ACI Worldwide Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

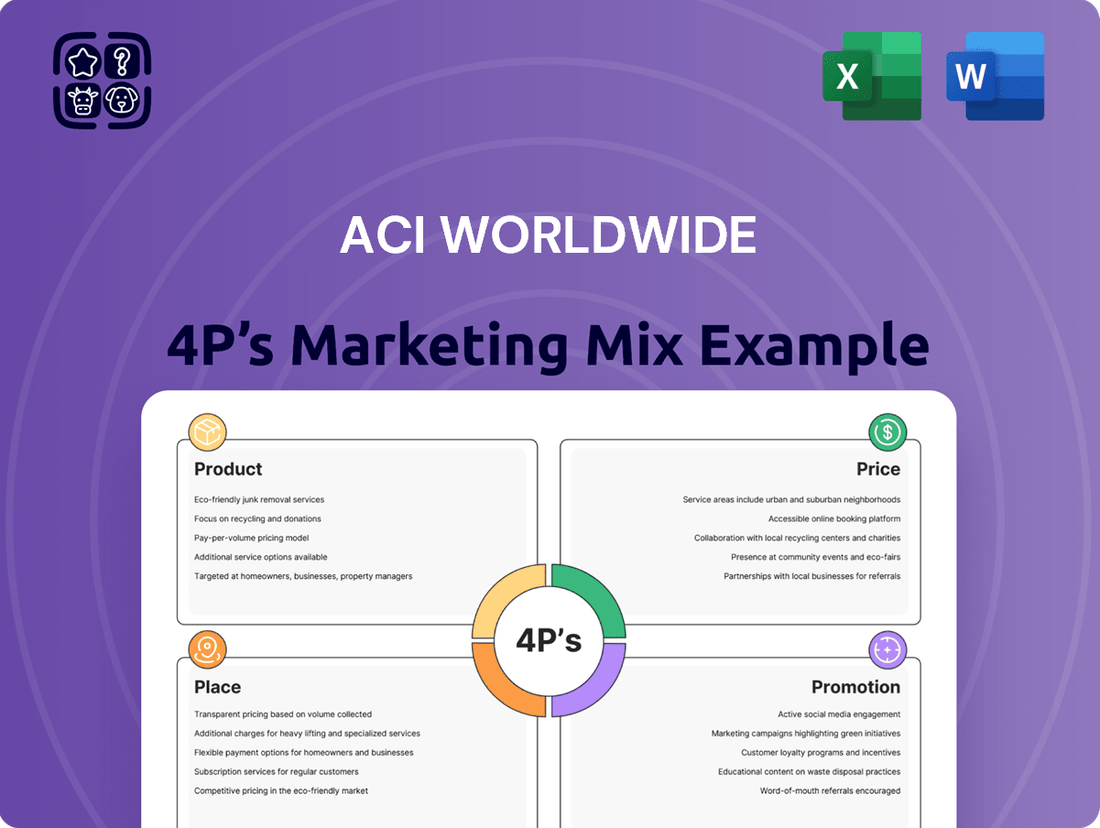

Discover how ACI Worldwide leverages its product innovation, strategic pricing, extensive distribution, and targeted promotion to dominate the payments industry. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Ready to unlock ACI Worldwide's marketing secrets? Get instant access to a comprehensive, editable report detailing their Product, Price, Place, and Promotion strategies, perfect for professionals and students seeking actionable insights.

Product

ACI Worldwide's Real-Time Payment Solutions are a cornerstone of their product strategy, offering businesses the ability to process electronic payments instantly. These solutions are vital for financial institutions and retailers aiming to modernize their payment systems, handling massive transaction volumes with efficiency. For instance, in 2024, the global real-time payments market was valued at approximately $16.8 billion and is projected to grow significantly, underscoring the demand for such advanced processing capabilities.

ACI Worldwide's fraud prevention and risk management solutions are a cornerstone of their product suite, leveraging cutting-edge AI and machine learning. These capabilities enable real-time detection and mitigation of financial fraud for banks, merchants, and billers, safeguarding them from losses and ensuring regulatory compliance.

