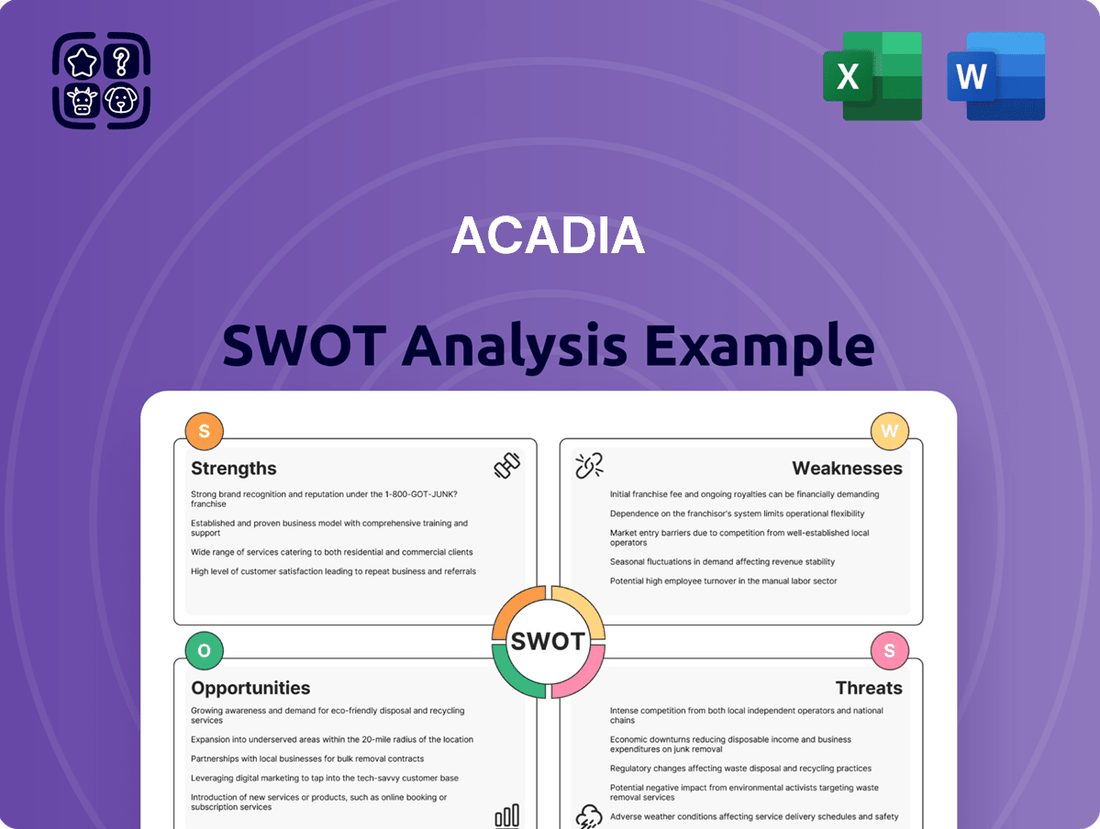

Acadia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

Acadia's strengths lie in its innovative product pipeline and strong brand recognition, but it faces challenges from intense market competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Acadia's market position, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Acadia Realty Trust's strength lies in its specialized, high-quality portfolio, primarily focusing on street retail and mixed-use properties in prime urban and suburban areas. This targeted approach fosters a deep understanding of specific market dynamics and tenant requirements, enabling superior performance in these niche segments.

The company's strategic emphasis on expanding its portfolio of top-tier retail assets in key U.S. retail corridors is a significant advantage. As of the first quarter of 2024, Acadia reported a robust portfolio occupancy rate of 96.2%, highlighting the desirability and stability of its curated holdings.

Acadia Realty Trust (AKR) has showcased impressive financial strength, with solid GAAP Net Earnings and Funds From Operations (FFO) reported in recent periods. This financial robustness is a key advantage for the company.

