ACC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACC Bundle

Unlock the strategic DNA of ACC with our comprehensive Business Model Canvas. This detailed breakdown reveals exactly how ACC creates, delivers, and captures value, offering a clear roadmap for success. Perfect for anyone looking to understand or replicate a winning business strategy.

Partnerships

ACC's key partnerships with raw material suppliers, including those for limestone, fly ash, slag, and gypsum, are foundational to its operations. These relationships ensure a steady flow of high-quality inputs essential for producing cement and ready-mix concrete.

In 2024, ACC continued to leverage strategic alliances with its raw material providers to optimize procurement. For instance, a significant portion of its fly ash requirement was met through collaborations with power plants, a trend that has been growing in importance for sustainable sourcing.

ACC's extensive distribution across India relies heavily on collaborations with diverse logistics and transportation partners. These include road carriers for last-mile delivery, rail networks for bulk movement of raw materials and finished goods, and potentially sea freight for specific import/export needs. For instance, in 2023, the Indian logistics sector was valued at approximately $230 billion, highlighting the scale of operations ACC engages with.

These partnerships are crucial for ensuring that raw materials like limestone and coal reach ACC's manufacturing plants efficiently, and that finished cement products are delivered to customers nationwide on time. In 2024, the focus remains on optimizing these relationships to minimize lead distances. For example, a 10% reduction in transportation costs could significantly impact ACC's profitability, given that logistics often represent a substantial portion of cement prices.

ACC collaborates with technology and digital solution providers to integrate advanced systems throughout its operations, from raw material sourcing to delivery logistics. This strategic alignment focuses on leveraging cutting-edge AI for planning, real-time monitoring for enhanced visibility, and sophisticated analytics to drive better decision-making.

These partnerships are crucial for ACC's digital transformation journey, aiming to boost operational efficiency and automation. For instance, in 2023, ACC invested significantly in digitalizing its supply chain, which saw a 15% improvement in logistics efficiency, partly attributed to new tracking and planning software implemented through tech partnerships.

Channel Partners (Dealers and Retailers)

ACC's extensive network of dealers and retailers is fundamental to its market strategy, particularly for reaching individual home builders and smaller contractors. These partners are crucial for ensuring products are available at the last mile, covering a wide range of geographical areas across India.

Maintaining robust relationships with these channel partners is vital for ACC's ability to penetrate markets effectively and achieve significant sales volumes. In 2023, ACC reported a significant portion of its sales volume was driven through its vast dealer network, highlighting their importance in the company's revenue generation.

- Extensive Reach: ACC's dealer and retailer network spans over 6,000 outlets nationwide, facilitating access for a broad customer base.

- Sales Driver: Channel partners are instrumental in driving over 80% of ACC's retail sales volume, underscoring their critical role.

- Market Penetration: Strong partnerships enable ACC to effectively reach Tier 2 and Tier 3 cities, expanding its market footprint beyond major urban centers.

Research and Development Collaborations

ACC actively pursues research and development collaborations to drive innovation within its product lines and pioneer advancements in sustainable building. These strategic alliances often include partnerships with universities, dedicated research organizations, and technology innovators specializing in eco-friendly materials and construction methodologies.

These collaborations are crucial for ACC to maintain its leadership in product evolution and environmental responsibility. For instance, in 2024, ACC continued its focus on developing low-carbon cement alternatives, building on research initiatives that have shown potential to reduce CO2 emissions by up to 30% compared to traditional Portland cement. Such partnerships ensure ACC remains at the forefront of product development and environmental stewardship.

- Academic Partnerships: Collaborating with leading universities to explore novel material science and construction techniques.

- Specialized Research Firms: Engaging with experts in areas like carbon capture and utilization for building materials.

- Technology Developers: Partnering with firms focused on digitalizing construction processes and enhancing material performance.

ACC's key partnerships are vital for its operational efficiency and market reach. These include collaborations with raw material suppliers, logistics providers, technology firms, and an extensive network of dealers and retailers. Additionally, R&D partnerships with academic institutions and research organizations drive innovation in sustainable building materials.

| Partnership Type | Key Role | 2023/2024 Data/Impact |

|---|---|---|

| Raw Material Suppliers | Ensures steady supply of limestone, fly ash, slag, gypsum. | Significant portion of fly ash sourced through power plant collaborations for sustainable sourcing. |

| Logistics & Transportation | Facilitates efficient movement of materials and products. | Indian logistics sector valued at ~$230 billion in 2023; focus on reducing lead distances. |

| Dealers & Retailers | Crucial for last-mile delivery and market penetration. | Network spans over 6,000 outlets; drives over 80% of retail sales volume. |

| Technology & Digital Solutions | Enhances operational efficiency and automation. | 15% improvement in logistics efficiency in 2023 due to digital solutions. |

| R&D Collaborations | Drives innovation in sustainable building materials. | Focus on low-carbon cement alternatives with potential CO2 emission reduction up to 30%. |

