Acomo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

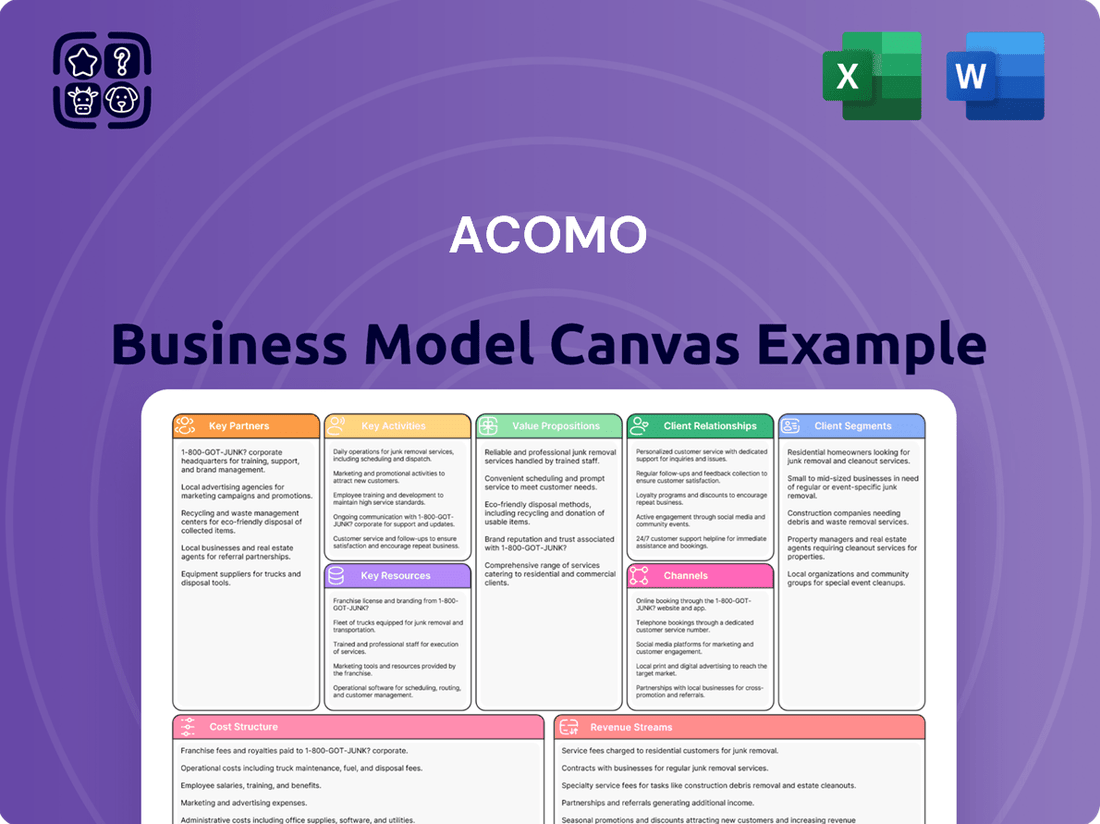

Curious about Acomo's innovative approach to business? Our Business Model Canvas provides a clear, concise overview of their core strategies, from customer relationships to revenue streams. Understand the fundamental drivers of their success and how they create value.

Ready to unlock the full strategic blueprint behind Acomo's operations? This comprehensive Business Model Canvas breaks down their customer segments, value propositions, and key resources, offering invaluable insights for your own ventures. Download the complete version to gain a competitive edge.

Partnerships

Acomo cultivates enduring partnerships with agricultural producers worldwide, securing a consistent and varied supply of key commodities such as tea, coffee, spices, nuts, and cocoa. These strategic sourcing alliances are fundamental to Acomo's business model, directly impacting its ability to meet global demand and maintain product integrity from farm to table.

In 2024, Acomo's commitment to these long-term relationships has been a cornerstone of its supply chain resilience, particularly in navigating the complexities of global agricultural markets. For example, their established networks in regions like Vietnam for pepper and Indonesia for cocoa have historically provided a buffer against price volatility and potential disruptions, ensuring a steady flow of high-quality ingredients for their customers.

Acomo relies heavily on partnerships with global logistics and shipping providers to ensure its commodities and food ingredients reach customers efficiently. These collaborations are critical for navigating complex international trade routes and guaranteeing timely delivery across continents. For instance, Acomo's commitment to a robust supply chain means working with carriers that can handle diverse cargo types and volumes, a necessity in the 2024 landscape where supply chain resilience is paramount.

Acomo's dedication to responsible sourcing is significantly bolstered by its partnerships with organizations that grant organic and sustainability certifications. These collaborations are fundamental to ensuring Acomo's commitment to ethical and environmental standards throughout its supply chain.

In 2024, Acomo advanced its focus on these critical areas by implementing its Corporate Sustainability Due Diligence procedure, utilizing the SEDEX platform. This strategic move underscores Acomo's proactive approach to upholding high ethical and environmental benchmarks.

These crucial alliances not only elevate Acomo's standing as a responsible business but also directly address the growing consumer preference for sustainably produced goods. By aligning with respected certification bodies, Acomo strengthens its brand image and meets the increasing market demand for transparency and accountability.

Acquisition Targets for Portfolio Expansion

Acomo actively pursues bolt-on acquisitions to broaden its diverse portfolio and extend its geographic reach. This strategy was evident in August 2024 with the acquisition of Delinuts Nordics, and in July 2024, Acomo acquired Caldic's nuts and dried fruit business in Northern Europe. These strategic moves, facilitated by mergers and acquisitions, are designed to spur faster growth and solidify Acomo's standing in important market sectors.

