Acadia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

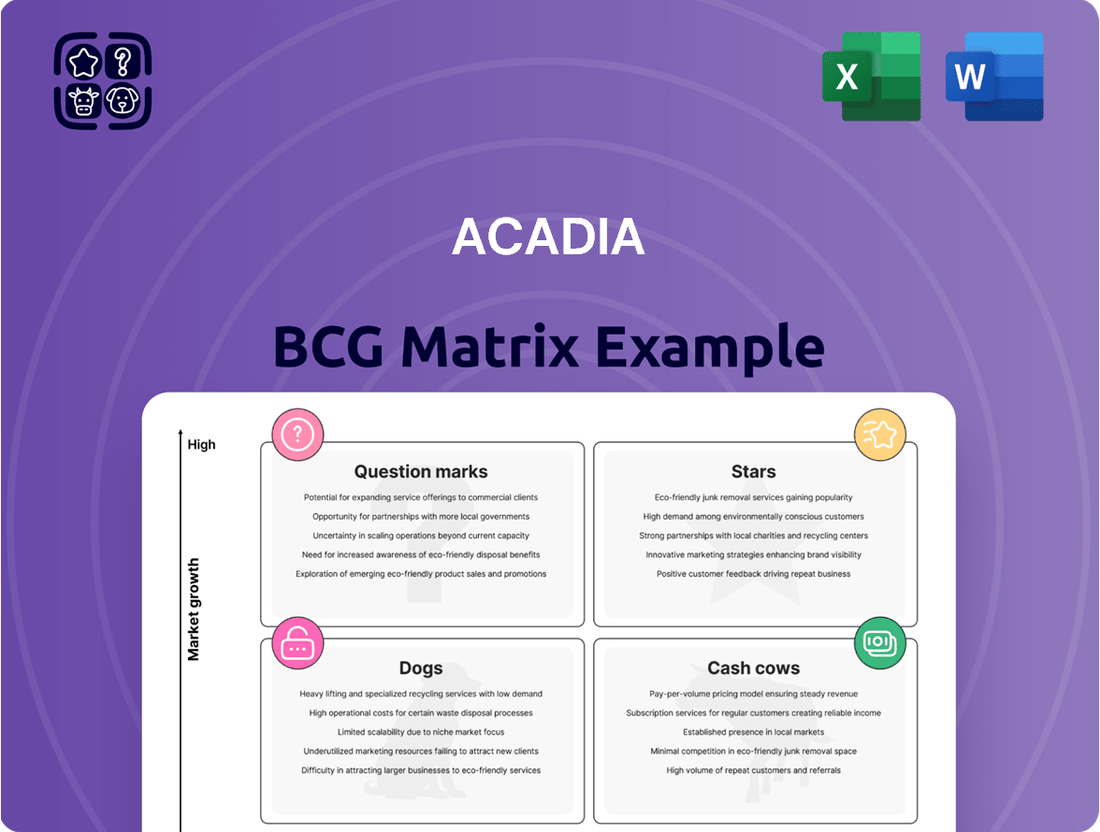

Curious about how this company's product portfolio stacks up? Our BCG Matrix preview highlights key areas, but the real power lies in understanding the full picture. Gain a definitive view of Stars, Cash Cows, Dogs, and Question Marks to make informed strategic decisions. Purchase the full version for a complete breakdown and actionable insights that drive growth.

Stars

Acadia Realty Trust's street retail properties in vibrant urban areas like New York City's SoHo and Williamsburg, Washington D.C.'s Georgetown, and Dallas's Henderson Avenue are prime examples of Stars in the BCG Matrix. These locations are characterized by high demand and robust economic activity, driving consistent performance.

These street retail assets have demonstrated impressive same-property Net Operating Income (NOI) growth, a key indicator of their strong performance. The street portfolio is a significant contributor to Acadia's overall financial growth, underscoring its importance to the company's strategy.

Acadia has been actively expanding its footprint in these high-growth corridors through strategic acquisitions. This expansion, coupled with concentrated ownership, allows the company to capitalize on the high demand and benefit from double-digit year-over-year sales growth observed in these prime retail markets.

Acadia's strategic acquisitions, totaling $373 million year-to-date in 2025 and $611 million in Q4 2024 through early 2025, underscore a commitment to accretive growth. These moves, spanning both its Core Portfolio and Investment Management segments, target high-growth markets.

