ACI Worldwide PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

Navigate the complex external forces impacting ACI Worldwide's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the company. Download the full version to gain actionable intelligence and refine your strategic approach.

Political factors

Governments worldwide are pushing for real-time payment systems, with the EU's Instant Payments Regulation (IPR) a prime example, mandating that banks offer instant transfers by January 2025. This regulatory shift presents a significant opportunity for ACI Worldwide, whose payment solutions are essential for building and maintaining these new infrastructures.

ACI Worldwide's success hinges on its capacity to develop and deploy solutions that meet these stringent, evolving regulatory requirements. This adaptability is key for expanding market share, especially in regions actively implementing or updating their real-time payment frameworks.

Governments and international organizations are actively promoting faster, more transparent, and efficient cross-border payments. Initiatives like SWIFT Go are a prime example of this global push, aiming to streamline international transactions. This directly benefits ACI Worldwide, a key player in payment technology, by increasing the demand for their interoperable systems designed for seamless global financial flows.

Governments worldwide are intensifying their focus on financial crime, with a particular emphasis on anti-money laundering (AML) and fraud prevention. This heightened regulatory environment directly impacts companies like ACI Worldwide, making their expertise in compliance and fraud detection increasingly valuable. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, pushing for more robust reporting and investigation capabilities across jurisdictions.

As regulations become stricter, ACI Worldwide's suite of fraud prevention and compliance solutions gains significant traction. The demand for real-time transaction monitoring and advanced analytics to identify illicit activities is on the rise. Reports from industry bodies in 2024 indicate a substantial increase in the value of assets frozen or confiscated due to AML investigations, underscoring the effectiveness of stringent regulatory frameworks and the tools that support them.

The evolving nature of financial crime, characterized by increasingly sophisticated fraud schemes, necessitates adaptive solutions. ACI's investment in real-time monitoring and artificial intelligence (AI) models is therefore strategically aligned with global political objectives to safeguard financial systems. The company's ability to offer dynamic fraud detection capabilities directly addresses the challenges posed by evolving criminal tactics, ensuring financial institutions can maintain compliance and security.

Data Privacy Regulations

The global increase in data privacy regulations, exemplified by the European Union's GDPR and the upcoming California Privacy Rights Act (CPRA) enhancements taking effect in 2025, creates a significant political challenge. ACI Worldwide, as a processor of sensitive financial transaction data, must navigate this patchwork of evolving laws. Compliance is not just a legal necessity but a critical factor in maintaining customer trust and avoiding substantial fines, which could impact revenue streams.

Key considerations for ACI Worldwide regarding data privacy include:

- Navigating diverse legal frameworks: Adhering to varying data protection requirements across different jurisdictions, including new state-level laws in the US set to impact operations in 2025.

- Ensuring robust data security: Implementing and maintaining advanced security measures to safeguard sensitive payment information against breaches, a growing concern with increased regulatory scrutiny.

- Maintaining customer trust: Demonstrating a commitment to data privacy is essential for retaining clients and attracting new ones in an environment where data protection is a paramount concern.

- Avoiding legal and financial penalties: Non-compliance with data privacy laws can result in significant fines, impacting profitability and brand reputation.

Central Bank Digital Currencies (CBDCs) Development

The global exploration and piloting of Central Bank Digital Currencies (CBDCs) by numerous nations is a significant political development impacting the financial sector. As of mid-2024, over 130 countries are exploring CBDCs, with several, like China with its digital yuan, conducting advanced pilot programs. This trend suggests a potential reshaping of payment infrastructures worldwide.

ACI Worldwide must closely monitor these evolving CBDC initiatives. The widespread adoption of CBDCs could necessitate adaptations to their payment solutions to facilitate these new digital currency transactions. This strategic alignment would be crucial for maintaining relevance and supporting national monetary policy objectives in a future digital currency landscape.

- 130+ countries are actively exploring or piloting CBDCs as of mid-2024.

- China's digital yuan pilot has seen significant transaction volume, indicating growing adoption.

- ACI Worldwide's ability to integrate with emerging CBDC frameworks will be key to future market positioning.

Governments are actively promoting real-time payments, with the EU's Instant Payments Regulation mandating instant transfers by January 2025, creating a direct opportunity for ACI Worldwide's infrastructure solutions. Additionally, global efforts to streamline cross-border payments, like SWIFT Go, increase demand for ACI's interoperable systems.

