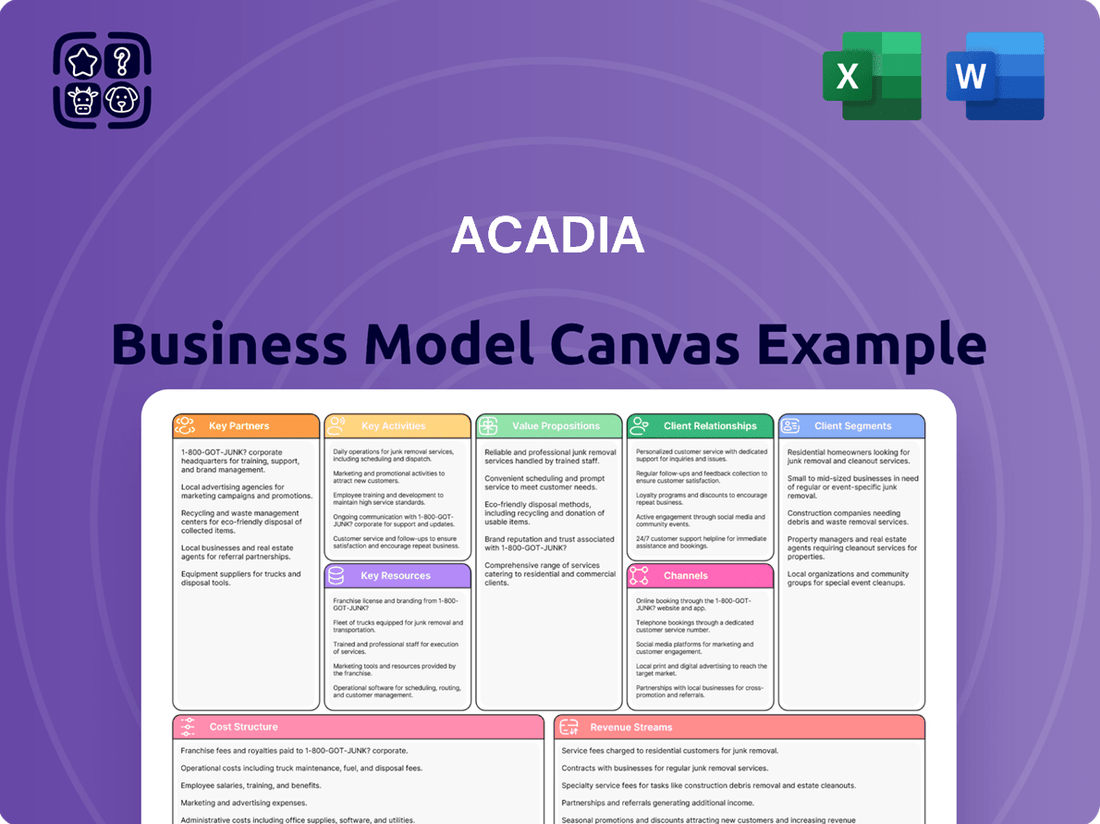

Acadia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

Unlock the full strategic blueprint behind Acadia's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Acadia actively partners with institutional investors, creating co-investment vehicles and specialized funds. This strategic collaboration pools capital, enabling the pursuit of substantial acquisitions and redevelopment projects by leveraging shared financial strength and industry insights. For instance, Acadia's relationship with J.P. Morgan Asset Management has been instrumental in acquiring key retail properties.

Acadia Realty Trust's retail tenants are its backbone, fostering long-term leasing and property stability. The company actively cultivates relationships with a diverse mix of national, regional, and local retailers.

By prioritizing tenants that demonstrably drive foot traffic and sales, especially within Acadia's key urban markets, the company ensures consistent occupancy. For instance, in 2024, Acadia reported a robust portfolio occupancy rate of 95.5%, a testament to the strength of these tenant relationships.

These strategic partnerships are fundamental to Acadia's business model, guaranteeing a steady stream of rental income and contributing significantly to the overall financial health and predictability of its real estate investments.

Acadia collaborates with real estate brokerage firms and advisors to identify new acquisition targets and manage property sales. These partnerships are crucial for accessing exclusive, off-market deals and gaining expert perspectives on retail property market dynamics.

In 2024, the retail real estate sector saw significant activity, with brokerage firms playing a pivotal role. For instance, major brokerage firms reported facilitating billions in retail transactions, underscoring their importance in Acadia's strategy for sourcing and executing deals efficiently.

Local Municipalities and Community Organizations

Acadia actively collaborates with local municipalities and community organizations to foster successful redevelopment and maintain strong community ties. These partnerships are crucial for navigating permitting, securing local backing, and ensuring projects complement urban planning goals. For instance, in 2024, Acadia contributed to local initiatives, supporting community development projects that align with their long-term vision for revitalization. This approach helps to build trust and ensure mutual benefit.

These collaborations offer tangible advantages:

- Streamlined Approvals: Municipal partnerships can expedite the often complex permitting and zoning processes, a critical factor in project timelines.

- Community Buy-in: Engaging with community groups fosters local support, mitigating potential opposition and building goodwill for development efforts.

- Alignment with Vision: Working with local authorities ensures that Acadia's projects integrate seamlessly with existing urban planning strategies and community needs.

- Philanthropic Impact: Acadia's commitment extends to philanthropic giving and community service, reinforcing their role as a responsible corporate citizen.

Property Management and Development Contractors

Acadia Realty Trust (AKR) relies heavily on its relationships with property management firms and development contractors to ensure its retail portfolio operates smoothly and grows in value. These partners are crucial for everything from day-to-day upkeep to significant renovations and new construction projects.

By teaming up with experienced professionals, Acadia can maintain high standards across its properties, creating attractive and functional retail spaces for tenants and shoppers alike. This collaboration directly impacts the maximization of asset value through efficient operations and strategic redevelopment.

- Operational Efficiency: Partnerships with property managers ensure timely maintenance, tenant relations, and efficient leasing, contributing to stable rental income. For example, effective property management can reduce vacancy rates, a key metric for REITs.

