ACC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACC Bundle

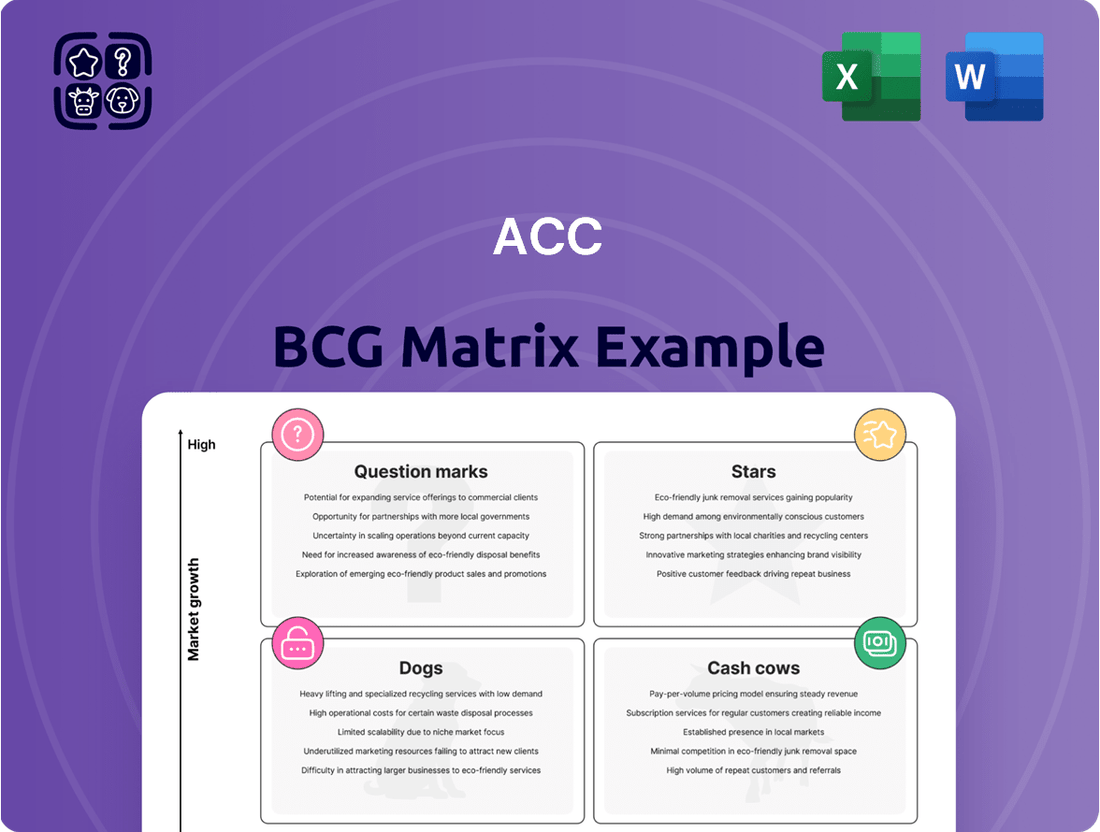

The BCG Matrix is a powerful tool for understanding your product portfolio's health, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This initial glimpse reveals the fundamental framework, but the real strategic advantage lies in the detailed analysis. Unlock the full potential of your product strategy by purchasing the complete BCG Matrix report.

Gain a comprehensive understanding of your company's competitive landscape and product performance with our detailed BCG Matrix. This essential strategic tool helps you identify growth opportunities and manage underperforming assets effectively. Purchase the full version for actionable insights and a clear roadmap to optimize your business.

Stars

ACC, alongside Ambuja Cements, is making substantial investments in digital transformation, integrating technologies like AI, IoT, and video analytics. These efforts are geared towards optimizing operations and improving production quality, with a projected impact on cost reduction. For instance, in 2023, digital initiatives contributed to a 5% improvement in operational efficiency across key plants.