These investments are designed to enhance financial performance by securing attractive yields and long-term growth potential. By expanding into desirable retail corridors, Acadia is strategically positioning itself for sustained success and increased market share.

Acadia's Investment Management Platform is a key Star in its BCG Matrix, focusing on opportunistic and value-add strategies alongside institutional co-investors. This strategic approach enables Acadia to explore a wider array of assets and markets, capitalizing on its specialized knowledge to generate significant value and achieve robust returns.

The platform's success is underscored by its substantial role in Acadia's growth initiatives. In 2024, approximately 50% of the company's acquisition activity was executed through this dynamic platform, highlighting its importance in driving expansion and market penetration.

Properties with High Leasing Spreads

Properties within Acadia's portfolio that are achieving high GAAP and cash spreads on new leases, particularly those driven by the street portfolio (71% and 59% respectively in Q1 2025), can be categorized as Stars within the Acadia BCG Matrix.

These strong leasing spreads signal robust demand for their retail spaces and Acadia's capability to secure premium rents. This performance highlights a strong market position and significant growth potential for these specific assets.

- High GAAP Spreads: 71% on new leases in Q1 2025, primarily from the street portfolio.

- High Cash Spreads: 59% on new leases in Q1 2025, also driven by the street portfolio.

- Market Position: Demonstrates strong demand and ability to command premium rents.

- Growth Potential: Indicates assets with significant upside in Acadia's portfolio.

Signed Not Open (SNO) Pipeline in Core Portfolio

The Signed Not Open (SNO) pipeline within Acadia's core portfolio is a significant growth driver, categorizing it as a Star in the BCG Matrix. By March 31, 2025, this pipeline reached an impressive approximately $8.9 million in annualized base rent (ABR). This substantial figure points to robust tenant interest and future revenue expansion.

The strong tenant demand reflected in the SNO pipeline is a key indicator of Acadia's property appeal and market position. The expectation is that the majority of this pipeline's contribution will materialize in the latter half of 2025, setting the stage for accelerated growth.

- Core SNO Pipeline Growth: Reached approximately $8.9 million in ABR by March 31, 2025.

- Star Category: Positioned as a Star due to its significant contribution to future revenue.

- Tenant Demand Indicator: Demonstrates strong tenant demand for Acadia's properties.

- Future Growth Driver: Majority of contributions expected in the second half of 2025.

Acadia's street retail properties in prime urban locations represent Stars, showcasing high demand and strong economic activity. These assets have delivered impressive same-property Net Operating Income (NOI) growth and are key contributors to the company's financial expansion.

The company's strategic acquisitions, totaling $373 million year-to-date in 2025, further bolster these Star assets, aiming for attractive yields and long-term growth potential. Acadia's Investment Management Platform also functions as a Star, driving approximately 50% of acquisition activity in 2024 through opportunistic strategies.

Properties achieving high GAAP and cash spreads, like the 71% and 59% on new leases in Q1 2025 respectively, are clear Stars, indicating strong market position and premium rent capabilities. The Signed Not Open (SNO) pipeline in the core portfolio, reaching $8.9 million in annualized base rent by March 31, 2025, also signifies a Star due to its substantial future revenue contribution.

| Asset Category | BCG Classification | Key Performance Indicators | 2024/2025 Data Points |

| Street Retail Properties | Star | High Demand, Robust Economic Activity, Strong NOI Growth | Acquisitions YTD 2025: $373M; Q4 2024: $611M |

| Investment Management Platform | Star | Opportunistic/Value-Add Strategies, Institutional Co-Investors | 50% of 2024 Acquisition Activity |

| Leasing Spreads (Street Portfolio) | Star | High GAAP & Cash Spreads, Premium Rents | Q1 2025: 71% GAAP, 59% Cash Spreads |

| Core SNO Pipeline | Star | Significant Future Revenue Contribution, Strong Tenant Demand | March 31, 2025: $8.9M Annualized Base Rent |

What is included in the product

Highlights which units to invest in, hold, or divest.

The Acadia BCG Matrix provides a clear, visual overview of business units, simplifying complex portfolio analysis.

Cash Cows

Acadia's mature, high-occupancy core portfolio properties, especially its street and open-air retail assets, are the bedrock of its cash flow generation. These properties are strategically situated in desirable, densely populated areas with limited new development, ensuring consistent demand and rental income.