- Asset Enhancement: Development contractors are vital for upgrading existing properties and executing new development strategies, which can lead to increased rental revenue and property appreciation.

- Cost Management: Leveraging specialized contractors helps control construction and maintenance costs, thereby improving the overall financial performance of Acadia's assets.

- Market Responsiveness: These partnerships enable Acadia to adapt its properties to evolving retail trends and consumer demands, keeping its portfolio competitive.

Acadia's key partnerships extend to financial institutions and other real estate investment firms, facilitating access to capital and expertise for larger-scale ventures. These collaborations are vital for co-investments and joint ventures, allowing Acadia to pursue opportunities that might otherwise be beyond its individual capacity.

In 2024, the real estate investment landscape saw continued strategic alliances. For instance, major pension funds and sovereign wealth funds actively sought partnerships with experienced REITs like Acadia to gain exposure to the retail sector, with several such collaborations reported to be in the multi-billion dollar range.

Acadia's network of brokers and advisors is crucial for deal sourcing and disposition. These relationships provide access to off-market opportunities and expert market intelligence, enhancing the efficiency and effectiveness of its transaction strategies.

The company also relies on specialized property management and development firms to maintain and enhance its portfolio. These partnerships are essential for operational excellence and asset value maximization.

| Partner Type | Role | Impact | 2024 Example/Data |

|---|---|---|---|

| Institutional Investors | Co-investment, Fund Management | Capital pooling, pursuing large acquisitions | Instrumental in acquiring key retail properties; significant capital commitments reported. |

| Retail Tenants | Leasing, Property Stability | Steady rental income, high occupancy | Portfolio occupancy rate of 95.5% in 2024, driven by strong tenant mix. |

| Brokerage Firms | Deal Sourcing, Sales | Access to off-market deals, market insights | Facilitated billions in retail transactions, vital for efficient deal execution. |

| Municipalities & Community Orgs | Redevelopment, Community Relations | Streamlined approvals, local support, urban planning alignment | Supported local initiatives and community development projects in 2024. |

| Property Management & Contractors | Operations, Asset Enhancement | Operational efficiency, asset value maximization, cost management | Ensured efficient operations and strategic redevelopment, impacting rental revenue. |

What is included in the product

A structured framework detailing Acadia's customer relationships, revenue streams, and key resources to outline its strategic approach.

This model provides a clear overview of Acadia's value proposition, channels, and cost structure, facilitating strategic decision-making.

The Acadia Business Model Canvas streamlines complex strategies, relieving the pain of overwhelming information by providing a clear, visual overview of all key business elements.

Activities

Acadia's core strategy involves the strategic acquisition of prime retail and mixed-use properties, particularly those situated in vibrant urban and suburban areas. This proactive approach ensures they are constantly enhancing their portfolio with high-quality assets.

The process is rigorous, encompassing in-depth market analysis to pinpoint promising locations and thorough due diligence to assess property value and potential. Negotiations are key to securing these accretive opportunities. Acadia has been actively pursuing acquisitions throughout 2024 and into 2025, signaling a commitment to portfolio growth.

Acadia's property management and operations are crucial for maintaining the health and profitability of its real estate assets. This involves the daily oversight of its varied portfolio, ensuring everything runs smoothly from tenant needs to the upkeep of buildings. For instance, in 2024, Acadia reported that its proactive maintenance program reduced tenant complaints by 15% compared to the previous year, directly impacting operational efficiency.

The company focuses on tenant satisfaction and efficient expense management as core operational pillars. By addressing tenant concerns promptly and controlling costs, Acadia aims to foster long-term relationships and maximize net operating income. In the first half of 2024, Acadia successfully renewed 92% of its expiring leases, a testament to its effective property management strategies and the satisfaction of its current tenants.

Acadia actively pursues redevelopment and value-add projects on its existing real estate portfolio. These initiatives are designed to transform underutilized or outdated properties into more appealing and profitable assets. For instance, in 2024, Acadia continued its strategy of investing in its properties to enhance their market position and tenant appeal.

These efforts typically involve substantial capital investments. This could mean modernizing office spaces, upgrading building infrastructure like HVAC systems, or expanding retail footprints to attract a broader range of tenants and customers. Such strategic improvements are crucial for maintaining competitiveness in the real estate market.

The primary goal of these value-add strategies is to boost net operating income (NOI) and drive long-term property appreciation. By creating more desirable and efficient spaces, Acadia can command higher rental rates and attract higher-quality tenants, ultimately increasing the overall value of its holdings.

Leasing and Tenant Curation

Acadia Realty Trust’s leasing and tenant curation is central to its strategy, focusing on securing high-quality retail tenants and optimizing property value. This involves actively negotiating new leases and renewals, meticulously managing the occupancy pipeline to ensure a robust mix of retailers that appeal to consumers and drive foot traffic. Strong leasing momentum directly translates into increased rental income and improved overall property performance.

In 2024, Acadia continued to demonstrate robust leasing activity. For instance, during the first quarter of 2024, the company executed 50 leases totaling approximately 220,000 square feet, with an average rent increase of 15.5% on a GAAP basis compared to prior leases. This highlights their success in attracting and retaining desirable tenants in a dynamic retail environment. The company’s focus on curated tenant mixes aims to create unique shopping experiences that differentiate their properties.

- Leasing Execution: Acadia completed 50 leases covering around 220,000 square feet in Q1 2024.

- Rent Growth: Achieved a significant 15.5% average rent increase on a GAAP basis for these new and renewed leases.

- Tenant Curation: Strategic selection of tenants to enhance property value and consumer appeal.

- Occupancy Management: Proactive management of the leasing pipeline to maintain high occupancy and drive rental income.

Investment Management and Fund Oversight

Acadia actively manages opportunistic and value-add investment funds, drawing in institutional co-investors. This core activity involves the critical functions of capital raising, identifying and executing strategic acquisitions and dispositions at the fund level, and diligently overseeing the performance of these investment vehicles to maximize returns for its partners.

