ACC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACC Bundle

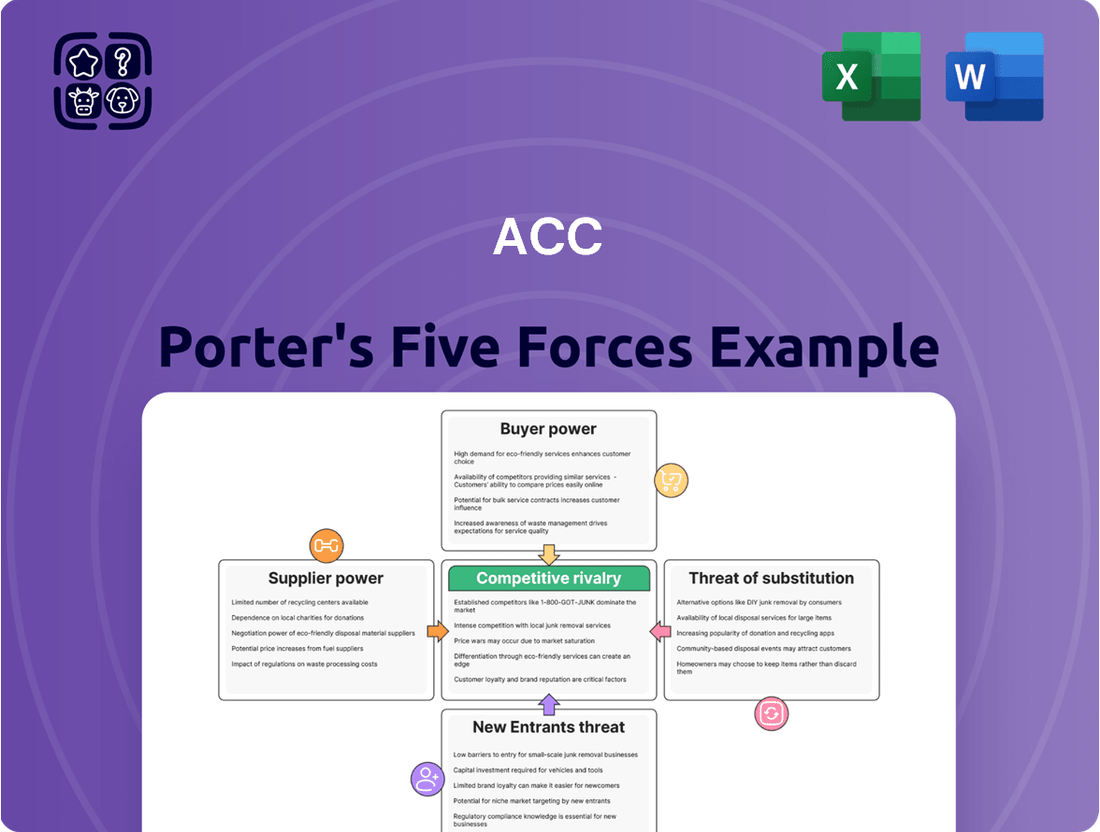

Understanding the competitive landscape for ACC is crucial, and Porter's Five Forces provides a powerful lens. This analysis reveals the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes impacting ACC's market.

The complete report reveals the real forces shaping ACC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Indian cement industry, including ACC, is significantly impacted by the volatile prices of essential raw materials like coal, petcoke, and limestone. While a dip in coal and petcoke prices was observed in October 2024, offering some relief, costs for limestone and fly-ash remained high through the first half of FY25.

Further cost pressures could arise from potential increases in limestone royalty rates or the introduction of new mining taxes. These factors directly influence ACC's input expenses, potentially squeezing profit margins if not effectively managed.

Cement manufacturing is incredibly energy-hungry, with power and fuel, especially coal, being major inputs. While we've seen some easing in petcoke and coal prices during fiscal year 2025, offering a bit of breathing room, the sheer volume of energy consumed means that fluctuations in global energy prices can still hit ACC's production costs hard.

