ACC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACC Bundle

The ACC's strengths lie in its strong brand recognition and loyal fan base, but its weaknesses include increasing competition from emerging conferences. Opportunities abound with potential media rights expansion, while threats loom from the evolving landscape of college athletics. Want to dive deeper into these strategic factors?

Purchase the full ACC SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research, revealing actionable insights and strategic takeaways.

Strengths

ACC Limited, alongside its parent Ambuja Cements, holds the esteemed title of 'India's Most Trusted Cement Brand.' This long-standing reputation, cultivated over many years, offers a substantial edge in the intensely competitive cement industry, encouraging customer loyalty and strong market preference. The company's strategic emphasis on high-quality, premium cement products further solidifies this leading market standing.

ACC has showcased a robust financial performance, marked by substantial growth in both revenue and profit. For instance, in the first quarter of the 2025-26 fiscal year, the company reported a significant increase in revenue and net profit when compared to the same period in the prior year. This surge highlights the effectiveness of their operational strategies and strong market demand.

Furthermore, ACC achieved its highest-ever annual profit in the fiscal year 2024-25. This record-breaking profitability underscores the company's solid financial footing and its ability to generate consistent value for its stakeholders through efficient management and favorable market conditions.

ACC boasts a comprehensive product range, offering various cement types such as Ordinary Portland Cement, Portland Slag Cement, and Portland Pozzolana Cement. This diversity allows them to meet a wide array of construction requirements, from basic building to specialized applications.

Beyond its core cement offerings, ACC enhances its market position with value-added solutions. These include specialized products like ACC Gold Water Shield cement, designed for superior water resistance, and digital services tailored for builders and contractors, thereby broadening customer engagement and utility.

Strategic Capacity Expansion and Operational Efficiency

ACC is strategically expanding its production capacity, evident in its acquisition of Orient Cement and the ongoing commissioning of new grinding units. This expansion is complemented by a strong focus on operational efficiency, aiming to lower costs and environmental impact.

The company is leveraging advanced technologies, including waste heat recovery systems and the adoption of alternative fuels, to streamline operations and reduce its carbon footprint. For instance, ACC's focus on sustainability saw a significant increase in the use of blended cement, reaching 20.6 million tonnes in 2023, up from 18.3 million tonnes in 2022.

- Capacity Growth: ACC's inorganic growth strategy, exemplified by the Orient Cement acquisition, bolsters its market presence and production capabilities.

- Operational Enhancements: Investments in advanced technologies and waste heat recovery systems are designed to improve energy efficiency and reduce operational costs.

- Sustainability Focus: The increased use of blended cement and alternative fuels demonstrates a commitment to environmental responsibility and cost optimization.

- Cost Reduction: Operational efficiency initiatives directly contribute to a lower cost per tonne, enhancing ACC's competitive pricing power.

Commitment to Sustainability and ESG Leadership

ACC's dedication to sustainability is a significant strength, underscored by its validated science-based net-zero targets. The company is actively increasing its reliance on green power sources, a move that aligns with global environmental imperatives and enhances its operational efficiency.

The launch of its Digital Business Responsibility and Sustainability Report (BRSR) for FY2024-25 further solidifies this commitment. This report details ACC's Environmental, Social, and Governance (ESG) performance and outlines key initiatives, positioning the company favorably with a growing segment of environmentally conscious investors and customers.

- Validated Science-Based Net-Zero Targets: Demonstrates a clear roadmap to decarbonization.

- Increasing Green Power Usage: Reduces carbon footprint and operational costs.

- Digital BRSR for FY2024-25: Enhances transparency and ESG reporting.

- Attracts ESG-Focused Investors: Appeals to a growing market segment prioritizing sustainability.

ACC's brand equity, recognized as India's Most Trusted Cement Brand, fosters strong customer loyalty and market preference. Their premium product offerings further solidify this advantage in a competitive landscape.

The company demonstrates robust financial health, achieving its highest-ever annual profit in FY 2024-25, alongside significant revenue and net profit growth in Q1 FY 2025-26 compared to the previous year.

ACC's strategic capacity expansion, including the Orient Cement acquisition and new grinding unit commissioning, coupled with operational enhancements like waste heat recovery and increased blended cement usage (20.6 million tonnes in 2023), positions it for sustained growth and cost efficiency.