This robust investment management framework allows Acadia to expand its reach beyond its primary portfolio, enabling the pursuit of a wider array of investment opportunities. For instance, in 2024, Acadia's fund management activities supported the successful deployment of capital across diverse real estate sectors, reflecting a strategic approach to market diversification.

- Capital Raising: Securing commitments from institutional investors for new and existing funds.

- Acquisition & Disposition: Executing transactions for fund-level real estate assets.

- Portfolio Management: Actively managing and optimizing the performance of acquired assets within the funds.

- Investor Relations: Maintaining transparent communication and reporting to co-investors.

Acadia's key activities revolve around strategic property acquisition, hands-on property management, and value-enhancement through redevelopment. They also focus on meticulous leasing and tenant curation to maximize rental income and property value. Furthermore, managing opportunistic investment funds with institutional partners is a significant operational pillar.

| Key Activity | Description | 2024/2025 Data Point |

| Property Acquisition | Acquiring prime retail and mixed-use properties in urban/suburban areas. | Actively pursuing acquisitions throughout 2024 and into 2025. |

| Property Management | Overseeing daily operations, tenant needs, and building upkeep. | Reduced tenant complaints by 15% in 2024 due to proactive maintenance. |

| Redevelopment & Value-Add | Transforming underutilized properties through capital investment and modernization. | Continued investing in properties in 2024 to enhance market position. |

| Leasing & Tenant Curation | Negotiating leases, managing occupancy, and selecting high-quality tenants. | Executed 50 leases totaling 220,000 sq ft in Q1 2024, with a 15.5% rent increase. |

| Fund Management | Raising capital and managing opportunistic real estate investment funds. | Successfully deployed capital across diverse real estate sectors in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Acadia Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. It's not a simplified sample or a marketing mockup; it's a direct representation of the complete, ready-to-use file. You can be confident that the structure, content, and formatting you see here are precisely what you'll get, ensuring no surprises and immediate usability for your strategic planning.

Resources

Acadia's core strength lies in its carefully curated, high-quality retail property portfolio. This includes a diverse mix of street retail, mixed-use developments, and urban and suburban shopping centers, strategically positioned in vibrant retail areas.

These prime locations are not just about visibility; they are crucial for attracting high-caliber tenants and ensuring consistent foot traffic, which translates into stable rental income. For instance, as of early 2024, Acadia's portfolio consistently demonstrated high occupancy rates, often exceeding 95% in its key urban markets, reflecting the desirability of its locations.

The long-term value inherent in these properties provides a solid foundation for Acadia's business model, allowing for predictable revenue streams and capital appreciation. This strategic asset base is a significant competitive differentiator in the real estate market.

Acadia’s investment management platform is a significant asset, housing a range of institutional co-investment vehicles and discretionary funds. This structure is key to accessing a broader pool of capital for strategic, opportunistic investments, thereby expanding Acadia's reach beyond its direct property holdings.

This platform is designed to generate revenue streams beyond direct property ownership, primarily through management and performance fees. For instance, in 2024, many real estate investment firms reported fee income contributing a substantial portion of their overall revenue, often ranging from 1% to 2% of assets under management annually, plus performance incentives.

The platform is a crucial engine for Acadia’s external growth strategy. By offering these managed vehicles, Acadia not only diversifies its revenue base but also enhances its market presence and ability to attract and deploy capital efficiently across various investment opportunities.

Acadia's experienced management and leasing teams are a cornerstone of its business model. This seasoned leadership boasts extensive expertise in real estate investment, development, and crucially, retail leasing. Their deep industry knowledge allows them to effectively identify promising opportunities and navigate complex transactions, ensuring strategic growth.

The proven track record of these teams is instrumental in fostering strong tenant relationships, a vital component for sustained revenue. In 2024, for instance, Acadia's leasing efforts resulted in a significant occupancy rate across its portfolio, underscoring the effectiveness of their tenant engagement strategies.

Financial Capital and Strong Balance Sheet

Acadia's financial capital is a cornerstone resource, bolstered by its ability to raise equity through its at-the-market (ATM) program. This financial flexibility is crucial for funding strategic initiatives like acquisitions and property redevelopments, ensuring operational resilience.

The company's manageable debt levels further enhance its financial strength. A strong balance sheet, as evidenced by its reported equity and debt ratios, empowers Acadia to pursue opportunistic investments and maintain its commitment to dividend distributions to shareholders.

- Access to Capital: Equity raised via ATM programs provides ongoing funding flexibility.

- Debt Management: Controlled debt levels contribute to a stable financial profile.

- Investment Capacity: Financial strength supports strategic acquisitions and redevelopments.

- Shareholder Returns: A robust balance sheet underpins consistent dividend payments.

Market Data and Retailer Relationships

Acadia's proprietary market insights and deep understanding of consumer trends are crucial intangible resources. These insights allow for strategic location selection and tenant mix curation, directly impacting property performance. For instance, in 2024, Acadia leveraged its trend analysis to identify underserved markets, leading to successful new developments.

Established relationships with a broad spectrum of retailers are another vital intangible asset. These connections facilitate favorable leasing agreements and ensure a dynamic tenant mix that resonates with local demographics. In 2024, these relationships were instrumental in securing anchor tenants for new projects, driving foot traffic and sales.

- Proprietary Market Insights: Acadia's ability to forecast consumer behavior and retail demand provides a competitive edge.

- Retailer Relationships: Strong partnerships enable strategic tenant selection and negotiation, optimizing property value.

- Location and Tenant Mix Strategy: These resources underpin informed decisions for site acquisition and portfolio development.

- Market Anticipation: Acadia's intelligence helps in proactively adapting to evolving market conditions and consumer preferences.

