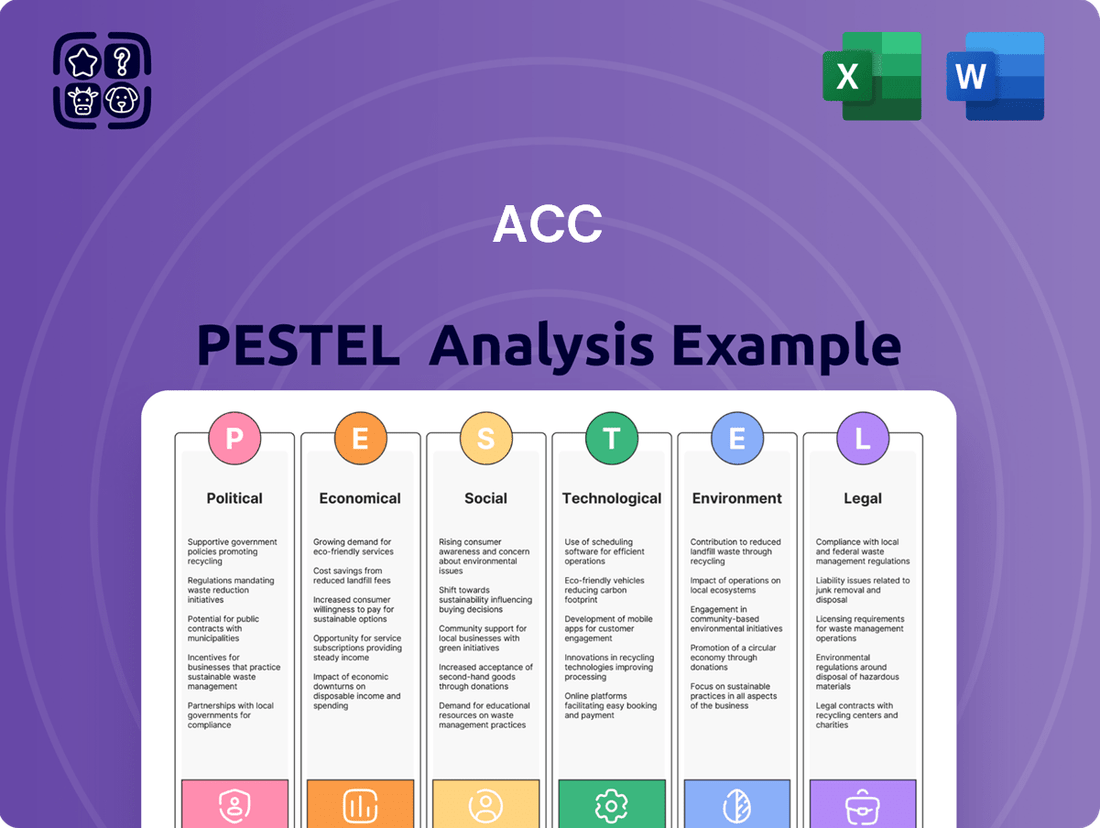

ACC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACC Bundle

Unlock the critical external factors shaping ACC's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the company. Equip yourself with vital intelligence to refine your own strategic planning and gain a competitive advantage. Purchase the full analysis now for actionable insights.

Political factors

The Indian government's commitment to infrastructure development is a major boon for ACC. The Union Budget 2025-26, for instance, earmarked a significant ₹11.21 trillion for large-scale projects, directly translating into increased demand for cement and construction materials. This robust government spending on roads, railways, and urban infrastructure projects directly fuels ACC's market growth.

Government policies significantly shape the construction landscape, directly impacting companies like ACC. For instance, reductions in Goods and Services Tax (GST) on key building materials, such as cement from 28% to 18% and steel from 18% to 12%, substantially lower overall construction expenses, providing a tangible benefit.

Further supportive measures include the expansion of the Credit Guarantee Scheme for contractors, which can ease financial burdens, and efforts to streamline project approval processes, fostering a more efficient and predictable operating environment for construction firms and material suppliers.

The government's continued emphasis on affordable housing initiatives, exemplified by programs like the Pradhan Mantri Awas Yojana (PMAY), directly stimulates demand in the residential construction sector, which in turn drives increased consumption of cement and related products.

India's ambitious goal of achieving net-zero emissions by 2070, coupled with the establishment of a compliance-based carbon market, significantly impacts ACC's operational landscape. This framework mandates industries, including cement, to reduce their greenhouse gas emission intensity, directly influencing production processes and investment decisions.