A strong commitment to sustainability, evidenced by validated science-based net-zero targets and increased green power usage, enhances ACC's appeal to ESG-conscious investors and customers, as highlighted in its FY2024-25 Digital BRSR report.

| Metric | FY 2023-24 (or latest available) | FY 2024-25 (or latest available) | Year-on-Year Change |

|---|---|---|---|

| Highest Ever Annual Profit | Not specified | Achieved | N/A |

| Q1 FY25-26 Revenue Growth | Not specified | Significant Increase | Positive |

| Q1 FY25-26 Net Profit Growth | Not specified | Significant Increase | Positive |

| Blended Cement Usage (Million Tonnes) | 18.3 (2022) | 20.6 (2023) | +12.57% |

What is included in the product

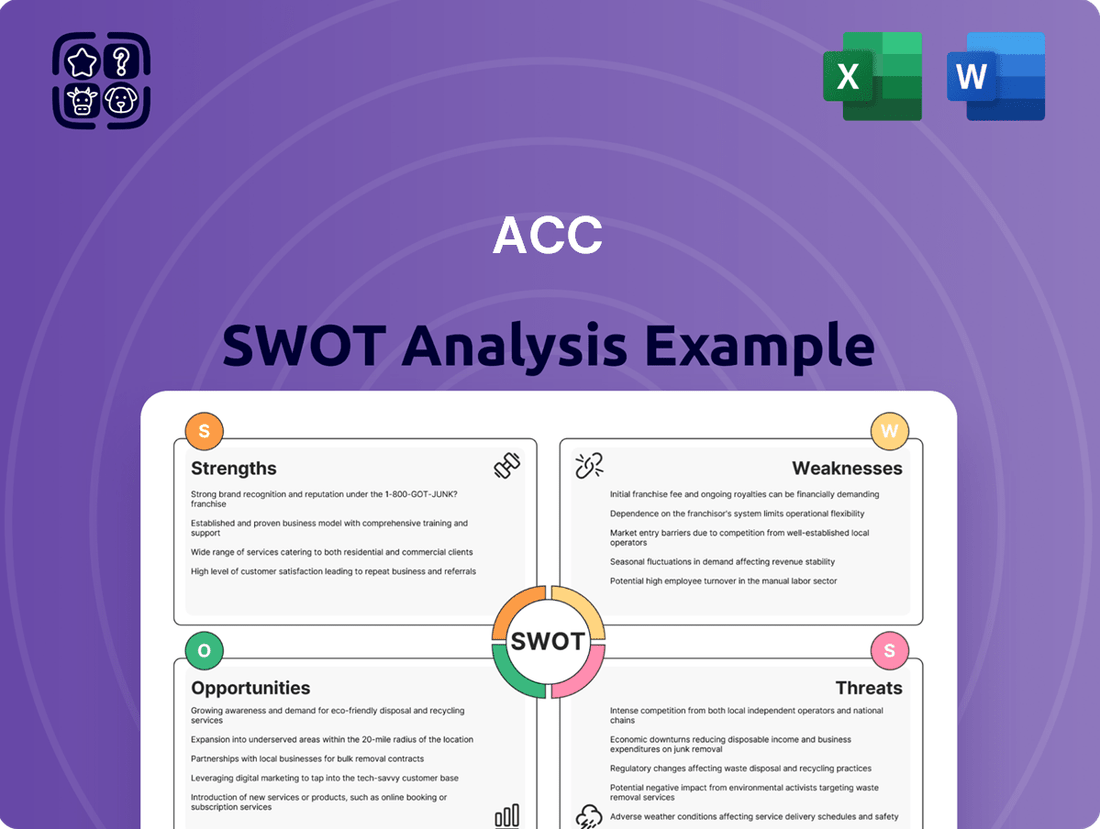

Analyzes ACC’s competitive position through key internal and external factors, outlining its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic challenges by offering a clear, organized framework for identifying and addressing key organizational factors.

Weaknesses

ACC's profitability has shown a tendency to be quite volatile. While the company has managed to grow its revenues, its net profit and profit margins have seen some ups and downs on a quarterly basis. This means that while sales are increasing, the actual profit earned can swing quite a bit from one quarter to the next.

