ACI Worldwide Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

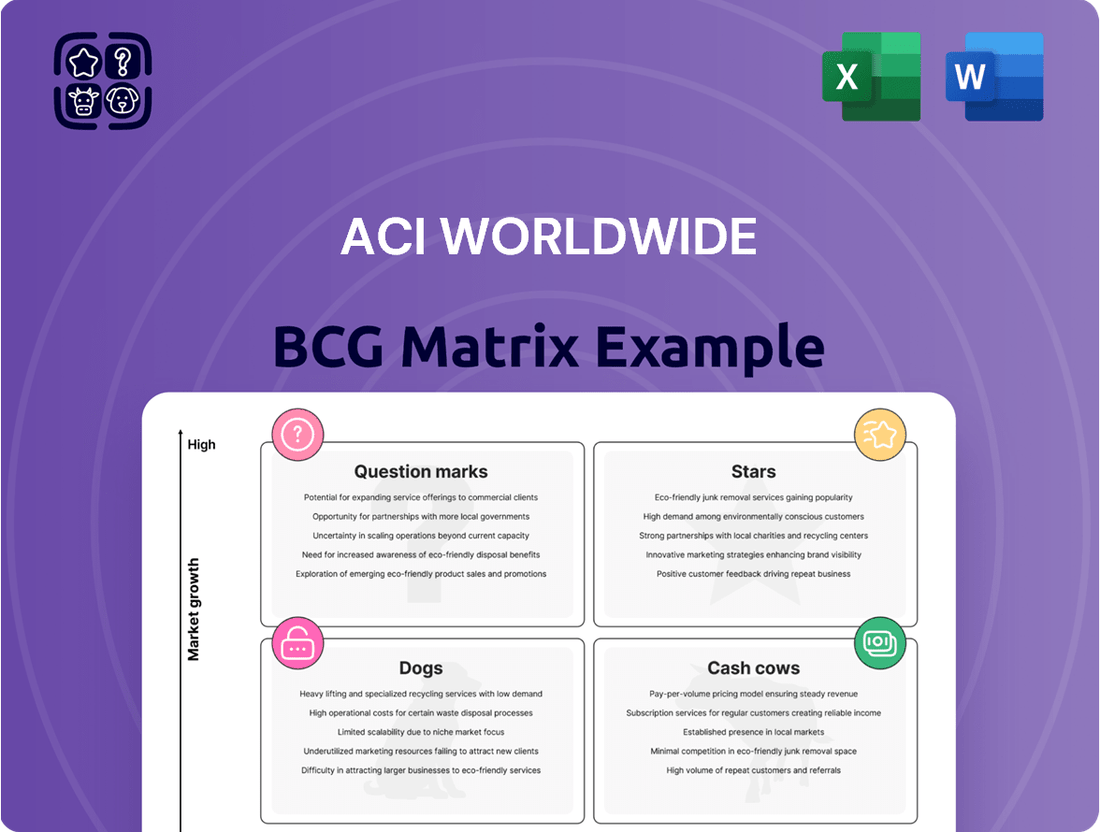

Curious about ACI Worldwide's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in the competitive payments landscape. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear roadmap to optimizing your investment and product portfolio.

Stars

ACI Connetic, launched in 2025, represents ACI Worldwide's strategic move into the future of payments. This cloud-native platform is designed to consolidate both card and account-to-account transactions, offering a unified solution for financial institutions. Its introduction addresses the growing demand for modern, agile payment infrastructures.

The platform's key features include AI-powered fraud prevention and real-time gross settlement capabilities. This allows banks to process any payment type instantaneously, a crucial advantage in today's fast-paced financial landscape. ACI Connetic is positioned to capitalize on the expanding market for cloud-native payment solutions.

ACI Worldwide stands out as a prominent player in the rapidly expanding real-time payments arena. Their solutions are currently operational in 18 countries, facilitating 26 distinct real-time payment schemes and integrating with 10 central payment infrastructures. This extensive reach underscores their significant market penetration and operational capability in a sector poised for substantial expansion.

The global market for real-time payments is on a significant upward trajectory. Projections indicate it will reach $110.89 billion by 2030, growing at an impressive compound annual growth rate of 25.42% starting from 2025. This robust growth forecast highlights the immense opportunity within this segment.

Given ACI Worldwide's established leadership and deep expertise in this high-growth real-time payments market, their solutions are unequivocally positioned as a Star within the BCG Matrix framework. Their ability to support a wide array of schemes and infrastructures, coupled with the sector's strong growth prospects, solidifies their leading status.