This reliance makes managing power and fuel expenses a constant priority for cement companies like ACC. For instance, in FY24, energy costs represented a significant portion of the total operating expenses for many cement producers, highlighting the direct impact of energy price swings on profitability.

While precise data on ACC's supplier concentration for key raw materials isn't publicly detailed, the fundamental components of cement production, such as limestone, fly ash, and slag, are generally sourced from a diverse range of suppliers. This broad availability helps to mitigate the risk of any single supplier holding excessive power.

The growing accessibility of industrial by-products like fly ash and slag, often sourced from power plants and steel industries respectively, further strengthens the position of cement manufacturers like ACC. This diversification in sourcing for crucial inputs limits the potential for significant price hikes by individual raw material providers, thereby enhancing ACC's bargaining power.

Sustainability-Driven Supplier Shifts

The cement industry's drive towards sustainability is reshaping supplier relationships. As companies like ACC prioritize reducing their carbon footprint, they are actively seeking alternative raw materials and fuels. This shift is opening doors for new suppliers offering eco-friendly inputs such as biomass, industrial wastes, and recycled materials.

This diversification of the supplier landscape can significantly influence procurement strategies. For instance, by 2024, the global market for alternative fuels in cement production was projected to see substantial growth, driven by environmental regulations and cost-saving opportunities. This trend empowers cement manufacturers to negotiate better terms with a broader range of suppliers, potentially lessening the bargaining power of traditional raw material providers.

- Increased demand for alternative fuels: The global market for alternative fuels in cement manufacturing is expanding, offering more choices for sourcing.

- Emergence of new supplier types: Suppliers of biomass, industrial wastes, and recycled materials are becoming increasingly important.

- Potential for better negotiation: A diversified supplier base can lead to more favorable procurement terms for cement producers.

- Focus on circular economy principles: The adoption of waste-derived materials aligns with circular economy goals, further strengthening the bargaining position of suppliers who can meet these criteria.

Logistics and Transportation Costs

The cost of moving raw materials to factories and finished goods to consumers is a substantial part of a company's spending. In 2024, for instance, the average cost of shipping a container internationally saw significant volatility, directly influenced by fuel prices.

Fluctuations in diesel prices have a direct impact on freight expenditure. For example, a rise in diesel costs in late 2023 and early 2024 led to increased transportation expenses for many industries, potentially increasing the bargaining power of logistics providers.

- Transportation costs are a major expense for many businesses.

- Diesel price changes directly affect freight bills.

- An efficient logistics network can help lessen supplier influence.

- Proximity to suppliers is key to managing delivery-related costs.

ACC's bargaining power with suppliers is influenced by the availability of key raw materials like limestone, fly ash, and slag. The industry's shift towards sustainability and the increasing use of industrial by-products, such as fly ash from power plants and slag from steel manufacturing, diversifies the supplier base. This diversification generally weakens the power of individual suppliers, allowing companies like ACC to negotiate more favorable terms.

The global market for alternative fuels in cement production was projected to grow significantly by 2024, driven by environmental regulations and cost-saving opportunities. This trend empowers cement manufacturers by providing a wider array of sourcing options, potentially reducing reliance on traditional fuel suppliers and improving ACC's negotiation leverage.

Transportation costs, heavily influenced by diesel prices, also play a role. Volatility in fuel costs, as seen with diesel price increases in late 2023 and early 2024, can empower logistics providers. However, efficient logistics and proximity to suppliers can help mitigate these costs and lessen supplier influence.

| Factor | Impact on ACC's Bargaining Power | Supporting Data/Trend (as of mid-2025) |

|---|---|---|

| Raw Material Availability | Generally High | Diversified sourcing of limestone, fly ash, and slag limits individual supplier power. |

| Alternative Fuels Market | Increasingly Favorable | Projected growth in alternative fuels by 2024 offers more sourcing choices. |

| Transportation Costs | Mixed | Diesel price volatility (e.g., late 2023-early 2024) can empower logistics providers, but efficient networks mitigate this. |

What is included in the product

This analysis dissects the competitive forces impacting ACC, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the presence of substitutes.