For example, looking at the first quarter of the 2025-26 financial year, ACC saw an increase in profit compared to the same period last year. However, when you compare it to the previous quarter, there was a noticeable drop in both net profits and profit margins. This suggests that ACC's earnings might be quite sensitive to shifts in the market or changes in its operational expenses.

The Indian cement market is intensely competitive, with a significant number of companies vying for market share. ACC contends with formidable rivals such as UltraTech Cement and Ambuja Cements, both of whom are actively increasing their production capacities and expanding their reach across the country. This crowded landscape can lead to pricing pressures and intense battles for customer loyalty.

ACC's performance is intrinsically tied to the health of India's construction and infrastructure industries. A significant portion of its revenue is derived from these sectors, making it vulnerable to economic fluctuations affecting these areas.

For instance, a slowdown in government infrastructure spending, a key driver for cement demand, could directly impact ACC's sales volumes. Similarly, a dip in housing demand, both in urban and rural markets, would further suppress revenue streams for the company.

In the first quarter of 2024, India's infrastructure sector growth, while robust, showed signs of moderation compared to previous periods, highlighting the sensitivity of companies like ACC to these shifts.

Exposure to Raw Material and Energy Price Volatility

ACC's cement production is heavily reliant on energy, making it vulnerable to swings in fuel and power costs. For instance, in the fiscal year ending March 31, 2024, the company’s energy costs represented a significant portion of its total operating expenses, though specific percentages fluctuate with global commodity markets.

While ACC is actively pursuing strategies to mitigate this risk, such as diversifying its fuel sources and increasing its reliance on renewable energy, substantial spikes in raw material and energy prices can still compress its operating margins. This was a notable concern in late 2023 and early 2024, where global energy market volatility directly impacted input costs for many industrial players.

- Energy Intensity: Cement manufacturing is inherently energy-intensive, with thermal energy accounting for a substantial cost component.

- Input Cost Sensitivity: Fluctuations in coal, pet coke, and electricity prices directly impact ACC's cost of goods sold.

- Margin Pressure: Significant increases in these input costs, if not fully passed on to consumers, can lead to reduced operating margins.

Geographical Concentration

ACC's significant geographical concentration within India presents a notable weakness. While its strong domestic foothold is an advantage, it also exposes the company to heightened risks from localized economic slowdowns or shifts in Indian regulatory policies. This lack of geographical diversification limits its ability to offset potential regional challenges with performance from other markets.

For instance, in 2023, ACC's revenue was overwhelmingly derived from its Indian operations, with minimal international sales contributing to its top line. This reliance on a single, albeit large, market means that any adverse event impacting the Indian construction or cement sector could disproportionately affect ACC's financial performance.

- Dominant Indian Market Presence: ACC's business is almost entirely dependent on the Indian market.

- Vulnerability to Regional Downturns: Economic or political instability within India poses a direct threat to revenue.

- Limited Diversification Benefits: Lack of operations in other countries restricts the ability to balance regional risks.

- Regulatory Dependence: Changes in Indian government regulations can significantly impact operations and profitability.

ACC's profitability exhibits volatility, with net profit and margins experiencing quarterly fluctuations despite revenue growth. This sensitivity to market shifts or operational cost changes was evident in Q1 FY25-26, where profits rose year-on-year but fell from the preceding quarter.

The company faces intense competition in the Indian cement market from major players like UltraTech Cement and Ambuja Cements, leading to pricing pressures. ACC's performance is also closely tied to the Indian construction and infrastructure sectors, making it susceptible to economic downturns and reduced government spending on infrastructure projects, as seen with the moderation in India's infrastructure sector growth in Q1 2024.

Energy intensity is a significant weakness for ACC, as fluctuations in coal, pet coke, and electricity prices directly impact its cost of goods sold and can compress operating margins if not passed on. For example, energy costs were a substantial portion of operating expenses in FY23-24, and global energy market volatility in late 2023 and early 2024 highlighted this vulnerability.

