ACI Worldwide Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

ACI Worldwide operates in a dynamic payments landscape, where the intensity of rivalry and the threat of new entrants significantly shape its competitive environment. Understanding the bargaining power of buyers and suppliers, alongside the looming threat of substitutes, is crucial for navigating this market.

The complete report reveals the real forces shaping ACI Worldwide’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ACI Worldwide's reliance on specialized technology infrastructure means the concentration of key technology providers can significantly influence its bargaining power. For instance, if only a few companies offer critical cloud services, database solutions, or security protocols, these suppliers can dictate terms and pricing.

ACI actively manages this risk through strategic partnerships. Collaborations with giants like Microsoft, Red Hat, and IBM for its cloud-native payments platform, ACI Connectic, are crucial. These alliances help ensure access to essential technologies and foster more favorable terms, mitigating the potential for supplier dominance.

The uniqueness of specialized software modules or data services crucial for real-time payment processing can significantly bolster supplier bargaining power. If ACI Worldwide relies on proprietary components that lack readily available substitutes, these suppliers can dictate terms and pricing more effectively. For instance, a supplier of a critical real-time fraud detection algorithm, if unique and highly effective, would hold considerable sway.

Switching costs for ACI Worldwide from one payment processing solution provider to another can be substantial. These costs encompass not only the direct financial outlay for new technology and integration but also the significant time and resources required for testing, retraining staff, and ensuring seamless service continuity.

High switching costs inherently bolster the bargaining power of ACI's existing suppliers. When it becomes difficult or expensive for ACI to change providers, suppliers are in a stronger position to negotiate terms, potentially leading to less favorable pricing or service level agreements for ACI.

ACI's established partnerships, such as those with Worldpay and Co-op, indicate a history of deep integration with their systems. These long-standing relationships often translate into higher switching costs, as the complexities of unwinding and re-establishing these vital connections can be considerable.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers represents a significant factor in assessing ACI Worldwide's bargaining power of suppliers. If ACI's technology partners were to develop and offer their own direct payment software solutions, they could effectively become competitors, directly challenging ACI's market position. This capability would undoubtedly enhance their leverage in negotiations with ACI.

However, the current landscape suggests this threat is somewhat mitigated. Many of ACI's key technology partners are specialized in foundational infrastructure rather than the development of end-user payment applications. This focus means their core business model does not inherently lend itself to directly competing with ACI's software offerings, reducing the immediate likelihood of widespread forward integration.

The potential for suppliers to integrate forward directly impacts ACI's strategic planning. ACI must continually evaluate the capabilities and strategic intentions of its supplier base. For instance, if a major infrastructure provider were to pivot towards application development, ACI would face the immediate risk of losing market share to a new, well-resourced competitor.

- Supplier Diversification: ACI's reliance on a diverse set of technology partners, rather than a single critical supplier, can dilute the impact of any single supplier's potential forward integration.

- Partnership Agreements: Existing contractual agreements and intellectual property clauses can also serve as deterrents or limitations to suppliers engaging in direct competition.

- Market Specialization: The highly specialized nature of payment processing software requires significant investment in R&D and regulatory compliance, areas where many infrastructure-focused suppliers may not have a competitive edge.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for ACI Worldwide. If ACI can readily source alternative components or technologies for its payment solutions, the leverage of any single supplier is reduced. For instance, the rapid development in areas like cloud-based infrastructure or specialized AI algorithms means ACI has more options, lessening dependence on any one provider.

The evolving landscape of payment technology presents numerous potential substitutes. Innovations in areas such as decentralized finance (DeFi) leveraging blockchain, or advanced data analytics platforms, could offer alternative pathways for ACI's product development. This dynamic environment means suppliers must remain competitive on price and innovation to retain ACI's business.

- Substitutes for Core Technologies: The presence of alternative technologies, like open-source payment processing frameworks versus proprietary solutions, directly impacts supplier power.

- Component Sourcing Flexibility: ACI's ability to switch between different hardware or software component providers for its infrastructure affects supplier negotiation strength.

- Impact of Emerging Tech: Advancements in AI for fraud detection or blockchain for secure transactions provide ACI with potential substitute inputs, thereby limiting the power of traditional suppliers.