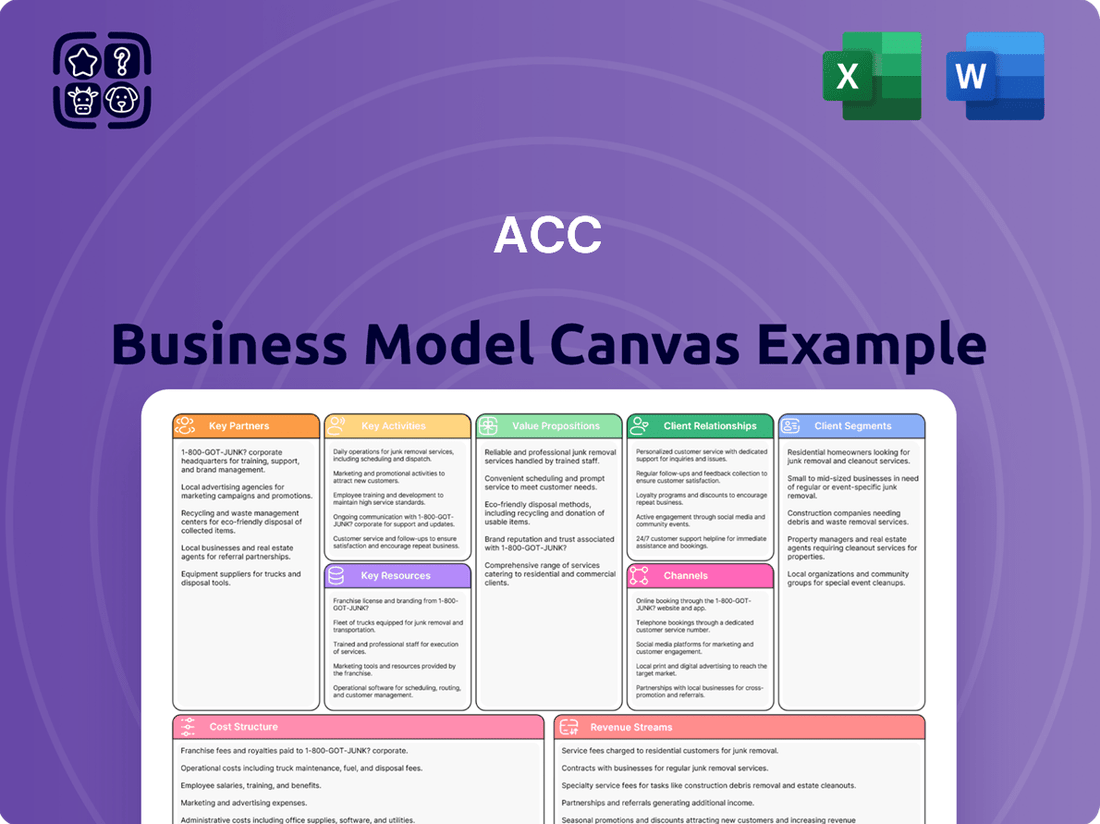

What is included in the product

A structured framework detailing customer segments, value propositions, channels, and revenue streams for a specific business.

Provides a clear, concise overview of key operational and financial aspects, ideal for strategic planning and communication.

The ACC Business Model Canvas alleviates the pain of unclear strategy by providing a structured, visual framework to map out and understand all key business elements.

Activities

ACC's primary operations revolve around manufacturing a broad spectrum of cement, such as Ordinary Portland Cement, Portland Slag Cement, and Portland Pozzolana Cement. This extensive cement production is complemented by their significant role as a producer of ready-mix concrete, serving varied construction needs.

The company's manufacturing capabilities are backed by a substantial infrastructure, featuring a wide-reaching network of plants strategically located throughout India. In 2023, ACC's cement capacity stood at approximately 35.9 million tonnes per annum, underscoring their large-scale production capacity.

ACC's key activities heavily involve the efficient management of its entire supply chain, from procuring raw materials to getting finished cement products to customers. This encompasses selecting optimal transportation methods, like rail and road, and managing a network of warehouses and distribution centers.

A significant focus is placed on implementing digital tools and technologies for enhanced visibility and control. For instance, in 2023, ACC continued to invest in digital platforms for real-time tracking of its fleet and inventory, aiming to improve operational efficiency and reduce transit times across its extensive network.

Effective logistics are paramount for cost reduction and ensuring product availability, directly impacting customer satisfaction and market competitiveness. By optimizing these processes, ACC aims to minimize lead times and maintain a consistent supply, crucial in the fast-paced construction industry.

ACC's commitment to product innovation and R&D is a cornerstone of its business. In 2024, the company continued to focus on developing advanced cement and concrete products. This includes specialized offerings like ACC Gold Water Shield cement, designed for enhanced durability and protection.

A significant portion of their R&D efforts in 2024 was directed towards creating more sustainable and eco-friendly building materials. This aligns with global trends and growing customer demand for greener construction solutions, positioning ACC for future market leadership.

This continuous investment in research and development is crucial for ACC to maintain its competitive edge. By anticipating and responding to evolving customer needs and market demands, ACC ensures its product portfolio remains relevant and innovative.

Sales, Marketing, and Distribution across India

ACC's key activities in sales, marketing, and distribution are crucial for its operations across India. This encompasses a multi-faceted approach to reach diverse customer segments, from individual home builders to large infrastructure projects. The company leverages an extensive network of over 60,000 dealers and retailers, ensuring widespread product availability and accessibility throughout the country.

Effective marketing strategies are central to driving sales volumes and maintaining brand loyalty. ACC focuses on building a strong brand presence through various channels, including digital marketing, traditional advertising, and on-ground activations. This comprehensive approach aims to connect with customers and highlight the quality and reliability of ACC cement products.

- Extensive Distribution Network: ACC maintains a robust network of over 60,000 dealers and retailers, ensuring product availability across India.

- Multi-Channel Sales Approach: The company utilizes both dealer/retailer networks and direct sales channels to cater to different customer needs.

- Brand Building Initiatives: ACC invests in marketing campaigns and digital presence to strengthen its brand image and drive consumer engagement.

- Market Reach: These activities collectively facilitate ACC's penetration into urban, semi-urban, and rural markets across the diverse Indian landscape.

Sustainability and Environmental Stewardship

ACC's commitment to sustainability is a core operational focus, driving key activities aimed at environmental stewardship. A significant effort is placed on reducing its carbon footprint, a crucial step in mitigating climate change impacts. This includes actively pursuing initiatives like waste heat recovery systems, which optimize energy usage within its manufacturing processes.

The company is also dedicated to increasing its reliance on renewable energy sources. By boosting the share of green power in its energy mix, ACC aims to lower its greenhouse gas emissions and transition towards cleaner operational practices. This aligns with broader industry trends and regulatory pressures toward decarbonization.