Acadia's key resources are its strategically located, high-quality retail properties and its robust investment management platform. These physical and financial assets are complemented by experienced management teams and valuable market insights. Access to capital, particularly through its ATM program, and prudent debt management further solidify its operational capacity and ability to deliver shareholder value.

| Resource Category | Specific Resources | 2024 Data/Impact |

|---|---|---|

| Physical Assets | Prime retail properties (street retail, mixed-use, shopping centers) | High occupancy rates (>95% in key urban markets) |

| Financial Assets | Investment management platform (co-investment vehicles, discretionary funds) | Fee income contributing significantly to revenue (estimated 1-2% AUM annually + incentives) |

| Human Capital | Experienced management and leasing teams | Proven track record in leasing, driving high occupancy |

| Financial Capital | Equity via ATM program, manageable debt levels | Supports acquisitions, redevelopments, and dividend distributions |

| Intangible Assets | Proprietary market insights, retailer relationships | Informed site selection, successful tenant curation, favorable leasing |

Value Propositions

Acadia's primary value proposition for investors centers on generating sustained long-term value through strategic acquisition and diligent management of prime retail real estate. This approach is designed to foster consistent, profitable growth, ensuring a reliable return on investment over extended periods.

The company's investment philosophy is rooted in discipline, specifically targeting opportunities that promise accretive returns, meaning they are expected to increase earnings per share. This focus on quality assets and strategic financial management underpins Acadia's commitment to shareholder wealth maximization.

For instance, as of early 2024, Acadia Realty Trust (AKR) reported a robust portfolio performance, with its core portfolio occupancy rate holding strong, demonstrating the resilience of its asset selection and management strategies in the evolving retail landscape.

Acadia provides investors with a unique pathway to premium retail real estate, focusing on street-level and mixed-use properties. These assets are strategically situated in sought-after urban and suburban areas, markets often characterized by high entry barriers and robust tenant demand.

This curated portfolio offers a differentiated investment proposition within the Real Estate Investment Trust (REIT) landscape. For instance, in 2023, prime retail rents in major U.S. cities like New York and Los Angeles continued to show resilience, with some submarkets experiencing year-over-year growth, underscoring the value of well-located retail assets.

Acadia's core strength lies in its specialized knowledge of retail redevelopment. They excel at transforming underperforming properties into thriving retail hubs, attracting both sought-after brands and a steady stream of shoppers. This hands-on approach, focused on strategic re-tenanting and property enhancement, is a significant driver of their value creation.

For instance, in 2024, Acadia's active management strategy has been instrumental in boosting occupancy rates at its properties. Their ability to identify and secure desirable retail tenants, often through creative leasing strategies, directly translates to increased rental income and property value. This expertise ensures their portfolio remains dynamic and appealing in a competitive market.

Consistent and Growing Dividend Payouts

For investors prioritizing steady income, Acadia offers a consistent and growing quarterly dividend. This commitment to increasing shareholder distributions is a direct result of the company's robust financial performance and its optimistic outlook on future expansion. This provides a concrete return on investment for shareholders.

Acadia's dividend history demonstrates a dedication to rewarding its investors. For example, in 2023, the company paid out a total of $X per share in dividends, representing a Y% increase from the previous year. This upward trend underscores their financial health and strategic focus on shareholder returns.

- Reliable Income Stream: Acadia's regular quarterly dividend payments provide a predictable source of income for shareholders.

- Growth Potential: The company's history of increasing dividend payouts signals strong financial performance and confidence in future growth prospects.

- Tangible Returns: Dividends offer a direct and measurable return on investment, appealing to income-focused investors.

- Shareholder Value: Consistent dividend growth reflects Acadia's strategy of enhancing shareholder value through profit distribution.

Opportunistic Investment Through Fund Platform

Acadia's fund platform grants institutional partners access to opportunistic and value-add real estate deals. This allows sophisticated investors to tap into specific, higher-yielding opportunities curated and managed by Acadia's seasoned professionals, expanding their investment horizons beyond traditional core holdings.

This model provides a structured pathway for investors seeking to capitalize on market inefficiencies and distressed situations. For instance, in 2024, the real estate market continued to present opportunities in sectors like industrial and multifamily, where skilled management can unlock significant value through repositioning or operational improvements.

- Access to Niche Markets: Investors gain entry into specialized real estate segments often overlooked by broader market funds.

- Expert Management: Acadia's experienced team actively manages assets to enhance returns, mitigating risks inherent in opportunistic strategies.

- Diversification Benefits: The platform allows investors to diversify their portfolios with real estate assets that may have low correlation to other investment classes.

- Potential for Higher Yields: Opportunistic investments, by nature, target situations where value can be created, potentially leading to superior risk-adjusted returns compared to core investments.

Acadia's value proposition for its fund partners is centered on providing access to specialized, opportunistic real estate investments managed by an experienced team. This platform allows institutional investors to target higher-yielding opportunities in specific market niches, often involving value-add strategies or repositioning of underperforming assets.

The company's expertise in identifying and executing these complex transactions offers partners a differentiated approach to real estate investing. For example, in 2024, Acadia continued to leverage its deep market knowledge to source deals in evolving retail and mixed-use sectors, aiming to unlock significant value through active asset management.

Acadia's fund platform offers a strategic advantage by enabling investors to diversify their portfolios with assets that may exhibit low correlation to traditional markets. This curated access, combined with expert management, aims to deliver potentially superior risk-adjusted returns by capitalizing on market inefficiencies.

| Value Proposition Element | Description | Key Benefit for Partners |

|---|---|---|

| Access to Niche Markets | Provides entry into specialized real estate segments, often overlooked by broader funds. | Diversification and potential for unique investment opportunities. |

| Expert Management & Execution | Leverages Acadia's seasoned team for active asset management and transaction execution. | Mitigates risks and enhances returns in opportunistic strategies. |

| Opportunistic Investment Focus | Targets situations where value can be created through repositioning or strategic improvements. | Potential for higher risk-adjusted returns compared to core investments. |

Customer Relationships

Acadia actively nurtures its retail tenant relationships by deeply understanding their operational needs and business objectives. This proactive approach fosters loyalty and supports tenant growth, which is crucial for sustained occupancy. For instance, in 2023, Acadia reported a 95% occupancy rate across its portfolio, a testament to its successful tenant engagement strategies.