ACI Worldwide's bargaining power with suppliers is influenced by the concentration of critical technology providers and the uniqueness of specialized software modules. Strategic partnerships with major tech companies help mitigate supplier leverage. High switching costs for ACI also strengthen existing suppliers' negotiating positions.

The threat of forward integration by suppliers is a key consideration, though many of ACI's partners focus on foundational infrastructure rather than direct payment application competition. Diversifying suppliers and robust partnership agreements help manage this risk.

The availability of substitute inputs, driven by rapid technological advancements like blockchain and AI, further limits supplier bargaining power by offering ACI more sourcing flexibility.

| Factor | Impact on ACI Worldwide | Supporting Data/Example (as of mid-2024) |

|---|---|---|

| Supplier Concentration | Moderate to High | ACI's reliance on cloud providers like Microsoft Azure and AWS for its payment infrastructure means these large entities hold significant influence. In 2023, cloud computing spending by businesses globally reached approximately $200 billion, highlighting the market power of major providers. |

| Switching Costs | High | Integrating and testing new payment processing solutions can take months and cost millions. For instance, a typical enterprise migration of a core banking system can range from $50 million to $200 million, indicating the substantial financial and operational commitment involved in changing providers. |

| Threat of Forward Integration | Low to Moderate | While some infrastructure providers could theoretically develop payment applications, their primary focus remains on core cloud services. For example, companies like IBM and Red Hat, key ACI partners, specialize in enterprise software and hybrid cloud solutions, not direct payment processing services. |

| Availability of Substitutes | Moderate to High | The rise of open-source payment gateways and alternative fintech solutions offers ACI more options. The global fintech market size was valued at $2.4 trillion in 2023 and is projected to grow, indicating a competitive landscape with numerous potential substitutes for specialized components. |

What is included in the product

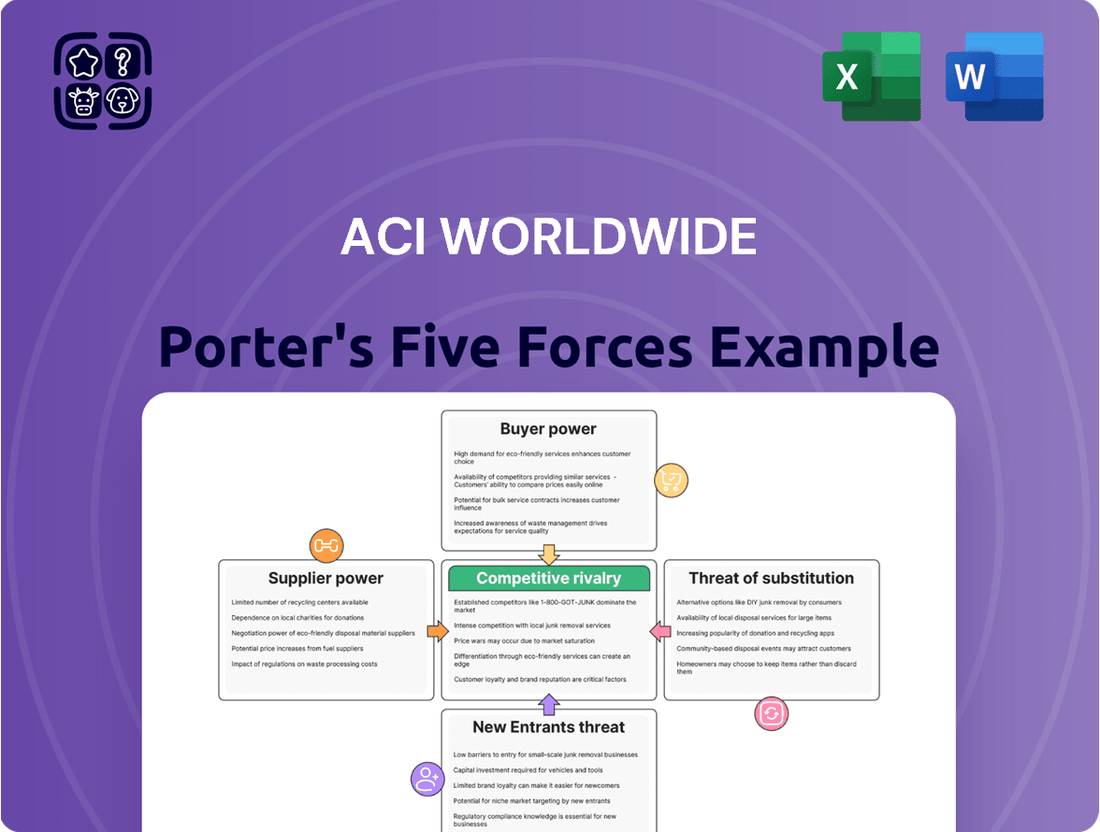

This analysis delves into the competitive forces impacting ACI Worldwide, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the payments processing industry.

