Acadia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acadia Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Acadia's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate challenges and capitalize on opportunities. Don't just react to market shifts—lead them. Download the full report now for actionable intelligence.

Political factors

Government policies focused on urban development are a key political factor for Acadia Realty Trust. Initiatives like the Biden-Harris Administration's Bipartisan Infrastructure Law, which allocated $1.2 trillion in 2021, are driving significant investment in urban infrastructure, potentially creating new opportunities for mixed-use developments. Favorable tax credits, such as those for historic preservation, can directly boost the profitability of Acadia's redevelopment projects.

Conversely, the success of Acadia's strategy heavily relies on local and state zoning laws and development approvals. For instance, a city's commitment to streamlining the permitting process, as seen in some tech-forward municipalities aiming to attract investment, could accelerate project timelines. However, stringent rent control regulations or a lack of public funding for affordable housing components within mixed-use projects could present challenges and impact the financial viability of Acadia’s urban acquisitions.

Local zoning and land use regulations are critical for Acadia Realty Trust, directly shaping where and how they can develop properties. For instance, a city might have specific zoning for retail-only areas, limiting mixed-use potential and impacting Acadia's ability to create diverse revenue streams from a single property. In 2024, many municipalities are reviewing or updating their zoning codes to encourage more housing or mixed-use development, which could present new opportunities for Acadia but also require careful navigation of evolving rules.

Changes in federal, state, and local tax policies, including property taxes and corporate income taxes, directly influence Acadia Realty Trust's profitability. For instance, the Tax Cuts and Jobs Act of 2017, while offering a deduction for pass-through income, also altered corporate tax rates, impacting the overall tax burden for entities like REITs. As of early 2024, discussions around potential adjustments to capital gains taxes or depreciation schedules remain a key area for Acadia to monitor.

The favorable tax treatment of REITs, which allows them to avoid corporate income tax if they distribute at least 90% of their taxable income to shareholders as dividends, is fundamental to their structure. Any shifts in regulations regarding these distributions, or changes to how capital gains are taxed upon property sales, could significantly affect Acadia's net income and the attractiveness of its shares to investors. For example, an increase in the corporate tax rate without a corresponding adjustment to REIT-specific rules could create a competitive disadvantage.

Furthermore, tax incentives aimed at encouraging specific types of real estate development, such as those promoting sustainable building practices or urban revitalization projects, could present strategic opportunities for Acadia. The Inflation Reduction Act of 2022, for example, introduced various credits for clean energy and energy efficiency, which could be leveraged by Acadia in its portfolio development and management strategies, potentially reducing operational costs and enhancing property valuations.

Political Stability and Investor Confidence

Political stability is a bedrock for investor confidence, directly impacting Acadia Realty Trust's (ACR) capacity to secure capital for its core and opportunistic funds. A predictable political landscape minimizes regulatory surprises, creating a business environment conducive to the long-term commitments real estate demands. This stability is crucial for attracting both local and global investment into ACR's portfolio.

Conversely, geopolitical friction or abrupt domestic policy changes can inject significant volatility into the real estate sector. For instance, in 2024, the ongoing geopolitical tensions in Eastern Europe continued to cast a shadow over global markets, influencing investor sentiment towards perceived safe-haven assets and potentially impacting cross-border real estate investment flows. Acadia Realty Trust, like many REITs, must navigate these broader political currents.

Key considerations for Acadia Realty Trust regarding political factors include:

- Regulatory Environment: Changes in zoning laws, tax policies, and environmental regulations at federal, state, and local levels can significantly alter the cost and feasibility of real estate development and operations.

- Government Spending and Infrastructure Projects: Government investment in infrastructure, such as transportation networks and urban development, can boost property values and create new investment opportunities in specific geographic areas.

- International Relations and Trade Policies: For REITs with international exposure or those reliant on foreign capital, shifts in trade agreements and diplomatic relations can influence investment flows and market access.

- Election Cycles and Policy Continuity: The outcome of elections and the subsequent policy direction can create uncertainty or provide clarity for long-term investment planning, affecting investor willingness to commit capital.

Trade Policies and Retail Supply Chains

Trade policies significantly influence Acadia Realty Trust's retail tenants by altering their supply chain economics. For instance, the imposition of tariffs on goods imported by retailers can directly increase their cost of goods sold, potentially squeezing profit margins. This was evident in the period leading up to mid-2024, where ongoing trade tensions, particularly between major economic blocs, led to increased uncertainty and cost volatility for many global supply chains.

Such cost pressures can translate into reduced tenant profitability, potentially impacting their ability to pay rent or even leading to store closures. This, in turn, affects Acadia's property performance through lower rental income and higher vacancy rates. A stable trade environment, conversely, supports predictable inventory management and pricing for retailers, fostering stronger demand for retail space.

Consider these points regarding trade policies and retail supply chains:

- Tariff Impact: Tariffs on imported apparel, for example, could raise costs for fashion retailers, a key tenant segment for many REITs like Acadia.