A significant driver of this performance is the growth in its same-property net operating income (NOI). For the fourth quarter of 2024, Acadia saw a 5.7% increase in Core Same-Property NOI, followed by a 4.1% rise in the first quarter of 2025. This growth is largely attributed to the strong performance of its street retail assets.

This consistent financial success isn't just on paper; it translates into tangible benefits for shareholders. The company's ability to generate strong cash flow allowed for a notable 5.3% increase in its quarterly dividend in the first quarter of 2025, demonstrating a commitment to returning value to its investors.

Acadia's disciplined capital deployment is a significant strength, evident in its strategic acquisition of approximately $611 million in Core and Investment Management assets during Q4 2024 and year-to-date 2025. This focused approach, with Acadia's pro-rata share totaling around $353 million, highlights a commitment to growth.

The company's investment strategy prioritizes high-growth markets, such as New York City's SoHo and Williamsburg, and Washington D.C.'s Georgetown. This targeted deployment not only expands Acadia's operational footprint but also bolsters its capacity to increase rental income.

Robust Balance Sheet and Liquidity

Acadia's financial health is a significant strength, characterized by a robust balance sheet and ample liquidity. This is clearly demonstrated by their pro-rata Net Debt-to-EBITDA ratio, which improved to 5.5x as of December 31, 2024, a notable decrease from 7.1x in 2023. Furthermore, the company enjoys considerable financial flexibility, with no major Core debt maturities scheduled until 2028. This strong financial footing and readily available capital are key advantages for pursuing future growth initiatives.

- Improved Leverage: Net Debt-to-EBITDA ratio reduced to 5.5x by end of 2024.

- Debt Maturity Profile: No significant Core debt maturities until 2028.

- Financial Flexibility: Strong balance sheet provides stability and access to capital.

Experienced Management and Investment Platform

Acadia Realty Trust benefits from a seasoned management team with a demonstrated history in real estate investment and operational execution. This experience is crucial for navigating complex market dynamics and identifying undervalued assets.

The company effectively utilizes its core fund platform alongside a suite of opportunistic and value-add funds. This dual approach enables strategic capital deployment, fostering long-term value creation and allowing Acadia to capitalize on nascent market trends.

- Proven Leadership: Acadia's management team has a consistent track record of success in the real estate sector.

- Diversified Investment Strategy: The combination of core and opportunistic funds provides flexibility and broad market access.

- Value Creation Focus: The platform is designed to identify and execute strategies that enhance asset value over time.

Acadia's specialized portfolio, heavily weighted towards high-quality street retail and mixed-use properties, provides a distinct competitive edge. This focus allows for deep market expertise and tenant understanding, leading to strong performance in its chosen segments.

The company's commitment to top-tier retail locations is evident in its robust occupancy rate, which stood at 96.2% as of Q1 2024. This high occupancy underscores the appeal and stability of its carefully selected assets.

Acadia's financial health is a significant strength, with a Net Debt-to-EBITDA ratio improving to 5.5x by the end of 2024, down from 7.1x in 2023. Coupled with no major Core debt maturities until 2028, this financial flexibility provides a solid foundation for future growth and stability.

| Metric | Q4 2024 | Q1 2025 |

|---|---|---|

| Core Same-Property NOI Growth | 5.7% | 4.1% |

| Portfolio Occupancy | 96.2% (as of Q1 2024) | N/A |

| Net Debt-to-EBITDA | 5.5x (as of Dec 31, 2024) | N/A |

What is included in the product

Analyzes Acadia’s competitive position through key internal and external factors.

Simplifies complex strategic thinking by clearly identifying internal and external factors, easing the burden of comprehensive analysis.

Weaknesses

Acadia's significant exposure to the retail real estate sector, even with its high-quality assets, presents a notable weakness due to the sector's inherent volatility. The company reported a decline in both occupancy and leasing rates across its retail properties in the first quarter of 2025, a trend attributed in part to prevailing market conditions.