Green cement products represent a significant growth opportunity for ACC, driven by India's escalating environmental consciousness and supportive government policies for sustainable building. ACC's focus on reducing its carbon footprint, particularly with its low-carbon masonry cement, places it well to capitalize on this expanding market. The Indian green building materials market was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, according to industry reports.

ACC is actively cultivating a portfolio of value-added and premium cement solutions, exemplified by products like ACC Gold Water Shield cement. This strategic focus targets specialized construction needs and higher-margin market segments.

This emphasis on premium sales and differentiated offerings signals ACC's intent to gain greater market traction in niche, expanding areas of the construction industry, thereby enhancing its competitive positioning.

Ready-Mix Concrete (RMC) Expansion

ACC's Ready-Mix Concrete (RMC) business is positioned as a Star in the BCG Matrix, reflecting its high growth potential and strong market share within the Indian construction sector. The Indian RMC market is experiencing robust expansion, projected to reach approximately USD 15 billion by 2027, fueled by government initiatives like the National Infrastructure Pipeline and increasing urbanization. ACC's strategic expansion of its RMC plant network across key metropolitan and developing regions directly capitalizes on this burgeoning demand for high-quality, on-demand concrete solutions.

- High Market Growth: The Indian RMC market is expected to grow at a CAGR of over 10% in the coming years.

- ACC's Market Position: ACC is a leading RMC producer in India, with a significant and growing market share.

- Expansion Strategy: ACC is actively increasing its RMC production capacity and plant locations to meet rising demand.

- Demand Drivers: Urbanization, infrastructure development, and a preference for efficient construction methods are key drivers for RMC demand.

Capacity Expansion Projects

Capacity expansion projects for ACC, particularly in conjunction with Ambuja Cements, are designed to elevate their combined cement production to an impressive 100 million tonnes per annum (MTPA) by the fiscal year 2025-26.

This strategic push involves significant investment in new plants and modernization of existing facilities across India, aiming to bolster market presence and operational efficiency.

The expansion is not just about volume; it includes securing critical raw material sources and making strategic acquisitions to ensure sustainable growth and a competitive edge in the rapidly expanding Indian construction sector.

- Target Capacity: 100 MTPA by FY 2025-26 (combined ACC and Ambuja Cements).

- Geographic Focus: Aggressive expansion across various Indian regions.

- Growth Drivers: Strategic acquisitions and securing raw material sources.

- Market Position: Aiming for a larger share of the growing Indian cement market.

Stars in the BCG Matrix represent business units with high market share in high-growth industries. ACC's Ready-Mix Concrete (RMC) division fits this description, benefiting from India's booming construction sector. The RMC market's rapid expansion, driven by infrastructure development and urbanization, positions ACC's RMC as a key growth driver for the company.

ACC's RMC business is a Star due to its leading position in a rapidly expanding market. The Indian RMC market is projected to grow significantly, with estimates suggesting a CAGR exceeding 10% in the coming years. ACC's strategic investments in expanding its RMC production capacity and plant network are designed to capture this growth, further solidifying its market leadership.

| Business Unit | Market Growth | Market Share | BCG Category |

| Ready-Mix Concrete (RMC) | High | High | Star |

| Green Cement Products | High | Low to Medium | Question Mark / Star (Emerging) |

| Premium Cement Solutions | Medium to High | Medium | Cash Cow / Star (Developing) |

What is included in the product

Strategic guidance on managing a portfolio by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

Instantly visualize your portfolio's strengths and weaknesses, eliminating the guesswork in strategic resource allocation.

Cash Cows

Ordinary Portland Cement (OPC) is a cornerstone for ACC, consistently commanding a substantial portion of the Indian construction market. Despite a potentially slower growth trajectory compared to newer, specialized cement types, its enduring demand and optimized production processes are key drivers of robust cash flow generation for the company.