The increasing focus on financial crime, including anti-money laundering (AML) and fraud prevention, makes ACI's compliance and fraud detection expertise more valuable, especially as organizations like the FATF update recommendations. Furthermore, evolving data privacy regulations, such as GDPR and upcoming CPRA enhancements in 2025, present challenges that ACI must navigate by ensuring robust data security and compliance to maintain customer trust and avoid penalties.

The global exploration of Central Bank Digital Currencies (CBDCs) by over 130 countries as of mid-2024, with China's digital yuan pilot showing significant transaction volume, signals a potential shift in payment infrastructures. ACI Worldwide's ability to adapt its solutions to support these emerging digital currency frameworks will be crucial for its future market positioning.

What is included in the product

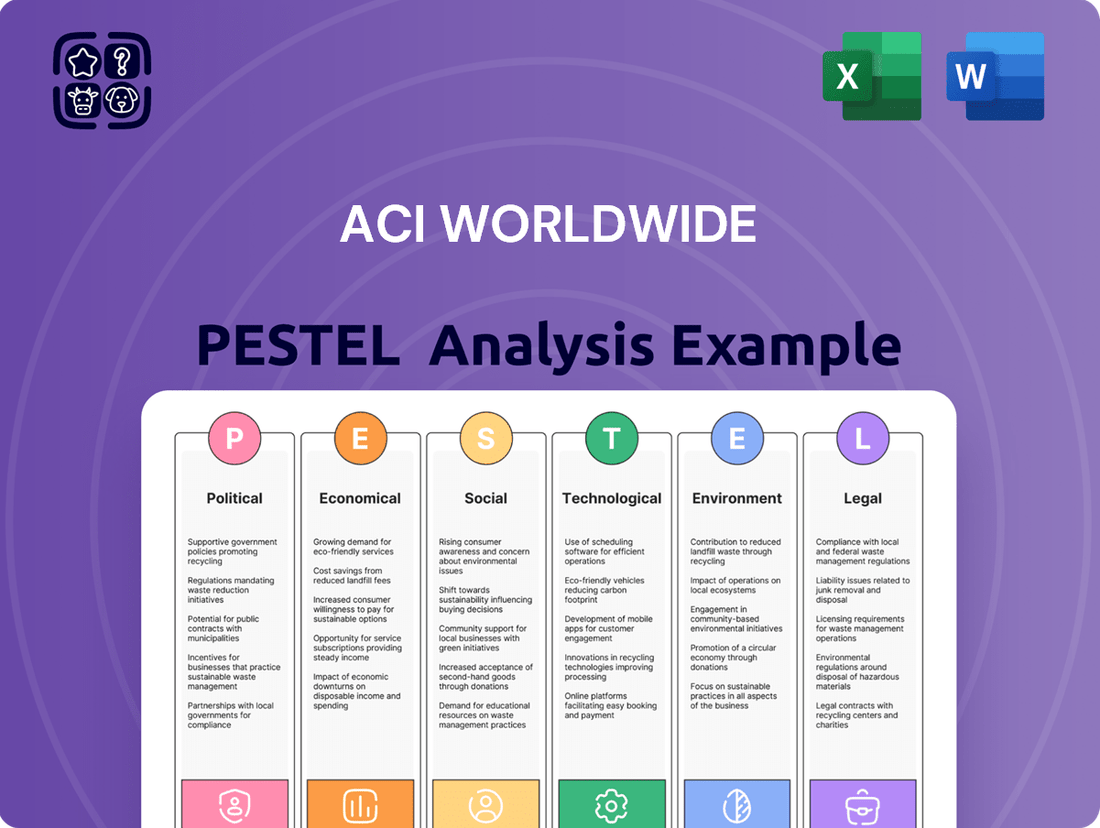

This PESTLE analysis of ACI Worldwide examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides a comprehensive overview of the external forces shaping the payments industry, offering insights into potential challenges and growth avenues for ACI Worldwide.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors digestible for strategic discussions.

Economic factors

The digital payments market is booming, with global revenues expected to surpass $10 trillion in 2024. This upward trend is projected to continue, reaching $137.43 billion in 2025 and further expanding to $198.99 billion by 2029.

