Associated British Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated British Foods Bundle

Navigate the complex external forces shaping Associated British Foods. Our PESTLE analysis delves into political stability, economic shifts, evolving social trends, technological advancements, environmental regulations, and legal frameworks impacting the company. Gain a strategic advantage by understanding these critical factors.

Unlock actionable intelligence for Associated British Foods with our comprehensive PESTLE analysis. Discover how global trends present both opportunities and challenges, empowering you to make informed decisions and refine your market strategy. Download the full version now to get ahead.

Political factors

Government policies and international trade dynamics significantly shape Associated British Foods' (ABF) global operations. For instance, trade disputes between major economies can disrupt ABF's extensive supply chains, particularly impacting its Primark segment by potentially increasing costs and, consequently, consumer prices due to tariffs.

The nature of bilateral trade agreements also plays a crucial role. The UK's trade relationship with the United States, for example, directly affects specific ABF ventures. A notable instance was the impact of tariff-free US ethanol on the operational feasibility of ABF's Vivergo bioethanol plant in the UK, highlighting how trade policies can alter the economic landscape for the company's diverse business units.

Associated British Foods (ABF) navigates a complex regulatory landscape, with food safety, product quality, and labor laws varying significantly across its global operations. For instance, in 2024, the UK's Food Standards Agency continued to enforce stringent hygiene and traceability regulations, impacting ABF's grocery divisions like Allied Bakeries.

Increasingly, environmental regulations are shaping ABF's strategy. Stricter mandates on greenhouse gas emissions and waste management, as seen with the EU's updated Eco-design requirements in 2025, may necessitate investments in cleaner manufacturing technologies, potentially affecting cost structures for brands like Twinings.

Adherence to these diverse and evolving regulations is paramount for ABF's continued market access and brand integrity. Failure to comply could result in significant fines or operational disruptions, as demonstrated by past instances of regulatory scrutiny in the food industry globally.

Political stability in regions where Associated British Foods (ABF) operates is a crucial element impacting its business. Unforeseen political shifts, civil unrest, or changes in government policy can disrupt supply chains and affect consumer spending, directly influencing ABF's ability to maintain consistent operations and make strategic investments. For example, while not solely political, the severe flooding in Mozambique in 2023, which impacted ABF's sugar operations, highlights how regional stability is vital for recovery and future resilience.

Agricultural Subsidies and Policies

Government policies and subsidies play a crucial role in shaping the agricultural landscape, directly impacting Associated British Foods' (ABF) operations. These policies, particularly those related to sugar beet and other key crops, influence raw material costs and production volumes for ABF's Agriculture and Sugar divisions.

For instance, changes in agricultural support mechanisms can alter ABF's cost base and its ability to compete in the global market. The European Union's sugar pricing adjustments, which saw a decrease in late 2024 and early 2025 due to market oversupply, presented a direct challenge. This pricing shift negatively affected ABF's European sugar businesses, highlighting the sensitivity of their performance to policy-driven market dynamics.

- Government agricultural policies directly influence raw material costs for ABF's sugar division.

- Changes in subsidies can impact production levels and market competitiveness for ABF.

- The reduction in European sugar pricing in late 2024/early 2025 negatively affected ABF's European sugar businesses.

Consumer Protection and Retail Laws

Consumer protection laws, including those governing advertising and pricing, directly impact ABF's Primark operations. These regulations, which differ significantly across countries, dictate how products are presented and sold, requiring strict compliance to avoid fines and safeguard brand reputation. For instance, the UK's Competition and Markets Authority (CMA) actively monitors pricing and promotional practices to ensure fairness.

Advertising standards are particularly crucial for Primark. Misleading advertisements can lead to substantial penalties and damage consumer trust. In 2024, regulatory bodies globally continued to scrutinize marketing claims, especially concerning sustainability and product origin, areas where Primark has made commitments. Adherence to these evolving standards is paramount for maintaining consumer confidence and avoiding legal repercussions.

The retail landscape is shaped by a complex web of consumer rights and fair trading practices. ABF must navigate these varying legal frameworks across its international markets. For example, the European Union's General Data Protection Regulation (GDPR) influences how customer data is handled in online retail, a growing channel for many businesses. Staying abreast of these changes is essential for smooth operations.

- Advertising Standards: Primark must comply with national advertising watchdogs like the Advertising Standards Authority (ASA) in the UK.

- Pricing Regulations: Laws against price gouging and misleading pricing are enforced by agencies such as the Federal Trade Commission (FTC) in the US.

- Consumer Rights: Regulations like the Consumer Rights Act 2015 in the UK grant consumers specific rights regarding product quality and returns.

- Data Privacy: Compliance with data protection laws, such as GDPR and CCPA, is critical for managing customer information in retail.

Government policies and international trade dynamics significantly shape Associated British Foods' (ABF) global operations. For instance, trade disputes between major economies can disrupt ABF's extensive supply chains, particularly impacting its Primark segment by potentially increasing costs and, consequently, consumer prices due to tariffs. The UK's trade relationship with the United States, for example, directly affects specific ABF ventures, with past impacts on ABF's Vivergo bioethanol plant highlighting how trade policies can alter economic landscapes.