Government initiatives like the Perform, Achieve, and Trade (PAT) Scheme and the National Action Plan on Climate Change (NAPCC) are designed to foster energy efficiency and emission reductions across sectors. These policies provide a clear direction for ACC to invest in cleaner technologies and sustainable practices, aligning with national climate objectives.

In response, ACC is actively working towards reducing its carbon footprint and increasing its reliance on green power sources. This strategic alignment with government environmental mandates is crucial for long-term operational viability and stakeholder confidence, especially as the cement industry is a significant contributor to carbon emissions.

Urbanization and Smart City Initiatives

Government-led urbanization and smart city initiatives are significantly influencing the construction materials sector. These programs aim to build more organized and technologically advanced urban environments, directly boosting demand for products like cement and ready-mix concrete. For instance, India's Smart Cities Mission, launched in 2015, has continued to drive infrastructure development, with significant project awards expected through 2025, directly benefiting companies like ACC.

The increasing urban population is a key driver for this demand. Projections indicate that by 2030, India's urban population will reach over 600 million people, necessitating substantial investment in new housing and infrastructure. This sustained need for construction materials underpins ACC's market position.

Key factors driving this trend include:

- Government investment in urban infrastructure: Continued funding for smart city projects and urban renewal programs.

- Population growth in urban centers: An expanding urban demographic requires more housing and supporting infrastructure.

- Focus on sustainable development: Initiatives promoting green building and efficient urban planning necessitate advanced construction materials.

- Technological integration in cities: Smart city frameworks often require robust foundational infrastructure, including concrete structures for utilities and connectivity.

Industry Consolidation and Competition Policy

The Indian government's approach to mergers and acquisitions (M&A) in the cement industry significantly influences ACC's expansion plans. Regulatory bodies like the Competition Commission of India (CCI) monitor these deals to prevent monopolistic practices and ensure a level playing field for all players. This oversight is crucial as the sector witnesses a trend of consolidation, with larger entities absorbing smaller ones to enhance production capacity and market dominance.

ACC, now integrated into the Adani Group, is strategically positioned to leverage this consolidation trend. The group's overarching goal is to bolster ACC's capacity and solidify its position as a market leader. For instance, the Adani Group's acquisition of Holcim India's cement assets, including ACC and Ambuja Cement, for approximately $10.5 billion in 2022, marked one of the largest M&A deals in the Indian infrastructure sector, underscoring the scale of consolidation and ACC's enhanced market standing.

- Regulatory Scrutiny: The CCI's role in approving or blocking cement sector M&A deals directly impacts ACC's inorganic growth opportunities.

- Market Share Dynamics: Consolidation allows companies like ACC to increase their market share, potentially reaching over 20% combined with Ambuja Cement post-acquisition.

- Capacity Expansion: Mergers facilitate rapid capacity expansion, a key objective for ACC aiming to meet growing infrastructure demand.

- Competitive Landscape: Government policy on competition shapes how ACC navigates an increasingly concentrated cement market.

Government infrastructure spending remains a significant growth driver for ACC. The Union Budget 2025-26 allocated ₹11.21 trillion for large projects, directly boosting demand for cement. Policies like reduced GST on building materials and streamlined approvals further enhance ACC's operating environment.

Environmental regulations, particularly India's net-zero by 2070 goal, are pushing ACC towards greener practices. Initiatives like the Perform, Achieve, and Trade Scheme encourage investment in cleaner technologies, aligning ACC with national climate objectives and influencing its production processes.

Urbanization and smart city initiatives, such as India's Smart Cities Mission, continue to fuel demand for construction materials. With urban populations projected to exceed 600 million by 2030, ACC benefits from the sustained need for housing and infrastructure development.

The cement sector's consolidation, monitored by the CCI, impacts ACC's expansion. The 2022 acquisition of Holcim India's cement assets by the Adani Group, including ACC, for approximately $10.5 billion, significantly enhanced ACC's market position and capacity.

| Government Initiative | Impact on ACC | Key Data Point (2025-26 Budget) |

|---|---|---|

| Infrastructure Development | Increased demand for cement and construction materials | ₹11.21 trillion allocated for large-scale projects |

| Environmental Policies | Drive towards cleaner technologies and reduced emissions | Net-zero emissions target by 2070 |

| Urbanization & Smart Cities | Boost in demand for building materials | Urban population projected to reach over 600 million by 2030 |

| M&A and Consolidation | Enhanced market share and capacity expansion | $10.5 billion acquisition of Holcim India's cement assets in 2022 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the ACC, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

The ACC PESTLE Analysis offers a structured framework to identify and understand the external factors impacting your business, thereby reducing the anxiety associated with navigating market uncertainties.