This significant expansion is fueled by several key economic factors, including rising internet penetration rates worldwide and the continuous growth of e-commerce. Furthermore, a global trend towards cashless societies is actively encouraging the adoption of digital payment solutions.

ACI Worldwide, a major player in providing essential software for digital payment systems, is positioned to directly benefit from this robust economic tailwind. The company's services are in high demand as more businesses and consumers embrace digital transactions.

Real-time payments are a powerful engine for economic growth. Projections indicate they will contribute an additional $285.8 billion to global GDP by 2028, while also bringing over 167 million new individuals into the formal banking system.

This surge in economic activity, coupled with significant cost savings for both consumers and businesses, directly fuels the demand for sophisticated real-time payment solutions like those offered by ACI Worldwide. The company's technological infrastructure is instrumental in enabling these instant transactions, thereby enhancing overall economic efficiency and creating a symbiotic relationship where ACI Worldwide benefits from this growth.

The increasing demand for digital wallets and mobile payments is a significant economic driver, with these methods now handling a substantial share of both online and physical retail transactions. Consumers are actively choosing these payment options due to their perceived convenience and enhanced security.

This trend translates into a robust economic opportunity for companies like ACI Worldwide. Their ability to facilitate a wide array of payment channels and provide cutting-edge digital solutions places them advantageously to benefit from this evolving consumer behavior and market evolution.

For instance, by mid-2024, global mobile payment transaction volume was projected to exceed $10 trillion, underscoring the massive scale of this economic shift and the potential market for ACI Worldwide's services.

Embedded Finance Growth

Embedded finance, the integration of financial services into non-financial platforms, is a significant economic driver. This trend allows businesses to offer customized financing and smoother payment experiences, moving beyond standard transactions. For instance, the global embedded finance market was projected to reach $2.4 trillion by 2024, demonstrating substantial growth.

ACI Worldwide's capacity to facilitate these integrated financial services broadens its market reach. By enabling clients to participate in this evolving landscape, ACI Worldwide taps into new revenue opportunities. The company's solutions support the seamless embedding of payments and lending, crucial for platforms looking to enhance customer journeys.

- Market Expansion: Embedded finance is projected to grow significantly, with estimates suggesting it could account for over 10% of global financial services revenue by 2030.

- New Revenue Streams: ACI Worldwide can generate revenue by providing the underlying technology and services that enable embedded finance for its clients.

- Customer Experience: Businesses leveraging embedded finance report higher customer satisfaction and increased transaction volumes.

- Technological Integration: The growth is fueled by advancements in APIs and cloud technology, making integration more accessible.

Global Economic Conditions and Spending Habits

Broader global economic conditions significantly shape ACI Worldwide's financial performance. Consumer spending habits, particularly the increasing reliance on digital payment methods, directly impact demand for ACI's payment processing and fraud detection solutions. Similarly, business investment in digital transformation initiatives, a trend accelerated by recent economic shifts, fuels the need for ACI's technology and services.

Despite prevailing macroeconomic uncertainty, ACI Worldwide demonstrated robust financial resilience through 2024. The company reported notable revenue growth and an increase in EBITDA, underscoring the sustained demand for its digital payment solutions. Looking ahead, ACI projects continued revenue growth into 2025, signaling confidence in its business model and the ongoing digital payment market expansion.

- 2024 Performance: ACI Worldwide reported strong financial results in 2024, achieving revenue and EBITDA growth.

- 2025 Outlook: The company projects continued revenue growth for 2025, indicating sustained demand.

- Digital Transformation Driver: Increased business investment in digital transformation globally supports ACI's growth trajectory.

- Consumer Spending: Evolving consumer spending habits, favoring digital payments, directly benefit ACI's service offerings.

Global economic factors are strongly favoring the digital payments sector, with projections showing continued robust growth through 2025. This expansion is driven by increasing consumer adoption of digital and mobile payment methods, alongside significant business investments in digital transformation. ACI Worldwide is well-positioned to capitalize on these trends, as evidenced by its strong 2024 financial performance and optimistic 2025 outlook.