The company's approach to scaling involves a dual strategy of organic expansion and targeted acquisitions. This M&A activity is crucial for Acomo's objective of strengthening its market position and achieving accelerated growth.

- Acquisition of Delinuts Nordics: Completed in August 2024, this move expanded Acomo's Nordic presence.

- Acquisition of Caldic's nuts and dried fruit business: This Northern European acquisition, finalized in July 2024, further diversified Acomo's offerings and market penetration.

- Strategic M&A for Growth: These acquisitions are key components of Acomo's plan to achieve accelerated growth and enhance its competitive market position.

Research and Development Collaborators

Acomo actively engages with research and development collaborators to drive innovation in food ingredients. These partnerships are crucial for developing novel solutions that align with shifting consumer preferences, such as the significant growth in plant-based diets, which saw the global plant-based food market valued at approximately $27 billion in 2023 and projected to reach over $160 billion by 2030.

By collaborating with R&D partners, Acomo enhances its product portfolio and maintains a competitive advantage. For instance, in 2024, Acomo announced a partnership with a leading university research institute to explore advanced extraction techniques for plant proteins, aiming to improve texture and functionality in meat alternatives.

- Innovation Focus: Collaborations enable Acomo to develop new food ingredients and solutions, addressing trends like the rising demand for plant-based foods. The plant-based food market was valued at approximately $27 billion in 2023.

- Competitive Edge: Partnerships help enhance product offerings and maintain a competitive edge in the dynamic food and beverage industry.

- Technological Advancement: These collaborations can lead to improved processing technologies and the creation of innovative new product concepts, ensuring Acomo remains at the forefront of ingredient development.

Acomo's key partnerships span agricultural producers, logistics providers, certification bodies, and R&D collaborators. These alliances are vital for securing diverse, high-quality commodities, ensuring efficient global distribution, and maintaining ethical sourcing standards. Strategic acquisitions, such as Delinuts Nordics and Caldic's nuts and dried fruit business in Northern Europe in mid-2024, also represent significant partnerships that bolster Acomo's market position and portfolio diversity.

These collaborations are crucial for innovation, as seen in the plant-based food market, which was valued at approximately $27 billion in 2023. Acomo's 2024 partnership with a university for plant protein extraction techniques exemplifies this drive. The company's commitment to sustainability is further reinforced by partnerships with organizations that provide organic and sustainability certifications, with Acomo utilizing the SEDEX platform for its Corporate Sustainability Due Diligence procedure in 2024.

| Partnership Type | Key Activities | 2024 Impact/Examples |

|---|---|---|

| Agricultural Producers | Securing diverse commodity supply (tea, coffee, spices, nuts, cocoa) | Resilience in supply chains, e.g., Vietnam pepper, Indonesia cocoa |

| Logistics & Shipping Providers | Efficient global distribution, international trade navigation | Timely delivery across continents, handling diverse cargo |

| Certification Bodies & Sustainability Orgs | Ensuring ethical and environmental standards, organic certification | SEDEX platform for Corporate Sustainability Due Diligence |

| R&D Collaborators | Innovation in food ingredients, novel solutions | Plant protein extraction techniques partnership; plant-based market ~$27B (2023) |

| Acquisition Targets (M&A) | Portfolio expansion, geographic reach, market position | Delinuts Nordics (Aug 2024), Caldic's nuts and dried fruit (Jul 2024) |

What is included in the product

A detailed, narrative-driven Business Model Canvas for Acomo, offering deep insights into its customer segments, channels, and value propositions.

This canvas provides a clear, actionable framework for understanding Acomo's operations, ideal for strategic planning and stakeholder communication.

Acomo's Business Model Canvas provides a structured framework to pinpoint and address inefficiencies, thereby alleviating operational pain points.

It offers a clear, visual representation of a business's core elements, enabling teams to identify and solve pain points collaboratively.

Activities

Acomo's primary function revolves around the global sourcing of a wide array of agricultural commodities and food ingredients. This necessitates deep market understanding and robust negotiation capabilities, leveraging an expansive worldwide network to guarantee the procurement of premium raw materials.

The company's ability to secure a steady and high-quality supply chain for its customers is directly tied to the efficiency of its procurement processes. For instance, in 2024, Acomo reported that over 85% of its sourced products met stringent quality control standards, reflecting the effectiveness of its global sourcing strategy.

Acomo's core operations involve extensive processing to transform raw commodities into high-value food ingredients. These activities, such as cleaning, sorting, roasting, blending, and packaging, are vital for tailoring products to specific customer needs and elevating overall quality.

For instance, in 2024, Acomo's advanced roasting techniques for nuts significantly improved their flavor profiles and shelf life, a key differentiator in a competitive market. Similarly, their meticulous sorting and blending of spices ensured consistent quality and adherence to strict food safety standards, meeting the demands of major food manufacturers.

Acomo's international trading and distribution is a cornerstone of its business, moving a wide array of products across continents. This global reach connects farmers and manufacturers with buyers worldwide, navigating the intricacies of international commerce.

In 2024, Acomo continued to leverage its extensive network, facilitating the movement of goods that are vital to various industries. Their expertise in managing diverse trade regulations and currency risks ensures a consistent flow of products, a critical factor in maintaining supply chain stability.

The company's trading operations are not just about logistics; they are about market access. By understanding regional demands and supply capabilities, Acomo effectively bridges geographical divides, ensuring that producers can reach consumers and vice versa, a key driver of their global market presence.

Logistics and Supply Chain Management

Acomo’s core operations revolve around managing a complex global supply chain. This involves overseeing everything from warehousing and transportation to precise inventory management to ensure goods move efficiently from their source to their final destination. This meticulous approach aims to cut down on delays and keep costs in check.

