ACI Worldwide Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

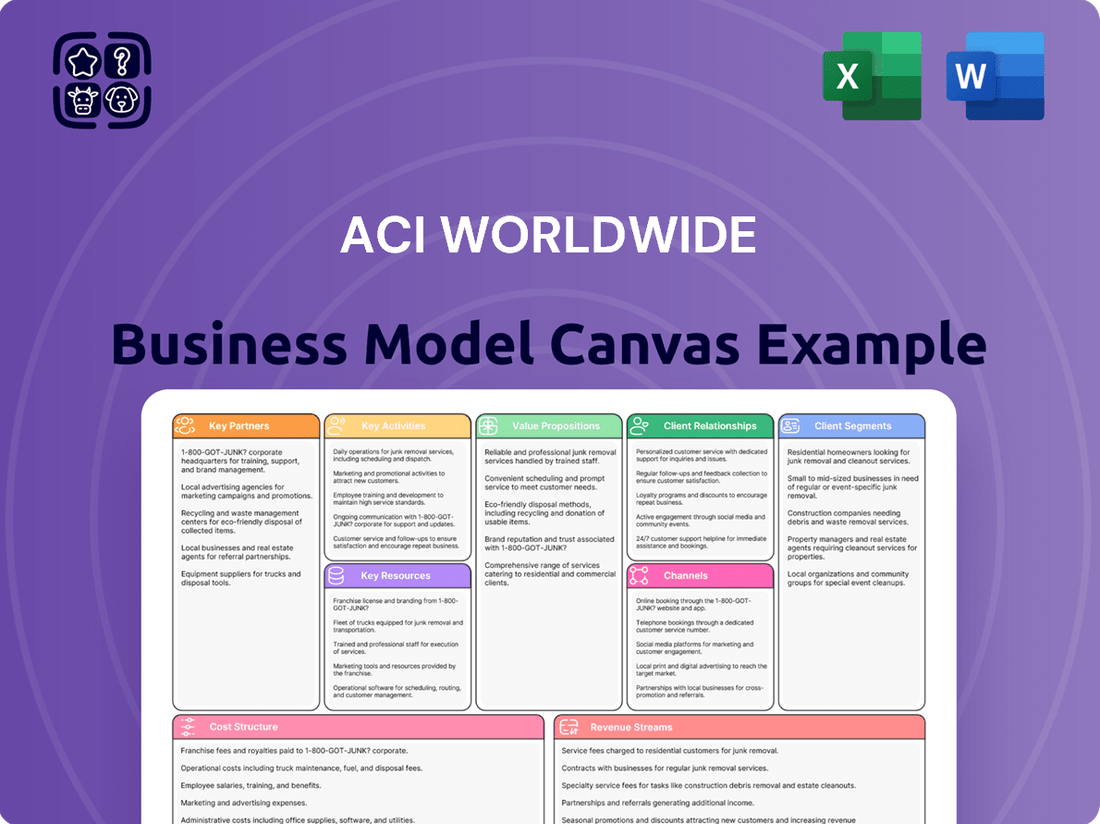

Discover the core components of ACI Worldwide's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and key revenue streams, offering a clear picture of their operational strategy.

Unlock the full strategic blueprint behind ACI Worldwide's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

ACI Worldwide collaborates with leading technology providers such as Microsoft, Red Hat, and IBM. These partnerships are crucial for ACI to utilize advanced cloud infrastructure and robust software solutions, powering its payments platform.

By integrating with these tech giants, ACI Worldwide enhances its cloud-native payments platform, ACI Connect. This integration is vital for ensuring high operational resilience and top-tier security, which are paramount for financial institutions worldwide.

ACI Worldwide strategically partners with major financial institutions and payment processors, like Worldpay, to deliver essential infrastructure for accepting payments and managing fraud. These collaborations are vital for ACI's ability to operate on a global scale, facilitating transactions for a vast number of merchants and handling substantial transaction volumes.

ACI Worldwide collaborates with major retailers, such as its long-standing alliance with Co-op in the UK, to offer integrated payment orchestration solutions. These partnerships are crucial for enabling seamless in-store, online, and mobile payment processing, alongside advanced fraud detection.

Central Banks and Government Bodies

ACI Worldwide collaborates with central banks and government bodies to spearhead the modernization of national payment infrastructures. For instance, their work with Banco de la República in Colombia and the U.S. Federal Reserve exemplifies this, focusing on developing robust real-time payment schemes. This partnership is crucial for establishing foundational payment systems and setting industry-wide standards.

These collaborations involve building the core technological infrastructures necessary for efficient and secure national payment operations. ACI's expertise helps these entities create advanced systems that can handle high transaction volumes and support innovative payment methods.

- Modernizing Payment Ecosystems: ACI partners with entities like the U.S. Federal Reserve to enhance national payment systems, driving efficiency and innovation.

- Real-Time Payment Development: The company assists governments in creating and implementing real-time payment schemes, as seen with Banco de la República in Colombia.

- Establishing Industry Standards: ACI plays a role in setting standards for fraud detection and mitigation within these national payment frameworks.

Fintechs and Industry Associations

ACI Worldwide strategically expands its reach and capabilities by forging partnerships with innovative fintech companies. For instance, collaborations with entities like Banfico enable ACI to offer specialized payment verification services, enhancing the value proposition for its clients and broadening its service portfolio. These alliances are crucial for staying agile in the rapidly evolving payments landscape.

Furthermore, ACI's active participation in key industry associations plays a vital role in shaping the future of the payments sector. By engaging with organizations such as the U.S. Faster Payments Council, ACI contributes to discussions and initiatives that address emerging challenges and opportunities, including the development of real-time payment systems. This involvement ensures ACI remains at the forefront of industry trends and regulatory developments.

These partnerships are not just about service expansion; they are about ecosystem building. By collaborating with fintechs and actively participating in industry bodies, ACI Worldwide strengthens its position as a central player in the global payments infrastructure. This approach allows ACI to leverage external innovation and collective industry intelligence to drive its own growth and contribute to a more efficient and connected payments world.