Associated British Foods (ABF) navigates a complex regulatory landscape, with food safety, product quality, and labor laws varying significantly across its global operations. For instance, in 2024, the UK's Food Standards Agency continued to enforce stringent hygiene and traceability regulations, impacting ABF's grocery divisions like Allied Bakeries. Increasingly, environmental regulations are shaping ABF's strategy, with stricter mandates on greenhouse gas emissions and waste management, as seen with the EU's updated Eco-design requirements in 2025, potentially necessitating investments in cleaner manufacturing technologies.

Government policies and subsidies play a crucial role in shaping the agricultural landscape, directly impacting Associated British Foods' (ABF) operations. These policies, particularly those related to sugar beet and other key crops, influence raw material costs and production volumes for ABF's Agriculture and Sugar divisions. Changes in agricultural support mechanisms can alter ABF's cost base and its ability to compete globally, as demonstrated by the European Union's sugar pricing adjustments in late 2024 and early 2025, which negatively affected ABF's European sugar businesses.

What is included in the product

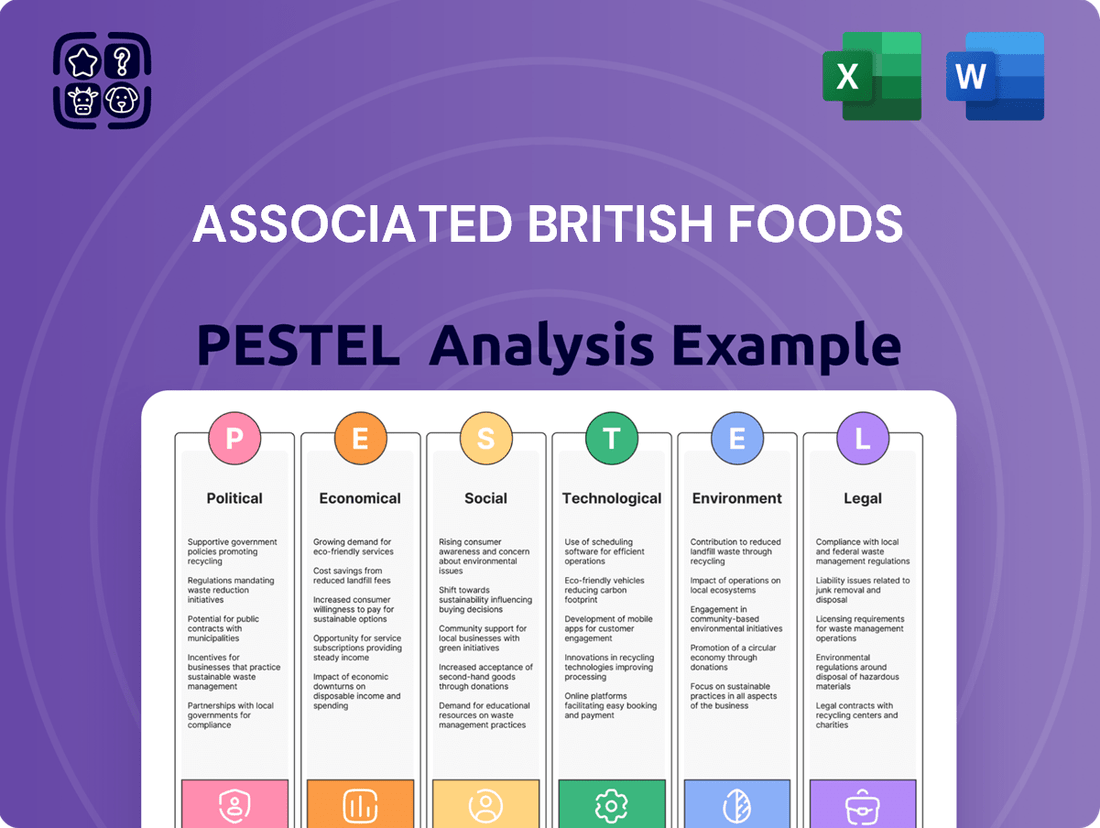

This PESTLE analysis of Associated British Foods delves into how political, economic, social, technological, environmental, and legal forces shape its operations and strategy.

It provides a comprehensive understanding of the external landscape, highlighting potential challenges and strategic advantages for the company.

Provides a clear, actionable overview of the external factors impacting Associated British Foods, simplifying complex political, economic, social, technological, legal, and environmental influences for strategic decision-making.

Economic factors

Associated British Foods (ABF) continues to grapple with persistent inflationary pressures, which significantly increase costs for essential inputs like raw materials, transportation, and labor. These rising expenses directly impact the company's profit margins across its diverse food and retail segments. For instance, the cost of sugar, a key commodity for ABF, saw notable increases in early 2024 due to adverse weather conditions in major producing regions.

While ABF experienced a positive margin recovery in its fiscal year 2024, largely due to a moderation in input cost inflation, the company remains susceptible to currency volatility. Fluctuations in exchange rates can still drive up expenses, particularly for importing necessary materials or for exporting finished goods, adding another layer of cost management complexity.