ACI's Scamscope report, a key piece of evidence, underscores the escalating danger posed by authorized push payment (APP) scams. This report highlights the critical necessity for strong, AI-powered defenses to combat these evolving threats effectively.

Omni-commerce and bill payment solutions are central to ACI Worldwide's product strategy, enabling businesses to manage transactions seamlessly across all customer touchpoints. This includes everything from physical stores to digital platforms, ensuring a consistent payment experience. In 2024, ACI Worldwide reported significant growth in its digital payments segment, driven by the increasing demand for these integrated solutions, with transaction volumes expected to climb by over 15% year-over-year.

The electronic bill payment aspect of their offerings is equally crucial, simplifying the often complex process of billing and payment for both companies and consumers. ACI's solutions aim to reduce payment friction and improve cash flow for businesses. By 2025, it's projected that over 70% of consumers will prefer digital bill payment methods, a trend ACI is well-positioned to capitalize on.

Cloud-Native Payment Orchestration

ACI Worldwide's cloud-native payment orchestration, exemplified by ACI Connect, offers financial institutions a unified platform for both account-to-account and card payments. This innovation directly addresses the market's need for modernized, simplified payment operations, aiming to enhance efficiency and reduce complexity. The platform's AI-driven fraud prevention capabilities are particularly crucial in today's evolving threat landscape.

The product's strategic placement within ACI's portfolio emphasizes its role in driving digital transformation for financial services. By supporting connectivity to diverse payment networks, it caters to the growing demand for flexible and integrated payment solutions. This focus on scalability and operational resilience is paramount, especially as global payment volumes continue to surge.

Key features and benefits include:

- Centralized Payment Hub: Unifies diverse payment types for streamlined management.

- AI-Powered Fraud Prevention: Leverages artificial intelligence to detect and mitigate fraudulent transactions.

- Enhanced Scalability and Resilience: Built for cloud-native environments to handle increasing transaction volumes and ensure uptime.

- Simplified Operations: Modernizes and simplifies complex payment processes for financial institutions.

Digital Wallets and Central Infrastructure

ACI Worldwide's product strategy includes a robust offering in digital wallets, allowing merchants to seamlessly accept payments from over 200 digital wallets globally through a single integration. This broadens merchant reach and simplifies payment processing in an increasingly fragmented digital payment landscape. For instance, by Q1 2025, the global digital wallet market is projected to reach $2.9 trillion, underscoring the significant opportunity ACI is addressing.

Complementing its digital wallet support, ACI provides critical central infrastructure solutions. These platforms are designed for central banks and financial institutions, facilitating account-to-account payments. This infrastructure often integrates with innovative digital overlays, such as request-to-pay functionalities and QR code payment systems, enhancing payment efficiency and user experience.

- Broad Digital Wallet Support: Enables merchants to accept over 200 digital wallets with a single integration, simplifying cross-border and diverse payment acceptance.

- Central Infrastructure for Payments: Offers account-to-account payment platforms for central banks and financial institutions, modernizing payment systems.

- Integration of Digital Overlays: Incorporates features like request-to-pay and QR code payments to enhance payment functionality and user convenience.

- Market Growth Alignment: Positions ACI to capitalize on the rapid expansion of digital payments, with the global digital wallet market expected to reach $2.9 trillion by Q1 2025.

ACI Worldwide's product suite is designed to address the evolving needs of the global payments landscape, focusing on real-time processing, fraud prevention, and seamless omni-channel experiences. Their solutions empower businesses to handle increasing transaction volumes and adapt to new payment methods. The company's commitment to innovation is evident in its cloud-native offerings and AI-driven security features.

ACI's product strategy centers on providing a comprehensive platform for modern payment needs. This includes robust support for real-time payments, which saw significant market growth, and a strong emphasis on digital wallets. The company also offers critical central infrastructure for account-to-account payments, integrating advanced features to improve efficiency and user experience.

ACI Worldwide's product portfolio is a key driver of its market position, offering solutions that cater to both immediate payment needs and long-term digital transformation. The company's focus on areas like real-time payments and digital wallet integration positions it to benefit from strong market trends. For example, the projected growth in digital payments highlights the relevance of ACI's offerings.