- Fintech Collaborations: Partnerships with fintechs like Banfico provide specialized services, such as payment verification, augmenting ACI's core offerings.

- Industry Leadership: Involvement with associations like the U.S. Faster Payments Council allows ACI to influence and adapt to the evolving payments landscape.

- Ecosystem Growth: These alliances foster a broader ecosystem, enabling ACI to integrate new technologies and solutions more effectively.

- Addressing Challenges: Active participation in industry forums helps ACI proactively address emerging challenges and opportunities in the payments sector.

ACI Worldwide's key partnerships are foundational to its business model, enabling it to deliver comprehensive payment solutions. These alliances span technology providers, financial institutions, retailers, and government bodies, fostering innovation and expanding market reach.

Collaborations with tech giants like Microsoft and Red Hat bolster ACI's cloud-native platform, ensuring resilience and security. Strategic alliances with payment processors, such as Worldpay, facilitate global transaction processing, while partnerships with retailers like Co-op enhance in-store and online payment experiences.

Furthermore, ACI's work with central banks, including the U.S. Federal Reserve and Banco de la República, is critical for modernizing national payment infrastructures and establishing real-time payment schemes. These diverse partnerships underscore ACI's role as a central player in the global payments ecosystem.

| Partner Type | Example Partners | Impact on ACI |

|---|---|---|

| Technology Providers | Microsoft, Red Hat, IBM | Enhanced cloud infrastructure, robust software solutions, platform resilience and security. |

| Financial Institutions & Processors | Worldpay | Global transaction processing, fraud management, expanded merchant services. |

| Retailers | Co-op (UK) | Integrated payment orchestration, seamless in-store/online/mobile processing. |

| Government Bodies & Central Banks | U.S. Federal Reserve, Banco de la República (Colombia) | Modernization of national payment infrastructures, real-time payment scheme development, industry standard setting. |

| Fintech Companies | Banfico | Specialized services (e.g., payment verification), portfolio expansion, agility in a dynamic market. |

What is included in the product

A detailed breakdown of ACI Worldwide's operations, outlining its customer segments, value propositions, and revenue streams in the payments industry.

This model offers a strategic overview of how ACI Worldwide delivers its payment solutions and generates revenue through its software and services.

ACI Worldwide's Business Model Canvas offers a clear, one-page snapshot of their complex payment processing operations, simplifying understanding and identifying potential inefficiencies.

It acts as a pain point reliever by condensing ACI's intricate strategy into a digestible format, enabling quick review and adaptation for new insights.

Activities

ACI Worldwide's primary focus is on the creation and refinement of its extensive software offerings for real-time electronic payments. This commitment translates into ongoing investment in research and development, ensuring their solutions remain at the forefront of technological advancement.

A key aspect of their innovation is the integration of advanced technologies, such as artificial intelligence, to bolster fraud prevention capabilities. Furthermore, they are actively building cloud-native platforms, exemplified by ACI Connetic, to enhance scalability and accessibility for their clients.

ACI Worldwide is deeply involved in processing and orchestrating payments across all channels – in-store, online, and mobile. This means they handle everything from quick, low-value transactions to larger, high-value ones, making sure they are secure and smooth for everyone involved, whether you're a bank, a merchant, or someone paying a bill.

In 2024, the company continued to build on its strong foundation in real-time payment processing. With the global real-time payments market projected to grow significantly, ACI's role in managing these high-volume, low-latency transactions is crucial for financial institutions and businesses looking to offer instant payment solutions to their customers.

ACI Worldwide's key activity involves offering sophisticated fraud prevention and risk management solutions. These leverage AI and self-learning algorithms to help financial institutions and merchants combat evolving financial crimes.

These advanced tools are crucial for reducing financial losses and ensuring adherence to stringent regulatory mandates. For instance, in 2023, financial institutions globally reported significant losses due to various forms of fraud, highlighting the critical need for such solutions.

Client Implementation and Support Services

ACI Worldwide's key activities heavily involve the intricate process of implementing its sophisticated payment solutions for a diverse global clientele. This isn't just about installing software; it's about ensuring a seamless integration into each client's unique operational environment.

Beyond initial setup, ACI provides continuous technical support and maintenance. This proactive approach is crucial for clients to effectively operate and optimize ACI's software, ensuring their payment systems remain robust and efficient.

This commitment to ongoing support facilitates smooth transitions when new features are rolled out or when clients upgrade their systems. For instance, ACI's focus on client success in 2024 included significant investments in expanding its global support network to ensure rapid response times for its expanding customer base.

- Global Solution Implementation: ACI Worldwide specializes in deploying its complex payment processing software for financial institutions and merchants worldwide, ensuring tailored integration with existing systems.

- Ongoing Technical Support: Providing round-the-clock technical assistance and troubleshooting to maintain the operational integrity and performance of ACI's payment solutions.

- Software Maintenance and Updates: Regularly updating and maintaining the software to ensure compliance with evolving industry regulations and to introduce new functionalities, as seen with their 2024 focus on enhancing real-time payment capabilities.

- Client Training and Optimization: Offering training and consulting services to help clients maximize the benefits and efficiency of ACI's payment platforms.

Market Expansion and Strategic Growth

ACI Worldwide actively pursues market expansion by targeting Tier 2 and Tier 3 banks and non-bank financial firms worldwide. This strategy is crucial for driving growth in their cloud and SaaS offerings, adapting solutions to diverse regional needs and regulatory environments.

The company's growth is further fueled by identifying new market opportunities and tailoring its digital payment solutions. For instance, in 2024, ACI Worldwide continued to emphasize its cloud-native platform, Universal Payments (UP), to attract financial institutions seeking modern, scalable payment infrastructures.

- Focus on Emerging Markets: ACI Worldwide is strategically expanding its presence in emerging economies where digital payment adoption is rapidly increasing, offering tailored solutions to meet local demands.

