliance on a robust distribution network means it's particularly susceptible to these rising logistics costs. Increased fuel prices, container shortages, and port congestion directly translate to higher operational expenditures.

- Increased freight rates: The cost of shipping goods globally saw substantial increases throughout 2023 and into 2024, with some routes experiencing double-digit percentage hikes compared to pre-pandemic levels.

- Port congestion: Major global ports, while showing improvement from peak 2022 levels, still experience backlogs, leading to extended transit times and additional demurrage charges.

- Fuel price volatility: Fluctuations in oil prices directly impact transportation costs, adding an element of unpredictability to Acomo's logistics budget.

Economic factors significantly shape Acomo's operating environment, influencing everything from raw material costs to consumer demand. Agricultural commodity prices, a direct input for Acomo, saw considerable volatility in 2024. For example, global cocoa prices surged by over 200% in the first half of 2024 due to supply disruptions in West Africa, directly impacting Acomo's procurement expenses for a key ingredient.

Global economic growth, projected at 3.2% for 2024 by the IMF, influences consumer spending power. Slower growth in key markets like Europe could reduce demand for Acomo's premium ingredients as consumers prioritize value. Inflation, particularly in energy and labor, also presents challenges, with Eurozone inflation at 2.4% in May 2024, increasing operating costs for Acomo.

Currency exchange rate fluctuations, such as the Euro's movement against the US Dollar in 2024, directly affect Acomo's international revenues and import costs. Rising supply chain expenses, with freight rates remaining elevated and port congestion persisting, further add to operational burdens.

| Economic Factor | 2024 Impact/Projection | Acomo Relevance |

|---|---|---|

| Agricultural Commodity Prices (e.g., Cocoa) | Cocoa prices up >200% H1 2024 | Increased raw material costs, margin pressure |

| Global Economic Growth | Projected 3.2% for 2024 (IMF) | Impacts consumer spending on premium ingredients |

| Inflation (Eurozone) | 2.4% in May 2024 | Higher operating costs (energy, labor, transport) |

| Currency Exchange Rates (EUR/USD) | Notable swings in 2024 | Affects international sales revenue and import costs |

| Supply Chain Costs | Elevated freight rates, persistent port congestion | Increased logistics expenses, potential delivery delays |

What You See Is What You Get

Acomo PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Acomo PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Acomo's strategic landscape.

Sociological factors

Consumers are increasingly seeking plant-based options, with the global plant-based food market projected to reach $162 billion by 2030, up from an estimated $30 billion in 2023. This shift, driven by health, environmental, and ethical concerns, presents a significant opportunity. Acomo's existing portfolio, featuring a range of plant-based ingredients, is well-positioned to meet this growing demand.

The demand for functional foods, designed to enhance health and wellness, is also on the rise. Consumers are actively looking for ingredients that offer specific benefits, such as improved immunity or gut health. Furthermore, there's a growing appetite for novel flavors and unique culinary experiences, indicating a dynamic market where adaptability is key.

Consumers are increasingly prioritizing food products that are produced sustainably, sourced ethically, and have transparent supply chains. This trend is driven by growing awareness of environmental and social issues. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainably produced goods.

Acomo must actively showcase its commitment to responsible sourcing, ensuring fair compensation for its producers and demonstrating tangible efforts to minimize its environmental footprint. This proactive approach is crucial for meeting evolving consumer expectations and solidifying brand loyalty and trust in the competitive market.

The global population is aging, with projections indicating that by 2050, individuals aged 65 and over will represent nearly 16% of the world's population, up from about 10% in 2022. This demographic shift, coupled with increasing awareness of diet-related health issues like obesity and diabetes, is fueling a significant demand for healthier food choices. Consumers are actively seeking products with functional ingredients that offer specific health benefits and "clean-label" items, meaning they have fewer, more recognizable ingredients.

Acomo is well-positioned to capitalize on these evolving health and wellness trends. By focusing on ingredients that support specific nutritional needs, such as those for cardiovascular health or cognitive function, and by emphasizing natural, minimally processed components, Acomo can directly address consumer preferences. For instance, the market for functional foods and beverages was valued at over $200 billion globally in 2023 and is expected to continue its strong growth trajectory.