The product's strategic importance lies in its ability to unify and simplify complex payment ecosystems. By offering a centralized hub for diverse payment types and leveraging AI for fraud prevention, ACI Worldwide provides essential tools for financial institutions. This approach is crucial as global payment volumes continue to surge, demanding greater efficiency and security.

| Product Area | Key Features | Market Relevance (2024-2025 Data) |

|---|---|---|

| Real-Time Payments | Instant transaction processing | Global market valued at ~$16.8 billion in 2024, with strong projected growth. |

| Fraud Prevention | AI/ML-driven detection and mitigation | Essential for combating escalating APP scams, as highlighted by ACI's Scamscope report. |

| Digital Wallets | Acceptance of 200+ global wallets | Global digital wallet market projected to reach $2.9 trillion by Q1 2025. |

| Bill Payment | Streamlined digital payment processes | Over 70% of consumers expected to prefer digital bill payments by 2025. |

What is included in the product

This analysis provides a comprehensive breakdown of ACI Worldwide's marketing strategies across Product, Price, Place, and Promotion, grounded in real-world practices and competitive context.

It's designed for professionals seeking a deep understanding of ACI Worldwide's marketing positioning and offers a solid foundation for strategic planning and benchmarking.

Simplifies ACI Worldwide's marketing strategy by clearly defining the 4Ps, alleviating the pain of complex, scattered information for better decision-making.

Place

ACI Worldwide's global reach is impressive, with operations spanning 95 countries and a physical presence in 34. This vast network allows them to tap into diverse markets and serve a broad customer base.

Their strategy emphasizes a strong local presence alongside this global footprint. This dual approach enables ACI to tailor payment solutions to specific regional needs and regulatory landscapes, fostering deeper customer relationships.

Distribution networks are strategically positioned across the Americas, EMEA, and Asia Pacific. These are further strengthened by globally coordinated sales teams and a network of local resellers and distributors, ensuring effective market penetration and support.

ACI Worldwide's direct sales approach is a cornerstone of its strategy, focusing on major financial institutions, payment intermediaries, and large enterprise merchants. This direct engagement is crucial for delivering highly customized solutions and fostering deep client relationships.

The company boasts an impressive client base, serving over 1,000 of the world's largest financial institutions and intermediaries. Furthermore, ACI directly supports more than 80,000 enterprise merchants, either on their own or through partnerships with Payment Service Providers (PSPs).

ACI Worldwide actively cultivates strategic alliances with major technology players like Microsoft, Red Hat, and IBM. These collaborations are crucial for enriching ACI's payment solutions and extending its global footprint. For instance, their deepened partnership with Worldpay underscores their commitment to providing essential payment infrastructure for merchants, fostering innovation across the entire payment landscape.

These symbiotic relationships are fundamental to ACI's strategy for building and maintaining highly dependable and resilient payment processing systems. By integrating with leading technology providers, ACI ensures its clients benefit from cutting-edge capabilities and robust security measures, vital in today's dynamic financial environment.

Cloud Deployment Models

ACI Worldwide is strategically leveraging cloud deployment models, including private and public cloud options, to deliver its solutions. This shift is often facilitated through partnerships, notably with Microsoft Azure, enabling a robust Software-as-a-Service (SaaS) model.

This cloud-first approach offers significant benefits to financial institutions. A key advantage is the accelerated time to value, allowing clients to implement and utilize ACI's payment solutions more rapidly. Furthermore, the inherent scalability of cloud environments ensures that ACI's offerings can seamlessly adapt to fluctuating transaction volumes, a critical factor in the dynamic payments landscape.

The emphasis on enhanced security within these cloud deployments is paramount. ACI's commitment to providing secure, compliant, and resilient payment infrastructure in the cloud directly addresses the stringent requirements of the financial sector. For instance, in 2024, the global cloud computing market for financial services was projected to reach over $50 billion, highlighting the industry's strong adoption of cloud technologies.

- Accelerated Time to Value: Faster deployment and integration of payment solutions.

- Scalability: Ability to handle fluctuating transaction volumes efficiently.

- Enhanced Security: Robust security measures within cloud environments.

- SaaS Model: Offering solutions as a service, reducing upfront infrastructure costs for clients.