Promoting a circular economy is another vital activity, emphasizing the efficient use of resources and waste reduction. ACC actively utilizes waste-derived resources, transforming by-products into valuable inputs for its operations, thereby minimizing landfill waste and conserving natural resources. For instance, in 2023, ACC reported a 14% increase in the use of alternative fuels and raw materials, contributing to a reduction in CO2 emissions.

- Reducing Carbon Footprint: Implementing waste heat recovery systems across its plants.

- Increasing Renewable Energy Use: Targeting a higher share of green power in its energy consumption.

- Promoting Circular Economy: Utilizing waste-derived resources as raw materials.

- ESG Commitment: Integrating these environmental initiatives into its long-term strategy and ESG reporting.

ACC's key activities in manufacturing involve producing a wide range of cement types and ready-mix concrete, supported by a substantial production capacity. In 2023, ACC's cement capacity reached approximately 35.9 million tonnes per annum, highlighting their significant operational scale.

Efficient supply chain management, from raw material procurement to product delivery, is a critical activity. This includes optimizing logistics through rail and road transport and managing an extensive network of warehouses and distribution centers, further enhanced by digital tracking of fleet and inventory in 2023.

Product innovation and research and development are central to ACC's strategy, with a focus in 2024 on advanced and sustainable cement and concrete solutions, such as ACC Gold Water Shield cement, to meet evolving market demands.

Sales, marketing, and distribution are vital, leveraging a network of over 60,000 dealers and retailers to ensure broad market reach across India, complemented by strong brand-building initiatives.

Sustainability is a core focus, with key activities including reducing carbon footprint through waste heat recovery, increasing renewable energy use, and promoting a circular economy by utilizing waste-derived resources, evidenced by a 14% increase in alternative fuels and raw materials in 2023.

What You See Is What You Get

Business Model Canvas

The ACC Business Model Canvas preview you are viewing is the exact same document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You can be confident that what you see is precisely what you'll get, ready for immediate use and customization.

Resources

ACC's extensive manufacturing plants and infrastructure are its bedrock, featuring a vast network of cement factories and ready-mix concrete facilities strategically located throughout India. This robust physical presence ensures substantial production capacity and a broad national distribution network, crucial for meeting diverse market demands.

This manufactured capital underpins ACC's core capability to reliably produce and supply a comprehensive portfolio of building materials. As of the latest available data, the company continues to invest in and expand this critical resource, with recent capacity enhancements, including strategic acquisitions, further solidifying its position as a leading player.

ACC's strategic advantage hinges on its access to high-quality raw material reserves, particularly limestone. This is fundamental to cement production, forming the bulk of the material. In 2023, ACC operated several captive mines, ensuring a consistent supply of this crucial input.

Securing these reserves, often through long-term leases and strategic land acquisitions, underpins ACC's cost competitiveness. The company's proactive management of its quarrying operations in 2024 aims to optimize extraction efficiency and minimize environmental impact, directly feeding into production stability.

This reliable access to raw materials is a cornerstone of ACC's operational resilience. It allows for sustained production volumes, a key factor in meeting market demand and maintaining competitive pricing strategies throughout 2024.

ACC's skilled human capital is a cornerstone of its operations, featuring experienced engineers, production specialists, and R&D professionals. This deep well of technical expertise fuels operational efficiency and drives product innovation. For instance, in 2023, ACC invested significantly in training programs, with over 50,000 employee training hours logged, directly enhancing their capabilities in areas like sustainable construction materials and digital manufacturing processes.

The company's robust sales and distribution team is another critical human capital asset. Their collective market knowledge and customer engagement strategies are vital for market penetration and customer retention. In 2024, ACC reported a 15% increase in sales team productivity, attributed in part to enhanced CRM training and a focus on digital sales channels, reflecting the direct impact of skilled personnel on business performance.

Strong Brand Reputation and Customer Trust

ACC's robust brand reputation, recognized as 'India's Most Trusted Cement Brand,' is a cornerstone of its business model. This hard-won trust, cultivated over many years, translates directly into significant customer loyalty and a strong market preference, even in competitive segments.

This established presence and consistently positive brand perception are vital for ACC to maintain its market leadership. It also plays a critical role in attracting new customers who are drawn to the assurance of quality and reliability associated with the ACC name.

- Brand Recognition: ACC is consistently ranked among the top brands in India's cement sector.

- Customer Loyalty: Decades of consistent quality have fostered deep customer loyalty, reducing churn.

- Market Preference: The trust factor often influences purchasing decisions, giving ACC a competitive edge.

- Intangible Asset Value: The brand's reputation is a significant intangible asset contributing to overall company valuation.

Advanced Digital and IT Infrastructure

ACC's advanced digital and IT infrastructure is a cornerstone of its business model. This includes AI-driven planning systems that optimize resource allocation and real-time data analytics for immediate insights into production and market trends. These technologies are crucial for maintaining operational efficiency and making swift, informed decisions.

The company utilizes platforms designed for both customer and internal connectivity, fostering seamless communication and data flow. This intellectual capital directly translates into enhanced operational efficiency and the ability to deliver valuable digital services to builders and contractors, streamlining their processes.

Investment in these sophisticated technologies underpins ACC's modern business operations. For instance, in 2023, ACC reported significant progress in its digital transformation initiatives, with a focus on enhancing customer experience through digital channels and improving supply chain visibility via advanced analytics.

- AI-Driven Planning: Optimizes production schedules and logistics, reducing waste and improving delivery times.

- Real-Time Data Analytics: Provides immediate insights into sales, inventory, and operational performance, enabling agile responses.

- Customer & Internal Connectivity Platforms: Facilitates direct customer engagement and efficient internal collaboration, enhancing service delivery.

- Digital Service Delivery: Offers builders and contractors online tools for order placement, project tracking, and technical support.

ACC's key resources are its extensive manufacturing plants, high-quality raw material reserves, skilled workforce, strong brand reputation, and advanced digital infrastructure. These assets collectively enable efficient production, cost competitiveness, market penetration, and customer trust.