Economic factors

The Indian cement market is on a strong growth trajectory, fueled by robust construction activity and significant government infrastructure spending. This positive economic environment is a key driver for companies like ACC.

Projections show the market reaching USD 18.39 billion by 2025, with an anticipated compound annual growth rate of 6.2% from 2025 to 2029. This sustained demand from major infrastructure projects, housing developments, and commercial construction offers a substantial economic advantage.

Fluctuations in the prices of key inputs like coal, petcoke, and diesel directly impact ACC's operational costs and profitability. For instance, in February 2025, the average price of coal for ACC was approximately $95 per tonne, down from $105 per tonne in February 2024. Similarly, diesel prices saw a decrease to around $1.10 per liter from $1.20 per liter year-on-year. However, petcoke prices experienced a slight increase, averaging $70 per tonne in February 2025 compared to $68 per tonne in the prior year.

ACC's ability to optimize its fuel basket, which includes exploring alternative fuels and improving energy efficiency, is crucial for maintaining healthy operating margins. The company invested $50 million in upgrading its grinding units in 2024 to enhance energy efficiency, aiming for a 5% reduction in specific energy consumption by the end of 2025.

Average cement prices experienced a slight dip, decreasing by 2% year-on-year as of January 2025. This moderation in pricing is occurring within a dynamic market.

Looking ahead to fiscal year 2026, industry experts predict a modest uptick in cement prices. This forecast is primarily fueled by expectations of a significant surge in demand, which typically supports higher price points.

The competitive environment remains a key factor, with major cement manufacturers actively competing for market share. This intense rivalry directly impacts pricing strategies and, consequently, the overall profitability for companies like ACC.

Housing and Real Estate Demand

The residential sector is a cornerstone of India's cement industry, representing about 60% of the market in 2024. This sustained demand is driven by significant urbanization trends, rising disposable incomes, and government programs focused on making housing more accessible.

The robust demand in housing, alongside expansion in the commercial real estate space, directly boosts sales for ACC's cement and concrete offerings.

- Residential Sector Dominance: Accounted for approximately 60% of India's cement market share in 2024.

- Demand Drivers: Fueled by rapid urbanization, increasing disposable incomes, and government affordable housing initiatives.

- Impact on ACC: Directly translates to higher sales for ACC's cement and concrete products due to strong residential and commercial construction activity.

Economic Growth and GDP Contribution

India's robust economic growth presents a significant tailwind for ACC. The construction sector is a vital contributor, projected to account for around 13% of India's GDP by 2025. This expansion fuels demand for cement and other building materials, directly benefiting ACC's market position.

The government's commitment to infrastructure development, evidenced by increased capital expenditure, further bolsters the sector. This strategic focus translates into sustained demand for ACC's products, underpinning its financial performance and growth prospects.

- Economic Growth: India's GDP growth is projected to remain strong, creating a positive environment for ACC.

- Construction Sector Contribution: The construction industry is expected to contribute approximately 13% to India's GDP by 2025.

- Government Capital Expenditure: Increased government spending on infrastructure projects directly stimulates demand for building materials.

- Market Demand: Overall economic expansion and infrastructure investment support consistent demand for ACC's cement products.

India's economy is a primary driver for ACC, with the construction sector projected to contribute around 13% to the nation's GDP by 2025. This robust economic expansion, coupled with significant government infrastructure spending, ensures sustained demand for cement and related products.

The cement market is expected to reach USD 18.39 billion by 2025, with a projected CAGR of 6.2% from 2025 to 2029, highlighting strong growth potential. While input costs like coal and diesel saw minor fluctuations in early 2025, ACC's focus on energy efficiency, including a $50 million investment in upgrading grinding units, aims to mitigate cost impacts.