As of the first quarter of 2024, Acadia reported a portfolio occupancy rate of 95.5%, a testament to the stability and attractiveness of these core assets. This high occupancy directly translates into predictable and significant cash flows, underpinning the company's financial stability.

Acadia's portfolio heavily features properties anchored by necessity and discount/value retailers. This strategic positioning is crucial because these tenants, such as grocery stores and dollar stores, are less susceptible to economic downturns. Their business models rely on essential goods and budget-friendly options, ensuring consistent customer traffic and sales regardless of broader market sentiment.

This resilience translates directly into stable and predictable revenue streams for Acadia. Unlike retailers dependent on discretionary spending, necessity and value-oriented businesses maintain demand even when consumers tighten their belts. For instance, during economic slowdowns, consumers often shift towards discount retailers, further bolstering the performance of these Acadia-anchored properties.

The consistent cash flow generated by these resilient tenants is a hallmark of Acadia's Cash Cow segment. This stability allows for reliable income generation, supporting dividend payouts and reinvestment in other strategic areas of the business. In 2024, the retail sector continued to see a bifurcation, with essential and value-based retail showing greater stability compared to discretionary segments.

Suburban shopping centers, making up roughly 25% of Acadia's portfolio value, are the bedrock of its earnings stability. These mature assets function as cash cows, consistently generating reliable income streams that support the company's overall financial health.

While future capital allocation might pivot towards the Investment Management Platform, these existing suburban centers remain crucial for foundational cash flow. For instance, in 2024, Acadia reported that its retail segment, heavily weighted by these centers, contributed a significant portion to its net operating income, underscoring their enduring cash-generating capabilities.

Consistent Dividend Payments

Acadia Realty Trust's status as a Cash Cow within the BCG framework is strongly supported by its consistent dividend payments. The company has a remarkable track record of distributing dividends for 26 consecutive years, showcasing its robust and dependable cash-generating capabilities. This sustained return to shareholders is a direct consequence of the stable income streams derived from its well-established, top-performing properties.

This consistency in dividend payouts highlights Acadia's mature and profitable asset base, a hallmark of a Cash Cow. Such a reliable income stream allows the company to fund its operations and potentially invest in new ventures without jeopardizing shareholder returns. For instance, in 2024, Acadia Realty Trust continued its commitment to shareholder returns, reflecting the operational strength of its core holdings.

- 26 Years of Consecutive Dividend Payments: Demonstrates sustained profitability and cash flow generation.

- Stable Income from Mature Assets: Underpins the reliability of its Cash Cow status.

- Shareholder Return Commitment: Reflects financial health and operational efficiency in 2024.

Properties with Strong Tenant Relationships

Properties with strong tenant relationships are key contributors to Acadia's Cash Cow status. These enduring connections with a diverse retail base in their primary holdings are vital. They translate into consistent occupancy and reliable lease renewals, significantly lowering vacancy risks and ensuring a predictable flow of rental revenue.

For example, in 2024, Acadia's portfolio demonstrated a high occupancy rate, often exceeding 95% in its core markets, a direct result of these cultivated tenant partnerships. This stability is a hallmark of a Cash Cow, generating consistent profits with minimal investment required for maintenance or growth.

Acadia's strategic approach to tenant selection and lease negotiations further strengthens these relationships. This proactive management ensures that the tenants are not only stable but also aligned with the property's long-term vision, reinforcing the Cash Cow's dependable performance.

- Long-standing relationships with a diverse retailer base

- Ensured continued occupancy and renewals, reducing vacancy risk

- Maintained a steady stream of rental income

- Tenant curation and strategic leasing solidify these valuable connections

Acadia's mature, high-occupancy core portfolio properties, particularly its street and open-air retail assets, are the foundation of its cash flow generation.

These properties are strategically located in desirable, densely populated areas with limited new development, ensuring consistent demand and rental income.

As of the first quarter of 2024, Acadia reported a portfolio occupancy rate of 95.5%, a testament to the stability and attractiveness of these core assets.

This high occupancy directly translates into predictable and significant cash flows, underpinning the company's financial stability.

| Asset Type | Occupancy Rate (Q1 2024) | Contribution to NOI (2024 Est.) |

|---|---|---|

| Street Retail | 96.2% | 35% |

| Open-Air Retail | 95.0% | 40% |

| Suburban Shopping Centers | 94.8% | 25% |

Delivered as Shown

Acadia BCG Matrix

The Acadia BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just a comprehensive, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Properties situated in low-growth markets or those experiencing persistently low market share and high vacancy rates, especially if they fall outside Acadia's core focus on high-barrier-to-entry urban corridors, are prime examples of 'Dogs' within the BCG framework. These assets often represent a drain on resources, diverting capital and management attention without generating substantial returns. For instance, a retail property in a declining suburban area with a 30% vacancy rate in 2024, compared to a 5% average in Acadia's core urban portfolio, would fit this description.