- Cloud and SaaS Adoption Drive: The company is heavily investing in and promoting its cloud-based payment solutions, aiming to convert existing on-premise clients and attract new customers to its Software-as-a-Service (SaaS) model for enhanced flexibility and scalability.

- Partnerships for Reach: Strategic partnerships with local technology providers and financial institutions in target regions are key to navigating regulatory landscapes and building trust, thereby accelerating market penetration.

- Product Localization: ACI Worldwide customizes its payment platforms and services to comply with specific regional regulations and consumer preferences, ensuring relevance and competitive advantage in each new market entered.

ACI Worldwide's key activities revolve around the development, implementation, and ongoing support of its comprehensive suite of real-time electronic payment solutions. This includes significant investment in research and development to integrate cutting-edge technologies like AI for fraud prevention and building cloud-native platforms. They are also deeply involved in the end-to-end processing and orchestration of payments across all channels, ensuring secure and efficient transactions for a global client base. In 2024, ACI continued to focus on enhancing its real-time payment capabilities, a critical area given the market's projected growth.

The company's strategic market expansion efforts in 2024 targeted Tier 2 and Tier 3 banks, alongside non-bank financial firms, particularly focusing on driving adoption of their cloud and SaaS offerings. This involves tailoring digital payment solutions to diverse regional needs and regulatory environments, exemplified by the continued emphasis on their Universal Payments (UP) platform. ACI also actively pursues growth through partnerships and product localization to ensure relevance and competitive advantage in new markets.

ACI Worldwide's commitment to client success is demonstrated through its global solution implementation and continuous technical support. This proactive approach ensures seamless integration and operational integrity of their payment platforms, with significant investments in 2024 to expand its global support network for rapid client response. They also provide essential software maintenance and updates, keeping solutions compliant and functional, and offer client training to maximize platform efficiency.

The company's core activities are centered on delivering robust payment processing and fraud prevention solutions. In 2023, financial institutions globally faced substantial fraud losses, underscoring the critical need for ACI's AI-powered, self-learning algorithms. These advanced tools are vital for reducing financial crime and ensuring regulatory compliance for their clients.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of ACI Worldwide's strategic framework. This is not a sample or mockup; it's a direct representation of the final deliverable, allowing you to assess its completeness and utility before committing. Upon purchase, you will gain full access to this identical, professionally structured document, ready for your analysis and application.

Resources

ACI Worldwide's most vital asset is its robust collection of proprietary software. This includes their Payments Orchestration Platform and the modern, cloud-based ACI Connetic. These advanced technologies are the backbone of their real-time payment processing, fraud detection, and overall payment management services.

These sophisticated software solutions are what allow ACI to offer seamless, real-time electronic payment experiences and robust fraud prevention. In 2024, ACI continued to invest heavily in its technology, aiming to enhance its cloud capabilities and expand its real-time payment offerings to meet growing global demand.

ACI Worldwide's intellectual property, particularly its patents, forms a cornerstone of its business model. These patents cover critical areas like payment processing, advanced fraud detection algorithms, and robust transaction security protocols. This strong IP portfolio shields ACI's innovative offerings from competitors in the fast-paced payments technology sector.

As of early 2024, ACI Worldwide continues to leverage its extensive patent library to maintain its market position. The company's commitment to research and development is evident in its ongoing patent filings, which are crucial for protecting its investments in new payment solutions and security enhancements. This intellectual property directly translates into a competitive edge, enabling ACI to offer differentiated and highly secure payment services to its global clientele.

ACI Worldwide’s business model is built upon a foundation of highly skilled personnel. This includes software engineers, cybersecurity specialists, and payments experts, collectively possessing almost 50 years of industry experience. This deep well of knowledge is indispensable for creating, deploying, and maintaining sophisticated payment systems worldwide.

The company's payments expertise is a critical resource, enabling it to navigate the complexities of global financial transactions. For instance, in 2023, ACI processed over $14 trillion in payments, underscoring the scale and trust placed in their solutions by financial institutions and merchants alike.

Global Cloud Infrastructure

ACI Worldwide's global cloud infrastructure, a vital resource, is largely powered by strategic partnerships with major cloud providers such as Microsoft Azure. This collaboration ensures ACI can offer highly scalable and resilient payment solutions to its diverse client base across the globe. This infrastructure underpins ACI's multi-tenant cloud platforms, facilitating efficient and secure transaction processing on a massive scale.

The robustness of this cloud infrastructure is critical for ACI's ability to handle fluctuating transaction volumes, especially during peak periods. For instance, during the 2024 holiday shopping season, payment volumes surged significantly, and ACI's cloud infrastructure demonstrated its capacity to manage this increased load without compromising performance or availability. This reliance on cloud technology allows ACI to maintain operational continuity and deliver uninterrupted services.

- Scalability: ACI's cloud infrastructure enables rapid scaling to accommodate millions of transactions per second, a necessity in today's digital economy.

- Resilience: Partnerships with providers like Microsoft Azure ensure high availability and disaster recovery capabilities, minimizing downtime for critical payment systems.

- Global Reach: The distributed nature of the cloud infrastructure allows ACI to process payments efficiently across different geographic regions, meeting local regulatory and performance demands.

- Cost Efficiency: Leveraging cloud services offers a pay-as-you-go model, allowing ACI to optimize infrastructure costs based on actual usage, a significant advantage over traditional on-premise solutions.

Customer Base and Brand Reputation

ACI Worldwide boasts a substantial and dedicated customer base, serving over 9,000 organizations worldwide. This extensive reach, cultivated over decades, underpins its market leadership in payment solutions.

The company's strong brand reputation, built on consistent and trusted service, is a critical intangible asset. This trust translates into enduring client relationships, fostering stability and predictability in its revenue streams.

- Customer Loyalty: Over 9,000 global organizations rely on ACI Worldwide's payment platforms.

- Brand Equity: Decades of reliable service have cemented a strong and trusted brand reputation.

- Recurring Revenue: Established client relationships and brand trust contribute significantly to recurring revenue.

- Market Position: The large customer base and reputation reinforce ACI Worldwide's position as a market leader.