Effortlessly identify and prioritize competitive threats with a visual breakdown of each of the five forces, simplifying complex market dynamics.

Customers Bargaining Power

The Indian cement market's intense competition significantly amplifies customer bargaining power through price sensitivity. Pan-Indian cement prices saw a dip in the latter half of FY24 and the first half of FY25, a direct consequence of this rivalry and increased supply, forcing companies like ACC to tread carefully with their pricing strategies.

ACC's diverse customer base, ranging from individual homeowners to large infrastructure developers, significantly impacts customer bargaining power. While individual buyers have minimal sway, major clients undertaking substantial projects, like those in India's burgeoning infrastructure sector, can negotiate more favorable terms due to the sheer volume of cement they purchase. For instance, in 2023, India's infrastructure spending was projected to reach approximately $1.4 trillion by 2027, indicating the immense purchasing potential of large-scale project developers.

Government spending plays a crucial role in boosting cement demand in India. Projects such as the Pradhan Mantri Gram Sadak Yojana, aimed at rural road development, and the National Infrastructure Pipeline, focusing on a wide array of infrastructure projects, directly translate into increased consumption of cement. For instance, in the fiscal year 2023-24, India's capital expenditure saw a significant increase, with a substantial portion allocated to infrastructure development, directly benefiting cement manufacturers.

Initiatives like the 'Housing for All' mission and the development of smart cities create a robust demand for construction materials, including cement. The ongoing expansion of the national highway network, with ambitious targets for kilometers to be constructed annually, further solidifies this demand. This consistent, government-driven demand helps to mitigate the bargaining power of individual customers, as companies like ACC can rely on these large-scale projects for predictable sales volumes.

Availability of Value-Added Products and Services

The availability of value-added products and services significantly influences the bargaining power of customers. ACC offers a diverse portfolio beyond standard cement, including specialized products like ACC Gold Water Shield, designed for enhanced durability and water resistance. This differentiation allows ACC to potentially command a premium, thereby mitigating the customer's ability to drive down prices solely based on bulk purchasing.

Furthermore, ACC is integrating digital services aimed at builders and contractors. These services could include project management tools, technical support, or online ordering platforms, which add convenience and efficiency for the customer. When customers perceive greater value or utility from these additional offerings, their focus shifts from pure price negotiation to the overall benefit package, potentially reducing their bargaining leverage.

- Differentiated Offerings: ACC's specialized cement types, such as ACC Gold Water Shield, cater to specific construction needs, reducing the commoditization of its products.

- Digital Integration: The introduction of digital services for builders enhances customer experience and loyalty, potentially decreasing price sensitivity.

- Reduced Price Sensitivity: By providing unique benefits and convenience through value-added services, ACC aims to lessen customers' focus on price alone, thereby weakening their bargaining power.

Growing Demand for Sustainable Solutions

Customers, especially those involved in the green building sector and government-backed initiatives, are showing a strong preference for sustainable and low-carbon construction materials. This growing demand for eco-friendly products significantly enhances their bargaining power.

ACC's strategic emphasis on developing green cement and adopting sustainable operational practices positions it to effectively meet this evolving customer need. This focus can lead to opportunities for premium pricing or securing a favored position as a supplier in a competitive market.

- Growing Demand for Sustainable Solutions: Customers increasingly prioritize eco-friendly building materials.

- Green Building Movement: The rise of sustainable construction practices empowers buyers seeking low-carbon options.

- Government Projects: Public sector initiatives often mandate or incentivize the use of green materials, increasing customer leverage.

- ACC's Response: ACC's investment in green cement production caters to this demand, potentially allowing for premium pricing or preferred supplier status.