- Supply Chain Disruptions: Trade disputes can lead to longer lead times and reduced product availability, affecting a retailer's ability to keep shelves stocked and satisfy consumer demand.

- Consumer Price Sensitivity: Increased operational costs for retailers may be passed on to consumers, potentially dampening retail sales and, consequently, tenant sales performance.

- Global Trade Agreements: Changes or renegotiations of trade agreements can create ripple effects across international retail supply chains, impacting product sourcing and cost structures.

Government policies directly shape Acadia Realty Trust's operational landscape, from urban development incentives to zoning regulations. The Biden-Harris Administration's infrastructure investments, totaling $1.2 trillion as of 2021, are a prime example of how public spending can stimulate urban growth and create opportunities for mixed-use projects. Tax credits, such as those for historic preservation, can also significantly enhance the financial viability of Acadia's redevelopment endeavors.

Local zoning laws are paramount, dictating where and how Acadia can develop properties; for instance, in 2024, many cities are revising codes to encourage mixed-use development, presenting both opportunities and compliance challenges. Furthermore, federal, state, and local tax policies, including property and corporate income taxes, directly impact Acadia's profitability, with ongoing discussions in early 2024 about potential capital gains tax adjustments requiring close monitoring.

The political climate's stability is crucial for Acadia Realty Trust's capital acquisition, as a predictable environment minimizes regulatory surprises and fosters long-term real estate commitments. Geopolitical tensions, such as those observed in Eastern Europe throughout 2024, can introduce market volatility and influence global investment flows, necessitating careful navigation by REITs like Acadia.

What is included in the product

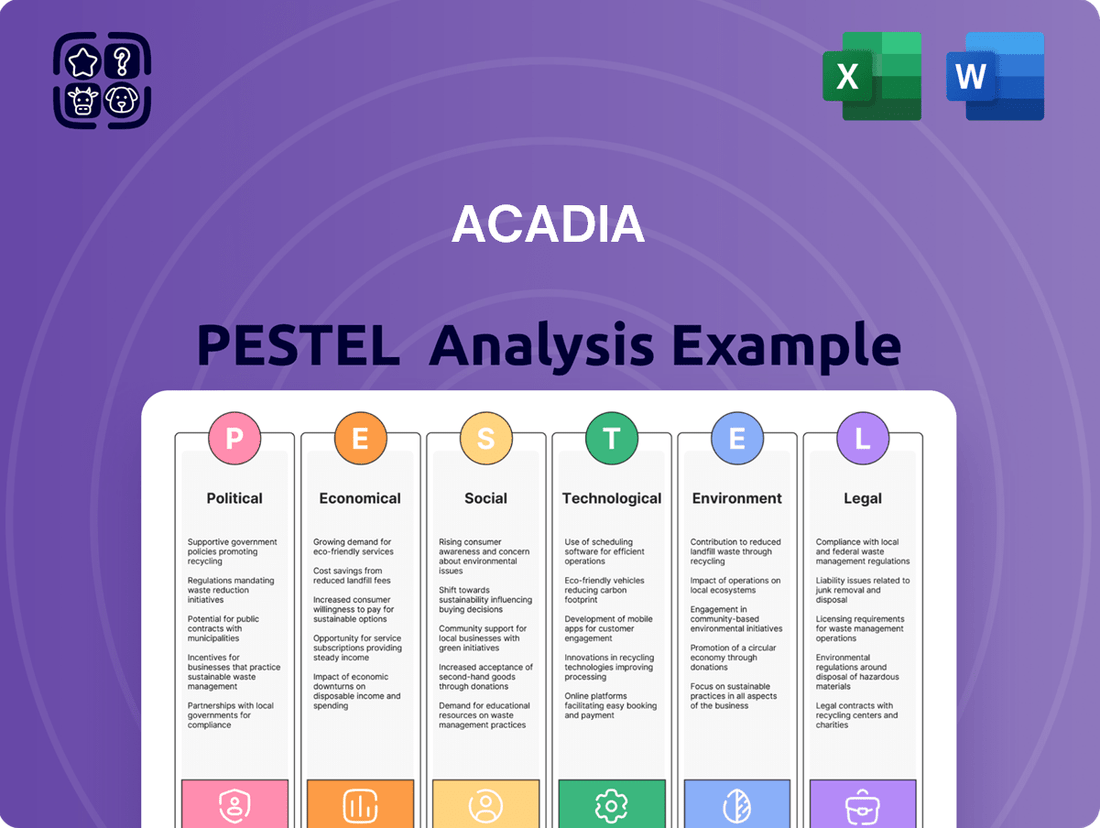

The Acadia PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the company's operating landscape.

This comprehensive review provides actionable insights for strategic decision-making by highlighting key external influences and their potential impact on Acadia's future.

A clear, actionable summary of Acadia's PESTLE factors, presented in a digestible format, removes the pain of wading through lengthy reports, enabling faster strategic decision-making.