ACI Worldwide's AI-driven fraud prevention, integrated into platforms like ACI Connect, is a significant player in a market expected to hit $252.7 billion by 2032. This robust capability directly addresses the growing threat of sophisticated scams, including Authorized Push Payment (APP) fraud.

The company champions a unified and orchestrated approach to fraud management, enabling real-time detection and response. This strategic focus on advanced, dynamic fraud mitigation within a booming sector firmly establishes its position as a Star in the BCG matrix.

Payment Software Segment Growth

ACI Worldwide's Payment Software segment, a consolidation of its former Bank and Merchant divisions, experienced robust expansion. In the first quarter of 2025, this segment saw its revenue surge by an impressive 42%.

This remarkable growth is fueled by several key factors, including significant modernization initiatives undertaken by large financial institutions. Additionally, there's a notable demand from mid-sized banks seeking advanced payment solutions.

- Revenue Growth: 42% increase in Q1 2025.

- Key Drivers: Modernization by large financial institutions and demand from mid-sized banks.

- Financial Health: Positive adjusted EBITDA underscores market strength.

- Market Position: Strong performance in a rapidly evolving payment landscape.

Strategic Global Expansion

ACI Worldwide is strategically growing its footprint in promising markets, with a particular emphasis on the Middle East and North America. This expansion is fueled by the increasing demand for real-time payments modernization in these areas.

The company's commitment to these high-growth regions is evident through key collaborations. For instance, partnerships with organizations like Arab Financial Services (AFS) are instrumental in advancing digital payment modernization for both banks and merchants across the Middle East.

This focused effort to penetrate new, high-potential geographical markets solidifies ACI Worldwide's position as a Star within the BCG Matrix. The company's proactive expansion strategy directly supports its growth trajectory in the dynamic global payments landscape.

- Geographic Focus: Middle East and North America are key expansion targets for ACI Worldwide.

- Growth Drivers: Real-time payments modernization is a primary catalyst for this expansion.

- Partnerships: Collaborations, such as with Arab Financial Services (AFS), facilitate market penetration and service delivery.

- BCG Classification: This strategic global expansion contributes to ACI Worldwide's Star portfolio.

ACI Worldwide's Payment Software segment, encompassing its former Bank and Merchant divisions, demonstrated exceptional growth, with a 42% revenue surge in Q1 2025. This expansion is driven by financial institutions' modernization efforts and mid-sized banks' demand for advanced payment solutions. The company's strong adjusted EBITDA further solidifies its market strength.

ACI Worldwide's strategic focus on high-growth regions like the Middle East and North America, evidenced by partnerships such as with Arab Financial Services (AFS), is a key driver of its Star status. This proactive geographical expansion addresses the increasing demand for real-time payment modernization, reinforcing its leading position.

The company's commitment to real-time payments, facilitating 26 distinct schemes across 18 countries, positions it as a leader in a market projected to reach $110.89 billion by 2030. ACI's AI-powered fraud prevention, crucial in a market expected to reach $252.7 billion by 2032, further cements its Star classification.

| Segment | 2025 Q1 Revenue Growth | Key Growth Drivers | Market Position | BCG Classification |

|---|---|---|---|---|

| Payment Software | 42% | Modernization by large banks, demand from mid-sized banks | Strong market strength, positive adjusted EBITDA | Star |

| Real-Time Payments | High Growth Sector | Global adoption of real-time payment schemes | Facilitates 26 schemes in 18 countries | Star |

| Fraud Prevention | Growing Market | Increasing need for advanced fraud mitigation (e.g., APP fraud) | AI-powered solutions, unified approach | Star |

| Geographic Expansion | Targeted Growth | Demand for real-time payments modernization in ME & NA | Key partnerships (e.g., AFS) | Star |

What is included in the product

This BCG Matrix overview provides strategic insights into ACI Worldwide's product portfolio, identifying areas for investment and divestment.

A clear ACI Worldwide BCG Matrix, visually placing each business unit, alleviates the pain of strategic uncertainty.

Cash Cows

ACI Worldwide's core payment processing infrastructure is a true cash cow, powering critical operations for over 9,000 clients, including major banks worldwide. This robust system manages billions of transactions each day, facilitating the flow of trillions of dollars, underscoring its immense scale and importance.