The digital payment market is experiencing substantial growth, with global revenues projected to exceed $10 trillion in 2024 and reach $137.43 billion in 2025. Real-time payments alone are expected to add $285.8 billion to global GDP by 2028. Embedded finance, a key growth area, was forecast to reach $2.4 trillion in 2024.

| Metric | 2024 Projection/Result | 2025 Projection |

| Global Digital Payments Revenue | >$10 Trillion | $137.43 Billion (Specific Segment) |

| Real-Time Payments GDP Contribution | N/A | $285.8 Billion by 2028 |

| Embedded Finance Market Size | $2.4 Trillion | Continued Growth |

| ACI Worldwide Revenue | Growth Reported | Continued Growth Projected |

| ACI Worldwide EBITDA | Increase Reported | N/A |

Full Version Awaits

ACI Worldwide PESTLE Analysis

The preview you see here is the exact ACI Worldwide PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ACI Worldwide, providing valuable strategic insights.

Sociological factors

Consumers increasingly expect digital interactions to be effortless and secure, mirroring their experiences with leading tech companies. This societal shift, evident in the widespread adoption of mobile banking and contactless payments, directly fuels demand for ACI Worldwide's payment solutions. For instance, by mid-2024, over 80% of retail transactions in developed economies were projected to be digital, highlighting the critical need for seamless payment infrastructure.

ACI Worldwide's emphasis on instant payment capabilities and intuitive mobile wallet integration directly addresses this consumer preference for convenience. The company's strategy to minimize friction in the payment process resonates strongly with a population that values speed and ease of use, making digital payment adoption a key driver for their business growth.

The global push for financial inclusion, driven by advancements like real-time payments, is significantly expanding access to financial services. Projections indicate that by 2028, millions more individuals worldwide will gain access to formal banking, particularly in developing economies.

This societal shift directly benefits companies like ACI Worldwide by widening the potential customer base for their payment infrastructure. As more people enter the formal financial system, the demand for robust and efficient payment solutions grows, creating a larger addressable market.

ACI's role in facilitating these accessible and affordable financial services positions them to capitalize on this expanding ecosystem. Their technology supports the very infrastructure that enables this inclusion, fostering a symbiotic relationship between societal progress and business opportunity.

Generational shifts, especially with Gen Z and Millennials, are fueling a surge in subscription services and digital payments. These younger consumers, accustomed to digital interactions, are shaping the demand for seamless and feature-rich payment solutions.

This evolving payment landscape directly impacts ACI Worldwide. The company must consistently adapt its payment technologies and services to meet the preferences of these digitally adept demographics, ensuring relevance in a rapidly changing market.

For instance, by 2025, it's projected that over 70% of the global workforce will be comprised of Millennials and Gen Z, a significant driver for digital payment adoption and innovation in the B2C space.

Increased Awareness of Fraud and Security

Societal awareness of fraud and cybersecurity threats is rapidly increasing as digital transactions become commonplace. This elevated concern directly fuels the demand for advanced security solutions. For instance, the Association of Certified Fraud Examiners reported that organizations lost an estimated 5% of revenue to fraud in their 2024 Global Fraud Survey, highlighting the significant impact of these issues.

ACI Worldwide is well-positioned to meet this demand. Their AI-powered fraud detection and secure payment processing capabilities are critical for businesses aiming to build and maintain customer trust in the digital economy. The company's focus on these areas directly addresses the public's growing apprehension about the safety of their financial data.

- Growing Fraud Concerns: Public awareness of payment fraud and cybersecurity risks is at an all-time high, driven by high-profile data breaches and increasing digital transaction volumes.

- Demand for Security: This societal awareness translates into a strong market demand for sophisticated fraud prevention and robust security measures from payment service providers.

- ACI's Solution Fit: ACI Worldwide's expertise in AI-driven fraud detection and secure transaction processing directly aligns with and addresses these critical societal concerns, making their services indispensable for maintaining confidence in digital payments.

Demand for Personalization in Financial Services

Consumers are increasingly demanding financial services that feel uniquely tailored to their needs, extending to every payment interaction. This shift means a one-size-fits-all approach simply doesn't cut it anymore. For instance, a 2024 survey indicated that over 70% of consumers are more likely to engage with financial providers that offer personalized experiences.

Artificial intelligence is the engine driving this personalization trend in payments. AI algorithms can analyze vast amounts of data to understand individual spending habits, preferences, and even predict future financial needs, enabling highly customized payment solutions. By 2025, it's projected that AI-powered personalization will be a key differentiator in customer loyalty.

- Growing Consumer Expectation: A significant majority of consumers now expect personalized financial advice and payment options.