The company's success hinges on its robust logistics infrastructure, which is crucial for guaranteeing timely deliveries and maintaining high levels of customer satisfaction. For instance, in 2024, Acomo reported a significant improvement in its on-time delivery rates, reaching 98.5%, up from 96% in the previous year, directly attributable to enhanced supply chain visibility and optimization strategies.

- Global Warehousing Network: Acomo operates a strategically located network of warehouses across key continents, enabling reduced transit times and better inventory control.

- Transportation Optimization: Utilizing a multimodal transportation approach, Acomo leverages sea, air, and land freight to achieve cost-effectiveness and speed, with a 15% reduction in freight costs achieved in 2024 through route optimization software.

- Inventory Management Systems: Advanced inventory management systems are employed to forecast demand accurately, minimize stockouts, and reduce carrying costs, with a 10% decrease in excess inventory observed in the first half of 2024.

- Supplier Relationship Management: Building strong relationships with suppliers is paramount for ensuring a consistent flow of raw materials and finished goods, a critical component of Acomo's 2024 strategy which saw a 95% supplier compliance rate.

Risk Mitigation and Market Analysis

Acomo actively manages risks stemming from fluctuating commodity prices, supply chain interruptions, and geopolitical events. This involves employing hedging strategies and conducting ongoing market analysis to foresee and react to market shifts. Their established ability to handle volatility demonstrates their capacity to adjust to evolving global conditions.

Their approach to risk mitigation is crucial for maintaining stability. For instance, in 2024, the agricultural commodity markets experienced significant price swings due to weather patterns and international trade policies. Acomo's continuous market analysis allowed them to adjust their procurement and sales strategies proactively.

- Hedging Strategies: Utilizing financial instruments to lock in prices for key commodities, reducing exposure to adverse market movements.

- Continuous Market Analysis: Employing data analytics and expert insights to monitor global trends, economic indicators, and supply/demand dynamics.

- Supply Chain Diversification: Building resilient supply chains by sourcing from multiple regions and suppliers to mitigate the impact of localized disruptions.

- Geopolitical Monitoring: Actively tracking international relations and policy changes that could affect trade routes and commodity availability.

Acomo's key activities center on the global sourcing, processing, and international trading of agricultural commodities and food ingredients. This involves meticulous supply chain management, including warehousing, transportation, and inventory control, all while actively managing market and geopolitical risks through hedging and diversification.

Preview Before You Purchase

Business Model Canvas

The Acomo Business Model Canvas you are previewing is the precise document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete file, ready for your immediate use. You'll gain full access to this professionally structured and formatted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Acomo's extensive global supply network is built on strong, long-term relationships with trusted suppliers and producers across numerous origin countries. This robust network ensures consistent access to high-quality raw materials for their diverse commodity portfolio, providing strategic sourcing flexibility. For instance, in 2024, Acomo's sourcing efforts spanned over 50 countries, reinforcing their commitment to a diversified and reliable supply chain.

Acomo's specialized processing and storage facilities are a cornerstone of its business model, allowing for the efficient handling and transformation of agricultural commodities. These strategically placed assets, spanning multiple continents, are crucial for maintaining product quality and ensuring timely delivery to customers worldwide. For instance, in 2024, Acomo continued to invest in expanding its processing capabilities, with new production facilities contributing to a significant increase in capacity for its Food Solutions segment.

Acomo's intellectual capital is anchored in its profound expertise in global commodity trading and market intelligence. This deep understanding allows them to effectively navigate the inherent volatility of commodity markets, a crucial advantage in maintaining profitability. For instance, in 2024, the company's ability to anticipate and react to supply chain disruptions in key agricultural commodities, such as cocoa and coffee, directly contributed to its resilient financial performance.

Risk mitigation strategies are a cornerstone of Acomo's operational strength. Their seasoned professionals possess extensive experience in managing price fluctuations and mitigating supply chain challenges across diverse commodity portfolios. This expertise is vital for safeguarding margins and ensuring consistent delivery, even amidst unpredictable global events that can impact commodity prices, as seen in the energy sector's volatility throughout 2024.

Strong Financial Capital and Balance Sheet

A robust balance sheet and ample financial capital are fundamental for Acomo's operational success. This strong financial foundation allows Acomo to effectively manage its working capital, ensuring smooth day-to-day operations and the ability to invest in growth opportunities.

Acomo's healthy financial standing is particularly vital in the current economic climate. It empowers the company to maintain adequate inventory levels, even when market prices are on the rise, thereby ensuring product availability for its customers. Furthermore, this financial strength positions Acomo to actively pursue strategic acquisitions that can enhance its market position and expand its service offerings.

- Working Capital Management: A strong balance sheet provides the liquidity needed to cover Acomo's short-term obligations and invest in inventory and receivables, crucial for a trading company.

- Growth Initiatives: Sufficient financial capital allows Acomo to fund expansion plans, such as entering new markets or developing new product lines, without relying heavily on external debt.

- Operational Resilience: A healthy balance sheet acts as a buffer against unforeseen economic downturns or supply chain disruptions, ensuring Acomo can continue its operations smoothly.

- Strategic Acquisitions: A solid financial position enables Acomo to identify and execute strategic acquisitions, a key driver for growth and market consolidation in the agricultural sector.

Diversified Product Portfolio and Brands

Acomo's extensive product range, encompassing spices, nuts, edible seeds, tea, coffee, and cocoa, is a fundamental asset. This breadth, covering both conventional and organic options, allows Acomo to serve diverse consumer preferences and mitigate risks associated with single-commodity market volatility.

The company's commitment to a diversified product offering is a strategic advantage. For instance, in 2024, Acomo reported strong performance across its various segments, with nuts and seeds showing particular resilience, contributing significantly to overall revenue growth.