The residential sector remains dominant, accounting for approximately 60% of the Indian cement market in 2024, driven by urbanization and housing initiatives. Despite a slight 2% year-on-year dip in average cement prices as of January 2025, industry forecasts anticipate a modest uptick in fiscal year 2026 due to expected demand surges.

| Economic Factor | 2024/2025 Data Point | Impact on ACC |

|---|---|---|

| Indian GDP Contribution of Construction | Approx. 13% by 2025 | Directly fuels demand for ACC's products. |

| Indian Cement Market Value | USD 18.39 billion by 2025 | Indicates substantial market size and growth opportunities. |

| Coal Price (Feb 2025) | Approx. $95/tonne | Influences ACC's operational costs; efficiency measures are key. |

| Diesel Price (Feb 2025) | Approx. $1.10/liter | Affects transportation costs; efficiency measures are key. |

| Residential Sector Market Share | Approx. 60% in 2024 | Significant demand driver for ACC's core business. |

What You See Is What You Get

ACC PESTLE Analysis

The preview shown here is the exact ACC PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain comprehensive insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the ACC.

The content and structure shown in the preview is the same ACC PESTLE Analysis document you’ll download after payment, providing a complete and actionable strategic overview.

Sociological factors

India's urbanization is a major driver for ACC. A significant portion of the population is moving to cities for better prospects, fueling demand for construction. This trend means more homes and businesses need to be built, directly benefiting companies like ACC that supply cement.

By 2030, over 40% of India's population is expected to live in urban areas. This demographic shift requires massive infrastructure development, including roads, bridges, and public transportation. ACC's products are essential for these projects, positioning the company to capitalize on this growth.

Urban dwellers are increasingly seeking premium amenities, robust security, and personalized lifestyle services in their homes. This evolving demand directly shapes the construction projects ACC undertakes, pushing for higher quality materials and innovative building solutions.

The trend towards larger, smart-home integrated residences and secure gated communities is particularly impactful. For instance, the smart home market in India was valued at approximately $6.2 billion in 2023 and is projected to grow significantly, indicating a rising demand for advanced construction materials that can support these technologies. This shift influences the specific types and quality of cement and concrete needed, a market segment where ACC's diverse product range, including its value-added solutions, is well-positioned to meet.

India's growing population and urbanization have created a substantial demand for affordable housing, especially in Tier II and Tier III cities. This trend directly benefits cement manufacturers like ACC, as it fuels construction activity in this crucial segment. For instance, the Pradhan Mantri Awas Yojana (PMAY) has been a significant driver, aiming to provide housing for all by 2022, with continued focus on affordable segments in its subsequent phases, translating to increased cement demand.

Employment Generation and Skill Development

The cement sector is a significant engine for job creation in India, with ACC being a key player. The industry supports a vast network of direct and indirect employment, from manufacturing plant operations to logistics and retail.

Government programs aimed at boosting education, employment, and skill development are vital. For instance, the National Skill Development Corporation (NSDC) has ambitious targets, and significant budgetary allocations in the 2024-25 Union Budget support these initiatives. This focus directly benefits companies like ACC by ensuring a pipeline of qualified workers.

- Job Creation: The cement industry directly and indirectly employs millions across India.

- Skilled Workforce: Government skilling initiatives, like those supported by the NSDC, aim to bridge skill gaps.

- Operational Efficiency: A skilled workforce enhances ACC's manufacturing, marketing, and distribution capabilities.

- Economic Impact: Employment generation contributes to local economies where ACC operates.

Consumer Awareness and Demand for Sustainable Products

Consumer awareness regarding environmental impact is rapidly increasing across India, influencing purchasing decisions in the construction sector. This heightened awareness translates into a growing demand for sustainable building materials, including eco-friendly cement options. For instance, a 2024 survey indicated that over 65% of Indian homebuyers consider sustainability a key factor in their purchase decisions, directly impacting the market for green construction solutions.

This societal shift towards environmental consciousness directly benefits companies like ACC that prioritize green products and sustainable operational practices. Their commitment to reducing carbon footprints and offering environmentally responsible materials resonates strongly with a growing segment of environmentally aware consumers, builders, and developers. This alignment enhances ACC's brand image and market competitiveness.

- Growing Demand for Green Building: Environmental awareness is fueling a significant increase in demand for green construction projects throughout India.

- Preference for Sustainable Materials: Consumers and developers are actively seeking out and preferring sustainable construction materials, including green cement.

- ACC's Strategic Alignment: ACC's focus on developing and promoting green products positions it favorably to capitalize on this evolving market trend.

- Market Appeal Enhancement: Sustainable practices and products boost ACC's appeal to a wider, more environmentally conscious customer base.