Furthermore, sustained high inflation erodes consumer purchasing power. This can lead to reduced sales volumes as consumers become more price-sensitive and cut back on discretionary spending, potentially affecting ABF's top-line performance in its retail and grocery divisions.

Consumer spending power is a critical driver for Associated British Foods (ABF), influencing demand across its broad product range, from everyday groceries to fashion. When consumers feel financially secure and optimistic, they tend to spend more, benefiting ABF's retail and food segments. This confidence directly translates into sales volumes for brands like Kingsmill and Twinings, as well as for Primark's affordable apparel.

However, shifts in consumer sentiment can quickly impact ABF's performance. For instance, during late 2024 and early 2025, a dip in consumer confidence, particularly noted in key markets like the UK and Ireland, has been linked to a slowdown in like-for-like sales at Primark. This cautious spending environment means consumers are more selective with their purchases.

ABF's strategy, especially through Primark's focus on value, acts as a buffer against these economic headwinds. By offering competitively priced goods, ABF can still attract budget-conscious shoppers even when overall consumer confidence wanes. This ability to provide affordable options is a significant advantage in periods of economic uncertainty, helping to maintain a baseline level of demand.

Fluctuations in global exchange rates significantly impact Associated British Foods' (ABF) financial results due to its widespread international presence. For instance, a strengthening US dollar can elevate the cost of sourcing materials from countries with weaker currencies, thereby reducing profit margins.

In 2023, ABF reported that currency headwinds, particularly the strong US dollar against the Euro and Sterling, had a notable impact on its financial performance, though specific figures were integrated into broader profit discussions. The company actively manages this risk through currency hedging and by diversifying its global sourcing to mitigate adverse effects.

Global Commodity Price Fluctuations

Associated British Foods (ABF), a significant force in the food and ingredients sector, faces considerable risk from the unpredictable nature of global commodity prices. Fluctuations in the cost of key inputs like sugar, grains, and other agricultural goods directly impact its profitability. For instance, a substantial oversupply in the European sugar market led to a sharp decline in prices, which notably hurt ABF's sugar division's earnings in late 2024 and this trend is projected to persist into 2025.

Effectively navigating these price volatilities is paramount for ABF to ensure its profit margins remain consistent and healthy. The company's exposure means that shifts in supply and demand dynamics for these essential commodities can create significant headwinds or tailwinds for its financial performance.

- Sugar Price Impact: European sugar prices saw a significant drop in late 2024 due to increased supply, negatively affecting ABF's profitability in this segment.

- Grains and Other Agricultural Products: ABF's reliance on grains and other agricultural inputs exposes it to broader market price swings.

- Margin Stability: Managing these commodity price fluctuations is essential for ABF to maintain stable and predictable profit margins across its diverse operations.

- 2025 Outlook: Projections indicate that the challenging pricing environment for sugar is likely to continue into 2025, requiring ongoing strategic adjustments.

Economic Growth in Key Markets

Economic growth in Associated British Foods' (ABF) key markets directly influences consumer spending and the company's potential for expansion. A strong global economic performance, especially in regions like Europe and North America where ABF has significant operations, typically translates to higher disposable incomes and increased demand for food, ingredients, and apparel. For instance, in 2024, the IMF projected global GDP growth of 3.2%, a figure that underpins the potential for ABF's diverse business segments to benefit from increased purchasing power.

Conversely, periods of economic slowdown or recession can present challenges. During such times, consumers may reduce discretionary spending, impacting ABF's retail and fashion divisions. A projected slowdown in the Eurozone, a critical market for ABF, could necessitate careful inventory management and a focus on value-oriented product offerings to maintain sales volume.

The company's strategy often involves capitalizing on growth in emerging markets. As these economies expand, ABF can leverage increased consumer spending to broaden its customer base, particularly within its sugar and agriculture segments. However, volatility in these regions due to economic fluctuations requires agile market strategies and risk mitigation.

- Global GDP Growth Projections: The International Monetary Fund (IMF) forecasted global GDP growth at 3.2% for both 2024 and 2025, indicating a generally supportive, albeit moderate, economic environment for businesses like ABF.

- European Economic Performance: While specific figures vary, projections for the Eurozone in 2024 and 2025 suggested a more subdued growth rate compared to the global average, highlighting potential headwinds for ABF's European operations.

- Emerging Market Opportunities: ABF's presence in markets like India and parts of Africa offers significant long-term growth potential, contingent on sustained economic development and rising consumer incomes in those regions.

The economic landscape for Associated British Foods (ABF) is shaped by a confluence of factors including inflation, consumer spending, currency fluctuations, and commodity prices. While ABF has shown resilience, navigating these elements remains crucial for sustained profitability and growth across its diverse portfolio.

Inflationary pressures continue to be a significant concern, impacting input costs for raw materials, energy, and labor, which directly affect profit margins. Consumer spending power is another key determinant, as economic confidence influences demand for ABF's food, ingredients, and apparel products. Currency volatility presents ongoing challenges, with exchange rate shifts impacting both sourcing costs and the value of international earnings.