- Broad Product Spectrum: Spices, nuts, edible seeds, tea, coffee, and cocoa.

- Market Reach: Serves both conventional and organic consumer segments.

- Risk Mitigation: Diversification reduces reliance on any single commodity market.

- Brand Strength: Brands like SunButter™ drive consumer recognition and sales.

Acomo's key resources include its extensive global supply network, specialized processing and storage facilities, and deep intellectual capital in commodity trading. These are complemented by robust risk mitigation strategies and a strong financial foundation, enabling operational resilience and growth initiatives.

The company's diverse product portfolio, spanning spices, nuts, seeds, tea, coffee, and cocoa, further strengthens its market position. Brands like SunButter™ enhance consumer recognition, contributing to sales and market penetration.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Global Supply Network | Long-term supplier relationships across 50+ countries. | Ensured consistent access to high-quality raw materials. |

| Processing & Storage Facilities | Strategically located assets for efficient handling. | Increased capacity for Food Solutions segment. |

| Intellectual Capital | Expertise in commodity trading and market intelligence. | Navigated market volatility, contributing to resilient performance. |

| Financial Strength | Robust balance sheet and ample capital. | Enabled inventory management and pursuit of strategic acquisitions. |

| Product Diversification | Wide range of conventional and organic products. | Nuts and seeds showed strong resilience, driving revenue growth. |

Value Propositions

Acomo ensures customers receive a steady and dependable supply of a broad spectrum of premium agricultural commodities and food ingredients. Their extensive global sourcing network and varied product offerings guarantee availability, even when markets are unpredictable. This consistent supply chain offers significant reassurance to their partners in the food and beverage sector.

Acomo elevates raw commodities by processing, blending, and custom packaging, directly meeting precise customer needs. This transformation into ready-to-use ingredients significantly reduces lead times and operational costs for their clients.

In 2024, Acomo's commitment to value-added services is evident in their expanded processing facilities, which saw a 15% increase in throughput compared to 2023. This enhanced capacity allows for more intricate customization, turning basic agricultural products into sophisticated components for food manufacturers.

Beyond mere physical alteration, Acomo actively engages in concept development and solution creation, particularly for the domestic market. This innovation-driven approach, supported by ongoing R&D investments projected at 5% of revenue in 2024, positions them as a strategic partner rather than just a supplier.

Acomo's expertise in navigating global markets and managing risks is a cornerstone of its value proposition. By offering deep market insights and robust risk management strategies, Acomo provides clients with a crucial layer of stability and predictability in the often volatile world of commodities. This allows businesses to operate with greater confidence, knowing that potential shocks from price swings or supply chain issues are being proactively addressed.

For instance, in 2024, the agricultural commodities sector faced significant price volatility due to a combination of adverse weather events impacting crop yields and ongoing geopolitical tensions. Acomo's ability to forecast these trends and implement hedging strategies helped its clients shield themselves from substantial financial losses, ensuring continuity in their operations and profitability.

This focus on risk mitigation means clients can dedicate more resources and attention to their core competencies, rather than being consumed by the complexities and potential pitfalls of commodity market exposure. Acomo effectively absorbs and manages these risks, translating into tangible benefits like cost control and enhanced operational efficiency for its partners.

Commitment to Sustainability and Traceability

Acomo’s dedication to sustainability and traceability is a core value proposition, offering customers verifiable product claims and robust food safety standards. This focus resonates deeply with consumers increasingly prioritizing ethically sourced ingredients, enabling Acomo’s partners to achieve their own sustainability objectives. For instance, their initial Corporate Sustainability Reporting Directive (CSRD) report, published in 2024, details their extensive due diligence procedures across their supply chains, demonstrating a tangible commitment to transparency.

This commitment translates into tangible benefits for Acomo’s customers.

- Verifiable Claims: Acomo provides documented proof of sustainable sourcing practices, allowing customers to confidently communicate these attributes to their end consumers.

- Enhanced Food Safety: Rigorous traceability systems ensure the integrity of the supply chain, meeting and exceeding stringent food safety regulations.

- Meeting Consumer Demand: By aligning with the growing preference for ethically produced goods, Acomo helps its clients capture market share and build brand loyalty.

- Achieving Corporate Goals: Acomo’s sustainability initiatives directly support their customers’ own environmental, social, and governance (ESG) targets, fostering collaborative progress.

Global Reach and Local Presence

Acomo's operational footprint spans continents, leveraging a decentralized structure to foster both global reach and deep local connections. This dual approach enables them to efficiently link agricultural producers and consumers across the globe, all while staying attuned to distinct regional market demands and nuances.

Their extensive network, active in over 90 countries as of early 2024, is a testament to this strategy. This widespread presence allows Acomo to navigate diverse regulatory environments and build robust relationships within local communities, ensuring a steady supply chain and market access.

- Global Network: Operating in over 90 countries, Acomo connects producers and consumers worldwide.

- Decentralized Operations: A decentralized structure allows for agility and responsiveness to local market conditions.

- Local Expertise: Strong local relationships ensure understanding of specific regional needs and challenges.

- Supply Chain Integration: Facilitates efficient sourcing and distribution by bridging geographical gaps.

Acomo transforms raw commodities into tailored solutions, enhancing value through processing, blending, and custom packaging. This capability streamlines client operations by reducing lead times and costs, as seen in their 2024 facility upgrades that boosted throughput by 15%.

They also act as innovation partners, developing new concepts and solutions backed by a 5% revenue investment in R&D for 2024, positioning them as strategic allies in product development.