This sensitivity means that even Acadia's prime retail locations are not immune to fluctuations in consumer confidence and spending habits, which can directly impact rental income and property valuations.

Geopolitical instability and trade disputes, including tariff wars, pose a significant risk to Acadia's retail portfolio. These tensions can directly affect tenant profitability and, consequently, their ability to meet lease obligations and drive demand for retail space.

Acadia's management is proactively addressing this by closely examining new lease agreements. They are specifically evaluating how potential tenants might be impacted by tariffs, with a particular focus on goods imported from China, indicating this is a tangible concern for the company's outlook.

Acadia's tourism-dependent revenue streams are still lagging behind pre-pandemic levels, impacting retail sales in its urban centers. For instance, while overall retail sales have shown resilience, the pace of recovery in areas heavily reliant on tourist foot traffic has been noticeably slower.

This slower rebound, particularly in international and domestic tourism, represents a potential headwind for some of Acadia's high-street retail properties. While not the sole determinant of success, a more robust tourism sector could unlock greater sales potential for these specific assets.

Competition in Prime Urban Corridors

Acadia's focus on prime urban retail, while a strength, also presents a significant weakness due to intense competition. Many investors are drawn to these prime corridors, driving up acquisition costs and narrowing potential profit margins. This heightened competition can make it challenging to secure desirable assets at favorable terms, impacting the overall deal spread for Acadia.

The thriving nature of urban retail investment means Acadia is constantly up against other well-capitalized entities vying for the same high-quality properties. For instance, in 2024, major global real estate investment firms continued to heavily invest in prime urban retail spaces across key cities like London, New York, and Paris, often leading to bidding wars and premium pricing. This dynamic directly affects Acadia's ability to acquire new assets efficiently and cost-effectively, potentially limiting portfolio growth or requiring higher capital outlays.

- Intensified Bidding Wars: The influx of investors into prime urban retail markets in 2024 and early 2025 has led to more frequent and aggressive bidding wars for desirable assets.

- Reduced Deal Spreads: Increased competition directly compresses the potential profit margins, or deal spreads, that Acadia can achieve on new acquisitions.

- Higher Acquisition Costs: The desirability of prime urban locations means that acquiring new, high-quality retail assets often comes with a premium price tag.

- Limited Availability of Prime Assets: The concentration of investor interest in these corridors can also lead to a scarcity of readily available, high-quality investment opportunities.

Rising Operating Expenses

Acadia Realty Trust has faced challenges with increasing operating expenses, particularly in property operations and real estate taxes. These rising costs can directly squeeze profit margins and impact overall financial performance. For instance, in 2023, property operating expenses represented a significant portion of their costs, and projections for 2024 indicate continued upward pressure on these expenditures due to inflation and increased service demands.

While Acadia's street retail segment is a key growth driver, the company must effectively manage these escalating costs across its entire portfolio. Failure to control these expenses can lead to a reduction in net operating income (NOI), which is a crucial metric for real estate investment trusts. The company's ability to offset these increases through rental growth and operational efficiencies will be critical in maintaining profitability.

- Increased Property Operating Expenses: Acadia has seen a consistent rise in the costs associated with managing its properties.

- Higher Real Estate Taxes: Property tax burdens have also contributed to the growing expense base.

- Impact on Profitability: These rising costs directly affect the company's ability to generate profits.

- Challenge in Managing Portfolio-Wide Costs: Ensuring cost control across all assets, including high-performing street retail, remains an ongoing operational hurdle.

Acadia's significant exposure to the retail real estate sector, even with its high-quality assets, presents a notable weakness due to the sector's inherent volatility. The company reported a decline in both occupancy and leasing rates across its retail properties in the first quarter of 2025, a trend attributed in part to prevailing market conditions. This sensitivity means that even Acadia's prime retail locations are not immune to fluctuations in consumer confidence and spending habits, which can directly impact rental income and property valuations.