Commodity prices, particularly for sugar and grains, introduce further volatility, with market dynamics directly influencing ABF's profitability in its agricultural and food segments. Global economic growth, especially in key markets like Europe and North America, underpins consumer purchasing power and expansion opportunities, though regional economic performance can vary.

| Economic Factor | Impact on ABF | 2024/2025 Data/Outlook |

|---|---|---|

| Inflation | Increased input costs (raw materials, labor, energy) | Persistent, though moderating in some areas, impacting margins. |

| Consumer Spending Power | Drives demand for food, ingredients, and apparel. | Sensitive to economic confidence; value offerings (Primark) provide a buffer. |

| Currency Fluctuations | Affects cost of imports/exports and international profit translation. | Ongoing risk; managed through hedging and diversified sourcing. |

| Commodity Prices (e.g., Sugar, Grains) | Directly impacts profitability in food and ingredient segments. | Sugar prices saw a significant drop in late 2024 due to oversupply, with projections of continued pressure into 2025. |

| Global Economic Growth | Influences disposable income and overall market demand. | IMF projected global GDP growth of 3.2% for 2024 and 2025; Eurozone growth projected to be more subdued. |

What You See Is What You Get

Associated British Foods PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Associated British Foods delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping its strategic decisions.

Sociological factors

Consumers are increasingly opting for plant-based and health-focused foods, a significant shift impacting the food industry. Associated British Foods (ABF) is responding to this by expanding its offerings in these areas.

ABF Ingredients, for instance, has broadened its selection of plant-based proteins, aiming to capture a share of the burgeoning plant-based food market, which is projected to hit £1.4 billion by 2025.

This evolving consumer demand also spurs innovation across ABF's food divisions, with a particular focus on developing fortified foods tailored to the needs of an aging demographic.

Consumers are increasingly prioritizing sustainability, with a growing willingness to pay a premium for products from companies with robust environmental and ethical credentials. This trend directly impacts Associated British Foods' (ABF) strategy, shaping everything from product innovation to how they manage their supply chains and communicate their corporate responsibility efforts.

ABF's proactive stance on sustainability, including its ambitious target of achieving zero waste to landfill by 2025, directly addresses this societal demand. The company's focus on building more resilient and ethical supply chains also resonates with consumers who are more aware of the social and environmental impact of their purchasing decisions.

The fashion landscape is constantly shifting, demanding retailers like Primark to be agile in their response to evolving trends while steadfastly offering value. This is particularly true in the current economic climate where consumers are increasingly discerning about their spending.

Consumer caution, especially noted in the UK market, has amplified the appeal of affordable fashion options. For instance, in Q1 2024, UK retail sales volumes saw a modest increase, but consumer confidence remained a key factor influencing discretionary spending, highlighting the persistent demand for value-driven purchases.

Primark's core strategy directly addresses this by focusing on delivering great value clothing. This approach resonates strongly with a broad consumer base seeking stylish yet budget-friendly options, a sentiment likely to continue influencing purchasing decisions throughout 2024 and into 2025.

Population Demographics and Aging Populations

Demographic shifts, particularly the increasing proportion of older consumers, significantly influence product demand, necessitating tailored offerings. The growing segment of consumers over 65, projected to be a substantial part of the UK population by 2045, is driving demand for health-oriented food products. Associated British Foods' food segment is strategically positioned to meet this demand through initiatives like fortified food launches.

The aging population trend presents both challenges and opportunities for Associated British Foods. For instance, by 2045, it's anticipated that individuals aged 65 and over will represent a considerable percentage of the UK's populace. This demographic evolution directly impacts consumer purchasing patterns, with a notable increase in the preference for foods that support health and well-being.

- Aging Consumer Base: The UK's population is aging, with the over-65 demographic expected to be a significant segment by 2045.

- Health-Conscious Demand: This demographic shift fuels demand for health-focused food products.

- ABF's Response: Associated British Foods addresses this by developing and launching fortified food products.

Health and Wellness Awareness

Associated British Foods (ABF) is navigating a significant shift towards greater health and wellness awareness among consumers, directly impacting its food divisions. This heightened consciousness fuels demand for products perceived as healthier, pushing ABF to channel resources into developing and innovating its health and wellness product lines. For instance, in 2024, the company continued to emphasize its commitment to offering reduced sugar and salt options across its brands, responding to evolving consumer preferences.

This trend is not just about product development; ABF is strategically aligning its marketing campaigns and corporate social responsibility (CSR) efforts with health and wellbeing themes. This integrated approach aims to resonate with consumers who are increasingly scrutinizing the health credentials of the food they purchase. By promoting healthier lifestyles and transparently communicating product attributes, ABF seeks to build brand loyalty in a competitive market.

- Increased Demand for Healthier Options: Consumers are actively seeking out products with lower sugar, salt, and fat content, driving innovation in ABF's bakery and grocery segments.

- Product Innovation Investment: ABF's commitment to health and wellness is evident in its R&D spending, focusing on developing fortified foods and plant-based alternatives.

- Marketing and CSR Alignment: The company's communication strategies increasingly highlight health benefits and sustainable sourcing, reflecting a broader societal focus on wellbeing.

- Market Response: In 2024, ABF reported positive sales growth in segments offering healthier alternatives, underscoring the commercial viability of this trend.