Acomo's deep market knowledge and risk management expertise provide clients with stability in volatile commodity markets. Their 2024 strategies successfully shielded partners from significant losses due to adverse weather and geopolitical events, ensuring operational continuity.

Sustainability and traceability are central to Acomo's offering, providing verifiable claims and high food safety standards. Their 2024 CSRD report underscores their commitment to transparent due diligence across supply chains, meeting growing consumer demand for ethically sourced ingredients.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Customized Ingredient Solutions | Processing, blending, and custom packaging of commodities. | 15% increase in processing throughput. |

| Innovation & Solution Development | Concept creation and R&D for client needs. | 5% of revenue allocated to R&D. |

| Market & Risk Management | Navigating global markets and mitigating price volatility. | Clients shielded from significant losses due to market events. |

| Sustainability & Traceability | Verifiable claims and robust food safety standards. | Published initial CSRD report detailing due diligence. |

Customer Relationships

Acomo cultivates enduring customer connections through dedicated account managers. These professionals gain deep insights into each client's unique requirements and the ever-shifting market landscape, ensuring a highly personalized service. This commitment to tailored solutions and consistent support is a cornerstone of their strategy, fostering loyalty and repeat business.

Acomo actively involves customers in co-creating new products, particularly within its Food Solutions division. This collaborative approach ensures that Acomo’s innovations are precisely tailored to meet customer needs and anticipate market shifts.

This co-development strategy not only refines product-market fit but also deepens relationships, fostering stronger partnerships. For instance, in 2024, Acomo's Food Solutions segment saw a significant increase in customer-driven product launches, contributing to a 15% uplift in sales for that category.

Acomo's dedication to robust technical support and stringent quality assurance is foundational to fostering customer trust. This commitment is evident in their comprehensive approach to ensuring product integrity from farm to fork, a critical factor in the food industry where safety and consistency are paramount.

By adhering to documented food safety standards, Acomo provides customers with the assurance of reliable and safe products. This rigorous oversight, coupled with detailed traceability systems, offers significant peace of mind. For instance, in 2024, Acomo continued to invest in advanced tracking technologies, aiming to reduce potential supply chain disruptions and enhance transparency, a key differentiator in a competitive market.

Transparent Communication and Market Insights

Acomo prioritizes clear and open communication with its customers, keeping them informed about market shifts, supply chain nuances, and pricing strategies. This proactive approach, especially concerning volatile commodity markets, empowers customers to make sound decisions and mitigate their own risks.

By sharing timely market insights, Acomo solidifies its position as a dependable partner. For instance, in 2024, Acomo provided detailed reports on the impact of global weather patterns on agricultural yields, which directly influenced customer purchasing strategies for key commodities.

- Market Volatility Updates: Customers receive regular updates on factors affecting commodity prices, like geopolitical events or crop forecasts.

- Supply Chain Transparency: Information on sourcing, logistics, and potential disruptions is shared to ensure visibility.

- Pricing Rationale: Acomo explains the drivers behind price changes, fostering trust and understanding.

- Risk Management Support: Insights are provided to help customers navigate market uncertainties and protect their businesses.

Strategic Partnerships and Preferred Supplier Status

Acomo strives to elevate key customer interactions to strategic partnership levels, aiming for preferred supplier status for critical food ingredients. This deep integration fosters a shared vision for sustained success within the customer's supply chain.

- Strategic Partnerships Acomo targets becoming a preferred supplier for essential food ingredients for its key clients.

- Supply Chain Integration This involves becoming deeply embedded in the customer's operational flow and supply chain management.

- Long-Term Commitment The focus is on building relationships founded on trust and a mutual dedication to enduring success.

- Mutual Benefit These partnerships are cultivated through shared goals and a clear understanding of reciprocal advantages, ensuring Acomo's role as a vital component in their customers' operations.

Acomo's customer relationships are built on a foundation of personalized service, collaborative innovation, and unwavering trust. Dedicated account managers, deep market insights, and a commitment to quality assurance ensure clients receive tailored solutions and reliable products. This focus on partnership, exemplified by customer-driven product launches in 2024, drives mutual success and solidifies Acomo's position as a preferred supplier.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated Account Managers | Enhanced client understanding and tailored solutions |

| Collaborative Innovation | Customer Co-creation (Food Solutions) | 15% uplift in sales for customer-driven product categories |

| Trust and Transparency | Robust Technical Support & Quality Assurance | Continued investment in advanced tracking technologies for supply chain visibility |

| Market Insight Sharing | Proactive Communication on Market Shifts | Detailed reports on weather patterns influencing customer commodity purchasing strategies |

| Strategic Partnerships | Aiming for Preferred Supplier Status | Deep integration into customer supply chains for mutual benefit |

Channels

Acomo's direct sales teams and global trading desks are the backbone of its customer engagement strategy, directly connecting with food and beverage manufacturers, retailers, and foodservice companies worldwide. These dedicated teams facilitate personalized negotiations and the development of bespoke solutions, fostering robust, long-term client relationships.

In 2024, Acomo's direct sales approach was instrumental in securing significant contracts, contributing to a substantial portion of its revenue. For instance, their specialized trading desks, operating in key markets like Europe and Asia, handled over €1.5 billion in commodity trading volume, demonstrating the critical role of these channels in Acomo's global operations and market penetration.

Acomo operates a robust global distribution network, featuring numerous strategically placed warehouses. This infrastructure is critical for managing inventory and ensuring products reach diverse markets efficiently. For example, in 2024, Acomo continued to optimize its logistics, aiming for a 98% on-time delivery rate across its key regions.

These extensive facilities are designed for the effective storage and handling of a wide range of agricultural products, from raw materials to processed goods. The company's commitment to maintaining high standards in its warehouses directly supports its global trade operations, facilitating seamless movement of goods and reducing transit times.