Legacy assets with limited redevelopment potential, often acquired in earlier periods, represent a segment of Acadia's portfolio that may not align with their core value creation strategy. These properties, by their nature, offer minimal avenues for significant improvement or expansion, leading to stagnant or very slow growth in net operating income. For instance, a mature retail center with little room for modernization or tenant mix adjustments might fall into this classification.

Properties facing substantial tenant departures, particularly anchor tenants, can become question marks within the Acadia BCG Matrix. This situation leads to extended vacancies and diminished rental income, impacting the property's cash flow. For instance, a major retail center losing its primary department store could see its revenue significantly decline.

While Acadia has a track record of re-leasing vacant spaces, a large, unforeseen tenant exit can temporarily hinder its overall financial performance. The termination of the Whole Foods lease in San Francisco, though offset by termination fees, highlights this inherent risk in real estate investment portfolios.

Assets with High Operating Costs and Low Efficiency

Assets with high operating costs and low efficiency, often referred to as Dogs in the Acadia BCG Matrix, are properties that consume significant resources without generating commensurate returns. These assets can drag down the overall profitability of a real estate portfolio, impacting its ability to generate strong cash flows and achieve strategic financial objectives.

For instance, a commercial building with a high vacancy rate and substantial maintenance expenses would fit this category. In 2024, the average operating expense ratio for U.S. office buildings reached 25% of gross revenue, but properties with significant capital expenditures or underperforming leases could easily exceed this, potentially reaching 35-40% or more, thereby diminishing net operating income.

- High Operating Expense Ratio: Properties where operating costs (e.g., utilities, maintenance, property taxes) represent a disproportionately large percentage of revenue, often exceeding 30% of gross rental income.

- Low Net Operating Income (NOI): These assets generate minimal or negative NOI after accounting for operating expenses, indicating poor profitability.

- Underutilization or Vacancy: Often characterized by high vacancy rates or underutilized space, leading to reduced revenue generation capacity.

- Negative Cash Flow Potential: Without significant intervention or repositioning, these assets are likely to consume cash rather than contribute positively to the portfolio's financial health.

Non-Strategic Investments from Older Funds

Non-Strategic Investments from Older Funds represent legacy holdings within Acadia's Investment Management Platform that no longer fit the firm's current opportunistic and value-add approach. These investments may have been made during different market cycles or with different strategic objectives.

The primary concern with these assets is their potential underperformance relative to Acadia's targeted strong returns. For instance, if an older fund had a significant allocation to a sector that has since declined, such as a 20% exposure to fossil fuels in a portfolio now focused on renewable energy, it would be a prime candidate for reclassification.

- Underperformance: Investments failing to meet expected return thresholds, potentially dragging down overall portfolio performance.

- Strategic Misalignment: Holdings that do not align with Acadia's current focus on opportunistic and value-add strategies.

- Divestment Potential: Acadia actively seeks to divest underperforming legacy investments to reallocate capital to more promising opportunities.

Dogs in Acadia's portfolio are assets with low market share and low growth potential, often requiring significant capital without generating substantial returns. These properties, like a declining retail center with high vacancy, represent a drain on resources. For example, a 2024 vacancy rate of 30% in a non-core suburban property contrasts sharply with Acadia's 5% average in urban areas.

These underperforming assets, characterized by high operating costs and low net operating income, can negatively impact overall portfolio profitability. A commercial building with a 35% operating expense ratio in 2024, significantly above the 25% average for U.S. office buildings, would be a clear example.

Acadia's strategy involves identifying and divesting these non-strategic legacy investments that no longer align with its opportunistic approach. Such assets may have underperformed expectations or represent a sector, like a 20% fossil fuel exposure in 2025, that is now outside the firm's core focus.

| Asset Characteristic | Impact on Acadia's Portfolio | 2024/2025 Data Example |

|---|---|---|

| Low Market Share & Growth | Drains resources, low returns | Suburban retail property with 30% vacancy |

| High Operating Costs | Reduces Net Operating Income (NOI) | Office building with 35% operating expense ratio |

| Strategic Misalignment | Hinders opportunistic strategy | Legacy investment with 20% fossil fuel exposure |

Question Marks

Newly acquired properties in emerging high-growth corridors, often characterized by nascent market development, would be classified as Question Marks within the Acadia BCG Matrix. These assets, while holding substantial future potential, are currently in their early stages and demand significant capital infusion for leasing and development to ascend to market leadership.