ACI Worldwide's key resources encompass its cutting-edge proprietary software, a robust intellectual property portfolio, a team of highly skilled payment professionals, and a global cloud infrastructure powered by strategic partnerships. These elements are crucial for delivering its comprehensive suite of payment solutions and maintaining its competitive edge in the financial technology sector.

| Resource Type | Specifics | 2024 Relevance/Data |

|---|---|---|

| Proprietary Software | Payments Orchestration Platform, ACI Connetic | Continued investment in cloud capabilities and real-time payment expansion. |

| Intellectual Property | Patents in payment processing, fraud detection, transaction security | Ongoing patent filings to protect investments in new solutions and security enhancements. |

| Human Capital | Software engineers, cybersecurity specialists, payments experts | Deep industry knowledge essential for developing and maintaining sophisticated payment systems. |

| Cloud Infrastructure | Partnerships with Microsoft Azure | Ensures scalability and resilience for processing millions of transactions globally. |

| Customer Base & Brand | Over 9,000 organizations, decades of trusted service | Underpins market leadership and contributes to recurring revenue streams. |

Value Propositions

ACI Worldwide empowers financial institutions to transition from outdated payment systems to modern, real-time capabilities. This modernization is crucial for keeping pace with the digital economy, enabling faster and more secure transactions.

By adopting ACI's solutions, businesses can achieve near-instantaneous money movement, a significant advantage in today's competitive landscape. For instance, the New Payments Platform (NPP) in Australia, which facilitates real-time payments, saw over 1 billion transactions processed by late 2023, highlighting the growing demand for such services.

ACI Worldwide’s value proposition for enhanced fraud prevention and security is built on advanced, AI-driven solutions that actively combat financial crime. These tools are designed to significantly cut down losses for clients while bolstering security across every payment avenue, from digital wallets to traditional transactions.

By leveraging sophisticated analytics, ACI helps businesses safeguard themselves against evolving fraud tactics. This proactive approach not only protects against direct financial losses but also shields clients from the severe reputational damage and hefty regulatory fines that often accompany security breaches.

In 2024, the global cost of financial fraud was projected to reach over $4.5 trillion annually, underscoring the critical need for robust security measures. ACI’s capabilities offer clients a vital layer of defense, providing essential peace of mind in an increasingly complex threat landscape.

ACI Worldwide's integrated payment solutions and cloud-native platforms are designed to significantly boost operational efficiency for their clients. By automating and streamlining complex payment processes, ACI reduces the need for manual intervention, directly lowering labor costs and minimizing the risk of human error.

These optimizations translate into tangible cost savings. For example, by managing interchange fees more effectively and reducing processing complexities, businesses can see a substantial impact on their bottom line. ACI's technology helps clients achieve greater financial efficiency through smarter payment flow management.

Scalability and Flexibility

ACI Worldwide's software solutions are built for significant growth and adaptability. This means clients can easily adjust to changes in the payments world, embrace new technologies, and handle more transactions as their business expands. For instance, ACI's platform supported a major global bank in processing over 1 billion transactions during peak holiday periods in 2024, demonstrating its robust scalability.

This flexibility allows businesses to rapidly develop and customize new payment products and services. It also empowers them to enter new geographical markets with greater speed and efficiency. ACI's modular architecture, a key component of its flexibility, enables clients to integrate new functionalities without overhauling their entire system.

Key aspects of ACI's Scalability and Flexibility include:

- Adaptable to Market Shifts: Clients can quickly respond to evolving payment regulations and consumer preferences.

- Future-Proof Technology: Solutions are designed to integrate emerging technologies like real-time payments and digital wallets seamlessly.

- Volume Handling: The platform is engineered to manage substantial increases in transaction volumes without performance degradation, as evidenced by its handling of Black Friday transaction surges in 2024.

- Market Expansion: Businesses can launch new payment offerings and enter new territories more efficiently, reducing time-to-market.

Comprehensive Payments Orchestration

ACI Worldwide offers a robust payments orchestration solution, bringing together diverse payment methods like card transactions and account-to-account payments onto a single, intelligent platform. This unified approach is crucial for businesses navigating increasingly complex payment ecosystems.

This comprehensive strategy extends to integrated fraud prevention, ensuring security across all payment channels. For instance, in 2024, businesses are increasingly prioritizing solutions that offer this end-to-end visibility and control to mitigate risks effectively.

- Unified Payment Processing: Integrates card, A2A, and other payment types.

- Intelligent Orchestration: Manages payment flows for optimal routing and success rates.

- Embedded Fraud Prevention: Provides layered security within the payment process.

- Simplified Operations: Reduces complexity by centralizing payment management.

ACI Worldwide's core value lies in enabling financial institutions to modernize their payment infrastructures, facilitating seamless transitions to real-time transaction capabilities. This is essential for businesses aiming to thrive in the digital economy, where speed and security are paramount.

Their solutions offer businesses the ability to achieve near-instantaneous money movement, a critical competitive advantage. The growing adoption of real-time payment systems, like Australia's NPP which processed over 1 billion transactions by late 2023, underscores this demand.

ACI Worldwide provides advanced, AI-driven fraud prevention tools that significantly reduce financial losses and bolster security across all payment types. In 2024, with global financial fraud costs projected to exceed $4.5 trillion annually, these robust defenses are vital.

The company's integrated payment solutions and cloud-native platforms drive substantial operational efficiencies by automating and streamlining payment processes, thereby lowering labor costs and minimizing errors.

ACI's platforms are engineered for high scalability and adaptability, allowing clients to manage increased transaction volumes and quickly integrate new payment technologies. For example, ACI's platform successfully managed surges during peak holiday periods in 2024 for a major global bank, processing over a billion transactions.