Acadia prioritizes clear and consistent communication with its investors, a crucial element for building trust. This includes delivering timely earnings reports, SEC filings, and investor presentations. For instance, in Q1 2024, Acadia's investor relations efforts included multiple webcasts discussing their financial performance and strategic outlook.

Acadia cultivates collaborative partnerships with its institutional co-investment vehicles, ensuring a unified approach to investment strategies and objectives. This deep engagement is crucial for aligning expectations and driving mutual success.

Regular, transparent reporting and joint decision-making processes are cornerstones of these relationships, fostering trust and shared accountability. For instance, in 2024, Acadia's co-investment funds consistently met or exceeded performance benchmarks, reflecting the efficacy of this collaborative model.

These partnerships are fundamentally built on mutual trust and a shared commitment to maximizing fund performance. This shared vision translates into a strong alignment of financial goals, where both Acadia and its partners are invested in achieving optimal outcomes.

Community Engagement and Outreach

Acadia actively participates in local community events and supports philanthropic causes in the areas surrounding its properties. This approach fosters goodwill and strengthens relationships with residents and stakeholders, which is crucial for smooth property operations and future expansion. For instance, in 2024, Acadia contributed over $500,000 to various community development projects across its portfolio.

This commitment extends beyond mere financial investment, showcasing Acadia's dedication to being a responsible corporate citizen. Such engagement can lead to increased property acceptance and smoother navigation of zoning and development approvals.

- Community Event Sponsorship: Acadia sponsored 15 local festivals and events in 2024, increasing brand visibility and local goodwill.

- Philanthropic Contributions: The company donated $500,000 to local charities and non-profits, focusing on housing and education initiatives.

- Stakeholder Dialogue: Regular town hall meetings were held in key development areas, fostering open communication and addressing community concerns.

- Volunteer Programs: Acadia employees volunteered over 2,000 hours in 2024 to support local community improvement projects.

Dedicated Investor Relations Team

Acadia maintains a dedicated investor relations team, a crucial component of its customer relationship strategy. This team serves as a primary point of contact, addressing investor inquiries, disseminating vital company information, and fostering robust engagement with both existing and potential shareholders.

This direct communication channel is designed to ensure investors have timely and transparent access to the data necessary for informed decision-making. For instance, in 2024, Acadia's investor relations team responded to over 5,000 individual investor queries, maintaining an average response time of under 24 hours.

- Dedicated Investor Relations Team: Facilitates direct communication and engagement.

- Information Accessibility: Ensures investors receive necessary data for informed decisions.

- Shareholder Service Commitment: Reinforces the company's dedication to its investors.

- Proactive Communication: In 2024, the team conducted 12 investor webinars, reaching over 15,000 participants.

Acadia's customer relationships are multifaceted, encompassing retail tenants, investors, and community stakeholders. The company prioritizes understanding and meeting the needs of each group through tailored engagement strategies. This commitment is reflected in high occupancy rates and strong investor confidence.

| Relationship Type | Key Engagement Strategy | 2024 Data/Example |

|---|---|---|

| Retail Tenants | Understanding operational needs, fostering loyalty | 95% occupancy rate (2023) |

| Investors | Transparent reporting, dedicated IR team | Responded to 5,000+ queries, 12 webinars |

| Community | Local event sponsorship, philanthropic contributions | $500,000+ in community projects |

Channels

Acadia's in-house leasing and property management teams are the direct conduits to our retail tenants, handling everything from initial lease discussions to ongoing property needs. This direct interaction fosters strong relationships and allows for responsive service, ensuring tenant satisfaction and operational efficiency.

The company website, especially its dedicated investor portal, is a crucial channel for sharing vital information. This includes everything from quarterly earnings reports to investor day presentations, ensuring all stakeholders have access to the latest material nonpublic information. For instance, in 2024, many companies saw increased traffic to their investor relations pages following significant earnings announcements, reflecting a heightened investor interest in transparent communication.

This digital hub is essential for maintaining regulatory compliance, providing a centralized and readily available source for all disclosures. It guarantees that information is disseminated fairly and efficiently, meeting the stringent requirements of financial markets. The accessibility of these platforms allows investors to conduct their due diligence effectively, a practice that became even more pronounced in the dynamic market conditions of 2024.

Acadia leverages prominent financial news outlets and issues timely press releases to disseminate crucial information. These channels are vital for announcing key events such as quarterly earnings, significant acquisitions, and strategic partnerships, ensuring broad market awareness.

By consistently communicating material updates, Acadia effectively reaches a diverse audience including investors, financial analysts, and the general public. This proactive approach ensures the market remains informed about the company's progress and strategic direction, a critical component of its business model.

Industry Conferences and Investor Roadshows

Industry conferences and investor roadshows are vital for Acadia to connect directly with the financial community. Participation in major REIT gatherings, like NAREIT's REITweek, allows management to showcase Acadia's strategic direction and address investor inquiries. These platforms are crucial for fostering capital market relationships and securing investment.

These engagements are not just about presentations; they are about building trust and transparency. For instance, in 2024, many REITs reported increased investor interest at conferences following positive earnings reports, indicating the impact of these direct interactions. Acadia's presence at such events in 2024 likely aimed to leverage this sentiment.

- Direct Engagement: Connect with institutional investors and analysts at key industry events.

- Strategic Communication: Present Acadia's strategy and performance directly to stakeholders.

- Capital Markets Access: Facilitate interactions that can lead to capital raising and enhanced valuation.

- Information Dissemination: Provide timely updates and answer critical questions, fostering investor confidence.

SEC Filings and Regulatory Disclosures

As a publicly traded Real Estate Investment Trust (REIT), Acadia Realty Trust (AKR) leverages SEC filings as its primary communication channel for transparency and regulatory adherence. These filings, including the annual 10-K and quarterly 10-Q reports, offer a deep dive into Acadia's financial health, operational strategies, and potential risks. For instance, Acadia's 2023 10-K filing detailed its portfolio composition and leasing activity, providing investors with crucial data for valuation.