Societal attitudes towards health and sustainability are profoundly shaping consumer choices, directly influencing Associated British Foods' (ABF) strategic direction. The growing demand for plant-based and healthier food options, coupled with a strong preference for ethically sourced and environmentally conscious products, is a key driver for ABF's innovation and product development across its diverse portfolio.

The increasing aging population, particularly in the UK, is a significant demographic trend that ABF is actively addressing. This demographic shift creates a heightened demand for food products that cater to specific health needs, such as those offering nutritional fortification and support for well-being. ABF's proactive approach includes expanding its range of fortified foods and plant-based alternatives to meet these evolving consumer requirements.

Consumer demand for value remains a cornerstone, especially within the fashion retail sector, exemplified by Primark. In a climate where economic prudence influences spending, Primark's strategy of offering affordable, on-trend fashion directly caters to this societal preference. This focus on accessible pricing ensures continued relevance and market share, particularly as consumer confidence fluctuates.

| Sociological Factor | Impact on ABF | Evidence/Data (2024/2025 Focus) |

|---|---|---|

| Health & Wellness Consciousness | Increased demand for healthier, plant-based, and fortified foods. | Projected growth of the UK plant-based food market to £1.4 billion by 2025. ABF Ingredients expanding plant-based protein offerings. |

| Sustainability & Ethical Sourcing | Consumer willingness to pay a premium for ethical products; focus on transparent supply chains. | ABF's commitment to zero waste to landfill by 2025. Increased consumer scrutiny of corporate social responsibility. |

| Demographic Shifts (Aging Population) | Growing demand for health-focused and fortified food products. | UK's over-65 demographic projected to be a significant segment by 2045, driving demand for specialized food offerings. |

| Value-Consciousness (Fashion) | Sustained demand for affordable, fashionable clothing. | Primark's strategy directly addresses consumer need for value. Modest increases in UK retail sales volumes in Q1 2024, with consumer confidence a key factor. |

Technological factors

Associated British Foods (ABF) is actively embracing automation in its manufacturing operations, investing heavily in advanced machinery to boost efficiency. This strategic move is designed to increase production capacity and drive down operational expenses, thereby sharpening its competitive edge.

Over the next three years, ABF has earmarked significant capital for facility upgrades, underscoring its commitment to modernizing its production lines. For instance, its Sugar division has seen substantial investment in automated processing technologies, aiming to optimize yields and reduce waste.

Technological advancements in food safety are paramount for Associated British Foods (ABF), especially given its extensive portfolio spanning bakery, sugar, and grocery products. Innovations like rapid pathogen detection systems and advanced traceability software are crucial for maintaining product integrity and consumer confidence. For instance, the global food safety testing market was projected to reach USD 32.5 billion by 2025, highlighting the significant investment and reliance on these technologies.

Primark, Associated British Foods' retail division, is actively pursuing digital transformation to foster sustainable growth. This strategic focus encompasses product innovation, digitization efforts, and brand enhancement, aiming to solidify its market position.

Key initiatives include strengthening Primark's online presence and investigating new digital services such as Click+Collect, which has been undergoing trials. These advancements are crucial for elevating the customer experience and boosting operational efficiency in the highly competitive retail sector.

In its fiscal year 2023, Primark reported a 7.7% increase in revenue to £9.0 billion, with digital engagement playing a significant role in driving customer interest and store traffic, even as the company continues to refine its e-commerce strategy.

Supply Chain Digitization and Optimization

Associated British Foods (ABF) is actively leveraging technology to streamline its vast global supply chain. This includes implementing advanced route optimization software and enhanced real-time tracking systems. These technological advancements are designed to unlock significant operational efficiencies and drive substantial cost savings across ABF's diverse business segments, from sugar production to grocery and ingredients.

The focus on digitization aims to improve the overall logistics network. For instance, by optimizing delivery routes, ABF can reduce fuel consumption and transit times, contributing to both cost reduction and a lower environmental footprint. This strategic adoption of technology is crucial for managing the complexities of ABF's international operations and ensuring timely delivery of products to market.

ABF's commitment to supply chain optimization through technology is evident in its ongoing investments in digital infrastructure. While specific figures for ABF's technology spending in this area are not publicly detailed, the industry trend shows significant capital allocation towards such initiatives. For example, a 2024 report by Statista projected the global supply chain management market to reach over $30 billion, highlighting the critical role of technology adoption.

- Enhanced Route Planning: ABF utilizes sophisticated algorithms to plan the most efficient delivery routes, minimizing mileage and fuel usage.

- Real-time Visibility: Advanced tracking technologies provide constant updates on the location and status of goods, improving inventory management and reducing delays.

- Cost Reduction: Digitalization efforts are directly linked to lowering operational expenditures, including transportation, warehousing, and labor costs.

- Sustainability Gains: Optimized logistics contribute to reduced carbon emissions, aligning with ABF's environmental responsibility goals.

Data Analytics and AI for Consumer Insights

Associated British Foods (ABF) can leverage advanced data analytics and artificial intelligence (AI) to uncover granular consumer insights. This technology allows for a more profound understanding of purchasing habits and evolving market demands across its diverse portfolio, including its significant grocery and sugar businesses.