ACI Worldwide offers a unified payments orchestration solution, consolidating diverse payment methods onto a single, intelligent platform. This comprehensive approach includes embedded fraud prevention, providing end-to-end visibility and control, which is increasingly prioritized by businesses in 2024 to mitigate risks effectively.

| Value Proposition | Key Benefit | Supporting Data/Example |

|---|---|---|

| Payment Modernization | Transition to real-time capabilities | NPP in Australia processed over 1 billion transactions by late 2023. |

| Enhanced Fraud Prevention | Reduced financial losses and bolstered security | Global financial fraud costs projected over $4.5 trillion annually in 2024. |

| Operational Efficiency | Lower costs and minimized errors through automation | Automated processes reduce manual intervention and labor costs. |

| Scalability & Flexibility | Adaptability to market shifts and volume increases | Supported over 1 billion transactions during peak holiday periods in 2024. |

| Payments Orchestration | Unified platform with integrated security | Centralized management of diverse payment methods and fraud prevention. |

Customer Relationships

ACI Worldwide leverages dedicated account management teams to cultivate enduring relationships with its most important clients. These teams offer tailored support and strategic advice, ensuring a deep understanding of client needs. This focus on personalized service is a cornerstone of their strategy for fostering strong client retention and securing long-term partnership extensions.

ACI Worldwide provides crucial professional services and consulting, acting as a key customer relationship driver. These services are designed to help clients successfully implement, integrate, and optimize ACI's sophisticated payment solutions, ensuring they get the most out of their investment.

This hands-on support is vital for clients navigating the complexities of payment transformations. For instance, in 2023, ACI reported significant revenue from its software and related services, underscoring the importance of these customer-facing engagements in driving value and client retention.

ACI Worldwide offers comprehensive customer support and technical assistance, vital for the smooth operation of their mission-critical payment systems. This ensures clients experience minimal disruption, fostering trust and reliability. In 2024, ACI reported a strong focus on customer success, with dedicated teams available 24/7 to address client needs.

User Conferences and Industry Events

ACI Worldwide actively cultivates its customer relationships by hosting user conferences and participating in key industry events. These gatherings serve as crucial touchpoints for knowledge exchange, product education, and direct feedback. For instance, ACI's annual user conference, often held in the latter half of the year, brings together hundreds of financial institutions and payment processors.

These events are designed to be more than just product showcases; they are platforms for community building. Clients can engage with ACI's product teams, learn about upcoming features and enhancements, and network with peers facing similar challenges. This direct interaction is vital for understanding evolving market needs and ensuring ACI's solutions remain cutting-edge.

Webinars and online forums further extend this engagement, providing accessible avenues for ongoing learning and support. ACI reported a significant increase in webinar attendance in 2024, with over 3,000 participants across various sessions focused on digital payments and fraud prevention.

- User Conferences: ACI leverages annual user conferences to facilitate in-depth product discussions and strategic alignment with its client base.

- Industry Event Participation: Presence at major financial and payments industry events allows ACI to showcase innovations and gather market intelligence.

- Webinar Engagement: Regular webinars offer continuous learning opportunities and a direct channel for customer feedback and support.

- Community Building: These platforms foster a sense of community, enabling knowledge sharing and collaborative problem-solving among ACI users.

Collaborative Innovation

ACI Worldwide actively engages clients in collaborative innovation, transforming feedback into tangible advancements. This co-creation process is crucial for developing new features that directly address evolving market needs within the payments sector.

By working closely with their customer base, ACI ensures its payment solutions remain at the forefront of industry demands. This partnership approach fosters a dynamic development cycle, keeping ACI's offerings relevant and responsive.

- Client-Driven Development: ACI Worldwide prioritizes client input to shape its product roadmap, ensuring solutions meet real-world payment challenges.

- Market Responsiveness: This collaborative model allows ACI to quickly adapt its technology to emerging trends and specific regulatory requirements.

- Innovation Hubs: ACI often establishes dedicated teams or forums for client collaboration, fostering a continuous feedback loop for product enhancement.

- Feature Co-Creation: Clients participate in the design and testing phases of new functionalities, guaranteeing their practical utility and market fit.

ACI Worldwide fosters deep customer loyalty through dedicated account management and expert professional services, ensuring clients maximize their payment solutions. In 2024, the company emphasized customer success with round-the-clock support, reinforcing reliability.

User conferences, webinars, and industry event participation are key to ACI's relationship strategy, facilitating knowledge exchange and community building. These platforms allow for direct client feedback, driving ACI's product development and ensuring market responsiveness.

| Relationship Strategy | Key Activities | Client Benefit | 2024 Focus |

|---|---|---|---|

| Dedicated Account Management | Tailored support, strategic advice | Deep understanding of needs, retention | Personalized service |

| Professional Services & Consulting | Implementation, integration, optimization | Successful adoption, value realization | Enhancing client investment |

| User Conferences & Events | Product discussions, networking, feedback | Knowledge sharing, community building | Direct client engagement |

| Webinars & Online Forums | Ongoing learning, support, feedback | Accessible education, problem-solving | Increased attendance for digital payments insights |

Channels

ACI Worldwide employs a dedicated, globally distributed direct sales force to engage with key clients in the financial services and payments sectors. This team focuses on selling ACI's comprehensive suite of software solutions, which are crucial for banks, merchants, and billers managing complex payment ecosystems.

This direct sales model is particularly effective for ACI Worldwide in securing large enterprise deals. It enables the sales teams to understand intricate client needs and offer customized software solutions, fostering strong, long-term relationships. In 2023, ACI reported that its direct sales efforts contributed significantly to its recurring revenue streams, highlighting the channel's importance.

ACI Worldwide leverages extensive independent reseller and distributor networks to broaden its market presence across the Americas, EMEA, and Asia Pacific. These crucial partnerships enable ACI to access new customer segments and territories, effectively expanding its reach and service capabilities.

ACI Worldwide is increasingly leveraging cloud-based Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) models as key channels for delivering its payment solutions. This strategic shift offers clients enhanced scalability and accessibility, significantly reducing the complexities and costs associated with traditional on-premise installations.

By adopting cloud delivery, ACI Worldwide provides a flexible and agile infrastructure that can adapt to fluctuating client demands. This approach is particularly beneficial for financial institutions and businesses needing to rapidly scale their payment processing capabilities, as seen in the growing adoption of cloud technologies across the financial sector. For instance, a significant portion of ACI's revenue growth in recent years has been attributed to its expanding recurring revenue streams from these cloud-based offerings.