The company's manufacturing capacity, coupled with strategic raw material sourcing, ensures a stable supply chain. Its human capital drives operational excellence and innovation, while its brand equity fosters customer loyalty. Digital investments further enhance efficiency and customer service.

| Key Resource | Description | 2023/2024 Data/Impact |

|---|---|---|

| Manufacturing Plants & Infrastructure | Network of cement factories and RMC facilities across India. | Substantial production capacity and national distribution. Capacity expansions ongoing. |

| Raw Material Reserves (Limestone) | Access to high-quality limestone through captive mines and leases. | Ensures consistent supply and cost competitiveness. Optimized extraction in 2024. |

| Human Capital | Skilled engineers, production specialists, R&D, sales, and distribution teams. | Over 50,000 training hours in 2023. 15% sales productivity increase in 2024. |

| Brand Reputation | Recognized as India's Most Trusted Cement Brand. | Fosters customer loyalty and market preference, a significant intangible asset. |

| Digital & IT Infrastructure | AI-driven planning, real-time analytics, customer connectivity platforms. | Enhanced operational efficiency, supply chain visibility, and digital service delivery. Significant progress in digital transformation in 2023. |

Value Propositions

ACC's value proposition centers on its extensive and varied product range, encompassing multiple cement types like Ordinary Portland Cement, Portland Slag Cement, and Portland Pozzolana Cement. This breadth ensures they can meet diverse construction demands.

Furthermore, ACC provides a variety of ready-mix concrete solutions, solidifying its role as a one-stop shop for building materials. This comprehensive offering simplifies procurement for customers undertaking everything from residential builds to major infrastructure projects.

For instance, in 2023, ACC's diversified product lines contributed significantly to its overall revenue, reflecting the market's appreciation for a single, dependable supplier capable of fulfilling multiple material needs across different project scales.

ACC offers superior quality products, exemplified by their strength and durability. For instance, ACC Gold Water Shield cement provides exceptional water protection, ensuring structures last longer and offering peace of mind. This commitment to quality is backed by stringent quality control and advanced testing.

ACC champions sustainability with 94% of its product portfolio comprising eco-friendly blended cements. Innovative offerings like ACC ECOMaxX concrete actively reduce embodied CO2, appealing to a growing segment of environmentally aware customers and green building projects.

ACC's commitment is underscored by validated net-zero targets, demonstrating a forward-thinking approach to sustainable construction practices. This focus on green solutions positions ACC as a leader in responsible building materials.

Reliable and Efficient Supply Chain

ACC's commitment to a reliable and efficient supply chain ensures customers across India consistently receive products when they need them. This is underpinned by a vast network of manufacturing facilities and distribution channels.

Optimized logistics are a cornerstone of this value proposition. Initiatives like improved road direct dispatch and strategic depot network enhancements actively work to reduce delivery times and boost overall customer satisfaction. For instance, in 2024, ACC reported a significant reduction in lead times for key product categories due to these network improvements.

- Extensive Network: ACC operates numerous manufacturing plants and strategically located depots nationwide.

- Logistics Optimization: Continuous investment in improving road dispatch and depot efficiency is a priority.

- Timely Delivery: This focus ensures project timelines are met and operational continuity is maintained for clients.

- Customer Convenience: Reduced delays directly translate to a more convenient experience for contractors and builders.

Value-Added Digital Services and Technical Support

ACC goes beyond just selling building materials by offering valuable digital services designed to streamline operations for builders and contractors. These include platforms for efficient project management and accurate material estimation, directly addressing common pain points in the construction industry.

Technical support is another cornerstone of ACC's value proposition. They provide crucial technical guidance and conduct training programs for masons and contractors, ensuring proper application of their products and enhancing overall project quality. This commitment to knowledge transfer fosters customer competency and builds trust.

These comprehensive support services empower ACC's customers by equipping them with essential knowledge and improving their operational efficiency. This focus on customer development cultivates stronger, more loyal relationships, moving beyond a transactional exchange to a partnership in success.

- Digital Tools: ACC offers platforms for project management and material estimation, enhancing efficiency for builders and contractors.

- Technical Training: The company provides expert guidance and training programs for masons and contractors, improving skillsets and product application.

- Customer Empowerment: These services equip customers with knowledge and boost their operational efficiency, fostering stronger business relationships.

- Relationship Building: By investing in customer development, ACC cultivates loyalty and positions itself as a supportive partner in the construction ecosystem.

ACC provides a broad spectrum of cement and concrete products, catering to diverse construction needs, from residential to large-scale infrastructure projects. Their commitment to quality is evident in products like ACC Gold Water Shield cement, ensuring durability and superior performance.

Sustainability is a core value, with 94% of their products being eco-friendly blended cements, and initiatives like ACC ECOMaxX concrete reducing embodied CO2. ACC's validated net-zero targets further solidify their leadership in responsible building materials.

A robust supply chain, supported by an extensive network of manufacturing plants and depots, ensures timely product delivery across India. For instance, in 2024, ACC reported significant reductions in lead times due to logistics enhancements.

ACC also offers valuable digital tools for project management and material estimation, alongside technical training for masons and contractors, empowering customers and fostering strong partnerships.

| Value Proposition | Description | Supporting Data/Initiative |

|---|---|---|

| Product Breadth & Quality | Comprehensive range of cement and concrete, ensuring high strength and durability. | 94% of product portfolio comprises eco-friendly blended cements. |

| Sustainability | Commitment to reducing environmental impact through eco-friendly products and net-zero targets. | ACC ECOMaxX concrete actively reduces embodied CO2. |

| Supply Chain & Logistics | Reliable and efficient delivery network across India. | Significant reduction in lead times reported in 2024 due to network improvements. |

| Customer Support & Digital Services | Digital tools for project management and technical training to enhance customer operations. | Platforms for efficient project management and accurate material estimation. |

Customer Relationships

ACC fosters deep customer connections through tailored technical support and expert advice for builders, contractors, and engineers. This hands-on approach includes valuable on-site help, clear guidance on product usage, and prompt solutions to any construction challenges encountered.