- AI as an Enabler: Advanced AI and machine learning are crucial for delivering the granular customization consumers desire in their payment journeys.

- ACI Worldwide's Strategy: ACI Worldwide's investment in AI and data analytics directly addresses this societal demand by creating optimized, individualized payment solutions.

- Market Impact: Financial institutions leveraging personalization see higher customer retention and transaction volumes, a trend expected to accelerate through 2025.

Societal expectations for seamless, secure, and personalized digital experiences are paramount, influencing how consumers interact with financial services. This trend is amplified by younger generations, who prioritize convenience and digital-first solutions. For instance, by 2025, it's projected that over 70% of the global workforce will be Millennials and Gen Z, driving demand for innovative payment technologies.

The increasing awareness of fraud and cybersecurity threats necessitates robust security measures, directly benefiting companies offering advanced protection. By mid-2024, over 80% of retail transactions in developed economies were digital, underscoring the need for secure payment infrastructure.

Furthermore, the global push for financial inclusion, facilitated by technologies like real-time payments, is expanding access to financial services for millions, creating a larger addressable market for payment solution providers.

ACI Worldwide's focus on AI-driven fraud detection, instant payments, and personalized financial experiences directly aligns with these evolving societal demands, positioning them to capitalize on these shifts through 2025.

Technological factors

The payments landscape is rapidly evolving, with real-time payment systems increasingly becoming the global norm for superior user experiences. ACI Worldwide's core operations are deeply rooted in facilitating these instant electronic transactions.

Platforms such as ACI Connect are specifically engineered to streamline and modernize payment processes, enabling immediate transactions. This significant technological shift directly amplifies the market's need for ACI's cutting-edge payment solutions.

By 2024, it's projected that over 70% of global payment transactions will be real-time, a substantial increase from previous years, underscoring the critical importance of ACI's offerings in this dynamic market.

Artificial intelligence and machine learning are fundamentally reshaping the payments landscape, especially in areas like fraud detection, risk management, and ensuring compliance with regulations. Financial institutions are notably boosting their spending on AI technologies to counter increasingly complex, AI-powered fraud schemes. For instance, in 2024, global spending on AI in financial services was projected to reach over $20 billion, highlighting this trend.

ACI Worldwide actively utilizes AI-driven solutions to provide real-time transaction monitoring and employ adaptive fraud detection models. This technological capability serves as a significant competitive advantage and a key driver for the company's growth in the evolving payments ecosystem.

The move to cloud-native payment platforms is a significant technological shift, boosting resilience, scalability, and operational efficiency. ACI Worldwide is actively investing in this area, exemplified by its development of ACI Connect, a unified cloud-native payments platform designed to handle modern banking needs and changing regulations.

This strategic focus on cloud-native solutions allows ACI Worldwide to better serve financial institutions by offering flexible and robust payment processing capabilities. By expanding its technology partnerships and enhancing its cloud offerings, ACI Worldwide aims to remain a leader in the modernization of payment infrastructure, catering to the increasing demand for agile and secure payment systems.

Adoption of ISO 20022 Standard

The increasing global adoption of the ISO 20022 payment messaging standard is a significant technological shift. This standard is designed to foster greater transparency and efficiency in payment communications worldwide, essentially creating a more unified language for financial transactions. By 2025, it's projected that over 70% of global payment messages will adhere to ISO 20022.

This transition necessitates substantial upgrades to the back-end systems of financial institutions. ACI Worldwide's product suite is strategically developed to accommodate and facilitate this transition, ensuring their clients can seamlessly integrate with the new standard. This capability allows financial entities to navigate the evolving payment ecosystem and maintain interoperability across diverse payment networks.

ACI Worldwide's commitment to ISO 20022 compliance positions them to assist financial institutions in meeting regulatory requirements and leveraging the benefits of enhanced data richness and structured messaging. This includes:

- Facilitating seamless cross-border payments through standardized messaging.

- Improving data analytics and reporting capabilities for financial institutions.

- Reducing operational costs by streamlining payment processing.

- Ensuring future-readiness in a rapidly digitizing financial landscape.

Emergence of New Authentication Technologies

The financial technology landscape is rapidly evolving with the emergence of new authentication methods. Biometric authentication, such as fingerprint or facial recognition, and voice-activated payments are becoming increasingly prevalent. These innovations offer enhanced security for transactions while simultaneously improving the customer experience by streamlining the payment process.