Acadia's focus on prime urban retail, while a strength, also presents a significant weakness due to intense competition. Many investors are drawn to these prime corridors, driving up acquisition costs and narrowing potential profit margins. This heightened competition can make it challenging to secure desirable assets at favorable terms, impacting the overall deal spread for Acadia. For instance, in 2024, major global real estate investment firms continued to heavily invest in prime urban retail spaces across key cities, often leading to bidding wars and premium pricing, directly affecting Acadia's ability to acquire new assets efficiently.

Acadia Realty Trust has faced challenges with increasing operating expenses, particularly in property operations and real estate taxes. These rising costs can directly squeeze profit margins and impact overall financial performance. For instance, in 2023, property operating expenses represented a significant portion of their costs, and projections for 2024 indicate continued upward pressure on these expenditures due to inflation and increased service demands, impacting net operating income.

Acadia's tourism-dependent revenue streams are still lagging behind pre-pandemic levels, impacting retail sales in its urban centers. For instance, while overall retail sales have shown resilience, the pace of recovery in areas heavily reliant on tourist foot traffic has been noticeably slower, representing a potential headwind for some of Acadia's high-street retail properties.

Full Version Awaits

Acadia SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Acadia SWOT analysis, ensuring you know exactly what you're getting before you buy. The complete, detailed report is yours to download immediately after purchase.

Opportunities

Current market volatility, while presenting hurdles, is anticipated to unlock further acquisition opportunities for Acadia's street retail and investment management divisions. This turbulence can lead to undervalued assets becoming available.

Acadia's robust financial standing and ready access to capital are key advantages, enabling the company to pursue and secure attractively priced investments that emerge from market disruptions. For instance, in Q1 2024, Acadia reported a strong liquidity position, with over $500 million in readily available cash and undrawn credit facilities, positioning them to act swiftly on strategic acquisitions.

The retail sector is shifting, with consumers increasingly seeking experiences over traditional shopping. This is evident in the rising popularity of mixed-use developments that blend retail with residential, office, and entertainment spaces. For instance, in 2024, retail properties with significant experiential components, such as dining and entertainment, saw occupancy rates exceeding 90% in prime urban markets, outperforming purely transactional retail centers.

Acadia's focus on mixed-use properties positions it favorably to capture this evolving consumer demand. By redeveloping and acquiring assets that offer integrated living, working, and leisure opportunities, Acadia can tap into a market segment that prioritizes convenience and engaging environments. This strategy aligns with projections showing that mixed-use developments are expected to represent a larger share of new retail construction in the coming years, with an estimated 15% annual growth in this sub-sector through 2025.

The retail sector is experiencing a significant construction slowdown, with new supply remaining limited. This, combined with steady demand, has pushed vacancy rates to historic lows in many areas. For instance, in Q1 2024, national retail vacancy rates hovered around 5.5%, a notable decrease from previous years.

This scarcity of new retail space directly benefits well-located, high-quality properties like those in Acadia's portfolio. Such properties are well-positioned to capitalize on rising rental income and secure higher occupancy levels, as tenants compete for limited available units.

Potential for Moderating Interest Rates

Industry forecasts point to a potential easing of interest rates throughout 2025. This shift could translate into reduced borrowing expenses for Real Estate Investment Trusts (REITs) like Acadia.

Lower financing costs directly benefit Acadia by decreasing its overall cost of capital. This makes pursuing new property acquisitions more financially attractive, potentially boosting earnings per share from these new investments and positively impacting property valuations across its portfolio.

- Reduced Cost of Capital: A decrease in interest rates could lower Acadia's borrowing costs, improving its net interest margin.

- Enhanced Acquisition Acquisitiveness: Lower financing expenses make new property purchases more likely to be accretive to earnings.

- Property Valuation Uplift: Falling rates can lead to higher property valuations as capitalization rates compress.

- Increased Investor Appeal: A more favorable interest rate environment generally boosts investor sentiment towards REITs.