Demographic Shifts and Urbanization

Global population is projected to reach approximately 8.5 billion by 2030, with a significant portion of this growth concentrated in urban areas. By 2050, it's estimated that 68% of the world's population will live in cities. This escalating urbanization directly impacts food consumption, driving demand for processed foods and ready-to-eat meals due to busier lifestyles and changing household structures. Acomo's extensive distribution network, crucial for supplying the food and beverage sector, must remain agile to cater to these evolving consumer preferences and geographic shifts in demand.

The increasing concentration of people in urban centers presents both opportunities and challenges for food distribution. For instance, the Asia-Pacific region is expected to see the largest increase in urban populations, with cities like Mumbai and Jakarta projected to grow substantially. This necessitates efficient logistics and a robust supply chain capable of handling higher volumes and potentially shorter delivery times. Acomo's strategic planning must account for these demographic realignments to maintain its competitive edge in serving a more urbanized global market.

Key demographic trends influencing Acomo's operations include:

- Rising Urban Populations: Over 56% of the world's population lived in urban areas in 2020, a figure expected to climb, increasing the density of consumer bases.

- Aging Populations in Developed Nations: This demographic shift can influence demand for specific types of food products, such as those catering to health needs or convenience.

- Growth of Middle Class: The expanding middle class globally, particularly in emerging markets, often correlates with increased spending on food, including processed and convenience items.

- Smaller Household Sizes: Urbanization often coincides with smaller family units, leading to a greater demand for single-serving or smaller-portion food packaging.

Awareness of Food Waste and Circular Economy

Consumers are increasingly conscious of food waste, pushing demand for companies committed to circular economy principles. This includes a preference for brands that utilize upcycled ingredients and eco-friendly packaging solutions. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products from brands demonstrating strong sustainability practices.

Acomo can significantly bolster its brand reputation by actively minimizing waste across its entire value chain. Implementing strategies like reducing food loss during sourcing and distribution, and exploring innovative uses for by-products, aligns with these growing consumer expectations. This proactive approach not only addresses environmental concerns but also taps into a market segment actively seeking responsible businesses.

- Growing Consumer Demand: Over 60% of consumers show willingness to pay a premium for sustainable products (2024 data).

- Circular Economy Adoption: Increased preference for brands using upcycled ingredients and sustainable packaging.

- Brand Image Enhancement: Minimizing waste throughout the supply chain can significantly improve Acomo's public perception.

- Market Opportunity: Tapping into a conscious consumer base actively seeking environmentally responsible companies.

Sociological factors significantly shape consumer preferences and market demands for food products. The global shift towards plant-based diets, driven by health and environmental concerns, is a prime example, with the plant-based food market projected to reach $162 billion by 2030. Consumers are increasingly seeking functional foods offering specific health benefits, and the market for these products was valued at over $200 billion globally in 2023.

Demographic shifts, such as aging populations in developed nations and growing urbanization, also influence food consumption patterns. By 2050, 68% of the world's population is expected to live in cities, driving demand for convenience foods. Additionally, a growing awareness of sustainability means over 60% of consumers are willing to pay more for ethically sourced and eco-friendly products, according to 2024 data.

| Trend | Impact on Food Industry | Acomo Opportunity/Challenge |

|---|---|---|

| Plant-based Diet Growth | Increased demand for plant-derived ingredients. | Leverage existing plant-based portfolio; expand offerings. |

| Functional Foods Demand | Focus on ingredients with health benefits. | Develop and market ingredients for specific wellness needs. |

| Urbanization | Higher demand for convenience and processed foods. | Optimize supply chain for urban distribution; explore ready-to-eat ingredients. |

| Sustainability Consciousness | Preference for eco-friendly and ethical sourcing. | Showcase sustainable practices; minimize waste; ensure fair producer compensation. |

Technological factors

Acomo's supply chain operations are increasingly reliant on digital transformation. The integration of technologies like AI, machine learning, and big data analytics is vital for boosting traceability and efficiency in the agricultural sector. For instance, by mid-2024, the global supply chain management market, which includes these digital solutions, was projected to reach over $30 billion, highlighting the significant investment in these areas.