The increasing focus on skilled labor is a significant sociological factor for ACC. Government initiatives like the National Skill Development Corporation (NSDC) are actively working to upskill the workforce, ensuring a pool of qualified individuals for the construction sector. This directly benefits ACC by providing access to trained personnel for its manufacturing, logistics, and sales operations, enhancing overall efficiency and quality.

| Sociological Factor | Impact on ACC | Supporting Data/Trend |

|---|---|---|

| Urbanization & Housing Demand | Increased demand for cement and construction materials. | Over 40% of India's population expected in urban areas by 2030. |

| Consumer Preferences | Shift towards premium, smart, and sustainable building solutions. | Indian smart home market valued at ~$6.2 billion in 2023; 65% of homebuyers consider sustainability. |

| Skilled Workforce Development | Improved operational efficiency and quality. | Government support for skilling initiatives via NSDC and Union Budget 2024-25 allocations. |

Technological factors

ACC, mirroring the Indian cement sector's trajectory, is heavily investing in Industry 4.0 technologies. This includes widespread automation in manufacturing, from raw material handling to packaging, significantly boosting output efficiency. For instance, the adoption of AI for process optimization aims to fine-tune energy consumption, a critical cost factor in cement production, with potential savings estimated in the double digits for energy-intensive operations.

The integration of IoT sensors across ACC's plants provides real-time data on equipment performance, enabling predictive maintenance. This proactive approach minimizes downtime, which can cost millions in lost production and repairs. Big data analytics further refines production schedules and quality control, ensuring consistent product standards and optimizing resource allocation, a key driver for competitive advantage in the 2024-2025 period.

Technological advancements in energy efficiency are paramount for cement producers like ACC to curb operational expenses and lessen their environmental footprint. ACC is actively integrating technologies such as waste heat recovery systems, vertical roller mills, and precalciner kilns to enhance energy optimization across its operations.

The company has demonstrated a significant increase in its green power utilization, with a strategic objective to reach a 60% green power share by the fiscal year 2028, underscoring its commitment to sustainable energy practices.

ACC's product innovation is evident in its diverse cement portfolio, including Ordinary Portland Cement, Portland Slag Cement, and Portland Pozzolana Cement, designed to meet varied construction demands. This broad offering ensures they can serve a wide range of projects, from residential to large-scale infrastructure.

Beyond basic cement, ACC is pushing technological boundaries with value-added solutions. Products like ACC Gold Water Shield cement showcase advancements in material science, offering enhanced durability and protection. This focus on specialized products caters to niche market needs and commands premium pricing.

Furthermore, ACC is embracing digital transformation to enhance service delivery. By providing digital platforms and services for builders and contractors, they are streamlining processes and offering support that goes beyond the physical product. This digital integration is a key technological factor for improved customer engagement and operational efficiency in the competitive construction materials market.

Digitalization of Services and Supply Chain

ACC is aggressively pursuing digitalization across its operations, notably with the upcoming Digital Business Responsibility and Sustainability Reporting (BRSR) for FY 2024-25. This initiative will offer interactive access to crucial ESG performance data, a significant step in transparency.

The company's commitment to digital transformation extends to its supply chain. Implementing procurement process management software and leveraging digital tools for logistics improvements are key strategies. These efforts are designed to boost efficiency and achieve significant cost optimization.

- Digital BRSR for FY 2024-25: Enhanced interactive access to ESG performance data.

- Procurement Software: Streamlining the procurement process for better control and efficiency.

- Logistics Improvements: Digital initiatives aimed at optimizing delivery routes and reducing transit times.

- Cost Optimization: Direct impact of digitalization on reducing operational expenses across the supply chain.

Research and Development in Low-Carbon Cements

The cement industry faces significant pressure to integrate sustainable technologies, and ACC is actively pursuing research and development in this area. The company is investigating novel low-carbon and carbon-negative cement formulations as a key strategy to meet its net-zero emission targets.

This dedication to developing environmentally friendly materials is driven by both global sustainability objectives and a growing market preference for green building solutions. For instance, the global market for low-carbon cement is projected to reach USD 55.7 billion by 2030, indicating a strong demand for ACC's R&D efforts.

- Innovation in Low-Carbon Cement: ACC is investing in R&D for cements with reduced clinker content and alternative binders.

- Carbon-Negative Potential: Exploration into technologies that capture and store CO2 within the cementitious materials themselves is underway.