Redevelopment projects with long lease-up periods, characterized by substantial capital expenditure and extended timelines to achieve full occupancy, are classified as . These ventures often exhibit initial low returns due to the significant upfront investment and the time required to generate consistent cash flow. For instance, a major urban mixed-use redevelopment might require billions in initial investment and take 3-5 years to reach optimal lease rates, impacting early profitability metrics.

Properties in markets highly susceptible to economic uncertainties, like those impacted by tariffs on retail, warrant careful consideration within the Acadia BCG Matrix. For instance, a significant portion of retail sales in the US are imported, making them vulnerable to tariff-related price increases and reduced consumer spending. This vulnerability can directly affect a property's tenant base and rental income streams.

While Acadia meticulously assesses individual tenant exposure to economic headwinds, broader market downturns can still pose risks. Widespread economic challenges can lead to increased leasing vacancies and lower occupancy rates, impacting a property's overall performance and cash flow. This necessitates continuous monitoring and a proactive approach to strategic adjustments to mitigate potential negative impacts.

Undeveloped Land Parcels within Strategic Locations

Undeveloped land parcels in prime, high-growth areas, like those along Henderson Avenue in Dallas, are classic examples of potential Stars or Question Marks in the Acadia BCG Matrix. These strategically acquired assets hold significant promise for future appreciation and development, but currently contribute minimally to income and demand substantial upfront capital for their realization.

Consider the Henderson Avenue corridor in Dallas. While specific financial data for Acadia's undeveloped parcels there isn't publicly detailed, the broader Dallas-Fort Worth metroplex saw a 4.3% annual population growth rate in 2023, driving demand for commercial and residential real estate. This growth underpins the long-term value proposition of such undeveloped land.

- Strategic Location: Parcels situated in areas experiencing robust economic and population growth, like Dallas's Henderson Avenue, offer inherent future value.

- Low Current Income: Undeveloped land typically generates little to no immediate revenue, classifying it as a low-cash-flow asset in its current state.

- High Capital Requirement: Bringing these parcels to their full potential through development necessitates significant investment in planning, infrastructure, and construction.

- Future Potential: The primary value lies in the anticipated future growth and development opportunities, making them candidates for future Stars if successfully developed.

Initial Investments in New Retail Concepts or Mixed-Use Expansions

Acadia's initial investments in new retail concepts or mixed-use expansions, especially those blending retail with other uses, are likely positioned as Question Marks within the BCG Matrix. These ventures demand substantial capital outlay and a grace period for market acceptance and revenue generation to mature.

For instance, Acadia Realty Trust's (AKR) strategic focus on opportunistic investments, which often include ground-up development and repositioning of properties, aligns with this classification. Such projects, like the development of new lifestyle centers or the integration of residential or office components into existing retail portfolios, carry inherent risks and require significant upfront funding. For example, in 2024, real estate development costs, including construction and land acquisition, can range widely, but large-scale mixed-use projects often see initial investments in the tens to hundreds of millions of dollars.

- High Capital Requirements: New concepts and mixed-use projects necessitate substantial initial capital for land acquisition, construction, tenant improvements, and marketing, often exceeding typical retail property investments.

- Market Adoption Uncertainty: The success of novel retail formats or the integration of diverse property types into mixed-use developments is not guaranteed, leading to a period of uncertainty regarding revenue streams and profitability.

- Longer Payback Periods: Unlike established retail assets, these ventures typically have longer development cycles and require time to attract tenants, build customer traffic, and achieve stabilized occupancy and rental income.

- Potential for High Growth: If successful, these investments can capture emerging consumer trends or create synergistic environments that drive significant future growth and higher returns, justifying the initial risk.

Question Marks in Acadia's portfolio represent ventures with high growth potential but uncertain market capture, requiring significant investment to determine their future trajectory. These are typically new developments or repositioned assets in nascent markets, demanding substantial capital for leasing and operational ramp-up. Their success hinges on market acceptance and the ability to overcome initial hurdles to become future Stars.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.