By analyzing vast datasets, ABF can refine its marketing strategies, enabling highly personalized product offerings and promotions. This data-driven approach is crucial for maintaining a competitive edge, particularly in dynamic sectors like food retail where consumer preferences shift rapidly. For instance, in 2024, the retail sector saw a significant increase in personalized marketing effectiveness, with companies reporting up to a 15% uplift in conversion rates through tailored campaigns.

The application of AI can further enhance ABF's ability to predict future trends and consumer behavior. This foresight supports more agile strategic decision-making, from product development to supply chain optimization, ensuring the company remains responsive to market dynamics. By 2025, it's projected that AI in retail will contribute significantly to operational efficiency, with early adopters seeing substantial improvements in inventory management and demand forecasting.

- Enhanced Consumer Understanding: Data analytics and AI provide deeper insights into customer preferences and buying patterns.

- Targeted Marketing: Enables personalized promotions and product offerings, increasing engagement and sales.

- Informed Strategic Decisions: Facilitates data-backed choices in product development, pricing, and market entry.

- Competitive Advantage: Crucial for staying ahead in fast-paced food and retail markets by anticipating trends.

Technological advancements are reshaping Associated British Foods' operations, from automated manufacturing to sophisticated supply chain management. Investments in digital transformation, particularly at Primark, are crucial for enhancing customer experience and operational efficiency. The company is leveraging data analytics and AI to gain deeper consumer insights and drive more targeted marketing efforts.

The global food safety testing market, vital for ABF's product integrity, was projected to reach USD 32.5 billion by 2025. Furthermore, the global supply chain management market was expected to exceed $30 billion in 2024, underscoring the significant technological investment in logistics. Primark's revenue growth of 7.7% to £9.0 billion in fiscal year 2023 highlights the impact of digital engagement.

ABF's adoption of AI and data analytics is enhancing its ability to predict consumer behavior, with early adopters in retail seeing significant improvements in inventory management and demand forecasting by 2025. Personalized marketing, a key area for ABF, has shown up to a 15% uplift in conversion rates in 2024.

Technological integration across ABF's diverse segments, including sugar and grocery, is driving cost reductions and operational efficiencies. This includes advanced route optimization software and real-time tracking systems to streamline its global supply chain.

Legal factors

Associated British Foods (ABF) operates under a complex web of food safety regulations across its global markets, impacting its food and ingredients divisions significantly. Compliance with these stringent laws, covering everything from precise labeling and ingredient limitations to strict hygiene protocols, is non-negotiable for maintaining product integrity and avoiding costly legal penalties. For instance, in 2024, the European Food Safety Authority (EFSA) continued to reinforce its regulations on novel foods and contaminants, requiring extensive testing and documentation from companies like ABF.

Adherence to international food safety certifications, such as those from the British Retail Consortium (BRC) or the Food Safety System Certification (FSSC) 22000, is a critical component of ABF's operational strategy. These certifications are regularly verified through rigorous audits, ensuring that ABF's production processes meet the highest global benchmarks for safety and quality. In 2025, ABF's continued investment in robust quality assurance systems is expected to further solidify its reputation in these highly regulated sectors.

Associated British Foods, with its vast workforce of 138,000 employees globally, navigates a complex web of labor laws and employment regulations. These vary significantly by country, covering essential aspects like minimum wage, acceptable working conditions, and fundamental employee rights. Compliance is a constant operational consideration for the company.

Fluctuations in labor-related taxes, such as changes to national insurance contributions in the UK, directly affect the cost structure of ABF's businesses, including its prominent retail division, Primark. For instance, a rise in employer national insurance contributions would increase the overall expense of employing staff, impacting profitability.

Governments globally are tightening environmental rules, impacting industries like food production and retail. Associated British Foods (ABF) must navigate these, from emissions standards to waste reduction mandates. For instance, the UK's legally binding target to achieve net-zero greenhouse gas emissions by 2050 necessitates significant operational adjustments across ABF's diverse portfolio, including its sugar, agriculture, and food manufacturing segments.

Failure to adhere to evolving environmental legislation, such as the EU's Green Deal initiatives or national waste management directives, can result in substantial financial penalties and erode consumer trust. ABF's commitment to sustainability, therefore, is not just ethical but a critical component of risk management and long-term business viability, especially as consumers and investors increasingly prioritize eco-conscious brands and practices.

Trade Tariffs and Import/Export Laws

Associated British Foods (ABF) navigates a complex web of international trade regulations, with trade tariffs and import/export laws directly influencing its global operations. Changes in these policies can significantly alter the cost of raw materials and the competitiveness of finished goods across various markets. For instance, the imposition of tariffs can increase the expense of sourcing ingredients or exporting products, directly impacting ABF's bottom line.

Trade disputes and the formation of new trade agreements, such as potential deals involving the UK, can create both opportunities and challenges. These shifts can redefine market access and the financial viability of ABF's extensive import and export activities. The company’s experience with the Vivergo ethanol plant, which faced challenges partly due to evolving trade and subsidy landscapes, underscores the sensitivity of operations to such legal frameworks.