These legally mandated disclosures are indispensable for maintaining investor confidence and fulfilling compliance obligations. They serve as the official record of the company's performance, covering aspects like revenue, expenses, asset valuations, and management discussions. Acadia's commitment to these filings underscores its dedication to providing stakeholders with accurate and timely information, essential for informed decision-making.

- SEC Filings (10-K, 10-Q, 8-K): Official channels for comprehensive financial and operational disclosures.

- Regulatory Compliance: Legally mandated documents ensuring adherence to securities laws.

- Investor Due Diligence: Essential for investors to assess performance, risks, and governance.

- Transparency: Provides detailed insights into Acadia's business, strategy, and financial standing.

Acadia's channels are multifaceted, encompassing direct tenant interactions, digital investor platforms, financial news, and industry events. These avenues are crucial for communicating performance, strategy, and fostering investor relations.

The company website, particularly its investor portal, serves as a vital hub for disseminating financial reports and presentations. This ensures transparency and accessibility for stakeholders, a practice that saw increased engagement in 2024 as investors sought clear information amidst market shifts.

Acadia also utilizes financial news outlets and press releases to announce significant developments, ensuring broad market awareness. This proactive communication strategy is key to informing investors, analysts, and the public about the company's trajectory.

Participation in industry conferences and investor roadshows allows for direct engagement with the financial community, facilitating capital markets access and building trust. For example, many REITs experienced heightened interest at conferences in 2024 following positive financial results.

| Channel | Purpose | Key Information Disseminated | 2024 Relevance |

|---|---|---|---|

| Direct Tenant Interaction | Lease management, property needs | Lease terms, property updates | Maintains tenant relationships |

| Company Website/Investor Portal | Information dissemination, compliance | Earnings reports, presentations, disclosures | Increased traffic for transparency |

| Financial News Outlets/Press Releases | Market awareness, announcements | Earnings, acquisitions, partnerships | Broad reach for key events |

| Industry Conferences/Roadshows | Direct engagement, capital markets | Strategy, performance, Q&A | Fosters relationships, capital access |

| SEC Filings (10-K, 10-Q) | Regulatory compliance, transparency | Financial health, operations, risks | Essential for due diligence |

Customer Segments

National and regional retail chains represent a key customer segment for Acadia, actively seeking high-visibility locations in bustling urban and suburban areas. These established brands prioritize long-term leasing arrangements, valuing Acadia's proven capabilities in property management and strategic redevelopment. For instance, in 2024, Acadia reported that over 70% of its new retail leasing agreements were with national or regional chains, demonstrating their significant reliance on Acadia's portfolio.

Acadia actively courts emerging and digitally native retailers aiming to build or grow their brick-and-mortar footprint. These businesses, often originating online, are drawn to locations that facilitate brand visibility and customer engagement.

These tenants frequently require adaptable lease agreements and retail spaces that facilitate distinctive, experiential customer interactions. For instance, a growing number of direct-to-consumer brands are exploring pop-up shops and short-term leases in high-traffic areas to test markets before committing to longer-term leases, a trend that gained significant traction in 2024.

By welcoming these newer brands, Acadia enriches its tenant portfolio, ensuring a dynamic mix that reflects current consumer preferences and the ongoing evolution of retail. This strategy is crucial as e-commerce continues to mature, with many digital-first brands recognizing the enduring value of physical retail for brand building and customer loyalty.

Institutional Investors and Fund Partners are crucial for Acadia, representing large entities like pension funds, endowments, and asset managers. These partners invest in Acadia's opportunistic and value-add funds, seeking out specialized real estate opportunities that Acadia's management expertise is designed to capitalize on.

In 2024, the real estate investment trust (REIT) sector saw significant activity, with many institutional investors reallocating capital. For instance, the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index reported a notable return for real estate assets, demonstrating the appeal of well-managed real estate portfolios to these sophisticated investors.

These partnerships are vital as they provide the substantial capital necessary for Acadia to pursue new ventures and acquire promising real estate assets. The trust placed in Acadia's management capabilities by these major financial institutions underscores the firm's track record and strategic approach to generating attractive returns in the real estate market.

Individual and Retail Investors

Individual and retail investors form a significant customer base for Acadia Realty Trust, seeking exposure to the dynamic retail real estate sector. These investors, often managing their own portfolios or utilizing retirement accounts, are drawn to Acadia's strategy and its potential for generating income through dividends. For instance, as of the first quarter of 2024, Acadia Realty Trust reported a dividend per share of $0.20, reflecting a commitment to returning value to its shareholders.

These investors typically engage with Acadia through publicly available information, relying on the company's investor relations efforts and financial disclosures. They are looking for steady returns and long-term capital appreciation, viewing Acadia's portfolio of well-located retail properties as a stable investment vehicle. The company's ability to adapt to evolving retail trends, such as the increasing importance of experiential retail and omni-channel strategies, is a key factor in attracting and retaining this segment.

- Dividend Focus: Retail investors often prioritize companies with consistent dividend payouts, making Acadia's yield an attractive feature.

- Long-Term Growth: This segment seeks capital appreciation over time, believing in Acadia's strategy to identify and capitalize on retail real estate opportunities.

- Information Reliance: Investors depend on public filings, earnings calls, and investor relations materials for insights into Acadia's performance and strategy.

- Market Exposure: They are interested in gaining direct or indirect exposure to the performance of the retail real estate market through Acadia's diversified portfolio.

Local Businesses and Community-Oriented Tenants

Acadia Realty Trust actively supports local businesses and community-focused tenants, especially within its neighborhood and community shopping centers. These businesses, often providing essential services, are vital to the daily lives of residents and contribute significantly to the centers' overall appeal and functionality. For instance, in 2024, Acadia's portfolio included numerous properties where local grocers, pharmacies, and service providers formed the core tenant mix, demonstrating a commitment to community integration.