Effortlessly assess competitive intensity across all five forces, providing a clear roadmap to navigate ACI Worldwide's market landscape.

Customers Bargaining Power

ACI Worldwide's customer base is diverse, serving over 1,000 of the world's largest financial institutions and thousands of global merchants. This broad reach, encompassing financial intermediaries and retailers across the globe, generally dilutes the bargaining power of any single customer. A concentrated customer base, where a few large clients account for a significant portion of revenue, could exert considerable pressure on pricing and terms, but ACI's wide distribution network helps to prevent this.

The costs and complexities for banks and merchants to move away from ACI Worldwide's payment solutions significantly impact their ability to negotiate. If switching requires substantial investment in integration, data migration, and employee retraining, customers have less leverage.

ACI's payment solutions are deeply embedded in the core infrastructure of financial institutions and businesses, suggesting that these switching costs are likely to be considerable. This integration makes it challenging and expensive for customers to adopt alternative providers.

Customers' price sensitivity is a major factor influencing ACI Worldwide. If clients are highly sensitive to cost, they will push ACI to reduce its pricing, especially in a crowded market. For instance, as of early 2024, the global digital payments market is projected to reach over $2 trillion, with intense competition driving a focus on value for money.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large financial institutions and major retailers, poses a significant challenge to ACI Worldwide. These entities could choose to develop their own payment processing capabilities, thereby cutting out intermediaries like ACI. This potential shift directly amplifies customer bargaining power.

However, the practical execution of such a move is often hindered by substantial barriers. Building and maintaining a sophisticated, real-time payment infrastructure demands immense capital investment and specialized technical expertise. For instance, the global payments market is projected to reach over $3 trillion by 2027, highlighting the scale of investment required to compete effectively.

- High Development Costs: Creating proprietary payment solutions requires significant upfront and ongoing investment in technology and talent.

- Complexity of Infrastructure: Real-time payment systems are intricate and require continuous updates to comply with evolving regulations and security standards.

- Focus on Core Competencies: Many large organizations prefer to concentrate on their primary business activities rather than managing complex payment processing operations.

Availability of Substitute Solutions for Customers

The availability of numerous alternative payment software providers and solutions significantly enhances customer bargaining power. This means clients aren't locked into a single vendor, as they can easily switch to a competitor if ACI Worldwide's pricing or service doesn't meet their expectations. For instance, the global digital payments market, valued at approximately $1.5 trillion in 2023, is highly competitive, with many players offering comparable real-time electronic payment, online banking, and fraud prevention services.

- High Customer Choice: Customers have a wide array of providers to select from, reducing reliance on any single entity.

- Competitive Landscape: The presence of numerous competitors offering similar services intensifies price and service competition.

- Switching Costs: While some switching costs exist, the availability of alternatives makes it feasible for customers to change providers.

- Market Dynamics: In 2023, the fintech sector saw significant investment, fueling the development of new payment solutions and increasing customer options.

ACI Worldwide's diverse customer base, serving over 1,000 major financial institutions and thousands of merchants globally, generally limits the bargaining power of individual clients. High switching costs, stemming from deep integration of ACI's payment solutions into core financial infrastructure, further reduce customer leverage. However, the competitive digital payments market, projected to exceed $2 trillion in 2024, increases customer price sensitivity and the appeal of alternative providers.

| Factor | Impact on ACI Worldwide | Data Point (2023-2024) |

|---|---|---|

| Customer Concentration | Low leverage due to broad customer base | Serves over 1,000 financial institutions |

| Switching Costs | High, reducing customer negotiation power | Deep integration into core financial systems |

| Price Sensitivity | Moderate to High, driven by market competition | Global digital payments market > $2 trillion (2024 projection) |

| Threat of Backward Integration | Potential, but hindered by high infrastructure costs | Market growth requires significant capital investment |

| Availability of Alternatives | Increases customer bargaining power | Highly competitive fintech sector with numerous providers |

What You See Is What You Get

ACI Worldwide Porter's Five Forces Analysis

This preview showcases the entirety of the ACI Worldwide Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the payments processing industry. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring no surprises or missing sections. This comprehensive analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, all of which are crucial for understanding ACI Worldwide's strategic positioning.