While this segment may not exhibit explosive growth, its deeply embedded nature within client systems ensures a consistent, high-volume stream of recurring revenue. For example, in 2023, ACI reported that its Payments segment, which includes this core infrastructure, generated a significant portion of its revenue, demonstrating its stability.

Established Merchant Solutions, a key component of ACI Worldwide's portfolio, functions as a Cash Cow within the BCG Matrix. ACI's extensive payment processing services cater to a vast network of merchants, spanning in-store, online, and mobile channels, often facilitated through partnerships with major payment service providers.

These deeply integrated solutions are designed for longevity, securing recurring revenue streams through enduring client relationships. ACI Worldwide reported that its Payments segment, which includes these established merchant solutions, generated substantial revenue, highlighting the consistent performance of these mature offerings. The company's focus on extending agreements with large retailers underscores the stability and trusted value these services deliver in the current market landscape.

ACI Worldwide's Biller Solutions are a cornerstone of their business, acting as a classic Cash Cow within their BCG Matrix. These solutions are vital for thousands of organizations across diverse industries, handling essential payment processing needs.

This segment consistently generates substantial revenue, demonstrating a solid 11% growth in Q1 2025 and a 6% increase in 2024. While its adjusted EBITDA growth lagged behind other segments, its stability and ACI's significant market share in this mature sector ensure a reliable and predictable stream of cash flow.

Long-Standing Financial Institution Partnerships

ACI Worldwide's long-standing partnerships with financial institutions represent a significant cash cow for the company. With nearly 50 years of experience, ACI serves all of the top 10 banks globally, demonstrating a deep and trusted presence in the industry. These relationships are not fleeting; they are built on the continuous use of ACI's critical platforms for essential banking operations, generating a reliable and substantial revenue stream. The company's success in retaining and expanding these engagements highlights the enduring value and proven reliability of its established solutions.

These enduring relationships are a testament to ACI's ability to consistently deliver for its clients. For instance, in 2023, ACI reported that its Payments business, which heavily relies on these institutional partnerships, continued to be a primary revenue driver. The company's platforms are integral to the daily functioning of these major banks, covering everything from transaction processing to fraud detection. This deep integration means that these partnerships are inherently sticky, providing a predictable and consistent revenue base.

- Deep Institutional Penetration: ACI serves all of the world's top 10 banks, showcasing unparalleled reach within the financial sector.

- Recurring Revenue Model: The continuous use of ACI's platforms for critical operations ensures a stable and predictable income.

- Proven Reliability and Value: Nearly 50 years of expertise translate into platforms that financial institutions trust for essential services.

- Strategic Importance: These partnerships are foundational to ACI's business, providing a robust cash flow that supports further innovation and growth.

High Recurring Revenue Base

ACI Worldwide benefits from a robust recurring revenue stream, a hallmark of its Cash Cow products. This stability is largely driven by its subscription-based model for payment processing solutions.

In the first quarter of 2025, ACI Worldwide reported that a substantial 80% of its revenue was recurring, a notable increase from 70% in 2023. This high percentage signifies a predictable and reliable income, primarily from ongoing service agreements and software subscriptions.

This sticky revenue base provides ACI Worldwide with significant financial flexibility. It allows the company to consistently fund new initiatives and research and development without being overly reliant on volatile, one-time sales.

- Recurring Revenue Growth: ACI Worldwide's recurring revenue climbed to 80% in Q1 2025, up from 70% in 2023.

- Revenue Sources: This recurring income is primarily generated through subscription fees and ongoing service contracts for its payment solutions.

- Financial Stability: The high percentage of recurring revenue ensures a stable and predictable cash flow, a key characteristic of Cash Cow business units.

- Investment Capacity: This reliable income stream provides the financial foundation to support new product development and strategic investments.

ACI Worldwide's established merchant solutions are a prime example of a Cash Cow. These offerings cater to a wide array of merchants, covering both physical and online transactions, often through collaborations with major payment processors. The deeply integrated nature of these solutions fosters long-term client relationships, securing a consistent revenue stream.

The company's Biller Solutions also represent a significant Cash Cow. Serving thousands of organizations across various sectors, these solutions handle critical payment processing tasks. While adjusted EBITDA growth might trail other segments, the stability and ACI's strong market presence in this mature area guarantee a dependable cash flow.

ACI Worldwide's core payment processing infrastructure is a true cash cow, powering critical operations for over 9,000 clients, including major banks worldwide. This robust system manages billions of transactions each day, facilitating the flow of trillions of dollars, underscoring its immense scale and importance.