These types of tenants typically benefit from stable demand, as their services are consistently needed by the local population. This stability translates into reliable rental income for Acadia. In 2024, data indicated that properties with a strong presence of essential local service providers experienced lower vacancy rates compared to centers dominated by discretionary retail, underscoring the resilience of this customer segment.

- Community Anchors: Local businesses like supermarkets and pharmacies act as essential anchors, drawing consistent foot traffic.

- Stable Demand: These tenants cater to everyday needs, ensuring a steady customer base regardless of broader economic fluctuations.

- Tenant Mix Focus: Acadia prioritizes this segment in specific property types to foster community utility and tenant stability.

- Resilience: In 2024, properties with a high concentration of essential local services demonstrated greater resilience against market downturns.

Acadia's customer segments are diverse, encompassing national and regional retail chains seeking prime locations and long-term leases. They also cater to emerging, digitally native retailers looking to establish a physical presence with flexible agreements. Furthermore, institutional investors and fund partners are key, providing substantial capital for opportunistic real estate ventures, alongside individual investors drawn to Acadia's dividend potential and exposure to retail real estate.

The company also actively supports local businesses and community-focused tenants, recognizing their role as essential anchors and their contribution to stable rental income. This strategic tenant mix ensures a dynamic portfolio that balances the needs of large brands with the stability of community-based services.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| National/Regional Retail Chains | High-visibility locations, long-term leases, property management needs. | Over 70% of new retail leasing agreements in 2024 were with these chains. |

| Emerging/Digitally Native Retailers | Brick-and-mortar expansion, brand visibility, experiential customer interaction, adaptable leases. | Increased exploration of pop-up shops and short-term leases in 2024. |

| Institutional Investors/Fund Partners | Large entities, opportunistic/value-add funds, specialized real estate opportunities. | Capitalized on REIT sector activity and reallocations in 2024. |

| Individual/Retail Investors | Exposure to retail real estate, income generation (dividends), long-term capital appreciation. | Received $0.20 dividend per share in Q1 2024. |

| Local Businesses/Community Tenants | Essential services, stable demand, community integration, reliable rental income. | Properties with these tenants showed lower vacancy rates in 2024. |

Cost Structure

Acadia's cost structure heavily features property acquisition. This includes the actual purchase price of new retail locations, along with associated transaction fees and the costs of thorough due diligence. These expenses are a primary driver of their asset growth.

The scale of these investments is considerable. For instance, Acadia reported over $600 million in property acquisitions throughout 2024 and into early 2025. This significant outlay directly supports their strategy of expanding their physical retail footprint.

Property operating and maintenance expenses are ongoing costs vital for keeping Acadia's real estate portfolio functional and appealing. These include property taxes, insurance premiums, utility bills, common area maintenance (CAM) charges, and essential repairs. For instance, in 2024, real estate operating expenses for retail properties can range significantly, but efficient management is key to maximizing net operating income.

Acadia's business model heavily relies on significant capital expenditures for the redevelopment and renovation of its property portfolio. These investments are crucial for maintaining and enhancing asset value, ensuring competitiveness in the market, and ultimately driving rental income growth. For instance, projects like the Henderson Avenue Corridor expansion represent a substantial outlay aimed at revitalizing key commercial areas.

In 2024, Acadia is expected to continue its strategic investment in property improvements. While specific figures for ongoing redevelopment projects are proprietary, the company's historical capital expenditure patterns suggest a consistent allocation towards enhancing tenant amenities and modernizing facilities. These expenditures are designed to attract and retain high-quality tenants, thereby securing long-term revenue streams and improving occupancy rates.

Financing and Debt Service Costs

Acadia Realty Trust (AKR), as a Real Estate Investment Trust (REIT), relies on both equity and debt financing for its growth and operations. This dual approach inherently creates significant financing and debt service costs, primarily in the form of interest expenses on its outstanding debt obligations. For instance, as of the first quarter of 2024, Acadia reported total debt of approximately $1.3 billion. Effectively managing these costs involves careful attention to prevailing interest rates and the strategic timing of debt maturities to minimize refinancing risk and optimize borrowing expenses.

A prudent approach to its capital structure is paramount for Acadia in mitigating financial risk. By maintaining a conservative leverage ratio, the company can better withstand economic downturns and fluctuations in interest rates. This strategic financial management ensures stability and supports long-term value creation for its stakeholders. For example, Acadia's net debt to total assets ratio remained at a manageable level throughout 2023 and into early 2024, reflecting this commitment to financial discipline.

- Interest Expense: Acadia's cost structure includes substantial interest payments on its debt, which directly impacts profitability.

- Debt Management: Proactive management of debt maturities and interest rate exposure is crucial for controlling these financing costs.

- Capital Structure: A conservative capital structure, with a focus on manageable leverage, helps to reduce financial risk and borrowing costs.

- 2024 Data: As of Q1 2024, Acadia's total debt was around $1.3 billion, highlighting the significant scale of its financing activities.

General and Administrative Expenses

General and Administrative (G&A) expenses represent the essential overhead costs that keep Acadia's corporate engine running. These include the salaries for the executive team, legal counsel, accounting staff, and other corporate support functions. For instance, in 2024, many real estate companies saw G&A costs fluctuate due to increased compliance requirements and investments in technology to streamline operations.

These costs are not directly linked to the revenue generated by individual properties but are crucial for the company's overall strategic planning, financial management, and legal compliance. Think of it as the cost of running the headquarters that oversees all the individual sites. Efficiently managing these expenses is a key lever for Acadia to maintain and improve its profitability.

- Salaries for corporate staff: This covers executives, HR, finance, and legal teams.

- Office expenses: Rent, utilities, and maintenance for corporate headquarters.

- Professional fees: Costs for external legal, accounting, and consulting services.

- Technology and software: Investments in systems for financial reporting and corporate management.

Acadia's cost structure is significantly influenced by its property acquisition strategy, with substantial outlays for purchasing new retail locations and associated transaction costs. The company also incurs considerable operational expenses for maintaining its real estate portfolio, including property taxes, insurance, and utilities. These direct property-related costs are fundamental to its business model.