By 2025, biometric authentication is anticipated to be a standard, default method for securing payments. This shift underscores the growing consumer and regulatory demand for more robust and user-friendly security measures. For companies like ACI Worldwide, which specializes in secure transaction processing, adapting to and supporting these advanced authentication technologies is crucial for maintaining a competitive edge and meeting the dynamic security expectations of the market.

- Biometric authentication adoption is expected to reach 70% of all online transactions by 2026.

- Voice biometrics market is projected to grow by 25% annually through 2027.

- ACI Worldwide's investment in R&D for new authentication solutions directly impacts its market share in secure payment gateways.

Technological advancements are reshaping payments, with real-time processing and cloud-native platforms like ACI Connect becoming essential. By 2024, over 70% of global transactions are projected to be real-time, highlighting the demand for ACI's solutions.

AI and machine learning are critical for fraud detection and compliance, with financial services AI spending expected to exceed $20 billion in 2024. ACI Worldwide leverages these technologies for competitive advantage.

The adoption of ISO 20022, a universal payment messaging standard, is accelerating, with over 70% of global messages expected to comply by 2025. ACI's products facilitate this transition, enhancing interoperability and data analytics.

Emerging authentication methods, such as biometrics, are crucial for security and user experience, with adoption expected to reach 70% of online transactions by 2026. ACI's investment in these areas is key to its market position.

Legal factors

The EU Instant Payments Regulation (IPR), effective January 2025, mandates that banks and payment service providers (PSPs) enable instant fund transfers. This means by specific deadlines in 2025, all relevant entities must be equipped to send and receive these payments. This regulatory shift directly influences ACI Worldwide's European business, compelling their clients to adopt compliant payment solutions.

Consequently, the IPR creates a significant market opportunity for ACI Worldwide, as financial institutions will require their technology and expertise to meet these new instant payment requirements. ACI's ability to offer compliant platforms positions them to capitalize on this evolving regulatory landscape, driving demand for their services in the European market.

The landscape of data privacy is constantly shifting, with new regulations emerging worldwide. In the US alone, several state-level privacy laws are set to take effect in 2025, adding layers of complexity for businesses. These laws dictate how personal data must be handled, from collection to storage, requiring robust compliance measures.

ACI Worldwide, dealing with sensitive financial information, must navigate this intricate web of regulations. Ensuring their software and operations meet requirements for consumer consent and data protection assessments is paramount. For instance, the California Privacy Rights Act (CPRA), fully implemented in 2023, already sets a high bar for data handling, and upcoming laws in states like Texas and Florida will further expand these obligations.

ACI Worldwide operates within a stringent legal landscape shaped by Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which are paramount for financial institutions and payment technology providers. These rules demand robust identity verification and transaction monitoring to combat illicit financial activities.

The increasing adoption of real-time payment systems, like those facilitated by ACI Worldwide's solutions, amplifies the need for immediate compliance. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing global AML/KYC standards throughout 2024 and into 2025, requiring continuous adaptation from companies like ACI.

ACI Worldwide's expertise in fraud prevention and compliance is therefore vital, enabling its clients to navigate these complex requirements. Their solutions are designed to provide the real-time monitoring capabilities essential for detecting and preventing financial crimes in an era of instant transactions, ensuring clients remain compliant with evolving legal mandates.

Operational Resilience Regulations

New regulations are significantly reshaping how financial institutions manage operational risks. Europe's Digital Operational Resilience Act (DORA), the UK's operational resiliency scheme, and Australia's CPS 230 Operational Risk Management standard are prime examples, imposing rigorous demands on safeguarding against technology-related disruptions. These frameworks necessitate robust strategies for information and communication technology (ICT) incident management.

ACI Worldwide's cloud-native platforms are strategically positioned to assist financial entities in navigating these complex legal landscapes. By offering advanced technological solutions and fostering key partnerships, ACI Worldwide helps financial institutions meet the escalating non-functional requirements and bolster their overall operational resilience. For instance, DORA, which came into effect in January 2024, mandates comprehensive ICT risk management frameworks, testing, and incident reporting for a vast majority of EU financial entities.

- DORA Compliance: Financial institutions in the EU must adhere to DORA's stringent requirements for ICT risk management and resilience, impacting over 20,000 entities.