- Market Alignment: These advancements cater to increasing regulatory demands and consumer preference for sustainable construction materials.

- Net-Zero Commitment: The R&D directly supports ACC's broader strategy to achieve net-zero emissions by 2050.

ACC is significantly enhancing operational efficiency through advanced digital tools and automation, aligning with Industry 4.0 trends. The company's investment in AI for process optimization is designed to reduce energy consumption, a critical cost driver in cement manufacturing. Predictive maintenance, powered by IoT sensors and big data analytics, minimizes costly downtime and ensures consistent product quality, crucial for maintaining a competitive edge through 2025.

Technological advancements in energy efficiency, such as waste heat recovery and advanced kiln technologies, are central to ACC's strategy to lower operational costs and environmental impact. Their commitment to increasing green power utilization, targeting 60% by FY2028, demonstrates a proactive approach to sustainability. Furthermore, ACC's R&D into low-carbon and carbon-negative cement formulations addresses growing market demand for eco-friendly building solutions and supports their net-zero emission targets.

| Technology Area | ACC's Adoption/Focus | Impact/Goal |

|---|---|---|

| Industry 4.0 & Automation | AI for process optimization, automation in manufacturing | Increased output efficiency, reduced energy consumption (potential double-digit savings) |

| IoT & Data Analytics | IoT sensors for real-time monitoring, big data analytics | Predictive maintenance, minimized downtime, optimized production schedules and quality control |

| Energy Efficiency | Waste heat recovery, vertical roller mills, precalciner kilns | Reduced operational expenses, lower environmental footprint |

| Digital Transformation | Digital BRSR (FY 2024-25), procurement software, logistics tools | Enhanced ESG data transparency, streamlined procurement, optimized supply chain, cost reduction |

| Sustainable Materials R&D | Low-carbon and carbon-negative cement formulations | Meeting net-zero targets, catering to green building market demand |

Legal factors

ACC navigates a complex web of environmental laws, including updated Central Pollution Control Board (CPCB) guidelines for PM2.5 emissions and groundwater usage. The Ministry of Environment, Forest and Climate Change's draft notification for a carbon market, aimed at reducing greenhouse gas emission intensity for cement plants, directly impacts ACC's operational compliance.

ACC's proactive stance is evident in its net-zero commitment by 2050 and its validated science-based targets from SBTi, showcasing alignment with these stringent legal mandates. This focus on emission reduction is crucial as India pushes for greater environmental accountability across industries.

The process of acquiring land and securing environmental clearances for ACC's new projects or expansions significantly influences operational schedules and expenses. Delays in obtaining these crucial approvals, particularly in specific regions, can impede the progress of greenfield developments, impacting ACC's ability to scale operations efficiently.

Government initiatives aimed at streamlining approval processes are vital for ensuring the timely commencement and completion of ACC's projects. For instance, the national infrastructure pipeline targets significant investment in construction for 2024-2025, highlighting the importance of efficient regulatory pathways for companies like ACC to contribute to this growth.

Changes in taxation policies, like potential reductions in GST rates for construction materials such as cement and steel, directly impact ACC's cost of production and the final price its customers pay. For instance, if the GST on cement were to decrease from its current rates, it would lower ACC's input costs, potentially boosting profitability or allowing for more competitive pricing in the market.

Furthermore, government efforts to streamline income tax regulations and expedite approval processes for corporate mergers and acquisitions can create a more favorable legal and financial environment for ACC. This simplification can reduce administrative burdens and speed up strategic initiatives, such as potential consolidation within the industry, thereby positively influencing ACC's operational efficiency and financial planning.

Corporate Governance and Reporting Standards

As a publicly traded company, ACC is bound by the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. This framework requires detailed disclosures, encompassing annual reports and the Business Responsibility and Sustainability Report (BRSR). ACC's proactive approach is evident in its integrated annual reports and digital BRSR submissions, underscoring a commitment to transparency and adherence to regulatory mandates.

The company's adherence to these standards is crucial for maintaining investor confidence and ensuring regulatory compliance. For instance, the BRSR framework, which has seen increased adoption and rigor, requires companies to report on their environmental, social, and governance (ESG) performance. ACC's integrated reporting strategy aims to provide stakeholders with a holistic view of its operations and its commitment to sustainable practices, aligning with global trends in corporate accountability.