Economic factors

Interest rate shifts directly influence Acadia Realty Trust's (AKR) expenses for acquiring and improving properties, alongside the worth of its current holdings. For instance, the Federal Reserve's benchmark interest rate, which influences many other rates, saw increases throughout 2022 and 2023, impacting borrowing costs. As of mid-2024, while rate hikes have paused, the prevailing higher rate environment means AKR faces increased costs for new debt.

A rise in interest rates makes borrowing more expensive, which can dampen enthusiasm for new property ventures and potentially push down property capitalization rates, affecting AKR's profitability. For example, if a property initially yielded a 5% cap rate with a 3% interest rate, a jump to a 5% interest rate would significantly squeeze net operating income and reduce the property's valuation.

Staying informed about the Federal Reserve's monetary policy decisions and broader economic signals concerning interest rates is crucial for Acadia to effectively manage its debt obligations and its pipeline of potential investments. This proactive approach helps mitigate risks associated with fluctuating capital costs.

Inflationary pressures directly impact Acadia Realty Trust's operating expenses. Costs for utilities, property maintenance, and local taxes are likely to rise, potentially squeezing net operating income if these increases cannot be fully passed on to tenants through rent adjustments.

While higher inflation can theoretically boost rental income, the actual benefit depends on lease structures and tenant agreements. Acadia must carefully manage the timing and magnitude of rent increases to ensure profitability and protect the real value of its investments against rising price levels.

For instance, the US CPI rose 3.3% in the twelve months ending May 2024, indicating persistent inflationary trends that directly influence property operating costs. Acadia's strategy must involve robust expense control and flexible lease terms to navigate these economic headwinds effectively.

Consumer spending is a major driver for Acadia Realty Trust, directly impacting their rental income and property occupancy. When consumers feel confident and have more money to spend, retail sales tend to rise, which is good news for Acadia's street retail and mixed-use properties. For instance, in the first quarter of 2024, U.S. retail sales excluding autos saw a 0.7% increase month-over-month, indicating a healthy demand environment.

However, any slowdown in consumer spending, perhaps due to inflation or economic uncertainty, can hurt foot traffic and sales for retailers. This could lead to difficulties for Acadia's tenants, potentially causing vacancies in their portfolio. The U.S. personal savings rate, a key indicator of disposable income, was around 3.4% in April 2024, down from higher levels seen during the pandemic, suggesting consumers may be more cautious with their spending.

Unemployment Rates and Economic Growth

Low unemployment rates and strong economic growth typically go hand-in-hand with higher consumer confidence and spending, which are beneficial for sectors like retail real estate. When more people are employed, they have more disposable income, leading to increased retail activity and a greater demand for shopping spaces. This trend directly impacts companies like Acadia Realty Trust, whose focus on urban and suburban retail properties relies heavily on the economic health and job market of these specific locations.

For instance, as of early 2024, the U.S. unemployment rate remained historically low, hovering around 3.7% according to the Bureau of Labor Statistics. This sustained low unemployment supports robust consumer spending, a key driver for retail performance. Acadia's strategy is thus well-positioned to benefit from these favorable employment conditions, as a strong job market translates to more shoppers and better leasing prospects for its portfolio.

- Job Market Strength: A low unemployment rate, such as the U.S. rate around 3.7% in early 2024, fuels consumer spending.

- Disposable Income: Higher employment levels directly correlate with increased disposable income, boosting retail demand.

- Tenant Performance: A healthy job market improves the financial stability of retail tenants, reducing vacancy risks.

- Location Sensitivity: Acadia's urban and suburban focus makes its investments particularly responsive to local employment trends.

Real Estate Market Valuations and Investment Returns

Broader real estate market valuations, influenced by supply-demand, investor sentiment, and economic forecasts, directly shape Acadia Realty Trust's capacity to generate enduring value from its portfolio. For instance, the U.S. commercial real estate market experienced a notable slowdown in transaction volumes in late 2023 and early 2024, with many investors adopting a wait-and-see approach amid higher interest rates and economic uncertainty. This environment directly affects Acadia's acquisition and disposition profitability, as property values and capitalization rates (cap rates) are key determinants.

Market liquidity, or the ease with which assets can be bought and sold, is also a critical factor for Acadia. In a less liquid market, raising and deploying capital efficiently becomes more challenging, potentially impacting the pace of growth and the ability to capitalize on opportunities. For example, during periods of economic contraction, lenders may tighten credit standards, making financing more difficult to secure for new acquisitions.

- Property Value Impact: Fluctuations in property values directly alter the equity base and potential returns on Acadia's holdings.

- Cap Rate Sensitivity: Changes in cap rates, which reflect the relationship between net operating income and property value, significantly influence acquisition pricing and investment yields.

- Liquidity Constraints: Reduced market liquidity can hinder Acadia's ability to divest assets at favorable prices or to quickly redeploy capital into new investments.