- UK Operational Resiliency: The Bank of England's framework, implemented in phases, requires firms to identify critical business services and set impact tolerances, with significant investment in resilience measures expected.

- Australia's CPS 230: This standard, effective from July 2025, mandates that Australian APRA-regulated entities establish and maintain robust operational risk management and business continuity frameworks.

- ACI's Role: ACI Worldwide's technology solutions are designed to help clients meet these evolving regulatory demands, particularly in areas like incident detection, response, and recovery.

Cross-Border Payment Regulations

Regulations for cross-border payments are increasingly focused on boosting transparency, cutting expenses, and speeding up transaction times. For ACI Worldwide, whose services are integral to international payments, adherence to these evolving rules is paramount. This includes complying with global messaging standards like ISO 20022, which is being adopted by major financial institutions and payment systems worldwide, aiming to standardize payment data and improve processing efficiency.

ACI Worldwide's payment solutions must navigate a complex web of international and national regulations designed to prevent financial crime and ensure market integrity. For instance, Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are critical, requiring robust verification processes for all transactions. The ongoing evolution of these rules, driven by bodies like the Financial Action Task Force (FATF), necessitates continuous adaptation of ACI's technology to maintain compliance and facilitate secure global commerce.

Initiatives from organizations like SWIFT, such as its ongoing gpi (Global Payments Innovation) program, are shaping expectations for faster and more transparent cross-border payments. ACI Worldwide's ability to integrate with and support these industry-led advancements is key to offering clients seamless and legally compliant global transaction processing. The push for real-time payments and enhanced data visibility across borders directly impacts how ACI's platforms must function.

- ISO 20022 Adoption: By late 2025, many major payment systems, including those in the EU and UK, will have fully adopted ISO 20022, impacting over 80% of global financial transactions by value.

- SWIFT gpi Growth: SWIFT gpi continues to expand, with over 11,000 financial institutions in more than 200 countries now using the service, emphasizing the demand for trackable and transparent international payments.

- Regulatory Scrutiny: Cross-border payment providers face increasing scrutiny regarding data privacy (e.g., GDPR) and sanctions compliance, requiring sophisticated systems to manage risk and ensure adherence to diverse legal frameworks.

- Digital Currency Impact: Emerging regulations around Central Bank Digital Currencies (CBDCs) and stablecoins will also influence the cross-border payment landscape, potentially requiring ACI Worldwide to adapt its offerings to support new forms of digital value transfer.

The EU's Instant Payments Regulation (IPR), effective January 2025, mandates instant fund transfers, directly impacting ACI Worldwide's European clients and creating a market opportunity for their compliant solutions.

Data privacy laws, like California's CPRA and upcoming state-level regulations in the US effective 2025, require ACI Worldwide to ensure robust consumer consent and data protection measures for sensitive financial information.

Evolving Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, influenced by bodies like the FATF, necessitate continuous adaptation of ACI's technology for real-time transaction monitoring and compliance in 2024-2025.

Operational resilience regulations such as DORA (effective Jan 2024), the UK's scheme, and Australia's CPS 230 (effective July 2025) demand rigorous ICT risk management, making ACI's cloud-native platforms crucial for financial institutions.

Environmental factors

The global shift towards digital and contactless payments is a significant environmental positive. By moving away from paper bills and checks, we're reducing the demand for paper production, which in turn conserves forests and lowers the energy and water consumption associated with papermaking. This trend directly benefits companies like ACI Worldwide, whose electronic payment solutions are at the forefront of this 'paper-saving revolution'.

ACI Worldwide's business model inherently supports environmental sustainability. Their platforms facilitate transactions that bypass the need for physical checks and paper statements, thereby cutting down on waste and the carbon footprint associated with printing, mailing, and processing paper. For instance, the global digital payments market was valued at approximately $8.7 trillion in 2023 and is projected to grow significantly, indicating a substantial reduction in paper-based transactions.

There's a significant surge in demand for 'green' payment solutions, driven by the increasing adoption of Environmental, Social, and Governance (ESG) principles. This push favors practices that lower carbon emissions and energy usage, while also promoting renewable energy sources. For instance, a 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions, highlighting a clear market shift.