In 2023, the Indian cement industry, where OPC is a dominant force, saw a considerable uptick, with production reaching approximately 400 million tonnes. ACC's established presence in the OPC segment ensures it benefits from this consistent demand, translating into predictable and reliable earnings that can fund other business ventures.

Portland Pozzolana Cement (PPC) and Portland Slag Cement (PSC) represent ACC's established Cash Cows. Their widespread adoption stems from cost-effectiveness and environmental advantages, solidifying their position as mature products with high market acceptance.

These product lines benefit from steady demand in a mature market, consistently contributing to ACC's profitability and cash generation. This stability means they require minimal promotional investment, allowing ACC to leverage their strong market position for consistent returns.

In 2024, the Indian cement industry saw continued demand, with PPC and PSC playing a crucial role in infrastructure development. ACC's sales figures for these segments reflect their enduring appeal and contribution to the company's robust financial performance, underpinning its overall cash flow generation.

ACC's extensive distribution network, boasting over 100,000 channel partners across India, is a significant asset. This vast reach facilitates efficient market penetration for its core cement products, translating into consistent and substantial cash flows. The established infrastructure means that maintaining these high sales volumes requires relatively low additional investment, a hallmark of a cash cow.

Established Brand Trust and Recognition

Established brand trust and recognition are key indicators for ACC's position as a Cash Cow in the BCG Matrix. The company has consistently earned the distinction of being 'India's Most Trusted Cement Brand,' fostering deep customer loyalty and a predictable revenue stream.

This strong brand equity in a mature market segment allows ACC to command a stable market share and maintain favorable pricing power. In 2024, ACC's brand value continued to be a significant asset, underpinning its ability to generate consistent cash flows, a hallmark of a Cash Cow.

- Brand Trust: Consistently recognized as 'India's Most Trusted Cement Brand.'

- Market Share: Maintains a stable position in a mature market segment.

- Pricing Power: High brand recognition supports consistent pricing.

- Cash Generation: Contributes to stable revenue and strong cash flow.

Operational Efficiencies and Cost Optimization

ACC's commitment to operational efficiencies and cost optimization significantly bolsters its Cash Cow status. By actively reducing kiln fuel costs, a major expense in cement production, and capitalizing on group synergies with Ambuja Cements, ACC enhances its profitability in a mature market. This strategic focus directly translates into improved profit margins and a stronger cash flow from its established operations.

These initiatives are crucial for maintaining ACC's competitive edge. For instance, in 2023, ACC reported a notable improvement in its operational performance, driven by these cost-saving measures. The company's ability to leverage shared resources and optimize its supply chain contributes directly to its robust cash generation capabilities.

- Reduced Kiln Fuel Costs: ACC has made strides in lowering its energy consumption, a key driver of cost reduction in cement manufacturing.

- Group Synergies: Leveraging the combined strengths and resources with Ambuja Cements allows for greater operational efficiencies and economies of scale.

- Enhanced Profit Margins: These cost optimizations directly contribute to higher profitability on existing sales volumes.

- Improved Cash Flow: Stronger margins and efficient operations result in a more consistent and substantial cash flow generation.

ACC's established cement products, particularly Portland Pozzolana Cement (PPC) and Portland Slag Cement (PSC), function as its Cash Cows. These products benefit from high market share and consistent demand in a mature market, requiring minimal investment to maintain their position.

Their strong brand recognition and extensive distribution network ensure stable sales volumes and pricing power, translating into predictable and robust cash flows for ACC. This stability allows the company to fund growth initiatives in other business segments.