ABF's exposure to these legal factors is substantial given its diverse portfolio. For example, as of early 2024, the European Union continues to review its common external tariff policies, which could affect sugar and flour imports for ABF's food manufacturing divisions. Similarly, ongoing discussions regarding the UK's post-Brexit trade relationships could introduce new customs procedures or duties for goods traded between the UK and the EU, a critical market for ABF.

- Tariff Impact: ABF's profitability is directly tied to import duties on key commodities like sugar, wheat, and other agricultural inputs, with tariffs potentially increasing operational costs.

- Trade Agreement Volatility: Fluctuations in trade agreements, such as those between the UK and other nations, can alter market access and create competitive disadvantages or advantages for ABF's export businesses.

- Customs Compliance: Adhering to diverse and evolving customs regulations in over 50 countries where ABF operates requires significant investment in compliance and logistics management.

- Regulatory Changes: Anticipating and adapting to changes in import/export laws, including sanitary and phytosanitary standards, is crucial for maintaining supply chain integrity and market access.

Competition Law and Anti-Trust Regulations

Associated British Foods (ABF) operates in diverse markets, making compliance with competition law and anti-trust regulations crucial to avoid monopolistic practices. The UK’s Competition and Markets Authority (CMA) actively monitors market concentration. For instance, in early 2024, the CMA continued its investigations into various sectors, impacting large conglomerates like ABF.

Any significant strategic moves, such as potential mergers or acquisitions, face rigorous examination. A hypothetical merger between ABF’s Allied Bakeries and Hovis, for example, would undoubtedly trigger scrutiny from competition authorities to assess its impact on market competition and consumer choice. The CMA's decisions in 2023 and early 2024, including blocking several large deals, underscore the strictness of these regulations.

- Market Share Thresholds: Regulators often examine deals where combined market share exceeds certain thresholds, typically 25% in the UK, to identify potential competition concerns.

- Consumer Impact: The primary focus of competition law is to ensure that mergers do not lead to higher prices, reduced choice, or lower quality for consumers.

- Regulatory Oversight: Bodies like the CMA in the UK and the European Commission have the power to investigate, approve, or block mergers and acquisitions based on their competitive impact.

Associated British Foods' global operations are heavily influenced by evolving trade policies and customs regulations. For instance, in 2024, the ongoing adjustments to UK-EU trade arrangements continued to impact ABF's supply chains, requiring diligent customs compliance across numerous product categories. The company’s extensive network necessitates navigating varying import duties on key commodities such as sugar and wheat, directly affecting production costs for its food manufacturing segments.

Changes in international trade agreements can significantly alter market access and competitive positioning for ABF's diverse export businesses. Regulatory shifts, including sanitary and phytosanitary standards, are critical for maintaining supply chain integrity and ensuring continued market access for products like Twinings tea and Jordans cereals.

ABF must also contend with competition laws and antitrust regulations across its operating regions to prevent anti-competitive practices. Regulatory bodies, such as the UK's Competition and Markets Authority (CMA), actively scrutinize market concentration. For example, the CMA's review of mergers and acquisitions in 2023 and early 2024 demonstrated a stringent approach to deals that could impact market competition and consumer choice.

The legal framework surrounding competition ensures that strategic business decisions, like potential acquisitions, are assessed for their impact on market dynamics. Regulators focus on preventing outcomes that could lead to higher prices or reduced consumer choice, making compliance a paramount concern for ABF's growth strategies.

| Legal Factor | Impact on ABF | 2024/2025 Relevance |

| Trade Tariffs & Duties | Affects cost of raw materials (sugar, wheat) and finished goods competitiveness. | Ongoing adjustments to UK-EU trade; potential new tariffs on agricultural imports. |

| Customs Regulations | Requires significant investment in compliance and logistics for global operations. | Navigating diverse and evolving customs procedures in over 50 countries. |

| Competition Law | Scrutiny of mergers/acquisitions impacting market concentration and consumer choice. | CMA and other bodies actively reviewing deals, impacting strategic expansion. |

| Sanitary & Phytosanitary Standards | Crucial for maintaining supply chain integrity and market access for food products. | Evolving standards require continuous adaptation to ensure product compliance. |

Environmental factors

Associated British Foods (ABF) is actively addressing climate change, particularly through its British Sugar division, which accounts for a substantial portion of the company's Scope 1 and 2 greenhouse gas emissions. Their multi-year decarbonisation program is a key initiative to manage these environmental impacts.

This commitment is in sync with ambitious governmental goals, such as the UK's legally binding target to achieve net-zero emissions by 2050. For instance, in the 2023-2024 financial year, ABF reported a reduction in its absolute Scope 1 and 2 GHG emissions, demonstrating tangible progress in their decarbonisation efforts.

Associated British Foods is making significant strides in waste management, targeting zero waste to landfill across its operations by 2025. This ambitious goal underscores their commitment to environmental stewardship.

The company is actively implementing circularity principles, focusing on diverting waste from landfills and finding innovative ways to reuse materials. For instance, in their sugar operations, efforts are underway to maximize the use of by-products, turning what was once waste into valuable resources.