Conferences and Industry Events

ACI Worldwide leverages key industry conferences and events, like Sibos, to connect with its global client base and demonstrate its latest payment innovations. These gatherings are vital for ACI to discuss emerging trends and showcase its technological advancements to a targeted audience. In 2024, Sibos, held in Singapore, attracted over 15,000 attendees, providing ACI with a significant opportunity for face-to-face engagement.

These events are more than just exhibition booths; they are strategic platforms for ACI to:

- Network with existing and potential clients, fostering deeper relationships within the payments industry.

- Showcase new technologies and solutions, highlighting ACI's commitment to innovation.

- Discuss industry trends and challenges, positioning ACI as a thought leader in the payments space.

- Foster collaborations and partnerships that drive growth and expand market reach.

ACI Worldwide's place in the market is defined by its extensive global reach, operating in 95 countries with a significant physical presence in 34. This broad operational footprint is complemented by a strategic emphasis on local engagement, allowing ACI to tailor payment solutions to diverse regional needs and regulatory environments. Their distribution is robust, spanning the Americas, EMEA, and Asia Pacific, supported by dedicated sales teams and a network of local partners.

Same Document Delivered

ACI Worldwide 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive ACI Worldwide 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You'll gain immediate access to this fully completed and ready-to-use analysis, offering valuable insights into ACI Worldwide's market approach.

Promotion

ACI Worldwide cultivates industry leadership through insightful reports like 'Prime Time for Real-Time Payments' and 'Scamscope.' These publications, drawing on extensive data, illuminate global payment trends, economic impacts, and fraud prevention strategies.

These reports provide critical data, such as highlighting that real-time payments are projected to exceed 200 billion transactions globally by 2027, according to ACI's research. This positions ACI as a go-to source for understanding the evolving payments landscape.

By offering deep dives into financial inclusion and scam mitigation, ACI's thought leadership drives awareness and establishes credibility with financial professionals and business strategists seeking actionable intelligence.

ACI Worldwide actively uses press releases and news announcements to communicate its progress and achievements. For instance, in 2024, the company has consistently shared updates regarding its financial performance, including quarterly earnings reports that detail revenue growth and profitability metrics. These releases are crucial for keeping stakeholders informed about ACI's ongoing business activities and strategic direction.

These communications serve as a vital channel for ACI to highlight significant developments such as new client acquisitions, strategic alliances, and the introduction of innovative payment solutions. For example, recent announcements in 2024 have showcased ACI's expanding partnerships within the digital payments ecosystem, reinforcing its market leadership. Such disclosures are essential for building investor confidence and demonstrating the company's competitive edge.

Furthermore, ACI leverages these platforms to publicize industry accolades and recognitions, underscoring its commitment to excellence and innovation. By consistently disseminating news about its financial health, technological advancements, and market impact, ACI Worldwide effectively manages its corporate reputation and strengthens its relationships with investors, partners, and the broader financial community throughout 2024 and into 2025.

ACI Worldwide leverages a robust digital content strategy to showcase its expertise and offerings. Through platforms like blogs, whitepapers, webinars, and podcasts, the company disseminates valuable insights on payment trends and industry developments.

This approach serves to educate and engage a diverse audience, from individual investors to financial professionals and business strategists. For instance, ACI's 2024 webinar series focused on emerging payment technologies, attracting over 5,000 participants seeking to understand the financial implications and strategic advantages of these innovations.

By providing comprehensive financial data and analytical frameworks, ACI Worldwide empowers its audience to make well-informed decisions. Their whitepapers often include case studies with quantifiable results, such as a recent analysis showing a 15% reduction in transaction costs for businesses adopting ACI's real-time payment solutions.

Strategic Partnerships for Market Visibility

Strategic partnerships are a powerful promotional lever for ACI Worldwide, significantly boosting market visibility and credibility. By aligning with other industry leaders and financial institutions, ACI expands its customer base and reinforces its standing in the market. These collaborations are crucial for reaching new audiences and solidifying ACI's brand reputation.

ACI's ongoing partnership with Worldpay is a prime example of how such alliances drive promotional value. This collaboration not only streamlines payment processing but also generates positive media coverage, increasing ACI's exposure. Similarly, its work with iNet in Saudi Arabia highlights how regional partnerships enhance service offerings while simultaneously capturing market attention and building brand awareness in critical geographic areas.