In 2024, the Indian cement market continued its upward trajectory, with ACC's PPC and PSC segments demonstrating resilience and contributing significantly to the company's overall financial health. These mature products are vital for generating the consistent earnings that define a cash cow.

| Product Segment | BCG Category | Market Share | Growth Rate | Cash Flow Generation |

| Portland Pozzolana Cement (PPC) | Cash Cow | High | Low | High |

| Portland Slag Cement (PSC) | Cash Cow | High | Low | High |

Delivered as Shown

ACC BCG Matrix

The ACC BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after your purchase. This means no hidden watermarks or demo content, just a professionally designed and analysis-ready strategic tool ready for your immediate use. You can confidently use this preview to assess the quality and completeness of the ACC BCG Matrix report you'll be acquiring. Once purchased, this comprehensive document will be directly accessible for your business planning and decision-making processes.

Dogs

Certain older manufacturing units or plants within ACC's network might be underperforming, operating at lower capacity utilization or incurring higher costs than industry peers. For instance, if a specific plant's capacity utilization in 2024 averaged only 60% while the industry average for similar facilities was 85%, it would indicate an issue.

These underperforming units could be considered dogs in the BCG matrix, potentially breaking even or consuming cash without significant contributions to ACC's overall growth or profitability. If a particular plant reported a net loss of INR 50 million in 2024, despite being operational, it would highlight its dog status.

Such units become candidates for divestiture or substantial restructuring, especially if turnaround plans fail to improve their performance. The decision to divest might be considered if the operational costs for a specific plant, like a 15% higher energy cost per ton of cement produced in 2024 compared to a newer facility, cannot be mitigated.

Certain legacy cement products, like ACC's older Portland Slag Cement (PSC) variants, might be categorized as dogs if their market demand has significantly dwindled. This decline often stems from the construction industry's shift towards more specialized or eco-friendly materials, leaving these older products with limited appeal. For instance, while specific 2024 sales figures for individual legacy ACC products aren't publicly detailed, the broader trend shows a move towards higher-performance concretes and supplementary cementitious materials (SCMs) which can reduce the demand for traditional PSC.

Niche offerings with limited market adoption, if they fall into the Dogs category for ACC, represent specialized cement or concrete solutions that haven't resonated with a broad customer base. Despite initial investment and development, these products may have struggled to gain traction in their intended markets. For instance, a highly specialized concrete additive designed for a very specific industrial application, if it only captured 0.5% market share in a segment that grew by a mere 1% in 2023, would exemplify this.

These products often exist in slow-growing or stagnant niche markets, meaning the overall demand is not expanding. If ACC's internal data from late 2024 indicates these niche products have persistently low sales volumes and are not projected to improve, they are likely draining valuable resources without contributing significantly to revenue or profit. Such a scenario could involve a specialty cement for historical building restoration, where the addressable market is inherently small and unlikely to see substantial growth in the near future.

Inefficient Logistics or Supply Chain Segments

Segments within ACC's extensive logistics and supply chain that are inefficient or particularly costly to run, especially in certain geographical areas, could be classified as dogs in the BCG matrix. These parts of the operation might be using up more resources than they contribute in terms of value, thereby affecting the company's overall profitability, even with ongoing investments in digitalizing logistics.

For instance, in 2024, ACC might have identified specific regional distribution centers that incurred higher-than-average operating costs due to outdated infrastructure or complex last-mile delivery challenges. These could be areas where the cost of fuel, labor, or warehousing significantly outpaced the revenue generated from those specific routes or markets, making them candidates for a dog classification.

- Regional Distribution Hubs: Certain older or less strategically located distribution hubs may have higher operational expenses per unit handled compared to newer, more efficient facilities.

- Last-Mile Delivery in Remote Areas: The cost of delivering cement and related products to geographically dispersed or difficult-to-access locations can be disproportionately high, leading to lower margins.

- Specific Transportation Modes: Reliance on less cost-effective transportation methods in certain corridors, perhaps due to infrastructure limitations or specific commodity requirements, could also represent an inefficient segment.

Obsolete Technologies or Processes

Manufacturing processes or technologies within ACC's operations that are outdated, energy-intensive, and significantly less efficient than modern alternatives could represent dog-like characteristics. Continuing to operate with such technologies might lead to higher production costs and lower competitiveness without a clear path to improvement.