In 2024, ACC's commitment to personalized support translated into a significant increase in customer retention, with repeat business rising by approximately 15%. This focus ensures clients not only use ACC products effectively but also feel confident and valued, leading to enhanced satisfaction and loyalty.

ACC actively cultivates strong ties with local communities and construction professionals through its Green Building Centres and comprehensive mason training programs. These initiatives are designed not just to promote sustainable building materials and practices but also to address critical skill shortages within the industry, thereby creating valuable livelihood opportunities for participants.

As of 2024, ACC's commitment to skill development has seen over 30,000 masons trained across India, significantly contributing to a more skilled and employable workforce. This focus on community engagement and capacity building fosters substantial goodwill and ensures a ready pool of trained professionals for construction projects.

ACC leverages digital platforms like 'OneConnect' and 'Adani Cement Connect' to foster strong customer relationships. These platforms offer real-time updates, facilitate seamless interactions, and provide specialized services, enhancing customer convenience and transparency.

In 2024, digital engagement is paramount. ACC's commitment to these channels reflects a strategic focus on catering to a growing segment of tech-savvy customers who expect efficient and accessible service delivery, thereby strengthening loyalty and operational efficiency.

Long-Term Strategic Partnerships with Large Clients

ACC focuses on building long-term strategic partnerships with key clients like large construction firms, infrastructure developers, and government agencies. These relationships are crucial for securing consistent demand for bulk supplies and participating in major projects.

These partnerships are often characterized by tailored solutions and ongoing collaboration, ensuring ACC meets the specific needs of large-scale ventures. For instance, in 2024, ACC's major project wins, such as supplying materials for significant highway expansions and urban development projects, underscore the value of these strategic alliances.

- Customized Solutions: Offering bespoke product mixes and delivery schedules to meet the unique demands of large projects.

- Bulk Supply Agreements: Securing multi-year contracts that guarantee substantial order volumes.

- Ongoing Collaboration: Working closely with clients on project planning and material management to ensure seamless execution.

- Preferred Supplier Status: Establishing ACC as the go-to provider for major infrastructure and construction undertakings.

Responsive Customer Feedback and Grievance Redressal

ACC actively seeks customer feedback through various channels, ensuring their voices are heard and acted upon. This responsiveness is crucial for refining offerings and addressing issues swiftly.

- Customer Feedback Channels: ACC utilizes surveys, online portals, and direct communication to gather customer insights.

- Grievance Redressal: A dedicated team ensures prompt and effective resolution of customer complaints, aiming for high satisfaction rates.

- Impact on Improvement: Customer feedback directly informs product development and service enhancements, as seen in recent updates to their digital platforms in early 2024.

- Building Loyalty: Proactive engagement and problem-solving foster stronger customer relationships and build lasting trust.

ACC cultivates robust customer relationships through a multi-faceted approach, blending personalized technical support with community engagement and digital convenience.

This strategy, evident in 2024 through a 15% increase in repeat business and the training of over 30,000 masons, aims to build lasting loyalty and ensure client success across all segments.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Technical Support | On-site assistance, expert advice, product guidance | 15% increase in customer retention |

| Community Engagement & Skill Development | Green Building Centres, mason training programs | 30,000+ masons trained |

| Digital Platforms | OneConnect, Adani Cement Connect | Enhanced customer convenience and transparency |

| Strategic Partnerships | Tailored solutions for large firms, developers, government | Secured supply for major highway expansions and urban projects |

| Customer Feedback | Surveys, online portals, grievance redressal | Informed product development and service enhancements |

Channels

ACC's extensive dealer and retailer network is a cornerstone of its business model, ensuring broad market reach across India. This network comprises thousands of authorized partners who facilitate the accessibility of ACC's cement products to a diverse customer base, from individual homeowners to small-scale contractors.

In 2024, ACC continued to leverage this robust distribution system, which is vital for last-mile delivery and maintaining a strong market presence. The company's commitment to its channel partners ensures that ACC cement is readily available in both urban and rural areas, supporting numerous construction projects nationwide.

ACC utilizes direct sales channels to engage with major players in the construction and infrastructure sectors. This approach is crucial for securing large-scale projects, such as those awarded through government tenders, where customized solutions and direct negotiation are paramount.

These direct engagements allow ACC to forge customized supply agreements tailored to the specific, often complex, requirements of these key clients. This includes managing bulk orders efficiently and addressing specialized needs that are common in large infrastructure developments.

For instance, in 2024, ACC's direct sales efforts likely contributed significantly to its revenue from major projects, mirroring historical trends where large-scale deals form a substantial portion of its business. This channel is supported by dedicated account management teams ensuring seamless communication and support.

ACC's business model leverages both company-owned ready-mix concrete (RMX) plants and a franchise network of Green Building Centres that also offer RMX. This dual approach ensures direct delivery of tailored concrete solutions to construction sites, optimizing freshness and customization.

The company's strategic expansion of its RMX plant network is a key driver for enhanced service delivery and broader market penetration. For instance, by the end of 2023, ACC had a significant presence of RMX plants across India, contributing to its market leadership.

Digital Platforms and Online Presence

ACC leverages its official website, acc.co.in, as a primary digital platform to showcase its extensive product range, including various cement types and building materials. This online presence is vital for providing detailed product information and specifications to architects, engineers, and individual builders.

Beyond product display, ACC's digital channels facilitate customer engagement and support. The website offers resources and tools for builders, aiming to streamline their project planning and execution. This digital interaction is key for lead generation and nurturing customer relationships, even if direct online sales of cement are not the primary focus.

In 2024, digital transformation remains a strategic imperative for ACC. The company continues to invest in enhancing its online customer experience, which includes providing access to technical support and project-specific advice. This digital push aims to improve accessibility and operational efficiency across its customer base.

- Website as Information Hub: ACC's website (acc.co.in) serves as a comprehensive resource for product details, technical specifications, and project case studies.