The bargaining power of customers in the Indian cement market is significantly influenced by price sensitivity and the availability of alternatives. In the latter half of FY24 and extending into the first half of FY25, pan-Indian cement prices experienced a decline due to intense competition and increased supply, forcing companies like ACC to be more strategic with their pricing. This environment allows large-volume buyers, particularly those in the booming infrastructure sector, to negotiate more favorable terms.

ACC's diverse product portfolio, including specialized cements like ACC Gold Water Shield, and its integration of digital services for builders aim to differentiate its offerings. By providing added value and convenience, ACC seeks to reduce customers' reliance on price alone, thereby mitigating their bargaining power. The growing demand for sustainable construction materials also empowers customers, especially as government projects increasingly favor eco-friendly options.

| Customer Segment | Bargaining Power Influence | Example Impact on ACC |

|---|---|---|

| Large Infrastructure Developers | High (Volume purchasing, project tenders) | Can negotiate bulk discounts, potentially impacting ACC's margins on large contracts. |

| Individual Homeowners | Low (Small purchase volume, localized competition) | Limited ability to influence ACC's pricing; more susceptible to market price fluctuations. |

| Green Building Sector Participants | Increasing (Demand for sustainable products) | Creates opportunity for premium pricing on eco-friendly cement, but also pressure to adopt greener practices. |

What You See Is What You Get

ACC Porter's Five Forces Analysis

This preview showcases the complete ACC Porter's Five Forces Analysis, offering a detailed examination of competitive and market forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase. You can confidently expect to download this comprehensive resource, ready for immediate application and strategic decision-making.

Rivalry Among Competitors

The Indian cement industry is experiencing a pronounced trend of consolidation. Companies like UltraTech Cement and the Adani Group, which now owns ACC and Ambuja Cements, are aggressively acquiring smaller players. This strategic move is reshaping the competitive landscape.

This consolidation means a few large entities now command a significant majority of the market's production capacity. For instance, by early 2024, the top 10 cement companies were estimated to hold over 60% of India's total cement capacity, leading to heightened competition among these dominant firms.

Despite a moderate capacity utilization rate in 2024, the Indian cement industry is witnessing aggressive expansion. Companies are projected to add a substantial 70-75 million tonnes per annum (MTPA) of grinding capacity between fiscal year 2025 and fiscal year 2026. This surge in capacity is fueled by optimistic demand forecasts.

This significant capacity addition intensifies competitive rivalry. Cement manufacturers are actively seeking to capture market share, which often leads to price competition. The drive to utilize new capacity can put downward pressure on cement prices, impacting profitability across the sector.

Intense competition within the cement sector, amplified by rising supply levels, has triggered significant price declines. This trend was particularly noticeable in the latter half of fiscal year 2024 and continued into early fiscal year 2025, directly impacting manufacturers' sales realizations and operating margins.

For instance, during FY24, average cement prices in India saw a dip in certain regions due to oversupply, despite overall demand growth. This competitive pressure forces companies like ACC to constantly re-evaluate their pricing strategies to maintain market share, often leading to reduced profitability.

While analysts anticipate a price recovery in 2025, driven by expected demand increases and ongoing industry consolidation, the historical prevalence of price wars underscores the deeply entrenched rivalry among cement producers. This ongoing battle for market dominance means that margin pressure remains a persistent challenge for established players.

Regional Market Dynamics

Competitive rivalry within India’s cement sector is not uniform, with regional market dynamics playing a crucial role. The southern region, for example, exhibits heightened competitive intensity, largely due to a greater concentration of cement manufacturers operating within its geographical boundaries. This can lead to more aggressive pricing strategies and a constant push for market share among players.

ACC's extensive pan-India footprint is a significant advantage, allowing it to buffer the impact of localized downturns in specific regions. However, this broad presence also means ACC must continually navigate and respond to distinct competitive pressures and varied pricing tactics that emerge from these different regional markets. For instance, while the northern market might see different competitive pressures than the west, ACC's strategy needs to be agile enough to adapt.