- Extended Partnership with Worldpay: This collaboration enhances ACI's reach and service capabilities, leading to increased market visibility.

- Collaboration with iNet in Saudi Arabia: This regional alliance strengthens ACI's presence and generates positive media attention, boosting its profile in key markets.

- Market Visibility Boost: Partnerships serve as a direct promotional channel, amplifying ACI's message and extending its influence across the financial ecosystem.

Awards and Recognitions

ACI Worldwide leverages its numerous awards and recognitions as a key promotional tool. Being named one of CNBC's World's Top Fintech Companies in 2023 and TIME's America's Best Mid-Size Companies in 2024 significantly bolsters its brand image and market credibility.

These distinctions act as powerful third-party validation, underscoring ACI Worldwide's innovation and leadership in the competitive financial technology landscape. Such accolades not only attract new business but also reinforce confidence among existing clients and potential investors, highlighting their commitment to excellence and forward-thinking solutions.

- CNBC's World's Top Fintech Companies: Recognized in 2023, showcasing global leadership.

- TIME's America's Best Mid-Size Companies: Honored in 2024, affirming domestic market strength.

- Industry Accolades: Numerous other awards from reputable financial and technology publications further solidify ACI's market position.

ACI Worldwide's promotional strategy heavily relies on thought leadership and data-driven insights, exemplified by reports like 'Prime Time for Real-Time Payments.' These publications, which project real-time payments to surpass 200 billion transactions globally by 2027, position ACI as a key source of market intelligence.

The company effectively utilizes press releases and news announcements to share its progress, including consistent updates on financial performance in 2024. These communications highlight achievements such as new client acquisitions and strategic alliances, reinforcing ACI's market leadership and investor confidence.

ACI's digital content strategy, featuring webinars and whitepapers, educates a broad audience on payment trends, with 2024 webinars on emerging technologies drawing over 5,000 participants. Their content often includes quantifiable results, like a 15% transaction cost reduction for businesses using ACI's solutions.

Strategic partnerships, such as the extended collaboration with Worldpay and regional alliances like the one with iNet in Saudi Arabia, significantly amplify ACI's market visibility and credibility. These alliances not only expand reach but also generate positive media attention, bolstering brand awareness.

ACI Worldwide also leverages industry accolades, including being named to TIME's America's Best Mid-Size Companies in 2024, as a powerful promotional tool. These recognitions serve as third-party validation, enhancing brand image and reinforcing market leadership in the fintech sector.

| Promotional Tactic | Key Focus/Example | Impact/Data Point (2023-2025) |

|---|---|---|

| Thought Leadership & Reports | 'Prime Time for Real-Time Payments' | Projected 200B+ global real-time transactions by 2027 |

| Press Releases & News | Q1-Q4 2024 Financial Performance Updates | Consistent communication of revenue growth and strategic direction |

| Digital Content | 2024 Webinar Series on Emerging Payments | Attracted 5,000+ participants; showcased 15% cost reduction case studies |

| Strategic Partnerships | Worldpay, iNet (Saudi Arabia) | Increased market visibility and regional brand awareness |

| Awards & Recognition | TIME's America's Best Mid-Size Companies (2024) | Enhanced brand image and market credibility |

Price

ACI Worldwide's pricing strategy heavily relies on subscription-based licensing for its comprehensive suite of payment and banking software. This model ensures a consistent and predictable revenue stream, a significant advantage in the financial technology sector.

Clients typically pay recurring fees, granting them access to ACI's advanced payment processing, robust fraud management, and essential banking solutions. This structure also guarantees customers continuous access to vital software updates and dedicated support services, fostering long-term partnerships.

For instance, ACI Worldwide reported total revenue of $1.43 billion for the fiscal year ending December 31, 2023, with a substantial portion derived from its recurring software and maintenance revenue. This subscription model underpins the company's financial stability and ability to invest in ongoing innovation.

ACI Worldwide's pricing strategy often employs a tiered structure based on transaction volumes. This means clients pay fees that correlate directly with the number of transactions processed through ACI's payment solutions. For instance, a company processing millions of transactions monthly might have a lower per-transaction cost than one processing thousands.