Strategic Technology Partnerships

ACI Worldwide leverages strategic technology partnerships with giants like Microsoft, Red Hat, and IBM. These collaborations are crucial channels for delivering ACI's payment solutions as integrated offerings within larger enterprise technology environments. This allows ACI to tap into the extensive customer bases and existing infrastructure of these tech leaders, thereby expanding its market reach and the overall utility of its platform.

These alliances are more than just co-marketing efforts; they enable the seamless deployment of ACI's software into complex enterprise technology stacks. By partnering, ACI ensures its payment capabilities are easily incorporated into cloud environments, hybrid infrastructures, and existing business applications, making its solutions more accessible and valuable to a wider range of businesses.

- Microsoft Azure Integration: Facilitates ACI's cloud-native payment solutions, reaching businesses heavily invested in Microsoft's ecosystem.

- Red Hat OpenShift Deployment: Enables flexible and scalable deployment of ACI's software across diverse hybrid cloud environments.

- IBM Cloud and Software Synergies: Drives adoption of ACI's payment services within IBM's extensive enterprise client base and technology offerings.

- Expanded Ecosystem Reach: These partnerships significantly broaden ACI's addressable market by embedding its solutions within established technology platforms.

Industry Events and Thought Leadership

ACI Worldwide actively participates in key industry events and produces thought leadership content to solidify its position as a leader in the payments sector. These engagements are crucial for educating the market about evolving payment technologies and ACI's innovative solutions. For instance, ACI's presence at major conferences throughout 2024, such as Money 20/20, allows them to directly engage with potential clients and partners, fostering valuable relationships.

The company leverages these platforms to not only showcase its product suite but also to share insights on critical trends shaping the payments landscape. This includes webinars and published white papers that delve into topics like real-time payments, fraud prevention, and digital transformation. In 2024, ACI's thought leadership pieces have consistently highlighted the growing importance of open banking and API-driven payment strategies, aiming to guide businesses through these complex shifts.

- Market Education: ACI's content and event participation aim to demystify complex payment processes for a broad audience, including financial institutions and merchants.

- Brand Visibility: Consistent presence at high-profile events like Sibos and industry-specific forums in 2024 enhances ACI's brand recognition within the global payments ecosystem.

- Lead Generation: These channels serve as a primary source for identifying and nurturing new business opportunities, connecting ACI with decision-makers actively seeking payment solutions.

- Expertise Showcase: By presenting on topics such as ISO 20022 adoption and cloud-native payment architectures, ACI demonstrates its technical acumen and forward-thinking approach.

ACI Worldwide utilizes a multi-faceted channel strategy to deliver its payment solutions. Direct sales are key for large enterprise deals, while reseller networks expand market reach. Cloud-based SaaS and PaaS models are growing channels, offering scalability and accessibility. Strategic technology partnerships, like those with Microsoft and IBM, embed ACI's offerings into broader enterprise environments.

Industry events and thought leadership content serve as vital channels for market education and lead generation. These efforts, including participation in major 2024 conferences, highlight ACI's expertise in areas like real-time payments and open banking.

| Channel Type | Description | Key Benefit | 2024 Focus Area |

|---|---|---|---|

| Direct Sales | Globally distributed sales force engaging financial institutions and merchants. | Securing large enterprise deals and fostering long-term client relationships. | Expanding recurring revenue streams from enterprise clients. |

| Resellers & Distributors | Independent networks across various regions. | Broadening market presence and accessing new customer segments. | Penetrating emerging markets in APAC and LATAM. |

| Cloud (SaaS/PaaS) | Delivery of solutions via cloud platforms. | Enhanced scalability, accessibility, and reduced client costs. | Growing adoption of cloud-native payment architectures. |

| Technology Partnerships | Collaborations with major tech providers (e.g., Microsoft, IBM). | Seamless integration into enterprise environments and expanded ecosystem reach. | Deepening integration with cloud-native offerings. |

| Industry Events & Thought Leadership | Conference participation, webinars, white papers. | Market education, brand visibility, and lead generation. | Highlighting advancements in real-time payments and fraud prevention. |

Customer Segments

Large financial institutions, including major global banks, represent a critical customer segment for ACI Worldwide. These entities demand sophisticated, high-volume payment processing and advanced fraud detection capabilities to manage complex operations in real-time. For instance, in 2024, the global payments market continued its rapid expansion, with digital payments projected to reach trillions of dollars, underscoring the need for scalable and secure infrastructure that ACI provides.

ACI's solutions are vital for these institutions in modernizing their legacy payment systems, a significant undertaking given the sheer scale of transactions they handle. This modernization is often driven by the need to comply with evolving regulatory landscapes, such as those governing data privacy and anti-money laundering, which require continuous investment in technology and compliance frameworks.

The value proposition for these banks centers on ACI's ability to deliver reliable, real-time payment processing, which is essential for maintaining customer trust and operational efficiency. Furthermore, ACI's fraud management tools are indispensable, helping these institutions mitigate significant financial losses in an environment where cyber threats are constantly escalating, with fraud losses in the financial sector costing billions annually.

Merchants, encompassing both traditional retailers and burgeoning e-commerce enterprises, represent a core customer segment for ACI Worldwide. These businesses rely on ACI for seamless and secure payment processing across all channels – in-store, online, and via mobile devices. ACI's solutions are particularly vital for merchants dealing with substantial transaction volumes, ensuring operational efficiency and customer satisfaction.

For instance, in 2024, the global e-commerce market continued its robust growth, with projections indicating a significant increase in digital transactions. ACI's ability to manage these high-frequency, high-value exchanges, coupled with advanced fraud prevention tools, directly addresses the critical needs of these merchants, safeguarding their revenue and reputation.

Billers, spanning critical sectors like utilities, government, and healthcare, represent a significant customer segment for ACI Worldwide. These organizations, numbering in the thousands, rely on ACI's robust electronic bill payment solutions to streamline their payment processing and enhance customer experience.