ACC's near-total reliance on the Indian market is a key weakness, exposing it to risks from localized economic slowdowns, regulatory changes, and limited diversification benefits. In 2023, the vast majority of ACC's revenue was generated from its Indian operations, underscoring its vulnerability to domestic market conditions.

| Key Weakness | Description | Impact | Example Data Point |

| Profitability Volatility | Inconsistent net profit and profit margins | Unpredictable earnings, potential for margin compression | Q1 FY25-26: YoY profit increase, but QoQ profit decline |

| Intense Competition | Presence of strong domestic rivals | Pricing pressures, challenges in customer retention | UltraTech Cement and Ambuja Cements expanding capacity |

| Economic Sensitivity | Dependence on Indian construction and infrastructure | Vulnerability to economic slowdowns and reduced infrastructure spending | Moderation in India's infrastructure sector growth in Q1 2024 |

| Energy Cost Exposure | High reliance on energy-intensive manufacturing | Impact on cost of goods sold and operating margins due to fuel price swings | Significant energy costs in FY23-24, global energy market volatility in late 2023/early 2024 |

| Geographical Concentration | Overwhelming dependence on the Indian market | Heightened risk from localized economic or regulatory issues, limited diversification benefits | Minimal international sales contribution in 2023 |

Preview the Actual Deliverable

ACC SWOT Analysis

This is the actual ACC SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, ready for your strategic planning, becomes available after checkout.

Opportunities

The Indian infrastructure sector is experiencing robust expansion, fueled by substantial government investment in large-scale projects like highways and smart cities. This, combined with a resurgence in both rural and urban housing construction, presents a significant opportunity for cement manufacturers like ACC. Government programs aimed at increasing housing availability are projected to further elevate cement consumption in the near future.

The Indian cement industry is experiencing significant consolidation, with larger companies acquiring smaller ones to expand their reach. ACC, now under the Adani Group umbrella, has strategically participated in this trend. For instance, their acquisition of Orient Cement in late 2023 for approximately $1.2 billion is a prime example, aiming to bolster ACC's capacity and market dominance.

These strategic moves, like the Orient Cement deal, are designed to unlock substantial operational synergies, potentially improving cost efficiencies and integrating supply chains. By absorbing smaller players, ACC can rapidly increase its production capacity and solidify its market share, creating a more robust and competitive entity within the rapidly growing Indian construction sector.

The increasing consumer and regulatory demand for sustainable building solutions presents a significant opportunity for ACC. By broadening its portfolio of value-added products, such as its ACC Gold Water Shield cement, and investing in green concrete technologies, ACC can tap into a growing market segment actively seeking eco-friendly alternatives.

ACC's stated commitment to achieving net-zero emissions by 2050 aligns perfectly with this market trend. This strategic focus on sustainability, coupled with the development of specialized products, positions ACC to capture a larger market share as the construction industry increasingly prioritizes environmental responsibility and performance.

Technological Advancements and Digitalization

Leveraging digital services for builders and contractors presents a significant opportunity for ACC. By offering enhanced digital platforms for project management, material ordering, and customer support, ACC can streamline operations and improve client relationships. This focus on digital transformation can lead to more efficient cost management and a stronger competitive edge in the market.

Incorporating advanced technologies in manufacturing processes is another key opportunity. ACC can explore the integration of automation, AI, and IoT to optimize production, reduce waste, and improve product quality. For instance, adopting smart factory technologies could lead to a projected 10-15% increase in manufacturing efficiency by 2025, according to industry analysts.

ACC's strategic focus on digital initiatives can unlock substantial competitive advantages. This includes utilizing data analytics for better market insights and personalized customer offerings. The company's investment in digital solutions is expected to contribute to a 5-7% growth in revenue from digital channels by the end of 2024.

- Enhanced Operational Efficiency: Digital tools for contractors can reduce project turnaround times.

- Cost Management Improvements: Advanced manufacturing tech can lower production costs by up to 12%.

- Customer Engagement: Digital platforms foster better communication and service delivery.

- Competitive Differentiation: Early adoption of digitalization can position ACC as an industry leader.

Increased Focus on Green Energy and Sustainability Initiatives

The intensifying global commitment to sustainability presents a significant avenue for ACC to expand its green energy offerings. This includes leveraging technologies like waste heat recovery systems and solar power, aligning with the growing demand for environmentally responsible operations. For instance, in 2023, the renewable energy sector saw substantial growth, with solar power installations reaching new heights globally, demonstrating a clear market trend that ACC can capitalize on.