- Market Cycle Awareness: Navigating real estate cycles, from expansion to contraction, is crucial for optimizing investment timing and risk management.

Economic factors significantly influence Acadia Realty Trust's financial performance and strategic decisions. Interest rate fluctuations directly impact borrowing costs and property valuations, while inflation affects operating expenses and rental income potential. Consumer spending and the strength of the job market are crucial drivers for retail property demand and tenant stability.

The real estate market's overall health, including transaction volumes and liquidity, also plays a vital role in Acadia's ability to acquire, manage, and dispose of assets profitably. Understanding these economic dynamics is key for Acadia to navigate market cycles and optimize its investment strategies.

| Economic Factor | Impact on Acadia Realty Trust (AKR) | Data Point (as of mid-2024 or latest available) |

|---|---|---|

| Interest Rates | Increases borrowing costs, affects property valuations and cap rates. | Federal Reserve benchmark rate paused but remains at elevated levels. |

| Inflation | Raises operating expenses (utilities, maintenance), impacts net operating income. | U.S. CPI rose 3.3% year-over-year ending May 2024. |

| Consumer Spending | Drives retail demand and occupancy for Acadia's properties. | U.S. retail sales (ex-autos) up 0.7% MoM in Q1 2024; Personal savings rate around 3.4% in April 2024. |

| Job Market | Low unemployment boosts disposable income and tenant financial health. | U.S. unemployment rate around 3.7% in early 2024. |

| Real Estate Market Conditions | Affects transaction volumes, liquidity, and property values. | Commercial real estate transaction volumes slowed in late 2023/early 2024. |

What You See Is What You Get

Acadia PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured. This Acadia PESTLE Analysis provides a comprehensive overview of the external factors impacting the business, ready for your immediate use.

The content and structure shown in the preview is the same document you’ll download after payment. You'll receive the complete Acadia PESTLE Analysis, covering Political, Economic, Social, Technological, Legal, and Environmental aspects.

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying. This Acadia PESTLE Analysis is a ready-to-use tool for strategic planning.

Sociological factors

Demographic shifts are reshaping consumer landscapes. For instance, the U.S. population is aging, with the 65+ age group projected to reach 73.1 million by 2030, impacting demand for healthcare-related retail and services. Simultaneously, Gen Z, now entering prime spending years, favors experiences and digital integration, influencing how retail spaces are designed and utilized. Evolving household structures, including smaller family units and single-person households, also alter consumption patterns, favoring convenience and smaller-format retail.

Acadia Realty Trust’s strategy, focusing on urban and suburban hubs, must account for these demographic currents. Understanding how an aging population affects demand for pharmacies or how Gen Z’s preference for curated online-to-offline experiences influences leasing strategies is vital. For example, in 2024, retail sales growth in urban areas is expected to be around 3.5%, but this can vary significantly based on the dominant age demographics within those specific locations.

Adapting to these lifestyle trends is paramount for tenant attraction and retention. Mixed-use developments that incorporate residential, office, and retail components are increasingly appealing to diverse age groups and lifestyles, offering convenience and community. By aligning their portfolio with these evolving consumer needs, Acadia can ensure sustained relevance and profitability in its chosen markets.

Consumers increasingly seek retail environments offering more than just products; they want experiences. This includes integrated dining, entertainment, fitness, and spaces for community interaction. For instance, a 2024 report indicated that 70% of consumers are more likely to visit a store if it offers an engaging experience.

Acadia Realty Trust's strategy aligns with this by focusing on street retail and mixed-use developments. By carefully selecting tenants and designing spaces that foster engagement, Acadia can attract more visitors. This approach is crucial for driving foot traffic and increasing property value in the current market.

The success of this trend hinges on effective placemaking and deep community integration. Properties that become community hubs, offering diverse activities and fostering a sense of belonging, are seeing higher occupancy rates and rental growth. This sociological shift underscores the evolving role of retail spaces.

The ongoing dance between city living and suburban sprawl significantly shapes retail property demand. Trends like the rise of remote work, coupled with the persistent challenge of housing affordability in major urban centers, are prompting more people to consider suburban locales, impacting where retail foot traffic is strongest. For instance, while urban cores remain vital, many suburban areas saw retail sales growth exceed urban centers in certain periods leading up to 2025, driven by these population shifts.

Acadia Realty Trust's strategy of investing in both urban and suburban markets positions them to capitalize on these dynamic population movements. This dual approach allows for flexibility as consumer preferences and living arrangements evolve. By monitoring which regions are attracting new residents or seeing changes in their demographic makeup, Acadia can better pinpoint promising investment areas and optimize its current property portfolio.

Impact of Work-From-Home Trends on Foot Traffic

The sustained adoption of work-from-home and hybrid models continues to reshape urban landscapes. For Acadia Realty Trust, this means a potential decrease in daily foot traffic for properties situated in traditional central business districts, as fewer employees commute to offices. This shift directly impacts retail and service tenants reliant on office worker patronage.