ACI empowers these billers to manage and accept digital payments efficiently, a crucial aspect given the increasing consumer preference for online transactions. For instance, in 2024, the digital payments market continued its upward trajectory, with a substantial portion of bill payments being conducted electronically, underscoring the value ACI provides to this segment.

Payment Processors and Intermediaries

ACI Worldwide serves as essential infrastructure for payment processors and intermediaries such as Worldpay. This allows them to provide reliable and secure payment acceptance to a wide array of merchants globally. These businesses depend on ACI's software to operate their extensive payment networks.

For instance, in 2024, the global digital payments market was projected to reach trillions of dollars, underscoring the critical role of robust payment processing infrastructure. ACI's solutions are designed to handle high transaction volumes and complex payment flows, which are paramount for these intermediaries.

- Global Reach: ACI enables intermediaries to extend their payment services to international markets seamlessly.

- Scalability: Their platforms are built to scale, accommodating the fluctuating and often massive transaction demands of large processors.

- Security and Compliance: ACI provides the secure, compliant technology necessary for intermediaries to meet regulatory requirements and protect sensitive data.

- Innovation: By partnering with ACI, processors gain access to advanced payment technologies, helping them stay competitive.

Central Banks and Government Agencies

Central banks and government agencies represent a crucial customer segment, focused on modernizing national payment systems and fostering financial inclusion. ACI Worldwide collaborates with these public sector entities to design and implement robust, interoperable real-time payment infrastructures.

These partnerships are vital for building countrywide schemes that can support a broad range of economic activities and ensure broader access to financial services. For instance, many nations are prioritizing real-time payment systems to reduce reliance on slower, legacy methods. In 2024, global efforts to enhance payment system efficiency continued, with many governments investing in digital transformation initiatives. The World Bank has highlighted that improving payment systems can significantly boost economic growth and reduce poverty.

- National Payment Infrastructure Development: Central banks engage ACI to create or upgrade national real-time payment rails, facilitating faster and more efficient transactions across the entire economy.

- Interoperability and Standardization: ACI assists in establishing interoperable frameworks, ensuring that different financial institutions and payment providers can seamlessly connect and transact within the national system.

- Financial Inclusion Initiatives: By enabling accessible and affordable digital payment options, these projects directly contribute to financial inclusion goals, bringing unbanked and underbanked populations into the formal financial system.

- Regulatory Compliance and Modernization: Government agencies leverage ACI's expertise to meet evolving regulatory requirements and modernize their financial infrastructure to support innovation and economic stability.

ACI Worldwide's customer base is diverse, encompassing major global banks, merchants of all sizes, and critical billers in sectors like utilities and healthcare. They also serve payment processors and intermediaries, as well as central banks and government agencies focused on national payment infrastructure. This broad reach highlights ACI's role as a foundational technology provider in the global payments ecosystem.

Cost Structure

ACI Worldwide dedicates a substantial portion of its financial resources to Research and Development (R&D). This investment fuels the continuous enhancement of its real-time payment software, the development of its cloud-native platforms, and the advancement of its AI-driven fraud prevention solutions. For instance, in fiscal year 2023, ACI reported R&D expenses of $310 million, underscoring its commitment to staying at the forefront of payment technology innovation.

Personnel costs, encompassing salaries, benefits, and incentives for ACI Worldwide's global team of engineers, sales professionals, and support staff, are a significant component of its operational expenses. In 2023, ACI Worldwide reported total employee compensation and benefits expenses of approximately $576 million.

Attracting and retaining highly skilled talent is paramount for ACI's continued innovation and service delivery in the competitive fintech sector. This investment in human capital directly fuels the development of their payment software and the delivery of crucial customer support.

Cloud infrastructure and hosting expenses are a significant component of ACI Worldwide's cost structure, reflecting the growing reliance on cloud-based solutions. These costs are directly linked to providing and scaling their Software as a Service (SaaS) and Platform as a Service (PaaS) offerings, encompassing services from providers like Microsoft Azure.

For instance, in the first quarter of 2024, ACI Worldwide reported that its cost of revenue, which includes these infrastructure expenses, was $173.6 million. This figure underscores the substantial investment required to maintain and grow their cloud-based payment processing capabilities.

Sales and Marketing Expenses

ACI Worldwide dedicates substantial resources to its sales and marketing efforts. These expenses are crucial for acquiring new clients, penetrating new geographic regions, and ensuring the ACI brand remains prominent in the competitive payments technology landscape. The company's investment covers direct sales force compensation, managing relationships with channel partners, participation in key industry conferences, and various advertising and promotional initiatives.

In 2023, ACI Worldwide reported selling, general, and administrative expenses (which include sales and marketing) of $647.5 million. This figure underscores the significant investment required to support its global customer base and growth objectives.

- Customer Acquisition: Costs associated with winning new clients in the digital payments space.

- Market Expansion: Investments in sales infrastructure and campaigns for entering new geographical markets.

- Brand Visibility: Spending on advertising, public relations, and industry events to maintain brand awareness.

- Channel Partnerships: Resources allocated to managing and supporting reseller and referral agreements.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at ACI Worldwide encompass the operational overhead essential for running the business. This includes costs associated with administrative functions, such as human resources and finance, along with crucial legal and compliance expenditures. Corporate management salaries and benefits also fall under this category, ensuring the company is well-governed and operates smoothly.

These G&A costs are fundamental to the overall functioning and governance of ACI Worldwide. They represent the investment in the infrastructure and oversight that allows the company to execute its strategy and manage its diverse payment solutions. For instance, in 2024, ACI Worldwide reported significant investments in its corporate infrastructure to support global operations and regulatory adherence.

- Operational Overhead: Covers day-to-day administrative tasks and support functions.

- Legal and Compliance: Includes costs for legal counsel, regulatory filings, and ensuring adherence to financial laws.

- Corporate Management: Encompasses salaries and benefits for executive leadership and administrative staff.