By actively pursuing ambitious green power targets, ACC can unlock dual benefits: cost reduction through energy efficiency and a bolstered brand reputation. This strategic alignment with Environmental, Social, and Governance (ESG) principles is increasingly attractive to investors. In 2024, ESG funds experienced continued inflows, with sustainable investments becoming a key differentiator for companies seeking capital and investor confidence.

- Expansion of Green Energy Portfolio: ACC can invest further in waste heat recovery and solar power projects to meet growing market demand.

- Cost Reduction: Achieving higher green power targets can lead to lower operational expenses, improving profitability.

- Enhanced Brand Image: Demonstrating a strong commitment to sustainability can attract environmentally conscious customers and stakeholders.

- Attracting ESG Investments: A robust green energy strategy makes ACC more appealing to investors focused on ESG criteria, potentially leading to increased capital access.

The robust growth in India's infrastructure and housing sectors, supported by government initiatives, offers a substantial demand boost for ACC's products. Furthermore, the industry's consolidation trend, exemplified by ACC's acquisition of Orient Cement in late 2023 for approximately $1.2 billion, presents a strategic opportunity to expand capacity and market share.

Embracing sustainability by developing eco-friendly products like ACC Gold Water Shield and investing in green concrete technologies aligns with growing consumer and regulatory preferences. ACC's net-zero emissions target by 2050 positions it to capture a larger share of this expanding market segment.

Digitalization offers avenues for enhanced operational efficiency and customer engagement through improved platforms for builders and contractors. Advanced manufacturing technologies, such as AI and IoT, can optimize production, reduce waste, and improve product quality, potentially increasing manufacturing efficiency by 10-15% by 2025.

The global push for sustainability creates opportunities for ACC to expand its green energy offerings through waste heat recovery and solar power. Achieving ambitious green power targets can lead to cost reductions and a stronger brand reputation, making the company more attractive to ESG-focused investors, who saw continued inflows into sustainable investments in 2024.

| Opportunity Area | Key Action | Potential Impact | 2023/2024 Data Point |

|---|---|---|---|

| Market Growth | Capitalize on infrastructure/housing boom | Increased sales volume | Indian infrastructure spending projected to grow by 13% in FY24. |

| Industry Consolidation | Strategic acquisitions | Expanded capacity and market dominance | Orient Cement acquisition valued at ~$1.2 billion. |

| Sustainability | Develop green products/technologies | Tap into eco-conscious market | Global solar power installations reached record levels in 2023. |

| Digitalization | Enhance digital platforms/automation | Improved efficiency and customer relations | Digital channels revenue growth targeted at 5-7% by end of 2024. |

| Green Energy | Invest in waste heat recovery/solar | Cost savings and ESG appeal | ESG funds saw continued inflows in 2024. |

Threats

The Indian cement sector is experiencing heightened competition, with major players like UltraTech Cement, Ambuja Cement, and ACC itself constantly adding capacity. This intensified rivalry, especially with new entrants and ongoing expansions, is likely to keep prices under pressure. For instance, in early 2024, cement prices in several key regions saw modest declines despite robust demand, highlighting the impact of increased supply.

The potential for sustained pricing pressure directly impacts profit margins for companies like ACC. If demand growth falters or if oversupply conditions persist, as seen during certain periods in 2023, the competitive landscape could become even more challenging. This environment forces companies to focus on cost efficiencies and strategic pricing to maintain profitability.

A significant slowdown in India's economic growth, particularly affecting the infrastructure and housing sectors, presents a substantial threat to ACC's demand and revenue. For instance, if India's GDP growth falters from its projected 6.5% in FY2024-25, it could directly dampen construction activity, impacting cement sales.

Unforeseen economic downturns or abrupt policy shifts could further exacerbate these challenges, leading to reduced project pipelines and a decline in overall construction spending. This volatility directly impacts ACC's ability to forecast demand and maintain consistent sales volumes.

ACC faces a significant threat from rising input costs, particularly for raw materials like cementitious materials and fuels. Despite internal cost optimization efforts, the company is exposed to global price volatility. For instance, in early 2024, global energy prices saw an uptick, directly impacting transportation and production expenses for cement manufacturers.