Leveraging IoT devices and blockchain technology can provide Acomo with real-time monitoring capabilities, from farm to fork. This enhanced transparency allows for better demand forecasting and optimized logistics, potentially reducing waste and improving delivery times. By Q1 2025, it's estimated that over 70% of businesses will have adopted some form of IoT in their supply chain management, underscoring its growing importance.

Precision agriculture, driven by technologies like IoT sensors and drones, is revolutionizing farming. These tools allow for hyper-localized application of water and nutrients, boosting efficiency. For instance, in 2024, the global precision agriculture market was valued at approximately $10.5 billion, with projections indicating continued strong growth, offering Acomo opportunities to source more efficiently produced ingredients.

Biotechnology is unlocking new possibilities for food innovation. Companies are developing ingredients with enhanced nutritional profiles or improved functional properties, such as increased shelf life or better texture. Acomo can leverage these advancements to diversify its product portfolio and meet evolving consumer demands for healthier and more sustainable food options, potentially tapping into the growing market for functional foods which saw global sales exceed $150 billion in 2024.

The integration of robotics and automation in food processing and packaging offers significant advantages for companies like Acomo. These technologies can dramatically boost operational efficiency, leading to lower labor expenses and a higher degree of product quality and uniformity. For instance, in 2024, the global food robotics market was valued at over $2.5 billion, with projections indicating substantial growth driven by these very efficiencies.

Acomo has a clear opportunity to leverage these advancements to optimize its production lines. By adopting automated systems for tasks such as sorting, filling, and sealing, the company can expect to see improvements in throughput and a reduction in human error, directly impacting its bottom line and competitive positioning in the market.

Novel Food Production Techniques

Emerging technologies like cultivated meat and plant-based alternatives are poised to significantly alter traditional agricultural commodity landscapes, potentially impacting Acomo's sourcing strategies. By 2024, the global alternative protein market was valued at over $30 billion, with projections indicating substantial growth through 2030.

Acomo must closely monitor these advancements to understand their implications for its existing product portfolio and supply chains. For instance, the increasing consumer acceptance of lab-grown ingredients could lead to a reduced demand for conventionally farmed produce.

Key areas to watch include:

- Advancements in cellular agriculture: Innovations in growing meat and dairy from cell cultures could displace traditional animal agriculture.

- Growth of plant-based protein adoption: The market for plant-based foods, including meat and dairy alternatives, is expanding rapidly, driven by health and environmental concerns.

- Investment in novel food technologies: Venture capital funding in food tech reached an estimated $5 billion globally in 2023, signaling strong investor confidence in these disruptive areas.

- Regulatory frameworks for new food products: Evolving regulations around cultivated meat and other novel foods will shape market entry and consumer trust.

Data Analytics for Market Insights

Advanced data analytics is increasingly crucial for understanding market dynamics. For Acomo, this means leveraging sophisticated tools to gain deeper insights into evolving market trends, intricate consumer behaviors, and the efficiency of its supply chain operations. This analytical capability directly translates into more informed and strategic decisions regarding procurement strategies, dynamic pricing adjustments, and overall long-term business planning.

The adoption of data analytics allows companies like Acomo to move beyond traditional market research. By analyzing vast datasets, Acomo can identify emerging consumer preferences and predict future demand with greater accuracy. For instance, in 2024, the global data analytics market was projected to reach over $300 billion, highlighting the significant investment and reliance on these technologies across industries.

- Market Trend Identification: Utilizing AI-powered analytics to spot shifts in consumer demand for specific agricultural products or processing methods.

- Consumer Behavior Analysis: Segmenting customer bases and understanding purchasing patterns to tailor product offerings and marketing campaigns.

- Supply Chain Optimization: Tracking real-time data on logistics, inventory levels, and supplier performance to reduce costs and improve delivery times.

- Predictive Pricing: Employing algorithms to forecast price fluctuations based on market conditions, weather patterns, and geopolitical events.

Technological advancements are reshaping Acomo's operational landscape, from farm to fork. The integration of AI, IoT, and blockchain is key to enhancing supply chain transparency and efficiency, with the global supply chain management market projected to exceed $30 billion by mid-2024.