These established partnerships with financial institutions are a cornerstone of ACI's cash cow strategy. Serving all top 10 global banks, ACI's platforms are integral to daily banking operations, generating substantial and reliable revenue. The company's ability to retain and expand these engagements highlights the enduring value and proven dependability of its mature solutions.

| Segment | BCG Category | Key Characteristics | Financial Highlight (2024/Q1 2025) |

|---|---|---|---|

| Core Payment Processing | Cash Cow | Powers critical operations for 9,000+ clients, handles billions of transactions daily. | Significant portion of revenue from Payments segment in 2023. |

| Established Merchant Solutions | Cash Cow | Extensive payment processing for merchants across channels, long-term client relationships. | Consistent performance in the Payments segment. |

| Biller Solutions | Cash Cow | Vital for thousands of organizations, handles essential payment processing. | 11% growth in Q1 2025, 6% growth in 2024. |

| Financial Institution Partnerships | Cash Cow | Serves all top 10 global banks, platforms integral to daily operations. | Payments business remained a primary revenue driver in 2023. |

What You’re Viewing Is Included

ACI Worldwide BCG Matrix

The ACI Worldwide BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive immediately after purchase. This means you get the complete strategic analysis, ready for immediate application without any watermarks or incomplete sections. The report is meticulously prepared by industry experts, ensuring you receive a professional and actionable tool for evaluating ACI Worldwide's product portfolio. You'll be able to leverage this exact analysis for your business planning and decision-making processes.

Dogs

Highly customized legacy on-premise software installations for ACI Worldwide likely fall into the Dogs category of the BCG Matrix. These systems, while still operational for some clients, face a market increasingly favoring cloud-based and standardized payment solutions, indicating low growth potential.

The ongoing shift in the payments industry towards modern, cloud-native platforms means these bespoke, older systems demand significant resources for maintenance and support, often disproportionately to their revenue generation. This makes them a less attractive investment for ACI Worldwide.

ACI's strategic direction clearly prioritizes migrating customers to their newer, more adaptable platforms. Consequently, investment and development efforts for these legacy on-premise solutions are expected to be minimal, further solidifying their position as a Dog.

Some older digital banking features, perhaps developed or acquired years ago, might now be in a market that isn't growing much and doesn't offer much unique value compared to competitors. These older systems may not keep up with the fast-paced innovation happening in mobile and instant digital experiences that customers expect today.

ACI Worldwide's focus on bringing together payments across different ways people bank highlights a move away from these standalone digital banking parts that aren't as connected. For example, while the digital banking market continues to grow, with projections suggesting a compound annual growth rate (CAGR) of around 10-12% globally through 2027, features lacking real-time capabilities or advanced personalization are likely to see slower adoption and less differentiation.

The commoditized payment gateway segments, marked by fierce price wars and little room for unique features, are likely considered Dogs for ACI Worldwide. These areas offer minimal potential for ACI to expand its market share or achieve substantial profits.

ACI's strategy appears to be shifting away from these low-margin, basic gateway services. Instead, the company is focusing on deeply integrated, value-added offerings that distinguish it from competitors.

For instance, in 2024, the global payment gateway market, while growing, saw significant pressure on pricing in its more basic functionalities. ACI's emphasis on advanced fraud prevention and specialized industry solutions, rather than just transaction routing, highlights this strategic pivot.

Solutions with High Technical Debt and Limited Scalability

Older software solutions that have accumulated significant technical debt and lack inherent scalability often find themselves in a challenging position, potentially fitting into a 'Dogs' category within a strategic matrix. These systems can become expensive to maintain, update, and integrate with modern technologies, which in turn hinders efficient operations and stifles future innovation. For instance, a company struggling with a decade-old payment processing system might face integration issues with new digital wallets, costing them potential market share.

ACI Worldwide's strategic shift towards cloud-native, modular architectures, such as their Connetic platform, directly addresses these limitations. This move signifies a deliberate effort to move away from the burdens of legacy technical debt. By investing in modern infrastructure, ACI aims to offer solutions that are inherently scalable and easier to adapt, allowing clients to respond more quickly to market changes and technological advancements. This focus on future-proofing is crucial in the rapidly evolving payments industry.

- High Maintenance Costs: Legacy systems often require specialized, expensive support and are prone to frequent, costly fixes.