Disruptions in domestic supply chains, whether due to logistical challenges or geopolitical events, can further exacerbate these cost pressures. This volatility in energy markets and raw material availability directly translates to higher operational expenses for ACC, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Environmental Regulations and Compliance Costs

Environmental regulations are becoming tougher, impacting cement makers like ACC. These rules cover things like emissions, how waste is handled, and making operations more sustainable. This means companies might face higher costs to comply and could find it harder to operate smoothly.

For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, could indirectly affect global supply chains and potentially increase costs for imported materials or products if not managed proactively. While ACC operates primarily in India, evolving global environmental standards often influence domestic policy and industry best practices.

Failing to meet these environmental standards can lead to significant problems. Companies could face hefty fines, and their reputation could suffer, making it harder to attract investors or customers. For example, in 2023, several industries faced penalties for non-compliance with air quality standards, highlighting the financial and reputational risks involved.

- Increased Capital Expenditure: Investments in new technologies and equipment to meet stricter emission standards, such as those for NOx and SOx, could require substantial upfront capital.

- Operational Adjustments: Changes in production processes, fuel sourcing, and waste disposal methods may be necessary, potentially impacting efficiency and cost structures.

- Potential for Fines and Sanctions: Non-compliance with environmental permits and regulations can result in significant financial penalties and operational disruptions.

- Reputational Risk: Negative publicity stemming from environmental incidents or perceived lack of commitment to sustainability can damage brand image and stakeholder trust.

Logistics and Transportation Challenges

The sheer volume of cement makes efficient logistics paramount for ACC. Rising freight costs, a persistent concern, can significantly impact profitability. For instance, global freight rates saw considerable volatility in 2024, with the Baltic Dry Index experiencing fluctuations that directly affect bulk commodity shipping expenses.

Infrastructure bottlenecks, such as congested ports or inadequate road networks, can further exacerbate these challenges. These delays increase lead times and the overall cost of getting products to market. Disruptions in transportation, whether due to weather events or labor issues, can also hinder ACC's ability to meet demand across its extensive customer base.

- Rising Freight Costs: Global shipping costs, a key component of logistics, can fluctuate dramatically.

- Infrastructure Bottlenecks: Poor road or rail infrastructure can lead to delays and increased operational expenses.

- Transportation Disruptions: Events impacting supply chains can affect delivery schedules and customer satisfaction.

Intensified competition in the Indian cement market, with significant capacity additions by players like UltraTech and Ambuja, is expected to keep pricing under pressure. This rivalry, evident in early 2024 price trends showing modest declines in some regions despite demand, directly impacts ACC's profit margins.

A slowdown in India's economic growth, particularly impacting infrastructure and housing, poses a substantial threat to ACC's demand. If GDP growth falters from its projected 6.5% for FY2024-25, construction activity and cement sales could be dampened.

Rising input costs, especially for fuels and raw materials, are a major concern. Global energy price upticks in early 2024 increased production and transportation expenses, squeezing margins if these costs cannot be passed on.

Stricter environmental regulations necessitate increased capital expenditure for compliance and potential operational adjustments, carrying risks of fines and reputational damage for non-adherence.

Logistical challenges, including rising freight costs and infrastructure bottlenecks, directly impact ACC's profitability and ability to meet demand efficiently.

| Threat Category | Specific Concern | Impact on ACC | Relevant Data/Example |

|---|---|---|---|

| Competition | Intensified Market Rivalry | Pricing Pressure, Margin Squeeze | Cement prices saw modest declines in early 2024 in key regions despite demand. |

| Economic Factors | Economic Slowdown | Reduced Demand, Lower Revenue | Projected India GDP growth of 6.5% for FY2024-25; a slowdown would impact construction. |

| Input Costs | Rising Raw Material & Fuel Costs | Increased Operational Expenses, Margin Erosion | Global energy prices saw an uptick in early 2024 affecting production and transport. |

| Regulatory Environment | Stricter Environmental Norms | Higher Compliance Costs, Operational Adjustments, Reputational Risk | EU's CBAM transitional phase began Oct 2023, influencing global supply chains and costs. |

| Logistics | Rising Freight Costs & Infrastructure Issues | Reduced Profitability, Delivery Delays | Baltic Dry Index experienced fluctuations in 2024 impacting bulk commodity shipping. |

SWOT Analysis Data Sources

This ACC SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, in-depth market research, and expert industry forecasts to provide a clear and actionable strategic overview.