- Southern India's competitive landscape: Higher concentration of cement companies leading to increased rivalry.

- Regional pricing variations: Localized competitive pressures influence pricing strategies across different Indian states.

- ACC's mitigation strategy: Pan-India presence helps offset regional market weaknesses but requires localized tactical adjustments.

- 2024 Market Context: In 2024, the Indian cement industry saw capacity utilization hover around 70-75%, with regional demand fluctuations impacting profitability and competitive intensity, particularly in high-supply areas like the South.

Focus on Cost Efficiency and Sustainability

Competitive rivalry in the cement industry is intense, with companies heavily focused on cost efficiency. This includes optimizing power and fuel consumption, which are significant cost drivers. For instance, in 2024, many major cement producers reported efforts to reduce their specific thermal energy consumption per ton of clinker, with some achieving reductions of up to 3% compared to the previous year through process improvements and alternative fuel adoption.

Furthermore, improving lead distances, or the transportation cost from plant to customer, is a key strategy to maintain price competitiveness. Companies are investing in logistics and strategically locating grinding units closer to demand centers. This focus on operational excellence is critical as the market demands cost-effective solutions.

Sustainability is also emerging as a significant competitive differentiator. The development and promotion of green cement solutions, such as those with lower clinker-to-binder ratios or incorporating supplementary cementitious materials, are gaining traction. By 2024, several leading cement manufacturers had increased their portfolio of low-carbon products, with some aiming for over 30% of their sales to come from these greener alternatives by 2027, aligning with stricter environmental regulations and growing consumer demand for sustainable building materials.

- Cost Efficiency Focus: Cement companies are actively reducing operational costs, particularly in power and fuel, to remain competitive.

- Logistics Optimization: Efforts to minimize transportation costs by reducing lead distances are a key strategy for market competitiveness.

- Sustainability as a Differentiator: The development and marketing of green cement products are becoming crucial for attracting environmentally conscious customers and meeting regulatory demands.

The competitive rivalry in India's cement sector is exceptionally high, driven by a concentrated market structure and aggressive capacity expansion. Companies are heavily engaged in price competition to capture market share, especially with new capacities coming online. This intense rivalry pressures profit margins, forcing a constant focus on cost efficiency and operational improvements.

In 2024, the industry saw significant capacity additions, projected at 70-75 million tonnes per annum between FY25 and FY26, intensifying the battle for market dominance. This surge in supply, coupled with regional demand variations, led to price declines in certain areas during FY24, impacting sales realizations for manufacturers like ACC.

Companies are actively pursuing cost-saving measures, including optimizing power and fuel consumption, with some achieving up to a 3% reduction in specific thermal energy consumption in 2024. Furthermore, investing in logistics to reduce lead distances and promoting green cement solutions are becoming critical differentiators in this fiercely competitive environment.

| Metric | FY24 Data/Trend | Implication for Rivalry |

| Capacity Expansion (MTPA) | 70-75 (FY25-FY26 projection) | Increased supply intensifies competition and price wars. |

| Average Cement Price Trend | Dip in certain regions (H2 FY24) | Downward pressure on margins due to oversupply. |

| Specific Thermal Energy Consumption | Reduction efforts by up to 3% (2024) | Focus on cost efficiency to maintain price competitiveness. |

| Green Cement Sales Share | Growing, target >30% by 2027 for some | Emerging differentiator, attracting environmentally conscious buyers. |

SSubstitutes Threaten

The Indian construction sector is increasingly embracing green building materials, presenting a significant threat of substitutes for traditional cement and concrete. Materials such as bamboo, fly ash bricks, and recycled plastics are gaining popularity, driven by growing environmental awareness and supportive government policies.

These sustainable alternatives, including bio-based options like hempcrete and mycelium, along with slag, offer competitive performance and reduced environmental impact. The market for green building materials in India is projected to grow substantially, with some reports indicating a compound annual growth rate exceeding 15% through 2025, directly impacting the demand for conventional construction inputs.