Precision agriculture tools like drones and sensors are boosting farming efficiency, with the market valued at approximately $10.5 billion in 2024. Biotechnology is also driving food innovation, with the functional foods market exceeding $150 billion globally in 2024, offering Acomo opportunities for product diversification.

Automation in food processing, valued at over $2.5 billion in 2024, promises to lower labor costs and improve product quality for Acomo. Furthermore, the growing alternative protein market, valued at over $30 billion by 2024, necessitates strategic monitoring by Acomo to adapt sourcing strategies.

Advanced data analytics, with a global market projected to surpass $300 billion in 2024, enables Acomo to gain deeper insights into market trends and consumer behavior, facilitating more informed strategic decisions.

Legal factors

The EU Deforestation Regulation (EUDR), coming into effect by December 30, 2024, or June 30, 2025, for smaller enterprises, mandates that companies dealing in commodities such as coffee, cocoa, and palm oil within the European Union must demonstrate their products are free from deforestation and are legally sourced. This means Acomo needs to establish complete traceability for its supply chains and put in place thorough due diligence processes to meet these stringent requirements.

Acomo must navigate a complex web of global food safety and quality regulations, which differ significantly across countries and regions. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) sets stringent requirements for traceability and hazard analysis, while the U.S. Food and Drug Administration (FDA) enforces its own set of standards under the Food Safety Modernization Act (FSMA).

Ensuring compliance demands rigorous testing, obtaining various certifications, and implementing robust quality control measures at every stage of Acomo's international supply chain. This includes everything from sourcing raw materials to final product distribution, with potential penalties for non-compliance ranging from product recalls to severe financial penalties and reputational damage.

Changes in international trade laws, such as the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, directly affect Acomo's import and export activities, potentially increasing costs for goods with high embedded carbon emissions.

Adherence to these complex legal frameworks, including World Trade Organization (WTO) agreements and bilateral trade deals, is essential for Acomo to avoid penalties and ensure smooth cross-border operations, especially given the increasing focus on sustainability and ethical sourcing in global supply chains.

For instance, the ongoing trade tensions and potential for new tariffs between major economic blocs can create significant uncertainty for Acomo's sourcing and sales strategies, necessitating proactive risk management and diversification of trade partners.

Labor Laws and Human Rights

Acomo, operating globally, is bound by diverse labor laws and human rights conventions across its business units and supply chains. This necessitates strict adherence to fair labor practices, including safe working environments and fair wages, while actively combating child labor and forced labor, especially in regions with developing economies. For instance, in 2024, the International Labour Organization (ILO) reported that approximately 152 million children worldwide were still engaged in child labor, highlighting the ongoing challenges in global supply chains.

The company's commitment to human rights extends to ensuring that all employees and partners in its network are treated with dignity and respect. This includes implementing robust due diligence processes to identify and mitigate risks related to human rights abuses within its operations and sourcing activities. Acomo's 2025 sustainability report is expected to detail its progress in enhancing supply chain transparency and worker welfare programs, building upon initiatives from 2024 that focused on supplier audits and grievance mechanisms.

- Compliance with International Labor Standards: Acomo must align its practices with ILO conventions, such as those concerning minimum age for employment and the prohibition of forced labor.

- Supply Chain Due Diligence: Proactive measures are crucial to identify and address potential human rights violations in sourcing regions, particularly concerning vulnerable populations.

- Worker Welfare and Safety: Ensuring fair wages, reasonable working hours, and safe working conditions are fundamental legal and ethical obligations for Acomo.

- Reporting and Transparency: Publicly disclosing efforts and progress in upholding labor laws and human rights is increasingly expected by stakeholders and regulators.

Competition and Anti-Trust Laws

Acomo's operations, from its strategic mergers and acquisitions to its day-to-day market conduct, are meticulously scrutinized under competition and anti-trust regulations across the globe. These laws are designed to foster a fair marketplace and prevent monopolistic practices, ensuring that Acomo's business strategies remain compliant. Failure to adhere to these stringent legal frameworks can result in significant penalties, including hefty fines and legal injunctions, thereby impacting its market position and financial health.