Suburban retail centers, conversely, may experience a positive uplift. As people spend more time in their local communities, there's an increased likelihood of them frequenting neighborhood shops and restaurants. This trend offers a counterbalancing opportunity for Acadia's suburban holdings.

Adapting urban retail strategies is crucial. Diversifying tenant mix to include more experiential offerings, dining, and essential services that cater to a residential population rather than a transient office workforce will be key. For instance, a 2024 report indicated a 15% increase in demand for local service-based retail in suburban areas compared to pre-pandemic levels, while urban core retail vacancy rates in some cities have seen a slight uptick.

- Work-from-home prevalence: Increased remote work reduces daily commuter foot traffic in urban cores.

- Suburban retail benefit: Localized activity boosts performance for retail in suburban areas.

- Urban adaptation needs: Diversifying tenant mix towards services and experiences is essential for urban properties.

- Market data: 2024 saw a 15% rise in suburban service retail demand, with some urban cores experiencing minor vacancy increases.

Growing Demand for Community-Centric Spaces

Consumers are actively seeking retail spaces that go beyond mere transactions, prioritizing environments that cultivate community and facilitate social connections. This growing demand for community-centric experiences presents a significant opportunity for Acadia Realty Trust.

Acadia can capitalize on this trend by developing and managing properties designed as lively community hubs. This involves integrating inviting public spaces, hosting local events, and curating a diverse tenant mix that encourages visitors to spend more time and engage with the environment. For example, a 2024 survey indicated that 65% of consumers prefer shopping experiences that offer opportunities for social interaction.

- Community Focus: Designing spaces that foster social interaction and a sense of belonging.

- Event Integration: Hosting local events and activities to draw in and retain visitors.

- Tenant Mix: Selecting tenants that complement each other and contribute to a vibrant atmosphere.

- Asset Value: Enhancing property appeal and tenant loyalty through authentic community engagement.

Societal values are shifting towards sustainability and ethical consumption, influencing consumer choices and tenant demands. Consumers and businesses alike are increasingly prioritizing environmental, social, and governance (ESG) factors in their decisions, impacting real estate investment and development.

Acadia Realty Trust’s focus on well-located urban and suburban retail properties aligns with this trend, as these areas often attract tenants and consumers who value community and responsible business practices. For example, in 2024, investments in green building certifications and sustainable retail operations saw a 10% increase in investor interest according to industry reports.

By incorporating ESG principles into its portfolio management and development strategies, Acadia can enhance its brand reputation, attract socially conscious tenants, and potentially achieve higher property valuations. This includes considering energy efficiency, waste reduction, and community engagement in property design and operations.

Technological factors

The relentless growth of e-commerce continues to reshape the retail landscape, presenting both challenges and opportunities for brick-and-mortar establishments. For Acadia Realty Trust, this trend necessitates supporting its tenant base in developing robust omnichannel strategies. This means ensuring their properties are equipped to handle services like buy online, pick up in-store (BOPIS) and last-mile delivery, crucial for bridging the gap between digital and physical retail. The global e-commerce market was valued at approximately $6.3 trillion in 2023 and is projected to reach $13.0 trillion by 2030, highlighting the scale of this shift.

Adapting to these evolving consumer behaviors is paramount for maintaining property appeal. Retailers increasingly seek locations that facilitate seamless integration of online and offline shopping experiences, making properties that can support BOPIS and efficient delivery logistics highly desirable. This adaptability ensures Acadia's portfolio remains attractive to modern retailers navigating the competitive digital marketplace.

Acadia Realty Trust's integration of smart building technologies, like IoT sensors for energy management and predictive maintenance, is key to boosting operational efficiency and cutting costs. For instance, smart HVAC systems can reduce energy consumption by up to 20%, a significant saving for a real estate investment trust.

These advancements also elevate tenant experience through better comfort control, which can translate to higher occupancy rates and stronger rental income. The adoption of these innovations is vital for Acadia to modernize its portfolio and meet its sustainability targets, especially as green building certifications become increasingly valued by tenants and investors.

Acadia Realty Trust can significantly enhance its operations by leveraging big data and analytics. This approach offers deep insights into consumer behavior and foot traffic, crucial for optimizing retail asset performance. For instance, by analyzing shopper data, Acadia can better understand preferences, leading to more effective tenant mix strategies.

The application of data analytics allows for informed decisions on property acquisitions and rental pricing. In 2024, the retail sector saw a continued emphasis on experiential retail, with data-driven insights helping landlords like Acadia identify locations and tenant types that align with evolving consumer demands. This data-driven approach is key to maximizing returns from their diverse retail portfolios.

Predictive analytics further empowers Acadia by identifying potential risks and opportunities within the market. For example, by forecasting future retail trends and tenant performance, Acadia can proactively adjust its strategy, ensuring long-term value creation. This forward-looking capability is vital in the dynamic real estate landscape of 2024 and beyond.