Increased Institutional Investor Interest in REITs

REITs are experiencing a surge in interest from institutional investors such as pension funds and sovereign wealth funds. These investors are drawn to REITs for their diversification benefits and consistent income generation. For example, in the first half of 2024, institutional allocations to real estate, including REITs, saw a notable uptick, with some reports indicating a 15% year-over-year increase in capital deployment into the sector.

This growing institutional capital flow presents a significant opportunity for Acadia. It could translate into enhanced access to funding for new projects and strategic partnerships for its investment management platform. The influx of sophisticated capital can also validate Acadia's investment strategies and potentially lead to more favorable terms on financing.

- Growing Institutional Demand: Pension funds and sovereign wealth funds are increasingly allocating capital to REITs.

- Diversification and Income: REITs offer attractive diversification and steady income streams, appealing to long-term institutional investors.

- Funding and Partnership Opportunities: Increased institutional interest can unlock broader access to capital and strategic alliances for Acadia.

- Market Validation: The inflow of institutional money can serve as a positive signal, validating Acadia's platform and investment approach.

The current market environment, characterized by volatility, is creating a fertile ground for strategic acquisitions. Acadia's strong financial position, evidenced by over $500 million in readily available capital and undrawn credit facilities as of Q1 2024, allows it to capitalize on potentially undervalued assets emerging from these market shifts. Furthermore, the retail sector's evolution towards experiential, mixed-use developments, which saw occupancy rates exceeding 90% in prime urban markets in 2024, aligns perfectly with Acadia's strategic focus. This trend is projected to see 15% annual growth in new construction through 2025.

The limited new supply in the retail sector, with national vacancy rates around 5.5% in Q1 2024, directly benefits well-located properties like those in Acadia's portfolio, driving rental income and occupancy. Additionally, anticipated interest rate easing in 2025 promises to lower Acadia's cost of capital, making acquisitions more accretive and potentially boosting property valuations. This favorable rate environment, coupled with a growing influx of institutional capital into REITs, as seen in a 15% year-over-year increase in allocations during H1 2024, presents significant opportunities for funding and strategic partnerships.

| Opportunity Area | Description | Supporting Data/Trend (2024-2025) | Acadia's Advantage |

|---|---|---|---|

| Acquisition of Undervalued Assets | Market volatility creates opportunities for acquiring distressed or undervalued properties. | Anticipated market turbulence unlocking opportunities. | Strong liquidity ($500M+ cash/credit Q1 2024) enabling swift action. |

| Growth in Experiential Retail | Consumer shift towards experiences favors mixed-use developments. | Experiential retail properties saw >90% occupancy in prime urban markets (2024). Mixed-use construction projected to grow 15% annually through 2025. | Acadia's focus on mixed-use properties aligns with evolving consumer demand. |

| Benefit from Limited New Supply | Scarcity of new retail space increases demand for existing, quality properties. | National retail vacancy rates around 5.5% (Q1 2024), historic lows. | Well-located, high-quality properties positioned for rising rents and occupancy. |

| Lower Cost of Capital | Potential interest rate reductions in 2025 decrease borrowing expenses. | Industry forecasts point to potential interest rate easing in 2025. | Reduced financing costs improve acquisition attractiveness and potential EPS growth. |

| Increased Institutional Investment | Growing interest from institutional investors in REITs for diversification and income. | Institutional allocations to REITs increased by ~15% YoY in H1 2024. | Enhanced access to capital and potential for strategic partnerships. |

Threats

A persistent high interest rate environment presents a significant challenge for Acadia Realty Trust (AKR). Despite some forecasts for rate moderation, the prospect of rates remaining elevated for an extended period increases borrowing costs, impacting profitability and making it harder to refinance existing debt. This can also make Acadia's shares less appealing compared to other investments offering higher yields, potentially dampening investor demand.

An economic slowdown poses a significant threat, potentially dampening consumer spending and impacting Acadia's retail tenants. Even with a focus on necessity and discount retailers, a severe or prolonged downturn could strain rental income and occupancy levels.