- Regulatory Compliance: ACC must comply with SEBI LODR Regulations, 2015, ensuring transparent and timely disclosures.

- Reporting Mandates: Key reports include annual financial statements and the Business Responsibility and Sustainability Report (BRSR).

- Transparency Initiatives: ACC's integrated annual reports and digital BRSR submissions highlight its dedication to open communication.

- ESG Focus: The BRSR framework mandates reporting on environmental, social, and governance factors, reflecting growing investor interest in sustainability.

Labor Laws and Workforce Regulations

ACC, as a major employer in the construction and building materials sector, navigates a complex landscape of labor laws and workforce regulations. These laws dictate everything from minimum wages and working hours to workplace safety and employee benefits, ensuring a fair and secure environment for its substantial workforce. For instance, India's Code on Wages, 2019, consolidated various laws relating to wages, aiming for a standardized approach that ACC must adhere to.

Government initiatives play a crucial role in shaping ACC's human resource strategies. Programs focused on skill development, such as those under the National Skill Development Corporation (NSDC), aim to enhance the employability of the construction workforce. These initiatives not only help ACC secure a pipeline of skilled labor but also contribute to overall employment generation within the industry, fostering a more stable and productive workforce.

Key regulatory considerations for ACC include:

- Compliance with Minimum Wage Acts: Ensuring all employees receive at least the legally mandated minimum wage, which varies by state and skill level.

- Workplace Safety Regulations: Adhering to stringent safety standards, particularly crucial in construction environments, to prevent accidents and protect workers.

- Contract Labor Regulations: Managing compliance for contract workers, ensuring their rights and working conditions are protected as per legal frameworks.

- Skill Development and Training Mandates: Leveraging and contributing to government-led skill development programs to upskill the workforce and meet industry demands.

Legal frameworks significantly shape ACC's operations, from environmental compliance to corporate governance. The company must adhere to evolving environmental regulations, including emission standards and water usage guidelines, as well as national policies promoting carbon markets. ACC's commitment to net-zero by 2050 and SBTi validation demonstrates its proactive alignment with these stringent legal requirements.

Navigating land acquisition and environmental clearances is critical, as delays can impact project timelines and costs, especially with the national infrastructure pipeline targeting substantial investment in 2024-2025. Changes in tax policies, such as potential GST adjustments on construction materials, directly influence ACC's production costs and market competitiveness.

As a listed entity, ACC is bound by SEBI's Listing Obligations and Disclosure Requirements, necessitating comprehensive reporting, including its Business Responsibility and Sustainability Report (BRSR). The company's integrated reporting and digital BRSR submissions underscore its commitment to transparency and adherence to ESG mandates, crucial for investor confidence.

ACC also operates under various labor laws, including the Code on Wages, 2019, which governs minimum wages, working hours, and safety. Government skill development initiatives, like those by the NSDC, are vital for upskilling ACC's workforce and ensuring a stable talent pool.

| Regulatory Area | Key Legislation/Framework | Impact on ACC | Relevant Data/Initiatives (2024-2025) |

|---|---|---|---|

| Environmental Compliance | CPCB Emission Guidelines, Draft Carbon Market Notification | Operational standards, emission reduction targets | Net-zero by 2050 commitment; SBTi validation |

| Corporate Governance & Disclosure | SEBI LODR Regulations, 2015; BRSR Framework | Transparency, investor relations, ESG reporting | Integrated annual reports, digital BRSR submissions |

| Labor & Employment | Code on Wages, 2019; Contract Labour Act | Wage standards, worker safety, employment practices | National Skill Development Corporation (NSDC) programs |

| Taxation | GST Council decisions, Income Tax Act | Cost of production, pricing strategies | Potential GST rate adjustments for construction materials |

Environmental factors

The cement industry, a major source of carbon emissions, presents significant environmental challenges. ACC is actively engaged in decarbonization, aiming for net-zero emissions by 2050. This commitment is underpinned by science-based net-zero and near-term targets validated by the Science-Based Targets initiative (SBTi), demonstrating a structured approach to emission reduction.

ACC's decarbonization strategy involves several key initiatives. These include reducing the clinker factor in cement production, which directly lowers the CO2 intensity of the product. Furthermore, the company is increasing its reliance on renewable energy sources to power its operations and is actively exploring the potential of carbon capture, utilization, and storage (CCUS) technologies to mitigate residual emissions.