In 2023, ABF reported a notable reduction in waste sent to landfill, with over 80% of their waste streams being diverted. This progress is a testament to their ongoing investment in waste reduction technologies and employee training programs aimed at fostering a culture of sustainability.

Associated British Foods (ABF) places significant importance on building sustainable supply chains, particularly for its food, ingredients, and retail operations. This commitment translates into a focus on the responsible sourcing of raw materials, ensuring that ethical and environmentally sound practices are upheld at every stage. This approach is driven by growing consumer expectations and stricter regulatory pressures demanding greater corporate accountability for sustainability.

In 2023, ABF reported that 80% of its key agricultural raw materials were covered by sustainable sourcing programs, a notable increase from previous years. For instance, its sugar business, a significant component of ABF, has seen substantial progress in its sustainable sourcing initiatives, with over 90% of its EU sugar beet sourced through its ‘Sustainable Agriculture’ program. This program aims to reduce environmental impact and improve social conditions for farmers.

Water Usage and Stewardship

Associated British Foods (ABF) faces significant environmental considerations regarding its water usage, especially within its extensive agricultural operations and food manufacturing facilities. The company's commitment to water stewardship is crucial for managing risks tied to water scarcity, which is becoming increasingly prevalent in many regions where ABF operates. For instance, in 2023, the UK experienced its driest spring on record, impacting agricultural yields and increasing the operational costs for water-intensive industries.

ABF's strategy likely involves implementing advanced water management techniques to boost efficiency and reduce overall consumption. This proactive approach not only helps in complying with stringent environmental regulations but also enhances operational resilience. By investing in water-saving technologies and promoting responsible water use across its supply chain, ABF aims to minimize its environmental footprint and ensure sustainable access to this vital resource.

- Water Efficiency Initiatives: ABF is likely to be implementing measures such as recycling process water, optimizing irrigation techniques in its agricultural segments, and investing in water-efficient machinery in its manufacturing plants.

- Regulatory Compliance: The company must adhere to evolving water quality standards and abstraction limits set by environmental agencies globally, which can impact operational permits and costs.

- Supply Chain Impact: ABF's stewardship extends to influencing water management practices among its suppliers, particularly in agriculture, to ensure a sustainable water footprint across its value chain.

- Climate Change Adaptation: As climate change exacerbates water stress, ABF's long-term planning will increasingly focus on adapting its operations and sourcing strategies to regions with more reliable water availability.

Impact of Weather and Climate on Agriculture

Associated British Foods' (ABF) agriculture and sugar divisions are particularly sensitive to environmental shifts. Extreme weather events, such as prolonged wet spells or severe droughts, directly influence crop yields and, consequently, production costs. For example, in the 2023/2024 period, Frontier, ABF's grain trading joint venture, experienced disruptions due to persistent wet weather, impacting grain availability and prices.

Similarly, drought conditions in key sugar-producing regions like South Africa and Zambia during the same timeframe led to reduced sugar beet and cane harvests, increasing the cost of raw materials for ABF's sugar operations. These climate-related challenges necessitate robust risk management strategies and potentially investments in climate-resilient agricultural practices.

The agricultural sector, a core component of ABF's business, faces increasing volatility. For instance, the 2024 growing season in Europe saw mixed weather patterns, with some areas experiencing unseasonably dry conditions while others dealt with excessive rainfall. This variability directly affects the quality and quantity of crops like wheat and barley, which are crucial inputs for ABF's food manufacturing segments.

The sugar business also grapples with these environmental factors. In 2023, global sugar production forecasts were revised downwards due to adverse weather in major producing countries, including India and Thailand. This has led to higher global sugar prices, impacting ABF's procurement costs and the profitability of its sugar refining operations.

Associated British Foods (ABF) is actively tackling climate change, with its British Sugar division being a key focus for reducing greenhouse gas emissions. The company's multi-year decarbonisation program aims to manage these environmental impacts in line with government targets, such as the UK's net-zero by 2050 goal. ABF reported a reduction in its absolute Scope 1 and 2 GHG emissions in the 2023-2024 financial year, showing progress in these efforts.

ABF is committed to waste management, striving for zero waste to landfill by 2025 across its operations. They are implementing circularity principles, focusing on diverting waste and reusing materials, with over 80% of waste streams diverted from landfill in 2023. This includes maximizing the use of by-products in their sugar operations.

Sustainable supply chains are a priority for ABF, particularly in food, ingredients, and retail, emphasizing responsible sourcing. By 2023, 80% of their key agricultural raw materials were covered by sustainable sourcing programs. For example, over 90% of their EU sugar beet is sourced through their ‘Sustainable Agriculture’ program.

Water usage is a significant environmental consideration for ABF, especially in agriculture and food manufacturing. The company is focused on water stewardship to manage risks associated with water scarcity, a growing concern in many operating regions. ABF's strategy includes implementing advanced water management techniques to improve efficiency and reduce consumption, ensuring compliance with regulations and operational resilience.

PESTLE Analysis Data Sources

Our Associated British Foods PESTLE Analysis is built on a robust foundation of data from reputable sources, including official government reports, leading financial institutions, and comprehensive market research firms. We integrate insights from economic indicators, legislative updates, and environmental assessments to provide a holistic view.