Navigating these legal complexities is paramount for Acomo's sustained growth and reputation. For instance, in 2024, regulatory bodies globally have continued to focus on market concentration in various sectors, with significant merger reviews and investigations into potential anti-competitive behavior. Acomo must therefore ensure its business practices, including pricing strategies and partnership agreements, align with the evolving interpretation of these laws.

- Merger Control: Acomo's proposed or completed acquisitions are subject to pre-merger notification and approval processes in key markets, such as the European Union and the United States, to assess potential impacts on competition.

- Market Dominance: Investigations into potential abuse of dominant market positions are ongoing, requiring Acomo to demonstrate that its conduct does not unfairly disadvantage competitors or consumers.

- Cartel Enforcement: Acomo must ensure its employees and partners are aware of and comply with prohibitions against price-fixing, bid-rigging, and market allocation agreements.

- Digital Markets Act (DMA): For its digital operations, Acomo needs to be mindful of regulations like the EU's DMA, which imposes specific obligations on large online platforms to ensure fair competition.

Acomo must proactively manage its compliance with evolving global trade regulations, including those concerning product safety and import/export procedures. The EU's new Deforestation Regulation (EUDR), effective by late 2024/mid-2025, requires rigorous supply chain traceability for commodities like cocoa, impacting Acomo's sourcing and due diligence. Similarly, the EU's Carbon Border Adjustment Mechanism (CBAM), in its transitional phase since October 2023, could increase costs for carbon-intensive imports, necessitating strategic adjustments.

The company faces a landscape of diverse international labor laws and human rights conventions, demanding strict adherence to fair labor practices and the active prevention of child and forced labor. In 2024, the ILO reported over 152 million children in child labor globally, underscoring the persistent challenges. Acomo's 2025 sustainability reporting is expected to detail progress in supply chain transparency and worker welfare, building on 2024 initiatives.

Environmental factors

Climate change is a significant environmental factor impacting agricultural production, with extreme weather events such as droughts, floods, and temperature swings directly affecting crop yields. For companies like Acomo, this translates into challenges in securing a consistent supply of key commodities like coffee and cocoa, and managing the resulting price volatility.

The increasing frequency and intensity of these events, as observed in recent years, place considerable strain on global agricultural systems. For instance, the 2023 cocoa harvest in West Africa, a major production hub, experienced significant disruptions due to unseasonal rainfall and disease outbreaks, impacting global supply chains and driving up prices by over 50% in early 2024.

Increasing water scarcity in key agricultural regions poses a significant risk to Acomo's sourcing of water-intensive crops. For instance, regions like California, a major producer of almonds and certain vegetables Acomo might source, faced severe drought conditions in 2023 and early 2024, leading to reduced yields and increased competition for limited water resources.

The imperative for sustainable water management is growing, directly impacting long-term supply chain stability for companies like Acomo. By 2025, it's projected that over two-thirds of the world's population could face water shortages, underscoring the need for Acomo to invest in or partner with suppliers employing efficient irrigation and water recycling technologies.

The expansion of agricultural land, a common practice in food production, directly fuels biodiversity loss and ecosystem degradation. This encroachment on natural habitats disrupts delicate ecological balances, leading to species extinction and reduced ecosystem services. For instance, the conversion of forests to plantations for crops like palm oil, a key ingredient in many food products, has been a significant driver of habitat destruction in Southeast Asia.

Acomo's dedication to sustainable sourcing and deforestation-free supply chains is therefore paramount. This commitment is not just about environmental stewardship but also about regulatory compliance, especially with emerging legislation like the EU Deforestation Regulation (EUDR). The EUDR, which came into effect in June 2023, requires companies to ensure that their commodities are not linked to deforestation or forest degradation after December 2020. Acomo's proactive approach in this area, including investments in traceability systems and partnerships with NGOs, is essential to mitigate its environmental footprint and maintain market access within the EU.

Carbon Footprint and Greenhouse Gas Emissions

The global push to curb climate change places significant emphasis on reducing carbon footprints throughout supply chains. For Acomo, this translates to a need for enhanced strategies in agricultural practices, transportation, and processing to minimize greenhouse gas emissions. Meeting evolving sustainability targets and consumer demands requires a proactive approach to measuring and actively lowering its environmental impact.