Digital Engagement Tools for Customer Experience

Acadia Realty Trust can significantly boost customer experience by integrating digital engagement tools. Property-specific apps, loyalty programs, and interactive directories are key to this strategy, aiming to increase repeat visits and dwell times. For instance, a well-designed app can offer personalized promotions, making shopping more rewarding.

These technologies transform physical retail spaces into dynamic, convenient destinations. Imagine seamless wayfinding or direct communication channels between tenants and shoppers, all managed through digital platforms. This not only enhances convenience but also fosters a stronger connection with the property.

The adoption of these digital tools provides Acadia with invaluable data. Analyzing user behavior through these platforms allows for continuous optimization of the customer journey. For example, data from a 2024 study indicated that properties with integrated digital loyalty programs saw a 15% increase in customer spending compared to those without.

- Enhanced Customer Experience: Digital tools like property apps and loyalty programs drive repeat visits and longer stays.

- Personalization and Convenience: Features such as personalized offers and easy wayfinding improve shopper satisfaction.

- Data-Driven Optimization: User data gathered from these tools enables continuous improvement of the retail environment.

- Increased Tenant Engagement: Seamless communication channels benefit both shoppers and tenants, fostering a better ecosystem.

Proptech Innovations for Real Estate Operations

Proptech innovations are reshaping real estate operations, offering significant advantages for companies like Acadia Realty Trust. Emerging technologies such as virtual reality (VR) for immersive property tours, blockchain for secure and efficient transaction management, and artificial intelligence (AI) for sophisticated property valuation are key drivers of this transformation. For instance, the global proptech market was valued at approximately $20.7 billion in 2023 and is projected to reach $50.4 billion by 2030, demonstrating substantial growth and adoption.

Embracing these advancements can lead to tangible improvements in efficiency and cost reduction. VR tours can significantly cut down on physical site visits, saving time and resources, while blockchain technology promises to streamline the often-complex and lengthy real estate transaction processes, potentially reducing costs by up to 20% in certain areas. AI-powered valuation tools, leveraging vast datasets, can offer more accurate and timely market insights, crucial for making informed acquisition decisions and maintaining a competitive edge.

- Virtual Reality (VR): Enhances property viewings, reducing physical travel and associated costs.

- Blockchain: Streamlines real estate transactions, improving transparency and reducing fraud.

- Artificial Intelligence (AI): Powers advanced property valuation models and market trend analysis.

- Market Growth: The proptech sector is experiencing rapid expansion, with significant investment and adoption expected in the coming years.

Technological advancements are fundamentally altering how retail properties are managed and experienced. Acadia Realty Trust must embrace digital integration to remain competitive, focusing on e-commerce support and smart building solutions. The increasing reliance on data analytics and proptech innovations like AI and VR offers significant opportunities for operational efficiency and enhanced tenant value.

The growth of e-commerce and the demand for omnichannel retail strategies mean Acadia's properties need to facilitate services like BOPIS. Smart building technologies, such as IoT sensors, are critical for reducing operational costs, with potential energy savings of up to 20%. Data analytics, including predictive modeling, is essential for optimizing retail asset performance and making informed strategic decisions in the dynamic 2024 market.

Proptech, including VR for tours and AI for valuations, is transforming real estate operations. The global proptech market is projected to reach $50.4 billion by 2030, indicating a significant shift towards technology-driven solutions. These innovations enhance efficiency, reduce costs, and provide more accurate market insights, vital for Acadia's portfolio management.

Legal factors

Acadia Realty Trust, as a Real Estate Investment Trust (REIT), operates under strict Internal Revenue Service (IRS) guidelines to preserve its tax-advantaged status. These regulations mandate specific asset holdings, income streams, and dividend payouts, crucial for its financial structure and investor proposition. For instance, REITs must derive at least 75% of their gross income from real estate-related sources and distribute at least 90% of their taxable income as dividends annually.

Adherence to these IRS rules is not merely procedural; it's fundamental to Acadia's business model, directly impacting its ability to avoid substantial tax liabilities and maintain its attractiveness to investors. Failure to comply can result in the loss of REIT status and the imposition of corporate income tax, significantly eroding profitability. Therefore, continuous vigilance regarding any shifts in tax legislation or IRS interpretations is a critical operational imperative for Acadia.

Acadia Realty Trust navigates a patchwork of tenant-landlord laws, influencing everything from lease terms to eviction processes. These regulations, which differ significantly by state and even municipality, directly impact how Acadia structures its lease agreements, manages property upkeep, and handles rent increases. For instance, in 2024, states like California continued to implement stronger tenant protections, potentially affecting lease renewal clauses and rent control measures for Acadia's West Coast holdings.

Compliance with these varied legal landscapes is paramount for Acadia to safeguard its revenue and maintain stable tenant relations. A misstep in lease drafting or an improper eviction procedure could lead to costly litigation, disrupting rental income and damaging the company's reputation. The operational flexibility of Acadia's retail portfolio is therefore intrinsically linked to its ability to adapt to and adhere to these evolving tenant-landlord statutes.