Rivalry Among Competitors

The real-time electronic payments arena is a crowded space, featuring a multitude of established giants and agile fintech startups. This intense competition directly impacts ACI Worldwide's market position.

ACI Worldwide contends with formidable rivals such as Razorpay and Xendit, which offer comprehensive payment processing solutions. Furthermore, broader payment ecosystems like PayPal Payments and Stripe present significant competitive challenges, capturing market share with their extensive user bases and diverse service offerings.

The competitive landscape is further complicated by the sheer diversity of players. This includes traditional banking software vendors adapting to new payment technologies, alongside cutting-edge cryptocurrency payment providers, all vying for a piece of the rapidly evolving digital payments market.

The global payment processing solutions market is booming, with projections indicating it will reach $141.1 billion by 2025, growing at a robust 16.3% compound annual growth rate. This rapid expansion, especially in areas like real-time payments, offers ample opportunity for players like ACI Worldwide. However, this very growth fuels intense competition as numerous companies strive to capture a larger piece of this expanding pie.

ACI Worldwide's competitive rivalry is significantly shaped by how well its product offerings stand out from those of its competitors. ACI focuses on providing a broad range of software solutions designed for electronic payments, fraud detection, and managing payment flows intelligently. This comprehensive approach, covering critical aspects of the payment ecosystem, aims to create a strong value proposition for its clients.

The degree of differentiation ACI achieves through its features, the robustness of its security measures, its ability to scale with client needs, and the quality of its customer support directly influences the intensity of rivalry. When ACI's solutions are perceived as distinctly superior or uniquely capable, it can lessen the pressure for direct price-based competition, allowing for a focus on value and innovation.

Switching Costs for Customers

High switching costs for customers significantly dampen competitive rivalry, making it more challenging for rivals to lure away ACI Worldwide's established clientele. ACI's deeply integrated payment solutions are critical components of financial institutions' and retailers' operational backbone, inherently creating substantial hurdles for any entity considering a change.

These integrated solutions, often embedded within core payment processing and transaction management systems, represent a considerable investment in time, resources, and operational disruption for customers. For instance, a major bank migrating its entire payment gateway infrastructure could face millions in costs and prolonged downtime, making the status quo more attractive.

However, the evolving payment landscape, with a growing emphasis on interoperability and open APIs, poses a potential threat to these high switching costs. As the industry moves towards more standardized protocols, the technical and financial barriers to switching providers may gradually decrease, potentially intensifying future competition.

- High Switching Costs: ACI's solutions are deeply embedded, making it difficult and expensive for clients to switch.

- Integrated Solutions: Core payment infrastructure integration creates significant barriers for financial institutions and retailers.

- Interoperability Trend: The push for industry-wide interoperability could eventually reduce these switching costs.

Exit Barriers

High exit barriers, like substantial investments in specialized payment technology and the commitment to long-term client contracts, can trap companies in a market even when profits dwindle. This forces them to remain competitive, potentially intensifying rivalry among existing players. For a company like ACI Worldwide, these barriers mean that exiting the payments processing space isn't a simple decision, contributing to ongoing competitive pressure.

The specialized nature of payment technology requires significant, often non-recoverable, fixed assets. Think about the infrastructure and software development needed for secure and compliant transaction processing. These are not easily repurposed. Furthermore, established relationships with banks and merchants, often cemented by service level agreements and data integration, create sticky customer bases. This makes it difficult and costly for both the provider and the client to switch, effectively raising exit barriers.

- High Fixed Asset Investment: Companies in payment technology often have considerable capital tied up in data centers, specialized hardware, and proprietary software.

- Specialized Knowledge and Skills: The expertise required in areas like cybersecurity, regulatory compliance, and payment network integration is highly specific and not easily transferable.

- Long-Term Client Contracts: Many payment processing agreements span multiple years, creating a commitment that is expensive to break.