Innovations like 3D printing with eco-friendly materials and modular construction are emerging as potent substitutes. These methods promise quicker project completion and reduced waste, potentially lessening the demand for traditional cement in specific construction segments.

For instance, the global 3D printed construction market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating a tangible shift towards alternative building technologies.

While not a direct material replacement for all cement applications, the increasing adoption of these technologies represents a long-term threat by offering more efficient and sustainable building solutions.

The Indian government's strong push for sustainable construction, including mandates for precast concrete elements and the use of urban solid waste in highways, directly increases the threat of substitutes for traditional cement production. These policies incentivize alternative materials and methods, potentially reducing demand for ACC's core products.

Cost-Effectiveness and Performance of Alternatives

Alternative materials are increasingly challenging traditional construction inputs. For instance, eco-bricks, often crafted from agricultural waste like rice husks or sawdust, present a compelling cost-effectiveness and lighter weight profile compared to conventional cement-based bricks. This can translate to lower transportation and structural support costs.

These substitutes can offer enhanced performance characteristics, such as superior thermal insulation or improved seismic resistance, which are critical considerations in modern building codes. As the technology and production scale for these alternatives mature, their overall value proposition strengthens, making them a more significant threat to established materials.

- Cost Savings: Eco-bricks can be up to 30% cheaper to produce than traditional fired clay bricks, according to some industry reports from 2024.

- Weight Reduction: The lighter weight of alternative materials can reduce foundation requirements and simplify construction logistics.

- Performance Benefits: Improved insulation properties in some alternatives can lead to lower energy bills for building occupants, a key selling point.

- Environmental Appeal: The use of recycled or waste materials appeals to a growing segment of environmentally conscious consumers and developers.

Cement Industry's Response: Green Cement

The cement industry, including ACC, is actively addressing the threat of substitutes by developing and promoting green cement. This innovative approach involves incorporating industrial by-products such as fly ash and slag into cement formulations. These materials reduce the amount of clinker needed, a key component that contributes significantly to carbon emissions.

This strategic shift makes cement a more environmentally friendly product, thereby diminishing the attractiveness of alternative building materials. By evolving the core product, cement manufacturers aim to retain market share and meet growing demand for sustainable construction solutions.

- Green Cement Adoption: By 2024, the global green cement market was projected to reach over $50 billion, demonstrating a significant industry pivot.

- Reduced Carbon Footprint: Utilizing fly ash and slag can reduce the carbon footprint of cement by up to 40%, making it more competitive against alternative materials.

- Product Evolution: This focus on sustainability is a direct response to increasing pressure from substitute materials and growing environmental regulations.

The threat of substitutes for traditional construction materials like cement is intensifying due to innovations in alternative materials and building techniques. These substitutes, ranging from eco-bricks made from agricultural waste to advanced 3D printing methods, offer competitive advantages in cost, performance, and environmental impact. The growing market for green building materials, projected to see substantial growth in India, directly challenges the dominance of conventional inputs.

The increasing adoption of sustainable alternatives, such as bamboo and recycled plastics, coupled with government support for eco-friendly construction, creates a significant competitive pressure. These alternatives often provide cost savings, as seen with eco-bricks being up to 30% cheaper to produce, and performance benefits like improved thermal insulation. The global 3D printed construction market, valued at approximately $1.5 billion in 2023, further underscores the shift towards alternative building technologies.

| Substitute Material/Technology | Key Benefits | Market Trend/Data (as of 2024/2025) |

|---|---|---|

| Eco-bricks (from agricultural waste) | Cost savings (up to 30% cheaper), lighter weight | Growing adoption in rural and semi-urban construction |

| 3D Printed Construction | Faster project completion, reduced waste, design flexibility | Global market projected for significant growth, valued ~$1.5 billion in 2023 |

| Green Cement (incorporating fly ash/slag) | Reduced carbon footprint (up to 40%), environmentally friendly | Global green cement market projected to exceed $50 billion |

Entrants Threaten

The cement industry, including players like ACC, demands immense capital for setting up manufacturing facilities. In 2024, the cost of establishing a new, modern cement plant can easily run into hundreds of millions of dollars, covering land, advanced machinery, and essential infrastructure. This substantial financial hurdle significantly deters new companies from entering the market, protecting existing large-scale producers.