- Digital Services for Builders: The platform offers tools and information tailored to assist builders and contractors, enhancing their project management capabilities.

- Customer Engagement and Lead Generation: Digital channels are crucial for building brand loyalty, providing customer support, and capturing new business leads.

- Brand Building and Accessibility: ACC utilizes its online presence to reinforce its brand image and make its offerings and support more accessible to a wider audience.

Green Building Centres (GBCs)

ACC's Green Building Centres (GBCs) function as specialized channels within their business model, focusing on the distribution of environmentally friendly building materials. These centers go beyond simple sales, offering crucial training and support to local communities and skilled masons, fostering the adoption of sustainable construction techniques.

These GBCs actively promote eco-conscious building practices and directly contribute to local economic development by supporting livelihood generation. They serve as vital community hubs, providing comprehensive building solutions and expertise.

- Channel Function: Distribution of eco-friendly building materials and provision of training/support.

- Community Impact: Promotion of sustainable construction and direct livelihood generation.

- Role: Act as community hubs for building solutions and knowledge sharing.

ACC's channel strategy is multifaceted, encompassing a vast dealer and retailer network for broad market accessibility, direct sales for large infrastructure projects, company-owned and franchised ready-mix concrete (RMX) plants for customized solutions, and a robust digital presence via acc.co.in for information dissemination and customer engagement. Additionally, Green Building Centres serve as specialized channels promoting sustainable materials and practices.

| Channel Type | Target Audience | Key Functionality | 2024 Focus/Data Point |

|---|---|---|---|

| Dealer & Retailer Network | Individual homeowners, small contractors | Broad market reach, last-mile delivery | Continued expansion and support for rural accessibility. |

| Direct Sales | Major infrastructure players, government tenders | Large-scale project acquisition, customized supply agreements | Securing bulk orders and specialized needs for infrastructure. |

| RMX Plants (Company & Franchise) | Construction sites requiring tailored concrete | Direct delivery of fresh, customized concrete solutions | Strategic expansion of plant network for enhanced service. |

| Digital Channels (acc.co.in) | Architects, engineers, builders, general public | Product information, technical support, lead generation | Enhancing online customer experience and digital support. |

| Green Building Centres (GBCs) | Communities, skilled masons, eco-conscious builders | Distribution of eco-friendly materials, training, knowledge sharing | Promoting sustainable construction and livelihood generation. |

Customer Segments

Individual Home Builders (IHBs) represent a significant customer base for ACC, encompassing those undertaking personal construction or renovation projects. These builders typically need smaller volumes of cement, often seeking a variety of product types for different stages of their build. Brand trust, consistent quality, and easy access to materials are paramount for IHBs. For instance, ACC's strong brand recognition, bolstered by products like ACC Gold, resonates well with this segment. In 2024, the demand from individual home builders remained robust, contributing to the overall growth in the retail segment of the cement industry, with ACC leveraging its widespread dealer network to meet these localized needs effectively.

Small to medium-sized contractors, a crucial segment for ACC, undertake a broad spectrum of projects, from building homes to small commercial spaces. In 2024, the construction industry saw continued growth, with small contractors playing a vital role in this expansion, often handling projects valued between $50,000 and $500,000.

These businesses prioritize dependable material supply and consistent product quality to ensure project timelines and client satisfaction. They also value access to technical expertise, particularly for specialized construction needs, which ACC addresses through its comprehensive cement offerings and support services.

ACC's commitment extends to providing value-added services like training programs, equipping these contractors with the knowledge to optimize material usage and adopt efficient building practices, thereby enhancing their operational efficiency and competitiveness in the market.

Large construction and infrastructure companies are a cornerstone customer segment for ACC. These entities undertake massive projects, from national highways to sprawling commercial developments, necessitating substantial volumes of cement and tailored ready-mix concrete solutions. Their primary concerns revolve around securing a reliable and consistent supply chain, meeting stringent technical specifications for project integrity, and achieving competitive pricing to manage project budgets effectively. For instance, during 2024, ACC's focus on these clients was evident in its robust supply chain management, ensuring timely delivery for projects like the ongoing development of the Mumbai Trans Harbour Sea Link, a critical infrastructure endeavor.

Government and Public Sector Undertakings

Government bodies and public sector enterprises are key customers, particularly for large-scale infrastructure projects. These entities often issue tenders requiring adherence to stringent quality benchmarks and precise delivery timelines. ACC's proven track record and substantial production capabilities position it as a reliable partner for these critical national development initiatives.

In 2024, the Indian government continued its focus on infrastructure development, allocating significant funds to projects like the PM GatiShakti National Master Plan. This plan aims to build multimodal infrastructure, enhancing connectivity and reducing logistics costs. ACC's ability to supply vast quantities of cement, meeting the demanding specifications of these projects, makes it a vital contributor to such government-led endeavors.

- Infrastructure Tenders: Government projects often involve massive cement requirements, with contracts awarded through competitive bidding processes.

- Quality and Compliance: Public sector undertakings demand cement that meets rigorous Indian Standards (IS) codes and specific project specifications.

- Project Scale: ACC's extensive manufacturing capacity, with a total installed capacity of around 36.9 million tonnes per annum as of early 2024, allows it to service the immense volume needs of public infrastructure projects.

- Reliability: Consistent supply and on-time delivery are paramount for government projects to avoid delays and cost overruns, areas where ACC has established strong operational efficiencies.

Real Estate Developers

Real estate developers, particularly those focused on large-scale residential townships, commercial complexes, and integrated urban developments, represent a crucial customer segment. These entities have a consistent and often substantial demand for building materials.

ACC caters to these developers by providing a reliable supply of high-quality cement and ready-mix concrete. The company understands that different projects have unique requirements, so ACC offers tailored solutions and a diverse product portfolio designed to meet specific performance characteristics, ensuring project success and structural integrity.