- Brand Reputation and Trust: In financial services, a strong reputation for reliability and security is paramount, making it hard for new entrants to displace established players and equally difficult for incumbents to abandon their market position without significant reputational damage.

The competitive rivalry for ACI Worldwide is intense, driven by a fragmented market with both established players and emerging fintechs. ACI faces direct competition from companies like Fiserv and FIS, which offer extensive payment processing and financial technology solutions. The market is further characterized by broad payment platforms such as Adyen and Worldpay, which compete on features, global reach, and pricing, intensifying the pressure on ACI.

ACI's ability to differentiate its offerings, particularly in real-time payments and fraud prevention, is crucial. For instance, while the global payments market is projected to reach $141.1 billion by 2025, this growth attracts numerous competitors, making market share gains challenging. ACI's strategy often involves deep integration into client systems, which, while creating high switching costs, also necessitates continuous innovation to maintain its edge against agile competitors.

| Competitor | Key Offerings | Market Focus |

|---|---|---|

| Fiserv | Payment processing, core banking, digital banking solutions | Financial institutions, merchants |

| FIS | Financial technology, payment processing, banking software | Financial institutions, capital markets |

| Adyen | Unified commerce, payment acquiring, data analytics | Large global merchants, e-commerce |

| Worldpay (part of FIS) | Global payment processing, e-commerce solutions | Merchants of all sizes |

SSubstitutes Threaten

The threat of substitutes for ACI Worldwide's payment processing solutions is significant, stemming from a diverse array of alternative payment methods. These substitutes directly address the core need for facilitating transactions, offering consumers and businesses more options beyond traditional card networks or ACI's proprietary software. For instance, the rapid rise of digital wallets like Apple Pay and Google Pay, which saw global transaction volumes reach trillions in 2024, provides a frictionless alternative for many consumers.

Further intensifying this threat are Buy Now, Pay Later (BNPL) services, which have experienced explosive growth, with the global BNPL market projected to exceed $3.5 trillion by 2027 according to some industry reports. Account-to-account (A2A) payments, leveraging open banking initiatives, also present a direct substitute by enabling direct bank transfers, bypassing traditional payment rails altogether. Even the evolving landscape of cryptocurrencies, while still nascent for mainstream retail, represents a potential future substitute for certain transaction types.

Large financial institutions and major retailers with substantial resources may opt to develop their payment processing systems internally. This strategic choice bypasses third-party providers like ACI Worldwide, offering greater control and customization. For instance, in 2023, major banks continued to invest heavily in their digital infrastructure, with some exploring in-house solutions for specific payment functionalities to enhance security and efficiency.

Emerging technologies like blockchain for cross-border payments present a significant threat. For instance, the global blockchain in payments market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, offering a decentralized alternative that could bypass traditional payment processing software.

Embedded finance solutions, allowing payments to be integrated directly into non-financial platforms like e-commerce or ERP systems, also act as substitutes. This trend is accelerating, with projections suggesting embedded finance could reach $7 trillion in transaction volume by 2030, potentially reducing reliance on standalone payment software providers.

Advanced AI tools integrated into business operations can streamline payment workflows, offering more efficient and cost-effective alternatives. These innovations aim to provide seamless, integrated payment experiences, potentially encroaching on ACI Worldwide's core business by offering solutions that don't require dedicated payment software.

Simpler, Lower-Cost Solutions

For certain market segments, especially smaller businesses, simpler and often less expensive payment processing solutions or payment gateways present a significant threat of substitution. These alternatives may not offer the full suite of enterprise-level features that ACI Worldwide provides, but they can attract customers who are primarily focused on minimizing costs rather than maximizing functionality.

Platforms that emphasize straightforward usability and competitive pricing can draw away customers who find ACI's comprehensive offerings to be more complex or costly than their needs dictate. For instance, many fintech startups and neobanks are entering the payment processing space, offering streamlined onboarding and transparent fee structures that appeal to a cost-conscious clientele.

Consider the landscape of payment facilitators (PayFacs) and Payment Service Providers (PSPs) that cater to small and medium-sized businesses. These entities often bundle payment processing with other services, creating a more attractive, all-in-one solution at a lower perceived cost. In 2024, the growth of these simpler solutions is evident, with many new entrants focusing on specific niches within the SMB market, potentially capturing market share from larger, more established players like ACI.