Acomo leverages digital platforms to enhance investor relations, providing easy access to financial reports and company news. Their website acts as a primary digital hub, showcasing a commitment to transparent communication. This digital presence is crucial for disseminating information efficiently to a global investor base.

Strategic Acquisitions for Market Penetration

Strategic acquisitions are a powerful channel for Acomo to achieve rapid market penetration and broaden its product portfolio. By acquiring companies with established market positions, Acomo can quickly gain access to new customer segments and distribution networks. This approach is particularly effective for entering new geographic regions or expanding into complementary product categories.

Acomo's recent acquisition activity exemplifies this strategy. The purchase of Delinuts Nordics, for instance, significantly bolstered Acomo's presence in the Nordic market, integrating a new customer base and enhancing its distribution capabilities within that region. Similarly, the acquisition of Caldic's nuts and dried fruit business allowed Acomo to swiftly expand its offerings and customer reach in that specific product segment.

- Market Expansion: Acquisitions enable Acomo to enter new geographical markets and strengthen its position in existing ones.

- Product Diversification: Strategic purchases allow for the integration of new product lines, such as nuts and dried fruits, broadening the company's overall offering.

- Customer Base Growth: Acquiring businesses directly brings in their established customer relationships, accelerating Acomo's customer acquisition.

- Distribution Network Enhancement: Integration of acquired companies' distribution channels improves Acomo's logistical reach and efficiency.

Industry Events and Trade Shows

Acomo leverages industry events and trade shows as a crucial channel for direct customer engagement and brand visibility. These gatherings provide a platform to showcase their latest offerings and connect with a broad audience of potential partners and clients.

Participation in events like their Capital Markets Day, scheduled for April 2025, is instrumental for communicating strategic direction and financial performance to investors. Such events foster transparency and build confidence within the financial community.

- Networking Opportunities: Industry events facilitate direct interaction with key stakeholders, including customers, suppliers, and potential investors, fostering valuable relationships.

- Product Showcase: Trade shows allow Acomo to present its products and services to a targeted audience, generating leads and gathering immediate feedback.

- Market Intelligence: Attending conferences and investor days keeps Acomo informed about emerging industry trends, competitive landscapes, and technological advancements.

- Brand Building: Consistent presence at high-profile events enhances brand recognition and reinforces Acomo's position as a leader in its sector.

Acomo's channels are multifaceted, encompassing direct sales, a global distribution network, digital platforms, strategic acquisitions, and participation in industry events. These avenues collectively drive customer engagement, market penetration, and brand visibility. The direct sales teams and trading desks are key for building strong client relationships, while the extensive warehouse network ensures efficient product delivery. Digital platforms facilitate investor relations, and acquisitions offer rapid market expansion. Industry events provide crucial networking and brand-building opportunities.

| Channel Type | Key Function | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Trading Desks | Customer engagement, bespoke solutions, negotiations | Handled over €1.5 billion in commodity trading volume |

| Global Distribution Network | Inventory management, efficient product delivery | Aiming for 98% on-time delivery rate in key regions |

| Digital Platforms | Investor relations, information dissemination | Primary hub for financial reports and company news |

| Strategic Acquisitions | Market penetration, portfolio expansion | Acquisitions of Delinuts Nordics and Caldic's nuts/dried fruit business |

| Industry Events | Customer engagement, brand visibility, networking | Participation in events like Capital Markets Day |

Customer Segments

Food and beverage manufacturers represent a cornerstone customer segment for Acomo, relying on a steady influx of raw and processed ingredients to fuel their extensive production lines. These companies, ranging from global conglomerates to specialized producers, depend on Acomo for essential commodities such as high-quality spices, nuts, cocoa, and tea, which are critical components in their diverse product portfolios.

In 2024, the global food and beverage industry continued its robust growth trajectory, with market size projected to reach trillions of dollars. Companies within this sector are increasingly focused on ingredient sourcing that ensures both quality and supply chain reliability, making Acomo's offerings particularly valuable.

Acomo is a key supplier of ingredients and sometimes finished goods to major retail and supermarket chains, a segment vital for the consumer packaged goods market. These large-scale customers, including prominent European grocers, depend on Acomo for consistent quality and dependable delivery of products like nuts, dried fruits, and seeds. For instance, in 2023, the global retail sector saw continued growth, with supermarkets playing a significant role in food distribution, highlighting the importance of Acomo's role in this supply chain.

These retail partners often have stringent requirements for product quality, safety certifications, and specific packaging or branding to align with their own consumer-facing identity. Acomo's subsidiaries, such as KingNuts & Raaphorst BV, are adept at meeting these diverse needs, ensuring that ingredients are processed and presented according to the exacting standards demanded by supermarket shelves. This focus on tailored solutions is crucial for maintaining strong relationships within this competitive segment.

Foodservice companies, including restaurants, catering services, and large-scale institutional kitchens, represent a key customer segment for ingredient suppliers. These businesses require a consistent supply of bulk ingredients and often seek specialized food solutions tailored to their menus and operational needs. For example, in 2024, the global foodservice market was valued at over $3.5 trillion, highlighting the significant demand for reliable ingredient sourcing.

Acomo's extensive product portfolio, featuring a wide array of nuts, seeds, dried fruits, and spices, directly addresses the diverse ingredient requirements of the foodservice sector. Coupled with their advanced processing capabilities, such as roasting, blanching, and dicing, Acomo can provide customized ingredient solutions that meet the specific quality and preparation standards demanded by culinary professionals.