ACI Worldwide's focus on corporate sustainability, including actively tracking and reducing its environmental impact, directly addresses this growing market expectation. By investing in energy-efficient data centers and promoting digital payment methods that reduce paper waste, ACI Worldwide positions itself favorably within this evolving landscape. Their 2024 sustainability report detailed a 15% reduction in their operational carbon footprint compared to 2022.

ACI Worldwide's extensive IT infrastructure and data centers, crucial for processing billions of transactions, demand substantial energy. This significant energy draw directly impacts their environmental footprint.

Focusing on energy optimization and investing in energy efficiency improvements is paramount for ACI Worldwide to reduce its greenhouse gas (GHG) emissions. Their commitment is reflected in their sustainability reports, which detail ongoing efforts to monitor and decrease Scope 1 and Scope 2 GHG emissions.

Environmental Impact of Supply Chain

While ACI Worldwide primarily deals in software, the environmental impact of its supply chain, particularly concerning hardware components for any physical infrastructure or client deployments, is an indirect but noteworthy consideration. The company's commitment to corporate sustainability means they actively engage in promoting environmental responsibility throughout their value chain, including their partners.

ACI Worldwide's focus on advancing supply chain sustainability involves collaborating with partners who demonstrate adherence to stringent environmental standards. This collaborative approach helps foster a more sustainable ecosystem, ensuring that even indirect environmental footprints are managed responsibly.

ACI Worldwide actively seeks partners who align with their environmental goals. For instance, in 2024, a significant portion of the tech industry, including software providers, reported increased scrutiny on their suppliers' carbon emissions and waste management practices. Companies like ACI are expected to follow suit, aiming for reduced environmental impact across all operational facets.

- Hardware Sourcing: Environmental impact arises from the manufacturing and disposal of any necessary hardware, from servers to end-user devices.

- Energy Consumption: Data centers and office operations, often reliant on third-party infrastructure, contribute to energy-related environmental impacts.

- Partner Compliance: ACI's commitment to sustainability necessitates ensuring their supply chain partners meet defined environmental performance metrics.

Regulatory and Stakeholder Pressure for ESG Reporting

ACI Worldwide faces growing demands from regulators and stakeholders for robust Environmental, Social, and Governance (ESG) reporting. This pressure directly impacts how the company communicates its environmental initiatives and performance.

ACI demonstrates its commitment through annual sustainability reports, adhering to established frameworks like the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI). These reports detail ACI's environmental footprint and address key ESG concerns crucial for investors, clients, and other interested parties.

- Regulatory Scrutiny: Governments globally are intensifying ESG disclosure mandates, pushing companies like ACI to provide more granular environmental data.

- Investor Expectations: A significant majority of institutional investors, often exceeding 70% in recent surveys, now integrate ESG factors into their investment decisions, demanding clear reporting from portfolio companies.

- Customer Demand: Businesses are increasingly prioritizing suppliers with strong ESG credentials, influencing ACI's client relationships and market competitiveness.

- SASB & GRI Alignment: ACI's adherence to SASB and GRI standards in its 2023 sustainability report highlights its focus on material ESG topics, providing standardized data for stakeholders.

The global push towards digital transactions significantly reduces paper waste and the associated environmental impact of production and disposal. ACI Worldwide's electronic payment solutions are central to this trend, aligning with growing consumer and business demand for sustainable practices. For example, the digital payments market is expected to reach over $15 trillion by 2027, indicating a substantial shift away from paper-based methods.

| Environmental Factor | Impact on ACI Worldwide | Supporting Data/Trend |

| Digitalization of Payments | Reduces paper waste, lowers carbon footprint from printing and mailing. | Global digital payments market projected to exceed $15 trillion by 2027. |

| Energy Consumption (Data Centers) | Significant energy demand for IT infrastructure, impacting GHG emissions. | ACI's 2024 sustainability report detailed a 15% reduction in operational carbon footprint compared to 2022. |

| Supply Chain Sustainability | Indirect impact from hardware sourcing and partner practices. | Over 70% of consumers consider sustainability in purchasing decisions (2024 data). |

| ESG Reporting & Compliance | Increasing demand for transparent environmental performance data. | ACI aligns with SASB and GRI standards, with over 70% of institutional investors integrating ESG factors. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for ACI Worldwide is built on a comprehensive blend of data, drawing from official government publications, reputable financial news outlets, and leading industry analysis reports. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the payments technology sector.