- Integration Challenges: Connecting older software with newer APIs or cloud services can be complex and resource-intensive.

- Limited Agility: The inability to scale or adapt quickly hinders a business's response to market demands and competitive pressures.

- Innovation Roadblocks: Technical debt can prevent the adoption of new features or technologies, slowing down product development.

Non-Strategic, Low-Volume Ancillary Services

ACI Worldwide might offer certain ancillary services that don't directly support its primary focus on intelligent payments orchestration and real-time processing. These could be smaller offerings, perhaps maintained to serve existing customer relationships.

These types of services typically have limited growth potential and a minimal impact on the overall market. Consequently, they would likely receive very little in terms of investment from ACI.

Given their non-strategic nature, ACI might consider phasing out these low-volume ancillary services or even divesting them entirely. For instance, if a service contributes less than 1% to ACI's overall revenue and requires significant maintenance, it could be a candidate for discontinuation.

- Non-strategic alignment

- Low growth prospects

- Minimal market impact

- Limited investment allocation

ACI Worldwide's older, on-premise payment solutions, particularly those requiring significant customization, are likely classified as Dogs in the BCG Matrix. These systems face a declining market as the industry shifts towards cloud-native and standardized offerings, limiting growth potential. Their high maintenance costs and integration challenges with modern platforms further reduce their strategic value.

The company's strategic focus on migrating clients to newer, more adaptable platforms like Connetic indicates a deliberate move away from these legacy assets. Investment in these older systems is minimal, and they are often maintained only to serve existing customer bases, reinforcing their Dog status.

Commoditized payment gateway segments with intense price competition and little differentiation also fall into the Dog category. ACI Worldwide is strategically pivoting from these low-margin services to value-added, integrated offerings that provide a competitive edge.

Certain ancillary services that do not align with ACI's core strategy of intelligent payments orchestration may also be considered Dogs. These offerings typically exhibit low growth and minimal market impact, making them candidates for discontinuation or divestment if they contribute less than 1% to overall revenue while demanding substantial maintenance.

| BCG Category | ACI Worldwide Product Examples | Market Characteristics | Strategic Implications |

|---|---|---|---|

| Dogs | Customized legacy on-premise payment software | Declining market, shift to cloud, low growth potential | Minimal investment, focus on migration, potential divestment |

| Dogs | Older, non-real-time digital banking features | Saturated market, lacks advanced personalization | Limited differentiation, focus on integrated solutions |

| Dogs | Basic, commoditized payment gateway services | High price competition, low margins | Strategic pivot to value-added services, away from basic routing |

| Dogs | Low-volume, non-strategic ancillary services | Limited growth, minimal market impact | Consider phasing out or divesting if ROI is low |

Question Marks

ACI Worldwide is actively enhancing its real-time payments offerings with new digital overlay services. These include white-label mobile apps, web portals, plug-ins, and robust APIs and SDKs designed for seamless integration into digital channels. This strategic move addresses the increasing demand for superior customer experiences and the growing adoption of QR code payments.

While ACI's new digital overlay services are positioned to capitalize on a high-growth market, their current market share in these specific, emerging functionalities is still in its nascent stages. The company recognizes that substantial investment will be crucial to accelerate widespread adoption and establish a more dominant market presence in this evolving segment.

ACI Worldwide is strategically targeting Tier 2 and Tier 3 banks with its adaptable, cloud-native payment solutions. These institutions are actively seeking cost-effective ways to modernize their systems to better compete with agile fintechs and digital-only banks.

This segment offers significant growth opportunities because many smaller banks are eager to enhance their digital capabilities and customer offerings. By providing modular solutions, ACI can help them achieve this without the massive upfront investment typically associated with legacy system overhauls.

ACI's success in this diverse market hinges on tailored approaches. This means focused sales efforts, targeted marketing campaigns that highlight cost savings and scalability, and implementation strategies that recognize the unique operational needs and resources of each Tier 2 and Tier 3 bank.

Real-time payments are expanding beyond simple consumer transactions, with exciting new applications like instant payroll and streamlined B2B payments gaining traction. ACI Worldwide is actively supporting these emerging use cases, though its market share in these newer areas is still developing.

The company is focusing on building out solutions for specific industry needs, recognizing the potential for significant growth. ACI's strategic investment in these nascent markets is key to solidifying its position and capturing future market leadership.