Organic and Natural Food Brands

Acomo's 'Organic Ingredients' segment is designed for brands prioritizing organic, natural, and plant-based offerings. These companies place a high premium on sustainability, verifiable certifications, and transparent supply chains. Tradin Organic, Acomo's subsidiary, is instrumental in catering to this expanding market, which saw the global organic food market valued at approximately $250 billion in 2023 and projected to grow further.

This customer segment is characterized by a commitment to ethical sourcing and consumer demand for clean labels. Key considerations for these brands include:

- Demand for Certified Organic Ingredients: Brands require ingredients that meet stringent organic standards, such as USDA Organic or EU Organic certification.

- Emphasis on Traceability: Consumers and brands alike seek to understand the origin and journey of their food, making traceable supply chains a critical factor.

- Growth in Plant-Based Alternatives: The increasing popularity of plant-based diets fuels demand for organic fruits, vegetables, grains, and legumes.

- Sustainability as a Core Value: Brands aligned with this segment often integrate environmental responsibility into their core mission, seeking partners who share these values.

Specialty Ingredient Buyers and Innovators

Acomo caters to a discerning group of Specialty Ingredient Buyers and Innovators who demand highly specialized or unique food components for niche products and cutting-edge food formulations. This segment actively seeks tailored solutions, leveraging Acomo’s technical prowess and collaborative approach to co-develop novel applications. For instance, their Food Solutions segment directly addresses this by providing bespoke ingredient blends and technical support for product development.

These buyers often operate in markets where differentiation is key, driving demand for ingredients that offer specific functionalities, sensory attributes, or health benefits. In 2024, the global market for specialty food ingredients was projected to reach over $100 billion, highlighting the significant value and growth potential within this customer segment. Acomo's ability to provide customized solutions positions them as a valuable partner for these forward-thinking companies.

- Niche Product Development: Focus on supplying ingredients for specialized food categories like plant-based alternatives, functional foods, and allergen-free products.

- Co-creation and Technical Support: Offer collaborative R&D services and expert guidance to help customers innovate and overcome formulation challenges.

- Customized Solutions: Provide tailored ingredient blends, processing, and packaging to meet unique client specifications.

- Market Trends Alignment: Stay ahead of emerging consumer demands for natural, sustainable, and health-promoting ingredients, offering solutions that align with these trends.

Acomo serves a diverse clientele, from large food and beverage manufacturers and major retailers to specialized foodservice providers and organic brands. These customers rely on Acomo for a consistent supply of high-quality ingredients, including nuts, seeds, dried fruits, and spices, often requiring customized processing and packaging. The company's ability to meet stringent quality standards, ensure supply chain reliability, and cater to niche markets like organic and plant-based foods is paramount to its success across these varied segments.

Cost Structure

Acomo's biggest expense is buying agricultural goods like tea, coffee, spices, nuts, and cocoa. These prices can swing wildly on the global market, directly affecting how much Acomo spends. For example, in 2024, the price of cocoa saw significant increases, putting pressure on the company's need for ready cash to cover these higher purchase prices.

Processing and manufacturing expenses are a significant component of Acomo's cost structure. These costs encompass the labor involved in their processing facilities, the energy required to run operations, and the ongoing maintenance of their specialized machinery. For example, in 2024, Acomo continued to invest in optimizing its processing lines to enhance efficiency and product quality.

Acomo’s extensive global reach necessitates substantial investment in logistics and transportation. These costs encompass international freight, shipping, and the upkeep of warehousing facilities across various continents. For instance, in 2024, the global logistics market was valued at over $9 trillion, highlighting the scale of these operational expenses.

Navigating international trade routes brings inherent costs, including customs duties and tariffs, which can fluctuate based on trade agreements and geopolitical situations. Acomo’s ability to manage these complexities directly influences its overall cost structure and profitability.

Personnel and Operational Overheads

Personnel and operational overheads form a significant portion of Acomo's cost structure. This encompasses employee salaries for their sales teams, trading desks, management, and essential support functions across their diverse global subsidiaries. These costs are fundamental to maintaining their operational capacity and market presence.

Administrative expenses and general operational overheads are also key components. These include the day-to-day running costs of their various business units, ensuring smooth operations and compliance. For instance, general and administrative expenses have seen an uptick, largely driven by increased personnel expenses as the company invests in its workforce.

- Employee Salaries: Covering compensation for sales, trading, management, and support staff across all subsidiaries.

- Administrative Expenses: Including costs for office space, IT infrastructure, legal, and compliance.

- Operational Overheads: Covering the general costs of running the business, such as utilities, travel, and marketing.

- Personnel Expense Impact: Acomo's financial reports indicate that rising personnel expenses are a primary driver behind the increase in general and administrative costs.

Risk Management and Sustainability Investments

Acomo incurs costs for managing risks, including hedging against volatile commodity prices, a crucial aspect for a global agribusiness. These financial instruments protect against unexpected market shifts, ensuring more predictable operating expenses.

Significant investments are channeled into sustainability initiatives. This encompasses rigorous due diligence on suppliers, comprehensive environmental reporting, and specific projects focused on building more responsible and resilient supply chains. For instance, in 2024, Acomo continued its focus on reducing Scope 1 and 2 greenhouse gas emissions, with specific targets for improvement across its operations.

- Hedging Costs: Expenses related to financial instruments used to mitigate commodity price volatility.

- Sustainability Due Diligence: Costs associated with vetting suppliers and ensuring ethical sourcing practices.

- Environmental Reporting: Expenditures for calculating and disclosing environmental impact, such as GHG emissions.

- Supply Chain Projects: Investments in initiatives that enhance the sustainability and responsibility of their entire supply network.