This volume-based approach aligns ACI's revenue with the success and operational scale of its clients. As a client's business grows and their transaction volume increases, ACI's revenue naturally scales alongside it, reflecting the enhanced value and system capacity being utilized.

In 2024, transaction processing fees remain a core component of ACI's revenue model, with specific rates varying based on the complexity of the transaction, the region, and the negotiated service level agreements. While exact figures are proprietary, industry benchmarks suggest that per-transaction costs for high-volume processors can fall into fractions of a cent, making volume the critical driver of overall pricing.

ACI Worldwide's revenue stream extends significantly beyond initial software licenses through its robust managed services and support offerings. These services are crucial for clients, providing continuous maintenance, essential updates, and expert technical assistance to keep complex payment systems running smoothly and securely.

For the fiscal year ending March 2024, ACI Worldwide reported total revenue of $1.39 billion. A substantial portion of this revenue is attributed to recurring service fees, underscoring the importance of their managed services in ensuring client retention and predictable income. These services are designed to optimize the performance and security of ACI's payment solutions, adding considerable value for customers.

Value-Based Pricing for Enterprise Solutions

ACI Worldwide employs value-based pricing for its enterprise solutions, recognizing the substantial impact these payment and fraud prevention systems have on their clients' operations. This strategy aligns pricing with the tangible benefits, such as enhanced efficiency, robust security, and accelerated growth, that financial institutions and large merchants gain.

The company's approach captures the perceived value and the significant return on investment (ROI) clients can achieve from ACI's sophisticated, integrated platforms. For instance, in 2024, ACI's solutions are instrumental in helping major banks process billions of transactions securely, with clients reporting efficiency gains that can translate into millions saved annually.

- Mission-Critical Value: Pricing reflects the essential role ACI's solutions play in ensuring seamless and secure payment processing for global enterprises.

- ROI Focus: The cost of ACI's services is directly tied to the measurable improvements in operational efficiency and fraud reduction delivered to clients.

- Scalability and Integration: Enterprise pricing accommodates the complexity and scale required for large financial institutions and merchants, reflecting the deep integration and customization involved.

- Market Benchmarking: While specific pricing tiers are proprietary, industry analyses suggest that enterprise software solutions with similar capabilities and market impact can range from hundreds of thousands to millions of dollars annually, depending on the scope of deployment and services utilized.

Competitive and Market-Driven Pricing

ACI Worldwide employs competitive and market-driven pricing for its payment and fraud solutions. Their strategy actively monitors rival offerings and the demand for real-time payment capabilities and robust fraud prevention, alongside broader economic trends.

While exact pricing structures are confidential business information, ACI focuses on maintaining a competitive edge. This approach ensures their innovative technology and deep industry expertise are valued appropriately in the market.

- Competitive Positioning: ACI Worldwide aims to offer pricing that is attractive relative to its competitors in the payments and fraud detection sectors.

- Value-Based Pricing: Pricing reflects the advanced technology, security, and efficiency benefits ACI's solutions provide to financial institutions and merchants.

- Market Responsiveness: Pricing strategies are designed to adapt to evolving market demands, particularly the increasing need for real-time payment processing and sophisticated anti-fraud measures.

ACI Worldwide's pricing is fundamentally built on a subscription model, ensuring recurring revenue through licensing of its payment and banking software. This approach, alongside volume-based transaction fees, allows for predictable income streams that directly correlate with client usage and success.

Value-based pricing is also key for enterprise solutions, reflecting the significant operational efficiencies and security enhancements ACI provides. The company strategically positions its pricing to remain competitive while capturing the substantial return on investment clients achieve.

| Revenue Component | FY 2023 (USD Billion) | FY 2024 (USD Billion) |

|---|---|---|

| Total Revenue | 1.43 | 1.39 |

| Recurring Software & Maintenance | Substantial Portion | Substantial Portion |

| Transaction Processing Fees | Core Component | Core Component |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for ACI Worldwide leverages a comprehensive blend of data, including their official SEC filings, investor relations materials, and detailed product documentation. We also incorporate insights from industry analyst reports and publicly available information on their partnerships and client implementations.