- Alternative Payment Gateways: Solutions like Stripe and Square, known for their ease of integration and developer-friendly APIs, offer competitive pricing for businesses that do not require ACI's extensive fraud detection or complex transaction routing capabilities.

- Embedded Finance Solutions: Companies embedding payment processing directly into their software or platforms, often at a lower marginal cost to the end-user, can divert demand from standalone payment processors.

- Fintech Startups: New entrants are continually innovating with lower-cost, user-friendly payment solutions, particularly targeting the underserved SMB market, which represents a substantial portion of potential ACI customers.

Regulatory Changes Promoting New Payment Rails

Regulatory changes promoting new payment rails represent a significant threat of substitutes for ACI Worldwide. For instance, the European Union's Instant Payments Regulation (IPR), which came into effect in July 2022 and is being fully implemented by July 2025, mandates that participating banks and payment service providers offer instant credit transfers in Euros. This regulatory push encourages the adoption of payment systems that can operate outside traditional, often software-dependent, infrastructure.

These new payment rails, such as those facilitated by open banking initiatives or central bank digital currencies (CBDCs) currently being explored and piloted in numerous countries, offer alternative methods for processing transactions. While ACI Worldwide is actively adapting its solutions to support these emerging rails, their increasing adoption could divert transaction volumes from established systems that rely on ACI's core software. This shift could diminish the reliance on existing payment processing software, thereby acting as a substitute for certain aspects of ACI's business model.

The competitive landscape is evolving rapidly, with many fintech companies and even established banks developing their own instant payment solutions or leveraging new infrastructure. For example, in the United States, the Federal Reserve's FedNow service, launched in July 2023, provides instant payment capabilities for financial institutions. By 2024, a significant number of banks were expected to integrate with FedNow, potentially rerouting transaction flows.

- Regulatory Mandates: Initiatives like the EU's IPR and the development of FedNow in the US are creating new, often faster, payment channels.

- Technological Shifts: These new rails can bypass or reduce reliance on legacy software infrastructures that ACI Worldwide has traditionally served.

- Competitive Response: Fintechs and banks are innovating, offering alternative payment solutions that may capture market share from traditional providers.

- Transaction Volume Diversion: Widespread adoption of these substitutes could lead to a decrease in transaction volumes processed through ACI's established software platforms.

The threat of substitutes for ACI Worldwide's payment processing solutions is substantial, driven by the proliferation of alternative payment methods and evolving consumer preferences. Digital wallets, Buy Now Pay Later (BNPL) services, and account-to-account (A2A) payments are increasingly popular, offering seamless and often more cost-effective transaction experiences. For instance, global digital wallet transaction volumes are in the trillions, while the BNPL market is projected to grow significantly. These alternatives directly compete by providing alternative ways for consumers and businesses to move money, potentially bypassing traditional payment infrastructure that ACI Worldwide supports.

| Substitute Type | Key Characteristics | Market Trend/Data (2024 Focus) | Impact on ACI Worldwide |

|---|---|---|---|

| Digital Wallets | Convenience, speed, integration with mobile devices | Global transaction volumes in trillions; widespread adoption | Reduces reliance on traditional card processing |

| Buy Now, Pay Later (BNPL) | Deferred payment options, increased purchasing power | Rapid growth, market projected to exceed $3.5 trillion by 2027 | Offers an alternative to traditional credit card payments |

| Account-to-Account (A2A) Payments | Direct bank transfers, bypasses card networks | Leveraging open banking initiatives, growing adoption | Disintermediates traditional payment flows |

| Embedded Finance | Payments integrated into non-financial platforms | Projected to reach $7 trillion in transaction volume by 2030 | Reduces need for standalone payment software |

Entrants Threaten

Entering the real-time electronic payments software market demands significant capital for R&D, robust technology infrastructure, and navigating complex regulatory landscapes. ACI Worldwide's established global presence, built over almost 50 years, underscores the immense investment needed to replicate its scale and operational capabilities. These high capital requirements serve as a formidable barrier, deterring potential new competitors from easily entering the space.

Established players like ACI Worldwide significantly benefit from economies of scale and scope. This allows them to offer more competitive pricing and a wider array of services, creating a substantial barrier for newcomers. For instance, ACI's extensive global infrastructure and large customer base in 2024 enable cost efficiencies that smaller, newer companies cannot easily match.