Ongoing geopolitical tensions and evolving trade policies, like potential tariffs, create significant uncertainty for Acadia's retail tenants. This instability can disrupt their supply chains and increase operational costs, potentially impacting their ability to meet lease obligations. For instance, the International Monetary Fund (IMF) projected in October 2024 that global growth would slow to 2.9% in 2025, partly due to persistent geopolitical fragmentation and trade restrictions.

This disruption directly affects Acadia's revenue streams. Retailers facing these challenges might delay expansion plans, seek rent concessions, or even default on leases, leading to vacancies and reduced rental income. Such events would negatively impact Acadia's cash flows and the overall valuation of its property portfolio.

Evolving Retail Landscape and E-commerce Competition

While brick-and-mortar retail has demonstrated surprising durability, the persistent shift in how consumers shop, with e-commerce continuing its upward trajectory, presents an enduring challenge. This evolving landscape necessitates that property owners like Acadia actively adapt to maintain the appeal and functionality of their physical spaces.

Retailers are responding by optimizing store footprints and integrating online and offline experiences seamlessly. This trend means Acadia must consistently invest in enhancing property appeal and curating a dynamic tenant mix to stay ahead in a competitive market. For instance, in 2024, e-commerce sales are projected to account for a significant portion of total retail spending, underscoring the need for physical retail to offer unique value propositions.

- Consumer behavior continues to favor online shopping, impacting foot traffic in physical stores.

- Retailers are downsizing physical stores and focusing on experiential retail to compete with e-commerce.

- Landlords must invest in property modernization and tenant curation to attract and retain shoppers.

Rising Property Operating Expenses and Real Estate Taxes

Acadia Realty Trust (AKR) is susceptible to escalating property operating expenses and real estate taxes. These rising costs can directly impact the company's net operating income, potentially squeezing profitability. For instance, in 2024, many municipalities saw property tax increases averaging 3-5%, and utility costs have also seen upward pressure.

Effectively managing these increased expenditures across Acadia's varied portfolio is crucial. The company must implement robust operational efficiencies to mitigate the impact on its profit margins and maintain its competitive edge in the market.

- Property Tax Increases: Municipalities continue to adjust property tax assessments, leading to higher annual tax burdens for property owners like Acadia.

- Operational Cost Inflation: Beyond taxes, expenses for maintenance, utilities, and property management services are also subject to inflationary pressures.

- Impact on NOI: Without offsetting revenue growth or cost savings, these rising expenses directly reduce Net Operating Income (NOI), a key profitability metric.

Acadia's reliance on debt financing makes it vulnerable to rising interest rates, which increased borrowing costs and refinancing challenges throughout 2024 and into 2025. An economic downturn could reduce tenant demand and rental income, impacting Acadia's revenue streams, especially given the IMF's October 2024 projection of a global growth slowdown to 2.9% in 2025 due to geopolitical fragmentation.

The persistent shift towards e-commerce continues to pressure physical retail, requiring Acadia to invest in property modernization and tenant curation to remain competitive. Furthermore, escalating property operating expenses and real estate taxes, with property taxes seeing 3-5% increases in many municipalities during 2024, directly erode net operating income.

| Threat | Description | Impact on Acadia (2024-2025) |

|---|---|---|

| Rising Interest Rates | Higher borrowing costs, refinancing difficulties. | Increased debt service expenses, potentially reduced profitability. |

| Economic Slowdown | Reduced consumer spending, lower tenant demand. | Decreased rental income, higher vacancy risk. |

| E-commerce Growth | Shift in consumer shopping habits. | Need for property upgrades, potential decline in physical store traffic. |

| Operating Expense Inflation | Increased costs for taxes, utilities, maintenance. | Erosion of Net Operating Income (NOI). |

SWOT Analysis Data Sources

This Acadia SWOT analysis is built on a foundation of robust data, drawing from comprehensive financial reports, in-depth market research, and expert industry insights to provide a clear and actionable strategic overview.