Initial Penetration in Untapped Geographic Markets

ACI Worldwide's expansion into nascent digital payment markets, where its sophisticated solutions are not yet widely adopted, positions these ventures as Question Marks within the BCG framework. These regions present a significant opportunity for growth as their payment infrastructures evolve, but ACI would initially face a low market share.

The company must allocate considerable resources to establish its brand, forge local alliances, and tailor its offerings to meet distinct regional demands. For instance, in many parts of Sub-Saharan Africa, where mobile money is prevalent but advanced digital payment systems are still emerging, ACI's potential is high but requires a strategic entry. In 2024, the digital payments market in Africa was projected to reach over $50 billion, with significant untapped potential for more complex payment solutions.

- High Growth Potential: Emerging markets are rapidly adopting digital payment technologies, creating a fertile ground for ACI's advanced solutions.

- Low Initial Market Share: Entering these markets means starting with minimal brand recognition and customer base, typical of a Question Mark.

- Substantial Investment Needed: Building infrastructure, local partnerships, and adapting products for specific regulatory and consumer needs requires significant upfront capital.

- Strategic Importance: These markets represent future revenue streams and diversification for ACI, mitigating reliance on more mature, saturated markets.

Advanced AI/ML Applications Beyond Core Fraud Prevention

ACI Worldwide is actively exploring advanced AI and ML applications beyond its core fraud prevention strengths, aiming to unlock new value across its payment ecosystem. This includes leveraging these technologies for predictive analytics in liquidity management and developing personalized payment experiences for consumers. These emerging areas represent a significant growth opportunity, with the broader AI in financial services market projected to reach substantial figures, though ACI's current market share in these specific advanced applications is still developing.

The potential for AI/ML in areas like liquidity forecasting and tailored payment solutions is immense. For instance, by analyzing vast datasets, ACI could offer more precise cash flow predictions, helping financial institutions optimize their working capital. Personalized payment offerings, driven by AI, could enhance customer engagement and loyalty, a key differentiator in the competitive payments landscape.

- Predictive Liquidity Management: AI can forecast cash flow needs with greater accuracy, potentially reducing idle balances and improving capital efficiency.

- Personalized Payment Experiences: ML algorithms can tailor payment options, rewards, and communication to individual customer preferences, boosting satisfaction.

- Market Growth Potential: The global AI in financial services market is experiencing rapid expansion, with various reports indicating multi-billion dollar valuations and strong compound annual growth rates (CAGR) in the coming years, highlighting the strategic importance of these advanced applications.

- Early Stage Market Entry: While the potential is high, ACI's footprint in these specific advanced AI/ML application segments is still in its nascent stages, presenting both a challenge and a significant opportunity for market capture.

ACI Worldwide's exploration into new digital payment markets, particularly in regions with rapidly evolving financial infrastructures, positions these ventures as Question Marks. These emerging markets offer substantial growth potential as digital payment adoption accelerates, but ACI's current market share in these nascent areas is minimal.

Significant investment is required to build brand awareness, establish local partnerships, and adapt solutions to unique regional needs and regulations. For example, in many African nations, mobile money is widespread, but advanced digital payment systems are still developing, presenting a high-potential but challenging entry point. The African digital payments market was projected to exceed $50 billion in 2024, indicating a vast opportunity for sophisticated payment solutions.

ACI's strategic focus on these developing markets is crucial for future revenue diversification and growth, especially as more mature markets become saturated. The company's success will depend on tailored market entry strategies that address specific local demands and competitive landscapes.

ACI Worldwide's ventures into advanced AI and ML applications beyond core fraud prevention, such as predictive liquidity management and personalized payment experiences, also fall into the Question Mark category. The global AI in financial services market is experiencing rapid growth, with significant multi-billion dollar valuations and strong projected CAGRs, underscoring the strategic importance of these innovations.

| Category | Description | Market Potential | ACI's Current Share | Investment Needs |

| New Digital Payment Markets (e.g., Sub-Saharan Africa) | Rapid adoption of digital payments, evolving infrastructure | High (Projected market value >$50B in 2024) | Low | High (Infrastructure, partnerships, localization) |

| Advanced AI/ML Applications (e.g., Predictive Liquidity, Personalization) | Leveraging AI for enhanced financial services | High (Global AI in FinServ market substantial growth) | Low | High (R&D, talent acquisition, data integration) |

BCG Matrix Data Sources

Our ACI Worldwide BCG Matrix leverages comprehensive data from public financial filings, industry analyst reports, and market research databases to accurately assess product performance and market share.