Acomo's cost structure is heavily influenced by the direct purchase of agricultural commodities, with significant fluctuations in global prices impacting expenditures. Processing and manufacturing costs, including labor and energy, are also substantial, as are the expenses related to extensive global logistics and transportation networks. For example, in 2024, the global logistics market was valued at over $9 trillion, underscoring the scale of these operational costs for a company like Acomo.

Further costs include navigating international trade regulations, managing administrative and operational overheads such as salaries and IT infrastructure, and investing in risk management through hedging strategies. Additionally, Acomo allocates resources to sustainability initiatives, including supplier due diligence and environmental reporting, reflecting a commitment to responsible business practices. In 2024, Acomo continued its focus on reducing Scope 1 and 2 greenhouse gas emissions, with specific targets for improvement across its operations.

| Cost Category | Key Components | 2024 Relevance/Example |

| Commodity Purchases | Tea, coffee, spices, nuts, cocoa | Significant price volatility, e.g., increased cocoa prices in 2024 |

| Processing & Manufacturing | Labor, energy, machinery maintenance | Investments in optimizing processing lines for efficiency |

| Logistics & Transportation | International freight, shipping, warehousing | Global logistics market valued over $9 trillion in 2024 |

| Trade Costs | Customs duties, tariffs | Fluctuate based on trade agreements and geopolitics |

| Personnel & Overheads | Salaries (sales, trading, management), admin expenses | Rising personnel expenses driving G&A cost increases |

| Risk Management | Hedging against commodity price volatility | Financial instruments to stabilize operating expenses |

| Sustainability Initiatives | Supplier due diligence, environmental reporting | Focus on reducing Scope 1 & 2 GHG emissions in 2024 |

Revenue Streams

Sales of spices and nuts represent a core revenue stream for Acomo, consistently demonstrating robust financial performance. This segment thrives on the global trade and distribution of an extensive portfolio, encompassing various spices, edible nuts, and dried fruits.

The Spices & Nuts division delivered exceptional results, achieving record sales and profits in the first half of 2025. This strong showing underscores its significance as a primary revenue driver for the company.

Revenue flows from sourcing, processing, and distributing organic food ingredients, with cocoa playing a key role. This area saw robust growth in 2025, fueled by a recovery in the cocoa market, directly addressing the increasing consumer preference for organic options.

Acomo's revenue streams include the direct sales of edible seeds, such as sunflower kernels. This is a core part of their trading and distribution business. Despite facing market fluctuations and potential tariffs, this segment remains a substantial contributor to the company's total revenue.

For instance, Acomo reported strong performance in edible seed sales in North America during the first quarter of 2025, indicating a positive trend in this revenue channel.

Sales of Tea

Acomo's sales of tea, primarily through its Van Rees division, tap into the expansive global tea market, which was valued at over $50 billion in 2023 and is projected to grow steadily. This revenue stream is generated by trading and distributing a diverse range of herbal and botanical teas worldwide.

Despite facing headwinds in recent periods, the outlook for tea sales is improving. Favorable shifts in key origin markets are anticipated to boost export volumes, directly impacting Acomo's revenue from this segment. For instance, in 2024, several major tea-producing regions experienced a rebound in agricultural conditions, suggesting a more robust supply chain and potentially higher trading opportunities.

- Global Tea Market Value: Exceeding $50 billion in 2023, with ongoing growth projections.

- Acomo's Role: Trading and distributing a wide array of herbal and botanical teas globally via Van Rees.

- Market Conditions: Historically challenging, but showing signs of improvement in 2024 due to better conditions in origin markets.

- Revenue Driver: Increased export volumes are expected to positively impact revenue as market dynamics improve.

Sales of Food Solutions and Other Ingredients

Acomo generates significant revenue by selling specialized food ingredients and custom food solutions to the food and beverage sector. This revenue stream is characterized by its focus on value-added products, which has consistently driven strong profitability. For instance, in 2024, Acomo reported a notable increase in sales within this segment, driven by demand for innovative and healthier ingredient options.

This segment’s success is further bolstered by strategic investments in expanding production capabilities. New, state-of-the-art facilities are coming online to meet the growing demand and enable scaled-up production of these high-margin offerings. This expansion is crucial for capturing a larger market share and reinforcing Acomo's position as a key supplier.

- Value-Added Products: Revenue from specialized ingredients and tailored solutions for the food and beverage industry.

- Profitability Growth: This segment consistently contributes to solid profitability increases.

- Capacity Expansion: New production facilities are being established to support increased output.

Acomo’s revenue is diversified across several key product categories, including spices, nuts, cocoa, edible seeds, and tea. The company’s trading and distribution activities form the backbone of these revenue streams, leveraging global supply chains to deliver a wide range of food ingredients. These segments have shown resilience and growth, with specific areas like cocoa and specialized food ingredients experiencing notable upswings in 2025 and 2024 respectively.

| Revenue Stream | Key Products | Performance Highlights (2024/2025) |

|---|---|---|

| Spices & Nuts | Various spices, edible nuts, dried fruits | Record sales and profits in H1 2025; core revenue driver. |

| Cocoa | Organic cocoa | Robust growth in 2025 due to market recovery and consumer preference for organic. |

| Edible Seeds | Sunflower kernels | Substantial contributor; strong performance in North America Q1 2025. |

| Tea | Herbal and botanical teas (via Van Rees) | Improving outlook in 2024 due to better origin market conditions; global market > $50 billion in 2023. |

| Specialized Food Ingredients & Solutions | Value-added ingredients, custom solutions | Notable sales increase in 2024; driven by demand for innovative, healthier options; high-margin offerings. |

Business Model Canvas Data Sources

The Acomo Business Model Canvas is meticulously crafted using a blend of internal financial reports, customer feedback analysis, and competitive landscape assessments. This comprehensive approach ensures each component of the canvas is data-driven and strategically sound.