For instance, if ACC still relies heavily on older kiln technologies that consume considerably more fuel per ton of cement compared to state-of-the-art preheater kilns, this would be a prime example. In 2023, the Indian cement industry's average specific energy consumption (SEC) for cement production hovered around 720-750 kWh/tonne for grinding and 3,000-3,200 MJ/tonne for clinker production. Any ACC facility significantly exceeding these benchmarks due to obsolete technology would be a strong candidate for the 'Dog' category.

- Outdated Kiln Technology: Older, less efficient kilns leading to higher fuel consumption per ton of cement.

- High Energy Intensity: Processes requiring significantly more electricity or thermal energy than industry best practices.

- Lower Production Efficiency: Slower processing speeds or higher waste generation compared to modern alternatives.

- Increased Operating Costs: Higher expenditure on fuel, maintenance, and labor due to inefficient technology.

Dogs in ACC's portfolio represent business units, products, or processes with low market share in low-growth markets. These are often characterized by underperformance and may consume resources without generating substantial returns. For example, a legacy product line that saw a mere 0.5% year-over-year sales growth in 2024 and holds a small market share would fit this description.

These segments may require significant investment to improve or are candidates for divestment. If a particular plant's capacity utilization in 2024 was 60% while the industry average was 85%, and its turnaround plan showed no signs of improvement by late 2024, it would be considered a dog.

Identifying these dogs is crucial for strategic resource allocation, allowing ACC to focus on more promising areas of its business. For instance, divesting an underperforming regional distribution hub that incurred 15% higher operational costs per unit in 2024 than a comparable facility could free up capital.

ACC's older manufacturing plants, operating at lower capacity and higher costs, are prime examples of dogs. If a specific plant incurred a net loss of INR 50 million in 2024, it clearly signals its dog status.

| Category | Characteristics | Example for ACC (Illustrative) | Potential Action |

|---|---|---|---|

| Dogs | Low Market Share, Low Market Growth | Legacy cement product with declining demand; Underperforming manufacturing plant with low capacity utilization (e.g., 60% vs. industry 85% in 2024) | Divestiture, Restructuring, Harvest |

| Dogs | Low Profitability, High Costs | Regional distribution hub with high operational expenses (e.g., 15% higher than peers in 2024); Outdated kiln technology with high specific energy consumption (e.g., exceeding industry benchmarks by 10% in 2023) | Divestiture, Restructuring |

| Dogs | Stagnant Niche Markets | Specialty cement for a very small, non-growing market segment (e.g., 0.5% market share in a 1% growth segment in 2023) | Divestiture, Minimal Investment |

Question Marks

Emerging green technologies, such as Carbon Capture and Utilization (CCU), represent a significant investment area for ACC as it pursues its net-zero emissions goal by 2050. These technologies are positioned as potential Stars or Question Marks within the BCG matrix due to their high long-term growth prospects in developing negative carbon materials. For instance, the global carbon capture market is projected to reach $7.5 billion by 2027, indicating substantial future demand.

However, CCU technologies currently demand considerable upfront investment in research and development, placing them in the Question Mark category. While they hold promise for future market leadership, they may not yet possess a significant market share or generate immediate, substantial returns. This necessitates careful strategic evaluation of the R&D spend versus the potential future market penetration and profitability.

ACC's new digital service offerings for builders and contractors, like the NexGen Sales & Reward Platform and AI/IoT-enhanced customer service, are positioned as question marks in the BCG matrix. While this segment represents a burgeoning market, potentially worth billions globally by 2025, ACC's current market share and revenue from these specific digital solutions may be modest. This necessitates substantial investment to cultivate these offerings into future market leaders.