ACI's comprehensive suite of solutions, covering real-time payments, online banking, and fraud prevention, provides a distinct advantage. New entrants would struggle to quickly replicate this breadth and depth of offerings, making it challenging to compete on both functionality and integration.

New entrants to the payment processing space often struggle to secure access to critical distribution channels and cultivate the deep customer relationships that established players like ACI Worldwide enjoy. Building trust and navigating the complex requirements to onboard major financial institutions or large retail partners is a significant hurdle, often taking years and substantial investment.

ACI Worldwide's established partnerships, for instance, with key clients such as Worldpay and Co-op, represent a substantial competitive advantage. These long-standing relationships are not easily replicated by newcomers, creating a formidable barrier to entry. The time and effort required to forge such alliances mean that new entrants face a considerable uphill battle in gaining market traction.

Regulatory Hurdles and Compliance

The payment industry faces significant threat from new entrants due to substantial regulatory hurdles. Companies must comply with rigorous security, data privacy, and anti-money laundering (AML) standards, making market entry a complex and expensive undertaking. For instance, in 2024, the ongoing implementation of regulations like Europe's Digital Operational Resilience Act (DORA) and Australia's CPS 230 continues to elevate compliance burdens for all players, including potential new entrants.

Navigating these intricate regulatory frameworks and securing the necessary licenses is a protracted and resource-intensive process. This acts as a powerful barrier, deterring many potential competitors from entering the market. The sheer cost and time involved in achieving compliance significantly limit the ease with which new companies can challenge established players like ACI Worldwide.

Key regulatory aspects that new entrants must address include:

- Data Security and Encryption: Meeting stringent standards like PCI DSS.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Implementing robust verification processes.

- Consumer Protection Laws: Adhering to regulations governing financial transactions and data handling.

- Licensing and Approvals: Obtaining necessary authorizations from financial authorities in each operating jurisdiction.

Proprietary Technology and Expertise

ACI Worldwide's robust proprietary technology and decades of accumulated expertise in payment processing present a significant hurdle for potential new entrants. Developing payment orchestration solutions comparable to ACI's, which emphasizes intelligent orchestration, requires substantial investment in research and development and the cultivation of specialized knowledge. This technological sophistication acts as a formidable barrier.

Newcomers would face immense challenges in replicating ACI's established technological infrastructure and the deep domain expertise that underpins its offerings. For instance, ACI's commitment to innovation is evident in its continuous investment in R&D, which in 2023 saw significant allocation towards enhancing its real-time payment capabilities and fraud detection systems. This ongoing development creates a moving target for any competitor seeking to enter the market.

- Proprietary Technology: ACI Worldwide holds numerous patents related to payment processing and fraud prevention, making direct replication difficult.

- Deep Expertise: The company's long history in the payments industry translates into a nuanced understanding of complex regulatory environments and customer needs, which is hard to acquire quickly.

- High R&D Investment: ACI's consistent investment in research and development, often exceeding 10% of its revenue, fuels its technological advantage and creates a high entry cost for competitors.

The threat of new entrants in the real-time electronic payments software market is significantly mitigated by ACI Worldwide's entrenched position. High capital requirements for R&D, infrastructure, and regulatory compliance, coupled with the need to replicate ACI's nearly 50 years of operational scale, act as substantial deterrents.

Economies of scale and scope enjoyed by ACI Worldwide, evident in its extensive global infrastructure and large 2024 customer base, allow for cost efficiencies that new entrants struggle to match. This creates a pricing and service breadth barrier, making it difficult for newcomers to compete effectively.

ACI's comprehensive solution suite, covering real-time payments to fraud prevention, presents a significant challenge for new entrants aiming to quickly replicate this depth and integration. Furthermore, securing critical distribution channels and building trust with major financial institutions, a process ACI has perfected over decades, remains a formidable hurdle.

The threat of new entrants is also constrained by the complex and costly regulatory landscape. Compliance with stringent data security, privacy, and AML standards, including evolving regulations like DORA in 2024, requires substantial investment and time, effectively limiting market entry.

Porter's Five Forces Analysis Data Sources

Our ACI Worldwide Porter's Five Forces analysis is built upon a robust foundation of data, drawing from ACI's public financial statements, investor presentations, and annual reports. We supplement this with insights from reputable industry analysis firms and market research reports focused on the payments and financial technology sectors.