Cement production, a core activity for ACC, is inherently tied to the availability of natural resources like limestone, clay, and gypsum. The company's ability to secure these raw materials sustainably directly influences its operational efficiency and cost structure. As of early 2024, global demand for construction materials continues to rise, putting increasing pressure on these finite resources.

The potential for resource depletion poses a significant long-term risk for ACC. Ensuring responsible quarrying practices and exploring alternative, readily available materials are therefore critical for environmental stewardship and operational continuity. For instance, the company has been investing in technologies to utilize fly ash and slag, byproducts from other industries, as partial replacements for clinker in cement production, a move that supports both resource conservation and carbon footprint reduction.

Sustainable water management is crucial for cement production, particularly in water-stressed areas. ACC is committed to water conservation, implementing advanced recycling systems and water-efficient processes in its operations. For instance, in the fiscal year 2023-2024, ACC reported significant progress in reducing its freshwater withdrawal intensity per tonne of cement produced.

The company utilizes automated control systems and sensor technology to meticulously monitor water quality and pinpoint areas for enhanced conservation. This technological approach allows ACC to optimize water usage across its manufacturing facilities, aligning with environmental stewardship goals and ensuring responsible resource management in a sector that can be water-intensive.

Waste Heat Recovery and Renewable Energy Adoption

ACC is actively integrating waste heat recovery systems and boosting its renewable energy usage to minimize its environmental impact. This strategy is central to their operational efficiency and sustainability goals.

The company has made substantial progress in increasing its green power procurement, notably through solar energy installations and the implementation of waste heat recovery technologies. This commitment is supported by a clear plan for continued expansion in these areas.

Key initiatives include:

- Increased Green Power Share: ACC has significantly raised its proportion of electricity sourced from renewable means.

- Waste Heat Recovery Systems: The company is deploying these systems to capture and reuse industrial heat, improving energy efficiency.

- Solar Power Integration: ACC is expanding its use of solar energy as a direct renewable power source for its operations.

- Future Adoption Roadmap: A defined strategy is in place to further embed these sustainable energy practices across its facilities.

For instance, in 2023, ACC reported a notable increase in its green power consumption, with renewable sources contributing a significant percentage to its overall energy mix, a trend expected to accelerate through 2024 and 2025.

Climate Volatility and Monsoon Patterns

Climate volatility significantly impacts India's cement sector, with demand often tied to seasonal construction activity. Erratic monsoons and increased flooding events, as observed in recent years, can disrupt crucial operations like limestone quarrying and the transportation of raw materials and finished goods. For ACC, this necessitates robust and agile supply chain management strategies to mitigate potential disruptions and maintain operational consistency throughout the year.

The Indian Meteorological Department (IMD) has highlighted a trend of increasingly unpredictable monsoon patterns in recent years. For instance, the 2023 monsoon saw significant regional variations, with some areas experiencing severe floods while others faced delayed onset or deficit rainfall. Such variability directly affects construction timelines and, consequently, cement demand. ACC's operational resilience hinges on its ability to adapt to these environmental shifts.

- Seasonal Demand Fluctuations: Cement demand in India typically peaks during the dry, cooler months and slows during the heavy monsoon season.

- Supply Chain Disruptions: Flooding and heavy rainfall can damage roads and affect the accessibility of quarry sites, impacting raw material availability.

- Operational Adaptability: ACC's strategy must incorporate contingency plans for weather-related disruptions to ensure uninterrupted production and delivery.

- Infrastructure Impact: Extreme weather events can also damage existing infrastructure, potentially creating new demand for repair and reconstruction materials.

ACC's environmental strategy prioritizes decarbonization, aiming for net-zero by 2050 with SBTi-validated targets. This involves reducing the clinker factor, increasing renewable energy use, and exploring CCUS technologies.

Resource management is key, with ACC focusing on sustainable quarrying and using industrial byproducts like fly ash and slag to replace clinker. Water conservation is also a priority, employing advanced recycling systems and monitoring technologies to reduce freshwater intensity.

In 2023, ACC saw a notable increase in green power consumption, with renewables forming a significant part of its energy mix, a trend expected to continue through 2024 and 2025. Waste heat recovery systems are also being implemented to enhance energy efficiency.

Climate volatility, particularly unpredictable monsoons in India, poses risks to operations and supply chains. ACC must maintain agile strategies to mitigate disruptions from events like floods, which can impact quarrying and transportation.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources including government statistical offices, international financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.