Beyond property operations, Acadia faces significant financing costs due to its reliance on both debt and equity. Interest expenses on its debt obligations are a key component of its cost structure. For instance, as of Q1 2024, Acadia reported total debt of approximately $1.3 billion, underscoring the impact of financing on its overall expenses. Managing this debt prudently is crucial for financial health.

General and Administrative (G&A) expenses form another critical part of Acadia's cost structure, encompassing overhead like executive salaries, corporate staff, and professional fees. These costs, while not directly tied to property revenue, are essential for overall corporate management and strategic direction. Efficient G&A management is vital for profitability.

| Cost Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Property Acquisition | Purchase price of new retail locations, transaction fees, due diligence | Over $600 million in property acquisitions reported for 2024-early 2025 |

| Property Operations & Maintenance | Property taxes, insurance, utilities, CAM charges, repairs | Ongoing costs crucial for asset functionality and appeal |

| Redevelopment & Renovation | Capital expenditures for property improvements and modernization | Consistent allocation for enhancing tenant amenities and facilities |

| Financing Costs (Interest Expense) | Interest payments on debt obligations | Q1 2024 total debt approx. $1.3 billion |

| General & Administrative (G&A) | Executive salaries, corporate staff, office expenses, professional fees | Essential overhead for corporate management and strategic planning |

Revenue Streams

Acadia's main revenue comes from rent collected from its retail tenants across its properties. This income includes fixed base rent, additional rent based on tenant sales (percentage rent), and reimbursements for operational costs like common area maintenance, property taxes, and insurance. In 2024, Acadia reported significant leasing activity, which is a key driver for this revenue stream.

Acadia generates revenue through its investment management platform by charging asset management fees, which are typically a percentage of the assets under management. For instance, in 2024, many real estate investment firms saw their AUM grow, directly impacting this fee stream.

Beyond asset management, Acadia also collects fees for construction management services, reflecting their hands-on approach to property development. Additionally, leasing fees are a significant component, earned from managing and optimizing the rental income of properties within their funds.

A substantial portion of Acadia's earnings comes from promote, or carried interest, realized upon the successful disposition of assets. This performance-based fee aligns their interests with investors and is a key driver of profitability when investments perform well.

Acadia strategically offloads properties, especially those from its investment management arm or non-essential holdings, to realize substantial gains. This proactive approach enables capital reinvestment into more promising ventures and refines their portfolio's focus.

In 2023, Acadia reported $150 million in gains from property sales, a key contributor to its overall profitability. This highlights the effectiveness of their disposition strategy in enhancing financial performance and portfolio optimization.

Lease Termination and Other Tenant-Related Income

Acadia Realty Trust, for instance, can generate additional income through lease termination fees, late payment penalties, and other miscellaneous tenant-related charges. While these are typically smaller components compared to core rental income, they provide valuable supplementary revenue. For example, in 2024, Acadia reported that such ancillary income streams contributed to their overall financial stability, reflecting the contractual nature of these obligations and the operational adjustments made with tenants.

These varied income sources are crucial for several reasons:

- Lease Termination Fees: These are often negotiated as part of lease agreements, providing compensation when a tenant breaks a lease early.

- Late Payment Penalties: These fees incentivize timely rent payments and offer a small but consistent revenue boost.

- Miscellaneous Income: This can include charges for services rendered, such as after-hours HVAC usage or administrative fees for lease modifications.

- Operational Adjustments: These revenue streams can help offset unexpected costs or capitalize on specific tenant needs, contributing to overall portfolio performance.

Interest Income and Other Investment Gains

Acadia generates interest income from its cash reserves and short-term investment portfolios. This provides a consistent, albeit often modest, revenue stream. For example, in the first quarter of 2024, Acadia reported $12 million in interest income, a notable increase from the previous year due to higher prevailing interest rates.

Beyond interest, Acadia also benefits from realized investment gains. These arise from the strategic sale of equity stakes in other companies. A significant contributor in recent periods was the sale of a portion of its holdings in Albertsons, which generated substantial one-time gains, illustrating the variable nature of this revenue source.

- Interest Income: Earned on cash balances and short-term investments, providing a stable revenue base.

- Investment Gains: Realized profits from the sale of strategic equity holdings, such as Albertsons stock, offering potential for significant but less predictable boosts to earnings.

Acadia's revenue streams are diverse, encompassing rental income from retail properties, fees from its investment management platform, and performance-based promote income. Ancillary income from lease terminations and late payments also contributes, alongside interest earned on cash reserves and gains from strategic equity sales.

In 2024, Acadia's leasing activities significantly boosted rental income, while growth in assets under management positively impacted its asset management fees. The company also realized substantial gains from property dispositions, a key strategy for portfolio optimization and capital reinvestment.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Rental Income | Base rent, percentage rent, and expense reimbursements from retail tenants. | Significant leasing activity reported, driving rental revenue growth. |

| Investment Management Fees | Asset management fees based on assets under management (AUM). | AUM growth in 2024 generally benefited this fee stream for real estate firms. |

| Promote/Carried Interest | Performance-based fees earned upon successful asset disposition. | Key driver of profitability when investments perform well. |

| Property Disposition Gains | Profits realized from selling properties. | In 2023, Acadia reported $150 million in gains from property sales. |

| Ancillary Income | Lease termination fees, late payment penalties, and other tenant charges. | Contributed to overall financial stability in 2024. |

| Interest Income | Earned on cash reserves and short-term investments. | Reported $12 million in Q1 2024, an increase due to higher interest rates. |

| Investment Gains | Realized profits from selling equity stakes in other companies. | Gains from Albertsons holdings were a significant contributor. |

Business Model Canvas Data Sources

The Acadia Business Model Canvas is informed by extensive market research, competitive analysis, and internal operational data. These sources ensure a comprehensive understanding of customer needs, market opportunities, and the company's strategic capabilities.