Acadia Realty Trust must strictly adhere to federal, state, and local building codes, fire safety regulations, and accessibility standards like ADA compliance for all its properties, especially during redevelopment. For instance, in 2024, the U.S. Department of Housing and Urban Development (HUD) continued to emphasize stricter enforcement of accessibility standards in commercial spaces, impacting renovation budgets. Non-compliance can lead to costly fines, project delays, and potential safety risks, underscoring the need for rigorous oversight.

Environmental Protection Laws and Disclosures

Acadia Realty Trust navigates a complex web of environmental protection laws, covering hazardous materials, waste management, and air and water quality. These regulations are particularly critical during property acquisitions, redevelopment projects, and daily operations, demanding strict adherence to avoid penalties and operational disruptions.

The growing emphasis on environmental responsibility and ESG (Environmental, Social, and Governance) reporting means Acadia must conduct thorough environmental due diligence and integrate sustainable practices. This proactive approach not only mitigates legal exposure but also bolsters its corporate image and long-term asset value, a key consideration in the current market landscape.

For example, the U.S. Environmental Protection Agency (EPA) continues to enforce regulations like the Resource Conservation and Recovery Act (RCRA) for waste management and the Clean Air Act. In 2024, the EPA proposed new rules aimed at further tightening emissions standards for industrial facilities, which could impact operational costs for properties with significant industrial components within Acadia's portfolio. Furthermore, state-level environmental regulations, such as California's Proposition 65, which requires warnings about exposure to chemicals known to cause cancer or reproductive toxicity, add another layer of compliance complexity.

- Hazardous Materials Management: Compliance with laws like CERCLA (Superfund) for the cleanup of contaminated sites is paramount, especially during property transactions.

- Waste Disposal Regulations: Adherence to RCRA and state-specific waste disposal rules ensures proper handling and minimization of landfill use.

- Air and Water Quality Standards: Meeting EPA and state standards for emissions and water discharge is essential for ongoing operations and new developments.

- ESG Disclosure Requirements: Increasing investor and regulatory demand for transparent ESG reporting necessitates robust data collection and disclosure on environmental performance.

Data Privacy and Consumer Protection Laws

Acadia Realty Trust, like many in the retail and property management sectors, must navigate a complex web of data privacy and consumer protection laws. As technology integration deepens, from in-store analytics to online leasing portals, compliance with regulations like the California Consumer Privacy Act (CCPA) and its amendments becomes paramount. These laws dictate how customer data, including browsing habits and personal information, can be collected, stored, and utilized.

Failure to adhere to these regulations can result in significant financial penalties and damage to brand reputation. For instance, the CCPA can impose statutory damages ranging from $100 to $750 per violation, or actual damages, whichever is greater. Acadia and its tenants must therefore implement robust data security measures and transparent privacy policies to maintain consumer trust and avoid legal repercussions in their retail environments.

- GDPR Applicability: While primarily focused on the EU, GDPR principles influence global data handling standards, potentially impacting Acadia if it processes data of EU citizens or has international operations.

- State-Level Consumer Protection: Laws like the CCPA (California) and similar legislation in states like Virginia (VCDPA) and Colorado (CPA) grant consumers rights over their personal data, including access, deletion, and opt-out of sale.

- Data Security Mandates: Regulations often require reasonable security procedures and practices to protect personal information from unauthorized access or disclosure.

- Transparency Requirements: Companies must clearly inform consumers about what data is collected, why it's collected, and how it will be used, typically through comprehensive privacy policies.

Acadia Realty Trust's operations are significantly shaped by employment laws governing its workforce, from hiring practices to workplace safety. Compliance with federal statutes like the Fair Labor Standards Act (FLSA) for wage and hour regulations and the Occupational Safety and Health Act (OSHA) for safe working conditions is crucial. For instance, in 2024, OSHA continued its focus on preventing workplace injuries in the construction and maintenance sectors, which directly impacts Acadia's property management and development teams.

Navigating anti-discrimination laws, such as Title VII of the Civil Rights Act, is also paramount to ensure fair treatment of all employees and to avoid costly litigation. The company must also stay abreast of state-specific labor laws, which can include varying minimum wage requirements or paid sick leave mandates, affecting operational costs and HR policies across its diverse property portfolio.

Acadia Realty Trust must also contend with intellectual property laws, particularly concerning its branding, marketing materials, and any proprietary software or technologies used in its operations. Protecting its trademarks and copyrights ensures brand integrity and prevents unauthorized use of its assets. For example, in 2024, the U.S. Patent and Trademark Office (USPTO) continued to process a high volume of trademark applications, highlighting the ongoing importance of IP protection in competitive markets.

Environmental factors

Acadia Realty Trust's portfolio faces significant physical climate risks, with an increasing likelihood of extreme weather events such as floods, hurricanes, and heatwaves impacting its properties. These events can lead to costly property damage, disrupt operations, and escalate insurance premiums, directly affecting profitability and asset valuation.