For instance, in 2024, the Indian real estate sector saw significant activity. The residential segment, a key area for developers, experienced a notable uptick in sales and new launches. ACC's ability to supply large volumes of specialized concrete, such as high-strength concrete for skyscrapers or durable mixes for infrastructure components within townships, directly addresses the needs of these developers.

- Demand for Volume and Consistency: Developers require bulk supplies of cement and RMC, necessitating a reliable and efficient supply chain.

- Product Specialization: Projects demand specific concrete properties like rapid setting, high strength, or enhanced durability, which ACC provides.

- Project Scale: The growth in integrated urban projects means developers are undertaking larger, more complex constructions requiring significant material volumes.

- Quality Assurance: Consistent quality is paramount for developers to meet building codes and ensure long-term structural soundness.

ACC serves a diverse customer base, ranging from individual home builders needing smaller quantities to large infrastructure companies requiring massive volumes. The company also partners with small to medium-sized contractors and government entities for public sector projects. Real estate developers, focusing on large-scale residential and commercial projects, form another critical segment.

| Customer Segment | Key Needs | ACC's Value Proposition | 2024 Relevance |

|---|---|---|---|

| Individual Home Builders | Brand trust, consistent quality, easy access | Strong brand recognition, widespread dealer network | Robust demand in retail segment |

| SME Contractors | Dependable supply, consistent quality, technical expertise | Comprehensive offerings, value-added services (training) | Vital role in industry expansion |

| Large Construction/Infra Companies | Reliable supply chain, stringent specifications, competitive pricing | Robust supply chain management, tailored RMC solutions | Critical for national infrastructure projects |

| Government/Public Sector | High quality, precise timelines, large volumes | Proven track record, substantial production capacity | Key supplier for government-led initiatives |

| Real Estate Developers | Volume, consistency, product specialization | Reliable supply, tailored solutions, diverse product portfolio | Addressing growth in residential and commercial sectors |

Cost Structure

ACC's cost structure is heavily influenced by the acquisition of key raw materials like limestone, fly ash, slag, and gypsum. These are the fundamental building blocks for cement production. For instance, in 2023, the company's cost of materials consumed was ₹10,455.5 crore, highlighting the significant impact of these inputs.

Fuel costs for kiln operations, primarily petcoke and coal, represent another substantial expense. In 2023, ACC's fuel and power expenses amounted to ₹4,723.9 crore. Managing these volatile commodity prices through strategic sourcing and optimizing the fuel mix is crucial for cost control.

Manufacturing and operational expenses are the backbone of ACC's cost structure, encompassing the day-to-day running of its cement and ready-mix concrete facilities. These costs are heavily influenced by energy consumption, with power and fuel being significant drivers. For instance, in 2023, ACC reported a notable increase in its energy costs, reflecting global energy price volatility.

Labor wages and the ongoing upkeep of machinery also contribute substantially to these operational expenditures. ACC actively invests in automation and modernizing its plants to enhance efficiency and reduce the long-term costs associated with manual labor and frequent repairs. This strategic focus on technological advancement is key to managing these essential production costs effectively.

The company's commitment to operational efficiency is further demonstrated through initiatives like waste heat recovery systems. By capturing and reusing heat generated during the manufacturing process, ACC aims to lower its reliance on external energy sources, thereby directly reducing its overall production costs and environmental footprint. This approach was a significant factor in their efforts to maintain cost competitiveness throughout 2024.

ACC's extensive pan-India operations mean that logistics and distribution are significant cost drivers. These expenses encompass freight for both incoming raw materials like clinker and cement, and outgoing finished products to a vast customer base. Warehousing, maintaining a fleet of trucks, and managing the entire supply chain network contribute substantially to the overall cost structure.

In 2024, ACC continued its focus on optimizing its logistics. Initiatives such as reducing average lead distances for cement dispatches, which stood at approximately 300-350 kilometers in recent years, are crucial for cost control. Furthermore, enhancing the efficiency of their fleet management and exploring multimodal transportation options help mitigate rising fuel and operational costs.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are a significant component of ACC's cost structure, covering everything from customer acquisition to back-office operations. These costs are vital for driving sales and ensuring the smooth functioning of the business. For instance, in 2024, many companies in the building materials sector saw increased SG&A due to rising marketing costs and the need to expand sales networks to reach a broader customer base.

This category includes direct selling expenses like advertising and promotions, which are essential for building brand awareness and attracting customers. It also encompasses general and administrative overheads such as salaries for management and support staff, office rent, and IT infrastructure. Efficiently managing these costs directly impacts ACC's bottom line and overall profitability.

Key elements within ACC's SG&A expenses likely include:

- Sales and Marketing: Advertising campaigns, digital marketing, sales force salaries and commissions, and promotional activities.

- General and Administrative: Executive and administrative staff salaries, office supplies, utilities, legal and accounting fees, and IT support.

- Dealer and Distribution Costs: Expenses related to maintaining relationships with dealers and distributors, including training and support.

- Brand Building: Investments in brand equity, sponsorships, and public relations efforts to enhance market perception.

Capital Expenditure (Capex) and Investment Costs

ACC's cost structure is heavily influenced by capital expenditure (Capex) and broader investment costs. These are essential for maintaining and growing its operational capacity and market position.

Significant outlays are directed towards expanding production capacity, upgrading existing manufacturing facilities, and acquiring other cement businesses. These investments are fundamental to ACC's strategy for sustained growth and achieving market leadership in the competitive cement industry.

Beyond physical assets, substantial investments are also allocated to research and development (R&D) initiatives, aiming to innovate product offerings and improve manufacturing processes. Furthermore, the ongoing development of digital infrastructure, including advanced analytics and automation, forms another key component of these investment costs.

- Capacity Expansion: Investments in building new plants or increasing output at existing ones.

- Modernization: Upgrading technology and equipment in current facilities for efficiency and sustainability.

- Acquisitions: Purchasing other cement companies to gain market share or new capabilities.

- R&D and Digitalization: Funding innovation in products and processes, and investing in technology infrastructure.