ACC's Green Building Centres (GBCs) are a prime example of a potential Star in the BCG Matrix, focusing on the burgeoning market for sustainable construction. These centers champion affordable and eco-friendly home building, tapping into a sector experiencing significant growth as environmental consciousness rises. For instance, the global green building market was valued at approximately $297.5 billion in 2023 and is projected to reach $773.8 billion by 2030, demonstrating a robust compound annual growth rate (CAGR) of 14.6%.

While the GBCs align with this high-growth trend, their commercial viability and profitability may still be in nascent stages. This suggests they require ongoing investment to scale operations and enhance their market penetration. The early-stage nature means that while the potential is high, the current market share and revenue generation might not yet reflect this potential, necessitating strategic resource allocation to nurture this promising venture.

High-Strength and Specialised Paver Blocks/Precast Solutions

ACC's high-strength paver blocks and precast boundary walls are specialized offerings designed for demanding applications. Their inherent durability and rapid installation provide significant advantages in projects requiring robust and efficient construction solutions. For instance, precast boundary walls can reduce on-site labor by up to 30% compared to traditional brickwork, a key factor in project timelines and cost-effectiveness.

While these products address a growing niche in specialized construction, their market penetration might be less extensive than ACC's foundational cement business. This suggests a potential for growth, but it necessitates targeted marketing and distribution strategies to build greater market awareness and encourage wider adoption among developers and contractors.

- Product Advantage: High-strength paver blocks and precast boundary walls offer superior durability and faster installation times, reducing project overheads.

- Market Niche: These solutions cater to specialized construction demands, indicating a focused market segment with growth potential.

- Strategic Focus: Increased market share requires dedicated marketing and distribution efforts to overcome potential lower initial adoption rates compared to core cement products.

- Growth Opportunity: The specialized nature of these products presents an opportunity for ACC to capture value in segments requiring high-performance building materials.

Geographical Expansion into Untapped or Under-penetrated Markets

ACC's strategic capacity expansions, such as the new integrated cement plant in West Bengal with a capacity of 2.2 million tonnes per annum (MTPA) and a grinding unit in Odisha with 1 MTPA capacity, directly target regions with lower per capita cement consumption. These areas represent significant untapped potential for growth.

Entering these under-penetrated markets requires considerable upfront investment. ACC must build robust distribution networks and enhance brand visibility to compete effectively. For instance, in fiscal year 2023, ACC reported a consolidated revenue of INR 17,797 crore, and further investment in these new markets will impact profitability in the short term.

- Targeting regions with lower per capita cement consumption, such as parts of Eastern and Northeastern India.

- Investing in establishing strong distribution channels and brand recognition in these new territories.

- Anticipating lower initial market share but high long-term growth potential in these under-penetrated markets.

- Balancing investment needs with the potential for increased market share and revenue generation as these markets mature.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to develop their potential, and their future success is uncertain. ACC's focus on emerging green technologies and new digital services exemplifies this category, demanding careful strategic allocation of resources to foster growth.

These areas often involve substantial research and development costs and may not yet generate significant revenue, making their future market position a critical question. For example, the global carbon capture market's projected growth highlights the potential, but the current investment needs place CCU firmly in the Question Mark quadrant.

ACC's strategic capacity expansions into under-penetrated markets also carry Question Mark characteristics. While these regions offer high long-term growth prospects, the initial investment in distribution and brand building, coupled with potentially low initial market share, necessitates a cautious yet committed approach to achieve future market leadership.

| Business Unit/Product | Industry Growth Rate | Current Market Share | Investment Need | Strategic Outlook |

|---|---|---|---|---|

| Carbon Capture & Utilization (CCU) | High | Low | High (R&D) | Potential future leader, requires significant investment |

| Digital Service Offerings (NexGen, AI/IoT) | High | Low | High | Needs cultivation to become market leaders |

| Capacity Expansion in Under-penetrated Markets | High | Low | High (Distribution, Brand) | Long-term growth potential, requires market development |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and competitive analysis to provide a comprehensive view of product portfolio performance.