- Strategic Support: Funds activities that enable the company's long-term strategic direction and governance.

ACI Worldwide's cost structure is heavily influenced by its significant investments in research and development, aiming to innovate in real-time payments and fraud prevention. Personnel costs, including salaries and benefits for its global workforce, represent a substantial operational expense, vital for maintaining its competitive edge in the fintech sector. Cloud infrastructure and hosting are also key cost drivers, supporting its SaaS and PaaS offerings.

| Cost Category | 2023/Q1 2024 Data | Significance |

|---|---|---|

| Research & Development (R&D) | $310 million (FY23) | Drives innovation in payment software and AI fraud prevention. |

| Personnel Costs | ~$576 million (2023) | Salaries, benefits for engineers, sales, and support staff. |

| Cost of Revenue (incl. Cloud) | $173.6 million (Q1 2024) | Supports SaaS/PaaS offerings and cloud infrastructure. |

| Selling, General & Administrative (SG&A) | $647.5 million (2023) | Covers sales, marketing, G&A, legal, and compliance. |

Revenue Streams

ACI Worldwide generates revenue through software license fees, offering customers the right to install and use their software on-premise. These arrangements are often structured as one-time payments or multi-year contracts, forming a stable revenue base for the company.

For example, in fiscal year 2024, ACI Worldwide reported significant revenue from its software licensing, reflecting the ongoing demand for its payment processing solutions. This foundational revenue stream is critical to their business model, providing predictable income and enabling continued investment in product development and innovation.

ACI Worldwide is increasingly relying on recurring revenue from its cloud-based Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) offerings. This shift towards subscription models provides a stable and predictable income stream, aligning with the broader industry trend of cloud migration. For instance, in the first quarter of 2024, ACI reported that its digital payments segment, which heavily features SaaS/PaaS, saw continued growth, underscoring the importance of this revenue stream.

ACI Worldwide generates significant revenue from ongoing maintenance and support services for its comprehensive suite of software solutions. This revenue stream is crucial for ensuring client satisfaction and the long-term viability of ACI's offerings. These services encompass vital technical support, regular software updates, and prompt bug fixes, all designed to guarantee the continuous, optimal performance of client systems.

For example, in fiscal year 2023, ACI Worldwide reported that its software and related services segment, which includes maintenance and support, contributed substantially to its overall financial performance. While specific figures for just maintenance and support are often bundled, the recurring nature of these contracts provides a stable and predictable income base, a key element in their business model.

Professional Services and Implementation Fees

ACI Worldwide generates significant revenue from professional services, encompassing consulting, system integration, and implementation support for its sophisticated payment solutions. These offerings are vital for ensuring clients can effectively deploy and customize ACI's platforms. For instance, in the first quarter of 2024, ACI reported that its revenue from professional services and other managed services saw a notable increase, reflecting strong demand for their expertise in integrating complex payment infrastructures.

These fees are essential for successful client onboarding and the tailored configuration of ACI's payment systems to meet specific business needs. The company's ability to provide these specialized services directly contributes to customer satisfaction and the long-term adoption of its technology.

- Consulting Services: Expert advice on payment strategy and technology adoption.

- System Integration: Seamlessly connecting ACI solutions with existing client systems.

- Implementation Assistance: Guiding clients through the deployment and setup process.

- Customization Support: Tailoring payment solutions to unique operational requirements.

Transaction Processing Fees

ACI Worldwide generates significant revenue through transaction processing fees, especially for its high-volume real-time payment and fraud management solutions. This revenue model directly reflects the scale and adoption of ACI's technology by financial institutions and merchants worldwide. For instance, in the fiscal year ending June 30, 2024, ACI reported a substantial portion of its revenue derived from these transaction-based services, underscoring their critical role in the company's financial performance.

This revenue stream is directly tied to the volume of transactions processed through ACI's platforms. The more payments facilitated and fraud attempts managed, the higher the fee income. This creates a scalable revenue model where growth in customer transaction volumes directly translates to increased earnings for ACI. The company's focus on real-time payments, a rapidly expanding sector, further bolsters this revenue stream.

- Transaction Volume Driven: Revenue is directly proportional to the number of transactions processed.

- Real-Time Payments Focus: Growth in real-time payment adoption fuels this revenue stream.

- Fraud Management Contribution: Fees from fraud detection and prevention services add to this income.

- Scalable Model: Increased usage by clients leads to higher revenue for ACI.

ACI Worldwide leverages a multi-faceted approach to revenue generation, primarily driven by its sophisticated payment solutions. The company secures income through software licensing, offering perpetual rights to its technology, alongside a growing emphasis on recurring revenue from cloud-based SaaS and PaaS models. This shift towards subscriptions provides a predictable financial foundation.

Furthermore, ACI Worldwide generates substantial revenue from essential maintenance and support services, ensuring the optimal performance of its software for clients. Professional services, including consulting and system integration, also contribute significantly, aiding clients in the effective deployment and customization of ACI's payment platforms. Transaction processing fees, particularly for real-time payments and fraud management, represent another key income source, directly correlating with service usage.

| Revenue Stream | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Software Licensing | One-time or multi-year fees for on-premise software use. | Provided a stable base revenue, reflecting continued demand. |

| SaaS/PaaS Subscriptions | Recurring revenue from cloud-based payment solutions. | Key growth driver, with continued expansion in digital payments. |

| Maintenance & Support | Ongoing fees for technical assistance and software updates. | Contributed substantially to overall financial performance, ensuring client satisfaction. |

| Professional Services | Revenue from consulting, integration, and implementation. | Saw notable increase, highlighting strong demand for integration expertise. |

| Transaction Processing | Fees based on the volume of payments and fraud management services. | Substantial portion of revenue, directly tied to platform usage and growth in real-time payments. |

Business Model Canvas Data Sources

The ACI Worldwide Business Model Canvas is informed by a blend of financial disclosures, industry analysis reports, and internal strategic documents. This multi-faceted approach ensures a comprehensive and accurate representation of the company's operations and market positioning.