For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, totaling over $92.9 billion in damages according to NOAA. Properties in vulnerable coastal or densely populated urban areas are particularly susceptible, making robust risk assessment and mitigation strategies paramount.

Implementing resilient design, adaptive building measures, and securing comprehensive insurance coverage are essential steps for Acadia to protect its asset values and maintain business continuity. This proactive approach is vital for the long-term sustainability of its real estate investments in the face of evolving climate challenges.

Acadia Realty Trust faces increasing regulatory pressure and tenant demand for energy-efficient buildings, pushing for investments in green building practices like LEED and BREEAM certifications. For instance, in 2024, the U.S. Green Building Council reported a 15% increase in LEED certifications compared to the previous year, highlighting this growing trend.

By enhancing energy efficiency through smart systems and sustainable materials, Acadia can expect to see reduced operating costs and improved property marketability. Studies from 2024 indicate that buildings with green certifications can command rental premiums of 3-5% and experience lower vacancy rates.

This focus on green initiatives directly supports Acadia's ESG performance, making its assets more attractive to environmentally conscious tenants and investors alike, aligning with broader sustainability goals that are becoming paramount in the real estate sector.

Acadia Realty Trust's retail properties face significant operational impacts from stringent waste management and recycling regulations. These rules mandate specific waste segregation, ambitious recycling targets, and careful hazardous waste disposal, influencing how Acadia manages its physical assets and tenant operations. For instance, in 2024, many municipalities are increasing landfill diversion rates, pushing businesses to achieve higher percentages of recycled materials.

To comply and minimize its environmental impact, Acadia must invest in and promote effective waste management strategies. This includes comprehensive recycling programs and ensuring responsible disposal of all waste streams, which can also lead to reduced operational costs through lower waste hauling fees. The push for sustainability is evident, with many retail tenants in 2025 actively seeking landlords with strong environmental credentials.

Water Scarcity and Water Management Practices

Water scarcity is becoming a significant operational hurdle for retail properties in many areas, directly affecting Acadia Realty Trust. Rising water costs can impact everything from maintaining green spaces and powering cooling systems to the everyday needs of tenants. For instance, in 2024, several regions experienced record-low reservoir levels, leading to increased municipal water surcharges for commercial properties.

Acadia must actively implement robust water management strategies to mitigate these challenges. This involves investing in water-efficient technologies and practices across its portfolio. By focusing on conservation, Acadia can not only reduce utility expenditures but also ensure compliance with increasingly stringent environmental regulations.

Key water management practices that Acadia can leverage include:

- Rainwater Harvesting Systems: Collecting and utilizing rainwater for irrigation and non-potable uses can significantly reduce reliance on municipal water supplies.

- Drought-Resistant Landscaping: Replacing water-intensive plants with native, drought-tolerant species lowers outdoor water consumption.

- Low-Flow Fixtures: Installing water-saving toilets, faucets, and showerheads in restrooms and common areas directly cuts down on indoor water usage.

- Smart Irrigation Technology: Employing sensors and weather-based controllers for landscape irrigation ensures water is only applied when necessary, preventing waste.

These measures are crucial for the long-term sustainability and resilience of Acadia's retail assets, ensuring operational continuity and cost control in the face of environmental pressures.

Tenant and Investor Demand for ESG Practices

Tenant and investor demand for ESG practices is a significant environmental factor for real estate companies like Acadia Realty Trust. Both retail tenants and institutional investors increasingly expect companies to showcase robust ESG performance. This translates to a need for clear reporting on environmental impacts, setting ambitious sustainability goals, and embedding ESG principles into investment and operational plans.

Meeting these expectations is crucial for enhancing Acadia's reputation and attracting capital. For instance, a 2024 survey by JLL found that 70% of institutional investors consider ESG factors in their real estate investment decisions. This growing preference can lead to preferred tenant relationships and contribute to long-term value creation.

- Growing Investor Focus: A significant majority of institutional investors now integrate ESG into their real estate decision-making.

- Tenant Preferences: Retail tenants are also prioritizing landlords with strong sustainability credentials.

- Reputational Benefits: Demonstrating ESG commitment boosts a company's image and attractiveness.

- Capital Attraction: Strong ESG performance can unlock access to a wider pool of investment capital.

Acadia Realty Trust must navigate evolving environmental regulations and the growing demand for sustainable practices. This includes adapting to stricter waste management rules, which are pushing for higher landfill diversion rates, and addressing water scarcity concerns through efficient water usage technologies. The company's commitment to ESG principles is becoming a key differentiator, influencing tenant attraction and investor capital in 2024 and beyond.

PESTLE Analysis Data Sources

Our Acadia PESTLE Analysis is grounded in data from reputable sources, including government publications, international organizations, and leading market research firms. We integrate economic indicators, regulatory updates, and technological forecasts to provide a comprehensive view.