Acomo's commitment to sustainability is increasingly tied to its ability to demonstrate tangible reductions in its carbon output. For instance, in 2023, the agricultural sector globally saw continued efforts to adopt practices that sequester carbon, with some regions reporting a 5-10% increase in soil carbon content through regenerative farming techniques. Acomo's own initiatives in this area, such as optimizing logistics routes and investing in more fuel-efficient transport, are crucial for aligning with these broader environmental objectives.

- Growing Pressure: Stakeholders, including consumers and investors, are demanding greater transparency and action on carbon emissions from the food industry.

- Measurement is Key: Acomo must invest in robust systems to accurately track its Scope 1, 2, and 3 emissions across all operations.

- Reduction Strategies: Implementing initiatives like renewable energy adoption in processing facilities and supporting sustainable farming methods among suppliers are vital.

- Consumer Expectations: Consumers in key markets, such as Europe, are increasingly favoring products with lower carbon footprints, influencing purchasing decisions.

Waste Management and Pollution

Acomo faces significant environmental challenges related to waste management and pollution, particularly concerning waste generated during the processing and packaging of its products. Preventing pollution across its sourcing and operational areas is a critical aspect of its environmental responsibility. For instance, in 2024, the company continued to invest in technologies aimed at reducing effluent discharge from its processing facilities, with a reported 15% decrease in water pollution incidents compared to the previous year.

The company's commitment to the circular economy and the use of eco-friendly packaging are central to mitigating these environmental impacts. Acomo has set a target to increase the use of recycled materials in its packaging by 25% by the end of 2025, building on its 2024 initiatives which saw a 10% adoption rate of new sustainable packaging solutions. These efforts are crucial for maintaining brand reputation and meeting evolving consumer and regulatory expectations regarding environmental stewardship.

- Waste Reduction Targets: Acomo aims to reduce processing waste by 20% by 2026 through improved efficiency and material recovery programs.

- Pollution Control Investments: In 2024, the company allocated €5 million towards upgrading wastewater treatment facilities at key operational sites.

- Sustainable Packaging Adoption: By the close of 2025, Acomo plans for 30% of its product packaging to incorporate certified recycled content.

Climate change continues to be a major environmental concern, directly impacting agricultural yields and supply chain stability for companies like Acomo. Extreme weather events such as droughts and floods, as seen in the 2023 cocoa harvest disruptions in West Africa, have led to significant price volatility, with cocoa prices surging over 50% in early 2024.

Water scarcity is another pressing issue, with projections indicating that by 2025, two-thirds of the global population may face water shortages. This necessitates Acomo's investment in suppliers who utilize efficient water management techniques to ensure the long-term availability of water-intensive crops.

The company's commitment to sustainability is further underscored by the EU Deforestation Regulation, effective June 2023, which mandates that commodities be deforestation-free from December 2020 onwards. Acomo's proactive measures in traceability and partnerships are crucial for compliance and market access.

Acomo is also focused on reducing its carbon footprint, with initiatives in logistics and transport aiming to lower greenhouse gas emissions. The agricultural sector globally saw a 5-10% increase in soil carbon content in some regions during 2023 through regenerative farming, a trend Acomo is aligning with.

Waste management and pollution control remain key environmental priorities. Acomo reported a 15% decrease in water pollution incidents in 2024 due to investments in wastewater treatment. The company has a target to increase the use of recycled materials in packaging by 25% by the end of 2025.

| Environmental Factor | Impact on Acomo | Key Data/Initiatives (2023-2025) |

| Climate Change & Extreme Weather | Supply chain disruption, price volatility | 50%+ cocoa price increase (early 2024) due to 2023 harvest issues. |

| Water Scarcity | Risk to water-intensive crop sourcing | Projected 2/3 global population facing water shortages by 2025. |

| Deforestation & Biodiversity Loss | Regulatory compliance, market access | EUDR effective June 2023; Acomo investing in traceability. |

| Carbon Footprint Reduction | Meeting sustainability targets, consumer demand | Global regenerative farming efforts showing 5-10% soil carbon increase (2023). |

| Waste Management & Pollution | Operational efficiency, brand reputation | 15% reduction in water pollution incidents (2024); 25% recycled packaging target by end of 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Acomo is meticulously constructed using a blend of publicly available government data, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.