Existing major players, including ACC, benefit from significant economies of scale in production, procurement, and distribution. For instance, in 2024, ACC's substantial production capacity, often exceeding tens of millions of tons annually, allows for bulk purchasing of raw materials like limestone and coal, driving down input costs per unit. This cost advantage makes it difficult for new entrants to compete on price without incurring substantial initial losses or focusing on very specific, high-margin market segments.

ACC's formidable distribution network, encompassing manufacturing, marketing, and logistics across India, presents a significant barrier to new entrants. Establishing a comparable reach requires immense capital investment and considerable time to develop the necessary infrastructure and market presence.

Regulatory Hurdles and Environmental Compliance

The cement industry faces significant regulatory hurdles, particularly concerning environmental compliance. New entrants must navigate complex regulations on emissions and waste management, which can be costly to meet.

India's ambitious net-zero emissions target by 2070, with specific interim goals for the cement sector, further elevates these barriers. Companies entering the market will likely require substantial investments in advanced green technologies, such as carbon capture and storage, to align with these evolving environmental standards.

- Stringent Environmental Regulations: Compliance with emission standards (e.g., SOx, NOx, particulate matter) and waste disposal norms adds to operational costs for new players.

- Green Technology Investment: The necessity to invest in technologies like carbon capture, utilization, and storage (CCUS) to meet net-zero commitments by 2070 represents a significant capital outlay.

- Compliance Costs: For instance, the average cost of implementing advanced emission control systems in cement plants can range from 15-25% of the total project cost, impacting the profitability of new entrants.

Brand Loyalty and Market Consolidation

Brand loyalty is a significant barrier for new cement companies looking to enter the market. Established players like ACC have cultivated decades of trust, earning them titles like 'India's Most Trusted Cement Brand.' This deep-rooted customer preference makes it challenging for newcomers to attract and retain buyers, even with competitive pricing.

The Indian cement industry is also experiencing considerable consolidation. Major players are actively acquiring smaller companies and expanding their production capacity. For instance, in 2023, the industry saw significant M&A activity, with deals aimed at increasing market share and operational efficiency. This trend concentrates market power among a few large entities, making it exceedingly difficult for new entrants to carve out a meaningful presence.

- Strong Brand Equity: ACC's long-standing reputation as a trusted brand creates a powerful moat against new competitors.

- Market Concentration: Industry consolidation, driven by acquisitions, reduces available market share for new entrants.

- Customer Inertia: Established customer relationships and the perceived risk of switching to an unknown brand further deter new market participants.

The threat of new entrants in the cement industry, impacting players like ACC, remains moderate due to significant capital requirements and established economies of scale. High initial investment for plant setup, often in the hundreds of millions of dollars for modern facilities as of 2024, acts as a primary deterrent. Furthermore, the cost advantages derived from large-scale production and procurement, where ACC's annual capacity can exceed tens of millions of tons, make it challenging for newcomers to compete on price.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Setting up a new cement plant in 2024 costs hundreds of millions of dollars. | High deterrent due to substantial upfront investment. |

| Economies of Scale | Large players like ACC benefit from lower per-unit costs through bulk purchasing and high production volumes. | New entrants struggle to match cost competitiveness. |

| Brand Loyalty & Market Concentration | Established brands like ACC have strong customer trust, and industry consolidation reduces available market share. | Difficult for newcomers to gain market traction and build customer relationships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including financial statements, industry-specific market research reports, and publicly available company filings.