ACC's cost structure is a complex interplay of raw material procurement, energy consumption, operational efficiency, logistics, and administrative overheads. The company's significant outlays in 2023, such as ₹10,455.5 crore for materials and ₹4,723.9 crore for fuel and power, underscore the impact of these core expenses.

Ongoing investments in plant modernization, capacity expansion, and R&D are crucial for long-term cost competitiveness and market positioning. In 2024, ACC continued to focus on optimizing logistics and leveraging technology, such as waste heat recovery systems, to manage these costs effectively.

The company's commitment to operational excellence is evident in its efforts to control manufacturing expenses, which include labor and maintenance, while also managing SG&A costs related to sales, marketing, and administration. These strategic cost management initiatives are vital for maintaining profitability in a dynamic market.

| Cost Component | 2023 Expense (₹ Crore) | Key Drivers |

|---|---|---|

| Materials Consumed | 10,455.5 | Limestone, fly ash, slag, gypsum procurement |

| Fuel and Power | 4,723.9 | Petcoke, coal, electricity for kiln operations |

| Logistics and Distribution | Significant | Freight, warehousing, fleet management |

| SG&A Expenses | Significant | Sales, marketing, administration, brand building |

| Capital Expenditure | Ongoing | Capacity expansion, modernization, R&D, digitalization |

Revenue Streams

ACC's core revenue generation hinges on the sale of its diverse cement product portfolio. This encompasses Ordinary Portland Cement, Portland Slag Cement, and Portland Pozzolana Cement, catering to a broad spectrum of construction needs.

Revenue streams are primarily derived from both bagged cement, distributed through a vast dealer network, and bulk cement, supplied directly to large-scale infrastructure and building projects. In 2023, ACC reported a revenue of ₹17,951 crore, with cement sales forming the substantial majority of this figure.

ACC's ready-mix concrete (RMX) segment is a significant revenue generator, supplying tailored concrete solutions directly to construction projects. This business line complements their core cement sales by offering a value-added service that meets diverse project specifications.

In 2024, ACC continued to expand its RMX capabilities, with a focus on increasing the number and capacity of its RMX plants. This strategic expansion directly supports the growth of this revenue stream, enhancing ACC's market presence in the construction materials sector.

ACC generates revenue from selling specialized cement and concrete products like ACC Gold Water Shield and ACC ECOMaxX. These premium items, offering enhanced performance, typically fetch higher prices. This strategy bolsters profit margins and distinguishes ACC in the market.

Services and Digital Solutions for Construction Professionals

ACC offers digital services and technical training for builders and contractors, which can be viewed as potential revenue streams. These services aim to enhance user experience and product adoption.

While not always direct sales, these digital solutions and training programs can foster customer loyalty, making them more likely to choose ACC's integrated products. This strategy is becoming increasingly important in the construction sector, with digital transformation initiatives gaining momentum.

- Digital Services: ACC provides digital tools and platforms designed to streamline operations for construction professionals.

- Technical Training: The company offers specialized training programs to enhance the skills of builders and contractors in using ACC products and industry best practices.

- Advisory Services: ACC also provides expert advice and consultation, helping clients optimize their construction processes.

- Customer Stickiness: These value-added services contribute to customer retention by increasing reliance on ACC's ecosystem.

By-product Sales and Waste Utilization (Indirect Savings)

While not a direct revenue generator, ACC's strategic approach to by-product sales and waste utilization significantly boosts financial performance. For instance, the sale of fly ash, a by-product of coal combustion, as a supplementary cementitious material, not only generates some income but also reduces the need for virgin raw materials like clinker. This circular economy practice is crucial for cost management.

The co-processing of various types of waste, such as industrial sludge and municipal solid waste, within ACC's kilns offers substantial indirect savings. This process replaces fossil fuels, thereby lowering energy costs. In 2023, for example, the cement industry in India, including major players like ACC, has been increasingly focusing on waste-to-energy initiatives to combat rising fuel prices and improve environmental footprints.

- Cost Reduction: By using by-products and waste as raw material substitutes and fuel, ACC lowers its operational expenses, particularly in energy and raw material procurement.

- Environmental Compliance: Waste utilization helps ACC meet stringent environmental regulations and promotes a sustainable business model, which can attract environmentally conscious investors.

- Circular Economy Contribution: This stream embodies ACC's commitment to the circular economy, turning waste into valuable resources and reducing landfill dependence.

ACC's revenue streams are multifaceted, predominantly driven by cement sales, both bagged and bulk, and a growing ready-mix concrete (RMX) segment. The company also generates income from specialized, higher-margin cement products and potential revenue from digital services and training.

In 2023, ACC reported revenues of ₹17,951 crore, with cement sales forming the bulk of this. The RMX business is a key growth area, with ACC expanding its plant network in 2024 to capture more market share.

Beyond direct sales, ACC benefits from cost savings and potential income through the sale of by-products like fly ash and the co-processing of waste, which replaces fossil fuels and reduces raw material costs.

| Revenue Stream | Primary Products/Services | 2023 Revenue Contribution (Approx.) | 2024 Focus/Growth Area |

|---|---|---|---|

| Cement Sales | Ordinary Portland Cement, Portland Slag Cement, Portland Pozzolana Cement (Bagged & Bulk) | Majority of ₹17,951 crore | Market share expansion, product innovation |

| Ready-Mix Concrete (RMX) | Tailored concrete solutions for construction projects | Significant contributor, growing | Expansion of RMX plant network and capacity |

| Specialty Products | ACC Gold Water Shield, ACC ECOMaxX | Higher margin, niche market | Premium product development and sales |

| Ancillary Services | Digital tools, technical training, advisory services | Indirectly supports core sales, customer retention | Enhancing digital offerings and training programs |

Business Model Canvas Data Sources

The ACC Business Model Canvas is constructed using a blend of internal financial statements, customer feedback surveys, and competitive landscape analyses. These diverse data sources ensure a comprehensive and validated understanding of our operational and market positioning.